Stellantis Unusual Options Activity

Deep-pocketed investors have adopted a bullish approach towards Stellantis STLA, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in STLA usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 9 extraordinary options activities for Stellantis. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 66% leaning bullish and 22% bearish. Among these notable options, 7 are puts, totaling $502,683, and 2 are calls, amounting to $74,300.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $13.0 to $15.0 for Stellantis over the recent three months.

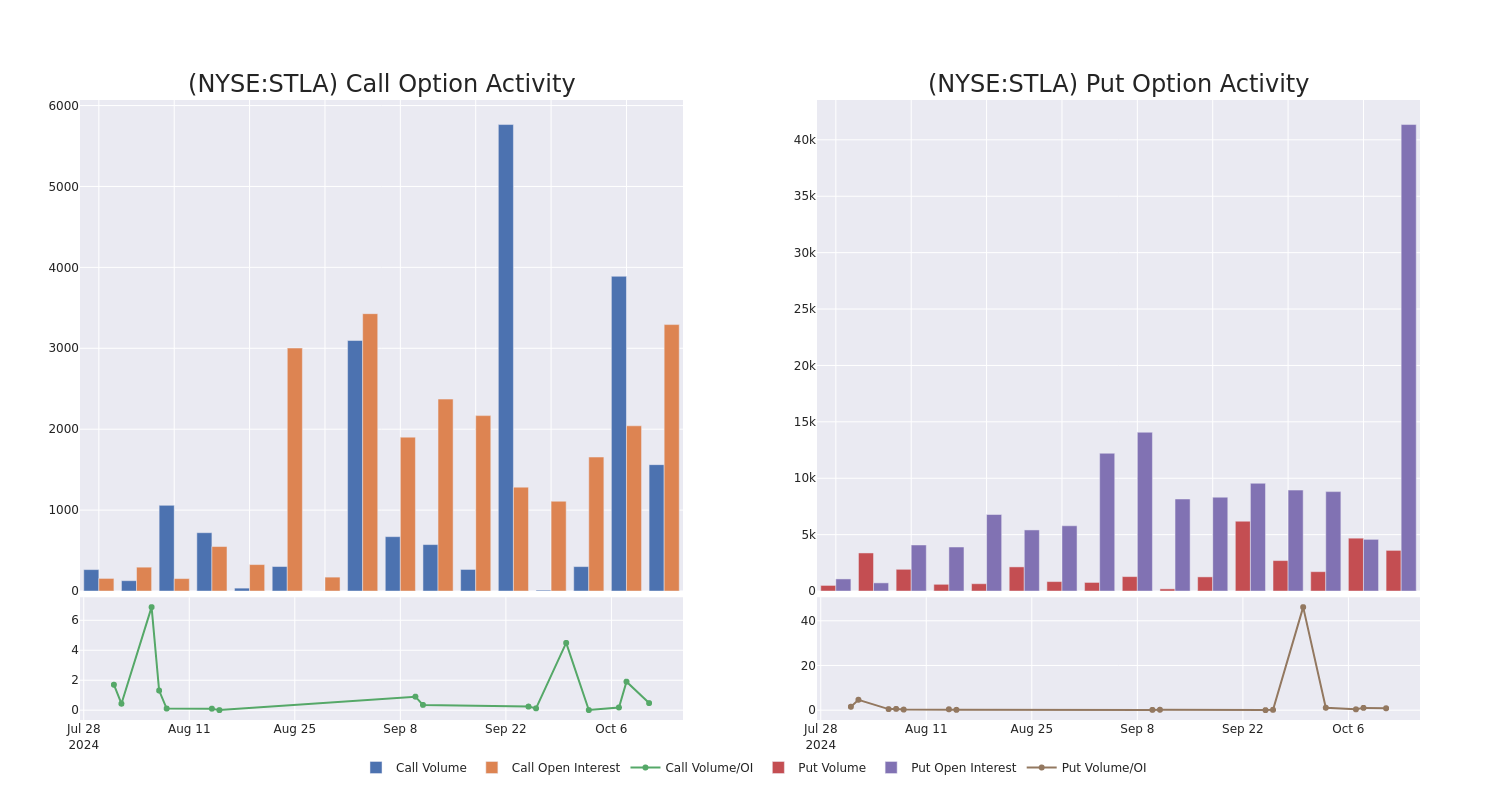

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Stellantis’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Stellantis’s significant trades, within a strike price range of $13.0 to $15.0, over the past month.

Stellantis 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| STLA | PUT | SWEEP | BULLISH | 01/16/26 | $3.0 | $2.85 | $2.9 | $15.00 | $149.6K | 16.1K | 516 |

| STLA | PUT | SWEEP | BULLISH | 01/15/27 | $3.5 | $3.2 | $3.3 | $15.00 | $135.9K | 3.4K | 1.1K |

| STLA | PUT | SWEEP | BEARISH | 06/20/25 | $3.0 | $2.75 | $2.8 | $15.00 | $66.3K | 9.6K | 242 |

| STLA | PUT | SWEEP | NEUTRAL | 01/17/25 | $2.35 | $2.25 | $2.3 | $15.00 | $63.3K | 8.8K | 291 |

| STLA | CALL | SWEEP | BULLISH | 01/17/25 | $0.4 | $0.35 | $0.4 | $15.00 | $40.1K | 2.1K | 1.1K |

About Stellantis

Stellantis was created out of the merger of US-based Fiat Chrysler Automobiles, or FCA, and French-based Peugeot, or PSA, in January 2021, resulting in the fourth-largest automotive original equipment manufacturer, or OEM, by vehicle sales. In 2023 it sold 6.4 million vehicles, 44% and 30% in Europe and North America, respectively. North America is the most profitable region, contributing 53% of operating income. Its brands include Fiat, Jeep, Chrysler, Ram, Peugeot, Citroen, Opel, Alfa Romeo, and Maserati.

After a thorough review of the options trading surrounding Stellantis, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Stellantis

- With a trading volume of 14,626,356, the price of STLA is down by -2.26%, reaching $13.0.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 125 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Stellantis, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply