Looking At Lyft's Recent Unusual Options Activity

Financial giants have made a conspicuous bullish move on Lyft. Our analysis of options history for Lyft LYFT revealed 8 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $144,622, and 4 were calls, valued at $116,700.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $12.0 to $13.5 for Lyft over the last 3 months.

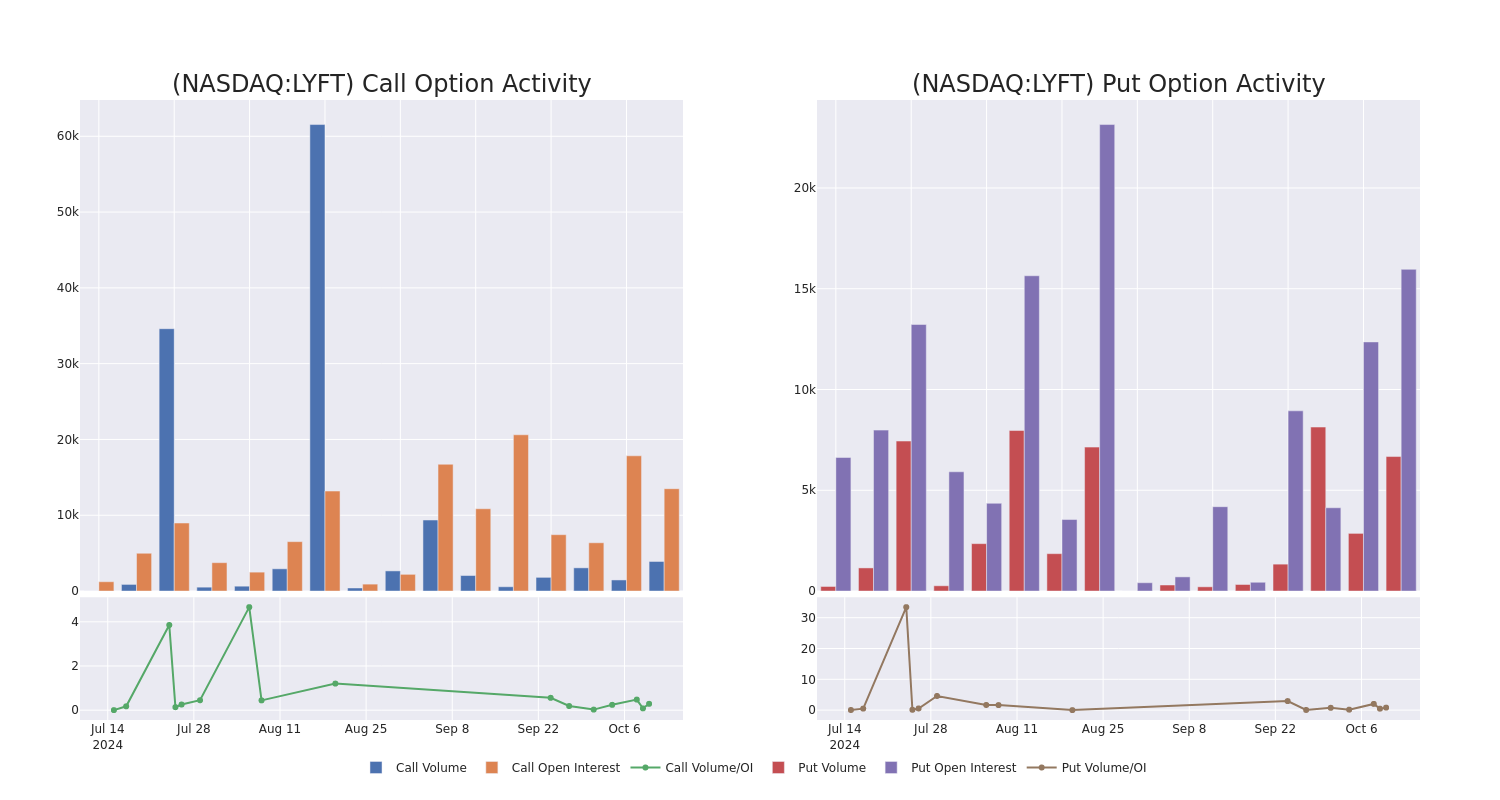

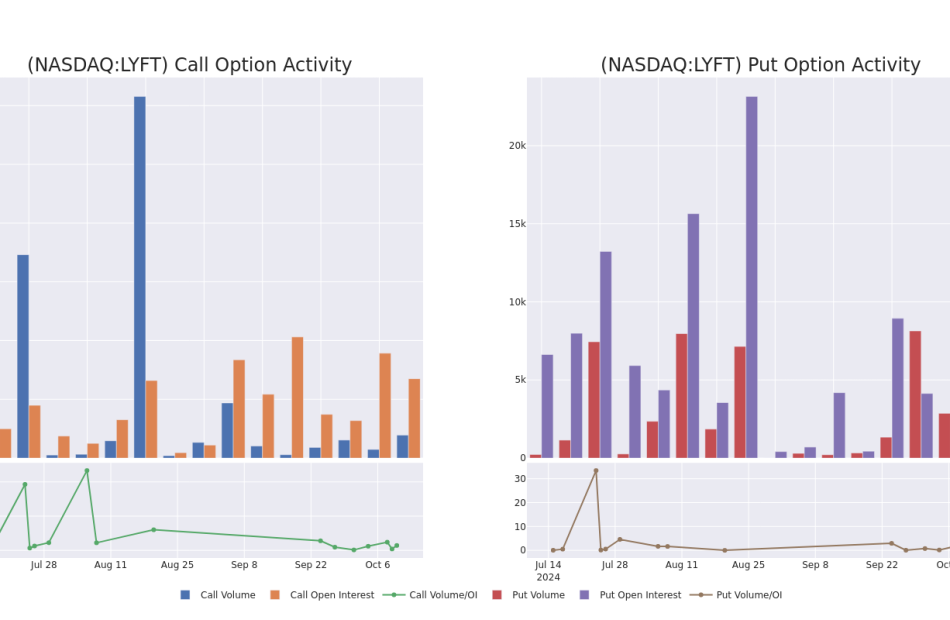

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Lyft’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Lyft’s substantial trades, within a strike price spectrum from $12.0 to $13.5 over the preceding 30 days.

Lyft Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LYFT | PUT | SWEEP | BEARISH | 10/11/24 | $0.52 | $0.51 | $0.52 | $12.50 | $42.4K | 8.5K | 898 |

| LYFT | PUT | SWEEP | BEARISH | 10/11/24 | $0.57 | $0.55 | $0.57 | $12.50 | $38.2K | 8.5K | 2.5K |

| LYFT | PUT | SWEEP | BEARISH | 10/11/24 | $0.55 | $0.52 | $0.55 | $12.50 | $34.9K | 8.5K | 1.5K |

| LYFT | CALL | SWEEP | BULLISH | 10/11/24 | $0.34 | $0.31 | $0.34 | $12.50 | $34.0K | 8.2K | 1.0K |

| LYFT | PUT | SWEEP | BULLISH | 10/11/24 | $0.31 | $0.29 | $0.29 | $12.00 | $29.0K | 7.4K | 1.6K |

About Lyft

Lyft is the second-largest ride-sharing service provider in the us and Canada, connecting riders and drivers over the Lyft app. Incorporated in 2013, Lyft offers a variety of rides via private vehicles, including traditional private rides, shared rides, and luxury ones. Besides ride-share, Lyft also has entered the bike- and scooter-share market to bring multimodal transportation options to users.

Where Is Lyft Standing Right Now?

- Currently trading with a volume of 7,939,222, the LYFT’s price is down by -1.56%, now at $12.31.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 27 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Lyft, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply