Decoding Futu Hldgs's Options Activity: What's the Big Picture?

High-rolling investors have positioned themselves bearish on Futu Hldgs FUTU, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in FUTU often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 16 options trades for Futu Hldgs. This is not a typical pattern.

The sentiment among these major traders is split, with 43% bullish and 50% bearish. Among all the options we identified, there was one put, amounting to $41,700, and 15 calls, totaling $1,030,484.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $70.0 and $190.0 for Futu Hldgs, spanning the last three months.

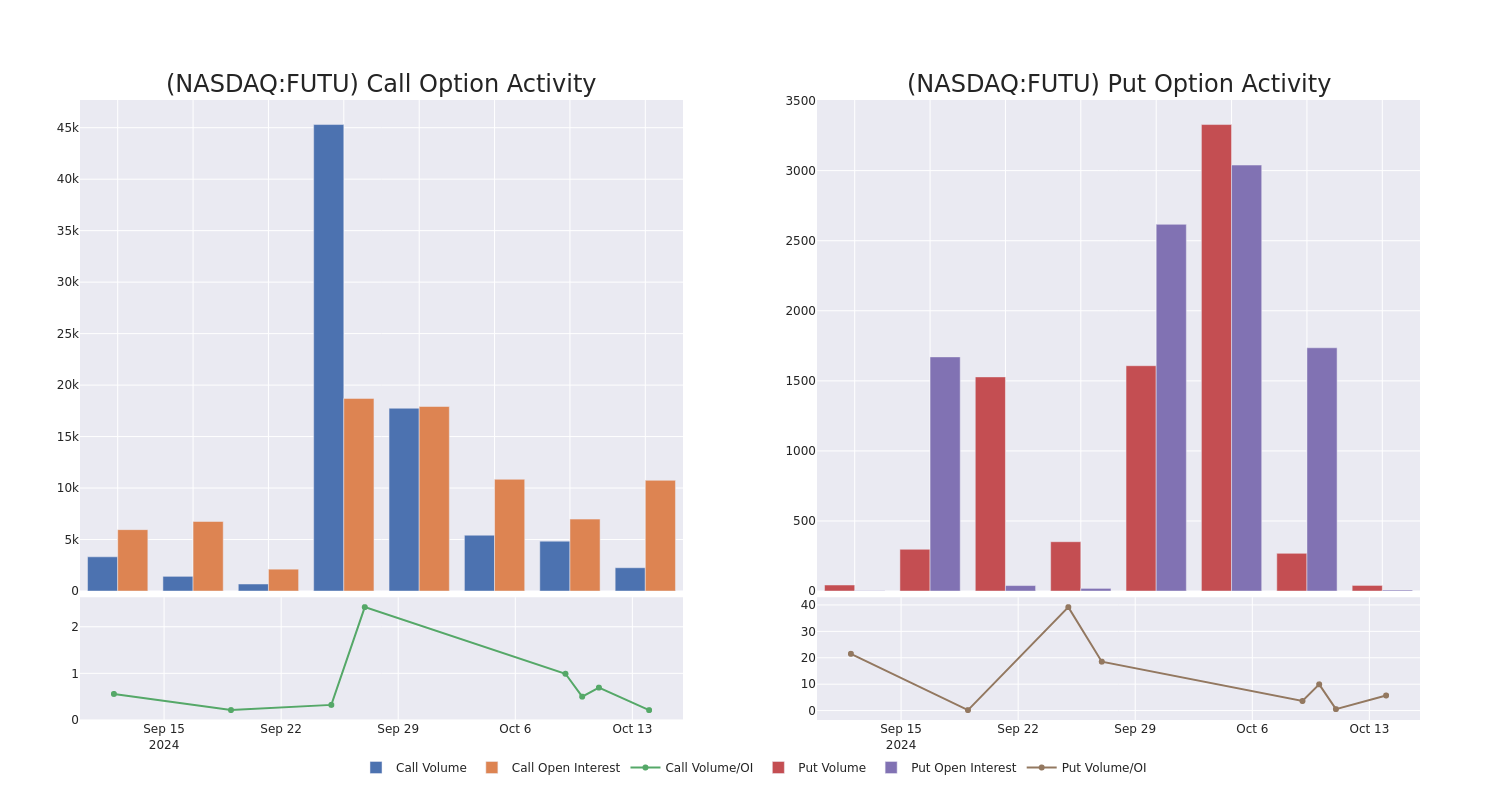

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Futu Hldgs options trades today is 896.83 with a total volume of 2,304.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Futu Hldgs’s big money trades within a strike price range of $70.0 to $190.0 over the last 30 days.

Futu Hldgs Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FUTU | CALL | TRADE | BEARISH | 11/15/24 | $14.95 | $13.95 | $14.0 | $100.00 | $151.2K | 787 | 295 |

| FUTU | CALL | TRADE | BULLISH | 12/20/24 | $9.3 | $8.95 | $9.31 | $120.00 | $93.1K | 1.3K | 148 |

| FUTU | CALL | SWEEP | BULLISH | 12/20/24 | $18.0 | $17.0 | $18.0 | $100.00 | $90.0K | 1.0K | 50 |

| FUTU | CALL | TRADE | BEARISH | 01/16/26 | $31.5 | $29.4 | $29.85 | $115.00 | $89.5K | 105 | 30 |

| FUTU | CALL | SWEEP | BULLISH | 01/17/25 | $42.4 | $39.75 | $42.45 | $70.00 | $84.8K | 1.2K | 0 |

About Futu Hldgs

Futu Holdings Ltd is an online broker providing one-stop online investing services. The company provides its services through its digital platform Futu NiuNiu, which includes market data, trading service, and news feed of Hong Kong, Mainland China, Singapore, and United States equity markets. It generates its revenue in the form of brokerage commission and handling charge services.

Having examined the options trading patterns of Futu Hldgs, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Futu Hldgs

- With a trading volume of 2,438,259, the price of FUTU is down by -2.95%, reaching $107.74.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 38 days from now.

Expert Opinions on Futu Hldgs

1 market experts have recently issued ratings for this stock, with a consensus target price of $90.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for Futu Hldgs, targeting a price of $90.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Futu Hldgs, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply