2 Stocks That Could Create Lasting Generational Wealth

Numerous investors, even those with a mindset to build for retirement, may not think in terms of “generational wealth.” This is somewhat understandable, as presumably one wants to live long enough to enjoy the fruits of their saving and investing.

Still, many also want to establish a legacy that will benefit their descendants once they are gone. Finding stocks to meet these criteria can become complicated, especially when considering that one-time consumer stalwarts such as Sears and Kodak went from market leadership to nearly not existing at all.

Thus, choosing such stocks is not an easy task. Nonetheless, here are two stocks that hold the potential to not only stand the test of time, but also generate the growth needed to build wealth for oneself and for subsequent generations.

1. Realty Income

Although no business is foolproof, it would probably take appallingly unwise decisions to undermine Realty Income (NYSE: O). The real estate investment trust (REIT) owns nearly 15,500 single-tenant commercial properties in seven different countries.

High-profile clients such as Walmart, Dollar General, Planet Fitness, and numerous others depend on Realty Income properties to interact with and serve customers. These properties are also structured as net leases, meaning the tenant pays for the property tax, insurance, and maintenance, which creates a stable income stream for Realty Income.

As a REIT, Realty Income is also a dividend stock. However, its payout stands out because shareholders receive a dividend every month. Additionally, its dividend has risen at least once per year since its inception in 1994. At $3.16 per share annually, the company pays a dividend yield of 5.1%, more than quadruple the S&P 500 index average of 1.25%.

Investors should also note that the company has continued to grow that dividend and the size of its property portfolio even in the rising interest rate environment of the last few years. Thus, despite its challenges, the funds from operations (FFO) income available to shareholders, a measure of the REIT’s free cash flow, reached $1.7 billion in the first half of 2024. That was a 25% increase compared to 12 months ago.

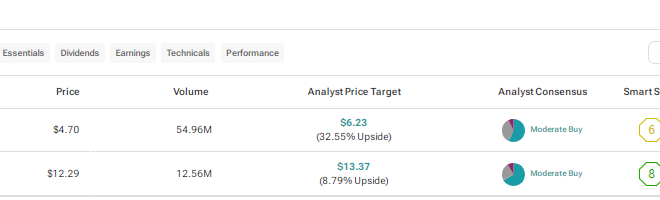

The stock trades at about 25% below its peak before the pandemic. It also sells for about 16 times its FFO income, an inexpensive valuation considering its continuing growth.

Now that the Federal Reserve has finally cut interest rates, this could be an excellent time to start building that wealth as more investors take a renewed interest in the stock.

2. MercadoLibre

As a company that serves Latin America only, MercadoLibre (NASDAQ: MELI) may not be a household name to U.S. investors. Additionally, Latin American countries sometimes face political turmoil, high inflation, and complex regulatory environments. Admittedly, such conditions are not typically drivers of generational wealth.

However, MercadoLibre is worth such consideration because it has thrived amid these regional challenges. When customers could not use its online platform because they operated exclusively with cash, it created Mercado Pago, which provided financial products enabling these customers to shop online.

Moreover, fulfillment and shipping often became an issue. Thus, it created Mercado Envios to provide these services. The company also introduced same-day and next-day shipping to areas where it did not previously exist.

Both Mercado Pago and Mercado Envios also went on to serve customers separate from the MercadoLibre platform, further expanding their reach. Additionally, this infrastructure also gives the company a competitive advantage over competitors that entered its markets, such as Amazon and Sea Limited.

MercadoLibre’s approach is so successful that revenue for the first half of 2024 was $5.1 billion, rising 42% from the same year-ago period. Also, the company reduced foreign currency losses and income tax, resulting in a net income for that time frame of $531 million, up from $262 million last year.

Furthermore, the stock recently surged past its peak during the pandemic. Given that rapid growth, it is likely investors will overlook a relatively elevated 73 P/E ratio. As MercadoLibre continues to attract more customers and capitalize on the synergies of its businesses, it will probably drive higher returns for years, and, likely, decades to come.

Should you invest $1,000 in MercadoLibre right now?

Before you buy stock in MercadoLibre, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and MercadoLibre wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Will Healy has positions in MercadoLibre and Sea Limited. The Motley Fool has positions in and recommends Amazon, MercadoLibre, Planet Fitness, Realty Income, Sea Limited, and Walmart. The Motley Fool has a disclosure policy.

2 Stocks That Could Create Lasting Generational Wealth was originally published by The Motley Fool

Leave a Reply