Stocks Hover Near Record High as Earnings in Sight: Markets Wrap

(Bloomberg) — Stocks hit fresh all-time highs as investors looked ahead to Corporate America for further vindication of soft-landing bets.

Most Read from Bloomberg

Without much in the way of economic data this week, earnings reports are poised to drive Wall Street sentiment. The S&P 500 rose almost 1%, notching another record — its 46th this year. That’s a hint investors are not deterred by the reduced forecasts for third-quarter results, and are instead betting this reporting season will once again deliver positive surprises.

Strategists are predicting S&P 500 firms will post their weakest results in the past four quarters, with just a 4.3% increase compared with a year ago, Bloomberg Intelligence data show. Meantime, corporate guidance implies a jump of about 16%. That solid outlook suggests companies could easily beat market expectations.

“Wall Street has underestimated Corporate America lately,” said Callie Cox at Ritholtz Wealth Management. “This environment is tough to get a read on, and I don’t blame anybody who’s approaching this rally with a bit of skepticism. We still think the biggest – and most expensive – risk here is to miss a rebound and an eventual rally higher.”

The S&P 500 hovered near 5,860 amid thin trading volume. The Nasdaq 100 added 0.8%. The Dow Jones Industrial Average climbed 0.5%. Nvidia Corp. led gains in megacaps, Apple Inc. gained on a bullish analyst call and Tesla Inc. rebounded after last week’s plunge. Goldman Sachs Group Inc. and Citigroup Inc. advanced ahead of results.

Treasury futures were marginally lower while cash trading was closed for a US holiday. The dollar edged up. Bitcoin jumped 5%. Oil declined after China’s highly anticipated Finance Ministry briefing on Saturday lacked specific new incentives to boost consumption in the world’s biggest crude importer.

Earnings season unofficially kicked off on Friday, led by financial bellwethers JPMorgan Chase & Co. and Wells Fargo & Co. On top of other big banks reporting this week, traders will be paying close attention to results from key companies like Netflix Inc. and JB Hunt Transport Services Inc.

An initial round of third-quarter financial results last week showed Corporate America is benefitting from lower rates early into the Federal Reserve’s easing cycle, according to Bank of America Corp. strategists.

Easing rates pressure was seen in a surge in debt underwriting, mortgage applications and refinancing activity, as well as signs of a bottom in manufacturing, the BofA team including Ohsung Kwon and Savita Subramanian said.

To Solita Marcelli at UBS Global Wealth Management, third-quarter results should confirm that large-cap corporate profit growth is solid against a resilient macro backdrop.

“We maintain our positive outlook for US equities, supported by healthy economic and profit growth, the Fed’s easing cycle, and AI’s growth story,” she said. “While valuations are high, we think they are reasonable against the favorable backdrop.”

Marcelli reiterated her S&P 500 price target of 6,200 by June 2025, and continues to like “AI beneficiaries and quality stocks.”

An improving trend in US macro data should continue to offer support for stocks tied to economic momentum, according to Morgan Stanley strategist Mike Wilson.

“Further stabilization in the economic surprise index should support quality cyclicals even if it comes amid higher yields,” Wilson and his team wrote in a note.

Better US data and supportive policy have helped lower downside risks near-term, according to Goldman Sachs Group Inc. strategists led by Christian Mueller-Glissmann. They shifted to overweight equities and underweight credit for the next three months.

The strategists noted equities can deliver attractive returns driven by earnings growth and valuation expansion in late-cycle backdrops, while credit total returns are usually constrained by tight credit spreads and rising yields.

While they think the risk of a bear market remains relatively low, the analysts see potential for volatility due to geopolitical shocks, US elections, and less favorable growth/inflation mix.

“Last week, the S&P 500 index surpassed our year-end price objective of 5,800,” said Craig Johnson at Piper Sandler. “We are leaving it unchanged for now but realize some ‘fine-tuning’ is needed as we expect equities to continue trending higher after the US presidential election.”

Despite the above-average gain in the first two years of this bull market, history says that investors need to be prepared for a possible setback in the coming 12 months, according to Sam Stovall at CFRA.

The average return following the 11 bull markets that celebrated their second anniversary was 2% (5.2% excluding those that became bear markets before the third year was out, Stovall noted. What’s more, all experienced a decline of 5%, while five endured selloffs in excess of 10% but less than 20%, and three succumbed to new bear markets. Despite this unsettling intra-year volatility, three bulls posted double-digit gains.

While bull markets that have made it this long have tended to go on a lot longer before they finally experience a 20% drop, that doesn’t mean there haven’t been hiccups along the way, according to Bespoke Investment Group.

Overall, the S&P has seen weaker-than-average returns in year three of bull markets, the firm said. The index has averaged a gain of just 3.7% in the 12 months following day 503 of past bull markets — with positive returns just 55% of the time. That compares to an average gain of 9.26% across all rolling 12-month periods for the market.

“What we’d note, however, is that of the 11 bull markets shown, only two of them came to an end at some point during the 12-month window following day 503, so this period between years two and three of long-lasting bulls has been more of a consolidation phase rather than an endpoint,” Bespoke concluded.

Corporate Highlights:

-

B. Riley Financial Inc., the money-losing broker-dealer and investment firm looking to cut debt, agreed to sell a majority stake in its Great American Holdings business to funds managed by Oaktree Capital Management LP.

-

Adobe Inc. unveiled artificial intelligence tools that can create and modify videos, joining Big Tech companies and startups in trying to capitalize on demand for the emerging technology.

-

Caterpillar Inc. was downgraded to underweight by Morgan Stanley, which flagged a disconnect between fundamentals and share price.

-

Amgen Inc. was downgraded to hold at Truist Securities, which said upcoming obesity data is already priced into the stock.

-

SoFi Technologies Inc. reached a deal to use $2 billion of Fortress Investment Group LLC funds for the origination of personal loans.

-

Elliott Investment Management has called for a special shareholder meeting at Southwest Airlines Co., officially kicking off the firm’s first US proxy fight since 2017.

Key events this week:

-

Eurozone industrial production, Tuesday

-

US Empire Manufacturing index, Tuesday

-

Goldman Sachs, Bank of America, Citigroup earnings, Tuesday

-

Donald Trump will be interviewed by Bloomberg editor-in-chief John Micklethwait at the Economic Club of Chicago, Tuesday

-

Fed’s Mary Daly, Adriana Kugler speak, Tuesday

-

Morgan Stanley earnings, Wednesday

-

ECB rate decision, Thursday

-

US retail sales, jobless claims, industrial production, Thursday

-

Fed’s Austan Goolsbee speaks, Thursday

-

China GDP, Friday

-

US housing starts, Friday

-

Fed’s Christopher Waller, Neel Kashkari speak, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 rose 0.8% as of 4 p.m. New York time

-

The Nasdaq 100 rose 0.8%

-

The Dow Jones Industrial Average rose 0.5%

-

The MSCI World Index rose 0.6%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.3%

-

The euro fell 0.3% to $1.0904

-

The British pound was little changed at $1.3055

-

The Japanese yen fell 0.4% to 149.78 per dollar

Cryptocurrencies

-

Bitcoin rose 5% to $65,865.01

-

Ether rose 6.5% to $2,619.04

Bonds

Commodities

-

West Texas Intermediate crude fell 2.1% to $73.97 a barrel

-

Spot gold fell 0.1% to $2,652.65 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

The Clinician Partners with Queensland Health for Statewide Implementation of Patient Reported Measures and Patient Safety Culture Surveys

BRISBANE, Australia, Oct. 14, 2024 /PRNewswire/ — The Clinician has been awarded a statewide contract by Queensland Health to implement their ZEDOC platform. This platform will enhance the collection and analysis of Patient Reported Measures (PRMs) and patient safety culture (PSC) staff surveys across all Hospital and Health Services (HHS).

This Off-the-Shelf (OTS) application will capture and report real-time patient reported and staff feedback, driving improvements in healthcare delivery and supporting clinicians in partnering with patients to achieve safe, high quality care.

Key features of the ZEDOC system include:

- Ward and Hospital Experiences: Collects Patient-Reported Experience Measures (PREMs) to provide insights into the overall experience of Queensland Health services.

- Individual Patient Outcomes: Gathers Patient-Reported Outcome Measures (PROMs) in real-time to support shared decision-making between patients and clinical teams, empowering patients to participate in their healthcare decisions.

- Staff Feedback on Patient Safety Culture: Collects and reports real-time data from staff, enabling the implementation of interventions in HHSs.

- Integrated Platform: The Clinician’s PRM platform will act as a single system for collecting and analysing PRMs and PSC data, simplifying access for patients, parents, and carers, while providing healthcare staff with a comprehensive reporting tool.

- Automated Patient Communication: Patients will be contacted via SMS or email following or during their engagement with a health service.

Building on Success This landmark contract follows The Clinician’s previous success with similar statewide global and local implementations, such as Singapore and South Australia Health. Learnings from these large-scale deployments will be instrumental in ensuring a smooth rollout in Queensland. This marks a significant step in The Clinician’s growth, as the New Zealand-headquartered company continues to expand its footprint in Australia and internationally. The Clinician’s recent move to cloud-agnostic infrastructure for their platform also allows for greater flexibility and scalability, positioning The Clinician for continued success in large healthcare systems.

“It’s a significant opportunity to collaborate with Queensland Health on this transformative project,” said Dr. Ron Tenenbaum, CEO and principal founder of The Clinician. “Our goal is to equip healthcare providers with the tools and insights necessary to enhance patient experiences, outcomes, and safety. By utilising real-time data from both patients and staff, Queensland Health will be empowered to make informed, data-driven decisions to elevate the quality of care across the state.”

The Clinician continues to lead the way in digital health innovation, and this partnership with Queensland Health underscores its commitment to improving healthcare outcomes for patients and staff across Australia.

About The Clinician:

The Clinician is a healthcare company that helps organisations globally create more connected, convenient, and patient-centred care journeys. The Clinician’s integrated health platform enables care teams to digitally monitor, inform, and empower patients along their entire healthcare journey, from the comfort of their own homes. The platform’s interoperability capabilities allow seamless integration with existing healthcare systems, facilitating the exchange of patient health outcomes, experiences, and educational content between clinical visits. By supporting this timely exchange, The Clinician provides care teams and patients with real-time, actionable information to improve health outcomes and experiences while reducing administrative burden.

To learn more, visit theclinician.com or follow us on LinkedIn

For Media Enquiries media@theclinician.com

![]() View original content:https://www.prnewswire.com/news-releases/the-clinician-partners-with-queensland-health-for-statewide-implementation-of-patient-reported-measures-and-patient-safety-culture-surveys-302275634.html

View original content:https://www.prnewswire.com/news-releases/the-clinician-partners-with-queensland-health-for-statewide-implementation-of-patient-reported-measures-and-patient-safety-culture-surveys-302275634.html

SOURCE The Clinician

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

You Can Now Buy The Former Home Of NBA Legend Kareem Abdul-Jabbar Designed For His 7'2″ Height, For Around $3 Million

If you’re a basketball fan and its legend Kareem Abdul-Jabbar or love unique luxury homes, you can now own his former home in Marina del Rey, California, for $2,995,000. Despite its outward appearance, this house is anything but ordinary – it was created with Kareem’s impressive 7’2″ height in mind and is a remarkable home for anyone who values grace, space and a piece of sports history.

Don’t Miss:

Located in an exclusive gated community across from the Ritz Carlton and the California Yacht Club, this house is one of just twelve in the area. Kareem lived here from 2011 to 2021 and the home has several custom modifications to suit his height and lifestyle. Enlarged doorways, higher countertops and spacious rooms were all designed to make life comfortable for the basketball legend – features that also make the home feel incredibly roomy.

See Also: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

The four-bedroom, three-bath house is 3,586 square feet. On the first floor, a big open space connects the living room, dining room and kitchen. The kitchen has granite countertops, a large island, custom cabinets and stainless steel appliances. Sliding doors lead to a garden patio, making it easy to enjoy indoor and outdoor spaces.

Go upstairs and see hardwood floors and a main bedroom designed for comfort. It has a fireplace, a walk-in closet and a private balcony with great views of the marina. The main bathroom feels like a spa, with two sinks, a separate jacuzzi tub and a steam shower – perfect for relaxing.

Trending: Commercial real estate has historically outperformed the stock market, and this platform allows individuals to invest in commercial real estate with as little as $5,000 offering a 12% target yield with a bonus 1% return boost today!

There’s also a third-floor loft that could be another bedroom, home office or workout area. It has its own balcony that looks out at the marina and the Ritz Carlton.

The area is a major selling factor, as noted by Top Ten Real Estate Deals. Marina del Rey is famous for its small-craft harbor, one of the largest in North America and is a popular spot for kayaking, bird-watching and enjoying waterfront views. The trendy Abbot Kinney stores, Trader Joe’s and several excellent restaurants are all within walking distance. The neighborhood is well-known for its star-studded locals and visitors, so you never know who you could run into.

Trending: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

Kareem Abdul-Jabbar is widely regarded as one of the greatest basketball players ever. He spent 20 seasons in the NBA with the Los Angeles Lakers and Milwaukee Bucks. He was well-known for his “skyhook” shot.

Abdul-Jabbar was also a 19-time NBA All-Star and a six-time NBA MVP. Standing at 7’2,” he dominated the game with his scoring, rebounding and defense and long held the record for the most points scored in NBA history.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

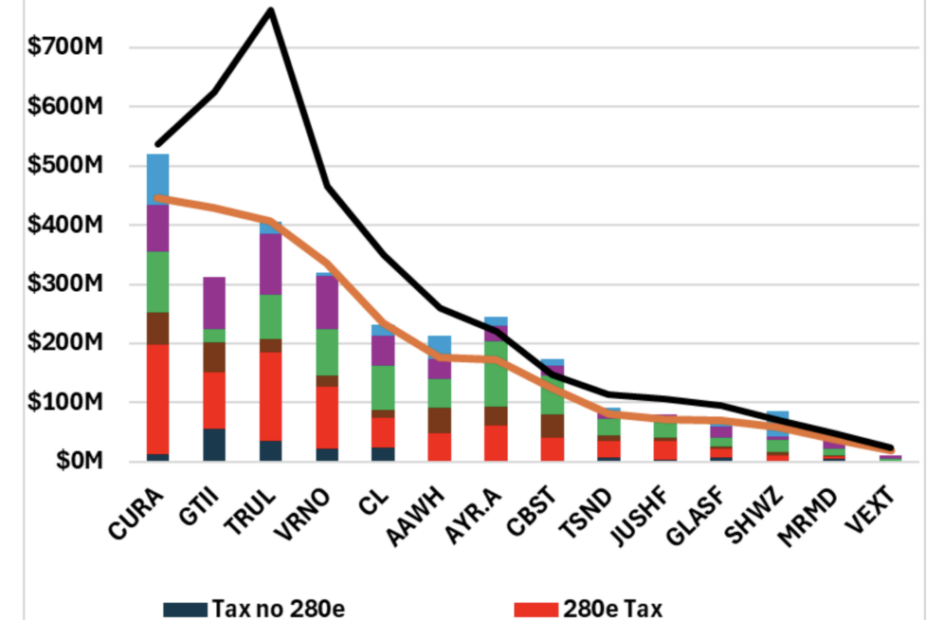

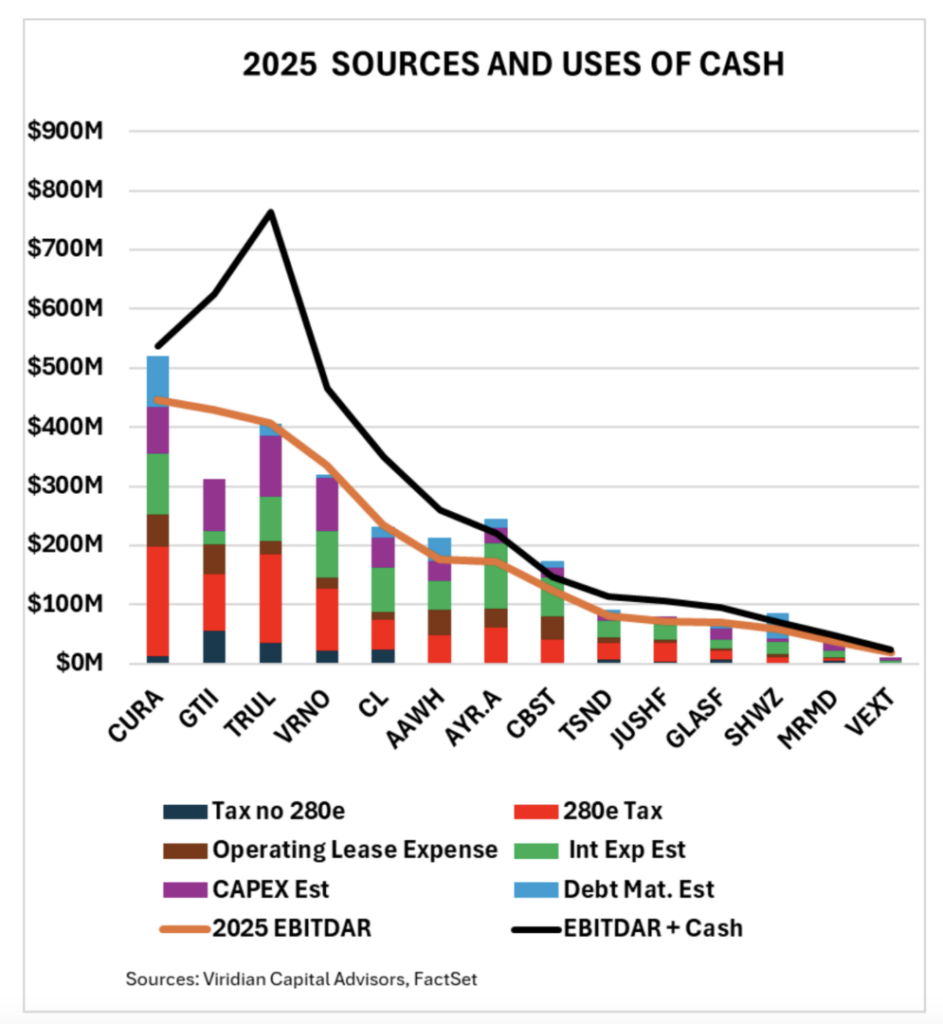

Almost Every Major Cannabis Company Could See Positive Cash Flow If 280E Is Removed In 2025

A recent analysis of 14 multi-state cannabis operators (MSOs) looks at how the potential removal of 280E in 2025 could impact their cash flows.

Section 280E of the U.S. tax code, which prevents cannabis companies from deducting normal business expenses due to federal prohibition, has long been a burden on the industry. If this tax provision were eliminated, cannabis companies would enjoy far better financial health.

Breakdown Of The Analysis

The chart provided by Viridian Capital Advisors shows the projected 2025 sources and uses of cash among the industry’s top MSOs, with an emphasis on how eliminating 280E could alter their financial standing.

- EBITDAR (Earnings Before Interest, Taxes, Depreciation and Rent): This is a critical metric because it represents the companies’ operational cash flow, excluding fixed charges.

- Additional Cash: Some companies are sitting on significant cash reserves, which serve as a buffer for covering operational needs. This is represented by the black line that shows EBITDAR plus existing cash.

- Impact of 280E: The red bars on the chart represent the additional tax expenses cannabis companies are incurring due to 280E. The black bars below reflect the estimated tax liability if 280E were removed. The significant gap between these bars shows how much relief companies could experience.

Financial Outlook For Major MSOs

According to the analysis, six companies, including Green Thumb GTBIF, Trulieve TCNNF, Verano VRNOF, Cresco CRLBF, Glass House GLASF, and MariMed MRMD, are projected to have enough cash flow to cover all fixed charges in 2025, even without the removal of 280E. Notably, every other company except Schwazze SHWZ would have positive cash flow if 280E were eliminated.

However, while 2025 looks relatively benign for MSO credit, 2026 could present challenges, with significant debt maturities that many companies will need to refinance, Viridian Capital analysts warn.

Additionally, companies like Curaleaf and Trulieve have substantial back taxes recorded as “uncertain tax liabilities,” which could become a financial strain depending on how repayment plans are structured.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

What This Means For The Cannabis Industry

If 280E is eliminated in 2025, the financial outlook for most cannabis companies would significantly improve. Companies would have more flexibility with cash flow and this relief could lead to higher profitability and more strategic investments. The potential tax reform could mark a turning point for an industry that has struggled under the burden of high taxes and federal prohibition.

Cover: image generated with IA tools.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Iridium Gearing Up to Report Q3 Earnings: Here's What to Expect

Iridium Communications IRDM is slated to release third-quarter 2024 earnings on Oct. 17, before market open.

The Zacks Consensus estimate for revenues is pegged at $205.7 million, indicating an increase of 4.1% from the year-ago level. The consensus estimate for earnings per share is pegged at 20 cents, unchanged in the past 60 days. In the year-ago quarter, the company reported a loss of 1 cent.

IRDM’s earnings beat the Zacks Consensus Estimate in two of the trailing four quarters, missed once and matched the same in the remaining quarter with the average surprise being 202.2%. In the past year, shares have lost 31.2% against sub-industry’s gain of 1.3%.

Image Source: Zacks Investment Research

Factors to Focus on Ahead of IRDM’s Q3 Earnings

Iridium’s third-quarter performance is likely to have gained momentum in the Service segment’s revenues and increasing subscriber base. Our estimate for segmental revenues is pegged at $155.5 million, implying a jump of 2.3% from a year-ago reported figure.

Strengthening commercial service revenues is a key catalyst. Commercial service revenues are likely to have been aided by strength in voice and data, IoT data, broadband, hosted payload and other data service business lines. We estimate commercial service revenues to be $129 million, indicating a 2.8% climb from the prior-year actual.

Revenues from voice and data are gaining from higher demand for Iridium’s push-to-talk services. Commercial IoT revenues are likely to have benefited from steady demand for personal satellite communications and traditional industrial services.

Hosted payload and other data service segment is also expected to have benefited from the new Iridium Satellite Time and Location offering.

Key Recent Developments

On Sept. 25, 2024, Iridium announced that the 3rd Generation Partnership Project (3GPP) approved its offer to broaden the capability of Narrowband Internet of Things (NB-IoT) for Non-Terrestrial Networks into the official Work Plan for 3GPP Release 19 (set to conclude in the fourth quarter of 2025). This initiative expands the company’s reach in global connectivity through its latest service, Iridium NTN Direct, which is expected to be the world’s first global 5G NB-IoT service.

On Sept. 19, 2024, Iridium announced its fourth stock repurchase authorization in four years. The $500 million authorization, approved by its board of directors, is the largest in the company’s history. It extends the total buyback authorization to $1.5 billion through Dec. 31, 2027.

On Sept. 3, 2024, the company introduced Iridium Certus GMDSS, making significant strides in maritime safety, compliance and communication. These terminals form a significant part of any ship’s hybrid network system with improved cost structure, efficiency and performance in maritime safety and security.

What Does Our Model Say for IRDM in Q3?

Our proven model does not conclusively predict an earnings beat for Iridium this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, this is not the case here.

Earnings ESP: Iridium has an Earnings ESP of 0.00%.

Zacks Rank: Iridium currently carries a Zacks Rank #2.

Stocks to Consider

Here are some stocks you may consider, as our model shows that these have the right combination of elements to beat on earnings this season.

Equifax EFX currently has an Earnings ESP of +1.56% and a Zacks Rank #2.

It is scheduled to release results for the third quarter of 2024 on Oct. 16. The Zacks Consensus Estimate for Equifax’s to-be-reported quarter’s earnings and revenues is pegged at $1.84 per share and $1.44 billion, respectively. Shares of EFX have gained 58.5% in the past year.

Netflix NFLX has an Earnings ESP of +1.37% and a Zacks Rank #2 at present. It is scheduled to release third-quarter 2024 results on Oct. 17. The Zacks Consensus Estimate for Netflix’s to-be-reported quarter’s earnings and revenues is pegged at $5.07 per share and $9.77 billion, respectively. Shares of NFLX have gained 100.3% in the past year.

Abbott Laboratories has an Earnings ESP of +0.18% and a Zacks Rank #2 at present. It is scheduled to release third-quarter 2024 results on Oct. 16. The Zacks Consensus Estimate for Abbott’s to-be-reported quarter’s earnings and revenues is pegged at $1.20 per share and $10.56 billion, respectively. Shares of ABT have gained 25.9% in the past year.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia and Advanced Micro Devices Just Gave Magnificent News to AI Chip Investors

How long will the strong artificial intelligence buildout last? The market appears optimistic, with AI chip leader Nvidia (NASDAQ: NVDA) trading at 34 times forward earnings estimates and challenger Advanced Micro Devices (NASDAQ: AMD) trading at 30 times.

However, there is a considerable debate among investors as to whether this hypergrowth is sustainable, or whether the AI buildout is going to pop like the dot-com bust.

This week, CEOs of AI chip leaders Nvidia and AMD made announcements, each of which gave even greater weight to the bull case for their stocks and AI chips stocks generally.

Bulls vs. bears on AI

AI stocks pulled back hard over the summer after a strong 18 months or so of performance, as skepticism worked its way into the story. After the Magnificent Seven, who are the main buyers of AI chips, reported good but not blowout earnings in July, investors appeared concerned that these big chip buyers weren’t seeing a requisite return on their investments in Nvidia chips. Most big tech stocks and AI chip plays sank in response.

Giant hedge fund Elliott Management piled onto the skepticism, giving especially bearish commentary on what it perceives as an AI “bubble.” Elliott wrote in its latest letter to investors that AI stocks were overhyped, declaring AI applications aren’t, “ever going to be cost-efficient, are never going to actually work right, will take up too much energy, or will prove to be untrustworthy.” Elliott dismissed the technology as only good for a few things such as summarizing reports and helping with computer coding.

That’s certainly a point of view that should be considered. It may even be true of the current models that are out today. However, virtually everyone participating in the technology industry believes in the benefits. If benefits weren’t likely going to be there, it seems unlikely every major technology company would be greatly expanding its AI investments today as they are.

For his part, Oracle Chairman Larry Ellison dismissed these concerns, declaring the race for AI supremacy “goes on forever, to build a better and better neural network.” Ellison believes that AI capabilities will improve with more compute and better models, and that the large tech companies can’t afford to cede the AI lead to competitors. With big tech armed with a ton of cash, he doesn’t see the buildout ending for five to 10 years.

Jensen Huang and Lisa Su just dropped the mic

This week then saw two massive announcements from the number one and two AI chip companies that should allay near-term fears about the durability of the AI trade. At the beginning of the month, Nvidia’s CEO Jensen Huang said demand for its next generation chip Blackwell was “insane.” Fast forward to last week, and analysts at Morgan Stanley revealed Blackwell is already sold out for the next 12 months, after the firm hosted Nvidia executives at their offices.

Then on Thursday, AMD held its “Advancing AI” event during which it unveiled its new EPYC 9005 CPUs and Instinct MI325X GPUs. During the presentation, CEO Lisa Su increased her projection for the market size for AI accelerators. Last year, Su surprised investors by forecasting the AI accelerator market would increase from $45 billion in 2023 to a whopping $400 billion in 2027.

So, has the past year made her more skeptical or anxious about all that spend, as Elliott surmises?

Just the opposite, in fact. During the conference, Su raised her guidance for the AI accelerator market to reach a whopping $500 billion by 2028, saying, “Since [last year], AI demand has continued to take off and exceed expectations. It’s clear that the rate of investment is continuing to grow everywhere, driven by more powerful models, new use cases, and actually just a wider adoption of AI use cases.”

If Su’s and Huang’s projections hold, more companies will benefit than just Nvidia and AMD. Any company with a strong competitive position in the related foundry, semicap equipment, server, or AI-integrated software industries should also see a benefit from this medium-term demand. Additionally, electricity and transmission providers should also see strong growth, as AI data centers consume a huge amount of energy.

Bubble brewing? Not just yet

While the dot-com bubble burst in the year 2000, remember that there was a five-year “boom” that preceded it. The boom coincided with the period after the Federal Reserve cut interest rates between 1995 through 1998. Looking at today’s situation, the AI boom is only about two years old, and the Fed similarly just began a rate-cutting cycle in September.

To this investor, it appears we may be more in the “mid-90s” analogy rather than the precipice of an enormous bubble bursting. There’s also a case for the boom to go on for a longer time than the internet boom did, as the companies investing AI, the Mag Seven, are all extremely strong financially — much stronger than a lot of the newer start-up tech companies of the mid-1990s. In addition, for all their success, the Mag Seven really don’t trade at the crazy valuations seen by big tech in the late 1990s.

That doesn’t mean the AI buildout couldn’t become a bubble — it could. But it still seems early, and AI stocks are too reasonably priced for a huge fall, barring any outside exogenous shocks.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Billy Duberstein and/or his clients have no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Oracle. The Motley Fool has a disclosure policy.

Nvidia and Advanced Micro Devices Just Gave Magnificent News to AI Chip Investors was originally published by The Motley Fool

John Bolton Says Israel Should Strike Iran By 'Going After Its Nuclear Weapons Program' — Tehran's Nukes Threaten America's Security

Trump-Era White House national security advisor, John Bolton, has called on Israel to target Iran’s nuclear program, despite worldwide appeals for moderation following Iran’s recent missile attack.

What Happened: Bolton said on X on Monday, “The Israeli government should consider retaliating against Iran by going after its nuclear weapons program.”

“Iran having nuclear weapons directly threatens Israel’s national security as well as America’s.”

He shared an article from Canada’s Global News in which he was quoted as saying, “I think that’s the point where Israel can have the maximum impact, precisely by going after the nuclear weapons program.” The former U.S. official said that there was “no guarantee” that Israel would have another opportunity that was as good.

In an interview with Mercedes Stephenson on The West Block, Bolton underscored the need for Israel to prevent Iran’s next attack from involving a nuclear warhead, according to the report.

“If you’re Israel, and you’ve seen in both the April attack from Iran and the Oct. 1 attack hundreds of ballistic missiles launched at you, you could have no confidence that the next time you see a ballistic missile coming from Iran, that under its nose cone it might not have a nuclear weapon.”

Why It Matters: Bolton has previously advocated for regime change in Iran and has criticized Iran’s role in attacks on Israeli civilians. His latest call for action comes after Israeli Prime Minister Benjamin Netanyahu expressed willingness to strike military targets rather than oil or nuclear facilities in Iran. This decision was seen as a move to avoid political interference in the U.S. elections and to prevent a surge in energy prices.

However, experts have warned that any Israeli military action targeting Iranian facilities could significantly impact global oil prices and lead to potential disruptions in the energy markets. This adds another layer of complexity to the already tense geopolitical situation.

Notably oil prices fell on Monday after Netanyahu said that Israel will not target Iran’s oil or nuclear targets.At the time of writing WTI Crude November 2024 futures traded 2.9% lower at $71.70. ICE Brent Crude December 2024 futures were down 2.8% at $75.28.

The United States Oil Fund LP USO ended Monday lower by 2% at $75.93 while the iShares US Oil & Gas Exploration & Production ETF IEO closed 1.1% lower at $96.03.

Image via Flickr/ Gage Skidmore

Did You Know?

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

B. Riley Financial to Establish Partnership with Oaktree in the Great American Group Businesses

Concludes Previously Announced Review of Strategic Alternatives for the Great American Group Businesses

LOS ANGELES, Oct. 14, 2024 /PRNewswire/ — B. Riley Financial, Inc. RILY (“B. Riley” and the “Company”), a diversified financial services platform, and funds managed by Oaktree Capital Management, L.P. (“Oaktree”), have signed a definitive agreement (the “Agreement”) to establish a partnership in Great American Holdings, LLC, a newly formed holding company (“Great American NewCo”).

Prior to the closing of the transactions contemplated by the Agreement, B. Riley will undertake a pre-closing internal reorganization and will contribute all of the interests in B. Riley’s Appraisal and Valuation Services, Retail, Wholesale & Industrial Solutions and Real Estate Advisory businesses (collectively known as the “Great American Group”) to Great American NewCo.

At the closing of the transaction, B. Riley will receive total consideration consisting of approximately $203 million in cash, subject to certain purchase price adjustments, Class B Preferred Units of Great American NewCo with an initial aggregate liquidation preference of approximately $183 million, and Class A Common Units of NewCo representing approximately 47% of the total outstanding common units. Oaktree will acquire Class A Preferred Units of Great American NewCo with an initial liquidation preference of approximately $203 million, as well as Class A Common Units representing approximately 53% of the aggregate amount of the issued and outstanding Class A Common Units of Great American NewCo, in exchange for cash consideration of approximately $203 million (the “Proposed Transaction”), implying a total enterprise value for the Great American NewCo of $386 million. The transaction has been approved by the Board of Directors of the Company and is subject to the receipt of required regulatory approvals and other customary closing conditions. It is expected to close in the fourth quarter of 2024.

Bryant Riley, Chairman and Co-Chief Executive Officer of B. Riley, said, “I am pleased to be partnering with Oaktree given its stellar track record and reputation as one of the world’s leading asset managers. We believe Oaktree’s scale and expertise in alternative investments and their strength as a capital provider, combined with the Great American Group’s leading position as a provider of asset disposition, financial advisory and real estate advisory services, will prove complementary as we join forces to deliver financial products and services to better serve our clients.”

Mr. Riley continued, “As we communicated last month, this transaction is an important step in our plan to reduce our debt while reinvesting in our core financial services businesses. We are very excited about this new partnership we established with Oaktree in the Great American Group as it will enable meaningful debt reduction while retaining significant equity upside in the business with a highly capable new partner that will increase its future growth prospects.”

“Great American offers an exciting investment opportunity for Oaktree in a leading valuation appraisal, asset disposition and real estate advisory platform. We are eager to provide both capital and our extensive operating expertise to support the future growth of the business,” said Nick Basso, Managing Director at Oaktree.

“As an experienced capital provider to the financial services sector, we are thrilled to partner with B. Riley and Great American’s talented leadership team. We look forward to bringing our resources and relationships to support Great American’s growth as an independent platform,” said Thomas Casarella, Managing Director at Oaktree.

Advisors

Moelis & Company LLC served as the exclusive financial advisor to B. Riley, and Sullivan & Cromwell LLP served as legal advisor to B. Riley. Wachtell, Lipton, Rosen & Katz served as legal advisor to Oaktree.

About B. Riley Financial

B. Riley Financial is a diversified financial services platform that delivers tailored solutions to meet the strategic, operational, and capital needs of its clients and partners. B. Riley leverages cross-platform expertise to provide clients with full service, collaborative solutions at every stage of the business life cycle. Through its affiliated subsidiaries, B. Riley provides end-to-end financial services across investment banking, institutional brokerage, private wealth and investment management, financial consulting, corporate restructuring, operations management, risk and compliance, due diligence, forensic accounting, litigation support, appraisal and valuation, auction, and liquidation services. B. Riley opportunistically invests to benefit its shareholders, and certain affiliates originate and underwrite senior secured loans for asset-rich companies. B. Riley refers to B. Riley Financial, Inc. and/or one or more of its subsidiaries or affiliates. For more information, please visit www.brileyfin.com.

About Oaktree

Oaktree is a leader among global investment managers specializing in alternative investments, with $193 billion in assets under management as of June 30, 2024. The firm emphasizes an opportunistic, value-oriented and risk-controlled approach to investments in credit, private equity, real estate and listed equities. The firm has over 1,200 employees and offices in 23 cities worldwide. For additional information, please visit Oaktree’s website at http://www.oaktreecapital.com/.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the Company’s performance or achievements to be materially different from any expected future results, performance, or achievements. Forward-looking statements speak only as of the date they are made and the Company assumes no duty to update forward looking statements, except as required by law. Actual future results, performance or achievements may differ materially from historical results or those anticipated depending on a variety of factors, some of which are beyond the control of the Company, including, but not limited to, the occurrence of any event, change or other circumstances that could give rise to the termination of the Agreement; the inability to consummate the transactions contemplated therein or the failure to satisfy other conditions to completion of the Proposed Transaction; potential litigation relating to the Proposed Transaction that could be instituted in connection with the Agreement; and the risk that the Proposed Transaction will not be consummated in a timely manner, if at all. In addition to these factors, we encourage you to review the “Risk Factors” set forth in B. Riley’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and other filings with the United States Securities and Exchange Commission, which identify important factors, though not necessarily all such factors, that could cause future outcomes to differ materially from those set forth in the forward-looking statements in this communication.

Contacts

B. Riley

Investors

ir@brileyfin.com

Media

press@briley.com

![]() View original content:https://www.prnewswire.com/news-releases/b-riley-financial-to-establish-partnership-with-oaktree-in-the-great-american-group-businesses-302275072.html

View original content:https://www.prnewswire.com/news-releases/b-riley-financial-to-establish-partnership-with-oaktree-in-the-great-american-group-businesses-302275072.html

SOURCE B. Riley Financial

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

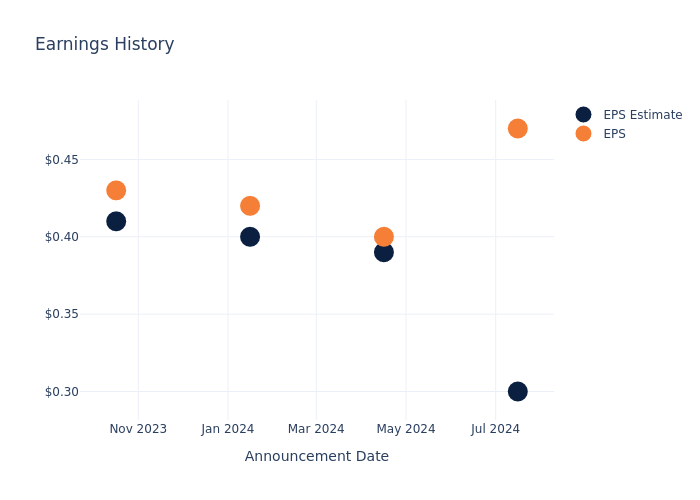

Earnings Outlook For Fulton Financial

Fulton Financial FULT is set to give its latest quarterly earnings report on Tuesday, 2024-10-15. Here’s what investors need to know before the announcement.

Analysts estimate that Fulton Financial will report an earnings per share (EPS) of $0.44.

Investors in Fulton Financial are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

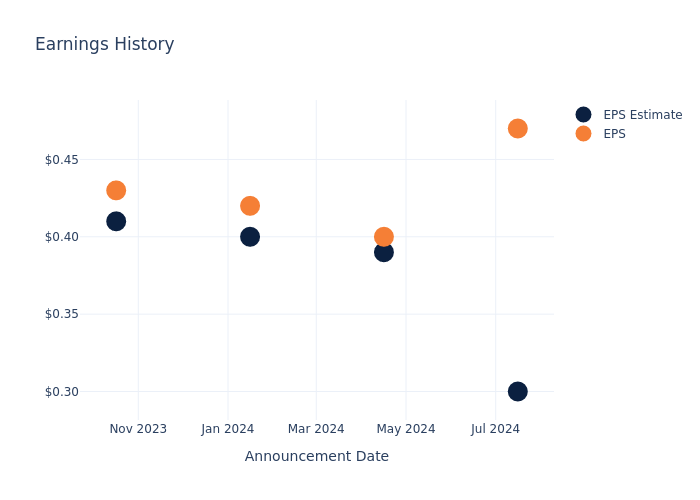

Earnings History Snapshot

Last quarter the company beat EPS by $0.17, which was followed by a 4.47% increase in the share price the next day.

Here’s a look at Fulton Financial’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.30 | 0.39 | 0.40 | 0.41 |

| EPS Actual | 0.47 | 0.40 | 0.42 | 0.43 |

| Price Change % | 4.0% | 0.0% | -1.0% | -2.0% |

Stock Performance

Shares of Fulton Financial were trading at $17.95 as of October 11. Over the last 52-week period, shares are up 41.74%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

To track all earnings releases for Fulton Financial visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fed's Waller Signals Caution On Interest-Rate Cuts: 'Latest Inflation Data Was Disappointing'

Federal Reserve Gov. Christopher J. Waller voiced concerns Monday over recent inflation data, signaling that the central bank must proceed cautiously on interest rate cuts.

Speaking at a conference at Stanford University, Waller struck a slightly hawkish tone, highlighting the U.S. economy’s strength while acknowledging worries over recent inflation upticks.

Waller emphasized the economy is on “solid footing,” with employment near the Federal Open Market Committee’s (FOMC) maximum objective. But he added, “The latest inflation data was disappointing.”

Despite progress in reducing inflation, recent figures suggest uneven progress toward the Fed’s 2% target.

Waller praised the economy’s resilience, noting that real GDP grew at a 2.2% annual rate in the first half of 2024 and is expected to accelerate in the third quarter.

He also mentioned that household resources remain in good shape, though lower-income groups continue to face financial strain. “These revisions suggest that the economy is much stronger than previously thought, with little indication of a major slowdown in economic activity,” Waller said.

Waller highlighted continued strength in consumer spending, despite some moderation.

Growth in personal consumption expenditures (PCE) has averaged around 2.5% this year. Waller’s business contacts expressed optimism about “considerable pent-up demand” for durable goods and home improvements, demand that has been delayed due to high interest rates.

As interest rates for credit cards and home equity loans begin to decline, Waller expects consumers to resume purchasing “durable goods, home improvements, and other big-ticket items.”

“Now that rates have started to come down and are expected to come down more, consumers will be eager to make those purchases,” he said.

Read Also: ‘Most Widely Hated’ Bull Market Reaches 2-Year Milestone: Top 20 S&P 500 Stocks Driving The Rally

Waller also addressed the September jobs report, which far exceeded expectations. “The labor market remains quite healthy,” he said, pushing back against speculation that the Fed might have considered an emergency rate cut earlier in the summer.

While Waller expects payroll gains to slow, he believes job growth will continue at a “solid rate.”

He did, however, caution that interpreting the October jobs report may be difficult due to temporary disruptions from recent hurricanes and the Boeing strike, which are expected to skew the numbers.

Turning to inflation, Waller expressed concern over September’s likely increase in PCE inflation, the Fed’s preferred measure. “We have made a lot of progress on inflation over the last year and a half, but that progress has clearly been uneven — at times it feels like being on a rollercoaster,” Waller said.

He remains uncertain whether the recent uptick in inflation is a temporary blip or a signal of more persistent inflationary pressures. “I will be watching the data carefully to see how persistent this recent uptick is,” he added.

Despite these concerns, Waller reaffirmed his outlook for gradual rate reductions over the next year, aligning with the FOMC’s median projection of 3.4% for the federal funds rate by the end of 2025.

However, he acknowledged, “There is less certainty about the final destination.”

Waller’s remarks have not significantly shifted interest-rate expectations. According to the CME FedWatch Tool, the odds of a 25-basis-point rate cut remained steady at 86%.

However, if more Fed policymakers also express concerns about inflation in the days to come, and if Thursday’s retail sales data exceeds expectations, the likelihood of the Fed holding rates unchanged could rise from here.

On Monday, Treasury yields were largely stable, with the two-year note yield — sensitive to rate policy — hovering around 4%. The U.S. dollar index (DXY), tracked by the Invesco DB USD Index Bullish Fund ETF UUP, rose 0.3%, reaching its highest level since late July.

Meanwhile, the S&P 500 index, monitored via the SPDR S&P 500 ETF Trust SPY, gained 0.8% to close at 5,859 points, extending its record highs.

Read Now:

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.