US Banks Top Q3 Earnings Estimates: JPMorgan Delivers 'Robust Beat,' Financial Sector Stocks Hit Record Highs

The U.S. financial sector kicked off the third-quarter earnings season on a high note as major players, including JPMorgan Chase & Co. JPM, Wells Fargo Corp. WFC, Bank of New York Mellon Corp. BK, and BlackRock Inc. BLK, all beat analyst expectations for earnings per share (EPS).

These results mark a strong start for the financial industry. Shares of each bank responded positively, with notable gains across the board.

The Financial Select Sector SPDR Fund XLF rallied nearly 2% to fresh record highs, eyeing the strongest-performing day since November 2023.

Chart: XLF ETF Sets New All-Time Highs As Major Banks Report Strong Q3 Earnings

JPMorgan Chase Q3 2024: A Beat Across The Board

JPMorgan Chase delivered another standout performance last quarter, surpassing both top and bottom-line estimates. The bank reported an EPS of $4.37, well above the analyst consensus of $4.00.

Revenue came in at $43.32 billion, topping estimates of $41.82 billion, fueled by stronger-than-expected performance across various segments.

- Investment banking revenue: $2.35 billion vs. $2.13 billion expected

- Equities sales & trading revenue: $2.62 billion vs. $2.37 billion estimate

- FICC sales & trading revenue: $4.53 billion vs. $4.36 billion expected

- Net interest income: $23.53 billion, beating the $22.8 billion estimate

The bank’s net charge-offs were $2.09 billion, below the $2.37 billion forecast, while total loans stood at $1.34 trillion, just edging past the expected $1.33 trillion. Total deposits reached $2.43 trillion, slightly above estimates.

Goldman Sachs analyst Richard Ramsden praised the bank’s “robust beat across every line,” noting JPMorgan’s operational strength. Management also raised its full-year 2024 net interest income (NII) guidance to $92.5 billion, up $1 billion from prior estimates, while slightly lowering expense forecasts.

Stock Reaction: JPMorgan shares surged over 5% in early trading, reflecting investor confidence in the bank’s strong results and upgraded outlook.

Wells Fargo: Solid Earnings But Weaker NII Guidance

Wells Fargo also posted stronger-than-expected third-quarter 2024 earnings, with EPS of $1.42, exceeding the $1.28 consensus. Total revenue reached $20.37 billion, narrowly missing the estimate of $20.41 billion.

While the bank’s net interest income (NII) fell short at $11.69 billion versus the expected $11.88 billion, its efficiency ratio of 64% matched market expectations, suggesting a steady cost-control effort.

The bank’s provision for credit losses was $1.07 billion, below the $1.34 billion consensus. Meanwhile, total average loans stood at $910.3 billion, in line with forecasts.

Wells Fargo’s CEO emphasized strong growth in fee-based revenue, which rose 16% year-over-year. However, the bank projected that NII would decline 8-9% for the full year 2024, leading to some investor caution.

“We expect a moderately positive investor response to results, as guidance implies no change to 4Q24 NII, and thus the same NII jumping off point for 2025,” Goldman Sachs’ Ramsden wrote.

Stock Reaction: Despite the slight revenue miss and cautious guidance, Wells Fargo shares jumped 5.5%, boosted by optimism about the bank’s ability to manage expenses and future growth.

Bank of New York Mellon: Strong Fee Revenue Drives Beat

Bank of New York Mellon (BNY Mellon) reported adjusted Q3 2024 EPS of $1.52, beating the analyst consensus of $1.42. The bank’s total revenue increased by 5% year-over-year to $4.648 billion, exceeding the $4.542 billion estimate. This growth was driven by a 5% rise in fee revenue, which reached $3.404 billion, bolstered by improved investment performance.

Net interest income also saw a modest 3% increase year-over-year. Meanwhile, noninterest expenses were flat at $3.1 billion, reflecting the company’s focus on efficiency savings.

BNY Mellon returned over $1 billion to shareholders through dividends and stock buybacks, achieving a 103% payout ratio year-to-date.

“The firm’s fee growth algo remains somewhat underappreciated by the market, which we think collectively sets up the stock well for durable EPS growth over the coming years and further upside to the stock,” Ramsden wrote.

Stock Reaction: Shares of BNY Mellon rose nearly 2%, and they are on track for their sixth straight session of gains, which has seen the stock hit new highs.

Read More: BNY Q3 Earnings: Fee Income Soars 5%, Setting New $50T Record In Assets Under Custody

BlackRock: Performance Fees Power Earnings Beat

BlackRock delivered strong third-quarter 2024 results, with adjusted EPS of $11.46, comfortably beating consensus estimates of $10.38.

Total revenue of $5.2 billion was 4% above analyst expectations, driven primarily by a significant outperformance in performance fees, coming in at $388 million vs. $168 million expected.

BlackRock’s organic growth was equally impressive. With $221 billion in total flows, it achieved 8% annualized organic growth for the quarter.

This strong performance underscored BlackRock’s ability to capitalize on favorable market conditions and maintain its leadership in asset management.

“We think BLK’s 3Q results clear a relatively high bar underscored by accelerating flow trends,” Ramsden said.

Stock Reaction: BlackRock shares surged over 4%, hitting record highs and marking the stock’s strongest session of the year.

Read Next:

Image created using artificial intelligence via Midjourney.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Corporate and Municipal CUSIP Request Volumes Slow in September

NORWALK, Conn., Oct. 11, 2024 (GLOBE NEWSWIRE) — CUSIP Global Services (CGS) today announced the release of its CUSIP Issuance Trends Report for September 2024. The report, which tracks the issuance of new security identifiers as an early indicator of debt and capital markets activity over the next quarter, found a decrease in request volume for new corporate and municipal identifiers.

North American corporate CUSIP requests totaled 7,160 in September, which is down 5.8% on a monthly basis. On a year-over-year basis, North American corporate requests closed the month up 4.3%. The monthly decline in volume was driven by a 7.7% decrease in request volume for U.S. corporate equity identifiers and a 10.0% decrease in request volume for Canadian corporate identifiers. Request volumes for short-term certificates of deposit (-5.4%) and longer-term certificates of deposit (-19.1%) also fell in September.

The aggregate total of identifier requests for new municipal securities – including municipal bonds, long-term and short-term notes, and commercial paper – fell 10.2% versus August totals. On a year-over-year basis, overall municipal volumes are up 7.2%. Texas led state-level municipal request volume with a total of 167 new CUSIP requests in September, followed by New York (134) and California (69).

“While CUSIP request volume is down across most asset classes, this month, that is largely a reflection of difficult comparisons to last month, where we saw a significant surge in new issuance activity,” said Gerard Faulkner, Director of Operations for CGS. “On an annualized basis, we’re seeing a positive trend in CUSIP request volume as we turn the corner to the fourth quarter.”

Requests for international equity CUSIPs fell 9.5% in September and international debt CUSIP requests rose 13.2%. On an annualized basis, international equity CUSIP requests are down 2.4% and international debt CUSIP requests are up 100.3%.

To view the full CUSIP Issuance Trends report for September, please click here.

Following is a breakdown of new CUSIP Identifier requests by asset class year-to-date through September 2024:

| Asset Class | 2024 YTD | 2023 YTD | YOY Change | |

| International Debt | 4,732 | 2,363 | 100.3% | |

| Long-Term Municipal Notes | 533 | 302 | 76.5% | |

| Private Placement Securities | 3,331 | 2,562 | 30.0% | |

| U.S. Corporate Debt | 18,845 | 15,372 | 22.6% | |

| U.S. Corporate Equity | 8,783 | 7,503 | 17.1% | |

| Syndicated Loans | 2,226 | 1,945 | 14.4% | |

| Municipal Bonds | 7,452 | 6,970 | 6.9% | |

| Canada Corporate Debt & Equity | 4,520 | 4,299 | 5.1% | |

| International Equity | 1,135 | 1,163 | -2.4% | |

| CDs > 1-year Maturity | 6,558 | 7,362 | -10.9% | |

| Short-Term Municipal Notes | 862 | 1,025 | -15.9% | |

| CDs < 1-year Maturity | 7,602 | 9,136 | -16.8% | |

About CUSIP Global Services

CUSIP Global Services (CGS) is the global leader in securities identification. The financial services industry relies on CGS’ unrivaled experience in uniquely identifying instruments and entities to support efficient global capital markets. Its extensive focus on standardization over the past 50 plus years has helped CGS earn its reputation as the industry standard provider of reliable, timely reference data. CGS is also a founding member of the Association of National Numbering Agencies (ANNA) and co-operates ANNA’s hub of ISIN data, the ANNA Service Bureau. CGS is managed on behalf of the American Bankers Association (ABA) by FactSet Research Systems Inc., with a Board of Trustees that represents the voices of leading financial institutions. For more information, visit www.cusip.com.

About The American Bankers Association

The American Bankers Association is the voice of the nation’s $24 trillion banking industry, which is composed of small, regional and large banks that together employ approximately 2.1 million people, safeguard $19 trillion in deposits and extend $12.4 trillion in loans.

For More Information:

John Roderick

john@jroderick.com

+1 (631) 584.2200

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Beverage Packaging Market is Anticipated to Grow at a CAGR of 4.7% through 2031, Claims SkyQuest Technology

Westford, USA, Oct. 11, 2024 (GLOBE NEWSWIRE) — SkyQuest projects that the global beverage packaging market will attain a value of USD 196.23 billion by 2031, with a CAGR of 4.7% over the forecast period 2024 to 2031. Rapidly increasing industrialization and advancements in chemical manufacturing technologies are forecasted to bolster the sales of beverage packaging over the coming years. High demand for agrochemicals in the wake of rapidly increasing global population also offers lucrative opportunities for beverage packaging companies.

Download a detailed overview: https://www.skyquestt.com/sample-request/beverage-packaging-market

Browse in-depth TOC on “Beverage Packaging Market” Pages – 197, Tables – 95, Figures – 76

Report Overview:

| Report Coverage | Details |

| Market Revenue in 2023 | $144.1 Billion |

| Estimated Value by 2031 | $196.23 Billion |

| Growth Rate | Poised to grow at a CAGR of 4.7% |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Material, Packaging, Application, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the world |

| Report Highlights | Updated financial information/product portfolio of players |

| Key Market Opportunities | Development of sustainable and eco-friendly Beverage Packaging |

| Key Market Drivers | Growing use of Beverage Packaging in different manufacturing applications |

Versatility of Plastic Allows it Remain the Preferred Material for Beverage Packaging

Plastic has emerged as a popular choice for packaging liquid and beverages since the 1970s and its popularity has never slowed down. From being cost-effective to lightweight, plastic helps companies deliver their beverages in a safe way while being highly profitable. Easy branding and marketing opportunities offered by versatility of plastic material will also help the dominance of this segment.

Demand for Beverage Packaging for Water is Slated to Surge at Notable Pace

Growing awareness regarding the importance of hydration among people and rising consumption of different types of water ranging from spring to black are helping create new opportunities in the market. Demand for sustainable and eco-friendly beverage packaging is estimated to surge at an impressive pace over the coming years. Use of recycled materials for water packaging will be a major trend for beverage packaging companies in the long run.

Presence of Key Beverage Manufacturers Helps Asia Pacific Emerge as Leader

Evolving consumer preferences and changing lifestyles are expected to bolster the demand for new beverages thereby also driving beverage packaging market growth. Rapidly increasing population in the Asia Pacific region, rising disposable income, and supportive government initiatives for manufacturing industries make this a highly rewarding market for beverage packaging companies. Consumerist economies of India and China are slated to spearhead the demand for beverage packaging in this region.

Request Free Customization of this report: https://www.skyquestt.com/speak-with-analyst/beverage-packaging-market

Beverage Packaging Market Insights:

Drivers

- Rising demand for different types of beverages

- Evolving consumer preferences and lifestyle changes

- Growing beverage manufacturing activity

Restraints

- Ban on use of plastic in different countries

- Fluctuations in availability and pricing of raw materials

Prominent Players in Beverage Packaging Market

- Amcor Limited

- Ardagh Group S.A.

- Ball Corporation

- Berry Global Inc.

- Crown Holdings, Inc.

- Mondi plc

- Orora Packaging Australia Pty Ltd

- SIG Combibloc Group AG

- Smurfit Kappa Group PLC

- Sonoco Products Company

Key Questions Answered in Beverage Packaging Market Report

- What drives the global market growth?

- Who are the leading beverage packaging providers in the world?

- Which region leads the demand for beverage packaging in the world?

Is this report aligned with your requirements? Interested in making a Purchase – https://www.skyquestt.com/buy-now/beverage-packaging-market

This report provides the following insights:

- Analysis of key drivers (rising demand for different types of beverages, evolving consumer preferences and lifestyle changes, growing beverage manufacturing activity), restraints (fluctuations in raw material pricing, bans on use of plastic), and opportunities (development of eco-friendly and sustainable beverage packaging), influencing the growth of Beverage Packaging market.

- Market Penetration: All-inclusive analysis of product portfolio of different market players and status of new product launches.

- Product Development/Innovation: Elaborate assessment of R&D activities, new product development, and upcoming trends of the Beverage Packaging market.

- Market Development: Detailed analysis of potential regions where the market has potential to grow.

- Market Diversification: Comprehensive assessment of new product launches, recent developments, and emerging regional markets.

- Competitive Landscape: Detailed analysis of growth strategies, revenue analysis, and product innovation by new and established market players.

Related Reports:

Sodium Nitrate Market: Global Opportunity Analysis and Forecast, 2024-2031

Lubricant Additives Market: Global Opportunity Analysis and Forecast, 2024-2031

Green Chemicals Market: Global Opportunity Analysis and Forecast, 2024-2031

About Us:

SkyQuest is an IP focused Research and Investment Bank and Accelerator of Technology and assets. We provide access to technologies, markets and finance across sectors viz. Life Sciences, CleanTech, AgriTech, NanoTech and Information & Communication Technology.

We work closely with innovators, inventors, innovation seekers, entrepreneurs, companies and investors alike in leveraging external sources of R&D. Moreover, we help them in optimizing the economic potential of their intellectual assets. Our experiences with innovation management and commercialization has expanded our reach across North America, Europe, ASEAN and Asia Pacific.

Contact:

Mr. Jagraj Singh

Skyquest Technology

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 351-333-4748

Email: sales@skyquestt.com

Visit Our Website: https://www.skyquestt.com/

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dow Jones Futures Fall; Tesla Stock Tumbles After Robotaxi Event; JPMorgan Earnings Top

Dow Jones futures were little changed early Friday, while S&P 500 futures and Nasdaq futures fell slightly.

Elon Musk showed off the Cybercab and Robovan at Thursday night’s Tesla robotaxi event. He once again sees self driving “next year.” There was no sighting or mention of an “affordable EV” expected in early 2025. Tesla (TSLA) fell solidly in premarket trading, while Uber Technologies (UBER) jumped.

JPMorgan Chase (JPM) kicked off bank earnings Friday morning, rising on strong results and net interest income guidance.

↑

X

This Leading Chip Stock’s Earnings Could Be Barometer For AI Spending Strength

The stock market fell slightly Thursday amid talk of a Fed rate-cut “pause.” Nvidia (NVDA) resumed its strong run, with several tech plays making bullish moves.

Dow Jones Futures Today

Dow Jones futures were even vs. fair value, with JPMorgan providing a lift. S&P 500 futures edged lower and Nasdaq 100 futures fell 0.2%, with Tesla a drag.

Crude oil futures fell slightly.

Overnight action in Dow futures and elsewhere doesn’t necessarily translate into actual trading in the next regular stock market session.

Join IBD experts as they analyze leading stocks and the market on IBD Live

Tesla Robotaxi Event

At the Tesla robotaxi event, Elon Musk rode the two-seat Cybercab, with butterfly doors and no steering wheel, briefly to the stage.

Musk expects the Cybercab price tag will be below $30,000, with production starting “before 2027.”

Further, he expects “fully autonomous unsupervised FSD in California and Texas next year — that’s with the Model 3 and Model Y.”

However, he admitted, “I tend to be a little optimistic with time frames.”

Elon Musk has said for years that Tesla would achieve self-driving “this year” or “next year,” while production targets often slip considerably. He also didn’t offer new evidence that Tesla FSD was making progress toward actual self-driving.

Musk didn’t offer significant details about business models, such as a ride-hailing service. There had been speculation that Tesla would launch a ride-hailing service with human drivers.

He also showed off a large Robovan, but with no timing on when that will go into production.

Musk also showed off the latest Optimus robot, with a handful walking around. He expects that the cost could be $25,000-$30,000 when produced at scale.

Notably, Tesla did not show or even mention an “affordable” vehicle. It’s supposed to enter production by mid-2025, but there have been no images of that, let alone a prototype. An affordable EV is key to Tesla’s near-term efforts to boost deliveries and use up excess capacity at its existing plants.

Tesla is pushing hard to boost sales and FSD take rates in Q4. On Thursday, Tesla will again let owners transfer FSD to a new Model 3, Y, S or X through Dec. 31. That comes on the heels of 0% financing for Model 3 and Y buys that include buying FSD.

Tesla Stock Tumbles

Tesla stock sold off 6% in premarket trading, threatening to undercut the 50-day line. Shares fell nearly 1% to 238.77 Thursday.

The EV giant has a 264.86 cup-with-handle buy point, according to MarketSurge. The 250 area offers an early entry.

The initial negative reaction to the Tesla robotaxi is a positive for ride-hailing giants Uber and Lyft (LYFT). Both jumped, with Uber stock set to break out.

Bank Earnings

JPMorgan earnings and revenue topped, with investment banking revenue above targets. The Wall Street giant added $1 billion to net reserves for credit losses, slightly more than expected. JPMorgan guided slightly higher on full-year net interest income, just a few weeks after warning that analyst estimates on NII were too high. JPMorgan stock advanced slightly in premarket trade. Shares are working on a flat base, just above its 50-day line.

Wells Fargo (WFC) topped EPS estimates, but revenue and net interest income slightly missed. Wells Fargo, which has lagged other banks, climbed modestly before Friday’s open, potentially breaking a trendline entry.

Asset management giant BlackRock (BLK) easily beat Q3 views before the open, with assets under management nearly hitting $11.5 billion. Blackrock stock, extended from buy points, was up modestly.

Stock Market Rally Thursday

CPI inflation came in hot and Atlanta Fed President Raphael Bostic raised the possibility of a November rate-cut “pause.” But the major stock indexes barely dipped.

The Dow Jones Industrial Average fell 0.1% in Thursday’s stock market trading. The S&P 500 index slipped 0.2% after hitting a record high Wednesday. The Nasdaq lost a fraction. The small-cap Russell 2000 declined 0.55%, but rebounded off its 50-day.

Many leading stocks made bullish moves, including AI play Samsara (IOT) and cybersecurity stocks Palo Alto Networks (PANW) and Fortinet (FTNT). Meanwhile, some techs are racing up from the bottom, including AI IPO Astera Labs (ALAB), Cloudflare (NET) and Datadog (DDOG).

ADMA Biologics (ADMA) dived 16%, knifing through its 50-day line. The big 2024 winner announced that its auditor is resigning.

Insurers, including Brown & Brown (BRO), reversed lower Thursday. They’ve had some swings this week due to Hurricane Milton.

U.S. crude oil prices popped 3.6% to $75.85 a barrel. The 10-year Treasury yield climbed three basis points to 4.09%, continuing a big run.

Nvidia stock is on IBD Leaderboard and SwingTrader. Samsara stock, Fortinet and Nvidia are on the IBD 50. Samsara was Thursday’s IBD Stock Of The Day.

ETFs

Among growth ETFs, the Innovator IBD 50 ETF (FFTY) fell 1.3%, hit by ADMA stock. The iShares Expanded Tech-Software Sector ETF (IGV) climbed 0.7%. The VanEck Vectors Semiconductor ETF (SMH) dipped 0.2%, even with Nvidia stock the dominant holding.

ARK Innovation ETF (ARKK) retreated 1%. Tesla stock remains a major holding across Ark Invest’s ETFs. Cathie Wood also owns a lot of Nvidia.

Nvidia AI Chips Sold Out

Nvidia stock rose 1.6% on Thursday, 134.81, still in buy range from various entries, including the Aug. 26 high of 131.26. Since testing its 50-day line on Oct. 1, NVDA stock has jumped 15.2%.

Nvidia executives told Morgan Stanley analysts that production of Blackwell artificial intelligence processors is in full swing, with the next-generation AI chips sold out for the next 12 months.

Advanced Micro Devices (AMD) on Thursday unveiled its upcoming Blackwell rival, with Instinct MI325X production starting by year-end. CEO Lisa Su predicted a $500 billion market for AI accelerators by 2028. AMD stock, which has lagged Nvidia and many other AI chip names, fell 4% Thursday.

What To Do Now

The stock market rally continues to act well. You can keep making incremental buys. If you already have heavy exposure, you might offset new buys by trimming or exiting relative laggards.

But if you’ve built up your portfolio and those stocks are working, let those positions work for the most part.

Keep updating your watchlists, reviewing your holdings and staying engaged.

Read The Big Picture every day to stay in sync with the market direction and leading stocks and sectors.

Please follow Ed Carson on Threads at @edcarson1971 and X/Twitter at @IBD_ECarson for stock market updates and more.

YOU MAY ALSO LIKE:

Why This IBD Tool Simplifies The Search For Top Stocks

Best Growth Stocks To Buy And Watch

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

How To Invest: Rules For When To Buy And Sell Stocks In Bull And Bear Markets

Billionaires Are Buying This Cryptocurrency That Could Soar 2,276%, According to Cathie Wood

The crypto market is preparing to soar, according to many famous investors. For example, ARK Invest founder Cathie Wood sees a bull-case price point of $1.5 million per Bitcoin (CRYPTO: BTC) in 2030. That would be a 2,276% return from today’s price, or a compound annual growth rate (CAGR) of 70% for six years.

That’s Wood’s most optimistic forecast, but even her bottom-end projections call for a $650,000 Bitcoin price by the end of this decade. Plenty of billionaires are building positions in this promising digital asset these days, hoping to capture the crypto’s long-term wealth creation at an early stage.

Let’s look at Cathie Wood’s rationale for these ultra-bullish price targets, and what these arguments could mean for us ordinary non-billionaires.

Wood’s bullish analysis

Wood doubled down on her million-dollar price targets for Bitcoin in a recent video interview with Peter Diamandis, founder of the XPRIZE Foundation, which promotes innovation. Her bullish argument centered around three core themes:

-

Thanks to Bitcoin’s planned scarcity with a hard cap of 21 million digital coins, it should eventually replace physical gold as a store of long-term value.

-

Institutional investors have not yet entered the market for the digital coin, despite the appearance of exchange-traded funds (ETFs) based on real-time crypto prices. When investment banks and financial advisors start taking the Bitcoin plunge, the whole industry should “fall in line pretty quick” with price-boosting results, Wood said.

-

Investors should see Bitcoin as an “insurance policy” against several financial risks like inflation, economic instability, or government overreach. These qualities should gain exposure and a following, especially in younger generations.

Together, she expects these pillars to support strong price growth.

“If we’re in the middle of the bull market, I think the next spur is going to be the platforms putting the spot Bitcoin ETF on it,” Wood said. “And I do think that will happen this year.”

Analyzing the bullish Bitcoin argument

I don’t see anything wrong with Wood’s logic.

The capped Bitcoin supply and gradual slowdown of new coin production are important parts of the cryptocurrency’s value system. The supply growth is already slower than the annual inflation of the gold supply from physical mining, so all that’s missing is a sustained increase in demand for the crypto. The good old law of supply and demand covers the rest of this argument.

Diamantis gave an anecdotal example of institutional resistance to Bitcoin assets, saying that a well-known financial advisor service refused to include spot Bitcoin ETFs in its portfolio services. That foot-dragging attitude could be the right idea if Bitcoin were destined to crash, burn, and go away. In any other scenario, the big banks should have to jump aboard the Bitcoin bandwagon eventually. The resulting cash infusions will push its price dramatically higher.

And the third bullish argument is just a question of consumer education. Bitcoin’s decentralized nature makes it difficult to impose government controls over this alternative financial system. I already explained how it is immune to traditional forces of supply-side inflation. The digital currency could be easier to use, but people are already leaning on Bitcoin in times of economic strife.

Bitcoin bulls should set realistic targets

Even so, I find it hard to peg a firm price target on Bitcoin — especially in the long term. Wood says that the institutional-investor dominoes should start to fall before the end of 2024, while the other bullish forces could have slower effects.

Keeping an eye on how quickly old-school bankers embrace the Bitcoin opportunity will provide a clearer map for what comes next. But the market isn’t quite there yet, so I’m holding my horses on the final analysis.

Will Bitcoin soar to $650,000 or even $1.5 million per coin in 2030? Maybe, but it doesn’t really matter. I expect it to gain value over time, most likely outperforming the S&P 500 (SNPINDEX: ^GSPC) stock market index in the long haul.

That’s good enough for me, and many investors with far deeper pockets would agree. The cryptocurrency, or one of the handy-dandy spot Bitcoin ETFs, should be a modest part of any diversified investment portfolio these days.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,022!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,329!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $393,839!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Anders Bylund has positions in Bitcoin. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.

Billionaires Are Buying This Cryptocurrency That Could Soar 2,276%, According to Cathie Wood was originally published by The Motley Fool

SHAREHOLDER ALERT: Faruqi & Faruqi, LLP Investigates Claims on Behalf of Investors of Verve Therapeutics

Faruqi & Faruqi, LLP Securities Litigation Partner James (Josh) Wilson Encourages Investors Who Suffered Losses Exceeding $75,000 In Verve To Contact Him Directly To Discuss Their Options

If you suffered losses exceeding $75,000 in Verve between August 9, 2022 and April 1, 2024 and would like to discuss your legal rights, call Faruqi & Faruqi partner Josh Wilson directly at 877-247-4292 or 212-983-9330 (Ext. 1310).

[You may also click here for additional information]

NEW YORK, Oct. 11, 2024 (GLOBE NEWSWIRE) — Faruqi & Faruqi, LLP, a leading national securities law firm, is investigating potential claims against Verve Therapeutics, Inc. (“Verve” or the “Company”) VERV and reminds investors of the October 28, 2024 deadline to seek the role of lead plaintiff in a federal securities class action that has been filed against the Company.

Faruqi & Faruqi is a leading national securities law firm with offices in New York, Pennsylvania, California and Georgia. The firm has recovered hundreds of millions of dollars for investors since its founding in 1995. See www.faruqilaw.com.

As detailed below, the complaint alleges that the Company and its executives violated federal securities laws by making false and/or misleading statements and/or failing to disclose that: (1) defendants did not fully disclose the circumstances under which the Heart-1 Phase 1b clinical trial (the “Heart-1 Trial”) of VERVE-101 would be halted (VERVE-101 is an investigational gene editing medicine designed to be a single course treatment that permanently turns off the PCSK9 gene in the liver to reduce disease-driving low-density lipoprotein cholesterol (LDL-C)); (2) defendants overstated the potential benefits of its proprietary lipid nanoparticle (LNP) delivery system; and (3) as a result, defendants’ statements about its business, operations, and prospects, were materially false and misleading and/or lacked a reasonable basis at all relevant times. When the true details entered the market, the lawsuit claims that investors suffered damages.

On April 2, 2024, before the market opened, Verve Therapeutics issued a press release entitled “Verve Therapeutics Announces Updates on its PCSK9 Program.” It disclosed that the Heart-1 clinical trial would be halted due to an adverse event in an individual who had been dosed at 0.45 mg/kg of VERVE-101, and that the LNP delivery system was to blame.

On this news, the price of Verve Therapeutics stock fell by $4.47, or 34.9%, to close at $8.32 on April 2, 2024.

The court-appointed lead plaintiff is the investor with the largest financial interest in the relief sought by the class who is adequate and typical of class members who directs and oversees the litigation on behalf of the putative class. Any member of the putative class may move the Court to serve as lead plaintiff through counsel of their choice, or may choose to do nothing and remain an absent class member. Your ability to share in any recovery is not affected by the decision to serve as a lead plaintiff or not.

Faruqi & Faruqi, LLP also encourages anyone with information regarding Verve’s conduct to contact the firm, including whistleblowers, former employees, shareholders and others.

To learn more about the Verve class action, go to www.faruqilaw.com/VERV or call Faruqi & Faruqi partner Josh Wilson directly at 877-247-4292 or 212-983-9330 (Ext. 1310).

Follow us for updates on LinkedIn, on X, or on Facebook.

Attorney Advertising. The law firm responsible for this advertisement is Faruqi & Faruqi, LLP (www.faruqilaw.com). Prior results do not guarantee or predict a similar outcome with respect to any future matter. We welcome the opportunity to discuss your particular case. All communications will be treated in a confidential manner.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/26e43ade-854b-424c-bf98-daee5da226b7

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Two High-Yield ETF Cash Machines for Your Retirement Portfolio

A high-yield dividend-paying exchange-traded fund (ETF) could be a valuable tool for investors seeking to build a solid portfolio that generates dividends. These ETFs offer a steady income stream, providing a cushion for living expenses and the potential for capital appreciation. Two standout ETFs currently offer high dividend yields, the potential for growth, and the ability to compound earnings, making them “cash machines” for investors seeking a consistent income stream.

The Preferred Stock Powerhouse

The Virtus InfraCap U.S. Preferred Stock ETF PFFA offers investors a compelling opportunity to capitalize on the income-generating potential of preferred stocks. PFFA seeks to provide income and the potential for capital appreciation by tracking an index of preferred stocks issued by U.S. companies.

As a preferred stock ETF, PFFA provides investors with a high level of dividend income. Its dividend yield is 8.58%, making it an attractive option for investors seeking a substantial and reliable income stream, especially those approaching retirement. This high yield can help retirees and investors supplement their savings and maintain their desired lifestyles.

PFFA employs a robust diversification strategy to mitigate risk, investing in a portfolio of 217 preferred stocks. This minimizes the impact of any company’s performance, ensuring a more stable and resilient portfolio, which is essential for long-term investors.

PFFA also benefits from the inherent stability of preferred stocks. These securities generally exhibit lower volatility than common stocks, providing a sense of security for investors, particularly during market fluctuations. This stability makes them an attractive addition to your portfolio, particularly for investors seeking to preserve capital and maintain their income stream.

The Power of Utilities and Fixed Income

The PIMCO Corporate & Income Opportunity Fund PTY is a closed-ended fixed-income mutual fund that primarily invests in corporate debt obligations. It offers exposure to a diverse range of fixed-income investments, including those issued by utility companies. PTY manages around $2 billion in assets, demonstrating its scale and potential for diversification within its portfolio.

PTY’s high dividend yield of 9.75% provides a steady and reliable income stream for investors. This yield surpasses the returns of many other fixed-income investments, making it a compelling option for those seeking to generate income. Moreover, PTY’s portfolio offers not just income, but also potential for growth, as the fund benefits from diversified investments across many sectors.

PTY’s bond portfolio can also serve as a hedge against inflation. As inflation rises, interest rates typically follow suit, which can benefit bond investments.

Furthermore, PTY’s focus on corporate debt provides diversification, mitigating risk, and enhancing portfolio stability. It also boasts high liquidity, with an average daily trading volume of 593,646 shares, ensuring investors can easily buy or sell shares.

PFFA and PTY: Cash Machines for Your Portfolio

The consistent income potential PFFA and PTY offer makes them particularly valuable for retirees and long-term investors. The ETF’s high dividend yields surpass those of traditional fixed-income investments like bonds and CDs, providing a powerful income generation alternative.

These ETFs act as reliable “cash machines” for investors, delivering a steady and predictable stream of income that can be used as retirement income or reinvested for compounded growth. For example, a $100,000 investment in PFFA could generate approximately $8,580 in annual income, while a similar investment in PTY could yield roughly $9,730. This consistent cash flow can help retirees cover essential expenses such as healthcare, travel, or entertainment, providing financial security and peace of mind.

A Balanced Perspective

While PFFA and PTY offer compelling opportunities for income generation and potential growth, investors must recognize that preferred stocks and fixed-income investments carry inherent risks.

For instance, preferred stocks, while often less volatile than common stocks, can still experience price fluctuations, particularly during periods of economic uncertainty. Both PFFA and PTY are also susceptible to interest rate sensitivity. As interest rates rise, the value of fixed-income securities, including those held by PTY, can decline, potentially leading to capital losses.

Understanding the concept of credit risk is crucial, as it applies mainly to PTY’s investment in corporate debt obligations. Credit risk arises from the possibility that a borrower, such as a company, may default on debt payments. This risk can significantly impact PTY’s performance, potentially reducing its income stream and capital appreciation.

Harnessing the Power of High-Yield ETFs

Investors should constantly seek ways to maximize their income potential while building a portfolio that works for them. High-yield ETFs offer a compelling solution. They provide the potential for income generation and capital appreciation, creating a powerful engine for building wealth and achieving financial goals.

While these ETFs present attractive opportunities, it’s crucial to remember that no investment is without risk. Thorough research, understanding the intricacies of different asset classes, and assessing your risk tolerance are essential steps before making investment decisions. By carefully considering your financial objectives and seeking guidance from a qualified professional, you can harness the power of high-yield ETFs to build a portfolio that aligns with your unique needs and aspirations. Whether you aim to supplement your current income, build a nest egg for the future, or simply generate a steady stream of returns, these ETFs offer a valuable tool for achieving financial success.

The article “Two High-Yield ETF Cash Machines for Your Retirement Portfolio” first appeared on MarketBeat.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Consumer Sentiment Falls In October After 2 Consecutive Months Of Improvement

On Friday, the University of Michigan released the preliminary October Survey of Consumers. Final October data will be released on 25 October.

Key Highlights:

- The University of Michigan consumer sentiment index fell from 70.1 in September to 68.9 points in October, marking a 1.7% monthly fall and below economist estimates of 70.9 as per data from Benzinga Pro.

- The sub-index for consumer expectations decreased from 74.4 to 72.9 points versus expectations of 75.

- The sub-index for current economic conditions also fell from 63.3 to 62.7 compared to the estimates of 64.3.

Surveys of Consumers Director Joanne Hsu noted that consumer sentiment dipped slightly in October, slipping by just 1.2 index points, which falls within the margin of error, after two consecutive months of improvement.

Despite this minor decline, sentiment remains 8% higher than a year ago and nearly 40% above the low point recorded in June 2022.

Based on data from Trading Economics, consumer confidence in the United States averaged 85.26 points between 1952 and 2024, peaking at 111.40 points in January 2000 and hitting a historic low of 50 points in June 2022.

Although inflation expectations have eased significantly since that time, consumers continue to express frustration with elevated prices.

However, long-term business conditions reached their highest level in six months, while current and future personal finances showed modest declines.

Despite widespread media coverage of the conflicts in the Middle East and Ukraine, only a small percentage of consumers (fewer than 5%) spontaneously linked these events to the economy.

With the upcoming election approaching, some consumers seem to be withholding judgment on the economy’s longer-term outlook.

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SUNSTONE HOTEL INVESTORS PROVIDES OPERATIONS UPDATE

ALISO VIEJO, Calif., Oct. 10, 2024 /PRNewswire/ — Sunstone Hotel Investors, Inc. (the “Company” or “Sunstone”) SHO today provided an update on recent operating activity for the third quarter and the estimated resulting impact on its previously provided full-year 2024 outlook.

Operations Update

The Company’s operations for July and August 2024 were consistent with its prior expectations and reflect continued strength in group activity, an acceleration in business travel and an anticipated market-wide moderation in leisure demand in Maui. During the first two months of the quarter, the Company generated growth in total portfolio RevPAR and Total RevPAR, excluding The Confidante Miami Beach, of 2.4% and 6.3%, respectively, and Adjusted EBITDAre of approximately $37 million, which was in-line with the full-year 2024 outlook as presented in the Company’s second quarter earnings release provided on August 7, 2024.

Beginning in September, the Company’s operations were impacted by labor activity at the 1,190-room Hilton San Diego Bayfront (the “Hotel”), which led to the cancellation of certain group events and overall lower business volume at the Hotel. Hilton, the Company’s manager of the Hotel, has been in negotiations with the union that represents a majority of the employees of the Hotel and has reached an agreement on renewed contract terms. The renewed contract terms were ratified by the union members on October 9, 2024, and the Hotel has resumed normal operations.

Based on the business that has been disrupted at the Hotel as a result of the labor activity, the Company anticipates that full-year 2024 total portfolio RevPAR growth will be 125 to 150 basis points lower, Adjusted EBITDAre will be $11 million to $13 million lower and Adjusted FFO Attributable to Common Stockholders per Diluted Share will be approximately $0.06 lower than the 2024 outlook as presented in the Company’s second quarter earnings release. Approximately $6 million to $7 million of the total estimated Adjusted EBITDAre impact relates to business that was disrupted in the third quarter, with the remainder related to business that has been cancelled for the fourth quarter. The Company expects a portion of the group events that have been cancelled will be rebooked at the Hotel for a future period.

The estimated impact on the Company’s prior full-year 2024 outlook is based only upon business that has been disrupted at the Hotel as a result of the labor activity and the Company expects to provide an updated 2024 outlook, including any changes in expectations for the remainder of its portfolio, as part of its third quarter earnings release on November 12, 2024.

Despite the isolated disruption resulting from the labor activity at the Hotel, Sunstone remains well positioned to deliver significant earnings growth into 2025 and beyond driven by the contribution from the Company’s recent brand conversions, including the full-year contribution and recapture of displacement at the recently converted Marriott Long Beach Downtown, the continued ramp-up of multiple assets in the portfolio, the full-year contribution from its recently completed acquisition of the Hyatt Regency San Antonio Riverwalk and the debut of Andaz Miami Beach.

Comparable operating statistics for all hotels excluding The Confidante Miami Beach were as follows (1):

|

Q3 2024 to August (2) |

September 2024 (3) |

Q3 2024 (3) |

2024 YTD (3) |

|||||||||||||

|

Occupancy |

74 |

% |

67 |

% |

72 |

% |

72 |

% |

||||||||

|

ADR |

$ |

295 |

$ |

316 |

$ |

302 |

$ |

313 |

||||||||

|

RevPAR |

$ |

218 |

$ |

212 |

$ |

216 |

$ |

227 |

||||||||

|

RevPAR Change vs. Prior Year |

2.4 |

% |

(5.4) |

% |

(0.2) |

% |

(0.2) |

% |

||||||||

|

Total RevPAR |

$ |

354 |

$ |

345 |

$ |

351 |

$ |

368 |

||||||||

|

Total RevPAR Change vs. Prior Year |

6.3 |

% |

(4.9) |

% |

2.4 |

% |

1.3 |

% |

||||||||

Comparable operating statistics for all 15 hotels were as follows (1):

|

Q3 2024 to August (2) |

September 2024 (3) |

Q3 2024 (3) |

2024 YTD (3) |

|||||||||||||

|

Occupancy |

71 |

% |

64 |

% |

69 |

% |

70 |

% |

||||||||

|

ADR |

$ |

295 |

$ |

316 |

$ |

302 |

$ |

313 |

||||||||

|

RevPAR |

$ |

209 |

$ |

203 |

$ |

208 |

$ |

219 |

||||||||

|

RevPAR Change vs. Prior Year |

1.0 |

% |

(6.1) |

% |

(1.4) |

% |

(2.8) |

% |

||||||||

|

Total RevPAR |

$ |

340 |

$ |

332 |

$ |

338 |

$ |

355 |

||||||||

|

Total RevPAR Change vs. Prior Year |

4.7 |

% |

(5.7) |

% |

1.1 |

% |

(1.6) |

% |

||||||||

|

(1) |

Comparable operating statistics presented in this release include both prior ownership results and the Company’s results for the Hyatt Regency San Antonio Riverwalk, acquired by the Company in April 2024. |

|

(2) |

Reflects results for July and August 2024. |

|

(3) |

Includes preliminary results for September which may change during the Company’s month-end closing process. |

Hurricane Milton Update

The Company’s Renaissance Orlando at SeaWorld® and Oceans Edge Resort & Marina in Key West remained open and operational during Hurricane Milton which impacted the state of Florida. Based on preliminary assessments, neither property incurred any meaningful physical damage from the storm. While both hotels have experienced cancellations, a portion of the lost group business at the Company’s hotel in Orlando has been offset by incremental transient demand as a result of the storm. The Company will continue to monitor the impact of the storm on its prior 2024 outlook and will provide an update as part of its third quarter earnings release.

Share Repurchase Update

Since the beginning of the third quarter, the Company repurchased 2.3 million shares of its common stock at an average purchase price of $9.79 per share for a total repurchase amount before expenses of $22.8 million. This brings total repurchases in 2024 to 2.7 million shares at an average purchase price of $9.83 per share for a total repurchase amount before expenses of $26.4 million. The Company currently has $428.3 million remaining under its existing stock repurchase program authorization.

About Sunstone Hotel Investors

Sunstone Hotel Investors, Inc. is a lodging real estate investment trust (“REIT”). Sunstone’s strategy is to create long-term stakeholder value through the acquisition, active ownership, and disposition of well-located hotel and resort real estate. For further information, please visit Sunstone’s website at www.sunstonehotels.com.

For Additional Information

Aaron Reyes

Chief Financial Officer

Sunstone Hotel Investors, Inc.

(949) 382-3018

Forward Looking Statements

This press release contains forward-looking statements within the meaning of federal securities laws and regulations. These forward-looking statements are identified by their use of terms and phrases such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” “will” and other similar terms and phrases, including opinions, references to assumptions and forecasts of future results. Forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors that may cause the actual results to differ materially from those anticipated at the time the forward-looking statements are made. These risks include, but are not limited to: we own upper upscale and luxury hotels located in urban and resort destinations in an industry that is highly competitive; events beyond our control, including economic slowdowns or recessions, pandemics, natural disasters, civil unrest and terrorism; inflation adversely affecting our financial condition and results of operations; system security risks, data protection breaches, cyber-attacks and systems integration issues, including those impacting the Company’s suppliers, hotel managers or franchisors; a significant portion of our hotels are geographically concentrated so we may be disproportionately harmed by economic conditions, competition, new hotel supply, real and personal property tax rates or natural disasters in these areas of the country; we face possible risks associated with the physical and transitional effects of climate change; uninsured or underinsured losses could harm our financial condition; the operating results of some of our hotels are significantly reliant upon group and transient business generated by large corporate customers, and the loss of such customers for any reason could harm our operating results; the increased use of virtual meetings and other similar technologies could lessen the need for business-related travel, and, therefore, demand for rooms in our hotels may be adversely affected; our hotels require ongoing capital investment and we may incur significant capital expenditures in connection with acquisitions, repositionings and other improvements, some of which are mandated by applicable laws or regulations or agreements with third parties, and the costs of such renovations, repositionings or improvements may exceed our expectations or cause other problems; delays in the acquisition, renovation or repositioning of hotel properties may have adverse effects on our results of operations and returns to our stockholders; accounting for the acquisition of a hotel property or other entity involves assumptions and estimations to determine fair value that could differ materially from the actual results achieved in future periods; volatility in the debt and equity markets may adversely affect our ability to acquire, renovate, refinance or sell our hotels; we may pursue joint venture investments that could be adversely affected by our lack of sole decision-making authority, our reliance on a co-venturer’s financial condition and disputes between us and our co-venturer; we may be subject to unknown or contingent liabilities related to recently sold or acquired hotels, as well as hotels we may sell or acquire in the future; we may seek to acquire a portfolio of hotels or a company, which could present more risks to our business and financial results than the acquisition of a single hotel; the sale of a hotel or portfolio of hotels is typically subject to contingencies, risks and uncertainties, any of which may cause us to be unsuccessful in completing the disposition; the illiquidity of real estate investments and the lack of alternative uses of hotel properties could significantly limit our ability to respond to adverse changes in the performance of our hotels; we may issue or invest in hotel loans, including subordinated or mezzanine loans, which could involve greater risks of loss than senior loans secured by income-producing real properties; if we make or invest in mortgage loans with the intent of gaining ownership of the hotel secured by or pledged to the loan, our ability to perfect an ownership interest in the hotel is subject to the sponsor’s willingness to forfeit the property in lieu of the debt; one of our hotels is subject to a ground lease with an unaffiliated party, the termination of which by the lessor for any reason, including due to our default on the lease, could cause us to lose the ability to operate the hotel altogether and may adversely affect our results of operations; because we are a REIT, we depend on third-parties to operate our hotels; we are subject to risks associated with our operators’ employment of hotel personnel; most of our hotels operate under a brand owned by Marriott, Hyatt, Hilton, Four Seasons or Montage, and should any of these brands experience a negative event, or receive negative publicity, our operating results may be harmed; our franchisors and brand managers may adopt new policies or change existing policies which could result in increased costs that could negatively impact our hotels; future adverse litigation judgments or settlements resulting from legal proceedings could have an adverse effect on our financial condition; claims by persons regarding our properties could affect the attractiveness of our hotels or cause us to incur additional expenses; the hotel business is seasonal and seasonal variations in business volume at our hotels will cause quarterly fluctuations in our revenue and operating results; changes in the debt and equity markets may adversely affect the value of our hotels; certain of our hotels have in the past become impaired and additional hotels may become impaired in the future; laws and governmental regulations may restrict the ways in which we use our hotel properties and increase the cost of compliance with such regulations, and noncompliance with such regulations could subject us to penalties, loss of value of our properties or civil damages; corporate responsibility, specifically related to environmental sustainability, social responsibility and corporate governance, or ESG, factors and commitments, may impose additional costs and expose us to new risks that could adversely affect our results of operations, financial condition and cash flows; our franchisors and brand managers may require us to make capital expenditures pursuant to property improvement plans or to comply with brand standards; termination of any of our franchise, management or operating lease agreements could cause us to lose business or lead to a default or acceleration of our obligations under certain of our debt instruments; the growth of alternative reservation channels could adversely affect our business and profitability; the failure of tenants in our hotels to make rent payments or otherwise comply with the material terms of our retail and restaurant leases may adversely affect our results of operations; we rely on our corporate and hotel senior management teams, the loss of whom may cause us to incur costs and harm our business; we could be harmed by inadvertent errors, misconduct or fraud that is difficult to detect; if we fail to maintain effective internal control over financial reporting and disclosure controls and procedures, we may not be able to accurately report our financial results or identify and prevent fraud; we have outstanding debt which may restrict our financial flexibility; certain of our debt is subject to variable interest rates, which creates uncertainty in the amount of interest expense we will incur in the future and may negatively impact our operating results; our stock repurchase program may not enhance long-term stockholder value, could cause volatility in the price of our common and preferred stock and could diminish our cash reserves; and other risks and uncertainties associated with the Company’s business described in its filings with the Securities and Exchange Commission. Although the Company believes the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that the expectations will be attained or that any deviation will not be material. All forward-looking information provided herein is as of the date of this release, and the Company undertakes no obligation to update any forward-looking statement to conform the statement to actual results or changes in the Company’s expectations.

This release should be read together with the consolidated financial statements and notes thereto included in our most recent reports on Form 10-K and Form 10-Q. Copies of these reports are available on our website at www.sunstonehotels.com and through the SEC’s Electronic Data Gathering Analysis and Retrieval System (“EDGAR”) at www.sec.gov.

Non-GAAP Financial Measures

We present the non-GAAP financial measure earnings before interest expense, taxes, depreciation and amortization for real estate, as adjusted for items defined below, or Adjusted EBITDAre, because we believe it is useful to investors as a key supplemental measure of our operating performance. This measure should not be considered in isolation or as a substitute for measures of performance in accordance with GAAP. In addition, our calculation of this measure may not be comparable to other companies that do not define Adjusted EBITDAre the same as the Company. This non-GAAP measure is used in addition to and in conjunction with results presented in accordance with GAAP. It should not be considered as an alternative to net income (loss), cash flow from operations, or any other operating performance measure prescribed by GAAP. This non-GAAP financial measure reflects an additional way of viewing our operations that we believe, when viewed with our GAAP results and the reconciliation to its corresponding GAAP financial measure, provides a more complete understanding of factors and trends affecting our business than could be obtained absent this disclosure. We strongly encourage investors to review our financial information in its entirety and not to rely on a single financial measure.

We present EBITDAre in accordance with guidelines established by the National Association of Real Estate Investment Trusts (“Nareit”), as defined in its September 2017 white paper “Earnings Before Interest, Taxes, Depreciation and Amortization for Real Estate.” We believe EBITDAre is a useful performance measure to help investors evaluate and compare the results of our operations from period to period in comparison to our peers. Nareit defines EBITDAre as net income (calculated in accordance with GAAP) plus interest expense, income tax expense, depreciation and amortization, gains or losses on the disposition of depreciated property (including gains or losses on change in control), impairment write-downs of depreciated property and of investments in unconsolidated affiliates caused by a decrease in the value of depreciated property in the affiliate, and adjustments to reflect the entity’s share of EBITDAre of unconsolidated affiliates.

We make additional adjustments to EBITDAre when evaluating our performance because we believe that the exclusion of certain additional items described below provides useful information to investors regarding our operating performance, and that the presentation of Adjusted EBITDAre, when combined with the primary GAAP presentation of net income, is beneficial to an investor’s complete understanding of our operating performance. In addition, we use both EBITDAre and Adjusted EBITDAre as measures in determining the value of hotel acquisitions and dispositions.

We adjust EBITDAre for the following items, which may occur in any period, and refer to this measure as Adjusted EBITDAre:

- Amortization of deferred stock compensation: we exclude the noncash expense incurred with the amortization of deferred stock compensation as this expense is based on historical stock prices at the date of grant to our corporate employees and does not reflect the underlying performance of our hotels.

- Amortization of contract intangibles: we exclude the noncash amortization of any favorable or unfavorable contract intangibles recorded in conjunction with our hotel acquisitions. We exclude the noncash amortization of contract intangibles because it is based on historical cost accounting and is of lesser significance in evaluating our actual performance for the current period.

- Amortization of right-of-use assets and obligations: we exclude the amortization of our right-of-use assets and related lease obligations, as these expenses are based on historical cost accounting and do not reflect the actual rent amounts due to the respective lessors or the underlying performance of our hotels.

- Undepreciated asset transactions: we exclude the effect of gains and losses on the disposition of undepreciated assets because we believe that including them in Adjusted EBITDAre is not consistent with reflecting the ongoing performance of our assets.

- Gains or losses from debt transactions: we exclude the effect of finance charges and premiums associated with the extinguishment of debt, including the acceleration of deferred financing costs from the original issuance of the debt being redeemed or retired because, like interest expense, their removal helps investors evaluate and compare the results of our operations from period to period by removing the impact of our capital structure.

- Cumulative effect of a change in accounting principle: from time to time, the FASB promulgates new accounting standards that require the consolidated statement of operations to reflect the cumulative effect of a change in accounting principle. We exclude these one-time adjustments, which include the accounting impact from prior periods, because they do not reflect our actual performance for that period.

- Other adjustments: we exclude other adjustments that we believe are outside the ordinary course of business because we do not believe these costs reflect our actual performance for the period and/or the ongoing operations of our hotels. Such items may include: lawsuit settlement costs; the write-off of development costs associated with abandoned projects; property-level restructuring, severance, and management transition costs; pre-opening costs associated with extensive renovation projects such as the work being performed at The Confidante Miami Beach; debt resolution costs; lease terminations; property insurance restoration proceeds or uninsured losses; and other nonrecurring identified adjustments.

|

Adjusted EBITDAre Reconciliation (Unaudited and in thousands) |

|||

|

Q3 2024 To August |

|||

|

Net income |

$ |

2,180 |

|

|

Depreciation and amortization |

21,044 |

||

|

Interest expense |

11,365 |

||

|

Income tax provision |

159 |

||

|

EBITDAre |

34,748 |

||

|

Amortization of deferred stock compensation |

1,584 |

||

|

Amortization of right-of-use assets and obligations |

(99) |

||

|

Pre-opening costs |

522 |

||

|

Adjustments to EBITDAre, net |

2,007 |

||

|

Adjusted EBITDAre |

$ |

36,755 |

|

![]() View original content:https://www.prnewswire.com/news-releases/sunstone-hotel-investors-provides-operations-update-302273404.html

View original content:https://www.prnewswire.com/news-releases/sunstone-hotel-investors-provides-operations-update-302273404.html

SOURCE Sunstone Hotel Investors, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

UK GDP Growth Won't Improve Borrowing Costs, Sentiment

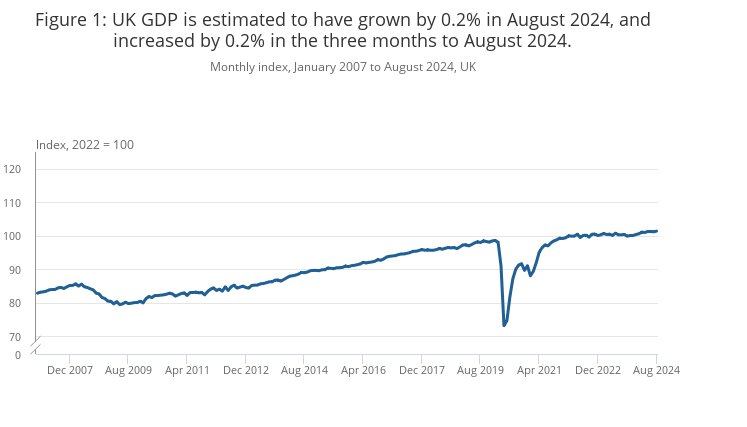

The British economy expanded in August, an improvement that is unlikely to change sentiment about the Labour Party’s economic stewardship.

GDP grew by 0.2% in August after flatlining in June and July, the Office for National Statistics (ONS) said. Economists polled by Reuters had forecast a 0.2% expansion.

“All main sectors of the economy grew in August,” ONS director of economic statistics Liz McKeown said today. “But the broader picture is one of slowing growth in recent months compared to the first half of the year.”

Accountancy, retail and many manufacturers had strong months, McKeown said. Construction recovered from July’s contraction, she added.

“These were partially offset by falls in wholesaling and oil extraction.”

Source: ONS

Confidence in the British economy has been hurt by uncertainty about the upcoming budget and an escalation in geopolitical tensions in the Middle East.

The Organization for Economic Co-operation and Development projected in September GDP at 1.1% in 2024 and 1.2% in 2025, up from 0.1% in 2023

UK GDP Data Makes Rate Cut Likely

Following the release of the UK GDP data, money markets suggest a 93% probability that the Bank of England (BOE) will reduce rates to 4.75% from 5% on November 7 from 97% earlier in October.

The British pound had fallen to a 3-month low against the US dollar then after BOE Governor Andrew Bailey told The Guardian that the bank may become a “bit more aggressive” if inflation continues to fall.

The British pound, which started the month with a 2.72% slump against the US dollar (GBP/USD), climbed 0.25%. “Cable” failed to sweep September’s 1.30 low, indicating a reversal on the cards.

The Euro’s advance against the pound (EUR/GBP) was less pronounced as it climbed 1.36% in the first week of October before erasing much of those gains. GBP’s further gains against both of these currencies would be unsurprising.

British Borrowing Costs Surge

British Chancellor of the Exchequer, Rachel Reeves, welcomed the “news that growth has returned” to the UK economy.

“Growing the economy is the number one priority of this Government,” she said. “We can fix the NHS, rebuild Britain, and make working people better off.”

However, the UK GDP growth comes as the British economy witnesses a sharp increase in long-term borrowing costs. The 10-year gilt yield climbed to 4.21% by early October from 3.75% in mid-September.

Source: UK 10-year bond yield, September-October 2024, Source: TradingEconomics

The surge has raised concerns about the UK’s fiscal policies less than three weeks before the Labour government’s first budget on October 30. The higher borrowing costs may pose a particular problem for Reeves to meet a budgetary shortfall.

She said after taking office that the UK government expected to reveal £22 billion of additional in-year spending pressures for 2024–25.

Reeves “has inherited an unenviable public finance situation,” the Institute for Fiscal Studies said yesterday. “Taxes are at a historic high by UK standards and yet debt is high.”

She will need to increase spending by £30 billion to meet her pledge not to reimpose austerity on struggling public services, the research firm said.

British Prime Minister’s Popularity Plummets

While the government welcomed the UK GDP growth data, it will unlikely improve public opinion.

Prime Minister Keir Starmer’s popularity has fallen steeply since moving into 10 Downing Street. The Ipsos Political Pulse showed that 54% of the British public was dissatisfied with Starmer, with only 33% satisfied.

The latest Opinium poll showed that Starmer’s approval rating has plunged below that of the Tory leader Rishi Sunak. Starmer has suffered a 45-point drop since July.

While 24% of voters approve of the job he is doing, 50% disapprove, giving him a net rating of -26%. Sunak’s net rating is one point better.

Reeves witnessed a 36-point drop in her net approval since July as well, according to The Guardian. She has cut winter fuel payments for all but the poorest pensioners and promised tough decisions the forthcoming budget.

Source: The Guardian

Starmer’s Labour Party won the elections in July against a backdrop of dissatisfaction among the British public about the health of the economy. A survey published on June 20 by the Pew Research Center showed that 78% said the British economy was in poor shape.

British Consumer Sentiment Crashes

The UK sentiment has not improved either. In September, consumer confidence crashed by the most in two-and-a-half years.

Research firm GfK said on September 20 that its monthly confidence index fell 7 points to -20. It cited households turning negative on the outlook for personal finances and the economy.

The country has experienced an escalation in social tensions after the murder of three young white girls in July. That sparked anti-immigration protests that left city streets covered in debris, police injured, and a nation deeply divided.

Source: Ipsos

Protestors have expressed concerns that their culture is being replaced and vocalized frustration with crime they associate with illegal immigrants. They are 70% adult males aged 18 and over, according to Migration Watch UK.

“The prognosis for Britain under Labour is dismal: mass immiseration and relentless decline, laced with class and generational warfare, justified on the grounds of “equality,” “morality,” and “international law,” Allister Heath, the editor of The Sunday Telegraph, wrote on October 9.

Disclaimer

Any opinions expressed in this article are not to be considered investment advice and are solely those of the authors. European Capital Insights is not responsible for any financial decisions made based on the contents of this article. Readers may use this article for information and educational purposes only.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.