Wells Fargo Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

Wells Fargo & Company WFC will release earnings results for its third quarter before the opening bell on Friday, Oct. 11.

Analysts expect the San Francisco-based bank to report quarterly earnings at $1.28 per share, down from $1.48 per share in the year-ago period. Wells Fargo projects to report revenue of $20.41 billion for the recent quarter, according to data from Benzinga Pro.

On Sept. 12, Wells Fargo said it reached a formal agreement with the OCC to enhance its anti-money laundering and sanctions risk management practices, following an enforcement action by the regulator.

Wells Fargo shares gained 0.4% to close at $57.75 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

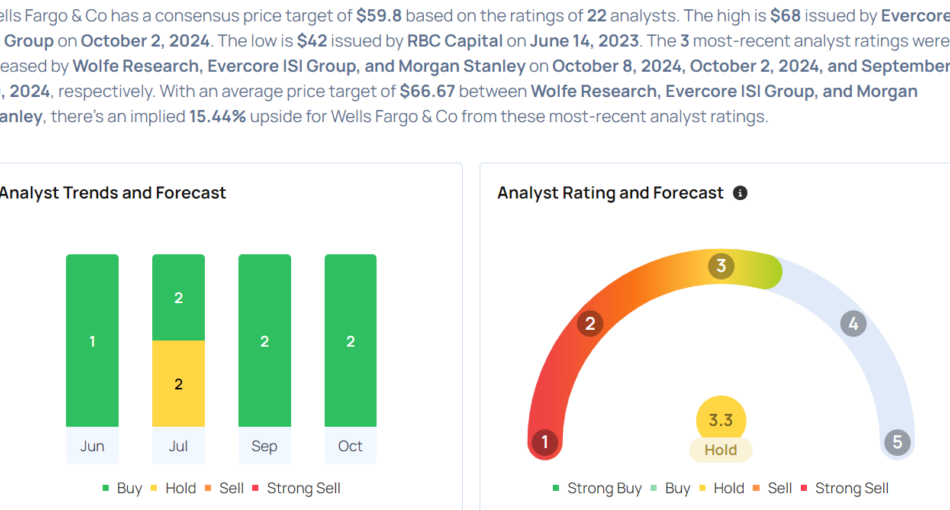

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Wolfe Research analyst Steven Chubak upgraded the stock from Peer Perform to Outperform with a price target of $65 on Oct. 8. This analyst has an accuracy rate of 65%.

- Evercore ISI Group analyst John Pancari maintained an Outperform rating and raised the price target from $65 to $68 on Oct. 2. This analyst has an accuracy rate of 62%.

- Goldman Sachs analyst Richard Ramsden maintained a Buy rating and cut the price target from $68 to $65 on Sept. 11. This analyst has an accuracy rate of 68%.

- Deutsche Bank analyst Matt O’ Connor upgraded the stock from Hold to Buy with a price target of $65 on Sept. 3. This analyst has an accuracy rate of 64%.

- BMO Capital analyst James Fotheringham maintained a Market Perform rating and raised the price target from $57 to $59 on July 15. This analyst has an accuracy rate of 75%.

Considering buying WFC stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply