An Ominous Warning for Wall Street: 4 of the Most Prominent Value-Focused Billionaire Investors Are Net Sellers of Stocks

Over the last century, stocks have stood on a pedestal above all other asset classes. While everything from Treasury bonds and housing to various commodities, including gold, silver, and oil, have delivered positive nominal returns for investors, none of these other asset classes comes remotely close to matching the average annualized return of stocks.

But just because stocks have consistently outperformed over extended periods, it doesn’t mean Wall Street’s major stock indexes move up in a straight line.

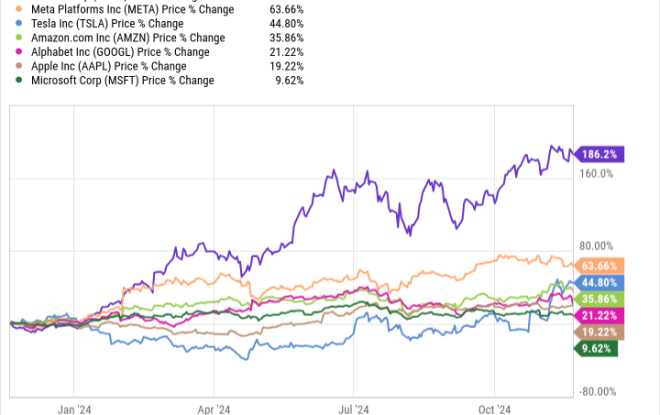

In 2024, the ageless Dow Jones Industrial Average (DJINDICES: ^DJI), benchmark S&P 500 (SNPINDEX: ^GSPC), and growth-driven Nasdaq Composite (NASDAQINDEX: ^IXIC) have reached record closing highs on multiple occasions. Yet based on the actions of some of Wall Street’s most prominent value investors, trouble may be brewing.

Wall Street’s most successful value-focused billionaire money managers offer a silent warning

The sails for the Dow, S&P 500, and Nasdaq Composite have been lifted by the artificial intelligence (AI) revolution, stock-split euphoria, a resurgent U.S. economy, and the prospect of a Federal Reserve rate-easing cycle boosting demand for loans.

Despite this positive news, select billionaire money managers haven’t been shy about pressing the sell button of late. While trading activity has been mixed among active hedge funds and predominantly growth-oriented asset managers, some of Wall Street’s best-known value investors have been decisive net sellers of stocks.

Arguably no value-focused money manager is better known than Berkshire Hathaway‘s billionaire CEO, Warren Buffett. The appropriately named Oracle of Omaha isn’t shy about sitting on his hands and waiting for emotion-driven selling to create price dislocations in time-tested companies with sustainable competitive advantages.

For seven consecutive quarters (through June 30, 2024), Buffett and his investment team have been net sellers of equities to the tune of almost $132 billion. Berkshire Hathaway is sitting on an all-time record $276.9 billion in cash, cash equivalents, and U.S. Treasuries, through the midpoint of the year.

But Buffett is far from alone.

Pershing Square Capital Management’s Bill Ackman is an undeniable value investor who seeks out contrarian stocks. Though Pershing Square’s Form 13F shows two new holdings were added during the June-ended quarter — Nike and Brookfield — selling activity in five other holdings, including Alphabet and Chipotle Mexican Grill, handily outpaced buying activity.

It was a similar story for “Britain’s Warren Buffett,” billionaire Terry Smith of Fundsmith, during the second quarter. Smith, who has a knack for finding amazing deals hiding in plain sight and prefers to hold time-tested businesses for lengthy periods, reduced his fund’s stakes in 37 out of 40 holdings.

Appaloosa’s value-focused billionaire chief David Tepper was active on sell-side trades during the June-ended quarter, too. Although Appaloosa’s 13F shows that nine holdings were added to in the second quarter, two were sold outright, with 26 other positions reduced. Interestingly, some of Tepper’s most notable reductions were among growth stocks, including Nvidia, Meta Platforms, and Microsoft.

While this selling activity may signal nothing more than simple profit-taking, it’s more likely that it’s a silent but ominous warning from some of the smartest investors on Wall Street of trouble to come.

Stock valuations are pushing into historic territory — and not in a good way

Let me preface this discussion by stating that “value” is in the eye of the beholder. Every investor perceives value and risk differently when putting their money to work on Wall Street. With this being said, we’re currently witnessing one of the priciest stock markets in history, dating all the way to the early 1870s.

There are a lot of ways to measure value, with the traditional price-to-earnings (P/E) ratio being the most well known. The P/E ratio divides a company’s share price into its trailing-12-month (TTM) earnings per share (EPS). This figure can then be compared to the TTM P/E ratios of its peers or major stock indexes to determine relative cheapness or priciness.

While the P/E ratio has its uses, it can also be easily disrupted. When shock events occur (e.g., COVID-19 lockdowns), the P/E ratio becomes ineffective in helping investors locate/decipher value.

The one measure of value that’s far more encompassing, and has a flawless track record of forecasting large moves in the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite, is the Shiller price-to-earnings ratio, which is also commonly known as the cyclically adjusted price-to-earnings ratio (CAPE ratio).

The S&P 500’s Shiller P/E ratio is based on average inflation-adjusted earnings from the previous 10 years. Examining 10 years of earnings history, and adjusting it for the effects of inflation, provides an apples-to-apples comparison that minimizes the impact of shock events.

When back-tested to January 1871, the S&P 500’s Shiller P/E has averaged 17.16. But as you can see from the chart above, it’s spent almost the entirety of the last 30 years above this mark. The internet making it easier than ever to access information and place stock trades, coupled with lower interest rates, increased the willingness of investors to take risks.

But there comes a point when this risk-taking becomes excessive. The unofficial line in the sand that’s represented a problem for Wall Street is a Shiller P/E reading above 30. For context, the S&P 500’s Shiller P/E closed above 37 on Oct. 9, which marks the third-highest reading during a continuous bull market throughout history.

There have been only six occurrences, including the present, where the S&P 500’s Shiller P/E has topped 30 dating back 153 years. Following all five previous instances, the Dow, S&P 500, and/or Nasdaq Composite lost at least 20% of their value, if not considerably more. In other words, the Shiller P/E has a flawless track record of forecasting eventual bear markets on Wall Street.

What the Shiller P/E can’t tell us is when these declines will occur. There’s no rhyme or reason as to how long stocks can be remain pricey in the short term. History merely shows us that extended valuations aren’t sustainable over long periods.

I don’t believe the selling activity we’re witnessing from four of Wall Street’s most revered value investors is coincidental. More than likely, it’s in response to the stock market being historically pricey. Having dry powder at the ready to take advantage of possible price dislocations, just like Buffett, Ackman, Smith, and Tepper, may be a smart move.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 802% — a market-crushing outperformance compared to 169% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now…

*Stock Advisor returns as of October 7, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Alphabet and Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Berkshire Hathaway, Brookfield, Brookfield Corporation, Chipotle Mexican Grill, Meta Platforms, Microsoft, Nike, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft, short December 2024 $54 puts on Chipotle Mexican Grill, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

An Ominous Warning for Wall Street: 4 of the Most Prominent Value-Focused Billionaire Investors Are Net Sellers of Stocks was originally published by The Motley Fool

Leave a Reply