UK GDP Growth Won't Improve Borrowing Costs, Sentiment

The British economy expanded in August, an improvement that is unlikely to change sentiment about the Labour Party’s economic stewardship.

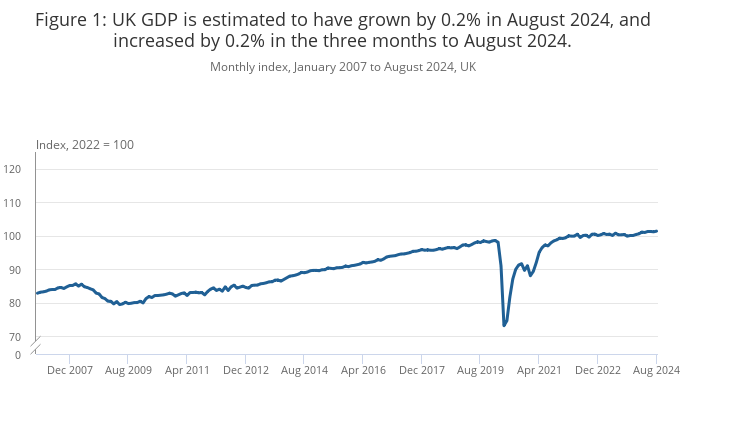

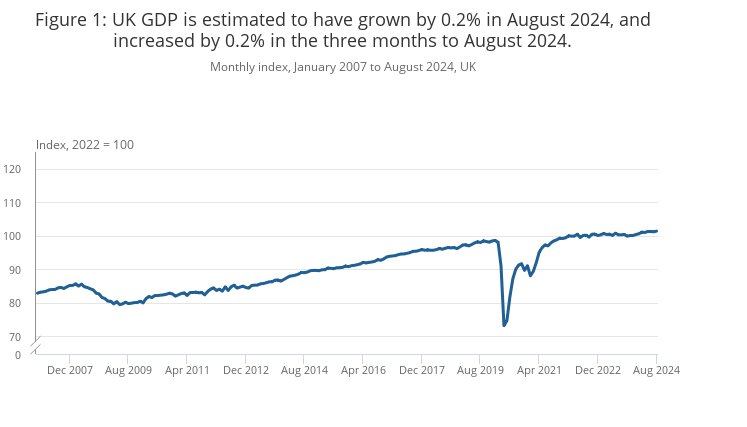

GDP grew by 0.2% in August after flatlining in June and July, the Office for National Statistics (ONS) said. Economists polled by Reuters had forecast a 0.2% expansion.

“All main sectors of the economy grew in August,” ONS director of economic statistics Liz McKeown said today. “But the broader picture is one of slowing growth in recent months compared to the first half of the year.”

Accountancy, retail and many manufacturers had strong months, McKeown said. Construction recovered from July’s contraction, she added.

“These were partially offset by falls in wholesaling and oil extraction.”

Source: ONS

Confidence in the British economy has been hurt by uncertainty about the upcoming budget and an escalation in geopolitical tensions in the Middle East.

The Organization for Economic Co-operation and Development projected in September GDP at 1.1% in 2024 and 1.2% in 2025, up from 0.1% in 2023

UK GDP Data Makes Rate Cut Likely

Following the release of the UK GDP data, money markets suggest a 93% probability that the Bank of England (BOE) will reduce rates to 4.75% from 5% on November 7 from 97% earlier in October.

The British pound had fallen to a 3-month low against the US dollar then after BOE Governor Andrew Bailey told The Guardian that the bank may become a “bit more aggressive” if inflation continues to fall.

The British pound, which started the month with a 2.72% slump against the US dollar (GBP/USD), climbed 0.25%. “Cable” failed to sweep September’s 1.30 low, indicating a reversal on the cards.

The Euro’s advance against the pound (EUR/GBP) was less pronounced as it climbed 1.36% in the first week of October before erasing much of those gains. GBP’s further gains against both of these currencies would be unsurprising.

British Borrowing Costs Surge

British Chancellor of the Exchequer, Rachel Reeves, welcomed the “news that growth has returned” to the UK economy.

“Growing the economy is the number one priority of this Government,” she said. “We can fix the NHS, rebuild Britain, and make working people better off.”

However, the UK GDP growth comes as the British economy witnesses a sharp increase in long-term borrowing costs. The 10-year gilt yield climbed to 4.21% by early October from 3.75% in mid-September.

Source: UK 10-year bond yield, September-October 2024, Source: TradingEconomics

The surge has raised concerns about the UK’s fiscal policies less than three weeks before the Labour government’s first budget on October 30. The higher borrowing costs may pose a particular problem for Reeves to meet a budgetary shortfall.

She said after taking office that the UK government expected to reveal £22 billion of additional in-year spending pressures for 2024–25.

Reeves “has inherited an unenviable public finance situation,” the Institute for Fiscal Studies said yesterday. “Taxes are at a historic high by UK standards and yet debt is high.”

She will need to increase spending by £30 billion to meet her pledge not to reimpose austerity on struggling public services, the research firm said.

British Prime Minister’s Popularity Plummets

While the government welcomed the UK GDP growth data, it will unlikely improve public opinion.

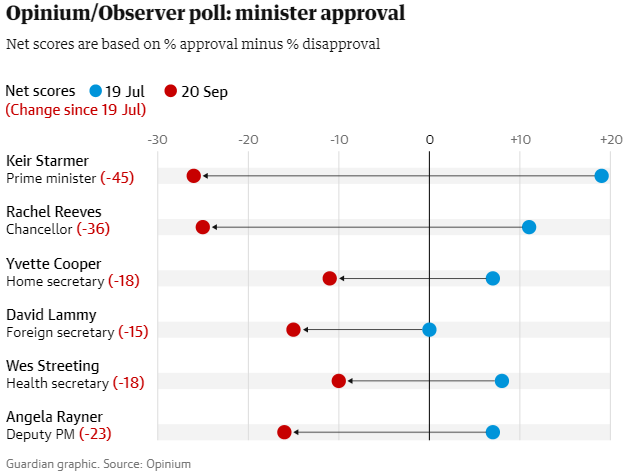

Prime Minister Keir Starmer’s popularity has fallen steeply since moving into 10 Downing Street. The Ipsos Political Pulse showed that 54% of the British public was dissatisfied with Starmer, with only 33% satisfied.

The latest Opinium poll showed that Starmer’s approval rating has plunged below that of the Tory leader Rishi Sunak. Starmer has suffered a 45-point drop since July.

While 24% of voters approve of the job he is doing, 50% disapprove, giving him a net rating of -26%. Sunak’s net rating is one point better.

Reeves witnessed a 36-point drop in her net approval since July as well, according to The Guardian. She has cut winter fuel payments for all but the poorest pensioners and promised tough decisions the forthcoming budget.

Source: The Guardian

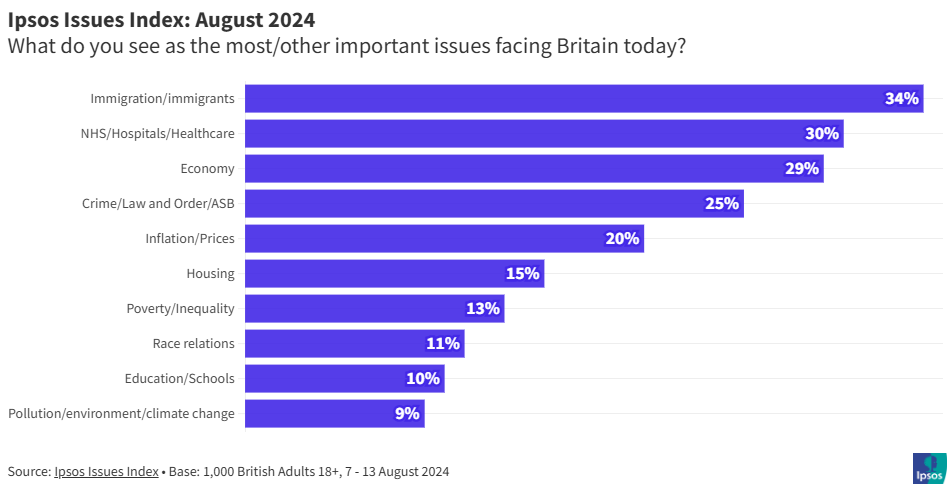

Starmer’s Labour Party won the elections in July against a backdrop of dissatisfaction among the British public about the health of the economy. A survey published on June 20 by the Pew Research Center showed that 78% said the British economy was in poor shape.

British Consumer Sentiment Crashes

The UK sentiment has not improved either. In September, consumer confidence crashed by the most in two-and-a-half years.

Research firm GfK said on September 20 that its monthly confidence index fell 7 points to -20. It cited households turning negative on the outlook for personal finances and the economy.

The country has experienced an escalation in social tensions after the murder of three young white girls in July. That sparked anti-immigration protests that left city streets covered in debris, police injured, and a nation deeply divided.

Source: Ipsos

Protestors have expressed concerns that their culture is being replaced and vocalized frustration with crime they associate with illegal immigrants. They are 70% adult males aged 18 and over, according to Migration Watch UK.

“The prognosis for Britain under Labour is dismal: mass immiseration and relentless decline, laced with class and generational warfare, justified on the grounds of “equality,” “morality,” and “international law,” Allister Heath, the editor of The Sunday Telegraph, wrote on October 9.

Disclaimer

Any opinions expressed in this article are not to be considered investment advice and are solely those of the authors. European Capital Insights is not responsible for any financial decisions made based on the contents of this article. Readers may use this article for information and educational purposes only.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply