What the Options Market Tells Us About Roku

High-rolling investors have positioned themselves bullish on Roku ROKU, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in ROKU often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 11 options trades for Roku. This is not a typical pattern.

The sentiment among these major traders is split, with 81% bullish and 9% bearish. Among all the options we identified, there was one put, amounting to $42,750, and 10 calls, totaling $426,979.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $50.0 to $110.0 for Roku over the last 3 months.

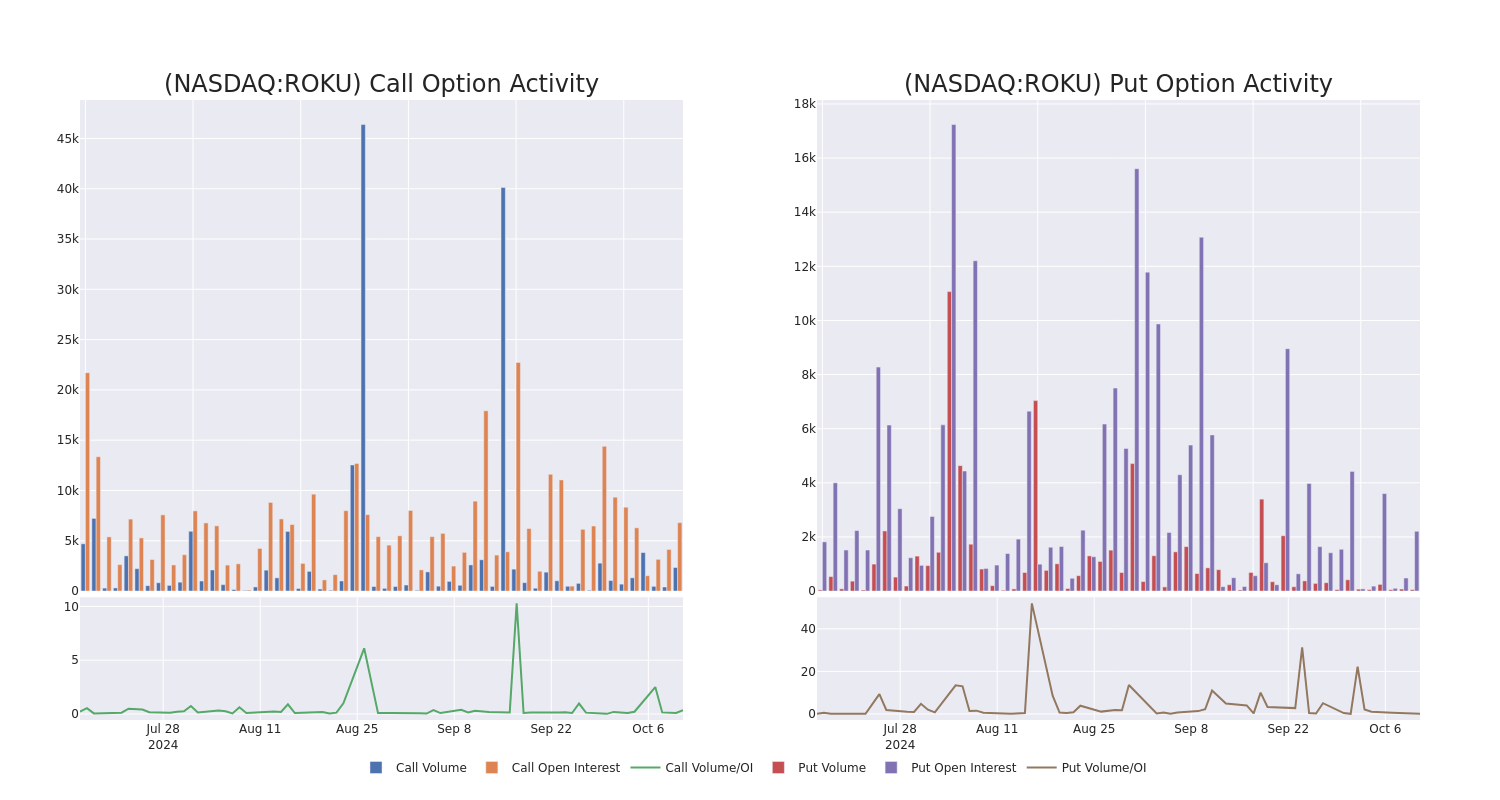

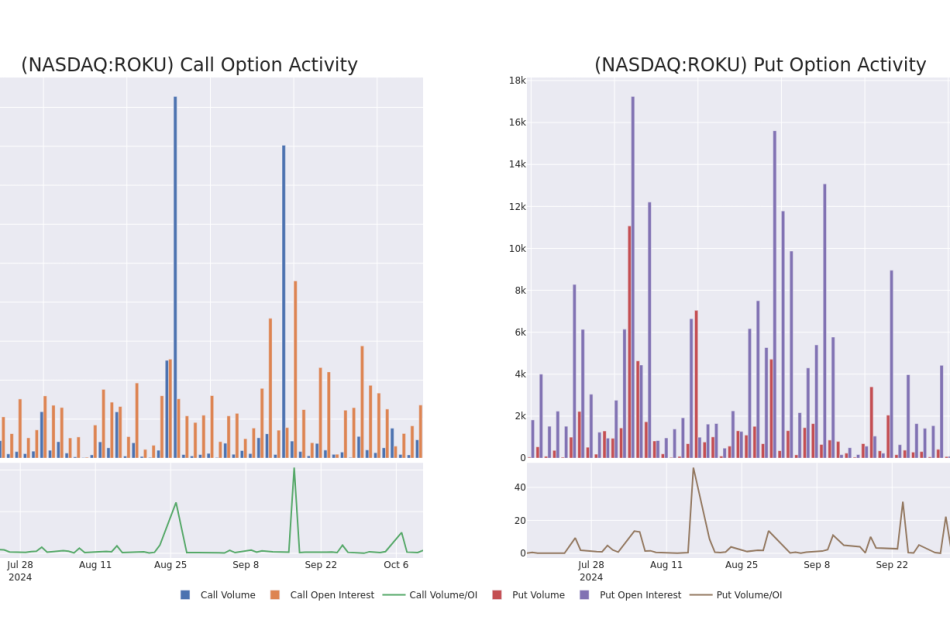

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Roku’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Roku’s whale trades within a strike price range from $50.0 to $110.0 in the last 30 days.

Roku Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ROKU | CALL | SWEEP | BULLISH | 10/25/24 | $2.32 | $2.06 | $2.31 | $80.00 | $70.2K | 513 | 978 |

| ROKU | CALL | SWEEP | BEARISH | 04/17/25 | $3.6 | $3.5 | $3.5 | $110.00 | $69.3K | 6 | 199 |

| ROKU | CALL | TRADE | NEUTRAL | 03/21/25 | $31.35 | $31.0 | $31.2 | $50.00 | $62.4K | 433 | 60 |

| ROKU | CALL | SWEEP | BULLISH | 10/25/24 | $2.28 | $2.2 | $2.21 | $80.00 | $43.5K | 513 | 675 |

| ROKU | CALL | TRADE | BULLISH | 12/20/24 | $9.45 | $9.3 | $9.4 | $75.00 | $43.2K | 1.0K | 83 |

About Roku

Roku enables consumers to stream television programming. It has more than 80 million streaming households and provided well over 100 billion streaming hours in 2023. Roku is the top streaming operating system in the US, reaching more than half of broadband households, according to the company. Roku’s OS is built into streaming devices and televisions that Roku sells and on connected televisions from other manufacturers that license Roku’s name and software. Roku also operates the Roku Channel, a free, ad-supported streaming television platform that offers a mix of on-demand and live television programming. Roku generates revenue primarily from selling devices, licensing, and advertising, and it receives fees from subscription streaming platforms that sell subscriptions through Roku.

Roku’s Current Market Status

- With a trading volume of 2,206,468, the price of ROKU is up by 1.29%, reaching $78.37.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 19 days from now.

What The Experts Say On Roku

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $92.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Citigroup continues to hold a Neutral rating for Roku, targeting a price of $77.

* Consistent in their evaluation, an analyst from Macquarie keeps a Outperform rating on Roku with a target price of $90.

* Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Roku, targeting a price of $92.

* An analyst from Benchmark downgraded its action to Buy with a price target of $105.

* Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $100.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Roku options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply