A Preview Of State Street's Earnings

State Street STT is set to give its latest quarterly earnings report on Tuesday, 2024-10-15. Here’s what investors need to know before the announcement.

Analysts estimate that State Street will report an earnings per share (EPS) of $2.13.

The announcement from State Street is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

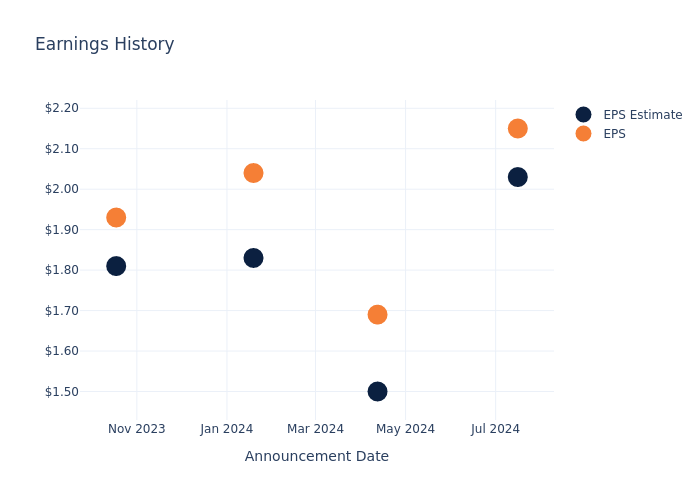

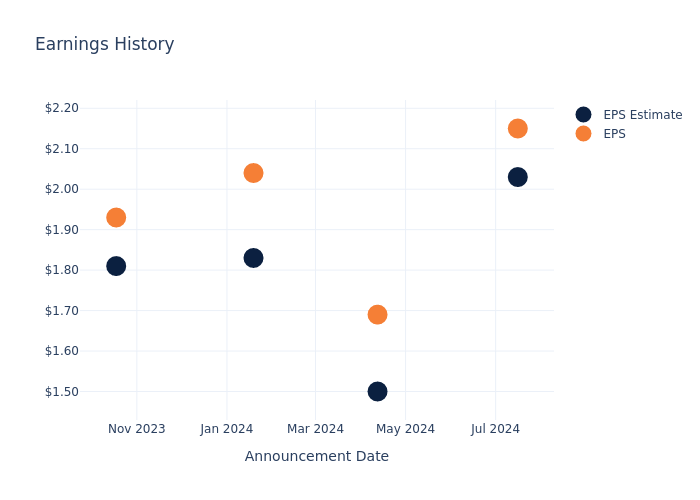

Past Earnings Performance

During the last quarter, the company reported an EPS beat by $0.12, leading to a 0.61% increase in the share price on the subsequent day.

Here’s a look at State Street’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 2.03 | 1.50 | 1.83 | 1.81 |

| EPS Actual | 2.15 | 1.69 | 2.04 | 1.93 |

| Price Change % | 1.0% | 3.0% | 2.0% | -3.0% |

State Street Share Price Analysis

Shares of State Street were trading at $89.83 as of October 11. Over the last 52-week period, shares are up 34.0%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts’ Perspectives on State Street

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on State Street.

Analysts have given State Street a total of 13 ratings, with the consensus rating being Neutral. The average one-year price target is $92.77, indicating a potential 3.27% upside.

Understanding Analyst Ratings Among Peers

The analysis below examines the analyst ratings and average 1-year price targets of Ares Management, Blue Owl Cap and Franklin Resources, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- The prevailing sentiment among analysts is an Neutral trajectory for Ares Management, with an average 1-year price target of $158.5, implying a potential 76.44% upside.

- Analysts currently favor an Outperform trajectory for Blue Owl Cap, with an average 1-year price target of $21.5, suggesting a potential 76.07% downside.

- For Franklin Resources, analysts project an Neutral trajectory, with an average 1-year price target of $21.66, indicating a potential 75.89% downside.

Comprehensive Peer Analysis Summary

Within the peer analysis summary, vital metrics for Ares Management, Blue Owl Cap and Franklin Resources are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| T. Rowe Price Gr | Neutral | 7.65% | $911.50M | 4.77% |

| Ares Management | Neutral | -20.67% | $718.06M | 5.04% |

| Blue Owl Cap | Outperform | 31.88% | $322.75M | 2.00% |

| Franklin Resources | Neutral | 7.82% | $1.70B | 1.29% |

Key Takeaway:

State Street ranks in the middle for consensus rating among its peers. It ranks at the bottom for revenue growth. It ranks at the top for gross profit. It ranks in the middle for return on equity.

Get to Know State Street Better

State Street is a leading provider of financial services, including investment servicing, investment management, and investment research and trading. With approximately $42 trillion in assets under custody and administration and $4.1 trillion assets under management as of Dec. 31, 2023, State Street operates globally in more than 100 geographic markets and employs more than 46,000 worldwide.

State Street’s Economic Impact: An Analysis

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Over the 3 months period, State Street showcased positive performance, achieving a revenue growth rate of 2.6% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Net Margin: State Street’s net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 20.53%, the company may face hurdles in effective cost management.

Return on Equity (ROE): State Street’s ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 2.96%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): State Street’s ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.2%, the company may face hurdles in achieving optimal financial performance.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.49, caution is advised due to increased financial risk.

To track all earnings releases for State Street visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply