Jefferies Financial Gr President Trades $12.62M In Company Stock

Revealing a significant insider sell on October 11, BRIAN FRIEDMAN, President at Jefferies Financial Gr JEF, as per the latest SEC filing.

What Happened: FRIEDMAN’s recent Form 4 filing with the U.S. Securities and Exchange Commission on Friday unveiled the sale of 200,000 shares of Jefferies Financial Gr. The total transaction value is $12,618,060.

As of Friday morning, Jefferies Financial Gr shares are up by 0.1%, currently priced at $63.16.

About Jefferies Financial Gr

Jefferies Financial Group Inc is a diversified financial services company. It has two reportable segments; Investment Banking and Capital Markets which is also the majority revenue generating segment, includes securities, commodities, corporate lending, futures and foreign exchange capital markets activities and its investment banking business, which provides underwriting and financial advisory services to clients across different sectors. The Asset Management reportable business segment provides alternative investment management services to investors in the U.S. and overseas and generates investment income from capital invested in and managed by it or its affiliated asset managers.

Financial Milestones: Jefferies Financial Gr’s Journey

Revenue Growth: Jefferies Financial Gr displayed positive results in 3 months. As of 31 August, 2024, the company achieved a solid revenue growth rate of approximately 27.18%. This indicates a notable increase in the company’s top-line earnings. When compared to others in the Financials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Profitability Metrics:

-

Gross Margin: The company maintains a high gross margin of 60.41%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): With an EPS below industry norms, Jefferies Financial Gr exhibits below-average bottom-line performance with a current EPS of 0.78.

Debt Management: Jefferies Financial Gr’s debt-to-equity ratio is below the industry average at 2.14, reflecting a lower dependency on debt financing and a more conservative financial approach.

Valuation Metrics:

-

Price to Earnings (P/E) Ratio: Jefferies Financial Gr’s P/E ratio of 26.97 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: With a P/S ratio of 1.47 below industry standards, the stock shows potential undervaluation, making it an appealing investment option for those focusing on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry averages at 5.53, Jefferies Financial Gr could be considered undervalued.

Market Capitalization Analysis: Above industry benchmarks, the company’s market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Navigating the Impact of Insider Transactions on Investments

Insider transactions, although significant, should be considered within the larger context of market analysis and trends.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Transaction Codes To Focus On

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Jefferies Financial Gr’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Christ Revocable Trust Implements A Sell Strategy: Offloads $4.78M In Altair Engineering Stock

Revealing a significant insider sell on October 10, Christ Revocable Trust, 10% Owner at Altair Engineering ALTR, as per the latest SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Thursday showed that Trust sold 49,952 shares of Altair Engineering. The total transaction amounted to $4,781,645.

In the Friday’s morning session, Altair Engineering‘s shares are currently trading at $96.0, experiencing a up of 1.06%.

All You Need to Know About Altair Engineering

Altair Engineering Inc is a provider of enterprise-class engineering software enabling origination of the entire product lifecycle from concept design to in-service operation. The integrated suite of software provided by the company optimizes design performance across multiple disciplines encompassing structures, motion, fluids, thermal management, system modeling, and embedded systems. It operates through two segments: Software which includes the portfolio of software products such as solvers and optimization technology products, modeling and visualization tools, industrial and concept design tools, and others; and Client Engineering Services which provides client engineering services to support customers. Majority of its revenue comes from the software segment.

Altair Engineering’s Economic Impact: An Analysis

Positive Revenue Trend: Examining Altair Engineering’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 5.41% as of 30 June, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Key Profitability Indicators:

-

Gross Margin: The company sets a benchmark with a high gross margin of 79.49%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Altair Engineering’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of -0.06.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.33.

Exploring Valuation Metrics Landscape:

-

Price to Earnings (P/E) Ratio: With a higher-than-average P/E ratio of 296.97, Altair Engineering’s stock is perceived as being overvalued in the market.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 12.76 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 95.42, the company’s EV/EBITDA ratio outperforms industry norms, reflecting positive market perception. This positioning indicates optimistic expectations for the company’s future performance.

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Illuminating the Importance of Insider Transactions

Insider transactions contribute to decision-making but should be supplemented by a comprehensive investment analysis.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Important Transaction Codes

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Altair Engineering’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Warren Buffett and Cathie Wood Agree: This Growth Stock Is a Buy

Warren Buffett and Cathie Wood typically don’t agree on much when it comes to assembling a portfolio. Only rarely have they owned the same company.

But there’s one growth stock that both of these investors love — Latin American fintech Nu Holdings (NYSE: NU) — so much so that they have invested nearly $1.5 billion combined into the business. And yet many investors have never heard of this company.

You can use this ignorance to your advantage by snapping up shares at an incredible discount.

This growth stock is a proven winner

It’s not often that you can buy a proven growth stock at a reasonable valuation, nonetheless a discounted valuation. That’s because once a growth trajectory has begun, the market rushes to price that proven potential into the stock.

This is, in part, what makes growth investing so challenging. You can buy and hold a stock that grows revenue by 500% over your holding period. But if the market had been pricing in 600% growth, you could still end up underperforming the market.

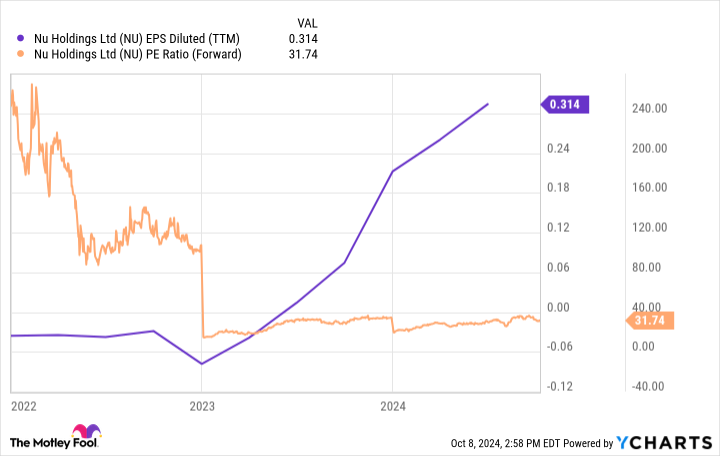

How do you get a discount on a proven growth stock? Just look at one that the market is ignoring — like Nu Holdings. And that might be the reason shares trade at just 32 times forward earnings, even though its bottom line has skyrocketed in recent years.

The issue for Nu isn’t a lack of famous investors. Buffett owns a bit more than $1.4 billion in shares through his holding company, Berkshire Hathaway — a position it has held since Nu’s initial public offering (IPO) in 2021. And through her company ARK Invest, Cathie Wood owns around 1.5 million shares of Nu, worth roughly $20 million.

The issue isn’t scale, either. Right now, Nu has more than 100 million customers. The issue is simply that Nu operates in just three countries: Brazil, Mexico, and Colombia. Unless you live in one of these nations, you likely have never heard of Nu — and certainly have never used its services.

What exactly is Nu’s business? It’s a fintech that offers a suite of financial services directly to customers through their smartphones. This might not sound so innovative today, but it was in Latin America in 2013.

Back then, a few stodgy incumbents controlled most of Latin America’s banking industry. Nu took the market by storm, offering more advanced services at a lower cost, available to anyone instantly through the device in their pocket.

There was clearly a lot of pent-up demand. Nu’s customer base went from essentially zero to more than 100 million over its first decade in business. And new product lines like its crypto trading platform surpassed 1 million users in its first month of operation.

Suffice it to say that the financials look great for Nu. Two years ago, its sales base had just surpassed $2 billion. Today, it’s approaching $8 billion. Meanwhile, earnings have flipped positive — a trajectory that is likely to be sustained for years to come. Over the next five years, for example, analysts expect earnings to grow at an average of 54% annually.

Should you follow Wood and Buffett into Nu stock?

Nu has an incredible story, a proven track record, and a reputable platform to build on. And its valuation — just 32 times forward earnings — is almost too good to pass up.

Just don’t think this will be a smooth ride. After its IPO, Nu shares actually lost 70% of their value over the first year of trading. Shares have completely rebounded since, but it’s a good reminder than rapid-growth stocks are often at the mercy of market volatility. The multiples assigned to these companies can vary widely based on market sentiment.

Like Buffett and Wood, I’m a big fan of Nu Holdings as an investment. But as with most stocks, it will be patience that ultimately generates the biggest returns. Don’t buy unless you’re willing to hold through the downward swings.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,022!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,329!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $393,839!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool recommends Nu Holdings. The Motley Fool has a disclosure policy.

Warren Buffett and Cathie Wood Agree: This Growth Stock Is a Buy was originally published by The Motley Fool

OUTLOOK ALERT: Bragar Eagel & Squire, P.C. is Investigating Outlook Therapeutics, Inc. on Behalf of Long-Term Stockholders and Encourages Investors to Contact the Firm

NEW YORK, Oct. 11, 2024 (GLOBE NEWSWIRE) — Bragar Eagel & Squire, P.C., a nationally recognized shareholder rights law firm, is investigating potential claims against Outlook Therapeutics, Inc. OTLK on behalf of long-term stockholders following a class action complaint that was filed against Outlook on November 3, 2023 with a Class Period from December 29, 2022 to August 29, 2023. Our investigation concerns whether the board of directors of Outlook have breached their fiduciary duties to the company.

The complaint alleges that throughout the Class Period, Defendants made materially false and misleading statements regarding the Company’s business, operations, and prospects. Specifically, Defendants allegedly made false and/or misleading statements and/or failed to disclose that: (i) there was a lack of substantial evidence supporting ONS-5010 as a treatment for wet AMD; (ii) Outlook and/or its manufacturing partner had deficient chemistry manufacturing and controls (“CMC”) and other manufacturing issues for ONS-5010, which remained unresolved at the time the ONS-5010 BLA was resubmitted to the FDA; (iii) as a result of all the foregoing, the FDA was unlikely to approve the ONS-5010 BLA in its present form; (iv) accordingly, ONS-5010’s regulatory and commercial prospects were overstated; and (v) as a result, the Company’s public statements were materially false and misleading at all relevant times.

If you are a long-term stockholder of Outlook, have information, would like to learn more about these claims, or have any questions concerning this announcement or your rights or interests with respect to these matters, please contact Brandon Walker or Marion Passmore by email at investigations@bespc.com, by telephone at (212) 355-4648, or by filling out this contact form. There is no cost or obligation to you.

About Bragar Eagel & Squire, P.C.:

Bragar Eagel & Squire, P.C. is a nationally recognized law firm with offices in New York and California. The firm represents individual and institutional investors in commercial, securities, derivative, and other complex litigation in state and federal courts across the country. For more information about the firm, please visit www.bespc.com. Attorney advertising. Prior results do not guarantee similar outcomes.

Contact Information:

Bragar Eagel & Squire, P.C.

Brandon Walker, Esq.

Marion Passmore, Esq.

(212) 355-4648

investigations@bespc.com

www.bespc.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wall Street Marks New Highs As Bank Stocks Rally, Tesla Tumbles As Robotaxi Disappoints: What's Driving Markets Friday?

Friday’s trading session saw another robust rally on Wall Street, with the S&P 500 and Dow Jones Industrial Average both reaching new record highs, fueled by better-than-expected third-quarter earnings from major U.S. banks.

The S&P 500 surged past 5,800 points, while the Dow Jones Industrial Average climbed above 42,800.

Leading the charge were top U.S. financial institutions, which kicked off the earnings season with strong results. JPMorgan Chase & Co. JPM, Wells Fargo & Co. WFC, Bank of New York Mellon Corp. BK, and BlackRock Inc. BLK all beat analysts’ earnings expectations. The upbeat results from these banking giants triggered a rally in financial stocks, pushing the sector to an all-time high.

Furthermore, gains spilled over to regional banks and the broader small-cap universe, as the SPDR S&P Regional Banking ETF KRE and the Russell 2000 rallied 2.7% and 1.7%, respectively.

Meanwhile, Tesla Inc. TSLA plunged by 8%, on track for its worst session in more than a month, with analysts expecting further declines after the lack of clear business plans for robotaxis and no updates on the lower-cost production vehicle, following the highly anticipated Robotaxi Day on Thursday.

On the macroeconomic front, inflation remains in focus. Following Thursday’s hotter-than-expected Consumer Price Index (CPI) report, Friday’s Producer Price Index (PPI) data also came in above forecasts, indicating a setback in the disinflationary narrative.

Despite the inflation uptick, market expectations for a Federal Reserve rate cut in November remained largely unchanged. According to CME’s FedWatch tool, there is still an 85% probability of a 25-basis-point rate cut next month.

In the commodities space, oil prices steadied after surging 3.5% on Thursday, amid a lack of relevant news from the Middle East front. Gold advanced 1.2%, while silver gained 1.4%.

Bitcoin BTC/USD also posted notable gains, rising over 3% in response to the strong earnings report from BlackRock, which showed higher-than-expected fund inflows. Investors appear optimistic about continued institutional interest in cryptocurrencies.

| Major Indices | Price | 1-day %chg |

| Russell 2000 | 2,223.00 | 1.7% |

| Dow Jones | 42,727.13 | 0.6% |

| S&P 500 | 5,807.71 | 0.5% |

| Nasdaq 100 | 20,259.87 | 0.1 % |

According to Benzinga Pro data:

- The SPDR S&P 500 ETF Trust SPY rose 0.4% to $578.52.

- The SPDR Dow Jones Industrial Average DIA rose 0.6% to $427.37.

- The tech-heavy Invesco QQQ Trust Series QQQ held steady at $492.55.

- The iShares Russell 2000 ETF IWM rose 1.6% to $220.38.

- The Financial Select Sector SPDR Fund XLF outperformed, up 1.9%. The Consumer Discretionary Select Sector SPDR Fund XLY lagged, down 0.4%.

- Uber Technologies Inc. UBER rose 9.1% in reaction to the dismal Robotaxi event.

- Shares of JPMorgan Chase & Co. rose 4.8% in reaction to upbeat quarterly earnings.

- Other banks reacting to earnings reports were Wells Fargo & Co., up 6.1%, BlackRock Inc., up 2.4%, and Bank of New York Mellon, down 1.8%.

- Fastenal Company FAST rallied 9.1% after reporting stronger-than-expected earnings.

- Shares of Affirm Holdings Inc. AFRM rallied over 10% after Wells Fargo upgraded the stock from Equal Weight to Overweight.

Read Now:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Is the One Stock Warren Buffett Keeps Buying, Regardless of Valuation

While there are a number of prominent money managers on Wall Street, none are followed as closely by the investment community as Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett.

One reason investors gravitate to the Oracle of Omaha is his track record. Though he’s not infallible, Buffett has overseen a nearly 5,500,000% aggregate return in his company’s Class A shares (BRK.A) since becoming CEO in the mid-1960s. On an annualized total return basis, which includes dividends, Berkshire Hathaway has practically doubled up the return of the benchmark S&P 500 spanning six decades.

The other lure for investors is Buffett’s willingness to be an open book. Whether through his annual letter to shareholders or during Berkshire’s annual meetings, Buffett often shares the characteristics he looks for in “wonderful companies,” as well as offers his take on the American economy.

But what Warren Buffett might be best known for is his penchant for value investing. There’s little that puts a smile on his face more than being able to put his company’s capital to work in a time-tested company with a sustainable moat at an advantageous price.

Though there are plenty of examples of the Oracle of Omaha nabbing amazing value stocks throughout history, there’s one stock he keeps buying regardless of valuation.

Warren Buffett has a knack for finding amazing deals hiding in plain sight

Despite selling more than 500 million shares of Apple (NASDAQ: AAPL) between Oct. 1, 2023 and June 30, 2024, Berkshire Hathaway’s top holding represents the perfect example of Warren Buffett stumbling on an amazing company at a highly favorable price point.

When Buffett began building his company’s stake in Apple during the first quarter of 2016, the tech giant’s trailing-12-month (TTM) price-to-earnings (P/E) ratio ranged from 10 to 12, which was well below that of the S&P 500. With the exception of the dot-com bubble, Apple’s stock had never been cheaper.

While its iPhone has remained dominant, in terms of domestic smartphone market share, Apple’s growth has been spearheaded by its Services division. This is a subscription-driven segment designed to keep users loyal to its ecosystem of products and services. It should also improve the company’s operating margin over the long run, as well as lessen the revenue peaks and troughs associated with iPhone upgrade cycles.

Today, Apple is hardly a bargain. As of the closing bell on Oct. 8, Apple’s stock was valued at a multiple of more than 34 times TTM earnings per share (EPS). Although Buffett hinted during Berkshire’s annual shareholder meeting in May that paring down his company’s stake in Apple was done for tax purposes, it’s quite possible valuation also came into play.

Berkshire Hathaway’s No. 3 holding, Bank of America (NYSE: BAC), serves as another example of Warren Buffett pouncing on a time-tested business that was historically inexpensive.

Following the financial crisis, Buffett invested $5 billion into BofA to shore up its balance sheet and received preferred stock and warrants in return. When this investment was announced in August 2011, Bank of America was trading at less than 38% of its book value. Something of an unwritten rule on Wall Street is to buy high-quality bank stocks at or below their book value and unload them at or near two times book value.

In the years since the financial crisis, Bank of America has been able to put its legal issues firmly in the rearview mirror. What’s more, it’s benefited immensely from being the most interest-sensitive of America’s money-center banks. The 525-basis-point increase in the federal funds rate by the Federal Reserve between March 2022 and July 2023 added billions of dollars in net interest income to BofA’s bottom line.

But with Bank of America stock now trading at a 16% premium to its book value, it’s perhaps no surprise that more than $10 billion in BofA stock has been unloaded by Buffett since mid-July.

The Oracle of Omaha is unwavering in his desire to get a good deal — with one exception.

This is the only stock Buffett keeps buying, regardless of its valuation

Despite spending a small fortune to build up Berkshire Hathaway’s stakes in Apple, Bank of America, Chevron, and Occidental Petroleum, there’s one stock that dwarfs them all, in terms of the amount of money Warren Buffett has invested.

However, investors aren’t going to find this company listed in Berkshire’s quarterly filed Form 13Fs. This is the filing that provides investors with a concise snapshot of what Wall Street’s brightest money managers have been buying and selling.

Rather, investors will have to dig into Berkshire Hathaway’s quarterly operating results to find evidence of Buffett purchasing his favorite stock. Toward the end of each quarterly filing, just prior to the executive certifications, you’ll find the page that lists Berkshire Hathaway’s share repurchase activity — because the stock Buffett keeps buying, regardless of valuation, is shares of his own company.

Berkshire Hathaway’s share buyback program has evolved quite a bit since the midpoint of 2018. Prior to July 2018, buybacks were only allowed if Berkshire Hathaway’s stock fell to or below 120% of its book value. Since Berkshire’s stock never fell below this line-in-the-sand threshold, Buffett was never able to spend a penny on buybacks.

On July 17, 2018, Berkshire Hathaway’s board amended the rules governing buybacks to allow Warren Buffett and then right-hand man Charlie Munger (who passed away in November 2023) more freedom to execute buybacks. These simplified new rules allowed for indefinite share repurchases with no end date as long as:

-

Berkshire Hathaway has at least $30 billion in cash, cash equivalents, and U.S. Treasuries on its balance sheet; and

-

Warren Buffett views his company’s stock as intrinsically cheap.

There’s a lot of leeway with this second point, which is what allows Buffett to regularly buy back his company’s stock. Since July 2018, Buffett has spent close to $78 billion repurchasing shares of Berkshire Hathaway, including $345 million during the June-ended quarter.

Additionally, buybacks have been made in all 24 quarters (through June 30, 2024) since these new repurchase rules were enacted. You’d have to go back to 2008 to find the last time Berkshire Hathaway’s stock was as pricey as it is now, relative to its book value… and yet Buffett keeps buying!

Because Berkshire Hathaway doesn’t pay a dividend, conducting buybacks is the easiest way for Buffett to reward his company’s shareholders and incent long-term thinking. Steadily reducing the company’s outstanding share count is incrementally increasing the ownership stakes of long-term investors.

To boot, companies with steady or growing net income, like Berkshire, tend to enjoy an EPS boost with fewer shares outstanding. This can make their stock more attractive to investors.

With Berkshire Hathaway sitting on an all-time record $276.9 billion in cash, cash equivalents, and U.S. Treasuries, as of the end of June, the Oracle of Omaha has every incentive to keep buying back his company’s stock, regardless of valuation.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,855!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,423!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $392,297!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America. The Motley Fool has positions in and recommends Apple, Bank of America, Berkshire Hathaway, and Chevron. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

This Is the One Stock Warren Buffett Keeps Buying, Regardless of Valuation was originally published by The Motley Fool

New Jersey Hemp Law Faces Setback As Federal Judge Blocks Out-of-State Product Ban

A federal judge has struck down parts of New Jersey’s recently enacted hemp law, ruling that certain provisions unlawfully restrict interstate commerce and conflict with federal regulations. The decision delivers a partial victory to hemp businesses that challenged the law, though key restrictions remain in place.

NJ Hemp Law Violates Commerce Clause

U.S. District Court Judge Zahid N. Quraishi ruled on Wednesday that specific sections of the New Jersey Hemp Act Amendments (NJHAA) violate the dormant Commerce Clause and are preempted by the 2018 Farm Bill, which federally legalized hemp. According to the New Jersey Monitor, the judge agreed with plaintiffs that the law’s definition of THC and its application discriminated against out-of-state hemp producers.

“The New Jersey Legislature cannot blatantly discriminate against out-of-state economic interests,” Judge Quraishi wrote in his decision.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

The NJHAA, signed by Governor Phil Murphy (D) last month, aimed to regulate intoxicating hemp products amid concerns that minors were accessing them easily. The law banned sales of such products to individuals under 21 and required sellers to obtain licenses through the state’s Cannabis Regulatory Commission (CRC), noted NJ.com.

Hemp Industry Celebrates Partial Legal Victory

While the judge upheld provisions banning sales to minors and the licensing requirement, he struck down parts that criminalized the sale or transport of federally compliant hemp products from other states. The decision prevents enforcement of the law’s restrictions on out-of-state hemp, ensuring that products adhering to federal standards can be sold in New Jersey.

Adam Terry, CEO of Cantrip and one of the plaintiffs, expressed satisfaction with the ruling. “We are vindicated in the belief that an outright ban on hemp is not the path forward,” he said, according to Forbes. “We must work together with lawmakers to develop sensible regulations.”

Read Also: US Army Tightens Substance Abuse Regulations, Banning Delta-8 THC, Warns Against Poppy Seeds

Critics, including a coalition of hemp businesses, argued that these restrictions not only stifled competition but also infringed upon federal guidelines that allow for the free movement of hemp products across state lines. They warned the law would harm local businesses and consumers, potentially forcing closures and job losses in the industry.

Moreover, concerns were also raised about the CRC’s ability to manage additional responsibilities without sufficient resources, as highlighted by NJ.com.

Bill Sponsor Calls For Hemp Law Adjustments

Senate Majority Leader M. Teresa Ruiz (D), a sponsor of the bill, acknowledged the need for legislative adjustments. “While I am pleased that the court order upheld the ban on selling intoxicating hemp products to minors, we must recognize that, without comprehensive regulation, these substances will continue to present a significant threat to the health and well-being of our communities,” said Ruiz.

The judge’s ruling comes as the deadline for businesses to remove intoxicating hemp products from shelves approaches on October 12. Until the CRC establishes new regulations, these products cannot be sold in the state.

This decision adds to the ongoing national debate over the regulation of psychoactive hemp products like delta-8 THC, which remain in a legal gray area due to a lack of federal oversight.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Drill Bit Hits Thickest Intercept So Far at Lithium Asset

Source: Greg Jones 10/09/2024

Though these results became available post feasibility study, they still could be incorporated into the mine plan, noted a BMO Capital Markets report.

Lithium Ionic Corp. LTHCF encountered its thickest intercept to date via drilling at its Bandeira project in Brazil, reported BMO Capital Markets analyst Greg Jones in an Oct. 8 research note.

“These [new drill] results continue to highlight the exploration potential at the property and could potentially provide for optimization opportunities ” Jones wrote. “Lithium Ionic is one of our preferred lithium developers.”

Undervalued Stock, 40% Return

Lithium Ionic, with a share price at the time of the report of about CA$0.89, noted Jones, is trading below the peer median, at about US$40 per ton of lithium carbonate equivalent versus US$60.

BMO’s target price on the Canadian company, is CA$1.25 per share and implies a possible return of 40%.

Lithium Ionic remains rated as Outperform.

Drill Results Offer Upside

The new drill results from Bandeira contained the following highlight intercepts, reported Jones, including the thickest intercept drilled to date via hole 24-276:

- 64.7 meters (64.7m) of 1.39% lithium oxide (Li2O) from 35m, including 22m of 1.67% Li2O and 20m of 1.62% Li2O, from hole 24-276

- 13m of 1.11% Li2O, including 5m of 1.51% Li2O, from hole 24-266

Lithium Ionic perhaps could capitalize on the upside these results offer to enhance the project even though the feasibility study (FS) already has been completed, the analyst wrote. The company has options for how to do it.

It might incorporate the resources defined after the FS cutoff date and, thereby, extend the mine life. It might upgrade and incorporate near-surface Inferred resources “to smooth the production profile.” It might move the processing of higher-grade material to earlier in the mine plan.

5 Reasons to Like LTH

Jones presented the following reasons why BMO considers Lithium Ionic a preferred lithium developer.

1) Its Bandeira project requires low capital, as outlined in the FS, about US$290 million, as estimated by BMO.

2) The company could be the first to production among developers in BMO’s coverage universe, given it has a well-understood permitting process and second-mover advantage, neighbor Sigma Lithium Resources being the first.

3) The Bandeira property encompasses a large, underexplored area, meaning the potential to expand the current resource exists.

4) Lithium Ionic has a second project in development in Brazil, called Salinas, of which a preliminary economic assessment is expected by year-end 2024.

5) The company is undervalued.

Important Disclosures:

- Lithium Ionic Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

- Disclosures for BMO Capital Markets, Lithium Ionic Corp., October 8, 2024

Analyst’s Certification I, Greg Jones, hereby certify that the views expressed in this report accurately reflect my personal views about the subject securities or issuers. I also certify that no part of my compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Analysts who prepared this report are compensated based upon (among other factors) the overall profitability of BMO Capital Markets and their affiliates, which includes the overall profitability of investment banking services. Compensation for research is based on effectiveness in generating new ideas and in communication of ideas to clients, performance of recommendations, accuracy of earnings estimates, and service to clients. Analysts employed by BMO Nesbitt Burns Inc. and/or BMO Capital Markets Limited are not registered as research analysts with FINRA. These analysts may not be associated persons of BMO Capital Markets Corp. and therefore may not be subject to the FINRA Rule 2241 restrictions on communications with a subject company, public appearances and trading securities held by a research analyst account.

Company Specific Disclosures Disclosure 2: BMO Capital Markets has provided investment banking services for remuneration with respect to Lithium Ionic Corp. within the past 12 months. Disclosure 4: BMO Capital Markets or an affiliate has received compensation for investment banking services from Lithium Ionic Corp. within the past 12 months. Disclosure 6A: Lithium Ionic Corp. is a client (or was a client) of BMO Nesbitt Burns Inc., BMO Capital Markets Corp., BMO Capital Markets Limited or an affiliate within the past 12 months: A) Investment Banking Services Disclosure 8A: BMO Capital Markets or affiliates have beneficial ownership of 1% or more of any class of the equity securities of Lithium Ionic Corp. (a) as of the end of the month prior to the issuance date of the research report, or (b) as of the end of the second most recent month if the report issuance date is less than 10 days after the end of the prior month.

Methodology and Risks to Target Price/Valuation for Lithium Ionic Corp. Methodology: We use a NAV-based methodology to value Lithium Ionic shares consistent with other developers in the mining sector. We apply a 0.60x multiple to our calculated NAV, appropriate in our view for an early-stage development company with a low-capital project in an attractive jurisdiction and balanced by the current market environment. Risks: 1) Permitting Risk. Delays in advancing the Bandeira project through permitting in a timely manner could impact our assumed production start date and negatively impact our NAV per share estimate. 2) Financing Risk. Inability for the company to secure the financing required to advance its development plans along its anticipated timeline could impact our modelled start date, and if significant equity capital is raised it could introduce dilution to shareholders. 3) Stage of development. The Salinas project is early-stage and its ability to continue growing and improving the confidence of the resource base and defining the project economics is a key aspect to the company’s growth story, in our view. 4) Geological risk. The presence of a river over portion of the Outro Lado deposit requires further study. A river passes over a portion of the Outro Lado deposit and will not allow for open pit mining of this area. Underground mining is contemplated, and additional mine design study is required, which could adversely affect the current mineral resource estimate for this area (3.4 Mt at 1.47% Li2O). 5) Commodity price risk. Weakness in lithium and spodumene demand and commodity prices could negatively impact share price performance.

Dissemination of Research Dissemination of fundamental BMO Capital Markets Equity Research is available via our website https:// researchglobal0.bmocapitalmarkets.com/. Institutional clients may also simultaneously receive our fundamental research via email and/or via services such as Refinitiv, Bloomberg, FactSet, Visible Alpha, and S&P Capital IQ. BMO Capital Markets issues a variety of research products in addition to fundamental research. Institutional clients may request notification when additional research content is made available on our website. BMO Capital Markets may use proprietary models in the preparation of reports. Material information about such models may be obtained by contacting the research analyst directly. There is no planned frequency of model updates. The analyst(s) named in this report may discuss trading strategies that reference a catalyst or event that may have a near or long term impact on the market price of the equity securities discussed. In some cases, the impact may directionally counter the analyst’s published 12 month target price and rating. Any such trading or alternative strategies can be based on differing time horizons, methodologies, or otherwise and are distinct from and do not affect the analysts’ fundamental equity rating in the report. Research coverage of licensed cannabis producers and other cannabis-related companies is made available only to eligible approved North American, Australian, and EU-based BMO Nesbitt Burns Inc., BMO Capital Markets Limited, Bank of Montreal Europe Plc and BMO Capital Markets Corp. clients via email, our website and select third party platforms. ~ Research distribution and approval times are provided on the cover of each report. Times are approximations as system and distribution processes are not exact and can vary based on the sender and recipients’ services. Unless otherwise noted, times are Eastern Standard and when two times are provided, the approval time precedes the distribution time. For recommendations disseminated during the preceding 12-month period, please visit: https://researchglobal0.bmocapitalmarkets.com/publicdisclosure/. For current ESG related material, please visit: https://researchglobal0.bmocapitalmarkets.com/esg/esg-landing-page/.

General Disclaimer “BMO Capital Markets” is a trade name used by BMO Financial Group for the wholesale banking businesses of Bank of Montreal, BMO Bank N.A. (member FDIC), Bank of Montreal Europe p.l.c, and Bank of Montreal (China) Co. Ltd, the institutional broker dealer business of BMO Capital Markets Corp. (Member FINRA and SIPC) and the agency broker dealer business of Clearpool Execution Services, LLC (Member FINRA and SIPC) in the U.S., and the institutional broker dealer businesses of BMO Nesbitt Burns Inc. (Member Canadian Investment Regulatory Organization and Member Canadian Investor Protection Fund) in Canada and Asia, Bank of Montreal Europe p.l.c. (authorised and regulated by the Central Bank of Ireland) in Europe and BMO Capital Markets Limited (authorised and regulated by the Financial Conduct Authority) in the UK and Australia. Bank of Montreal or its subsidiaries (“BMO Financial Group”) has lending arrangements with, or provide other remunerated services to, many issuers covered by BMO Capital Markets. The opinions, estimates and projections contained in this report are those of BMO Capital Markets as of the date of this report and are subject to change without notice. BMO Capital Markets endeavours to ensure that the contents have been compiled or derived from sources that we believe are reliable and contain information and opinions that are accurate and complete. However, BMO Capital Markets makes no representation or warranty, express or implied, in respect thereof, takes no responsibility for any errors and omissions contained herein and accepts no liability whatsoever for any loss arising from any use of, or reliance on, this report or its contents. Information may be available to BMO Capital Markets or its affiliates that is not reflected in this report. The information in this report is not intended to be used as the primary basis of investment decisions, and because of individual client objectives, should not be construed as advice designed to meet the particular investment needs of any investor. The information in this report is based on general considerations and do not purport to meet the objectives or needs of specific recipients. Nothing herein constitutes any investment, legal, tax or other advice nor is it to be relied on in any investment or decision. If you are in doubt about any of the contents of this document, the reader should obtain independent professional advice. This material is for information purposes only and is not an offer to sell or the solicitation of an offer to buy any security. In furnishing this report, BMO Capital Markets intends to take advantage of the exemption from the principal and agency trading restrictions in Section 206(3) of the Investment Advisers Act of 1940 and Rule 206(3)-1 thereunder. Accordingly, recipients of this report are advised that BMO Capital Markets or its affiliates may act as principal for its own account or agent for another person in connection with the purchase or sale of any security mentioned in or the subject of this report. BMO Capital Markets or its affiliates, officers, directors or employees have a long or short position in many of the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. The reader should assume that BMO Capital Markets or its affiliates may have a conflict of interest and should not rely solely on this report in evaluating whether or not to buy or sell securities of issuers discussed herein

Additional Matters This report is directed only at entities or persons in jurisdictions or countries where access to and use of the information is not contrary to local laws or regulations. Its contents have not been reviewed by any regulatory authority. BMO Capital Markets does not represent that this report may be lawfully distributed or that any financial products may be lawfully offered or dealt with, in compliance with regulatory requirements in other jurisdictions, or pursuant to an exemption available thereunder. To Australian residents: BMO Capital Markets Limited and Bank of Montreal are exempt from the requirement to hold an Australian financial services licence under the Corporations Act in respect of financial services they provide to wholesale investors (as defined in the Corporations Act). BMO Capital Markets Limited is regulated by the UK Financial Conduct Authority under UK laws, and Bank of Montreal in Hong Kong is regulated by the Hong Kong Monetary Authority and the Securities and Futures Commission, which differ from Australia laws. This document is only intended for wholesale clients (as defined in the Corporations Act 2001), Eligible Counterparties or Professional Clients (as defined in Annex II to MiFID II) and Professional Investors (as defined in the Securities and Futures Ordinance and the Securities and Futures (Professional Investor) Rules under the Securities and Futures Ordinance of Hong Kong). To Canadian Residents: BMO Nesbitt Burns Inc. furnishes this report to Canadian residents and accepts responsibility for the contents herein subject to the terms set out above. Any Canadian person wishing to effect transactions in any of the securities included in this report should do so through BMO Nesbitt Burns Inc. The following applies if this research was prepared in whole or in part by Colin Hamilton, Alexander Pearce or Raj Ray: This research is not prepared subject to Canadian disclosure requirements. This research is prepared by BMO Capital Markets Limited and distributed by BMO Capital Markets Limited or Bank of Montreal Europe Plc and is subject to the regulations of the Financial Conduct Authority (FCA) in the United Kingdom and the Central Bank of Ireland (CBI) in Ireland. FCA and CBI regulations require that a firm providing research disclose its ownership interest in the issuer that is the subject of the research if it and its affiliates own 5% or more of the equity of the issuer. Canadian regulations require that a firm providing research disclose its ownership interest in the issuer that is the subject of the research if it and its affiliates own 1% or more of the equity of the issuer that is the subject of the research. Therefore each of BMO Capital Markets Limited and Bank of Montreal Europe Plc will disclose its and its affiliates’ ownership interest in the subject issuer only if such ownership exceeds 5% of the equity of the issuer. To E.U. Residents: In an E.U. Member State this document is issued and distributed by Bank of Montreal Europe plc which is authorised and regulated in Ireland and operates in the E.U. on a passported basis. This document is only intended for Eligible Counterparties or Professional Clients, as defined in Annex II to “Markets in Financial Instruments Directive” 2014/65/EU (“MiFID II”). To U.S. Residents: BMO Capital Markets Corp. furnishes this report to U.S. residents and accepts responsibility for the contents herein, except to the extent that it refers to securities of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Capital Markets Corp. To U.K. Residents: In the UK this document is published by BMO Capital Markets Limited which is authorised and regulated by the Financial Conduct Authority. The contents hereof are intended solely for the use of, and may only be issued or passed on to, (I) persons who have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) or (II) high net worth entities falling within Article 49(2)(a) to (d) of the Order (all such persons together referred to as “relevant persons”). The contents hereof are not intended for the use of and may not be issued or passed on to retail clients. To Hong Kong Residents: In Hong Kong, this report is published and distributed by Bank of Montreal. Bank of Montreal (incorporated in Canada with limited liability) is an authorized institution under the Banking Ordinance and a registered institution with the Securities and Futures Commission (CE No. AAK809) to carry on Type 1 (dealing in securities) and Type 4 (advising in securities) regulated activities under the Securities and Futures Ordinance (Cap 571 of the Laws of Hong Kong). This report has not been reviewed or approved by any regulatory authority in Hong Kong. Accordingly this report must not be issued, circulated or distributed in Hong Kong other than (a) to professional investors as defined in the Securities and Futures Ordinance and the Securities and Futures (Professional Investor) Rules under the Securities and Futures Ordinance of Hong Kong, or (b) in circumstances which do not result in or constitute an offer to the public in Hong Kong. To Korean Residents: This report has been provided to you without charge for your convenience only. All information contained in this report is factual information and does not reflect any opinion or judgement of BMO Capital Markets. The information contained in this report should not be construed as offer, marketing, solicitation or investment advice with respect to financial investment products in this report. To Japan Residents: This report has not been reviewed by any regulatory authority in Japan. This report is provided for information purposes only and it should not be construed as an offer to sell, a solicitation to buy, or a recommendation for any security, or as an offer to provide investment management or advisory or other services in Japan. Securities may not be offered or sold in Japan by means of this report or any other document other than to Qualified Financial Institutions within the meaning of item (i) of Article 17-3 of the Government Ordinance to enforce the Financial Instruments and Exchange Act (Kinyu Shohin Torihiki Ho Sekou Rei). Unless specified otherwise, the securities that may be offered to you are not and will not be registered in Japan pursuant to the Financial Instruments and Exchange Acts. To Taiwanese Residents: This report is not intended to constitute investment advice nor a public offer for any investment products to investors in Taiwan. This report should only be accessed by investors in Taiwan that are qualified to invest in investment products pursuant to relevant Taiwanese laws and regulations, and subject to sales restrictions as set forth in the relevant Taiwanese laws and regulations. BMO Capital Markets has not and will not secure the required licenses in Taiwan for the offer of securities and investment services. Any offer of securities has not been and will not be registered or filed with or approved by the Financial Commission of Taiwan and/or other regulatory authority pursuant to relevant securities laws and regulations of Taiwan, and may not be issued, offered or sold within Taiwan through a public offering or in circumstances which constitute an offer that requires a registration, filing or approval of the Financial Supervisory Commission of Taiwan and/or other regulatory authority in Taiwan under relevant securities laws and regulations of Taiwan. No person or entity in Taiwan has been authorized to offer or sell the securities in Taiwan. To Singapore Residents: This report is intended for general circulation and does not and is not intended to constitute the provision of financial advisory services, whether directly or indirectly, to persons in Singapore. You should seek advice from a financial adviser regarding the suitability of the investment products, taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase the investment product. This report has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, it should not be circulated or distributed, nor may the securities described herein be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (a) to an institutional investor or a relevant person as defined in and pursuant to and in accordance with the conditions of the relevant provisions of the Securities and Futures Act of Singapore or (b) otherwise pursuant to and in accordance with the conditions of, any other applicable provision of the SFA. To Israeli residents: BMO Capital Markets is not licensed under the Israeli Law for the Regulation of Investment Advice, Investment Marketing and Portfolio Management of 1995 (the “Advice Law”) nor does it carry insurance as required thereunder. This document is to be distributed solely to persons that are qualified clients (as defined under the Advice Law) and qualified investors under the Israeli Securities Law of 1968. This document represents the analysis of the analyst but there is no assurance that any assumption or estimation will materialize. These documents are provided to you on the express understanding that they must be held in complete confidence and not republished, retransmitted, distributed, disclosed, or otherwise made available, in whole or in part, directly or indirectly, in hard or soft copy, through any means, to any person, except with the prior written consent of BMO Capital Markets. Click here for data vendor disclosures when referenced within a BMO Capital Markets research document. For assistance with accessible formats of online content, please contact research@bmo The recommendation contained in this report was produced at October 08, 2024, 08:01 ET. and disseminated at October 08, 2024, 08:01 ET.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Is It Worth Investing in TJX Based on Wall Street's Bullish Views?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock’s price. Do they really matter, though?

Let’s take a look at what these Wall Street heavyweights have to say about TJX TJX before we discuss the reliability of brokerage recommendations and how to use them to your advantage.

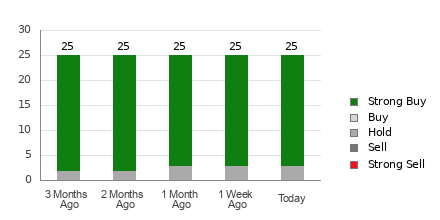

TJX currently has an average brokerage recommendation of 1.24, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc.) made by 25 brokerage firms. An ABR of 1.24 approximates between Strong Buy and Buy.

Of the 25 recommendations that derive the current ABR, 22 are Strong Buy, representing 88% of all recommendations.

Brokerage Recommendation Trends for TJX

The ABR suggests buying TJX, but making an investment decision solely on the basis of this information might not be a good idea. According to several studies, brokerage recommendations have little to no success guiding investors to choose stocks with the most potential for price appreciation.

Are you wondering why? The vested interest of brokerage firms in a stock they cover often results in a strong positive bias of their analysts in rating it. Our research shows that for every “Strong Sell” recommendation, brokerage firms assign five “Strong Buy” recommendations.

In other words, their interests aren’t always aligned with retail investors, rarely indicating where the price of a stock could actually be heading. Therefore, the best use of this information could be validating your own research or an indicator that has proven to be highly successful in predicting a stock’s price movement.

With an impressive externally audited track record, our proprietary stock rating tool, the Zacks Rank, which classifies stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), is a reliable indicator of a stock’s near -term price performance. So, validating the Zacks Rank with ABR could go a long way in making a profitable investment decision.

ABR Should Not Be Confused With Zacks Rank

In spite of the fact that Zacks Rank and ABR both appear on a scale from 1 to 5, they are two completely different measures.

The ABR is calculated solely based on brokerage recommendations and is typically displayed with decimals (example: 1.28). In contrast, the Zacks Rank is a quantitative model allowing investors to harness the power of earnings estimate revisions. It is displayed in whole numbers — 1 to 5.

It has been and continues to be the case that analysts employed by brokerage firms are overly optimistic with their recommendations. Because of their employers’ vested interests, these analysts issue more favorable ratings than their research would support, misguiding investors far more often than helping them.

In contrast, the Zacks Rank is driven by earnings estimate revisions. And near-term stock price movements are strongly correlated with trends in earnings estimate revisions, according to empirical research.

Furthermore, the different grades of the Zacks Rank are applied proportionately across all stocks for which brokerage analysts provide earnings estimates for the current year. In other words, at all times, this tool maintains a balance among the five ranks it assigns.

There is also a key difference between the ABR and Zacks Rank when it comes to freshness. When you look at the ABR, it may not be up-to-date. Nonetheless, since brokerage analysts constantly revise their earnings estimates to reflect changing business trends, and their actions get reflected in the Zacks Rank quickly enough, it is always timely in predicting future stock prices.

Should You Invest in TJX?

Looking at the earnings estimate revisions for TJX, the Zacks Consensus Estimate for the current year has remained unchanged over the past month at $4.15.

Analysts’ steady views regarding the company’s earnings prospects, as indicated by an unchanged consensus estimate, could be a legitimate reason for the stock to perform in line with the broader market in the near term.

The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #3 (Hold) for TJX.

It may therefore be prudent to be a little cautious with the Buy-equivalent ABR for TJX.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Hingham Savings Reports Third Quarter 2024 Results

HINGHAM, Mass., Oct. 11, 2024 (GLOBE NEWSWIRE) — HINGHAM INSTITUTION FOR SAVINGS HIFS, Hingham, Massachusetts announced results for the quarter ended September 30, 2024.

Earnings

Net income for the quarter ended September 30, 2024 was $5,846,000 or $2.68 per share basic and $2.66 per share diluted, as compared to $3,297,000 or $1.53 per share basic and $1.50 per share diluted for the same period last year. The Bank’s annualized return on average equity for the third quarter of 2024 was 5.52%, and the annualized return on average assets was 0.54%, as compared to 3.25% and 0.31% for the same period last year. Net income per share (diluted) for the third quarter of 2024 increased by 77% compared to the same period in 2023.

Core net income for the quarter ended September 30, 2024, which represents net income excluding the after-tax gain on equity securities, both realized and unrealized, and the after-tax gain on the disposal of fixed assets, was $3,163,000 or $1.45 per share basic and $1.44 per share diluted, as compared to $2,895,000 or $1.35 per share basic and $1.32 per share diluted for the same period last year. The Bank’s annualized core return on average equity for the third quarter of 2024 was 2.99% and the annualized core return on average assets was 0.29%, as compared to 2.85% and 0.27% for the same period last year. Core net income per share (diluted) for the third quarter of 2024 increased by 9% over the same period in 2023.

Net income for the nine months ended September 30, 2024 was $16,816,000 or $7.73 per share basic and $7.67 per share diluted, as compared to $20,056,000 or $9.33 per share basic and $9.14 per share diluted for the same period last year. The Bank’s annualized return on average equity for the first nine months of 2024 was 5.35%, and the annualized return on average assets was 0.52%, as compared to 6.70% and 0.64% for the same period in 2023. Net income per share (diluted) for the first nine months of 2024 decreased by 16% over the same period in 2023.

Core net income for the nine months ended September 30, 2024, which represents net income excluding the after-tax gain on securities, both realized and unrealized, and the after-tax gain on the disposal of fixed assets, was $7,558,000 or $3.47 per share basic and $3.45 per share diluted, as compared to $12,686,000 or $5.90 per share basic and $5.78 per share diluted for the same period last year. The Bank’s annualized core return on average equity for the first nine months of 2024 was 2.41%, and the annualized core return on average assets was 0.23%, as compared to 4.24% and 0.41% for the same period in 2023. Core net income per share (diluted) for the first nine months of 2024 decreased by 40% over the same period in 2023.

See Page 10 for a reconciliation between Generally Accepted Accounting Principles (“GAAP”) net income and non-GAAP core net income. GAAP requires that gains and losses on equity securities, net of tax, realized and unrealized, be recognized in the Consolidated Statements of Income. In calculating core net income, the Bank did not make any adjustments other than those relating to after-tax gain on equity securities, realized and unrealized, and the after-tax gain on disposal of fixed assets.

Balance Sheet

Total assets were $4.450 billion at September 30, 2024, representing a 1% annualized decline year-to-date and 2% growth from September 30, 2023.

Net loans were $3.863 billion at September 30, 2024, representing a 2% annualized decline year-to-date and 1% growth from September 30, 2023. Origination activity was concentrated in the Boston and Washington D.C. markets and remained focused on stabilized multifamily commercial real estate and multifamily construction. The Bank continues to evaluate new opportunities in the San Francisco market, where interest in acquisitions and refinancing activity from the Bank’s customers began to pick up in 2024. In the third quarter of 2024, the Bank continued to experience loan prepayments more consistent with historic trends, including continued significant turnover in the Bank’s construction portfolio. As noted below, asset quality remained strong and finding high-quality loan assets remains a core business objective of the Bank.

Retail and business deposits were $1.977 billion at September 30, 2024, representing 8% annualized growth year-to-date and 3% growth from September 30, 2023. Non-interest-bearing deposits, included in retail and business deposits, were $358.0 million at September 30, 2024, representing 7% annualized growth year-to-date and stable from September 30, 2023.

Growth in non-interest bearing and money market balances in the first nine months of 2024 reflected the Bank’s focus on developing and deepening deposit relationships with new and existing commercial and non-profit customers. Investments in new relationship managers over the last nine months continued to contribute to deposit growth in the third quarter of 2024. The Bank continues to recruit actively for talented commercial bankers in Boston, Washington, and San Francisco, particularly as respected competitors have exited these markets or merged with larger regional banks.

The stability of the Bank’s balance sheet, as well as full and unlimited deposit insurance through the Bank’s participation in the Massachusetts Depositors Insurance Fund, continues to be appealing to customers in times of uncertainty.

Wholesale funds, which includes Federal Home Loan Bank borrowings, brokered deposits, and Internet listing service deposits were $2.015 billion at September 30, 2024, representing a 10% annualized decline year-to-date and 1% growth from September 30, 2023. In the first nine months of 2024, the Bank continued to manage its wholesale funding mix to optimize the cost of funds while taking advantage of the inverted yield curve by adding lower rate longer term liabilities. Wholesale deposits, which include brokered and Internet listing service time deposits, were $482.2 million at September 30, 2024, representing a 1% annualized decline year-to-date and a 2% decline from September 30, 2023. Borrowings from the Federal Home Loan Bank totaled $1.531 billion at September 30, 2024, representing a 13% annualized decline from December 31, 2023, and 1% growth from September 30, 2023. As of September 30, 2024, the Bank maintained an additional $815.5 million in immediately available borrowing capacity at the Federal Home Loan Bank of Boston and the Federal Reserve Bank, in addition to $368.1 million in cash and cash equivalents.

Book value per share was $193.42 as of September 30, 2024, representing 3% annualized growth year-to-date and 4% growth from September 30, 2023. This growth is not consistent with the Bank’s long-term objectives. In addition to the increase in book value per share, the Bank declared $2.52 in dividends per share since September 30, 2023.

On September 25, 2024, the Bank declared a regular cash dividend of $0.63 per share. This dividend will be paid on November 13, 2024 to stockholders of record as of November 4, 2024. This was the Bank’s 123rd consecutive quarterly dividend.

The Bank has also generally declared special cash dividends in each of the last twenty-nine years, typically in the fourth quarter, but did not declare a special dividend in 2023. The Bank sets the level of the special dividend based on the Bank’s capital requirements and the prospective return on other capital allocation options, particularly the incremental return on capital from new loan originations. This may result in special dividends, if any, significantly above or below the regular quarterly dividend. Future regular and special dividends will be considered by the Board of Directors on a quarterly basis.

Operational Performance Metrics

The net interest margin for the quarter ended September 30, 2024 increased 11 basis points to 1.07%, as compared to 0.96% in the quarter ended June 30, 2024. This was the second consecutive quarter of continued expansion. This improvement was the result of an increase in the yield on earning assets combined with a decline in the cost of interest-bearing liabilities. The six basis points increase in the yield on earning assets was driven primarily by a higher yield on loans, as the Bank continued to originate loans at higher rates and reprice existing loans. The cost of interest-bearing liabilities fell three basis points, as the Bank began to reduce rates later in the third quarter and continued to take advantage of the inverted yield curve by adding lower rate FHLB advances and brokered deposits. The net interest margin in the final month of the third quarter of 2024 was 1.14% annualized.

Key credit and operational metrics remained strong in the third quarter of 2024. At September 30, 2024, non-performing assets totaled 0.04% of total assets, compared to 0.03% at December 31, 2023 and 0.00% at September 30, 2023. Non-performing loans as a percentage of the total loan portfolio totaled 0.04% at both September 30, 2024 and December 31, 2023, as compared to 0.01% at September 30, 2023. The Bank did not record any charge-offs in the first nine months of 2024 or 2023. All non-performing assets and loans cited above were and are residential, owner-occupant loans.

The Bank did not have any delinquent or non-performing commercial real estate loans as of September 30, 2024, December 31, 2023, or September 30, 2023. The Bank did not own any foreclosed property as of September 30, 2024, December 31, 2023 or September 30, 2023.

The efficiency ratio, as defined on page 5 below, fell to 62.19% for the third quarter of 2024, as compared to 68.57% in the prior quarter and 62.55% for the same period last year. Operating expenses as a percentage of average assets rose to 0.68% for the third quarter of 2024, as compared to 0.67% for the prior quarter and the same period last year. As the efficiency ratio can be significantly influenced by the level of net interest income, the Bank utilizes these paired figures together to assess its operational efficiency over time. During periods of significant net interest income volatility, the efficiency ratio in isolation may over or understate the underlying operational efficiency of the Bank. The Bank remains focused on reducing waste through an ongoing process of continuous improvement and standard work that supports operational leverage, positioning the Bank to operate more efficiently in future.

Chairman Robert H. Gaughen Jr. stated, “Returns on equity and assets in the third quarter of 2024 were significantly lower than our long-term performance, reflecting the challenge from the increase in short-term interest rates over the last twenty-four months and a historically long and deep inversion of the yield curve. These conditions have posed a significant – albeit ultimately temporary – challenge to our business model. Our core business has been particularly challenged during this period and our investment operations have been critical to sustaining some growth in book value per share in this environment. As our assets continue to reprice higher and our liabilities, including both deposits and wholesale funding, reprice lower, conditions have become somewhat more favorable for our model.

While this market environment has been extraordinarily challenging, the Bank’s business model has been built over time to compound shareholder capital through economic cycles. During all such periods, we remain focused on careful capital allocation, defensive underwriting and disciplined cost control – the building blocks for compounding shareholder capital through all stages of the economic cycle. These remain constant, regardless of the macroeconomic environment in which we operate. I believe that over the past twenty-four months we have retained this focus and it will serve us well as our business emerges from this period.”

The Bank’s quarterly financial results are summarized in this earnings release, but shareholders are encouraged to read the Bank’s quarterly report on Form 10-Q, which is generally available several weeks after the earnings release. The Bank expects to file Form 10-Q for the quarter ended September 30, 2024 with the Federal Deposit Insurance Corporation (FDIC) on or about November 6, 2024.

Incorporated in 1834, Hingham Institution for Savings is one of America’s oldest banks. The Bank maintains offices in Boston, Nantucket, Washington, D.C., and San Francisco.

The Bank’s shares of common stock are listed and traded on The NASDAQ Stock Market under the symbol HIFS.

| HINGHAM INSTITUTION FOR SAVINGS Selected Financial Ratios |

|||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||

| 2023 | 2024 | 2023 | 2024 | ||||||||

| (Unaudited) | |||||||||||

| Key Performance Ratios | |||||||||||

| Return on average assets (1) | 0.31 | % | 0.54 | % | 0.64 | % | 0.52 | % | |||

| Return on average equity (1) | 3.25 | 5.52 | 6.70 | 5.35 | |||||||

| Core return on average assets (1) (5) | 0.27 | 0.29 | 0.41 | 0.23 | |||||||

| Core return on average equity (1) (5) | 2.85 | 2.99 | 4.24 | 2.41 | |||||||

| Interest rate spread (1) (2) | 0.39 | 0.34 | 0.65 | 0.24 | |||||||

| Net interest margin (1) (3) | 1.05 | 1.07 | 1.26 | 0.96 | |||||||

| Operating expenses to average assets (1) | 0.67 | 0.68 | 0.68 | 0.67 | |||||||

| Efficiency ratio (4) | 62.55 | 62.19 | 53.69 | 68.76 | |||||||

| Average equity to average assets | 9.59 | 9.82 | 9.58 | 9.65 | |||||||

| Average interest-earning assets to average interest-bearing liabilities | 120.53 | 120.59 | 121.28 | 120.14 | |||||||

| September 30, 2023 |

December 31, 2023 |

September 30, 2024 |

|||||||||

| (Unaudited) | |||||||||||

| Asset Quality Ratios | |||||||||||

| Allowance for credit losses/total loans | 0.69 | % | 0.68 | % | 0.69 | % | |||||

| Allowance for credit losses/non-performing loans | 13,528.72 | 1,804.47 | 1,662.35 | ||||||||

| Non-performing loans/total loans | 0.01 | 0.04 | 0.04 | ||||||||

| Non-performing loans/total assets | 0.00 | 0.03 | 0.04 | ||||||||

| Non-performing assets/total assets | 0.00 | 0.03 | 0.04 | ||||||||

| Share Related | |||||||||||

| Book value per share | $ | 186.74 | $ | 188.50 | $ | 193.42 | |||||

| Market value per share | $ | 186.75 | $ | 194.40 | $ | 243.31 | |||||

| Shares outstanding at end of period | 2,152,400 | 2,162,400 | 2,180,250 | ||||||||

| (1) | Annualized. | |

| (2) | Interest rate spread represents the difference between the yield on interest-earning assets and the cost of interest-bearing liabilities. | |

| (3) | Net interest margin represents net interest income divided by average interest-earning assets. | |

| (4) | The efficiency ratio is a non-GAAP measure that represents total operating expenses, divided by the sum of net interest income and total other income, excluding gain on equity securities, net and gain on disposal of fixed assets. | |

| (5) | Non-GAAP measurements that represent return on average assets and return on average equity, excluding the after-tax gain on equity securities, net and the after-tax gain on disposal of fixed assets. | |

| HINGHAM INSTITUTION FOR SAVINGS Consolidated Balance Sheets |

|||||||||||

| (In thousands, except share amounts) | September 30, 2023 |

December 31, 2023 |

September 30, 2024 |

||||||||

| (Unaudited) | |||||||||||

| ASSETS | |||||||||||

| Cash and due from banks | $ | 6,122 | $ | 5,654 | $ | 7,147 | |||||

| Federal Reserve and other short-term investments | 347,419 | 356,823 | 360,953 | ||||||||

| Cash and cash equivalents | 353,541 | 362,477 | 368,100 | ||||||||

| CRA investment | 7,973 | 8,853 | 9,040 | ||||||||

| Other marketable equity securities | 65,213 | 70,949 | 88,604 | ||||||||

| Securities, at fair value | 73,186 | 79,802 | 97,644 | ||||||||

| Securities held to maturity, at amortized cost | 3,500 | 3,500 | 6,493 | ||||||||

| Federal Home Loan Bank stock, at cost | 62,457 | 69,574 | 62,812 | ||||||||