Fastenal Q3 Earnings: Taking a Look at Key Metrics Versus Estimates

Fastenal FAST reported $1.91 billion in revenue for the quarter ended September 2024, representing a year-over-year increase of 3.5%. EPS of $0.52 for the same period compares to $0.52 a year ago.

The reported revenue represents a surprise of -0.26% over the Zacks Consensus Estimate of $1.92 billion. With the consensus EPS estimate being $0.52, the company has not delivered EPS surprise.

While investors closely watch year-over-year changes in headline numbers — revenue and earnings — and how they compare to Wall Street expectations to determine their next course of action, some key metrics always provide a better insight into a company’s underlying performance.

Since these metrics play a crucial role in driving the top- and bottom-line numbers, comparing them with the year-ago numbers and what analysts estimated about them helps investors better project a stock’s price performance.

Here is how Fastenal performed in the just reported quarter in terms of the metrics most widely monitored and projected by Wall Street analysts:

- Business days: 64 Days versus the six-analyst average estimate of 64 Days.

- Daily sales: $29.80 versus the four-analyst average estimate of $29.92.

- Number of in-market locations: 3,583 compared to the 3,567 average estimate based on three analysts.

- Weighted FASTBin/FASTVend installations: 123,193 versus 122,318 estimated by two analysts on average.

- Number of active Onsite locations: 1,986 compared to the 1,979 average estimate based on two analysts.

- Number of branch locations: 1,597 versus the two-analyst average estimate of 1,591.

- Weighted FASTBin/FASTVend signings: 7,281 compared to the 6,570 average estimate based on two analysts.

Shares of Fastenal have returned +0.2% over the past month versus the Zacks S&P 500 composite’s +5.4% change. The stock currently has a Zacks Rank #4 (Sell), indicating that it could underperform the broader market in the near term.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 No-Brainer Stocks to Buy if Donald Trump and Republicans Sweep in November

In 24 days, millions of Americans will head to the polls. Many others have already begun early voting.

DecisionDesk HQ predicts that former President Donald Trump has a 48% chance of returning to the Oval Office for a second term. According to its model, Republicans have a 71% chance of winning the Senate and 54% chance of holding on to control of the House of Representatives.

While these are only estimates that could prove to be wrong, there’s a real possibility that the GOP will hold the presidency and both chambers of Congress in 2025. Here are three no-brainer stocks to buy if Trump and Republicans sweep in November.

1. ExxonMobil

Trump wants U.S. “energy dominance.” He wants to expand drilling for oil and gas on federal lands. He’s against several renewable energy initiatives that would reduce the country’s dependence on fossil fuels. Attendees at his political rallies will often hear him proclaim, “Drill, baby, drill.”

It’s uncertain exactly how much Trump’s policies would benefit the oil and gas industry. However, perception can become reality. And the perception is a second Trump administration will almost certainly be highly favorable to oil companies. As the biggest U.S. oil producer by market cap, ExxonMobil (NYSE: XOM) stands to be a big winner if the former president becomes the next president.

Things are already looking up for ExxonMobil. The company recently delivered its second-highest second-quarter earnings of the last decade. ExxonMobil’s acquisition of Pioneer Natural Resources significantly increased its upstream production capabilities.

The stock could be a big winner over the long term regardless of which political party is in power. ExxonMobil is investing heavily in carbon capture and storage (CCS) technology. Thanks to its 2023 acquisition of Denbury, the company owns the largest CO2 pipeline network in the U.S. If ExxonMobil’s CCS bet pays off, the oil producer will drill, baby, drill for decades to come.

2. Coinbase Global

Trump was skeptical about cryptocurrency in the past. He isn’t now. In July, he told the audience at a major cryptocurrency conference that he wants the U.S. to become the “crypto capital of the planet.” The former president has committed to implementing several cryptocurrency-friendly policies. Republicans even included language in their official party platform promising to defend Americans’ right to their digital assets.

For these reasons, another Trump term could be music to the ears of Coinbase Global (NASDAQ: COIN) shareholders. The company operates one of the world’s largest cryptocurrency exchanges. Roughly $226 billion was traded through Coinbase in the quarter ending June 30, 2024.

Coinbase has been a highly volatile stock since its initial public offering in 2021 as evidenced by its super-high beta coefficient of 3.35. The huge swings in its share price have been in part due to the volatility of the cryptocurrency market itself, especially with the failure of several top crypto platforms.

However, a presidential administration that actively supports cryptocurrency could create a more stable environment in which Coinbase could flourish. Wall Street already thinks the stock should be a big winner even before the election results are in. The average 12-month price target for Coinbase reflects an upside potential of 53%.

3. Costco Wholesale

Presidential policies can have both positive and negative impacts. Many economists have roundly criticized Trump’s proposed tariffs on all imported products. For example, the Peterson Institute for International Economics estimates that those tariffs could cause inflation to spike to as much as 7.4% above baseline by 2026.

Higher inflation would hurt many companies. But it could help Costco Wholesale (NASDAQ: COST). The company’s membership warehouses and e-commerce websites offer low prices on a wide range of products. When Americans are pinching their pennies, they shop more at Costco.

However, Costco doesn’t need inflation levels to rise to deliver strong results. The company has continued to grow regardless of the macroeconomic environment.

The biggest knock against Costco is valuation. Shares trade at a forward earnings multiple of 49.5. But this premium price underscores just how much investors prize Costco’s resilient business model. This stock is likely to reward shareholders no matter who occupies the White House and controls Congress next year.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,022!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,329!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $393,839!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Keith Speights has positions in ExxonMobil. The Motley Fool has positions in and recommends Coinbase Global and Costco Wholesale. The Motley Fool has a disclosure policy.

3 No-Brainer Stocks to Buy if Donald Trump and Republicans Sweep in November was originally published by The Motley Fool

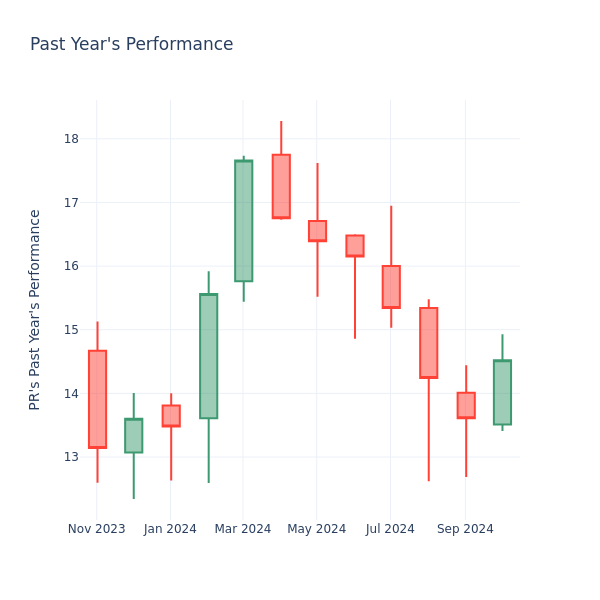

P/E Ratio Insights for Permian Resources

Looking into the current session, Permian Resources Inc. PR shares are trading at $14.52, after a 0.83% spike. Moreover, over the past month, the stock spiked by 7.64%, but in the past year, fell by 3.39%. Shareholders might be interested in knowing whether the stock is undervalued, even if the company is performing up to par in the current session.

Comparing Permian Resources P/E Against Its Peers

The P/E ratio measures the current share price to the company’s EPS. It is used by long-term investors to analyze the company’s current performance against it’s past earnings, historical data and aggregate market data for the industry or the indices, such as S&P 500. A higher P/E indicates that investors expect the company to perform better in the future, and the stock is probably overvalued, but not necessarily. It also could indicate that investors are willing to pay a higher share price currently, because they expect the company to perform better in the upcoming quarters. This leads investors to also remain optimistic about rising dividends in the future.

Permian Resources has a lower P/E than the aggregate P/E of 18.07 of the Oil, Gas & Consumable Fuels industry. Ideally, one might believe that the stock might perform worse than its peers, but it’s also probable that the stock is undervalued.

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company’s market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company’s financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2 No-Brainer, High-Yield Dividend Stocks to Buy Right Now for Less Than $1,000

Natural gas demand is on track to grow sharply by 2030. The lower-carbon fuel is helping meet the accelerating demand for power in the U.S. and abroad, which is fueling robust and rising cash flows for natural gas-infrastructure operators, enabling them to pay attractive dividends and invest in expanding their operations.

Kinder Morgan (NYSE: KMI) and Williams (NYSE: WMB) are two of the country’s natural gas-infrastructure leaders. That makes these pipeline stocks look like no-brainer investments for those with less than $1,000 to invest right now.

Lots of fuel to pay and grow its dividend

Kinder Morgan operates the largest natural gas-transmission network in the country. It has 66,000 miles of pipelines that move 40% of the country’s gas production. It also owns 15% of the country’s storage capacity and other related infrastructure, like gas-processing plants and export terminals.

The company’s gas-infrastructure assets supply it with very stable cash flow (68% is take-or-pay or hedged, meaning it gets paid the full value of its contracts no matter what). Kinder Morgan expects to produce about $5 billion in cash this year, $2.6 billion of which it plans to pay investors via dividends. It will retain the rest to fund expansion projects and maintain a strong balance sheet to capitalize on acquisition opportunities as they appear.

Kinder Morgan currently has $5.2 billion of expansion projects under construction, with half of those projects expected to come online and contribute to its cash flow by the end of next year. About $4.2 billion of its projects support natural gas demand, including a $1.7 billion pipeline expansion to supply more gas to Southeastern power and local distribution markets when it comes online in late 2028. These projects give it a lot of visibility into its ability to grow its cash flow and dividends in the coming years. The company has increased its payout, which currently yields nearly 5%, for seven straight years. At that rate, every $100 you invest in the stock would produce more than $5 of dividend income each year.

The company expects to capture many more growth opportunities in the future. Kinder Morgan anticipates that gas demand will grow by 20 billion cubic feet per day (Bcf/d) by 2030, fueled by rising U.S. power and industrial demand, and increasing LNG and Mexican exports. That doesn’t include the potential incremental-demand growth to power more data centers. The base case is that data centers will drive an incremental 3 Bcf/d to 6 Bcf/d of demand by 2030 with the potential for 10+ Bcf/d of additional demand. That should enable the company to continue investing to expand its infrastructure, which should grow its cash flow and dividend.

Lots of visibility into its future growth

Williams is a leader in natural gas infrastructure. The company owns more than 33,000 miles of pipelines that transport a third of all the gas used in the country. Its most important pipeline is the Transco system, which is the nation’s largest gas pipeline by volume. It also owns gathering and processing assets, and gas-storage capacity.

The pipeline giant expects to produce about $5 billion in funds from operations (FFO) this year. That’s enough cash flow to cover its nearly 4% dividend by a very comfortable 2.2 times. Williams retains the rest of its cash to invest in expansion projects and maintain its financial flexibility to capitalize on accretive-acquisition opportunities as they arise.

Williams has an extensive pipeline of growth-capital projects under construction. The company plans to spend an average of $1.7 billion on expansions over the next two years on projects that will come online through 2027. That includes 12 gas-transmission projects to add 4.2 Bcf/d of capacity through 2027. Those projects give it a lot of visibility into its future growth. It drives the company’s view that it should be able to grow its dividend by around a 5% to 7% annual rate through at least next year.

The company has lots of growth potential beyond that time frame. It’s currently working on 30 more gas transmission-expansion projects that could add 11.5 Bcf/d of additional capacity by 2032. Meanwhile, it would also likely need to build additional gas-gathering and processing capacity to support rising production. These future projects and the potential for accretive acquisitions could give Williams lots of fuel to grow its FFO and dividend in the future.

Lots of dividend income and growth

Kinder Morgan and Williams generate billions of dollars in stable cash flow each year from their natural gas-infrastructure platforms. That gives them the money to pay high-yielding dividends and invest in expanding their operations. With lots of growth ahead, these pipeline companies could produce strong total returns in the coming years as they continue capitalizing on growing gas demand.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,022!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,329!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $393,839!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Matt DiLallo has positions in Kinder Morgan. The Motley Fool has positions in and recommends Kinder Morgan. The Motley Fool has a disclosure policy.

2 No-Brainer, High-Yield Dividend Stocks to Buy Right Now for Less Than $1,000 was originally published by The Motley Fool

Could Buying SoundHound AI Now Be Like Buying Nvidia in 2023?

Nvidia‘s (NASDAQ: NVDA) stock has been an absolutely incredible performer recently. Since the start of 2023, it rose by more than 800%. Most investors would be thrilled to own a stock that delivered returns like that, but not every company has the potential. It requires a massive growth catalyst to justify such gains.

SoundHound AI (NASDAQ: SOUN) is one company that could have this potential. It’s a key player in one niche of the artificial intelligence (AI) sector, and has a massive backlog for its products.

SoundHound’s product is gaining momentum

SoundHound AI’s technology can parse human speech and perform various tasks based on what it hears. Among the ways it’s already being used most are in processing restaurant orders and improving digital assistants in vehicles, but its capabilities extend far beyond those two use cases.

In the automotive segment, SoundHound partnered with Stellantis; the giant automaker will integrate SoundHound’s tech into its vehicles across Europe and Japan. This will give people access to generative AI functions while they’re driving — an improvement from the voice assistants that are available on vehicles today. If SoundHound can win business with other automakers and break into other regions, this segment of its business alone could provide it with a huge amount of growth.

SoundHound also worked with several companies in the restaurant sector to automate telephone and drive-thru orders, which saves restaurants on wages. According to the company, these AI assistants actually outperform humans in terms of order speed and accuracy, so the customer doesn’t feel like the experience declined. Some of SoundHound’s restaurant customers, among them White Castle and Jersey Mike’s, are fairly big, but there’s serious room for it to grow if it can capture some of the largest fast-food businesses.

SoundHound AI could achieve even greater success if its solutions are utilized in new applications.

But is that potential enough to make its stock the next Nvidia?

Nvidia has one key advantage that SoundHound does not

In the second quarter, SoundHound generated $13.5 million in revenue, which was up 54% year over year. That’s quite small compared to other AI businesses.

However, the key figure investors should focus on is SoundHound’s backlog, which totals $723 million. This figure doubled from a year ago, showing that rising demand has outpaced SoundHound’s capability to integrate its product with its customers’ systems.

This is factoring into SoundHound’s current valuation, as Wall Street has high hopes for the company.

Trading at 23 times sales, SoundHound stock already carries a premium valuation. By contrast, Nvidia traded for around 15 times forward earnings at the start of 2023. That was a dirt-cheap price, and also a far cry from the forward earnings ratio of 47 it trades at today.

SoundHound already has a premium price tag, which detracts from its growth potential from here. But if it can mature into a business that generates $100 million in revenue per quarter, Nvidia-like performance for the stock is still possible.

If SoundHound achieved that and carried a valuation of 20 times sales, it would be worth $8 billion, up 370% from its market cap today. That would be a solid return, but still far less than what Nvidia produced.

SoundHound stock’s premium price tag may prevent it from delivering Nvidia-like returns from here, but that doesn’t mean it won’t be a great investment. However, it’s a bit of a long shot considering the niche use cases for its product and the company’s small size. It could make investors some serious money, but don’t expect Nvidia-like returns.

Should you invest $1,000 in SoundHound AI right now?

Before you buy stock in SoundHound AI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoundHound AI wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Stellantis. The Motley Fool has a disclosure policy.

Could Buying SoundHound AI Now Be Like Buying Nvidia in 2023? was originally published by The Motley Fool

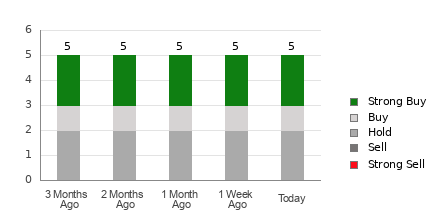

Wall Street Analysts Think IonQ Is a Good Investment: Is It?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock’s price, do they really matter?

Let’s take a look at what these Wall Street heavyweights have to say about IonQ, Inc. IONQ before we discuss the reliability of brokerage recommendations and how to use them to your advantage.

IonQ currently has an average brokerage recommendation of 2.00, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc.) made by five brokerage firms. An ABR of 2.00 indicates Buy.

Of the five recommendations that derive the current ABR, two are Strong Buy and one is Buy. Strong Buy and Buy respectively account for 40% and 20% of all recommendations.

Brokerage Recommendation Trends for IONQ

The ABR suggests buying IonQ, but making an investment decision solely on the basis of this information might not be a good idea. According to several studies, brokerage recommendations have little to no success guiding investors to choose stocks with the most potential for price appreciation.

Are you wondering why? The vested interest of brokerage firms in a stock they cover often results in a strong positive bias of their analysts in rating it. Our research shows that for every “Strong Sell” recommendation, brokerage firms assign five “Strong Buy” recommendations.

In other words, their interests aren’t always aligned with retail investors, rarely indicating where the price of a stock could actually be heading. Therefore, the best use of this information could be validating your own research or an indicator that has proven to be highly successful in predicting a stock’s price movement.

Zacks Rank, our proprietary stock rating tool with an impressive externally audited track record, categorizes stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), and is an effective indicator of a stock’s price performance in the near future. Therefore, using the ABR to validate the Zacks Rank could be an efficient way of making a profitable investment decision.

Zacks Rank Should Not Be Confused With ABR

Although both Zacks Rank and ABR are displayed in a range of 1-5, they are different measures altogether.

Broker recommendations are the sole basis for calculating the ABR, which is typically displayed in decimals (such as 1.28). The Zacks Rank, on the other hand, is a quantitative model designed to harness the power of earnings estimate revisions. It is displayed in whole numbers — 1 to 5.

Analysts employed by brokerage firms have been and continue to be overly optimistic with their recommendations. Since the ratings issued by these analysts are more favorable than their research would support because of the vested interest of their employers, they mislead investors far more often than they guide.

In contrast, the Zacks Rank is driven by earnings estimate revisions. And near-term stock price movements are strongly correlated with trends in earnings estimate revisions, according to empirical research.

In addition, the different Zacks Rank grades are applied proportionately to all stocks for which brokerage analysts provide current-year earnings estimates. In other words, this tool always maintains a balance among its five ranks.

There is also a key difference between the ABR and Zacks Rank when it comes to freshness. When you look at the ABR, it may not be up-to-date. Nonetheless, since brokerage analysts constantly revise their earnings estimates to reflect changing business trends, and their actions get reflected in the Zacks Rank quickly enough, it is always timely in predicting future stock prices.

Should You Invest in IONQ?

Looking at the earnings estimate revisions for IonQ, the Zacks Consensus Estimate for the current year has remained unchanged over the past month at -$0.84.

Analysts’ steady views regarding the company’s earnings prospects, as indicated by an unchanged consensus estimate, could be a legitimate reason for the stock to perform in line with the broader market in the near term.

The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #3 (Hold) for IonQ.

It may therefore be prudent to be a little cautious with the Buy-equivalent ABR for IonQ.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

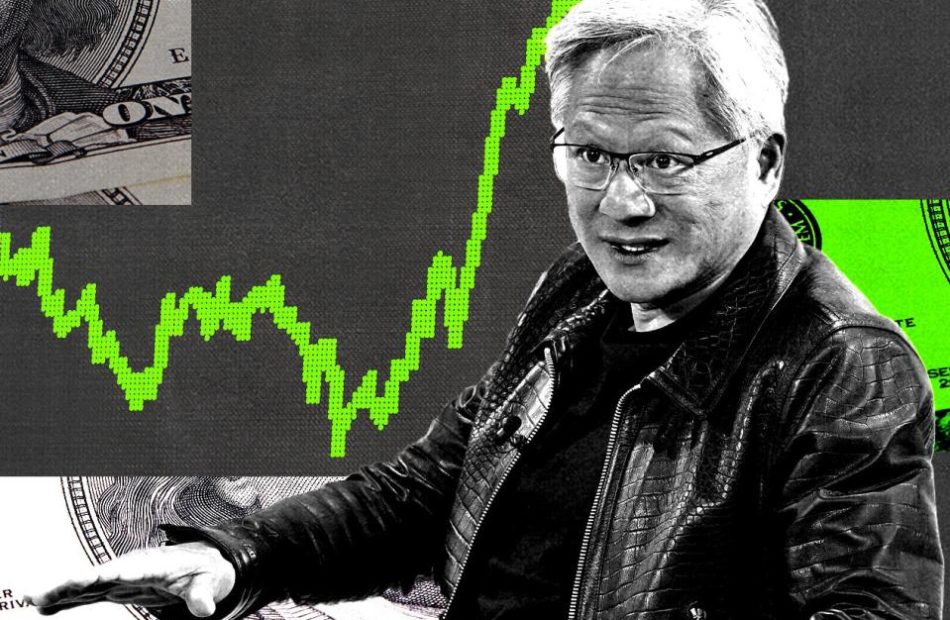

Morgan Stanley recently met with Nvidia's management team. Here are the biggest takeaways as the bank eyes another 12% upside for the stock.

-

Nvidia stock is set for more gains as demand for its GPU chips surges, Morgan Stanley says.

-

Nvidia’s Blackwell GPU is on schedule and is sold out for the next 12 months, the company said.

-

Inference computing growth boosts the long-term demand potential for Nvidia’s AI GPU chips.

Nvidia stock is poised for more gains as its GPU chip business continues to see surging demand.

That’s according to Morgan Stanley, which hosted meetings with Nvidia CEO Jensen Huang, CFO Colette Kress, and other members of the chip maker’s management team for three days in New York City this week.

The key takeaway is that “every indication from management is that we are still early in a long term AI investment cycle,” Morgan Stanley analyst Joseph Moore said.

The bank reiterated its “Overweight” and “Top Pick” ratings and $150 price target, representing potential upside of 12% from current levels.

Moore said Nvidia’s production ramp of its next-generation Blackwell GPU chip is “progressing on schedule,” adding that the product is sold out for the next 12 months.

“Any new Blackwell orders now that aren’t already in queue will be shipped late next year, as they are booked out 12 months, which continues to drive strong short term demand for Hopper which will still be a major factor through the year,” Moore explained.

Hopper is Nvidia’s previous generation of AI-enabled GPU chips, which are being sold in clusters to cloud “hyperscalers” like Amazon, Microsoft, and Meta Platforms.

And Nvidia has a new “element” to its story, according to Moore, which is the view that inference computing “is starting to solve much more complex problems which will require a much richer mix of hardware.”

That should be a boon for Nvidia’s GPU chip product set, according to the note.

“The longer term vision is that deep thinking will allow every company in the world to hire large numbers of “digital AI employees” that can execute challenging tasks,” Moore said.

He added: “The notion that a more thoughtful, task oriented inference would cause an exponential jump in inference complexity strikes us an important new avenue for growth, and another clear area where NVIDIA’s full stack approach to solving these problems adds to the company’s considerable lead.”

Nvidia CEO Jensen Huang made it clear to Morgan Stanley that the company expects to see meaningful growth in 2025 that spills over into 2026, “though he did not quantify,” Moore said.

Nvidia’s shares have increased since the start of October, rising about 10%. Nvidia stock is up 172% since the start of this year.

Read the original article on Business Insider

Why Chinese stocks will climb another 50% from current levels, research CEO says

-

Chinese stocks are poised for a huge run-up in the next year, according to Renaissance Macro’s Jeff deGraaf.

-

The research firm CEO said perfect conditions are aligning for additional gains exceeding 50%.

-

Other notable investors have been looking to buy the dip in Chinese stocks amid continued stimulus efforts.

China’s stock rally isn’t over — and the nation could have the perfect cocktail of ingredients to stage a monster run-up over the next year, according to one Wall Street forecaster.

Jeff deGraaf, the CEO of Renaissance Macro Research, says he sees China’s benchmark stock index climbing to 6,000 over the next year. That implies a 54% increase from the CSI 300’s current levels, thanks to the right mix of conditions in Beijing that should power equities higher, he told Bloomberg on Friday.

“Skepticism, valuation, stimulus, momentum and a trend change,” deGraaf said of China’s investing environment, adding that it was “one of the best set-ups” he’s seen over his 35-year career.

Chinese stocks have been on a roller coaster in recent weeks after Beijing announced its latest monetary stimulus package, which included lowering interest rates and pumping the stock market with $114 billion. The package sparked the steepest rally in Chinese stocks since 2008 before it quickly fizzled, a sign investors were disappointed Beijing didn’t announce more stimulus measures.

Markets, though, are expecting the nation to announce a fresh fiscal stimulus package at a briefing on Saturday, potentially reviving the bull case for stocks. Most investors expect China to add 2 trillion yuan, or $283 billion, in fiscal stimulus through 2025, according to a Bloomberg poll of market participants.

“We see the policy response as self-preservation, a reaction to the weakness and a potential Mario Draghi-esque ‘Do what it takes’ moment for China,” deGraaf said, later urging investors to “keep stops in place” when betting on Chinese stocks.

Other traders on Wall Street have shown interest in buying the dip in Chinese equities, despite fear that Beijing’s economic slowdown could stick around.

Investors poured a record $39.1 billion into Chinese stock funds in the week ending October 9, according to EPFR Global data cited by Bank of America in a note.

“We buy any China dips,” BofA strategist Michael Hartnett wrote in a note. Stimulus efforts will continue to “be used aggressively to boost domestic animal spirits and demand,” he added.

Additionally, the Shenzhen Huaan Hexin Private Investment Fund Management Co., a Chinese hedge fund up 800% since 2017, also says it’s buying the dip in technology stocks listed in Hong Kong. The Hang Seng Index has dropped 3% over the last five trading days, but is still up 27% from levels at the start of the year.

“Such a correction is more like a buying opportunity,” Yuan Wei, the fund’s founder, said in an interview with Bloomberg this week. “If you compare to their fundamentals, the stocks remain very cheap.”

China’s onshore market has a 50% chance of starting a new bull run, as opposed to a short-term bounce, and the bear market in equities should be over by now, Yuan said.

“The market is just rebounding from an extremely bearish level to a level that’s still undervalued,” he later added.

Other strategists on Wall Street have made bullish calls on Chinese equities in recent weeks, with eyes on continued stimulus measures in Beijing. Goldman Sachs predicted China’s stock market could rally another 20%, thanks to “more substantial policy measures” and Chinese stocks being oversold, strategists said in a note.

Read the original article on Business Insider

WM Technology, Inc. Announcement: If You Have Suffered Losses in WM Technology, Inc. (NASDAQ: MAPS), You Are Encouraged to Contact The Rosen Law Firm About Your Rights

NEW YORK, Oct. 11, 2024 (GLOBE NEWSWIRE) —

Why: Rosen Law Firm, a global investor rights law firm, continues to investigate potential securities claims on behalf of shareholders of WM Technology, Inc. MAPS resulting from allegations that WM Technology may have issued materially misleading business information to the investing public.

So What: If you purchased WM Technology securities you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement. The Rosen Law Firm is preparing a class action seeking recovery of investor losses.

What to do next: To join the prospective class action, go to https://rosenlegal.com/submit-form/?case_id=29177 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

What is this about: On September 25, 2024, the U.S. Securities and Exchange Commission (the “SEC”) issued a litigation release in which it announced it had “charged public company WM Technology, Inc. MAPS, its former CEO, Christopher Beals, and its former CFO, Arden Lee, for making negligent misrepresentations in WM Technology’s public reporting of a self-described key operating metric, the “monthly active users,” or “MAU,” for WM Technology’s online cannabis marketplace.” The same announcement noted the SEC had “also instituted a related settled administrative proceeding against WM Technology” and “WM Technology also agreed to pay a civil penalty of $1,500,000.”

On this news, WM Technology’s stock fell 1.9% on September 25, 2024.

Why Rosen Law: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources, or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CBH Homes Promotes Women in Construction at the House that She Built Event.

Boise, Idaho, Oct. 11, 2024 (GLOBE NEWSWIRE) — CBH Homes, Idaho’s leading home builder, is thrilled to announce the return of “The House That She Built” event and in 2024 is launching a new addition to make it even better. Last year, CBH Homes hosted 300 Girl Scouts and quickly realized the need to open it to the entire community was apparent.

“We were awestruck last year. The turnout of Girl Scouts blew us away and inspired us to open it up to all girls in the community,” said Ronda Conger, Vice President of CBH Homes. “We’re passionate about showing girls that construction is a rewarding and promising career.”

Inspired by the children’s book “The House That She Built” by Mollie Elkman, this interactive event empowers young girls to explore the exciting world of construction. The book, based on a true story of an all-women built house in Utah, highlights the diverse skills and people involved in building a home.

This year’s main event, open for all girls, will be held on Thursday, October 12th, from 2:00 PM to 4:00 PM at CBH Homes’ newest community, Spring Shores in Nampa, Idaho.

With a workforce comprised of 70% women, CBH Homes is committed to fostering a more inclusive construction industry. “The House That She Built” event provides a unique platform for girls to:

- Engage in hands-on activities: Girls will participate in a mini construction project, providing a tangible experience of the building process.

- Connect with industry role models: Meet and learn from successful women in various construction roles, gaining valuable insights and inspiration.

- Tour a CBH Home community: Explore a real-world construction site and witness different stages of the home building process.

- Enjoy fun giveaways: Receive exciting takeaways, making the experience even more memorable.

Event Details:

The House That She Built With CBH Homes

Date: Saturday, October 12th, 2024

Time: 2:00 PM – 4:00 PM

Location: Spring Shores by CBH Homes Community – 7514 E Shields Dr, Nampa, ID

Price: FREE

Spaces are limited! Sign up for this exciting event by clicking here.

About The House That She Built: A children’s book inspired by a true story written by Mollie Elkman. The mission of The House That She Built is to support workforce development initiatives in the construction industry by generating awareness of the skilled trades to the largest underrepresented community. The movement has grown to Girl Scout Patch Program, Events, and now a non-profit organization shebuilt.org.

About CBH Homes: CBH Homes has been building new homes for sale in Idaho for over 32 years, and for 19 of those, CBH Homes has been Idaho’s #1 Builder, a Best Places to Work in Idaho, ranked #42 in the nation, and proudly working with over 26,000 happy homeowners. Start shopping today, click here! Cbhhomes.com RCE-923

CeCe Cheney CBH Homes 208.288.5560 cecec@cbhhomes.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.