Super Micro Computer Shares Surge on Shipment News. Can the Stock Continue to Rebound?

After a strong start to the year, shares of Super Micro Computer (NASDAQ: SMCI) have been under a lot of pressure following a disappointing earnings report, unwanted attention from a notable short-seller, the delay of its annual 10-K filing, and a possible investigation by the Department of Justice (DOJ). However, the stock rallied after the company put out a press release that mentioned its quarterly shipment volume.

Against that backdrop, let’s take a closer look at the company’s recent announcement, what it means, and whether it can be the start of a bigger rebound for the stock.

Over 100,000 GPU shipments

As part of an announcement introducing new cooling technology, Supermicro slipped into the press release headline that it is currently shipping over 100,000 graphics processing units (GPUs) per quarter. It clarified in the release that it has recently deployed more than 100,000 GPUs with direct liquid cooling (DLC) solutions for some very large data centers built to power artificial intelligence (AI) applications.

Now, it is important to understand what exactly Supermicro does as it relates to this statement. It does not design GPUs like Nvidia or manufacture them like Taiwan Semiconductor. What it does is purchase components, such as GPUs, and then design and assemble servers and rack solutions for customers.

The company doesn’t offer the same level of support as branded servers made by Dell, but it sells them at much lower prices. Supermicro has also carved out a niche by being one of the first server companies to embrace DLC. GPUs generate a lot of heat, so they must be kept cool to avoid failure and to help save on energy costs.

To promote this technology, Supermicro is charging the same price as the more standard air-cooled systems. While Dell also has DLC technology, it is just starting to ramp it up, so Supermicro has a first-mover advantage.

Selling a lot of high-priced GPUs will boost revenue, but the company is not collecting a big markup on those chips. As such, it has quite low gross margins, which have come under pressure recently. Last quarter, its gross margin dropped to 11.2%, down from 17.0% a year go. By comparison, Nvidia reported a gross margin of 75% in its latest quarter, while contract manufacturer Taiwan Semiconductor had a gross margin of 53%.

Can the stock continue to rebound?

Beyond the margin pressure, Supermicro stock has come under fire following allegations from Hindenburg Research of accounting manipulation, violated sanctions, and management self-dealing. A few years ago, the company settled with the SEC for $17.5 million over similar accounting issues, though the company never admitted to the SEC’s claims.

And to make matters worse, Supermicro has delayed the filing of its annual report in the wake of Hindenburg’s short report. Since then, The Wall Street Journal also reported that the DOJ was probing the company over accounting issues, although neither party has confirmed the existence of an investigation.

As troubling as some of the developments may be, Supermicro is clearly benefiting from the billions of dollars being poured into AI infrastructure buildouts. It may not have a particularly wide moat, but with large tech companies scooping up GPUs in a massive arms race, it will continue to benefit.

The stock is not expensive, either, as it trades at 14 times analysts’ fiscal 2025 earnings estimate. This isn’t a stock you should expect to command a high price-to-earnings multiple, but with the AI growth opportunity in front of it, it does look undervalued.

The question, of course, is what comes next? There are a number of scenarios where the stock can rally, but Supermicro remains a risky pick because of the uncertainty surrounding its annual report and the possible DOJ investigation. Investors should approach the stock with caution.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,266!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,047!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,794!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

Super Micro Computer Shares Surge on Shipment News. Can the Stock Continue to Rebound? was originally published by The Motley Fool

Oppenheimer Predicts up to 740% Rally for These 2 ‘Strong Buy’ Stocks

Investors have plenty to feel positive about. Inflation is easing, with the latest data showing an annualized rate of 2.4%, just shy of the Fed’s target by less than half a percentage point. Meanwhile, the stock market continues its bullish run, with the S&P 500 hitting a record high of 5,822 on Friday, marking a 22% year-to-date gain.

The naysayers have, so far, been proven wrong – the economy, at least as far as the stock market is concerned, remains robust. Oppenheimer’s chief investment strategist, John Stoltzfus, echoes this positive sentiment, stating, “The S&P 500’s closing price suggests to us a bull market that persists bolstered by economic resilience supported by business and consumer activity with opportunity for stocks to move higher into year-end… We remain positive on equities.”

How positive is Oppenheimer when it comes to equities? Positive enough for the firm’s analysts to project massive gains for certain stocks – including one with a potential upside of up to 740%.

We’ve dived into the TipRanks database to gauge Wall Street’s general view on two Oppenheimer picks. The consensus? Strong Buy ratings across the board, with substantial upside potential. Let’s take a closer look at the details.

Rani Therapeutics (RANI)

Biologics made serious waves in the medical world. These are a class of drugs that target severe and chronic autoimmune, inflammatory, and metabolic diseases – conditions that have in the past proven resistant to traditional treatments and medications. The big problem with biologics is the delivery – they are dosed through IV infusion, as they cannot withstand stomach acids. This is where Rani Therapeutics, the first Oppenheimer pick we’ll look at, has made its great contribution.

The company has developed the RaniPill, a delivery system that allows biologic drugs to be dosed orally. The RaniPill capsule can move through the stomach and remain intact, allowing for the biologic drug within to be effectively absorbed by the highly vascularized wall of the small intestine. It’s an innovative design that bypasses one of the largest ‘patient problems’ with biologics, improving both patient comfort and medication compliance.

Rani has followed up the development of this new delivery system with several clinical trials on new drug candidates targeting several applicable metabolic or inflammatory conditions. Key drugs in its pipeline include RT-102 for osteoporosis and RT-111 for psoriasis, both of which have shown promising results in early trials. RT-102 is slated to begin a Phase 2 trial in Europe by year-end, while RT-111, following positive Phase 1 results, will be tested at higher doses to further assess safety and efficacy.

In addition, the company is working with ProGen on the development and commercialization of PG-102, an obesity treatment, delivered with the RaniPill and designated RT-114. Development is focusing on convenient delivery through a once-weekly dose, and a Phase 1 study is planned for initiation next year.

Oppenheimer analyst Andreas Argyrides sees great potential in Rani’s pipeline, noting that it could open the door to the global biologics market, which was valued at $516 billion in 2022 and is projected to reach $856 billion by 2031. Argyrides estimates that Rani’s pipeline could generate $1.1 billion in total product revenue.

“We consider Rani Therapeutics a compelling investment opportunity based on its innovative RaniPill… The RaniPill’s ability to achieve bioavailability comparable to or better than subcutaneous injections while eliminating the discomfort and inconvenience associated with needle-based delivery positions it as a potential game-changer in the biologics market across multiple indications,” Argyrides opined.

Discussing both the stock and the clinical pipeline, the analyst adds, “While shares have been under pressure so far this year due to a lack of catalysts, we see an opportunity for the stock to recover with the initiation of a Ph2 study with RT-102 in osteoporosis in Europe this year followed by an IND in the US. Positive Phase 1 results from RT-111 in psoriasis and from ProGen’s PG-102 hint at the potential to address significant unmet needs across various therapeutic areas, including metabolic and inflammatory diseases. With strong IP covering the RaniPill, RaniPill HC and the delivery of various biologics and large molecules using the platform, we see Rani as a pioneer in the oral biologics space and we recommend buying shares at current discounted levels.”

Backing this positive outlook, Argyrides gives RANI a Buy rating, with a $17 price target, implying a robust one-year upside potential of ~740%. (To watch Ahmad’s track record, click here)

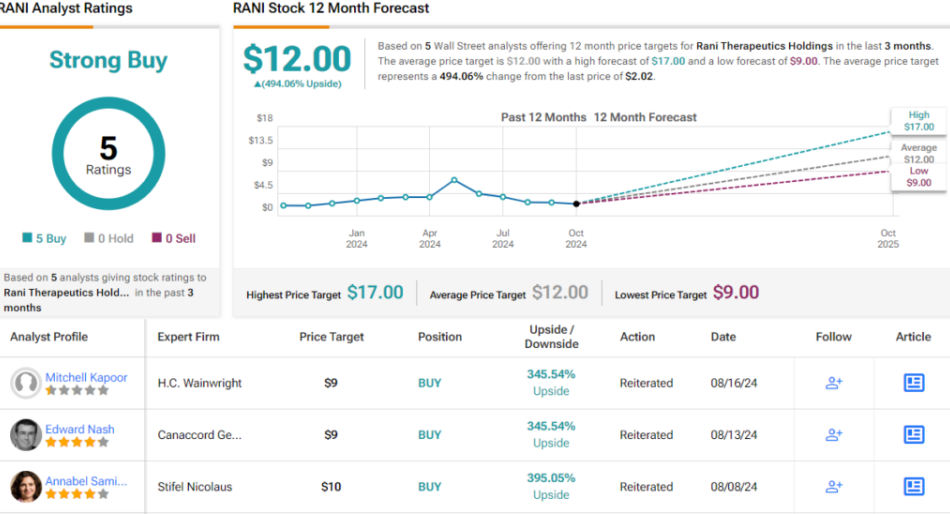

Overall, RANI has picked up 5 recent positive analyst reviews, for a unanimous Strong Buy consensus rating. The shares are trading in the penny-stock range, at $2.02, and the $12 average price target implies a one-year upside potential of 494%. (See RANI stock forecast)

Ultra Clean Holdings (UCTT)

The next Oppenheimer pick we’re looking at is Ultra Clean Holdings, a tech firm that provides tools and services to the semiconductor chip industry. Ultra Clean develops the critical subsystems, components, parts, and high-purity cleaning services necessary to turn silicon wafers into microchips.

The company operates through two divisions – Products, which focuses on giving solutions for subassemblies, improved design-to-delivery cycles, prototyping, and high-precision manufacturing; and Services, which offers tool chamber parts cleaning and coating, as well as micro-contamination analysis. While these services are critical for the chip industry, they have also found use in other high-tech assembly niches, such as the petrochemical industry, the pharmaceutical industry, and in the manufacture of LCD displays.

In its 2Q24 earnings report, Ultra Clean posted revenue of $516.1 million, marking a 22% year-over-year growth and exceeding expectations by over $26 million. On the bottom line, the company reported non-GAAP earnings of 32 cents per share, beating forecasts by 6 cents. Looking ahead to its Q3 report, the company has projected revenues in the range of $490 million to $540 million, with a midpoint of $515 million – comfortably above the consensus estimate of $490.5 million.

Oppenheimer analyst Edward Yang highlights that AI compute demand is doubling every six months, while hardware advancements, limited by Moore’s Law, only improve every two years. As a result, Yang foresees a chronic shortage of advanced semiconductors and the tools required to produce them. He considers UCT a ‘picks-and-shovels’ investment that addresses this growing supply challenge.

Yang outlines several factors that could lead the company to surpass expectations, stating, “UCT is: 1) highly leveraged to the semiconductor upcycle and could exceed estimates if wafer fab equipment (WFE) recovers as expected; 2) well positioned in AI growth areas, including nascent, but booming franchises in high-bandwidth memory (HBM), advanced packaging, and vacuum based EUV tools, all with leading Western OEMs; and 3) uniquely hedged against the US/China ‘Chips War’ with a strong local presence supplying rising Chinese equipment makers. Currently, UCT is well on its way to reclaiming its prior peak levels, but remains down 20% in quarterly revenue and gross margin, with operating margin and stock price halved, making it a coiled spring poised for upward movement.”

To this end, Yang rates UCTT shares as Outperform (i.e. Buy) with a price target of $70, indicating a potential 76% upside within the next year. (To watch Yang’s track record, click here)

Overall, there are 3 recent analyst reviews of UCTT shares on record, and they are unanimously positive – for a Strong Buy consensus rating. The stock’s $39.68 trading price and $65 average target price together imply a one-year gain of ~64%. (See UCTT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

2 Stocks That Could Create Lasting Generational Wealth

Numerous investors, even those with a mindset to build for retirement, may not think in terms of “generational wealth.” This is somewhat understandable, as presumably one wants to live long enough to enjoy the fruits of their saving and investing.

Still, many also want to establish a legacy that will benefit their descendants once they are gone. Finding stocks to meet these criteria can become complicated, especially when considering that one-time consumer stalwarts such as Sears and Kodak went from market leadership to nearly not existing at all.

Thus, choosing such stocks is not an easy task. Nonetheless, here are two stocks that hold the potential to not only stand the test of time, but also generate the growth needed to build wealth for oneself and for subsequent generations.

1. Realty Income

Although no business is foolproof, it would probably take appallingly unwise decisions to undermine Realty Income (NYSE: O). The real estate investment trust (REIT) owns nearly 15,500 single-tenant commercial properties in seven different countries.

High-profile clients such as Walmart, Dollar General, Planet Fitness, and numerous others depend on Realty Income properties to interact with and serve customers. These properties are also structured as net leases, meaning the tenant pays for the property tax, insurance, and maintenance, which creates a stable income stream for Realty Income.

As a REIT, Realty Income is also a dividend stock. However, its payout stands out because shareholders receive a dividend every month. Additionally, its dividend has risen at least once per year since its inception in 1994. At $3.16 per share annually, the company pays a dividend yield of 5.1%, more than quadruple the S&P 500 index average of 1.25%.

Investors should also note that the company has continued to grow that dividend and the size of its property portfolio even in the rising interest rate environment of the last few years. Thus, despite its challenges, the funds from operations (FFO) income available to shareholders, a measure of the REIT’s free cash flow, reached $1.7 billion in the first half of 2024. That was a 25% increase compared to 12 months ago.

The stock trades at about 25% below its peak before the pandemic. It also sells for about 16 times its FFO income, an inexpensive valuation considering its continuing growth.

Now that the Federal Reserve has finally cut interest rates, this could be an excellent time to start building that wealth as more investors take a renewed interest in the stock.

2. MercadoLibre

As a company that serves Latin America only, MercadoLibre (NASDAQ: MELI) may not be a household name to U.S. investors. Additionally, Latin American countries sometimes face political turmoil, high inflation, and complex regulatory environments. Admittedly, such conditions are not typically drivers of generational wealth.

However, MercadoLibre is worth such consideration because it has thrived amid these regional challenges. When customers could not use its online platform because they operated exclusively with cash, it created Mercado Pago, which provided financial products enabling these customers to shop online.

Moreover, fulfillment and shipping often became an issue. Thus, it created Mercado Envios to provide these services. The company also introduced same-day and next-day shipping to areas where it did not previously exist.

Both Mercado Pago and Mercado Envios also went on to serve customers separate from the MercadoLibre platform, further expanding their reach. Additionally, this infrastructure also gives the company a competitive advantage over competitors that entered its markets, such as Amazon and Sea Limited.

MercadoLibre’s approach is so successful that revenue for the first half of 2024 was $5.1 billion, rising 42% from the same year-ago period. Also, the company reduced foreign currency losses and income tax, resulting in a net income for that time frame of $531 million, up from $262 million last year.

Furthermore, the stock recently surged past its peak during the pandemic. Given that rapid growth, it is likely investors will overlook a relatively elevated 73 P/E ratio. As MercadoLibre continues to attract more customers and capitalize on the synergies of its businesses, it will probably drive higher returns for years, and, likely, decades to come.

Should you invest $1,000 in MercadoLibre right now?

Before you buy stock in MercadoLibre, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and MercadoLibre wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Will Healy has positions in MercadoLibre and Sea Limited. The Motley Fool has positions in and recommends Amazon, MercadoLibre, Planet Fitness, Realty Income, Sea Limited, and Walmart. The Motley Fool has a disclosure policy.

2 Stocks That Could Create Lasting Generational Wealth was originally published by The Motley Fool

Is Donald Trump or Kamala Harris Better for Stocks? Statistically, One Party Has Overseen a Considerably Higher Average Annual Return Over the Last Century.

In a little over three weeks, voters from across the country will head to the polls to determine the direction of our great country over the coming four years.

Although not every action taken by the incoming president and Congress will have a bearing on Wall Street, the fiscal policy proposals ultimately put into place by the incoming administration will impact corporate America and the stock market.

Over the last two presidential terms, investors have done quite well. During Donald Trump’s four years in the Oval Office, the ageless Dow Jones Industrial Average (DJINDICES: ^DJI), broad-based S&P 500 (SNPINDEX: ^GSPC), and innovation-inspired Nasdaq Composite (NASDAQINDEX: ^IXIC), respectively, gained 56%, 67%, and 138%!

Meanwhile, the Dow Jones, S&P 500, and Nasdaq Composite rallied 36%, 50%, and 36%, respectively, during President Joe Biden’s term, as of the closing bell on Oct. 10, 2024.

But with President Biden set to leave office in a little over three months, the million-dollar question becomes: Which candidate is better for stocks, Donald Trump or Kamala Harris?

Though history shows both parties are beneficial to equities, one party has overseen a notably higher average annual return for stocks over the last century.

Trump or Harris will inherit a historically pricey stock market

Before digging into party-dependent historical return data, it’s important to recognize the challenge that awaits the next president. Despite nearing the second anniversary of the current bull market, America’s next president will be inheriting one of the priciest stock markets on record.

While there are a lot of ways to measure value, the S&P 500’s Shiller price-to-earnings (P/E) ratio — also known as the cyclically adjusted price-to-earnings ratio (CAPE ratio) — does a particularly good job of conveying just how pricey equities are at the moment.

Unlike the traditional P/E ratio, which can be easily skewed by shock events, the Shiller P/E takes into account average inflation-adjusted earnings over the previous 10 years. Looking back a full decade minimizes the impact of shock events and allows for apples-to-apples valuation comparisons.

As of the closing bell on Oct. 10, the S&P 500’s Shiller P/E was north of 37, representing the third-highest reading during a continuous bull market when back-tested to January 1871.

What’s more, in 153 years, there have only been six occurrences when the S&P 500’s Shiller P/E ratio has surpassed 30 during a bull market, including the present. Following the five previous instances, the Dow, S&P 500, and/or Nasdaq Composite lost between 20% and 89% of their value. In this respect, history is working against the candidate who wins in November.

There are other potential concerns, as well, beyond just the stock market being exceptionally pricey.

For example, we’ve borne witness to the longest yield-curve inversion in history. Normally, the Treasury yield curve slopes up and to the right, with bonds set to mature in 10 or 30 years sporting higher yields than bills maturing in a year or less. But when the yield curve inverts and short-term bills bear higher yields than long-term Treasury bonds, it’s often a sign that economic turbulence is coming.

Additionally, the U.S. M2 money supply had its first notable year-over-year decline since the Great Depression in 2023. There have been only five instances when the M2 money supply has contracted by at least 2% on a year-over-year basis, including 2023, and the four prior occurrences all correlated with U.S. depressions and a double-digit unemployment rate.

Suffice it to say, neither candidate will be stepping into an ideal scenario come inauguration day.

Here’s what history says regarding which candidate is better for stocks

With these challenges in mind, let’s turn back to the question at hand: Is Donald Trump or Kamala Harris better for stocks?

Putting aside their policy proposals and how they might alter the landscape for corporate America, history shows a number of positive scenarios for investors, with one party notably outperforming the other.

Over the last 71 years, there have been 13 presidents (seven Republicans and six Democrats). Only two of these presidents (George W. Bush and Richard Nixon, both Republicans) oversaw a negative compound annual growth rate (CAGR) in the benchmark S&P 500 while in office. The average S&P 500 CAGR of the last seven Republican presidents is 6.2%, notably lower than the 9.6% mean S&P 500 CAGR for Democratic presidents.

This historic outperformance for Democratic Party presidents extends back roughly a century.

Based on data analyzed from 1926 through 2023 by Retirement Researcher, the average annual return for the S&P 500 under a unified (i.e., one party controlling both houses of Congress) or divided Congress is as follows:

-

Unified Republican: 14.52% average annual return over 13 years

-

Unified Democrat: 14.01% average annual return over 36 years

-

Divided with Republican president: 7.33% average annual return over 34 years

-

Divided with Democratic president: 16.63% average annual return over 15 years

Using this data, we can see that Republican presidents have overseen a very respectable 9.32% average annual return in the S&P 500 since 1926. However, Democratic presidents have enjoyed a considerably more robust average annual return of 14.78% in the S&P 500 during 51 years in the Oval Office.

Based purely on historical data and nothing else (note the italics!), a Kamala Harris victory in November would seem ideal for Wall Street.

Nevertheless, patience and perspective are far more important in determining investment returns than which party controls the Oval Office.

Historically speaking, time, and not any particular political party, is the greatest ally for investors. With periods of economic expansion lasting considerably longer than recessions, investors who wager on the U.S. economy to expand over long periods are set up for success.

What’s more, an extensive study updated earlier this year by Crestmont Research examined the rolling 20-year total returns, including dividends, of the S&P 500 dating back to the start of the 20th century. Even though the S&P didn’t exist until 1923, researchers were able to track the total return of its components from other indexes to 1900. This research yielded 105 rolling 20-year periods (1919-2023).

Crestmont found that all 105 rolling 20-year periods produced positive total returns. Put another way, if an investor had, hypothetically, purchased an S&P 500 index fund at any point since 1900 and held that position for 20 years, they made money, without fail, every time.

Despite the uncertainty that can accompany elections, investors who can exercise patience and perspective are perfectly positioned to thrive whether Donald Trump or Kamala Harris wins in November.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 799% — a market-crushing outperformance compared to 170% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now…

*Stock Advisor returns as of October 7, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Is Donald Trump or Kamala Harris Better for Stocks? Statistically, One Party Has Overseen a Considerably Higher Average Annual Return Over the Last Century. was originally published by The Motley Fool

German SPD lays out campaign for industry growth, job protection, tax breaks

FRANKFURT (Reuters) – Germany’s Social Democrats (SPD), led by Chancellor Olaf Scholz, presented on Sunday an agenda for tax breaks and investment support in a bid to preserve jobs in industry and appeal to voters in general elections due in September 2025.

“Investors in Germany will be getting tax breaks,” said the strategy paper, a copy of which was obtained by Reuters.

The paper laid out proposals to change course against a damaging recession, as Germany struggles with rising unemployment, high energy costs and competition from China and the United States in export markets.

The presidium of the left-wing party that in 2021 forged a three-way coalition with the Greens and pro-business Free Democrats approved the proposals, which also envisage giving income tax breaks to 95% of taxpayers, on Saturday.

It also says minimum wages should be gradually raised to 15 euros from 12.41 euros. There were no financial details of how these plans would be funded.

The Bild am Sonntag (BamS) Sunday paper was first to report the plans.

All parties are preparing for the elections scheduled for September 2025, though the vote could be held earlier if the coalition were to break up in coming months over a raft of problems.

The SPD plans include purchase bonuses for locally-made electric vehicles which have seen sluggish sales and face stiff competition from cheaper Chinese-made imports.

The party reiterated calls for a revision of a debt brake to roll back decades of underinvestment in crucial infrastructure and proposes helping manufacturers save on electricity grid fees as part of a package of more competitive industry power prices.

Economy Minister Robert Habeck of the Green Party supports the grid fee move.

The SPD board is due to approve the strategy at a meeting on Sunday afternoon.

(Reporting by Andreas Rinke, writing by Vera Eckert; Editing by Emelia Sithole-Matarise)

Possible Stock Splits in 2025: 2 Unstoppable Growth Stocks Each Up More Than 600% in 8 Years to Buy Now, According to Wall Street

When a company decides to split its stock, it doesn’t change any of the underlying fundamentals or value of the business. Nonetheless, it usually follows significant share-price appreciation, and it signals confidence from management that the future will see the stock continue to rise. As such, many investors flock to stocks when they announce forward stock splits as well as shortly after the splits occur.

This suggests investors may do well to take a look at companies that have the potential to be stock-split candidates. These companies still have plenty of upside left and a stock split could attract a lot more investor attention. Getting in before the stock split could work out nicely, even for long-term investors who are less concerned about timing a stock purchase. Even if these stocks never split their shares again, Wall Street still sees good upside for each.

Both Microsoft (NASDAQ: MSFT) and ASML Holdings (NASDAQ: ASML) have seen their share prices soar more than 600% over the past eight years. That’s the kind of price appreciation that often leads to stock splits, especially since neither stock was starting from a small base. Meanwhile, the average analyst on Wall Street still sees significant upside for both.

1. Microsoft: Up 622% from October 2016

Microsoft made an early bet on generative artificial intelligence (AI) leader OpenAI and sizably increased that bet in early 2023 with an extra $10 billion investment. As a result, Microsoft’s Azure cloud computing platform has become the first stop for developers looking to build on top of large language models like GPT-4o. Not only that, but Microsoft’s integrated generative AI capabilities across its various software platforms, including Github, Dynamics 365, Office 365, and the Power platform.

Its efforts have driven incredible results. Azure revenue climbed 30% in the fourth quarter. What’s more, management expects Azure results to accelerate in the second half of fiscal 2025 as its massive investments in new data center capacity come online.

Microsoft is also seeing strong uptake on its Copilot software, an AI-powered assistant that can help workers accomplish tasks more efficiently and effectively. Copilot customers for Microsoft 365 grew more than 60% sequentially in the fourth quarter. With over 400 million Office 365 users, Microsoft has a long runway for continued growth. Not to mention, the number of users continues to grow, as Microsoft dominates the workplace productivity software space.

The average price target among Wall Street analysts is $496, which implies about 19% upside for the tech giant’s stock. At its current price, shares trade around 32 times forward earnings estimates. Considering the growth drivers pushing Microsoft’s operating results and its competitive position, that high multiple is well worth paying for investors looking at growth stocks. Even at its massive size, Microsoft is growing quickly.

While shares have backed off of their all-time high price, they still trade well above $400. A split at this price is a reasonable maneuver for the third-highest-priced Dow component.

2. ASML Holdings: Up 694% from October 2016

ASML has also been a beneficiary of the booming demand for artificial intelligence. Its extreme ultraviolet (EUV) lithography machines are essential hardware for printing the most advanced semiconductors in the market. ASML is the only company supplying those machines.

As companies like Microsoft and other hyper scalers build out massive data centers full of silicon, ASML stands to see the benefits over the long run. It’s important to note that chip manufacturers, known as foundries, can’t just expand their operations overnight. There are long lead times for ASML’s massive machines: Not only do they need to take delivery and install them, they also need the space in the first place.

As such, ASML’s management has called 2024 a transition year. It expects flat revenue and gross margin contraction as it ramps up production of its newest machinery for delivery in 2025. But 2025 should be a big year for the company. It expects 30 billion to 40 billion euros ($33.2 billion to $44.2 billion) in revenue, an increase of 27% from 2023 at its midpoint.

In the long term, ASML should see strong growth from unit sales and even better growth from ongoing servicing of its existing install base. In 2022, management forecast 44 billion euros to 60 billion euros ($48.1 billion to $65.6 billion) by 2030 with gross margin expanding to as much as 60% from about 51.5% today. Considering those forecasts preceded the boom in demand for AI chips, investors should expect revenue closer to the high end of that forecast.

The average price target among Wall Street analysts is $1,127, which implies about 33% upside for the stock. With shares trading at about 26 times 2025 earnings estimates, the shares look inexpensive relative to their earnings growth over the next few years. With strong forthcoming sales and expanding margins, analysts expect earnings growth above 20% for the next five years. That makes the stock extremely attractive at this price.

ASML shares are well off their all-time high, but shares trade around $850 each. That’s plenty high enough to justify a stock split, but as shares climb above $1,000 and remain there, it could push the company to split its stock and bring the price back down to the triple-digit territory.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,266!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,047!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,794!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Adam Levy has positions in Microsoft. The Motley Fool has positions in and recommends ASML and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Possible Stock Splits in 2025: 2 Unstoppable Growth Stocks Each Up More Than 600% in 8 Years to Buy Now, According to Wall Street was originally published by The Motley Fool

Stocks Are Steady as Traders Assess China Stimulus: Markets Wrap

(Bloomberg) — European stocks and US futures were little changed as investors weighed the impact of fresh Chinese stimulus and looked ahead to major earnings this week.

Most Read from Bloomberg

Europe’s Stoxx 600 and S&P 500 futures struggled to advance following volatile trading in China, which reflected skepticism among some traders about Beijing’s latest efforts to jumpstart growth. The euro edged lower as investors anticipated an interest rate cut from the European Central Bank on Thursday.

China’s Finance Minister Lan Fo’an vowed more support for the real estate sector at a weekend briefing, but stopped short of producing a headline monetary stimulus figure. Investor attention turns next to results from big US banks, with Citigroup Inc., Goldman Sachs Group Inc. and Bank of America Corp. reporting Tuesday.

“Sentiment is back to being hopeful, but will also get into a seeing-is-believing mode to await actual numbers and more details on consumption and property measures, which were lacking,” said Xin-Yao Ng, an investment director at abrdn Asia Ltd.

In Europe, the ECB will probably advance the global push for monetary easing with an interest-rate cut that policymakers had all but ruled out just a month ago.

Concerns about French finances and German malaise had the euro on the back foot on Monday, while French bond futures were little changed. The region’s biggest economy is suffering a mild recession and output across the whole of 2024 will be flat, according to a Bloomberg survey.

“Clearly, softer activity data and faster disinflation have had an immediate impact on both ECB communication and markets, which are now pricing a 95% probability of a 25-basis point cut this week,” Barclays Plc strategists including Themistoklis Fiotakis wrote in a note to clients. “We view risks to European macro and interest rates as skewed to the downside, which creates scope for further euro weakness, particularly on crosses.”

Cash Treasuries trading is closed Monday for a US holiday.

China’s main CSI 300 Index rose as much as 2.4% after swinging between gains and losses earlier. It capped its worst week since late July on Friday. A Bloomberg Intelligence gauge of Chinese developers rose more than 3%. Investors and analysts surveyed by Bloomberg had expected China to deploy as much as 2 trillion yuan ($283 billion) in fresh fiscal stimulus on Saturday.

“There’s going to be consolidation and pullback,” Wendy Liu, chief Asia and China equity strategist at JPMorgan Chase & Co., told Bloomberg TV. “Structurally, it looks fine. Short-term, it’s not as satisfying.”

Key events this week:

-

China trade balance, Monday

-

India CPI, Monday

-

UK unemployment rate and average weekly earnings, Tuesday

-

Eurozone industrial production, Tuesday

-

Canada CPI, Tuesday

-

Goldman Sachs, Bank of America, Citigroup earnings, Tuesday

-

Republican presidential candidate Donald Trump will be interviewed by Bloomberg editor-in-chief John Micklethwait at the Economic Club of Chicago, Tuesday

-

New Zealand CPI, Wednesday

-

Thailand, Philippines and Indonesia central bank interest-rate decisions, Wednesday

-

UK CPI, PPI, RPI and house price index, Wednesday

-

ASML, Morgan Stanley earnings, Wednesday

-

Australia unemployment, Thursday

-

Eurozone CPI, ECB rate decision, Thursday

-

US retail sales, jobless claims, industrial production, business inventories, Thursday

-

TSMC, Netflix earnings, Thursday

-

Japan CPI, Friday

-

China GDP, retail sales, industrial production, home prices, Friday

-

UK retail sales, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 was little changed as of 8:14 a.m. London time

-

S&P 500 futures were little changed

-

Nasdaq 100 futures were little changed

-

Futures on the Dow Jones Industrial Average were little changed

-

The MSCI Asia Pacific Index was little changed

-

The MSCI Emerging Markets Index was little changed

Currencies

-

The Bloomberg Dollar Spot Index rose 0.1%

-

The euro was little changed at $1.0927

-

The Japanese yen fell 0.1% to 149.30 per dollar

-

The offshore yuan fell 0.2% to 7.0842 per dollar

-

The British pound was little changed at $1.3064

Cryptocurrencies

-

Bitcoin rose 2.1% to $64,090.77

-

Ether rose 2.5% to $2,521.05

Bonds

-

The yield on 10-year Treasuries was little changed at 4.10%

-

Germany’s 10-year yield was little changed at 2.26%

-

Britain’s 10-year yield advanced one basis point to 4.22%

Commodities

-

Brent crude fell 1.4% to $77.95 a barrel

-

Spot gold rose 0.2% to $2,662.72 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Matthew Burgess, Zhu Lin and James Hirai.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Brandes Fund Rivals US Tech Gains With Europe’s Cheaper Stocks

(Bloomberg) — One of Europe’s best-performing equity funds has matched the steep gains of US tech without betting on the likes of Nvidia Corp. or Apple Inc. — instead by buying some of the region’s most undervalued stocks.

Most Read from Bloomberg

Brandes Investment Funds Plc’s European Value Fund, which has about €678 million ($742 million) in assets and counts Heineken Holding NV, Sanofi SA and UBS Group AG among its top holdings, has beaten 99% of its peers over the past five years, according to data compiled by Bloomberg.

The winning formula, co-fund manager Jeffrey Germain says, is buying stocks that are trading well below long-term valuations, either due to specific issues with the business or because of a weak economic cycle.

“We’re looking for businesses that are out of favor, where we think the long-term value is above where they’re trading,” Germain said in an interview. “We’re not trying to play the momentum aspects of the market or guess where earnings are going to be next quarter.”

His fund has surged 173% since hitting a pandemic-driven low in March 2020, according to data compiled by Bloomberg. The Nasdaq 100 has rallied 189% over that time.

One example of a big bet that paid off has been UK engine maker Rolls-Royce Holdings Plc.

The company struggled to recover from Covid-related supply chain issues, before a transformation program led by a new chief executive officer fueled a more than 450% recovery in the shares since the end of 2022. Germain’s fund first bought the stock that year, when it was trading near a 20-year low.

“The business itself had been going through a number of idiosyncratic issues,” he said, referring to Rolls-Royce. “But we thought the risks were not outweighing the opportunity.”

Rolls-Royce declined to comment on its share price rise.

No Big Tech

At a time when artificial intelligence and Big Tech has been all the rage in financial markets, it’s been rare for a European fund to outperform without much tech exposure. The benchmark Stoxx Europe 600 Index has trailed the S&P 500 Index in eight of the past 10 years, according to data compiled by Bloomberg.

Information technology accounted for about 3.7% of the Brandes fund’s total holdings as of end-August, considerably lower than the benchmark MSCI Europe Index, according to its fact-sheet. Consumer staples and financials had the highest exposure — both sectors with below-average price-to-earnings valuations.

While several market strategists have recently voiced concerns about an impact on banks’ net interest margins as rates fall, Germain said his longer-term conviction in the sector remains intact. “The multiple being applied to banks still looks too low and we do like the holdings in the portfolio.”

Luxury goods are another area of focus. Stocks including Cartier owner Richemont SA, Gucci parent Kering SA and Swatch Group AG have felt the impact of weaker demand in key market China. All three are held by Brandes, and Germain said he had increased allocation to the sector more broadly — although the fund currently doesn’t hold LVMH because of high valuations.

One sector still out of favor is autos — Europe’s cheapest sub-index.

Most major European carmakers have issued profit warnings over the past quarter as the industry struggles with sluggish demand, including in China — from where firms also face competition on electric vehicles. Both are reasons for Brandes to stay away.

“You’re in a cycle that is negative, which creates fertile ground for us, but it’s not clear who the winners of EV transitions are going to be,” Germain said.

–With assistance from Siddharth Philip.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

The Centurion Condominium New York has opened the first Analytic Gym in the United States

NEW YORK, Oct. 13, 2024 /PRNewswire/ — New Yorkers are known for their focus on health, making a fitness facility one of the most important amenities in Manhattan’s luxury buildings. The Centurion Condominium, located in Midtown New York near Central Park, and designed by legendary architect I.M. Pei, was due for a renovation of its gym. Instead of just updating the equipment and giving the space a fresh coat of paint, the board of the Centurion aimed to provide its residents with a world-class facility within just 1,400 square feet.

After months of planning and design in collaboration with Technogym, the company that supplied training equipment for the 2024 Olympic Games, a completely new type of residential gym was created, redefining residential fitness.

“The goal was to make our fitness facility the catalyst for a lifestyle transformation,” says board member and real estate broker Thomas Guss, who led the project. “We wanted our fitness facility to be more than just a place to work out. It’s about empowering our residents to measure and enhance their performance in the privacy of their building,” Guss explains.

The centerpiece of the new gym is the Technogym CheckUp, the first of its kind in the United States. It measures body composition, strength, balance, mobility, and cognitive abilities, processes the results using artificial intelligence models, and creates a personalized training protocol based on real data, which is then presented to the building’s residents on their smartphones.

The cardio section includes training options for running, biking, stepping, rowing, and skiing. The strength machines automatically adjust to the user, ensuring maximum neuromuscular activation as well as correct exercise settings. A stretching station helps residents to reduce muscular tension and avoid back pain, and free weights and other training materials allow for a wide range of additional workouts.

The interior design of the gym emphasizes natural woods, special lighting to enhance mood and energy, artwork by Alex Katz, and a triple-stage air filtration system to ensure cleaner air than in an operating room.

The Centurion’s residents love it, not only as a free amenity in the building they call home but as an important component of their lives. Others take notice – several developers have approached the Centurion team to help them redesign their own gyms. The building even noted a surge in interest in buying and renting at the Centurion, including a penthouse currently on the market at $9,8 million, demonstrating how a thoughtfully designed amenity can further elevate an entire building’s appeal.

Press Contact:

New York Residence Inc.

www.NYR.com

+1 212.360.7000 ext. 103

tg@NYR.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/the-centurion-condominium-new-york-has-opened-the-first-analytic-gym-in-the-united-states-302274582.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/the-centurion-condominium-new-york-has-opened-the-first-analytic-gym-in-the-united-states-302274582.html

SOURCE NYR.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 Vanguard ETF to Buy Now, 1 to Avoid

One of the best innovations in investing has been the exchange-traded fund (ETF), an investment vehicle that lets anyone easily buy shares of a fund that holds a group of related stocks, often in an index.

Vanguard founder Jack Bogle is credited with creating one of the first index funds, a mutual fund that paved the way for the popular Vanguard 500 Fund, which tracks the S&P 500.

Today, Vanguard remains one of the most popular ETF managers and it offers investors dozens to choose from. Let’s take a look at one worth investing in and one to avoid right now.

One Vanguard ETF to buy now

The Vanguard ETF worth buying right now is the Vanguard Financials ETF (NYSEMKT: VFH), which tracks the MSCI US benchmark of large, mid-, and small-cap stocks in the financial sector.

Few ETFs are as cheap as the Vanguard Financials ETF today. The fund trades at a price-to-earnings (P/E) ratio of 16.6 right now, compared to 29 for the Vanguard 500 ETF, meaning the S&P 500 is about 60% more expensive right now.

Bank stocks tend to carry a low valuation even in a bull market because their growth is closely tied to the economy, and they’re cyclical, meaning they’re highly vulnerable to economic slowdowns or recessions.

Falling interest rates can create a headwind for banks because they tend to squeeze net interest margins, or the difference between interest earned on loans and other assets and the interest paid on deposits. But overall, lower rates should be a net positive because it encourages borrowing and economic growth, reigniting the investment banking market for initial public offerings and merger and acquisition deals. Meanwhile, a strengthening economy and falling rates will also lower the risk of credit losses, helping to boost profits.

The Vanguard Financials ETF is also much more than bank stocks. Its top 10 holdings include Warren Buffett’s Berkshire Hathaway, Visa, Mastercard, S&P Global, American Express, and Progressive.

The Federal Reserve looks on track to achieve the soft landing it’s been aiming for, meaning the economy could be set up for strong, steady growth over the next few years. That should favor financial stocks both as businesses and as perceived by investors, supporting multiple expansions. Meanwhile, falling rates could lead to a jump in demand for mortgages, auto loans, and other consumer financial products.

One Vanguard ETF to avoid

The Vanguard Financials ETF looks like a good buy because it trades at a discount to the S&P 500 and should benefit from economic tailwinds.

The Vanguard Consumer Staples ETF (NYSEMKT: VDC), on the other hand, looks expensive, and the economic conditions that have supported the sector are shifting.

Investors tend to favor consumer staples like Coca-Cola and Procter & Gamble in difficult economic times as consumers buy these kinds of products no matter what the economy is doing, effectively making them recession-proof. However, the flip side is that the upside potential is limited during economic expansions.

Currently, the Consumer Staples ETF trades at a price-to-earnings ratio of 25, making it only slightly cheaper than the S&P 500 ETF.

However, unlike the broad-market index, which holds fast-growing companies like Nvidia, the Consumer Staples ETF is made up of slower-growing companies like Procter & Gamble, Costco, and Walmart, which make up its top three holdings.

Those are great companies, but their valuations already look stretched. For example, P&G trades at a P/E ratio of 28; Costco is valued all the way up at 54, and Walmart trades at a P/E of 41.

Based on those valuations, investors are better off waiting for lower entry points for those stocks, which make up such a big component of the Consumer Staples ETF. Meanwhile, the Vanguard Financials ETF is the better choice here.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,266!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,047!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,794!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

American Express is an advertising partner of The Ascent, a Motley Fool company. Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway, Costco Wholesale, Mastercard, Nvidia, Progressive, S&P Global, Vanguard S&P 500 ETF, Visa, and Walmart. The Motley Fool recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

1 Vanguard ETF to Buy Now, 1 to Avoid was originally published by The Motley Fool