Morgan Stanley recently met with Nvidia's management team. Here are the biggest takeaways as the bank eyes another 12% upside for the stock.

-

Nvidia stock is set for more gains as demand for its GPU chips surges, Morgan Stanley says.

-

Nvidia’s Blackwell GPU is on schedule and is sold out for the next 12 months, the company said.

-

Inference computing growth boosts the long-term demand potential for Nvidia’s AI GPU chips.

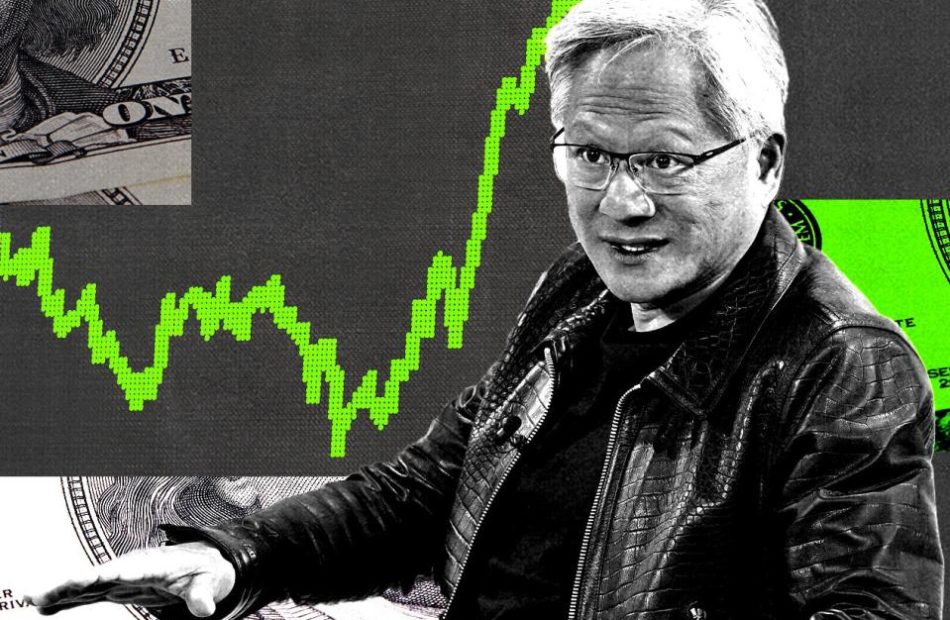

Nvidia stock is poised for more gains as its GPU chip business continues to see surging demand.

That’s according to Morgan Stanley, which hosted meetings with Nvidia CEO Jensen Huang, CFO Colette Kress, and other members of the chip maker’s management team for three days in New York City this week.

The key takeaway is that “every indication from management is that we are still early in a long term AI investment cycle,” Morgan Stanley analyst Joseph Moore said.

The bank reiterated its “Overweight” and “Top Pick” ratings and $150 price target, representing potential upside of 12% from current levels.

Moore said Nvidia’s production ramp of its next-generation Blackwell GPU chip is “progressing on schedule,” adding that the product is sold out for the next 12 months.

“Any new Blackwell orders now that aren’t already in queue will be shipped late next year, as they are booked out 12 months, which continues to drive strong short term demand for Hopper which will still be a major factor through the year,” Moore explained.

Hopper is Nvidia’s previous generation of AI-enabled GPU chips, which are being sold in clusters to cloud “hyperscalers” like Amazon, Microsoft, and Meta Platforms.

And Nvidia has a new “element” to its story, according to Moore, which is the view that inference computing “is starting to solve much more complex problems which will require a much richer mix of hardware.”

That should be a boon for Nvidia’s GPU chip product set, according to the note.

“The longer term vision is that deep thinking will allow every company in the world to hire large numbers of “digital AI employees” that can execute challenging tasks,” Moore said.

He added: “The notion that a more thoughtful, task oriented inference would cause an exponential jump in inference complexity strikes us an important new avenue for growth, and another clear area where NVIDIA’s full stack approach to solving these problems adds to the company’s considerable lead.”

Nvidia CEO Jensen Huang made it clear to Morgan Stanley that the company expects to see meaningful growth in 2025 that spills over into 2026, “though he did not quantify,” Moore said.

Nvidia’s shares have increased since the start of October, rising about 10%. Nvidia stock is up 172% since the start of this year.

Read the original article on Business Insider

Leave a Reply