Are Stock Markets Open on Monday for Columbus Day?

Key Takeaways

-

Next Monday, Oct. 14, is Columbus Day, a federal holiday.

-

Stock and bond markets typically follow the federal holiday schedule, but the New York Stock Exchange and Nasdaq will operate normal hours Monday.

-

However, bond markets will be closed, along with many banks and government operations like the post office.

This year, Oct. 14 is the second Monday of October, the date that Columbus Day is celebrated in the U.S., meaning you may be wondering if stock markets will be open for trading.

Considering the New York Stock Exchange (NYSE) and Nasdaq largely follow the calendar of federal holidays for closures, it may come as a surprise that both will be open and operating normally on Monday.

The two remaining holidays on the exchanges’ respective calendars for 2024 are Thanksgiving and Christmas, with additional shortened hours on the day after Thanksgiving and on Christmas Eve.

However, federal operations like the Federal Reserve and post offices will be closed, as will commercial banks that follow the federal holiday schedule. Bond markets will also be closed.

Read the original article on Investopedia.

1 Dividend Stock Yielding 8% to Buy in Case of a Bear Market

It might not seem like it today with market indexes rocketing to all-time highs, but bear markets do exist. They happen around once a decade and are defined as a period when an index such as the S&P 500 falls 20% or more from all-time highs.

One happened in 2022 (it seems so long ago) as well as briefly in 2020. Before that, there were bear markets in 2009, 2001, and 1990.

When stock prices are soaring, it can feel like the time to put your foot on the gas and get more aggressive with your portfolio. But counterintuitively, it is the best time to get more conservative and mix in some stocks that can weather any recession or bear market. You don’t want your entire portfolio in risky hypergrowth technology stocks that can fall 80% in a market downturn. Many investors made this mistake in 2022.

Dividend stocks with high yields can be great ballast in your portfolio when preparing for an upcoming bear market. One of the top-yielding stocks is Altria Group (NYSE: MO). Here’s why it is an ideal choice to balance out a portfolio of expensive hypergrowth stocks.

Legacy tobacco and pricing power

Altria Group is the corporate owner of Philip Morris USA, which owns brands such as Marlboro and Copenhagen. Cigarettes power the boat for the company, with Marlboro leading the way. However, smoking has been going down in the United States for many years.

Although this is a concern for tobacco companies, Altria has been able to counteract these volume declines with price increases. Revenue is up 13.1% in the last 10 years, while operating income is up 50% cumulatively over that time period.

This is why Altria has been able to consistently raise its dividend per share — most recently by 4.1% to $1.02, its 59th increase in 55 years.

At a current yield of 8%, Altria Group looks like an attractive income stock if it can keep raising prices — and therefore its dividend payout. The big questions are whether this party can continue, and whether management can switch customers over to nicotine alternatives.

Can the company switch customers to other product categories?

Pricing power is great, but it can’t sustain Altria Group indefinitely. Eventually — if the trends of the last few decades persist — cigarettes will be a minuscule part of consumer spending in the United States.

Replacing cigarettes are vaping devices and nicotine pouches. Altria Group has invested in both with its Njoy and on! brands.

Both brands are growing, but still are below direct competitors. On! nicotine pouches have 8.1% market share of the oral tobacco market (including legacy chewy tobacco and new nicotine-pouch brands), while Njoy held just 5.5% of the vaping market in the United States. Combined, the two brands still form just a small portion of Altria’s consolidated revenue.

Over the next five to 10 years, shareholders will need to keep track of the growth of these two brands. They can help replace sales volume lost from people quitting cigarettes.

Buy it for steady returns and low volatility

Altria Group is not a high-growth company. In fact, I wouldn’t expect its revenue to grow much over the next five years. Cigarette volumes will keep declining, which Altria can counteract with price increases and growth from on! and Njoy. But at current prices, I don’t think you need much revenue growth for the stock to do well.

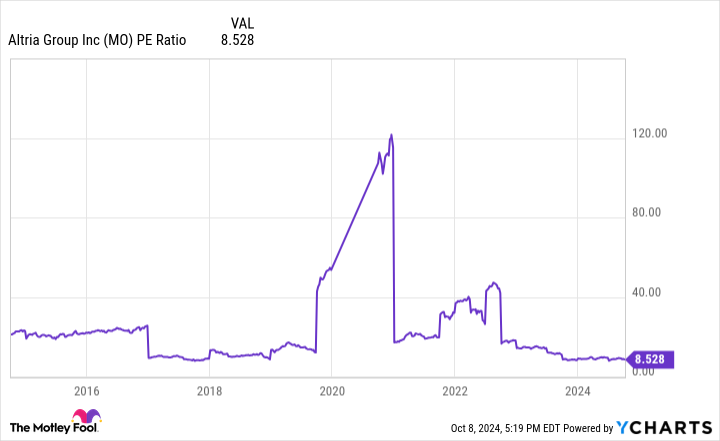

It has a price-to-earnings ratio of just 8.5. The company is repurchasing a ton of its stock, which means it can grow its dividend per share without growing its nominal dividend payout.

The starting yield is around 8% today, and the company has a long history of growing its dividend per share. This means that even if the stock price goes nowhere — or falls in a bear market — investors will be getting a consistent 8% yield.

For all these reasons, I think Altria Group is a cheap stock you would love to own during the next bear market, whenever it arrives.

Should you invest $1,000 in Altria Group right now?

Before you buy stock in Altria Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $812,893!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

1 Dividend Stock Yielding 8% to Buy in Case of a Bear Market was originally published by The Motley Fool

The stock market's bull rally is 2 years old. Here's what tends to happen next.

-

The stock market has surged since October 2022, with major indexes posting strong gains.

-

With the bull market in stocks now two years old, investors are wondering how long the rally can last.

-

According to stock market experts, the answer is: a lot longer.

The stock market bottomed on October 12, 2022, marking two years since the start of the ongoing bull rally.

Since then, the Nasdaq 100, S&P 500, and Dow Jones Industrial Average have posted impressive gains of 88%, 62%, and 46%, respectively.

A resilient job market, lower inflation, and continued corporate earnings growth helped push the stock market higher over the past two years.

So, what’s in store for the bull market from here?

Here’s what market experts told Business Insider about what history says about the bull market’s future as it enters its third year.

Freedom Capital Markets, Jay Woods

Chief global strategist Jay Woods of Freedom Capital Markets said what’s most telling about the current bull market is that very few believed in it in the beginning.

“I think it’s important to preface it with when it started, no one believed it. They just thought it was a bear market rally. And then they doubted that it had legs, and then it was just seven stocks,” Woods told Business Insider.

He added: “And now, all of a sudden, it is powerful. And I think the momentum is continuing. You got the rate cycle, you got broadening out, we have wind at our sails, and this bull market should last at least another 12, maybe 18 months.”

Woods said he is encouraged that market leadership is diverse and no longer concentrated in mega-cap technology companies. A recent example is the rotation into utility stocks, which have surged on the AI power demand narrative.

A common Wall Street expression is “rotation is the lifeblood of a bull market,” and that appears to be playing out.

“It’s good to look back and celebrate two years, but it still feels like the party is just beginning,” Woods said.

Carson Group, Ryan Detrick

According to Carson Group chief market strategist Ryan Detrick, the bull market in stocks is still young.

“Although many might think this bull market has gone too far and is getting old, that isn’t the case at all. If you look back at history, bull markets last more than five years on average, making this one at two years actually young,” Detrick told Business Insider.

Detrick said that while he sees more gains ahead, he doesn’t expect another big year for returns like in 2023 and so far in 2024, with the S&P 500 delivering gains of 24% and 22%, respectively.

Instead, Detrick said that the average gain of a bull market in year three is about 8%, which is right around the average annual return for stocks.

“All in all, we expect stocks to be up at least low double digits over the next year,” Detrick said.

Baird, Ross Mayfield

Baird investment strategist Ross Mayfield said the third year of this current bull rally could deliver stronger returns than history suggests because the first two years of the bull delivered underwhelming performance relative to history.

“The first two years of this bull market have been somewhat muted vs. historical standards, so there is ample opportunity for outperformance of the typical year 3 performance,” Mayfield told Business Insider.

Mayfield also echoed Detrick’s sentiment that the average bull market is over five years long, so he thinks “there is plenty of room to run.”

“It would not be surprising if year three of the bull market outperformed the typical year three given the rates backdrop, expected earnings growth, and tepid investor sentiment,” Mayfield said.

US Bank Asset Management, Rob Haworth

Investment strategist Rob Haworth of US Bank Asset Management believes the S&P 500 could surge to 6,480 in its third year of the bull market, representing potential upside of 12%.

Haworth’s bullish view is backed by what really drives stock prices higher: earnings growth.

“The key forward metric for market returns remains the pace of earnings growth,” Haworth told Business Insider. “As we look ahead, we still see a constructive path.”

Haworth expects the S&P 500 to deliver $270 in earnings per share next year, representing about 13% growth from 2024 consensus levels.

“Lower interest rates from the Federal Reserve and soft or no-landing economic scenarios are helping lift growth into next year, supporting further equity market gains,” Haworth said.

Read the original article on Business Insider

DexCom, Inc. (DXCM) Investors: October 21, 2024 Filing Deadline in Securities Class Action – Contact Kessler Topaz Meltzer & Check, LLP

RADNOR, Pa., Oct. 12, 2024 (GLOBE NEWSWIRE) — The law firm of Kessler Topaz Meltzer & Check, LLP (www.ktmc.com) informs investors that a securities class action lawsuit has been filed in the United States District Court for the Southern District of California against DexCom, Inc. (“DexCom”) DXCM on behalf of investors who purchased or otherwise acquired DexCom securities between April 28, 2023 and July 25, 2024, inclusive (the “Class Period”) The lead plaintiff deadline is October 21, 2024.

CONTACT KESSLER TOPAZ MELTZER & CHECK, LLP:

If you suffered DexCom losses, you may CLICK HERE or go to: https://www.ktmc.com/new-cases/dexcom-inc?utm_source=PR&utm_medium=link&utm_campaign=dxcm&mktm=r

You can also contact attorney Jonathan Naji, Esq. by calling (484) 270-1453 or by email at info@ktmc.com.

DEFENDANTS’ ALLEGED MISCONDUCT:

The complaints allege that, throughout the Class Period, Defendants intentionally or recklessly misled investors by failing to disclose that: (1) DexCom’s sales force expansion strategy was causing slow customer growth; (2) DexCom’s sales force expansion strategy was undermining relationships with durable medical equipment (“DME”) distributors, its largest sales channel, leading to lower-margin revenue; (3) DexCom’s deteriorating relationships with DME distributors were causing the Company to lose significant market share to competitors; and (4) as a result of the foregoing, DexCom’s Class Period statements about its business, operations, and prospects were false and misleading.

THE LEAD PLAINTIFF PROCESS:

DexCom investors may, no later than October 21, 2024, seek to be appointed as a lead plaintiff representative of the class through Kessler Topaz Meltzer & Check, LLP or other counsel, or may choose to do nothing and remain an absent class member. A lead plaintiff is a representative party who acts on behalf of all class members in directing the litigation. The lead plaintiff is usually the investor or small group of investors who have the largest financial interest and who are also adequate and typical of the proposed class of investors. The lead plaintiff selects counsel to represent the lead plaintiff and the class and these attorneys, if approved by the court, are lead or class counsel. Your ability to share in any recovery is not affected by the decision of whether or not to serve as a lead plaintiff.

Kessler Topaz Meltzer & Check, LLP encourages DexCom investors who have suffered significant losses to contact the firm directly to acquire more information.

CLICK HERE TO SIGN UP FOR THE CASE OR GO TO: https://www.ktmc.com/new-cases/dexcom-inc?utm_source=PR&utm_medium=link&utm_campaign=dxcm&mktm=r

ABOUT KESSLER TOPAZ MELTZER & CHECK, LLP:

Kessler Topaz Meltzer & Check, LLP prosecutes class actions in state and federal courts throughout the country and around the world. The firm has developed a global reputation for excellence and has recovered billions of dollars for victims of fraud and other corporate misconduct. All of our work is driven by a common goal: to protect investors, consumers, employees and others from fraud, abuse, misconduct and negligence by businesses and fiduciaries. The complaints in this action were not filed by Kessler Topaz Meltzer & Check, LLP. For more information about Kessler Topaz Meltzer & Check, LLP please visit www.ktmc.com.

CONTACT:

Kessler Topaz Meltzer & Check, LLP

Jonathan Naji, Esq.

(484) 270-1453

280 King of Prussia Road

Radnor, PA 19087

info@ktmc.com

May be considered attorney advertising in certain jurisdictions. Past results do not guarantee future outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tesla Stock Tumbles After Underwhelming Robotaxi Presentation

Tesla Inc. TSLA stock fell by 10% after a less-than-stellar robotaxi reveal event on Friday that failed to wow Wall Street.

What Happened: Tesla CEO Elon Musk unveiled the company’s future vision on Friday, which includes two-seater Cybercabs operating without human intervention. Notably, these vehicles are designed without a steering wheel or foot pedals.

According to the report by Business Insider, Wall Street was not impressed, especially considering the already operational robotaxi service by Waymo. Analysts drew parallels between the Cybercab demos and a slow, short amusement park ride, criticizing them for their controlled environment.

The report states that Tesla Inc. shares closed at $238.77 on Thursday. On Friday, the stock opened at $220.13, dropped to a low of $214.38 during early trading, and finished the day at $217.80.

Analysts also highlighted the absence of details on Tesla’s execution strategy. Toni Sacconaghi, a Bernstein analyst, pointed out the need for Tesla to provide more proof to investors, commenting on the lack of detail.

Despite Musk’s projected timeline of launching a robotaxi network by 2026 or 2027, Sacconaghi expressed doubts about the potential for significant profits due to technical and regulatory hurdles.

Simultaneously, Uber’s stock witnessed a 9% increase, as investors are of the opinion that Tesla’s proposed robotaxi network is unlikely to disrupt Uber’s main business.

Why It Matters: The lackluster response to Tesla’s robotaxi reveal event underscores the challenges the company faces in convincing investors of its future vision.

The skepticism expressed by analysts and the subsequent drop in Tesla’s stock value highlight the importance of providing detailed plans and demonstrating the feasibility of such ambitious projects.

Furthermore, the rise in Uber’s stock suggests that investors still see value in traditional ride-hailing services, despite the advancements in autonomous vehicle technology.

Read Next:

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Storelocal Storage Offers 2 Months Free Self Storage to Hurricane Victims at Knoxville, Tennessee Locations

KNOXVILLE, Tenn., Oct. 11, 2024 /PRNewswire/ — Storelocal Storage is extending a helping hand to victims of Hurricane Helene by offering two months of free storage at its two Knoxville locations on Hillview Ave and Rutledge Pkwy. The initiative aims to assist individuals and families impacted by the storm as they work to rebuild their lives and homes.

Hurricane Helene’s destruction impacted the East Tennessee region, including Knoxville, between September 24-27, 2024, bringing heavy rainfall, massive storm surge, flooding, power outages, and infrastructure disruptions. While Knoxville avoided the worst of the devastation, nearby communities were hit harder, and emergency services from the area were deployed to assist in recovery efforts. Tragically, four fatalities were reported in the region as a result of the storm’s impact.

“We are dedicated to providing meaningful support and hope this offer helps reduce some of the stress that comes with rebuilding after the storm,” said Genevieve Sigmund, President of Platinum Storage Group, which manages Storelocal facilities.

Hurricane victims in need of temporary storage can contact either Knoxville facility by phone or in person to take advantage of this offer. Both locations feature climate-controlled units, 24/7 security cameras, and easy online rental and payment options to ensure customers’ belongings are stored safely and conveniently.

About Storelocal Storage of Knoxville

Storelocal Storage of Knoxville offers state-of-the-art self-storage solutions, with a wide range of unit sizes and types to meet various storage needs. With climate-controlled units and 24-hour security monitoring, customers can trust that their belongings will be stored securely. Convenient online rental and payment options are available.

Visit our Knoxville locations:

About Storelocal Storage

Storelocal is a membership organization designed to empower independent self-storage owners by offering access to industry-leading products, services, and technology solutions. With a network of over 1,500 members and a combined real estate value exceeding $10 billion, Storelocal enables independent operators to compete with large, corporate storage chains by providing essential resources like property management software, branding, and online rental platforms.

Click here for more information about Storelocal Storage Brand Licensing

Click here for more information about Storelocal Membership

About Platinum Storage Group

Platinum Storage Group is a privately-held real estate company specializing in self-storage development, acquisitions, and management. Established in 1999, Platinum manages a portfolio of over 2.5 million square feet of storage facilities and currently oversees 34 locations under the Storelocal Storage brand.

For more information about Platinum Storage Group, visit Platinum Storage Group.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/storelocal-storage-offers-2-months-free-self-storage-to-hurricane-victims-at-knoxville-tennessee-locations-302273680.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/storelocal-storage-offers-2-months-free-self-storage-to-hurricane-victims-at-knoxville-tennessee-locations-302273680.html

SOURCE Storelocal Storage

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Selling: George J Christ Unloads $4.78M Of Altair Engineering Stock

Disclosed on October 10, George J Christ, 10% Owner at Altair Engineering ALTR, executed a substantial insider sell as per the latest SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Thursday showed that Christ sold 49,952 shares of Altair Engineering. The total transaction amounted to $4,781,645.

Altair Engineering‘s shares are actively trading at $95.0, experiencing a down of 0.0% during Friday’s morning session.

Get to Know Altair Engineering Better

Altair Engineering Inc is a provider of enterprise-class engineering software enabling origination of the entire product lifecycle from concept design to in-service operation. The integrated suite of software provided by the company optimizes design performance across multiple disciplines encompassing structures, motion, fluids, thermal management, system modeling, and embedded systems. It operates through two segments: Software which includes the portfolio of software products such as solvers and optimization technology products, modeling and visualization tools, industrial and concept design tools, and others; and Client Engineering Services which provides client engineering services to support customers. Majority of its revenue comes from the software segment.

Financial Insights: Altair Engineering

Revenue Growth: Over the 3 months period, Altair Engineering showcased positive performance, achieving a revenue growth rate of 5.41% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Information Technology sector.

Evaluating Earnings Performance:

-

Gross Margin: The company maintains a high gross margin of 79.49%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Altair Engineering’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of -0.06.

Debt Management: Altair Engineering’s debt-to-equity ratio is below the industry average at 0.33, reflecting a lower dependency on debt financing and a more conservative financial approach.

Evaluating Valuation:

-

Price to Earnings (P/E) Ratio: The current Price to Earnings ratio of 296.97 is higher than the industry average, indicating the stock is priced at a premium level according to the market sentiment.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 12.76, Altair Engineering’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Altair Engineering’s EV/EBITDA ratio, surpassing industry averages at 95.42, positions it with an above-average valuation in the market.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Activity Matters in Finance

Insider transactions contribute to decision-making but should be supplemented by a comprehensive investment analysis.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

A Deep Dive into Insider Transaction Codes

Delving into transactions, investors typically prioritize those unfolding in the open market, as precisely outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Altair Engineering’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin, Ethereum, Dogecoin See Friday Gains, But Trader Warns '$59,000 Must Hold, No Major Moves Expected This Weekend'

Cryptocurrency markets were trading higher before entering the weekend with altcoins also being pushed up.

| Cryptocurrency | Price | Gains +/- |

| Bitcoin BTC/USD | $63,000.44 | +5.8% |

| Ethereum ETH/USD | $2,459.54 | +4.3% |

| Solana SOL/USD | $145.88 | +6.2% |

| Dogecoin DOGE/USD | $0.111 | +6.2% |

| Shiba Inu SHIB/USD | $0.00001775 | +8.2% |

- IntoTheBlock data showed large transaction volume decreasing by 23.2% and daily active addresses up by 3.6%. Transactions greater than $100,000 were up from 7,555 to 8,264 in a single day. Exchanges netflows were down by 327.6%. Currently, 87% of Bitcoin holders made profits while 13% were at breakeven.

- Coinglass data reported 38,216 traders were liquidated in the past 24 hours with the total liquidations at $115.88 million.

| Cryptocurrency | Price | Gains +/- |

| Ethena ENA/USD | $0.3366 | +25.2% |

| Mog Coin MOG/USD | $0.051709 | +24.2% |

| Worldcoin WLD/USD | $1.93 | +14.9% |

Trader Notes: With Bitcoin prices trading higher beyond $62,000, crypto trader Javon Marks saw the crypto king still looking to reclaim its all-time highs of $73,700. Also, based on historical performance of a similar pattern, prices could also be set for a move much higher. He predicted the next target at $116,650.

Crypto analyst Miles Deutscher marked $59,000 as must hold level. He predicted not making any “major moves this weekend (apart from trading memes), as directionality is still a bit unclear.”

He added there needed to be a higher high to officially break downtrend structure.

Michael van de Poppe highlighted the trend switched and the next test is at $65,000.

Another crypto trader Seth advised to not make any mistakes as the bull market is going on. He noted whales were accumulating and grabbing liquidity from the retail traders. He predicted the liquidity will help “ascend.”

What’s Next: The influence of Bitcoin as an institutional asset class is expected to be thoroughly explored at Benzinga’s upcoming Future of Digital Assets event on Nov. 19.

Read Next:

Photo: Avi Rozen on Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Did Musk Try To Stop Government Workers From Discussing AI Supercomputer?

Elon Musk‘s artificial intelligence venture xAI is under fire for alleged covert interactions with government officials in Memphis, Tennessee, regarding the construction of a supercomputer.

What Happened: According to a report, xAI conducted a secret meeting with local and national law enforcement agencies six months ago, prior to the public or city councilors being informed about the construction of “the world’s largest supercomputer” in the area.

The meeting entailed signing non-disclosure agreements (NDAs) with CTC Property, a shell company overseen by Musk’s personal banker, Jared Birchall, reports Forbes.

Forbes was the first to reveal that government officials had signed NDAs with xAI, forbidding them from discussing the “Colossus” project. The agreement and other internal documents were procured through a series of public records requests.

Scott Banbury, conservation director of the Sierra Club Tennessee Chapter, denounced the move as “unethical,” contending that government agencies should primarily be accountable to the citizens of Memphis.

Also Read: Elon Musk’s xAI Eyes Share of Future Tesla Revenue in Potential Deal

“Colossus” was assembled in just four months in a vacant factory along the Mississippi River. It was officially online a month after the Chamber publicly announced in June that xAI would be establishing its “new home” in Memphis.

However, xAI’s expansion into Memphis has been accompanied by aggressive demands on local resources.

The data center has requested enough power to run 100,000 households and will draw more than 1 million gallons of water daily from the Memphis Aquifer for cooling its servers.

Despite the secrecy surrounding the project, xAI has reportedly declined to engage with the Memphis community. The company’s reluctance to share information about the project has sparked concerns among residents and environmental justice groups.

Why It Matters: This incident underscores the ongoing debate about the ethical implications of tech companies’ dealings with government entities.

The secrecy surrounding xAI’s project and the company’s refusal to engage with the local community has raised questions about transparency and accountability in the tech sector.

Furthermore, the project’s significant demand on local resources highlights the environmental impact of such large-scale tech projects.

This incident serves as a reminder of the need for tech companies to balance innovation with social responsibility.

Read Next

Elon Musk’s AI Startup Could Reach A Whopping $20 Billion Valuation, Exceeding Initial Expectations

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Willis Lease Finance Recent Insider Activity

Brian R. Hole, President at Willis Lease Finance WLFC, disclosed an insider purchase on October 10, based on a new SEC filing.

What Happened: Hole’s recent move, as outlined in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday, involves purchasing 11,066 shares of Willis Lease Finance. The total transaction value is $1,712,242.

As of Friday morning, Willis Lease Finance shares are up by 0.06%, currently priced at $163.5.

About Willis Lease Finance

Willis Lease Finance Corp with its subsidiaries is a lessor and servicer of commercial aircraft and aircraft engines. The company has two reportable business segments namely Leasing and Related Operations which involves acquiring and leasing, pursuant to operating leases, commercial aircraft, aircraft engines and other aircraft equipment and the selective purchase and resale of commercial aircraft engines and other aircraft equipment and other related businesses and Spare Parts Sales segment involves the purchase and resale of after-market engine parts, whole engines, engine modules and portable aircraft components. The company generates the majority of its revenue from leasing and related operations.

Willis Lease Finance’s Economic Impact: An Analysis

Positive Revenue Trend: Examining Willis Lease Finance’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 38.65% as of 30 June, 2024, showcasing a substantial increase in top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Analyzing Profitability Metrics:

-

Gross Margin: The company sets a benchmark with a high gross margin of 77.98%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): The company excels with an EPS that surpasses the industry average. With a current EPS of 6.34, Willis Lease Finance showcases strong earnings per share.

Debt Management: With a high debt-to-equity ratio of 3.95, Willis Lease Finance faces challenges in effectively managing its debt levels, indicating potential financial strain.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 12.69 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 2.2, Willis Lease Finance’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Willis Lease Finance’s EV/EBITDA ratio, lower than industry averages at 10.08, indicates attractively priced shares.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Pay Attention to Insider Transactions

Investors should view insider transactions as part of a multifaceted analysis and not rely solely on them for decision-making.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

Important Transaction Codes

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Willis Lease Finance’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.