China Liberal Education Holdings Limited Reports Financial Results for the First Six Months of Fiscal Year 2024

BEIJING, Oct. 11, 2024 /PRNewswire/ — China Liberal Education Holdings Limited CLEU (“China Liberal,” the “Company,” “we,” “our,” or “us”), a China-based company that provides technological consulting services for smart campus solutions and other educational services, today announced its unaudited financial results for the first six months of fiscal year 2024 ended June 30, 2024.

Ms. Ngai Ngai Lam, Chairwoman and CEO of China Liberal, commented, “Amidst the challenging economic and market conditions, our revenue experienced a decline in the first half of fiscal year 2024, primarily due to the conclusion of two technological consulting projects for smart campus solutions. Despite these challenges, we successfully maintained a relatively stable revenue stream from our core tailored job readiness training services, which remains the backbone of our income. We are also pleased to report a resurgence in revenue from the sales of textbooks and course materials. Additionally, we sustained a strong gross margin of 84.8%, a significant surge from 63.2% in the same period of last year, driven by our established business strategies and targeted restructuring efforts. Furthermore, our total cash position grew significantly to $84.15 million as of June 30, 2024, a notable increase from $20.34 million as of December 31, 2023. Those figures are a testament to the resilience of our business model and operations, and we expect to navigate short-term headwinds and resume our long-term growth trajectory. Looking forward, we remain confident in our business model and committed to translating our efforts into sustained growth and creating value for our shareholders.”

First Six Months of Fiscal Year 2024 Financial Summary

|

For the Six Months Ended June 30, |

||||||

|

($ millions, except for percentages or per share data) |

2024 |

2023 |

%Change |

|||

|

Revenue |

0.89 |

1.36 |

(34.8 %) |

|||

|

Gross profit |

0.75 |

0.86 |

(12.6 %) |

|||

|

Gross margin |

84.8 % |

63.2 % |

21.5pp |

|||

|

Loss from operations |

(4.56) |

(0.74) |

515.7 % |

|||

|

Net (loss) income |

(4.72) |

0.38 |

NM |

|||

|

Basic and diluted (loss) earnings per share |

(2.04) |

0.18 |

NM |

|||

Note: pp represents percentage points; NM represents not meaningful.

- Revenue was $0.89 million for the six months ended June 30, 2024, compared to $1.36 million for the same period of last year.

- Gross profit was $0.75 million for the six months ended June 30, 2024, compared to $0.86 million for the same period of last year.

- Gross margin was 84.8% for the six months ended June 30, 2024, increased by 21.5% from 63.2% for the same period of last year.

- Loss from operations was $4.56 million for the six months ended June 30, 2024, compared to income from operations of $0.74 million for the same period of last year.

- Net loss was $4.72 million for the six months ended June 30, 2024, compared to net income of $0.38 million for the same period of last year.

- Basic and diluted loss per share were $2.04 for the six months ended June 30, 2024, compared to basic and diluted earnings per share of $0.18 for the same period of last year.

First Six Months of Fiscal Year 2024 Financial Results

Revenue

Revenue decreased by $0.5 million, or 34.8%, to $0.89 million for the six months ended June 30, 2024, from $1.36 million for the same period of last year. The decrease in revenue was mainly attributable to the decrease in revenue from technological consulting services for smart campus solutions in the first six months ended June 30, 2024.

Revenue from tailored job readiness training services decreased by $83,297, or 8.8% to $0.86 million for the six months ended June 30, 2024, from $0.94 million for the same period of last year, which was mainly attributed to the loss of certain customers, which reduced revenue contribution from tailored job readiness training services.

Revenue from providing smart campus related technological consulting service decreased by $0.4 million, or 97.4%, to $0.01 million for the six months ended June 30, 2024 from $0.41 million for the same period of last year. The decrease was primarily because two projects were completed for the six months ended June 30, 2024 as compared to six completed projects for the same period of last year. Also, the size and the scope of the projects carried out in the six months ended June 30, 2024 were smaller compared those completed in the six months ended June 30, 2023, and the service fees charged by the Company decreased accordingly.

In order to ensure the quality of course content delivered to students and to meet international standards, the Company developed, edited, and published 12 English textbooks and course materials with an emphasis on language training, and distributed these materials to students enrolled with Fuzhou Melbourne Polytechnic, a three-year college in China (“FMP”) and Strait College of Minjiang University, a four-year university in China (“Strait College”). In 2021, the Company engaged a publisher to handle the printing of these textbooks and course materials. Under the Company arrangement with the publisher, the Company charge 8% royalties for each book and the Company do not receive royalties for the first 5,100 copies of each book. Revenue from textbooks and course material sales increased by $13,476, or 100.00%, to $13,476 for the six months ended June 30, 2024 from nil for the same period of last year. The increase was mainly attributed to the increased demand for textbooks and course materials. According to the Company’s agreement with the publisher, the Company will be able to receive a fee only when the number of copies printed by the publisher exceed a pre-determined volume.

Cost of Revenues

Cost of revenue decreased by $0.36 million, or 73.00%, to $0.14 million for the six months ended June 30, 2024 from $0.50 million for the same period of last year, primarily due to reduced average size and scope of the technology consulting projects completed in the six months ended June 30, 2024. Accordingly, costs associated with hardware and components installation in Technology Consulting Services for Smart Campus related projects decreased significantly when comparing the six months ended June 30, 2024 to the six months ended June 30, 2023. Cost of revenue accounted for 15.2% and 36.8% of total revenue for the six months ended June 30, 2024 and 2023, respectively.

Gross Profit

Gross profit decreased by $0.1 million, or 12.6%, to $0.75 million for the six months ended June 30, 2024 from $0.86 million for the same period of last year, while gross profit margin increased by 21.5% to 84.8% for the six months ended June 30, 2024 from 63.2% for the same period of last year. The decrease in gross profit was primarily due to a decrease in gross profit contribution from smart campus related technological consulting services, which mainly resulted from the decrease in average project size and average gross profit per project for the six months ended June 30, 2024 compared to the same period of last year.

Allowance for Doubtful Accounts

The Company maintain allowance for doubtful accounts for estimated losses. The Company review accounts receivable on a periodic basis and make general and specific allowances when there is doubt as to the collectability of individual balances. In evaluating the collectability of individual receivable balances, the Company consider various factors, including the age of the balance, customer’s payment history, its current credit-worthiness and current economic trends. Accounts are written off after efforts at collection prove unsuccessful. Allowance for doubtful accounts was $2.56 million and $24,554, for the six months ended June 30, 2024 and 2023, respectively. The allowance for doubtful accounts for the six months ended June 30, 2024 was mainly related to working capital provided for the two colleges, FMP and Strait College, which were expected to have collectability issues and allowance for doubtful accounts were made for the estimated losses.

Operating Expenses

Selling expenses decreased by $0.07 million, or 59.8%, to $0.04 million for the six months ended June 30, 2024 from $0.11 million for the same period of last year. The decrease in selling expenses was primarily attributable to the decrease in salaries and related costs of marketing staff which caused by reduction of three staff in the marketing department.

General and administrative expenses increased by $1.2 million, or 84.5%, to $2.7 million for the six months ended June 30, 2024 from $1.5 million for the same period of last year, primarily due to share based compensation expense of $1.2 million incurred in the six months ended June 30, 2024.

Interest Expenses

Interest expenses increased by $0.04 million, or 36.3%, to $0.16 million for the six months ended June 30, 2024 from $0.12 million for the same period of last year, primarily due to interest expenses on short-term bank loans, loans from third parties and loans from a related party.

Government Subsidy Income

Government subsidy income increased by $0.05 million, or 100%, to $0.05 million for the six months ended June 30, 2024 from nil for the same period of last year, primarily due to value-added tax refund from the tax authority.

Other (Expense) Income, Net

Other expenses increased by $0.3 million, or 121.2%, to $0.06 million for the six months ended June 30, 2024 from other income of $0.26 million for the same period of last year, primarily due to forfeiture of advance from a supplier of $0.3 million due to project cancellation in 2023.

Income Tax Expenses

Income tax expenses were nil and $1,966 for the six months ended June 30, 2024 and 2023, respectively, as the operating entities in China did not generate taxable income in the six months ended June 30, 2024.

Net (Loss) Income

Net loss was $4.7 million for the six months ended June 30, 2024, compared to net income of $0.38 million for the six months ended June 30, 2023. Basic and diluted loss per share were $2.04 for the six months ended June 30, 2024, compared to basic and diluted earnings per share of $0.18 for the same period of last year.

Financial Condition

As of June 30, 2024, the Company had cash of $84.15 million, compared to $20.34 million as of December 31, 2023.

Net cash used in operating activities was $1.28 million for the six months ended June 30, 2024, compared to $1.72 million for the same period of last year.

Net cash provided by investing activities was $40.00 million for the six months ended June 30, 2024, compared to nil for the same period of last year.

Net cash provided by financing activities was $25.07 million for the six months ended June 30, 2024, compared to $1.25 million for the same period of last year.

About China Liberal Education Holdings Limited

China Liberal is an educational services provider headquartered in Beijing, China. China Liberal provides a wide range of services, including technological consulting for Chinese universities to improve their campus information and data management systems, designed to enhance the teaching, operating, and management environment of the universities, thus establishing a “smart campus.” Additionally, China Liberal offers tailored job readiness training for graduating students. For more information, please visit the Company’s website at http://ir.chinaliberal.com/.

Forward-Looking Statements

This document contains forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s expectations and projections about future events, which the Company derives from the information currently available to the Company. Such forward-looking statements relate to future events or our future performance, including: our financial performance and projections; our growth in revenue and earnings; and our business prospects and opportunities. You can identify forward-looking statements by those that are not historical in nature, particularly those using terminology such as “may,” “should,” “expects,” “anticipates,” “contemplates,” “estimates,” “believes,” “plans,” “projected,” “predicts,” “potential,” or “hopes” or the negative of these or similar terms. When evaluating these forward-looking statements, you should consider various factors, including our ability to change the direction of the Company; our ability to keep pace with new technology and changing market needs; and the competitive environment of our business. These and other factors may cause actual results to differ materially from any forward-looking statement. Forward-looking statements are only predictions. The forward-looking events discussed in this press release and other statements made from time to time by us or our representatives, may not occur, and actual events and results may differ materially and are subject to risks, uncertainties, and assumptions about us. The Company undertakes no obligation to update forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as required by law. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, it can provide no assurance that these expectations will prove to be accurate, and it cautions investors that actual results may differ materially from the anticipated results. Investors are encouraged to review the risk factors that may affect future results in the Company’s most recent annual report on Form 20-F for the year ended December 31, 2023 and in its other filings with the U.S. Securities and Exchange Commission.

Investor Relations Contact

China Liberal Education Holdings Limited

Email: ir@chinaliberal.com

Ascent Investor Relations LLC

Tina Xiao

President

Phone: +1 646-932-7242

Email: investors@ascent-ir.com

|

China Liberal Education Limited |

||||||||

|

Condensed Consolidated Balance Sheets |

||||||||

|

As of June 30, |

As of December 31, |

|||||||

|

2024 |

2023 |

|||||||

|

ASSETS |

(Unaudited) |

|||||||

|

CURRENT ASSETS |

||||||||

|

Cash |

$ |

84,147,075 |

$ |

20,337,847 |

||||

|

Accounts receivable, net |

1,462,571 |

1,453,230 |

||||||

|

Advance to suppliers |

322,331 |

3,521,176 |

||||||

|

Inventories, net |

144,862 |

167,493 |

||||||

|

Prepaid expenses and other current assets, net |

99,954 |

114,732 |

||||||

|

Receivable from disposal of subsidiaries |

– |

40,000,000 |

||||||

|

TOTAL CURRENT ASSETS |

$ |

86,176,793 |

$ |

65,594,478 |

||||

|

NON-CURRENT ASSETS |

||||||||

|

Goodwill on acquisitions |

6,747,543 |

6,747,543 |

||||||

|

Property and equipment, net |

3,275 |

5,157 |

||||||

|

Intangible assets, net |

312,836 |

351,680 |

||||||

|

Right-of-use assets |

70,987 |

102,509 |

||||||

|

TOTAL NON-CURRENT ASSETS |

$ |

7,134,641 |

$ |

7,206,889 |

||||

|

TOTAL ASSETS |

$ |

93,311,434 |

$ |

72,801,367 |

||||

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

||||||||

|

CURRENT LIABILITIES |

||||||||

|

Account payables |

$ |

432,261 |

$ |

571,432 |

||||

|

Contract liabilities |

– |

212,473 |

||||||

|

Short-term bank loan |

437,154 |

32,191 |

||||||

|

Taxes payable |

1,185,754 |

1,438,658 |

||||||

|

Due to related parties |

679,730 |

1,395,225 |

||||||

|

Lease liabilities |

65,799 |

63,410 |

||||||

|

Loans from third parties |

1,668,053 |

1,589,702 |

||||||

|

Accrued expenses and other current liabilities |

835,992 |

928,816 |

||||||

|

TOTAL CURRENT LIABILITIES |

$ |

5,304,743 |

$ |

6,231,907 |

||||

|

NON-CURRENT LIABILITY |

||||||||

|

Lease liabilities |

– |

32,525 |

||||||

|

TOTAL NON-CURRENT LIABILITY |

– |

32,525 |

||||||

|

TOTAL LIABILITIES |

$ |

5,304,743 |

$ |

6,264,432 |

||||

|

COMMITMENTS AND CONTINGENCIES |

||||||||

|

SHAREHOLDERS’ EQUITY |

||||||||

|

Ordinary shares, $0.015 par value, 500 million shares authorized, |

$ |

432,250 |

$ |

5,028 |

||||

|

Additional paid-in capital* |

97,861,862 |

72,142,580 |

||||||

|

Statutory reserve |

1,006,384 |

1,006,384 |

||||||

|

Accumulated deficits |

(11,511,722) |

(6,786,949) |

||||||

|

Accumulated other comprehensive income |

217,917 |

169,892 |

||||||

|

Total shareholders’ equity |

$ |

88,006,691 |

$ |

66,536,935 |

||||

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

$ |

93,311,434 |

$ |

72,801,367 |

||||

|

* On January 19, 2024, the Company consolidated its ordinary shares of fifteen (15) ordinary shares with par value |

||||||||

|

China Liberal Education Holdings Limited |

||||||||

|

Condensed Consolidated Statements of Operations and Comprehensive Income (Loss) |

||||||||

|

(Unaudited) |

||||||||

|

For the six months end June 30, |

||||||||

|

2024 |

2023 |

|||||||

|

REVENUE |

$ |

885,804 |

$ |

1,358,617 |

||||

|

COST OF REVENUE |

(135,008) |

(499,788) |

||||||

|

GROSS PROFIT |

750,796 |

858,829 |

||||||

|

OPERATING EXPENSES |

||||||||

|

Allowance for doubtful accounts |

(2,563,577) |

(24,554) |

||||||

|

Selling expenses |

(44,662) |

(111,098) |

||||||

|

General and administrative expenses |

(2,700,351) |

(1,463,385) |

||||||

|

Total operating expenses |

(5,308,590) |

(1,599,037) |

||||||

|

LOSS FROM OPERATIONS |

(4,557,794) |

(740,208) |

||||||

|

OTHER (EXPENSES) INCOME |

||||||||

|

Interest income |

562 |

975 |

||||||

|

Interest expenses |

(162,884) |

(119,479) |

||||||

|

Government subsidy income |

50,891 |

– |

||||||

|

Other (expense) income, net |

(55,548) |

262,403 |

||||||

|

Total other (expenses) income, net |

(166,979) |

143,899 |

||||||

|

Loss before income taxes |

(4,724,773) |

(596,309) |

||||||

|

Income tax expenses |

– |

(1,966) |

||||||

|

Net loss from continuing operations |

(4,724,773) |

(598,275) |

||||||

|

Net income from discontinued operations |

– |

974,486 |

||||||

|

Net (loss) income |

(4,724,773) |

376,211 |

||||||

|

COMPREHENSIVE INCOME (LOSS) |

||||||||

|

Total currency translation differences arising from consolidation |

48,025 |

57,460 |

||||||

|

TOTAL COMPREHENSIVE (LOSS) INCOME |

$ |

(4,676,748) |

$ |

433,671 |

||||

|

(Loss) earnings per share |

||||||||

|

Basic and diluted |

$ |

(2.04) |

$ |

0.18 |

||||

|

Weighted average number of shares outstanding |

||||||||

|

Basic and diluted |

2,321,643 |

2,106,556 |

||||||

|

China Liberal Education Holdings Limited |

||||||||

|

Condensed Consolidated Statements of Cash Flows |

||||||||

|

(Unaudited) |

||||||||

|

For the six months ended June 30, |

||||||||

|

2024 |

2023 |

|||||||

|

Cash flows from operating activities |

||||||||

|

Net (loss) income |

$ |

(4,724,773) |

$ |

376,211 |

||||

|

Net income from discontinued operations |

– |

974,486 |

||||||

|

Net loss from continuing operations |

$ |

(4,724,773) |

$ |

(598,275) |

||||

|

Adjustments to reconcile net (loss) income to net cash provided by |

||||||||

|

Allowance for accounts receivable |

4,510 |

(53,507) |

||||||

|

Allowance for inventory |

– |

3,645 |

||||||

|

Allowance for prepaid expenses and other current assets |

(16,631) |

78,061 |

||||||

|

Depreciation of property and equipment |

1,776 |

6,491 |

||||||

|

Amortization of intangible assets |

30,967 |

32,064 |

||||||

|

Non-cash lease expenses |

29,371 |

– |

||||||

|

Share-based compensation |

1,256,504 |

– |

||||||

|

Changes in operating assets and liabilities: |

||||||||

|

Accounts receivable, net |

(47,612) |

326,605 |

||||||

|

Advance to suppliers |

3,140,123 |

– |

||||||

|

Inventories, net |

18,910 |

– |

||||||

|

Prepaid expenses and other current assets |

29,328 |

(99,391) |

||||||

|

Accounts payable |

(126,919) |

(416,048) |

||||||

|

Contract liabilities |

(186,045) |

(886,852) |

||||||

|

Taxes payable |

(221,359) |

66,186 |

||||||

|

Lease liabilities |

(28,128) |

2,197 |

||||||

|

Accrued expenses and other current liabilities |

(442,768) |

(186,021) |

||||||

|

Net cash used in operating activities from continuing operations |

(1,282,746) |

(1,724,845) |

||||||

|

Net cash used in operating activities from discontinued operations |

– |

(3,364,997) |

||||||

|

Net cash used in operating activities |

(1,282,746) |

(5,089,842) |

||||||

|

Cash flows from investing activities |

||||||||

|

Other receivable |

40,000,000 |

– |

||||||

|

Net cash provided by investing activities from continuing operations |

40,000,000 |

– |

||||||

|

Net cash used in investing activities from discontinued operations |

– |

(64,586) |

||||||

|

Net cash provided by (used in) investing activities |

40,000,000 |

(64,586) |

||||||

|

Cash flows from financing activities |

||||||||

|

Repayment of advances from a related party |

(198,470) |

(5,563) |

||||||

|

Proceeds from loans from third parties |

519,160 |

1,252,108 |

||||||

|

Repayment of loans from third parties |

(553,808) |

– |

||||||

|

Proceeds from short-term bank loans |

412,736 |

– |

||||||

|

Net proceeds from issuance of ordinary shares |

24,890,000 |

– |

||||||

|

Net cash provided by financing activities from continuing |

25,069,618 |

1,246,545 |

||||||

|

Net cash provided by financing activities from discontinued operations |

– |

2,459,821 |

||||||

|

Net cash provided by financing activities |

25,069,618 |

3,706,366 |

||||||

|

Effect of changes of foreign exchange rates on cash |

22,356 |

(34,351) |

||||||

|

Net increase (decrease) in cash |

63,809,228 |

(1,482,413) |

||||||

|

Cash, beginning of period |

20,337,847 |

13,650,071 |

||||||

|

Cash, end of period |

$ |

84,147,075 |

$ |

12,167,658 |

||||

|

Reconciliation of cash, beginning of period |

||||||||

|

Cash from continuing operations |

$ |

20,337,847 |

$ |

12,121,824 |

||||

|

Cash from discontinued operations |

– |

1,528,247 |

||||||

|

Cash, beginning of period |

$ |

20,337,847 |

$ |

13,650,071 |

||||

|

Reconciliation of cash, end of period |

||||||||

|

Cash from continuing operations |

$ |

84,147,075 |

$ |

11,646,021 |

||||

|

Cash from discontinued operations |

– |

521,637 |

||||||

|

Cash, end of period |

$ |

84,147,075 |

$ |

12,167,658 |

||||

|

Supplemental disclosure of cash flow information: |

||||||||

|

Cash paid for interest expense |

– |

– |

||||||

|

Cash paid for income tax |

– |

2,324 |

||||||

![]() View original content:https://www.prnewswire.com/news-releases/china-liberal-education-holdings-limited-reports-financial-results-for-the-first-six-months-of-fiscal-year-2024-302273801.html

View original content:https://www.prnewswire.com/news-releases/china-liberal-education-holdings-limited-reports-financial-results-for-the-first-six-months-of-fiscal-year-2024-302273801.html

SOURCE China Liberal Education Holdings Limited

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Cannabis Investors Should Make This Bold Move Before Florida's Vote: What To Buy And Sell Now

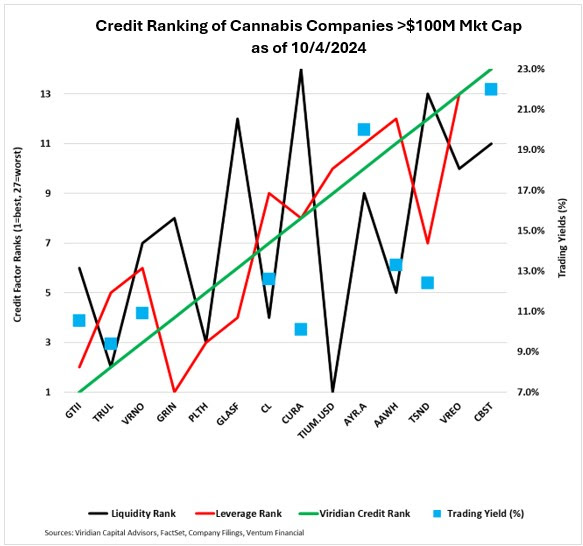

As Florida’s pivotal vote on recreational cannabis looms, investors are eyeing key opportunities in the market. The Viridian Credit Tracker ranks AYR Wellness AYRWF as a strong buy, with a compelling 20% yield driven by its significant presence in Florida’s cannabis market. With the potential for Florida voters to approve recreational use, AYR stands to gain considerably, making it a prime target for investors before the vote.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

AYR Wellness Offers 20% Yield: Capitalize on Florida’s Potential Vote

According to the Viridian Credit Tracker from Viridian Capital Advisors, AYR’s exposure to Florida’s market gives it a unique advantage ahead of the state’s potential legalization of recreational cannabis.

With a 20% trading yield, AYR outpaces many of its competitors. If Florida approves recreational cannabis, AYR’s valuation could see a substantial boost, making this stock a strategic buy for investors ahead of the vote.

Cresco Labs vs. Curaleaf: A 250 Basis Point Difference

Another suggested pair trade from the report is to buy Cresco Labs CRLBF at a 12.6% yield and sell Curaleaf CURLF at 10.1%. This trade offers investors a 250 basis point yield upgrade, backed by Cresco’s solid financials and credit improvement. Investors looking for higher returns and credit strength should consider this opportunity.

Read Also: EXCLUSIVE: 80% Growth Despite The Chaos: How Dutchie, C3 Defy 2024’s Cannabis Slump

TerrAscend: Why 12% Yield Might Not Be Enough

In contrast, TerrAscend TRSSF, which offers a 12% yield, is recommended as a sell. While TerrAscend remains a significant player in the cannabis industry, its lower yield and reduced exposure to Florida’s growth potential make it less appealing compared to AYR.

Cannabist Faces Liquidity Challenges

Despite the attractive spreads among top stocks, Cannabist CCHWF ranks as the weakest credit in the group, largely due to liquidity concerns following recent asset sales. Investors should note that Cannabist’s lower credit rating may limit its near-term upside despite potential improvements in the future.

Take Action Now: Florida’s Vote Could Change the Game

With Florida’s cannabis market potentially expanding, investors looking to maximize gains should consider this pair trade: buy AYR at 20%, sell TerrAscend at 12%, and look into Cresco Labs at 12.6% versus Curaleaf at 10.1%. The vote could transform the landscape for cannabis stocks, and taking action before this pivotal event could provide substantial returns.

Read Next: SEC Charges ‘Magic Mushroom’ Co. Minerco In $8M Pump-And-Dump Scheme

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Artificial Intelligence (AI) Servers Are Set to Become a $187 Billion Industry in 2024: 2 Hot Stocks That Are Set to Soar Thanks to This Massive Opportunity

Shipments of artificial intelligence (AI) servers have shot up remarkably in the past couple of years as cloud service providers have been investing huge amounts of money in infrastructure that’s capable of training AI models, as well as for AI inferencing purposes to deploy those models in real-world applications.

Market research firm TrendForce estimates that the global AI server market could hit a whopping $187 billion in revenue this year, up by 69% from 2023. Several companies are already benefiting big time from this huge end-market opportunity. From chip manufacturers such as Nvidia to custom chip producers such as Broadcom and server solutions providers such as Dell Technologies, there are multiple ways to invest in the booming AI server market.

In this article, however, we will take a closer look at the prospects of Micron Technology (NASDAQ: MU) and Marvell Technology (NASDAQ: MRVL), two companies that make critical components that go into AI servers.

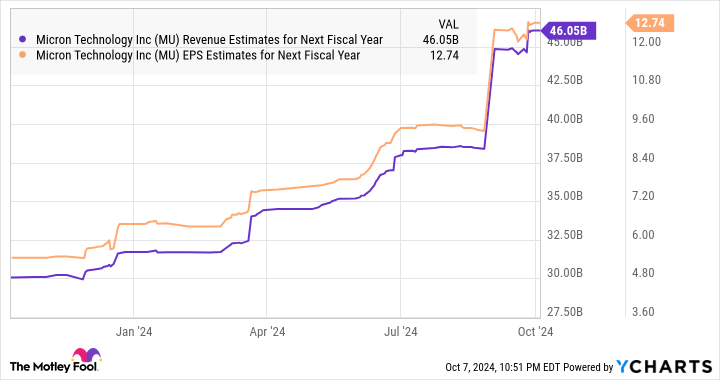

Micron Technology’s high-bandwidth memory chips are in terrific demand

High-bandwidth memory (HBM) is used in AI server chips such as graphics processing units (GPUs) because of its ability to enable faster transfer of data to reduce processing times and boost performance, as well as reduce power consumption. The demand for HBM is so strong that Micron says that it has sold out its entire capacity for this year and the next.

Even better, Micron management points out that it “will have a more diversified HBM revenue profile” for 2026 thanks to the new business that it has landed for its latest HBM3E chip. The chipmaker points out that it has already begun shipments of this new chip to its customers for approval.

Micron claims that HBM3E consumes 20% less power and provides 50% more capacity as compared to rival offerings. The company expects to start the production ramp of HBM3E in early 2025 and increase its output as the year progresses. Even better, Micron is confident that it will continue to gain more share in the HBM market.

Singapore-based news channel CNA points out that Micron is reportedly aiming to grab 20% to 25% of the HBM market by next year. That is likely to give Micron’s growth a big boost next year as it expects the HBM market’s revenue to jump to an impressive $25 billion in 2025 from just $4 billion in 2023.

An expansion of the end market along with Micron’s focus on grabbing a bigger share of the HBM space are the reasons the company’s revenue is expected to jump by a stunning 52% to $38 billion in the current fiscal year (which started on Aug. 30). Meanwhile, analysts are forecasting Micron’s earnings to increase to $8.94 per share from $1.30 per share in the previous year.

Micron is expected to keep growing at a terrific pace in the next fiscal year as well.

Buying shares of Micron Technology right now could turn out to be a smart move for investors looking to benefit from the growing deployment of AI servers. The stock has a forward earnings multiple of just 11, while its price/earnings-to-growth ratio (PEG ratio) of just 0.16 further reinforces the fact that it is incredibly undervalued with respect to the growth that it is forecast to deliver.

Marvell Technology is getting a nice boost because of its custom AI chips

Marvell Technology is known for manufacturing application-specific integrated circuits (ASICs), which are custom chips designed to perform specific tasks. It is worth noting that the demand for these custom chips deployed in AI servers is increasing since major cloud service providers such as Meta Platforms, Alphabet‘s Google, and Amazon are looking to reduce their costs by developing in-house processors.

As a result, ASICs are expected to account for 26% of the overall market for AI server chips in 2024. Even better, the deployment of ASICs in AI servers is expected to increase at a nice clip in the future and open a potential revenue opportunity worth an impressive $150 billion. Marvell is already capitalizing on this lucrative opportunity.

The company’s overall revenue was down 5% year over year in the second quarter of fiscal 2025 (for the three months ended Aug. 3) to $1.27 billion thanks to the weakness in the carrier infrastructure, consumer, automotive, and enterprise networking end markets. However, it delivered a tremendous year-over-year increase of 92% in data center revenue to $881 million.

There is a good chance that Marvell’s data center business will continue to grow at a healthy clip as the company’s AI chip production is set to ramp up, as pointed out by CEO Matt Murphy on the latest earnings conference call:

Our AI custom silicon programs are progressing very well with our first two chips now ramping into volume production. Development for new custom programs we have already won, including projects with the new Tier 1 AI customer we announced earlier this year, are also tracking well to key milestones.

As a result, Marvell is expecting its data center business’s growth to “accelerate into the high teens sequentially on a percentage basis” in the current quarter, which would be an improvement over the 8% sequential growth it reported in the previous quarter. This explains why Marvell’s guidance for the current quarter points toward an improvement in its financial performance.

The company is expecting revenue of $1.45 billion in fiscal Q3, up from $1.42 billion in the same quarter last year. So, Marvell is set to return to growth from the current quarter, and analysts are expecting it to deliver robust growth over the next couple of fiscal years.

Additionally, analysts are expecting Marvell’s earnings to increase at a compound annual growth rate of 21% for the next five years. So, investors looking to get their hands on a semiconductor stock to benefit from the growing demand for custom AI chips can consider adding Marvell Technology to their portfolios. Its growth is set to accelerate thanks to the tremendous opportunity in the AI server market.

Should you invest $1,000 in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, and Nvidia. The Motley Fool recommends Broadcom and Marvell Technology. The Motley Fool has a disclosure policy.

Artificial Intelligence (AI) Servers Are Set to Become a $187 Billion Industry in 2024: 2 Hot Stocks That Are Set to Soar Thanks to This Massive Opportunity was originally published by The Motley Fool

Wall Street Marks New Record Highs On Strong Start To Earnings Season, Investors Downplay Inflation Surge, Tesla Disappoints: This Week In The Market

The S&P 500 and Dow Jones Industrial Average both achieved record highs this week.

A strong kickoff to the third-quarter earnings season fueled both indexes, offsetting concerns from last month’s unexpected inflation surge.

JPMorgan Chase & Co. JPM, Wells Fargo & Co. WFC, Bank of New York Mellon Corp. BK and BlackRock Inc. BLK all exceeded analyst earnings forecasts Friday. This triggered a stock rally and propelled the financial sector to new highs.

In contrast, Tesla Inc. TSLA faced investor disappointment. The Austin, Texas-based car company is one of the worst performers within the S&P 500 this week.

The much-anticipated “We, Robot” event on Thursday was partly to blame. The presentation failed to impress analysts and investors, alike. Critics said it was more fanfare than substance.

While the company showcased its CyberCab and Optimus robot, key details about commercialization and timelines were lacking. The event sparked mixed reactions from investors, with concerns about whether Tesla can deliver on its ambitious autonomous vehicle promises.

As a result, the Elon Musk-led EV manufacturer saw its share price plunge Friday.

You might have missed…

Economic data disappoints

September inflation reports for both consumers and producers come in higher than expected, while jobless claims posted the sharpest rise in over a year.

Despite the inflation uptick, interest rate expectations remained largely unchanged, with most traders and economists maintaining their outlook for a November rate cut. The unemployment spike was attributed to temporary factors, including Michigan auto layoffs and Hurricane Helene.

No Stimulus Measures In China

Chinese stocks saw their worst weekly performance of the year. The absence of expected stimulus measures from Chinese authorities weighed heavily on investor sentiment, despite a strong rally in recent weeks.

Mortgage Rates Surge

Mortgage rates saw a sharp reversal last week, jumping to 6.36% and leading to a 5.1% drop in homebuyer applications. The housing market awaits further rate cuts, but rising Treasury yields —driven by a resilient labor market — pose significant challenges to mortgage rate relief in the near term.

Google fights back

Alphabet Inc.‘s GOOGL Google is challenging the Department of Justice’s efforts to break up its search dominance, labeling the proposed antitrust remedies as radical.

The tech giant argues the DOJ’s recommendations could dismantle its core business, impacting innovation and consumer choice.

Keep Reading:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nurix Therapeutics Reports Third Quarter Fiscal 2024 Financial Results and Provides a Corporate Update

Initiated Phase 1b dose expansion of NX-5948 in chronic lymphocytic leukemia patient population with Fast Track Designation from the FDA

Initiated Phase 1b dose expansion of NX-5948 in Waldenstrom’s macroglobulinemia, follicular lymphoma and marginal zone lymphoma patients

Reinitiated enrollment for NX-2127 in a Phase 1a/b trial in oncology

Presented preclinical data on Degrader-Antibody Conjugates (DACs), a new class of therapeutics

Well capitalized with cash and marketable securities of $457.5 million

SAN FRANCISCO, Oct. 11, 2024 (GLOBE NEWSWIRE) — Nurix Therapeutics, Inc. NRIX, a clinical stage biopharmaceutical company developing targeted protein modulation drugs designed to treat patients with cancer and inflammatory diseases, today reported financial results for the third quarter ended August 31, 2024, and provided a corporate update.

“We continue to make great progress and remain focused on execution as we advance our pipeline of wholly owned and partnered programs in oncology, inflammation and immunology,” said Arthur T. Sands, M.D., Ph.D., president and chief executive officer of Nurix. “As we approach the end of the year, we are well capitalized and look forward to building further momentum as we head into clinical data readouts in the fourth quarter of 2024 and the initiation of pivotal studies of NX-5948 in 2025.”

Recent Business Highlights

- Expanded clinical development of NX-5948: In the third quarter of 2024, Nurix initiated the Phase 1b portion of its ongoing Phase 1a/b clinical trial in adults with relapsed or refractory B-cell malignancies. The Phase 1b expansion includes a randomization to a low dose (200mg QD) or a high dose (600mg QD) of NX-5948 in patients with chronic lymphocytic leukemia (CLL) who have been treated with at least two prior regimens including a Bruton’s tyrosine kinase (BTK) inhibitor and a BCL2 inhibitor. This is the patient population for which the FDA granted Nurix Fast Track designation in January 2024. Cohorts were also initiated to evaluate NX-5948 in patients with Waldenstrom’s macroglobulinemia (WM), marginal zone lymphoma and follicular lymphoma.

- Re-initiated enrollment in NX-2127 Phase 1a/b trial: Nurix recently reinitiated enrollment with its new chirally controlled drug product in a standard dose escalation study within the current Phase 1a/1b trial. As previously announced, in March 2024, the U.S. Food and Drug Administration (FDA) lifted a manufacturing-related, partial clinical hold on the NX-2127 clinical trial. Patients enrolled prior to the partial clinical hold who are deriving clinical benefit continue to receive uninterrupted treatment with the original drug product.

- Presented early preclinical data from ongoing collaboration with Pfizer to develop Degrader-Antibody Conjugates, a new class of therapeutics: On September 10, 2024, at the ADC & Radiopharmaceuticals Pharma & Biotech Partnering Summit, Nurix’s chief scientific officer, Gwenn M. Hansen, Ph.D., presented an outline of the advantages of DACs, Nurix’s matrixed approach to the generation and optimization of DACs using its DELigase platform, and early preclinical data demonstrating cell-type selective degradation of targeted proteins by DACs. Nurix believes that DACs may represent a next generation of antibody drug conjugate (ADC) technology that could broaden its use in oncology and potentially other indications. DACs combine the catalytic activity of a targeted protein degrader with the tissue specificity of an antibody which has the potential to provide improved therapeutic index and broader applicability than standard ADCs and which can potentially be applied to any protein target in any tissue.

Upcoming Program Highlights*

NX-5948: NX-5948 is an investigational, orally bioavailable degrader of BTK that is currently being evaluated in the Phase 1b portion of a Phase 1a/b clinical trial in adults with relapsed or refractory B-cell malignancies. By year-end 2024, Nurix plans to present additional clinical data from this study for patients with CLL. Later this month, at the 12th International Workshop on Waldenstrom’s Macroglobulinemia (IWWM 12), Nurix will present a clinical update from this study on patients with WM. Additional information on the Phase 1a/b clinical trial can be accessed at www.clinicaltrials.gov (NCT05131022).

Nurix is also conducting a Phase 1 healthy volunteer study to assess food effects and drug-drug interactions in anticipation of initiating pivotal development in 2025. Additional information on this Phase 1 clinical trial can be accessed at www.clinicaltrials.gov (NCT06593457).

Nurix continues to lay the groundwork for indication selection in autoimmune and inflammatory diseases and expects to complete ongoing preclinical studies in 2024 that can enable an investigational new drug (IND) application for NX-5948 in autoimmune indications. An abstract titled “NX-5948, a Clinical-Stage BTK Degrader, Achieves Deep Suppression of BCR, TLR, and FcR Signaling in Immune Cells and Demonstrates Efficacy in Preclinical Models of Arthritis and Other Inflammatory Diseases” was accepted for a poster presentation at the upcoming annual meeting of the American College of Rheumatology (ACR 2024), being held November 14–19, 2024, in Washington, D.C.

NX-2127: NX-2127 is an orally bioavailable BTK degrader that also degrades cereblon neosubstrates IKZF1 (Ikaros) and IKZF3 (Aiolos) for the treatment of relapsed or refractory B‑cell malignancies. Nurix is conducting a Phase 1a/b clinical trial of NX-2127, which includes Phase 1b expansion cohorts focused on patients with diffuse large B-cell lymphoma (DLBCL) and mantle cell lymphoma (MCL). Nurix recently introduced a new chirally controlled drug product, which is being evaluated in a dose escalation within this Phase 1a/b trial. Future clinical updates are anticipated in 2025. Additional information on the clinical trial can be accessed at www.clinicaltrials.gov (NCT04830137).

NX-1607: NX-1607 is an orally bioavailable inhibitor of the E3 ligase Casitas B-lineage lymphoma proto-oncogene B (CBL-B) for immuno-oncology indications, including a range of solid tumor types and lymphoma. Nurix is evaluating NX-1607 in an ongoing Phase 1 trial in monotherapy and in a combination cohort utilizing paclitaxel in adults in a range of oncology indications. This study includes a thorough investigation of both dose and schedule in Phase 1a. Nurix anticipates providing a program update by year-end 2024. Additional information on the clinical trial can be accessed at www.clinicaltrials.gov (NCT05107674).

GS-6791 (previously NX-0479): GS-6791 is a potent, selective, oral IRAK4 degrader. Degradation of IRAK4 by GS-6791 has potential applications in the treatment of rheumatoid arthritis and other inflammatory diseases. Nurix’s partner, Gilead, is responsible for conducting IND-enabling studies and advancing this program to clinical development. An abstract titled “IRAK4 Degrader GS-6791 Inhibits TLR and IL-1R-Driven Inflammatory Signaling, and Ameliorates Disease in a Preclinical Arthritis Model” was accepted for a poster presentation at ACR 2024.

STAT6 degrader: In April 2024, Nurix announced an extension of the ongoing research program with Sanofi for STAT6 (signal transducer and activator of transcription 6), a key drug target in type 2 inflammation, with the goal of nominating a development candidate in the first year of the extended term. Nurix remains on track for this goal.

Continued pipeline advancement of strategic collaborations with Gilead, Sanofi and Pfizer: Nurix expects to continue to achieve substantial research collaboration milestones throughout the terms of its collaborations with Gilead, Sanofi and Pfizer.

* Expected timing of events throughout this press release is based on calendar year quarters.

Fiscal Third Quarter 2024 Financial Results

Collaboration revenue for the three months ended August 31, 2024, was $12.6 million compared with $18.5 million for the three months ended August 31, 2023. Revenue from the collaboration with Gilead decreased as the initial research term for certain drug targets ended. The decrease was offset by an increase in revenue from the collaboration agreement with Pfizer that was entered into in the fourth quarter of fiscal year 2023.

Research and development expenses for the three months ended August 31, 2024, were $55.5 million compared with $47.9 million for the three months ended August 31, 2023. The increase was primarily due to clinical and contract manufacturing costs as Nurix continued to accelerate the enrollment of NX-5948 and progress its other clinical trial programs for NX-2127 and NX-1607.

General and administrative expenses for the three months ended August 31, 2024, were $11.7 million compared with $10.6 million for the three months ended August 31, 2023. The increase was primarily due to an increase in professional service and consulting costs.

Net loss for the three months ended August 31, 2024, was $49.0 million, or ($0.67) per share, compared with $37.0 million, or ($0.68) per share, for the three months ended August 31, 2023.

Cash, cash equivalents and marketable securities was $457.5 million as of August 31, 2024, compared to $452.5 million as of May 31, 2024.

About Nurix Therapeutics, Inc.

Nurix Therapeutics is a clinical stage biopharmaceutical company focused on the discovery, development and commercialization of innovative small molecules and antibody therapies based on the modulation of cellular protein levels as a novel treatment approach for cancer, inflammatory conditions, and other challenging diseases. Leveraging extensive expertise in E3 ligases together with proprietary DNA-encoded libraries, Nurix has built DELigase, an integrated discovery platform, to identify and advance novel drug candidates targeting E3 ligases, a broad class of enzymes that can modulate proteins within the cell. Nurix’s drug discovery approach is to either harness or inhibit the natural function of E3 ligases within the ubiquitin-proteasome system to selectively decrease or increase cellular protein levels. Nurix’s wholly owned, clinical stage pipeline includes targeted protein degraders of Bruton’s tyrosine kinase, a B-cell signaling protein, and inhibitors of Casitas B-lineage lymphoma proto-oncogene B, an E3 ligase that regulates activation of multiple immune cell types including T cell and NK cells. Nurix is headquartered in San Francisco, California. For additional information visit http://www.nurixtx.com.

Forward-Looking Statements

This press release contains statements that relate to future events and expectations and as such constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. When or if used in this press release, the words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “outlook,” “plan,” “predict,” “should,” “will,” and similar expressions and their variants, as they relate to Nurix, may identify forward-looking statements. All statements that reflect Nurix’s expectations, assumptions or projections about the future, other than statements of historical fact, are forward-looking statements, including, without limitation, statements regarding: Nurix’s future financial or business performance; Nurix’s future plans, prospects and strategies; Nurix’s plans and expectations with respect to its current and prospective drug candidates; the tolerability, safety profile, therapeutic potential and other advantages of Nurix’s drug candidates; the planned timing and conduct of Nurix’s clinical trials; the planned timing for the provision of updates and findings from Nurix’s preclinical studies and clinical trials; the potential benefits of and Nurix’s expectations with respect to its strategic collaborations, including the achievement of research milestones; and the potential benefits and advantages of Nurix’s scientific approach, DELigase™ platform and Degrader-Antibody Conjugates. Forward-looking statements reflect Nurix’s current beliefs, expectations, and assumptions regarding the future of Nurix’s business, its future plans and strategies, its development plans, its preclinical and clinical results, future conditions and other factors Nurix believes are appropriate in the circumstances. Although Nurix believes the expectations and assumptions reflected in such forward-looking statements are reasonable, Nurix can give no assurance that they will prove to be correct. Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and changes in circumstances that are difficult to predict, which could cause Nurix’s actual activities and results to differ materially from those expressed in any forward-looking statement. Such risks and uncertainties include, but are not limited to: (i) whether Nurix will be able to advance its drug candidates, obtain regulatory approval of and ultimately commercialize its drug candidates; (ii) uncertainties related to the timing and results of preclinical studies and clinical trials; (iii) whether Nurix will be able to fund development activities and achieve development goals; (iv) uncertainties related to the timing and receipt of payments from Nurix’s collaboration partners, including milestone payments and royalties on future product sales; (v) the impact of global business, political and macroeconomic conditions, cybersecurity events, instability in the banking system, and global events, including regional conflicts around the world, on Nurix’s business, clinical trials, financial condition, liquidity and results of operations; (vi) whether Nurix will be able to protect intellectual property and (vii) other risks and uncertainties described under the heading “Risk Factors” in Nurix’s Quarterly Report on Form 10-Q for the fiscal quarter ended August 31, 2024, and other SEC filings. Accordingly, readers are cautioned not to place undue reliance on these forward-looking statements. The statements in this press release speak only as of the date of this press release, even if subsequently made available by Nurix on its website or otherwise. Nurix disclaims any intention or obligation to update publicly any forward-looking statements, whether in response to new information, future events, or otherwise, except as required by applicable law.

Contacts:

Investors

Jason Kantor, Ph.D.

Nurix Therapeutics, Inc.

ir@nurixtx.com

Elizabeth Wolffe, Ph.D.

Wheelhouse Life Science Advisors

lwolffe@wheelhouselsa.com

Media

Aljanae Reynolds

Wheelhouse Life Science Advisors

areynolds@wheelhouselsa.com

– More –

| Nurix Therapeutics, Inc. Condensed Consolidated Statements of Operations (in thousands, except share and per share amounts) (unaudited) |

|||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||

| August 31, | August 31, | ||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Revenue: | |||||||||||||||

| Collaboration revenue | $ | 12,588 | $ | 18,467 | $ | 41,265 | $ | 41,828 | |||||||

| License revenue | — | — | — | 20,000 | |||||||||||

| Total revenue | 12,588 | 18,467 | 41,265 | 61,828 | |||||||||||

| Operating expenses: | |||||||||||||||

| Research and development | 55,481 | 47,856 | 154,408 | 139,435 | |||||||||||

| General and administrative | 11,718 | 10,623 | 35,227 | 32,122 | |||||||||||

| Total operating expenses | 67,199 | 58,479 | 189,635 | 171,557 | |||||||||||

| Loss from operations | (54,611 | ) | (40,012 | ) | (148,370 | ) | (109,729 | ) | |||||||

| Interest and other income, net | 5,737 | 3,030 | 13,612 | 7,737 | |||||||||||

| Loss before income taxes | (48,874 | ) | (36,982 | ) | (134,758 | ) | (101,992 | ) | |||||||

| Provision for income taxes | 82 | — | 262 | — | |||||||||||

| Net loss | $ | (48,956 | ) | $ | (36,982 | ) | $ | (135,020 | ) | $ | (101,992 | ) | |||

| Net loss per share, basic and diluted | $ | (0.67 | ) | $ | (0.68 | ) | $ | (2.13 | ) | $ | (1.88 | ) | |||

| Weighted-average number of shares outstanding, basic and diluted | 72,779,381 | 54,390,859 | 63,384,174 | 54,227,491 | |||||||||||

| Nurix Therapeutics, Inc. Condensed Consolidated Balance Sheets (in thousands) (unaudited) |

|||||||

| August 31, | November 30, | ||||||

| 2024 | 2023 | ||||||

| Assets | |||||||

| Current assets: | |||||||

| Cash and cash equivalents | $ | 99,044 | $ | 54,627 | |||

| Marketable securities, current | 349,008 | 233,281 | |||||

| Prepaid expenses and other current assets | 7,991 | 7,595 | |||||

| Total current assets | 456,043 | 295,503 | |||||

| Marketable securities, non-current | 9,472 | 7,421 | |||||

| Operating lease right-of-use assets | 27,083 | 31,142 | |||||

| Property and equipment, net | 17,069 | 16,808 | |||||

| Restricted cash | 901 | 901 | |||||

| Other assets | 3,032 | 3,823 | |||||

| Total assets | $ | 513,600 | $ | 355,598 | |||

| Liabilities and stockholders’ equity | |||||||

| Current liabilities: | |||||||

| Accounts payable | $ | 3,918 | $ | 6,401 | |||

| Accrued expenses and other current liabilities | 27,828 | 24,970 | |||||

| Operating lease liabilities, current | 6,553 | 7,489 | |||||

| Deferred revenue, current | 47,997 | 48,098 | |||||

| Total current liabilities | 86,296 | 86,958 | |||||

| Operating lease liabilities, net of current portion | 20,590 | 23,125 | |||||

| Deferred revenue, net of current portion | 29,858 | 45,022 | |||||

| Total liabilities | 136,744 | 155,105 | |||||

| Stockholders’ equity: | |||||||

| Common stock | 67 | 49 | |||||

| Additional paid-in-capital | 1,056,665 | 746,299 | |||||

| Accumulated other comprehensive loss | 344 | (655 | ) | ||||

| Accumulated deficit | (680,220 | ) | (545,200 | ) | |||

| Total stockholders’ equity | 376,856 | 200,493 | |||||

| Total liabilities and stockholders’ equity | $ | 513,600 | $ | 355,598 | |||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Marijuana Stock Movers For October 11, 2024

GAINERS:

LOSERS:

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.

Is It Too Late to Buy Nvidia Stock? Evidence Is Piling Up That Provides a Compelling Answer.

There are no two ways about it: The dawn of the artificial intelligence (AI) revolution in early 2023 has been a windfall for chipmaker Nvidia (NASDAQ: NVDA). The company pioneered the graphics processing units (GPUs) that have become the gold standard for a variety of use cases by providing the computational horsepower needed to underpin video games, data centers, and even earlier versions of AI.

Generative AI went viral early last year, with Nvidia at the heart of what many are calling the next industrial revolution. The results have been striking: Nvidia stock is up more than 800% since the start of 2023 and hovers less than 2% off its all-time high (as of this writing) — but it’s been a bumpy ride. Nvidia stock lost as much as 27% during the four weeks starting in early July but has rebounded vigorously, gaining nearly all that back over the past month.

Causing the recent decline were fears that demand for AI could dwindle, and a great deal of future growth was already baked into the stock price. That said, there’s mounting evidence that answers the question: Is it too late to buy Nvidia stock?

Faltering demand, or the calm before the storm?

What distinguishes generative AI from its predecessors is the need for not only massive amounts of data, but also the corresponding computational horsepower needed to parse the data. When it comes to AI-centric processors, Nvidia is without equal, controlling an estimated 98% of the market in 2023, similar to its share in 2022, according to semiconductor analyst company TechInsights. This dominance put Nvidia in pole position when generative AI burst on the scene.

The unprecedented demand fueled triple-digit revenue and profit growth for Nvidia for five successive quarters. So, when the company forecast only 79% growth for its fiscal 2025 third quarter (which ends in late October), some investors saw the writing on the wall. They concluded that demand was ebbing and they headed for the exits, but that move was likely premature — and costly. The evidence is growing that demand for AI continues unabated.

Super Micro Computer, commonly called Supermicro, provided one piece to the demand puzzle on Monday. In a press release, the company revealed that it had delivered more than 2,000 direct liquid-cooling (DLC) rack systems since June and was currently shipping more than 100,000 GPUs per quarter. Shipments of that magnitude suggest that demand for Nvidia’s GPUs remains robust.

Nvidia CEO Jensen Huang provided some boots-on-the-ground commentary as well. In an interview late last week, the chief executive said that demand for Blackwell — the company’s next-generation AI platform — is “insane.” He called this the “first wave of AI,” which started with the modernization of $1 trillion worth of existing data centers, upgrading them with chips capable of processing generative AI. Huang went on to say that the next phase — the “biggest wave of AI” — will involve “companies using AI to be more productive.” These comments suggest that the AI boom has only just begun.

Furthermore, Nvidia recently expanded its partnership with global IT consultancy company Accenture to help enterprise companies “rapidly scale their AI adoption.” To that end, Accenture launched the new Accenture Nvidia Business Group, which will be staffed by 30,000 business professionals to help customers with “process reinvention, AI-powered simulation, and sovereign AI.” Accenture noted in the press release that generative AI drove $3 billion in bookings in its recently completed fiscal year and shows no signs of slowing.

Finally, data provided on Wednesday by Taiwan Semiconductor Manufacturing, commonly called TSMC, left no question about the ongoing demand for AI. The company released its September Revenue Report, which reported quarterly revenue of 759.7 billion New Taiwan dollars ($24.6 billion), increasing 39% year over year and coasting past Wall Street’s consensus estimate of NT$748. Nvidia is one of TSMC’s largest customers, accounting for roughly 11% of sales last year. This suggests that AI-related demand remains strong for Nvidia as well.

The evidence is clear

Nvidia investors have been on a non-stop thrill ride since early last year. The company’s fiscal 2025 second-quarter results help illustrate its success. For the fiscal 2025 second quarter (ended July 28), Nvidia delivered record revenue that grew 122% year over year to $30 billion, fueled by record data center revenue of $26.3 billion, up 154%. Profits also soared as diluted earnings per share (EPS) of $0.67 surged 168%.

Nvidia won’t report its fiscal third-quarter results until late November, so we won’t know for sure until then. However, if the latest developments are any indication, Nvidia should have another strong showing in the works.

The company’s forecast is calling for revenue of $32.5 billion, which would represent year-over-year growth of 79%, with a corresponding increase in profitability. While that’s slower than the triple-digit growth investors had become accustomed to, it’s remarkable nonetheless.

Then there’s the matter of Nvidia’s valuation. At 62 times earnings, it certainly appears expensive — at least at first glance. However, Wall Street is forecasting EPS of $4.02 for Nvidia’s fiscal year that begins in January. That works out a forward price-to-earnings (P/E) ratio of 33, which is only slightly higher than the multiple of 30 for the S&P 500.

For me, the evidence is clear: Nvidia stock is still a buy.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,855!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,423!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $392,297!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Danny Vena has positions in Nvidia and Super Micro Computer. The Motley Fool has positions in and recommends Accenture Plc, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2025 $290 calls on Accenture Plc and short January 2025 $310 calls on Accenture Plc. The Motley Fool has a disclosure policy.

Is It Too Late to Buy Nvidia Stock? Evidence Is Piling Up That Provides a Compelling Answer. was originally published by The Motley Fool

Unity Bancorp Reports Quarterly Earnings of $10.9 Million

CLINTON, N.J., Oct. 11, 2024 (GLOBE NEWSWIRE) — Unity Bancorp, Inc. UNTY, parent company of Unity Bank, reported net income of $10.9 million, or $1.07 per diluted share, for the quarter ended September 30, 2024, compared to net income of $9.5 million, or $0.93 per diluted share for the quarter ended June 30, 2024. This represents a 15.3% increase in net income and a 15.1% increase in net income per diluted share. For the nine months ended September 30, 2024, Unity Bancorp reported net income of $29.9 million, or $2.94 per diluted share, compared to net income of $29.9 million, or $2.88 per diluted share, for the nine months ended September 30, 2023. This represents no change in net income and a 2.1% increase in net income per diluted share, reflecting the Company’s repurchase of outstanding shares.

James A. Hughes, President and CEO, commented on the financial results: “We are excited to announce the highest quarterly earnings results in the Unity Bancorp Inc.’s history. For the quarter, we achieved $10.9 million of net income, equivalent to $1.07 per diluted share. Our net interest margin expanded to 4.16% and we delivered an impressive ROA of 1.76% and ROE of 15.55%.

In the third quarter, our organization demonstrated its commitment to granting credit to small and medium-sized businesses operating in our local communities. Gross loans grew $46.9 million, or 2.2%, and commercial loans grew $50.6 million, or 3.8%, sequentially.

We have also benefited from continued deposit momentum, with customer deposits growing $42.6 million, or 2.4% sequentially. Deposits will continue to be the fuel that enables our credit growth. We look forward to continuing to support our communities by growing loans and deposits in tandem.

In September, the Federal Reserve cut short-term interest rates 50 basis points, signaling a change to the operating environment. At Unity, we are able to maintain strong profitability metrics in all interest rate scenarios. We will continue to manage our interest rate sensitivity, maintain a conservative capital position and ensure ample liquidity levels. Our asset quality ratios remain favorable and we closely monitor and manage our nonperforming and past-due credit relationships.

Lastly, our strong financial results are a reflection of our talented employee base. Their hard work and dedication to our company significantly support the local economies of the communities we serve.”

For the full version of the Company’s quarterly earnings release, including financial tables, please visit News – Unity Bank (q4ir.com).

Unity Bancorp, Inc. is a financial services organization headquartered in Clinton, New Jersey, with approximately $2.6 billion in assets and $2.0 billion in deposits. Unity Bank, the Company’s wholly owned subsidiary, provides financial services to retail, corporate and small business customers through its robust branch network located in Bergen, Hunterdon, Middlesex, Morris, Ocean, Somerset, Union and Warren Counties in New Jersey and Northampton County in Pennsylvania. For additional information about Unity, visit our website at www.unitybank.com, or call 800-618-BANK.

This news release contains certain forward-looking statements, either expressed or implied, which are provided to assist the reader in understanding anticipated future financial performance. These statements may be identified by use of the words “believe”, “expect”, “intend”, “anticipate”, “estimate”, “project” or similar expressions. These statements involve certain risks, uncertainties, estimates and assumptions made by management, which are subject to factors beyond the Company’s control and could impede its ability to achieve these goals. These factors include those items included in our Annual Report on Form 10-K under the heading “Item IA-Risk Factors” as amended or supplemented by our subsequent filings with the SEC, as well as general economic conditions, trends in interest rates, the ability of our borrowers to repay their loans, our ability to manage and reduce the level of our nonperforming assets, results of regulatory exams, and the impact of any health crisis or national disasters on the Bank, its employees and customers, among other factors.

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction.

News Media & Financial Analyst Contact:

George Boyan, EVP and CFO

(908) 713-4565

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Producer Inflation Rises More Than Expected In September As Food, Transportation Costs Jump

Price pressures on U.S. producers jumped unexpectedly in September, mirroring a similar trend observed in consumer inflation data reported a day earlier.

The Producer Price Index (PPI) rose more sharply than anticipated in September, and the August reading was upwardly revised. Core producer prices — excluding energy and food — also climbed more than forecasted.

Prior to the release of the PPI report, traders had assigned a nearly 85% chance of a 25-basis-point interest rate cut in November.

September Producer Price Index Report: Key Highlights

- Headline PPI for final demand rose by 1.8% year-over-year in September, down from an upwardly revised 1.9% in August. This outcome was slightly above economist expectations of 1.6%, as tracked by TradingEconomics.

- On a monthly basis, PPI flattened, decelerating from August’s reading and coming in below the forecasted 0.1% increase.

- Food costs soared by 1% month-over-month, recording the largest increase since February.

- A significant factor in the September rise in prices for final demand services was a 3% increase in the index for deposit services.

- Other contributing indexes included machinery and vehicle wholesaling, furniture retailing, software publishing for desktop and portable devices, apparel wholesaling, and airline passenger services, all of which saw gains

- Core PPI soared to 2.8% year-over-year in September, up from August’s 2.4% and slightly above market expectations of 2.7%.

- On a month-over-month basis, core PPI rose 0.2%, down from August’s 0.2% pace and matching forecasts.

| PPI Metrics | September 2024 | August 2024 | Econ. consensus |

|---|---|---|---|

| Headline PPI (YoY) | 1.8% | 1.9% (upwardly revised from 1.7%) |

1.6% |

| Headline PPI (MoM) | 0.0% | 0.2% | 0.1% |

| Core PPI (YoY) | 2.8% | 2.4% | 2.7% |

| Core PPI (MoM) | 0.2% | 0.3% | 0.2% |

Market Reactions

November interest rate cut expectations a marginal downward move after the release.

The U.S. dollar index (DXY), tracked by the Invesco DB USD Index Bullish Fund ETF UUP, as Treasury yields inched higher.

Notably, 30-year yields were up by 5 basis points to 4.41%, the highest since late July. As such, the iShares 20+ Year Treasury Bond ETF TLT was 0.7% lower during the premarket trading in New York, eyeing a 10-week low.

Futures on the S&P 500 were unchanged, while contracts on the tech-heavy Nasdaq 100 eased 0.2%. On Wednesday, , the SPDR S&P 500 ETF Trust SPY closed 0.2% lower.

Read Next:

Photo via Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Grown Rogue Secures $800K, Vireo Forfeits 4.5M Warrants In Cannabis Shakeup—What's Next For Both?

Grown Rogue International Inc. GRIN GRUSF a craft cannabis company based in Oregon’s Rogue Valley announced the termination of its advisory agreement with Vireo Growth Inc. VREO VREOF as of September 30, 2024.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

The Deal

The deal, in place for 18 months, saw Grown Rogue providing advisory services to Vireo’s cultivation operations across several markets, including New Jersey.

As part of the termination, Vireo will forfeit 4.5 million of the 8.5 million warrants it held in Grown Rogue, with a strike price of CAD $0.225, equivalent to approximately $759,375.

Additionally, Vireo has agreed to pay Grown Rogue $800,000, with the option to defer the payment in four quarterly installments of $250,000. Grown Rogue will retain 10 million Vireo warrants and receive full fees for services rendered during Q3.

Read Also: Tilray Reports $200M Q1 Net Revenue, Up 13% YoY As Net Loss Improves

CEO Obie Strickler of Grown Rogue expressed gratitude for the collaboration, emphasizing that the agreement helped Grown Rogue sharpen its strategy for national expansion. The company now plans to apply these learnings to its New Jersey operations and expand into Illinois in 2025.

Leadership Transition At Vireo Growth

On the same day, Vireo announced a leadership transition, with Amber Shimpa stepping into the role of CEO. Shimpa, with the company since 2014, previously served as President. She replaces Josh Rosen, who resigned from his role as CEO and interim CFO but will remain an advisor. Vireo also appointed Joe Duxbury as interim CFO.

Shimpa’s leadership will focus on the company’s upcoming expansion into Minnesota’s adult-use market next year.

Read Next: Hold My Beer: Breweries Offer THC On Tap In Minnesota, What Investors Need To Know

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.