A Look Ahead: JB Hunt Transport Servs's Earnings Forecast

JB Hunt Transport Servs JBHT is gearing up to announce its quarterly earnings on Tuesday, 2024-10-15. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that JB Hunt Transport Servs will report an earnings per share (EPS) of $1.44.

The announcement from JB Hunt Transport Servs is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

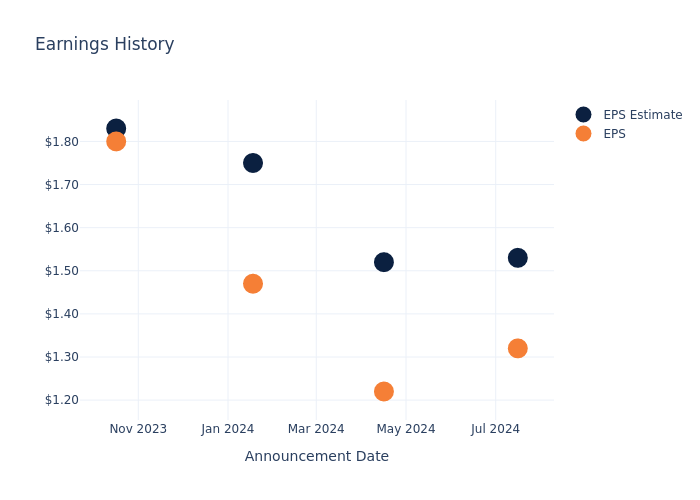

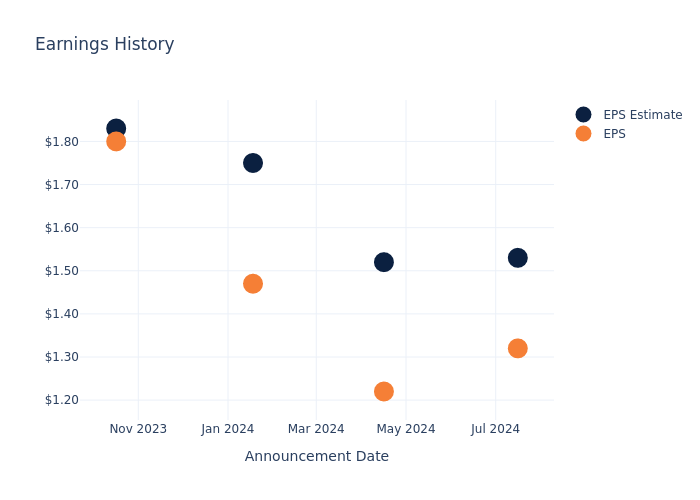

Earnings Track Record

Last quarter the company missed EPS by $0.21, which was followed by a 6.87% drop in the share price the next day.

Here’s a look at JB Hunt Transport Servs’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 1.53 | 1.52 | 1.75 | 1.83 |

| EPS Actual | 1.32 | 1.22 | 1.47 | 1.80 |

| Price Change % | -7.000000000000001% | -8.0% | 1.0% | -9.0% |

Tracking JB Hunt Transport Servs’s Stock Performance

Shares of JB Hunt Transport Servs were trading at $170.72 as of October 11. Over the last 52-week period, shares are down 13.76%. Given that these returns are generally negative, long-term shareholders are likely unhappy going into this earnings release.

Analysts’ Take on JB Hunt Transport Servs

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on JB Hunt Transport Servs.

Analysts have given JB Hunt Transport Servs a total of 15 ratings, with the consensus rating being Neutral. The average one-year price target is $173.2, indicating a potential 1.45% upside.

Understanding Analyst Ratings Among Peers

The analysis below examines the analyst ratings and average 1-year price targets of and XPO, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- XPO is maintaining an Buy status according to analysts, with an average 1-year price target of $137.0, indicating a potential 19.75% downside.

Peer Analysis Summary

The peer analysis summary presents essential metrics for and XPO, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| JB Hunt Transport Servs | Neutral | -6.51% | $502.68M | 3.30% |

| XPO | Buy | 8.45% | $265M | 10.60% |

Key Takeaway:

JB Hunt Transport Servs has a lower revenue growth compared to its peer. Its gross profit is higher than its peer. The return on equity of JB Hunt Transport Servs is lower than its peer. Overall, JB Hunt Transport Servs is positioned in the middle compared to its peer in terms of these financial metrics.

Discovering JB Hunt Transport Servs: A Closer Look

J.B. Hunt Transport Services ranks among the top surface transportation companies in North America by revenue. Its primary operating segments are intermodal delivery, which uses the Class I rail carriers for the underlying line-haul movement of its owned containers (48% of sales in 2023), dedicated trucking services that provide customer-specific fleet needs (28%), for-hire truckload (6%), heavy goods final-mile delivery (7%), and asset-light truck brokerage (11%).

JB Hunt Transport Servs: A Financial Overview

Market Capitalization: Positioned above industry average, the company’s market capitalization underscores its superiority in size, indicative of a strong market presence.

Negative Revenue Trend: Examining JB Hunt Transport Servs’s financials over 3 months reveals challenges. As of 30 June, 2024, the company experienced a decline of approximately -6.51% in revenue growth, reflecting a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: The company’s net margin is a standout performer, exceeding industry averages. With an impressive net margin of 4.64%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): JB Hunt Transport Servs’s financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 3.3%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): The company’s ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.61%, the company showcases effective utilization of assets.

Debt Management: JB Hunt Transport Servs’s debt-to-equity ratio is below the industry average at 0.36, reflecting a lower dependency on debt financing and a more conservative financial approach.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply