Michael Saylor Reveals MicroStrategy's Endgame Is To Be The 'Leading Bitcoin Bank' With $100B-$150B In BTC Holdings

Michael Saylor has an ambition plan to turn MicroStrategy MSTR into the top Bitcoin BTC/USD bank.

What Happened: Saylor recently called MicroStrategy a “merchant bank.”

Or, “you could call it a Bitcoin finance company,” he told Bernstein analysts, according to The Block.

MicroStrategy recently acquired 7,420 BTC, increasing its holdings to 252,220 BTC (worth $15 billion). This makes the company the largest corporate Bitcoin holder globally.

Saylor, who started MicroStrategy in 1989, sees Bitcoin as a potent hedge against inflation and an exceptional tool for long-term value preservation. He anticipates that Bitcoin’s volatility will draw investors seeking high returns and will become indispensable for institutional and retail portfolios over time.

“If we end up with $20 billion of converts, $20 billion of preferred stock, $10 billion of debt and say $50 billion of some kind of debt instrument and structures instrument, we’ll have $100-$150 billion of Bitcoin,” Saylor said.

Why It Matters: Saylor projects that by 2045, Bitcoin will constitute 7% of global financial capital. This suggests a $13 million price per Bitcoin.

The company’s unique approach to Bitcoin banking involves borrowing rather than lending. Saylor contended that investing in the crypto king is less risky than lending to individuals, corporations, and governments. And the firm currently has no intentions to lend out its Bitcoin holdings.

CoinDesk analyst James Van Straten tweeted Bernstein’s latest MicroStrategy rating as outperform with a price target of $290, marking a 37% upside from current levels.

What’s Next: The influence of Bitcoin as an institutional asset class is expected to be thoroughly explored at Benzinga’s upcoming Future of Digital Assets event on Nov. 19.

Read Next:

Image: Wikimedia

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Hearth Market is Poised to Generate CAGR of 4.2% during 2024-2029

Delray Beach, FL, Oct. 11, 2024 (GLOBE NEWSWIRE) — The Hearth Market is expected to reach USD 13.4 billion by 2029 from USD 10.9 billion in 2024, at a CAGR of 4.2% during the 2024–2029 period. The major factors driving the market growth of the hearth Industry include rising application in hospitality industry. Additionally, the ongoing technological advancements, rising interest in outdoor hearth products, and visually appealing designs in hearth products provide growth opportunities to the market players.

The increasing demand for home automation is propelled by consumers’ desire for convenience, control, and enhanced living experiences within their homes. Integrated hearth products with home automation systems empower users to remotely manage heating settings, schedule operation times, and monitor energy usage via smartphones or other smart devices. Manufacturers embracing advanced home automation capabilities gain a competitive edge. By leveraging the rising demand for home automation, they can distinguish their products in the market, appealing to a broader consumer base.

To know about the assumptions considered for the study

Major Hearth Companies Included:

- HNI Corp. (US),

- Glen Dimplex (Ireland),

- Napoleon (Canada),

- Travis Industries Inc. (US),

- HPC Fire Inspired (US),

- Jøtul (Norway),

- Montigo (Canada),

- Stove Builder International (Canada),

- Innovative Hearth Products (US) and

- Empire Comfort Systems (US).

Hearth Market Segmentation:

Inserts as a product to grow at the highest CAGR in the hearth industry

Fireplaces dominated the market, capturing a major share among hearth appliances, underscoring their enduring popularity and historical significance as one of the oldest types of hearth products. The segment of fireplace inserts is projected to experience significant growth making inserts a versatile solution for modern home heating needs. As one of the oldest modes of heating appliances, government agencies and stove manufacturers are making long-term efforts to minimize concerns related to air pollution, deforestation, and climate change. Consumers increasingly seek both traditional and modern hearth solutions, creating profitable opportunities for manufacturers in various sectors of the hearth industry .

Electricity- based fuel type accounts for the largest market share of the hearth industry

Electric- based hearths have become increasingly popular due to their highly energy-efficiency, ease of installation, ventless system, cost saving and offering ambiance. They provide reliable heat with adjustable settings such as remote-controlled, voice automation and LED lighting systems. The use of wood as a fuel type is experiencing a decline. This decrease can be attributed to increasing environmental concerns, stricter regulations on emissions, and the inconvenience associated with sourcing and storing wood. The growing demand for pellets highlights a shift towards more sustainable and efficient heating options globally.

Europe held the second largest share of the hearth industry

Europe is accounted for the second largest share of the hearth industry. The presence of established several hearth manufacturing companies such as Glen Dimplex (Ireland), Jøtul (Norway), increasing integration in various sectors, government-led initiatives for environment sustainability are the major factors driving the market growth in Europe. North America has a high prevalence of fireplaces and stoves in both residential and commercial properties, holding the largest market share. The hearth industry is growing steadily in regions like South America, and the Middle East & Africa.

Key Market Dynamics:

Opportunity: Rising interest in hearth products within the hospitality industry

The hospitality industry is experiencing a rise in demand for hearths, which are used to improve guest satisfaction, extending outdoor dining, and socializing seasons and maximizing revenue opportunities for hospitality businesses. Outdoor hearth products enable the creation of versatile event spaces for weddings, corporate gatherings, and social events, generating additional revenue streams and offering guests unique and memorable experiences. The emphasis on sustainability and energy efficiency in the hospitality sector further enhances the appeal of hearth products that utilize eco-friendly fuels and technologies. By leveraging these features, hotels and resorts can attract environmentally conscious guests and enhance their green credentials, aligning with evolving consumer preferences for sustainable accommodation options.

Challenge: Competition from alternative heating solutions

Competition from alternative heating solutions presents a significant challenge to traditional hearth products like fireplaces, stoves, and inserts. HVAC systems, heat pumps, and radiant floor heating are among the alternatives impacting the demand for traditional hearth products. These alternative solutions diminish the demand for traditional hearth products, especially in new construction and home renovation projects. Consumers prioritize the convenience, energy efficiency, and versatility offered by alternatives, while builders may opt for integrated systems that align with modern design trends. However, traditional hearth products maintain niche appeal for ambiance, aesthetics, and nostalgic charm. In regions with access to affordable fuel sources, they remain popular for cost-effectiveness and backup heating capabilities during emergencies.

About MarketsandMarkets™ MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report. MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients. Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes. The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing. Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook. Contact: Mr. Rohan Salgarkar MarketsandMarkets Inc. 1615 South Congress Ave. Suite 103, Delray Beach, FL 33445 USA : 1-888-600-6441 UK +44-800-368-9399 Email: sales@marketsandmarkets.com Visit Our Website: https://www.marketsandmarkets.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

GameStop PFO and PAO Sold $51K In Company Stock

Daniel Moore, PFO and PAO at GameStop GME, executed a substantial insider sell on October 11, according to an SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Friday showed that Moore sold 2,376 shares of GameStop. The total transaction amounted to $51,091.

Tracking the Friday’s morning session, GameStop shares are trading at $20.82, showing a down of 0.43%.

About GameStop

GameStop Corp is a U.S. multichannel video game, consumer electronics, and services retailer. The company operates across Europe, Canada, Australia, and the United States. GameStop sells new and second-hand video game hardware, physical and digital video game software, and video game accessories, mainly through GameStop, EB Games, and Micromania stores and international e-commerce sites. The majority of sales are from the United States.

A Deep Dive into GameStop’s Financials

Negative Revenue Trend: Examining GameStop’s financials over 3 months reveals challenges. As of 31 July, 2024, the company experienced a decline of approximately -31.41% in revenue growth, reflecting a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Discretionary sector.

Holistic Profitability Examination:

-

Gross Margin: With a low gross margin of 31.17%, the company exhibits below-average profitability, signaling potential struggles in cost efficiency compared to its industry peers.

-

Earnings per Share (EPS): GameStop’s EPS is below the industry average. The company faced challenges with a current EPS of 0.04. This suggests a potential decline in earnings.

Debt Management: GameStop’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.12.

Exploring Valuation Metrics Landscape:

-

Price to Earnings (P/E) Ratio: GameStop’s current Price to Earnings (P/E) ratio of 149.36 is higher than the industry average, indicating that the stock may be overvalued according to market sentiment.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 1.5 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): GameStop’s EV/EBITDA ratio of 209.84 exceeds industry averages, indicating a premium valuation in the market

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Delving Into the Significance of Insider Transactions

While insider transactions provide valuable information, they should be part of a broader analysis in making investment decisions.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Transaction Codes To Focus On

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of GameStop’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Teradyne Is Considered a Good Investment by Brokers: Is That True?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock’s price, do they really matter?

Let’s take a look at what these Wall Street heavyweights have to say about Teradyne TER before we discuss the reliability of brokerage recommendations and how to use them to your advantage.

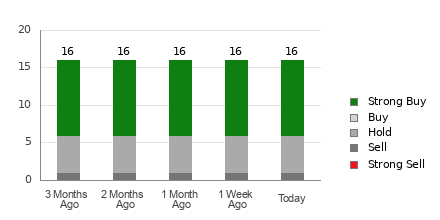

Teradyne currently has an average brokerage recommendation of 1.81, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc.) made by 16 brokerage firms. An ABR of 1.81 approximates between Strong Buy and Buy.

Of the 16 recommendations that derive the current ABR, 10 are Strong Buy, representing 62.5% of all recommendations.

Brokerage Recommendation Trends for TER

The ABR suggests buying Teradyne, but making an investment decision solely on the basis of this information might not be a good idea. According to several studies, brokerage recommendations have little to no success guiding investors to choose stocks with the most potential for price appreciation.

Are you wondering why? The vested interest of brokerage firms in a stock they cover often results in a strong positive bias of their analysts in rating it. Our research shows that for every “Strong Sell” recommendation, brokerage firms assign five “Strong Buy” recommendations.

In other words, their interests aren’t always aligned with retail investors, rarely indicating where the price of a stock could actually be heading. Therefore, the best use of this information could be validating your own research or an indicator that has proven to be highly successful in predicting a stock’s price movement.

Zacks Rank, our proprietary stock rating tool with an impressive externally audited track record, categorizes stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), and is an effective indicator of a stock’s price performance in the near future. Therefore, using the ABR to validate the Zacks Rank could be an efficient way of making a profitable investment decision.

Zacks Rank Should Not Be Confused With ABR

Although both Zacks Rank and ABR are displayed in a range of 1-5, they are different measures altogether.

Broker recommendations are the sole basis for calculating the ABR, which is typically displayed in decimals (such as 1.28). The Zacks Rank, on the other hand, is a quantitative model designed to harness the power of earnings estimate revisions. It is displayed in whole numbers — 1 to 5.

Analysts employed by brokerage firms have been and continue to be overly optimistic with their recommendations. Since the ratings issued by these analysts are more favorable than their research would support because of the vested interest of their employers, they mislead investors far more often than they guide.

In contrast, the Zacks Rank is driven by earnings estimate revisions. And near-term stock price movements are strongly correlated with trends in earnings estimate revisions, according to empirical research.

In addition, the different Zacks Rank grades are applied proportionately to all stocks for which brokerage analysts provide current-year earnings estimates. In other words, this tool always maintains a balance among its five ranks.

There is also a key difference between the ABR and Zacks Rank when it comes to freshness. When you look at the ABR, it may not be up-to-date. Nonetheless, since brokerage analysts constantly revise their earnings estimates to reflect changing business trends, and their actions get reflected in the Zacks Rank quickly enough, it is always timely in predicting future stock prices.

Should You Invest in TER?

Looking at the earnings estimate revisions for Teradyne, the Zacks Consensus Estimate for the current year has remained unchanged over the past month at $3.02.

Analysts’ steady views regarding the company’s earnings prospects, as indicated by an unchanged consensus estimate, could be a legitimate reason for the stock to perform in line with the broader market in the near term.

The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #3 (Hold) for Teradyne.

It may therefore be prudent to be a little cautious with the Buy-equivalent ABR for Teradyne.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Age-related Macular Degeneration Drugs Market to Hit USD 17.37 Billion by 2029 with 10.7% CAGR | MarketsandMarkets™

Delray Beach, FL, Oct. 11, 2024 (GLOBE NEWSWIRE) — The global AMD drugs market is set to grow from USD 10.46 billion in 2024 to USD 17.37 billion by 2029, reflecting a robust CAGR of 10.7%. This growth in the Age-Related Macular Degeneration market is fueled by the increasing prevalence of AMD, which is closely linked to lifestyle changes, alongside a rise in research and development investments that lead to more drug approvals and improved reimbursement policies. The market is particularly expanding in developing countries and is seeing a notable shift towards innovative therapies, including gene therapy. However, challenges such as high treatment costs and the off-label use of drugs like Avastin pose significant barriers to market potential.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=37446234

Browse in-depth TOC on “Age-related Macular Degeneration Drugs Market“

378 – Tables

54 – Figures

336 – Pages

The global Age-Related Macular Degeneration drugs market is categorized by molecules such as Ranibizumab, Aflibercept, Faricimab, Pegcetacoplan, and others like Conbercept, Brolucizumab, Avacincaptad Pegol, and Bevacizumab-Gamma. In 2023, Aflibercept dominated the market, largely due to its widespread use in treating wet AMD, thanks to its strong affinity for VEGF proteins, which helps reduce angiogenesis and vascular permeability. The molecule’s effectiveness is further validated by numerous studies comparing it to other treatments, with ongoing innovations in drug delivery methods and biosimilars driving continued market growth.

The market is also segmented by AMD type, with wet AMD representing the largest segment in 2023, driven by its higher global prevalence—over 20 million people affected. The increase in cases, particularly in the aging population, is expected to grow as the number of individuals over 60 years old is projected to double by 2050. Additionally, emerging drugs targeting earlier stages of the disease, such as OPT-302 and KSI-301, are bolstering the market.

By end-user, hospitals led the market share in 2023, due to their advanced infrastructure, specialized care, and role in research and drug availability. Hospitals are crucial in providing diagnostics, treatment, and patient monitoring, which enhance treatment outcomes for AMD patients. They also collaborate with pharmaceutical companies to ensure the optimal availability of AMD drugs.

The key regional markets include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa, with North America holding the largest share, fueled by a high incidence of AMD, particularly in the U.S., where over 200,000 new cases are reported annually. Contributing factors include rising obesity, smoking, and diet-related issues, along with the region’s robust healthcare infrastructure, which supports early diagnosis and treatment.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=37446234

The global Age-Related Macular Degeneration (AMD) market features prominent players like Regeneron Pharmaceuticals Inc. (US), Bayer AG (Germany), F. Hoffmann-La Roche Ltd (Switzerland), Novartis AG (Switzerland), Apellis Pharmaceuticals (US), Coherus BioSciences (US), and others. These companies, along with emerging players such as Stealth BioTherapeutics Inc. (US) and Ocular Therapeutix, Inc. (US), are driving market growth with their innovative drug candidates, many of which are in phase 3 clinical trials.

Regeneron Pharmaceuticals Inc. is a leader in the market, known for its widely adopted drug Eylea, used to treat wet AMD. In collaboration with Bayer AG, Regeneron manufactures and distributes Eylea outside the U.S. The company has made significant investments to improve Eylea HD, a higher dose formulation that reduces treatment burden for patients. Regeneron also leverages innovative technologies like TRAPS and VelociSuite to develop next-generation ophthalmic treatments.

F. Hoffmann-La Roche Ltd offers several FDA-approved drugs for wet AMD, including Lucentis, Vabysmo, and Susvimo, along with Avastin, commonly used off-label due to its affordability. Roche has heavily invested in R&D, with a focus on advanced research methods, and continues to expand its market presence globally. Its Genentech Ophthalmology Co-pay Program helps make treatments more accessible to patients.

Novartis AG is another key player, known for its focus on ophthalmology, particularly with drugs like Lucentis and Beovu (brolucizumab) for wet AMD. The company is also expanding its research into diabetic retinopathy through phase 3 trials for Beovu. Novartis continues to innovate in treatment options while ensuring affordability and accessibility through flexible contract structures in over 130 countries.

For more information, Inquire Now!

Related Reports:

Cardiac Monitoring Devices Market

Life Science Instrumentation Market

Get access to the latest updates on AMD Drugs Companies and Age-related Macular Degeneration Drugs Market Size

About MarketsandMarkets™ MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report. MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients. Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes. The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing. Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook. Contact: Mr. Rohan Salgarkar MarketsandMarkets Inc. 1615 South Congress Ave. Suite 103, Delray Beach, FL 33445 USA : 1-888-600-6441 UK +44-800-368-9399 Email: sales@marketsandmarkets.com Visit Our Website: https://www.marketsandmarkets.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Are Trump's Proposed Corporate Tax Cuts The Key To Unleashing A Stock Market Boom? Here's What History Tells Us About Similar Moves

Former President Donald Trump is again turning heads with his push to slash the federal corporate tax rate. The 2024 GOP presidential nominee proposes lowering it from 21% to 15%, which has stirred up much debate. Some see it as the key to supercharging the U.S. economy and stock market. Others, however, aren’t so sure.

Don’t Miss:

Supporters of Trump’s plan point to past economic gains when taxes were lowered. According to the Tax Foundation, dropping the corporate tax rate to 15% could boost the U.S. GDP by 0.4% and add roughly 93,000 full-time jobs.

This is music to the ears of those who believe that lower taxes will make the U.S. more attractive for business. A more competitive environment, they argue, could drive corporate growth, pump up earnings and ultimately benefit shareholders as stock prices climb.

Trending: ‘Scrolling to UBI’: Deloitte’s #1 fastest-growing software company allows users to earn money on their phones – invest today with $1,000 for just $0.25/share

Advocates also think this cut could push companies to funnel more money into share buybacks, further inflating stock prices. But the critics have their doubts. One big concern is the potential impact on federal revenues. As cited by CNN, Trump’s proposal could increase the national debt by between $1.5 trillion and $15.2 trillion.

Even when factoring in economic growth, the revenue loss would still be a whopping $460 billion. As the U.S. grapples with a rising federal deficit – already expected to hit 202.6% of GDP by 2065 – some worry that these tax cuts might tie the government’s hands when funding essential programs.

Trending: The global games market is projected to generate $272B by the end of the year — for $0.55/share, this VC-backed startup with a 7M+ userbase gives investors easy access to this asset market.

Another question in the air is whether corporate tax cuts reliably lead to stock market booms?

Trump significantly boosted Corporate America by lowering the corporate tax rate from 35% to 21%. This legislation, along with a strong economy, led to record-breaking corporate earnings. Many executives decided to reward shareholders rather than investing in growth or hiring.

See Also: This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

Data from S&P Dow Jones Indices shows that companies within the S&P 500 repurchased a whopping $189 billion worth of stock in the first quarter alone. This figure shattered the previous record set in 2007. Tech giant Apple (AAPL) led the charge, setting a record by buying back $22.8 billion of its own shares – the largest stock buyback by any company in a quarter of U.S. history.

Vice President Kamala Harris, representing the Biden administration, has suggested raising the corporate tax rate to 28%. Wall Street is concerned that Harris’s tax plan could negatively impact U.S. corporate profits, with Yung-Yu Ma, chief investment officer of BMO U.S. Wealth Management, warning that higher taxes would likely result in lower corporate profits and reduced stock valuations. “Essentially, what you have is the likelihood of a significant pullback in the stock market due to higher taxes,” Ma stated.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Are Trump’s Proposed Corporate Tax Cuts The Key To Unleashing A Stock Market Boom? Here’s What History Tells Us About Similar Moves originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Defense Metals Corp. issues Convertible Note to RCF Opportunities Fund II L.P.

DENVER, Oct. 11, 2024 (GLOBE NEWSWIRE) — RCF Opportunities Fund II L.P. (“RCF“) reports that it has filed an early warning report under National Instrument 62-103 – The Early Warning System and Related Take-Over Bid and Insider Reporting Issues in connection to its acquisition of a C$500,000 secured convertible note (the “Convertible Note“) issued by Defense Metals Corp. (the “Company“) to RCF as part of the Company’s non-brokered bridge financing of secured convertible notes (the “Note Financing“).

On October 11, 2024, the Company issued the Convertible Note to RCF pursuant to the Note Financing. Pursuant to the terms of the Convertible Note, at any time up to seven days prior to a Mandatory Conversion Event (as defined in the Convertible Note), RCF may elect to convert the principal amount of the Convertible Note into Common Shares at a deemed price per Common Share of C$0.125 (the “Conversion Price“), in accordance with the terms set out in the Convertible Note. Upon the occurrence of a Mandatory Conversion Event, the principal of the Convertible Note will automatically convert into Common Shares at a 15% discount to the applicable price of the offering implied by such Mandatory Conversion Event, provided that if such conversion price would be less than the Conversion Price, there will be no mandatory conversion.

The Convertible Note will bear interest from the date of issuance at the rate of 10% per annum, payable quarterly in Common Shares, subject in each instance to approval of the TSX Venture Exchange (the “TSX-V“), in accordance with the conversion rights set forth in the Convertible Note. The deemed share price used to calculate the number of Common Shares to be issued pursuant to such interest payments will be determined by using the greater of (i) the volume-weighted average trading price per share on the TSX-V for the 20 consecutive trading days ending on the last day of each three month period after the issue date, and (ii) the lowest price permitted under the policies of the TSX-V. The Convertible Note is secured against all personal property of the Company, including a security interest against the Company’s mining claims in respect of the Wicheeda REE Project. All note holders under the Note Financing will rank pari passu among themselves.

Immediately prior to the issuance of the Convertible Note, RCF owned and controlled a total of 25,836,263 Common Shares, representing approximately 9.99% of the issued and outstanding Common Shares. Assuming the conversion of the principal amount of the Convertible Note at the Conversion Price, RCF would own 29,836,263 Common Shares, representing approximately 11.36% of the issued and outstanding Common Shares.

RCF acquired the Convertible Note in accordance with RCF’s investment policy to generate proceeds from its investment in the Company. RCF may from time to time acquire additional securities of the Company, dispose of some or all of the existing or additional securities or may continue to hold its securities in the Company.

The Company’s head office is located at Suite 1020 – 800 West Pender Street, Vancouver, British Columbia V6C 2V6.

To obtain a copy of the early warning report filed under applicable Canadian securities laws in connection with the transactions hereunder, please see the Company’s profile on the SEDAR+ website at www.sedarplus.ca.

About RCF Opportunities Fund II L.P.

RCF is a private investment fund existing under the laws of the Cayman Islands. RCF is ultimately controlled by RCF Management LLC. For further information and to obtain a copy of the early warning report, please contact:

RCF Opportunities Fund II L.P.

1400 Wewatta Street, Suite 850

Denver, Colorado, 80202

Telephone: (720) 946-1444

Attn: Mason Hills

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Community Associations Institute Seeks Preliminary Injunction Against Corporate Transparency Act

Falls Church, Va., Oct. 11, 2024 (GLOBE NEWSWIRE) — Today, the United States District Court for the Eastern District of Virginia will hold its first hearing in the case of Community Associations Institute, et al. v. Janet Yellen, et al. Community Associations Institute, the leading international authority on the community association housing model that includes condominium associations, homeowners associations, and housing cooperatives, is pursuing a preliminary injunction today in its lawsuit against the United States Department of the Treasury regarding the Corporate Transparency Act. The hearing will take place at 9:00 a.m. ET.

“Today, we seek a preliminary injunction to block the enforcement of the Corporate Transparency Act’s reporting requirements until this matter has been fully adjudicated,” says Thomas M. Skiba, CAE, CAI’s chief executive officer. “Protecting United States community association governance is essential, and we are pursuing this legal action to ensure communities can operate free from unnecessary and burdensome regulations.”

Enacted by Congress in 2021, the Corporate Transparency Act requires entities such as corporations and limited liability companies to disclose personal information about their beneficial owners to the Treasury Department’s Financial Crimes Enforcement Network. While CAI supports the goal of enhancing transparency to combat money laundering and terrorist financing, it argues the law’s broad application improperly includes community associations. Unlike traditional businesses, community associations are nonprofit, volunteer-led organizations focused on managing and maintaining communities, with no more financial or ownership interest in the association than their fellow homeowners. Their purpose is not to generate profits or engage in commercial activities, making the application of these reporting requirements particularly burdensome and unnecessary.

CAI seeks to halt the enforcement of the act’s reporting requirements against community associations while the lawsuit is pending. This legal action aims to protect community associations from burdensome regulations that impose significant administrative and privacy challenges on community association board members who volunteer their time and energy for civic purposes.

The purpose of today’s hearing focuses on CAI’s request for immediate relief and maintain the status quo as the court deliberates the merits of the case. CAI’s legal team will advocate for a rapid response due to the impending Jan. 1 compliance deadline. A ruling on the preliminary injunction will follow in the coming weeks.

For more information on the lawsuit and its impact on community associations, visit www.caionline.org/corporate-transparency-act/.

Blaine Tobin Community Associations Institute 703-970-9235 btobin@caionline.org

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

10% Owner At GATX Sells $1.96M Of Stock

It was reported on October 10, that STATE FARM MUTUAL AUTOMOBILE INSURANCE CO, 10% Owner at GATX GATX executed a significant insider sell, according to an SEC filing.

What Happened: CO’s recent Form 4 filing with the U.S. Securities and Exchange Commission on Thursday unveiled the sale of 14,722 shares of GATX. The total transaction value is $1,961,986.

Tracking the Friday’s morning session, GATX shares are trading at $132.89, showing a down of 0.0%.

All You Need to Know About GATX

GATX Corp is a provider of railcar leasing and maintenance services. GATX operates four business segments: rail North America, rail international, and portfolio management. The rail business offers railcar leasing and maintenance, as well as asset-related, financial, and management services. The company owns and leases fleets in North America, Europe, and Asia, which consist of tank and freight railcars. Industries served include refining and petroleum, chemicals and plastics, railroads and other transportation, mining, and food and agriculture.

GATX: A Financial Overview

Revenue Growth: GATX displayed positive results in 3 months. As of 30 June, 2024, the company achieved a solid revenue growth rate of approximately 12.67%. This indicates a notable increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Industrials sector.

Interpreting Earnings Metrics:

-

Gross Margin: The company maintains a high gross margin of 47.22%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): GATX’s EPS is below the industry average. The company faced challenges with a current EPS of 1.22. This suggests a potential decline in earnings.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 3.61, caution is advised due to increased financial risk.

Assessing Valuation Metrics:

-

Price to Earnings (P/E) Ratio: GATX’s P/E ratio of 20.44 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 3.18, GATX’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Boasting an EV/EBITDA ratio of 13.37, GATX demonstrates a robust market valuation, outperforming industry benchmarks.

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Activity Matters in Finance

Insightful as they may be, insider transactions should be considered alongside a thorough examination of other investment criteria.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Essential Transaction Codes Unveiled

Investors prefer focusing on transactions that take place in the open market, indicated in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S indicates a sale. Transaction code C indicates the conversion of an option, and transaction code A indicates grant, award or other acquisition of securities from the company.

Check Out The Full List Of GATX’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

QFIN or IBTA: Which Is the Better Value Stock Right Now?

Investors looking for stocks in the Technology Services sector might want to consider either Qifu Technology, Inc. QFIN or Ibotta IBTA. But which of these two stocks offers value investors a better bang for their buck right now? We’ll need to take a closer look.

We have found that the best way to discover great value opportunities is to pair a strong Zacks Rank with a great grade in the Value category of our Style Scores system. The Zacks Rank is a proven strategy that targets companies with positive earnings estimate revision trends, while our Style Scores work to grade companies based on specific traits.

Currently, Qifu Technology, Inc. has a Zacks Rank of #1 (Strong Buy), while Ibotta has a Zacks Rank of #3 (Hold). This means that QFIN’s earnings estimate revision activity has been more impressive, so investors should feel comfortable with its improving analyst outlook. But this is just one piece of the puzzle for value investors.

Value investors also tend to look at a number of traditional, tried-and-true figures to help them find stocks that they believe are undervalued at their current share price levels.

Our Value category grades stocks based on a number of key metrics, including the tried-and-true P/E ratio, the P/S ratio, earnings yield, and cash flow per share, as well as a variety of other fundamentals that value investors frequently use.

QFIN currently has a forward P/E ratio of 6.40, while IBTA has a forward P/E of 311.16. We also note that QFIN has a PEG ratio of 0.44. This popular metric is similar to the widely-known P/E ratio, with the difference being that the PEG ratio also takes into account the company’s expected earnings growth rate. IBTA currently has a PEG ratio of 8.18.

Another notable valuation metric for QFIN is its P/B ratio of 1.68. Investors use the P/B ratio to look at a stock’s market value versus its book value, which is defined as total assets minus total liabilities. By comparison, IBTA has a P/B of 5.08.

These metrics, and several others, help QFIN earn a Value grade of A, while IBTA has been given a Value grade of D.

QFIN has seen stronger estimate revision activity and sports more attractive valuation metrics than IBTA, so it seems like value investors will conclude that QFIN is the superior option right now.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.