Robert Kiyosaki Predicts Stock Market Crash, Says Invest In Gold, Silver, And Bitcoin

Robert Kiyosaki, renowned investor and author, has expressed concerns over a potential stock market crash and highlighted the importance of investing in gold, silver, and Bitcoin BTC/USD.

What Happened: On Saturday, Kiyosaki took to X to share his views on the current state of the market. He noted that the price of gold has reached an all-time high, indicating that investors are becoming more pessimistic and shifting their investments to defensive assets. “So higher gold prices are not necessarily a good sign,” he said in the post.

He further warned of a looming stock market crash, stating, “If a major stock market crash occurs… Which I am expecting… Because the stock market has been high for too many years… This is not good news for people who do NOT own gold, silver, and Bitcoin.”

Also Read: Robert Kiyosaki Rings Alarm Bells Over Soaring US Debt: ‘The Dollar Is Trash’

Why It Matters: Kiyosaki’s comments come at a time when the stock market has been experiencing a prolonged bull run. He emphasized that those who have not invested in the bull market should learn from their inaction.

“When this market crashes…and you have nothing because you did nothing…I would do what smart investors will be doing….Which is to take my time… study…join an investment club….watch for bargains….and start buying assets at low prices…carefully,” he advised.

He concluded his thread by encouraging potential investors to be patient, join investment clubs, avoid greed, identify bargains, and strive to become richer. “The lesson is: ‘smart investors get rich….regardless if markets are going up or down.’”

Read Next

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stock market today: Asian shares gain after China says more help is needed for its slowing economy

BANGKOK (AP) — Asian shares gained ground on Monday, with stocks in China rising more than 2% after the finance minister said over the weekend that more stimulus is needed for the slowing economy.

U.S. futures were little changed and oil prices retreated.

China’s finance minister, Lan Foan, said Saturday that the government was considering additional ways to boost the economy, but he didn’t give details of a major new stimulus plan. Stock investors and analysts have been hoping for a plan of up to 2 trillion yuan, or about $280 billion.

But any expressions of support by officials tend to push share prices higher, and the “national team” of big state-run companies and financial institutions tend to weigh in with stock purchases to help stabilize markets, analysts say.

“The devil, as they say, is always in the details — or in this case, the glaring lack of them. When it comes to Chinese policy briefings, it’s usually all sizzle and no steak,” Stephen Innes of SPI Asset Management said in a commentary. “By mid-week, we’ll see if the market bid has legs, and by month’s end, we’ll know for sure if Beijing is delivering the goods or if it’s just more smoke and mirrors.”

The Shanghai Composite index rose 2.1% to 3,284.32 and the smaller market in Shenzhen gained 3%. Hong Kong’s Hang Seng index lost 0.9% to 21,061.23.

China reported that consumer inflation weakened in September and that wholesale prices fell further, reflecting continued weakness in domestic demand that has spurred the government into a flurry of measures meant to revive falling housing sales and other spending.

Large-scale Chinese military exercises surrounding Taiwan and its outlying islands on Monday appeared to have scant impact on markets.

Taiwan’s Taiex was up 0.3%.

Tokyo’s markets were closed for a public holiday. In South Korea, the Kospi added 1% to 2,623.29, while Australia’s S&P/ASX 200 picked up 0.5% to 8,252.80.

The advance in Asia followed a strong close on Friday on Wall Street as U.S. stocks rose to records, lifted by strong profits at big banks.

The S&P 500 climbed 0.6% to 5,815.03, topping its all-time high set earlier in the week and closing out its fifth straight winning week. The Dow Jones Industrial Average jumped 1% to set its own record, at 42,863.86. The Nasdaq composite lagged the market with a gain of 0.3% after a slide for Tesla kept it in check. It closed at 18,342.94.

Wells Fargo rose 5.6% after reporting stronger profit for the latest quarter than analysts expected. JPMorgan Chase climbed 4.4% after reporting a milder drop in profit than analysts feared. It was the strongest single force pushing upward on the S&P 500.

BlackRock, meanwhile, rose 3.6% after likewise delivering better profit for the latest quarter than analysts expected. The investment giant ended September managing a record $11.5 trillion in total assets for its customers.

The gains for banks helped make up for Tesla’s 8.8% tumble after the electric-vehicle maker unveiled its long-awaited robotaxi on Thursday night. Critics highlighted a lack of details about its planned rollout.

Following the unveiling of the “Cybercab,” potential rival Uber Technologies jumped 10.8% and was one of the strongest forces lifting the S&P 500. Lyft rose 9.6%.

In the bond market, Treasury yields were mixed following the latest updates on inflation at the wholesale level and on sentiment among U.S. consumers.

Prices paid by producers were 1.8% higher in September than a year earlier, improved but not by as much as economists expected.

In other dealings early Monday, U.S. benchmark crude oil lost $1.23 to $74.33 per barrel in electronic trading on the New York Mercantile Exchange.

Brent crude, the international standard, fell $1.26 to $77.78 per barrel.

The dollar rose to 149.30 Japanese yen from 149.08 late Friday. The euro fell to $1.0928 from $1.0935.

Struggling Retailers Brace For Halloween Consumer Spending Slump

The U.S. retail industry is set to face another blow with a predicted drop in Halloween spending, adding to the woes of debt-laden retailers grappling with increased overheads and a consumer shift towards cheaper products.

What Happened: As per a recent report by Bloomberg, the National Retail Federation anticipates a 5% decrease in US Halloween expenditure, amounting to $11.6 billion this year.

The most significant decline is expected in the sales of greeting cards and costumes, which could hit merchants relying on seasonal spending in an already tough year for the retail sector.

Higher unemployment rates and persistent inflation have particularly impacted lower-income households. During a recent earnings call, Michaels Cos. MIK pointed out that households with earnings below $100,000 are tightening their belts, resulting in smaller shopping baskets.

Also Read: Impending Recession? US Consumer Spending Shows Worrying Signs

Several struggling companies, including Michaels and At Home Group Inc. HOME, are under the ownership of private equity managers. These firms are facing difficulties due to poorly timed buyouts during the pandemic, which coincided with surging interest rates and inflation that strained household budgets.

Despite the hurdles, both Michaels and At Home remain hopeful about securing a larger portion of holiday spending. However, the overall spending cutback is posing challenges for the wider industry, leading to a series of high-profile bankruptcies this year.

Why It Matters: The predicted decrease in Halloween spending is a reflection of the ongoing economic challenges faced by US households.

The retail sector, already hit hard by the pandemic, is now grappling with reduced consumer spending due to inflation and high unemployment rates. This scenario is particularly concerning for firms owned by private equity managers, who are already struggling with the repercussions of ill-timed buyouts during the pandemic.

The situation underscores the need for strategic planning and innovative solutions to navigate the current economic landscape.

Read Next

Brighter Outlook: Goldman Sachs Optimistic On U.S. Economy, Cuts Recession Risk Down To 20%

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Could Occidental Petroleum Become the Next ExxonMobil?

Occidental Petroleum (NYSE: OXY), which normally just goes by its ticker Oxy, is a big player in the energy sector. But when you compare it to the industry giants, well, it is still kind of small. However, it is working to expand its diversified portfolio. It looks like it wants to take on the big players, like ExxonMobil (NYSE: XOM). Is that realistic?

What does Oxy do?

Occidental Petroleum is an integrated energy company. That means that it owns assets in the upstream (oil and natural gas production), midstream (pipelines), and downstream (chemicals and refining) segments. This is the same model used by some of the largest energy companies in the world, including U.S. energy giants ExxonMobil and Chevron (NYSE: CVX). Having this diversification across the sector helps to soften the ups and downs in what is a rather volatile industry.

Meanwhile, Occidental Petroleum’s portfolio of assets is spread across the United States, the Middle East, and North Africa. That’s not as diversified as some of its larger brethren, but you have to start somewhere when you are looking to expand internationally. And, at the end of the day, Oxy really does still have an international reach. In some ways, it is like a tiny Exxon or Chevron. Market cap shows just how “small” Oxy is, with its still sizable $50 billion market cap dwarfed by $550 billion Exxon and $270 billion Chevron.

That said, Oxy has shown a great willingness to take on the industry giants. Notably it outbid Chevron to buy Anadarko Petroleum, eventually teaming up with Warren Buffett’s Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) to fund the deal. Unfortunately, Oxy bit off more than it could chew there, and it ended up cutting its dividend when energy prices tumbled in the early days of the coronavirus pandemic. It has since paid down debt and made a more explicit commitment to financial prudence. Debt reduction was a big discussion point in its most recent, and much smaller, acquisition of Crown Rock.

Occidental wants to play with the big kids

So Oxy’s business model is similar to that of giants like Exxon and Chevron. It is buying assets out from under the giants. And when it isn’t stealing deals, it is buying assets similar to those the giants are eyeing. Crown Rock, for example, operates in the U.S. market, where both Exxon and Chevron have been expanding their reach. Oxy basically wants to grow to become one of the energy industry’s top dogs.

There’s probably room for it to do so. The energy industry is in an interesting position today because the world is increasingly using cleaner energy sources, like solar and wind power. But most industry watchers expect oil and natural gas to remain important to the global energy picture for decades to come.

But material growth from this point probably isn’t in the cards, which suggests that energy industry winners are going to be large and efficient operators. That’s basically what Exxon and Chevron are.

Occidental Petroleum is no schlub, either, but there’s clearly room for it to expand its operating scale. Acquisitions in an industry that seems ripe for consolidation should help it do that, which is why it is acting as an industry consolidator. In fact, it probably has more opportunity than its larger peers because smaller deals are more meaningful to its business.

Catching up isn’t necessary

To be fair, it seems unlikely that Oxy will ever catch up to an industry giant like Exxon, noting that Exxon is also growing via acquisition. But that doesn’t diminish the long-term opportunity that an acquisition-focused growth plan can achieve with Oxy. That said, there are risks to consider, noting that the energy giant has overstepped in the past and investors ended up suffering for it (thanks to the subsequent dividend cut).

Conservative investors should probably stick with existing giants like Exxon or Chevron, but if you are a growth-minded investor willing to take on a little extra risk, Oxy might be worth a deep dive as it attempts to compete with the big boys.

Should you invest $1,000 in Occidental Petroleum right now?

Before you buy stock in Occidental Petroleum, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Occidental Petroleum wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway and Chevron. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

Could Occidental Petroleum Become the Next ExxonMobil? was originally published by The Motley Fool

What's the Best "Magnificent Seven" Stock to Buy if Trump Wins in November?

Only once in U.S. history has a former president who lost reelection after his first term managed to become president again. The last time it happened was in 1892 when Grover Cleveland became the first — and, so far, only — president elected for two non-consecutive terms.

But Cleveland might soon have company. Former President Donald Trump is running neck-and-neck with Vice President Kamala Harris in the 2024 presidential race. If elected, his policies could impact the businesses of the so-called “Magnificent Seven” companies: Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), Amazon (NASDAQ: AMZN), Apple (NASDAQ: AAPL), Meta Platforms (NASDAQ: META), Microsoft (NASDAQ: MSFT), Nvidia (NASDAQ: NVDA), and Tesla (NASDAQ: TSLA). What’s the best Magnificent Seven stock to buy if Trump wins in November?

Trump’s proposals that could impact the Magnificent Seven

Three major Trump proposals could impact the Magnificent Seven the most. The GOP presidential nominee’s proposed corporate tax cuts arguably belong at the top of the list.

During his first term, Trump signed legislation that overhauled the federal corporate tax rate structure. Previously, large corporations paid federal taxes of 15% to 35%. After the Trump tax cuts, these businesses paid a flat tax of 21%. The former president wants to slash this rate to 15% if he’s elected again.

Another key part of Trump’s economic policy for a potential second term is the implementation of across-the-board tariffs. He promises to impose tariffs of up to 20% on all imported products. Trump, who has referred to himself as “Tariff Man,” wants to impose tariffs of 60% on goods imported from China. He has also threatened to enact tariffs of 100% on products made in Mexico.

When Trump was president before, he was a fan of deregulation. Reducing federal regulations is likely to be a major focus again if he returns to the White House. Trump wants to eliminate 10 existing regulations for every new regulation. One promise that’s especially relevant to the Magnificent Seven is his pledge to repeal an executive order signed by President Biden that regulates artificial intelligence (AI).

How the Magnificent Seven could be affected

Paying less in federal taxes should be good for all the Magnificent Seven. However, the impact of Trump’s proposed corporate tax cuts perhaps won’t be as great as it might seem. As the following table shows, none of these giant companies pay the 21% federal tax rate in place now.

|

Company |

Effective Tax Rate in the Last Fiscal Year |

|---|---|

|

Alphabet |

13.9% |

|

Amazon |

9.7% |

|

Apple |

14.7% |

|

Meta Platforms |

17.6% |

|

Microsoft |

18.0% |

|

Nvidia |

12.0% |

|

Tesla |

(50% Tax Benefit) |

Data sources: Company 10-K filings. *Tesla received more tax benefits than it paid in taxes in 2023.

Steeper tariffs could especially impact the Magnificent Seven companies that rely on imported products and components. Although the companies would probably pass the increased costs along to consumers, the higher prices could negatively impact sales.

Apple would likely be the hardest hit by tariffs because of its global supply chain. All the others could also feel some effects of higher tariffs. The Magnificent Seven members that generate more revenue from services, particularly Alphabet and Meta, would probably be the least impacted by Trump’s proposed tariffs.

What about Trump’s deregulation focus? I think the major cloud service providers — Amazon, Microsoft, and Alphabet — could be helped by reduced AI regulations. So would Nvidia and, perhaps to a lesser extent, Meta and Tesla.

However, Trump has specifically criticized Alphabet, telling Fox Business host Maria Bartiromo in a recent interview, “Google has been very bad. They’ve been very irresponsible. And I have a feeling that Google’s going to be close to shut down, because I don’t think Congress is going to take it.” The former president has also called Meta’s Facebook “a true enemy of the people” in a social media post.

And while Tesla CEO Elon Musk supports Trump for president, Trump’s proposed policies could hurt Tesla. The GOP presidential nominee has railed against federal incentives for electric vehicles in the past. On the other hand, he told an audience at one of his rallies, “I’m for electric cars. I have to be because Elon endorsed me very strongly.”

The best Magnificent Seven stock to buy if Trump wins

So, what’s the best Magnificent Seven stock to buy if Trump wins in November? I think it’s a close contest between Microsoft and Nvidia.

Microsoft might be helped more by Trump’s proposed corporate tax cuts because it pays the highest effective tax rate of the Magnificent Seven companies. Both Microsoft and Nvidia could be hurt to some extent by the former president’s tariffs but helped by his regulatory stance. Neither has been singled out for attacks by Trump as Alphabet and Meta have nor have the industries in which they operate been the target of his ire like Tesla.

I believe Nvidia has stronger growth prospects than Microsoft, though. If I had to pick just one Magnificent Seven stock to buy if Trump returns to the White House, I would buy Nvidia.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keith Speights has positions in Alphabet, Amazon, Apple, Meta Platforms, and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

What’s the Best “Magnificent Seven” Stock to Buy if Trump Wins in November? was originally published by The Motley Fool

China Puts Investor Patience to Test as Key Briefing Underwhelms

(Bloomberg) — China’s highly anticipated Finance Ministry briefing on Saturday lacked the firepower that equity investors had hoped for, indicating that the volatility that’s gripped the market following a world-beating rally will likely extend.

Most Read from Bloomberg

While Finance Minister Lan Fo’an promised more support for the struggling property sector and hinted at greater government borrowing to shore up the economy, the briefing didn’t produce a headline dollar figure for fresh fiscal stimulus that the markets had sought. A lack of new incentives to boost consumption, which has been a weak link in the economy, is another reason why traders may feel disappointed.

The ministry “tried its best,” but there is a large gap between what was announced and what the market was expecting, said Shen Meng, a director at Beijing-based boutique investment bank Chanson & Co. “So the overall sentiment for investors is negative.”

Patience has been wearing thin among investors, who have clamored for Beijing to announce big-bang fiscal measures to help sustain the rally sparked by the stimulus blitz that authorities unleashed in late September. The CSI 300 Index, a benchmark of onshore equities, capped its biggest weekly loss since late July on Friday, with volatility rising ahead of the MOF briefing.

The Australian and New Zealand dollars, proxies for China sentiment among developed market currencies, both slipped 0.2% in early trading Monday.

A further unwinding of the rally risks fueling concern that equities are heading for yet another false dawn, which may bring more selling pressure. The market has been caught in a start-stop cycle of gains and losses a few times before as Beijing’s piecemeal approach to stimulus produced only brief rebounds.

Local governments will be allowed to issue special bonds to buy unsold homes and turn them into subsidized housing, Lan and his deputies said on Saturday, while refraining from putting a price tag on any additional stimulus. Lan also hinted at room for issuing more sovereign bonds and greater government spending, steps that could be announced later this month or early November.

Prior to the weekend, investors and analysts surveyed by Bloomberg had expected China to deploy as much as 2 trillion yuan ($283 billion) in fresh fiscal stimulus on Saturday, including potential subsidies, consumption vouchers and financial support for families with children.

“The room for further fiscal stimulus is still on the table,” said Britney Lam, head of long-short equities for Magellan Investments Holdings Ltd. In the meantime, “markets will likely see further profit taking,” she said.

Inflation data released on Sunday is likely to add to investor concerns. It showed that China’s consumer prices rose less than forecast in September, while factory-gate charges fell for a 24th straight month, underscoring the need for further policy support to help the economy break out of deflation.

The CSI 300 Index slid 3.3% last week, but it’s still up 21% from its close on Sept. 23, the day before China’s central bank announced a broad package of measures that included an interest-rate cut and liquidity support for the equity market. In Hong Kong, the Hang Seng China Enterprises Index lost 6.6% last week after surging more than 30% in the previous three weeks.

While the epic rebound in Chinese shares has spurred the likes of Goldman Sachs Group Inc. and BlackRock Inc. to upgrade the market, it has also drawn skepticism from others such as Invesco Ltd. and Morgan Stanley who say stocks have already run too far too fast.

“I’m still a little bit disappointed,” said Kenny Wen, head of investment strategy at KGI Asia Ltd. While the finance minister announced some specific measures, the ‘timing and amount’ were still missing.

What’s Next?

Investors will soon turn attention to the next major policy briefing in the coming weeks — from the Communist Party-controlled parliament that oversees the budget — for details of more stimulus. At its October meeting last year, the Standing Committee of the National People’s Congress approved additional sovereign debt and raised the budget-deficit ratio.

China’s sovereign bonds were little changed on the measures announced on Saturday. By noon on the day, the 10-year yield had erased an earlier drop of as much as two basis points, according to traders, who asked not to be identified as they are not allowed to comment publicly on the rates market.

A strengthened fiscal push would likely weigh on China’s bonds by encouraging traders to move funds into riskier investments with potentially better returns. An increased supply of debt may also sap liquidity in the financial system, making it harder for the market to absorb the entire amount.

The yield curve will probably move lower, given debt issuance this year may come below market consensus, said Zhaopeng Xing, a senior strategist at Australia & New Zealand Banking Group. Going forward, “we expect 1 trillion yuan of ultra-long treasury and 1 trillion yuan of local bonds to be announced,” he added.

–With assistance from Abhishek Vishnoi, Zhu Lin, Wenjin Lv, Shuiyu Jing, April Ma, Matthew Burgess, Michael G. Wilson and Toby Alder.

(Adds AUD, NZD move in fifth paragraph. An earlier version of this story was corrected to fix gender of a strategist and remove an erroneous reference to stocks in their comment.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

1 Top Artificial Intelligence (AI) Semiconductor Stock to Buy Hand Over Fist Before Oct. 17

Artificial intelligence (AI) has played a central role in lifting semiconductor stocks over the past couple of years, which is evident from the tremendous 131% spike in the PHLX Semiconductor Sector index during this period. The good part is that the proliferation of this technology is set to drive stronger growth in this market, as AI adoption moves from data centers to edge devices such as smartphones, personal computers (PCs), and automotive applications, among others.

For instance, the market for chips used in smartphones is expected to jump from $104 billion in 2023 to $146 billion next year. PC semiconductor spending, on the other hand, could jump to $107 billion in 2025 from $89 billion last year, while automotive market chip spending is forecast to jump to $104 billion next year from $79 billion last year. Meanwhile, spending on semiconductors deployed in AI servers and data centers is set to jump from $78 billion in 2023 to $136 billion next year.

For investors looking to capitalize on all these fast-growing semiconductor end markets that have received a big boost thanks to AI, Taiwan Semiconductor Manufacturing (NYSE: TSM), popularly known as TSMC, seems like an ideal bet.

The foundry giant serves all the verticals discussed, and the latest news from the company reinforces the fact that AI is turning out to be a solid growth driver for the company. Let’s look at the reasons why.

TSMC is on track to deliver yet another terrific quarterly report

TSMC has just released its sales data for September, and the company has reported an impressive year-over-year increase of almost 40% in its monthly revenue to 251.8 billion New Taiwan (NT) Dollars. If we add the monthly revenue for July, August, and September, TSMC’s Q3 revenue would come in at almost 760 billion NT Dollars, an impressive jump of 39% from the same period last year.

That number is higher than analysts’ Q3 revenue estimates of 748 billion NT Dollars. So, TSMC seems set to exceed Wall Street’s expectations when it releases its third-quarter results on Oct. 17. Analysts have been forecasting $1.80 per share in earnings from the company, a jump of 40% from the same period last year, but the better-than-expected revenue growth is likely to translate into stronger bottom-line gains.

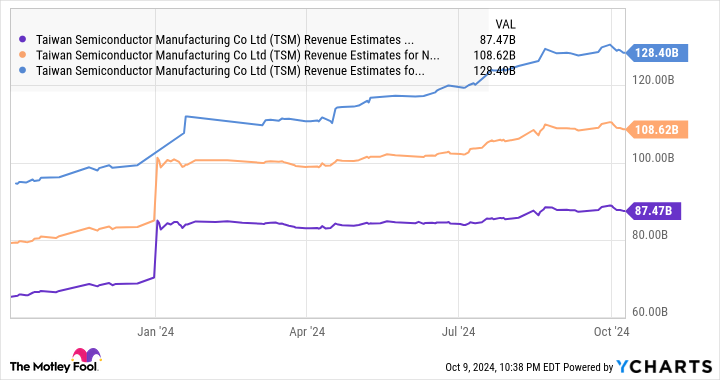

Another thing worth noting is that TSMC’s revenue in the first nine months of 2024 increased by 32% from the same period last year. This means TSMC is well on course to outpace the 26% revenue growth to $87.2 billion that analysts are expecting the company to deliver in 2024. More importantly, TSMC is expected to sustain healthy growth levels over the next couple of years as well.

However, don’t be surprised to see TSMC’s revenue growth outpacing Wall Street’s expectations. That’s because the company is one of the most important pick-and-shovel plays in the massive AI space. It manufactures and fabricates chips for a range of fabless chipmakers such as Nvidia, AMD, Qualcomm, Broadcom, and Marvell Technology.

Even better, chipmakers with fabrication plants of their own, such as Intel, are also turning to TSMC to capitalize on the latter’s advanced chip manufacturing processes to produce more efficient, powerful chips. But that’s not where TSMC’s AI-related opportunity ends. The company also manufactures chips for Apple, putting it in position to make the most of the growth in AI smartphone sales.

Now, a closer look at the customers discussed will make it clear that TSMC is one of the best ways to play the AI chip boom in different sectors. Nvidia, AMD, and Intel, for instance, are trying to make the most of the opportunities available in AI accelerators. Nvidia is running away with this market right now, making chips using TSMC’s process nodes to deliver faster performance and lower power consumption than rivals.

Qualcomm, AMD, and Intel are present in the AI-enabled PC market. Similarly, Qualcomm and Apple present avenues through which TSMC can tap the smartphone space. And finally, Marvell and Broadcom allow TSMC to tap into another fast-growing niche of AI semiconductors in the form of custom AI chips. Simply stated, it doesn’t matter which of these companies wins more market share and ends up dominating their respective niches — TSMC is most likely going to be the ultimate winner.

That’s why TSMC’s advanced packaging technology that’s used for producing AI chips is sold out until 2025. As a result, the company is expanding its capacity to produce AI chips a year ahead of the original schedule, according to Morgan Stanley. This should ideally allow TSMC to make more chips, fulfill more orders, and deliver stronger growth in revenue and earnings.

Buying the stock before Oct. 17 is a no-brainer

This discussion makes it clear that TSMC is carrying terrific momentum going into its Q3 earnings report that’s due on Oct. 17. There is a strong chance that it will beat consensus estimates and also deliver stronger-than-expected guidance for Q4, all of which could give the stock a nice shot in the arm.

TSMC stock has jumped 77% this year already, and it looks all set to end the year on a strong note. Given that this AI stock is trading at an attractive 22 times forward earnings even after its outstanding run this year, buying it looks like a no-brainer right now considering that it seems built for more upside.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom, Intel, and Marvell Technology and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

1 Top Artificial Intelligence (AI) Semiconductor Stock to Buy Hand Over Fist Before Oct. 17 was originally published by The Motley Fool

Energy Transfer: Buy, Sell, or Hold

Energy Transfer (NYSE: ET) stock has had a solid run recently. The stock has risen by over 17% this year and has about doubled since the end of 2021.

Given that solid performance, investors may be wondering if the stock is a buy, sell, or hold at this point. Let’s take a look at each case.

The buy case for Energy Transfer

There are a number of facets to the bull case for Energy Transfer. The first is the solid growth opportunities in front of the midstream master limited partnership (MLP). The company has one of the most robust expansion backlogs in the space, with it looking to spend $3.1 billion on growth projects this year. With projects set to come online both in 2025 and 2026, the company has solid visibility into growth.

In addition, Energy Transfer has been one of the biggest consolidators in the space in recent years, buying up smaller rivals and integrating them into its expansive system. The company has a solid history of finding assets that are ultimately more valuable as part of its integrated system than they are by themselves.

Given its large integrated system and access to cheap gas out of the Permian, the company is also well positioned to benefit from the increasing energy needs associated with the artificial intelligence (AI) data center buildout. The company has already signed deals to bring more gas to power companies based on increasing AI demand and has even had discussions with data center operators looking to build onsite power generation.

Outside of its growth opportunities, Energy Transfer has done a nice job of improving its balance sheet and learning to grow within its means. Its second-quarter results reported a distribution coverage ratio of over 1.8 times based on its non-consolidated distributable cash flow, which is cash flow before growth capital expenditures (capex), and payout to partners.

At the same time, Energy Transfer continues to trade at a forward enterprise-value-to-EBITDA multiple of 8 times based on 2025 estimates, which is well below historical levels, not to mention one of the lowest valuations in the MLP space. As a reference, the midstream industry as a whole traded at a 13.7 times EV/EBITDA average multiple between 2011 and 2016.

The sell case for Energy Transfer

While Energy Transfer has newfound discipline, that hasn’t always been the case. The company had to cut its distribution in half in the fall of 2020 after it had gotten over its skis with its debt and needed to reduce its leverage. It was able to accomplish that pretty quickly, and the distribution is now higher than before the cut, but there is always the risk the company could once again overextend itself.

At the same time, in the past when the master limited partnership’s general partner (GP) and limited partner (LP) traded as two entities, Energy Transfer was not known to be particularly shareholder-friendly under then-CEO Kelcy Warren. While merging the GP and LP and removing Warren as CEO helped eliminate the conflicts of interest and align shareholder interests with those of Warren, he is still the company’s largest shareholder and still involved as chairman. Warren’s continued involvement could be a significant reason why the stock continues to trade at a discount to peers.

At the end of the day, Energy Transfer is still in the energy business. As a transporter of fossil fuels, where domestic volumes are headed in the future matter for the company. The push toward green energy could turn out to be a long-term headwind, although the pace of the green transition seems to be slowing, as evidenced by the big slowdown in sales growth of electric vehicles (EVs) this year as well as the massive buildout of energy-hungry AI data centers.

The hold case for Energy Transfer

With a robust forward yield of 7.9%, investors still get a nice return if the stock does much of nothing. In fact, that is pretty much what the stock has done since early May, simply trading in a very tight range. The trading range has been particularly narrow since mid-August.

With an attractive yield and growing distribution, income-oriented investors probably don’t mind Energy Transfer’s current lack of volatility. That would make it a solid hold for these investors.

The verdict

With its issues now firmly in the past, I’d be a buyer of the stock given its growth opportunities, current financial discipline, and attractive valuation and yield. The stock has had a solid year in 2024, but I think there could be more upside ahead.

If the company can start to show that it’s an AI beneficiary, I think it should start to attract more investors. In the meantime, investors can enjoy collecting its robust distribution.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,266!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,047!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,794!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Geoffrey Seiler has positions in Energy Transfer. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Energy Transfer: Buy, Sell, or Hold was originally published by The Motley Fool

POWW INVESTOR ALERT: Bronstein, Gewirtz & Grossman LLC Announces that AMMO, Inc. Investors with Substantial Losses Have Opportunity to Lead Class Action Lawsuit

NEW YORK, Oct. 13, 2024 (GLOBE NEWSWIRE) — Attorney Advertising — Bronstein, Gewirtz & Grossman, LLC, a nationally recognized law firm, notifies investors that a class action lawsuit has been filed against AMMO, Inc. (“AMMO” or “the Company”) POWW and certain of its officers.

Class Definition

This lawsuit seeks to recover damages against Defendants for alleged violations of the federal securities laws on behalf of all persons and entities that purchased or otherwise acquired AMMO securities between August 19, 2020, and September 24, 2024, inclusive (the “Class Period”). Such investors are encouraged to join this case by visiting the firm’s site: bgandg.com/POWW.

Case Details

The complaint alleges that throughout the Class Period, Defendants made materially false and/or misleading statements, as well as failed to disclose material adverse facts about the Company’s business, operations, and prospects. Specifically, Defendants failed to disclose to investors: (1) that the company lacked adequate internal controls over financial reporting; (2) that there was a substantial likelihood the Company failed to accurately disclose all executive officers, members of management, and potential related party transactions in fiscal years 2020 through 2023; (3) that there was a substantial likelihood the Company failed to properly characterize certain fees paid for investor relations and legal services as reductions of proceeds from capital raises rather than period expenses in fiscal years 2021 and 2022; (4) there was a substantial likelihood the Company failed to appropriately value unrestricted stock awards to officers, directors, employees and others in fiscal years 2020 through 2022; and (5) that, as a result of the foregoing, Defendants’ positive statements about the Company’s business, operations, and prospects were materially misleading and/or lacked a reasonable basis.

What’s Next?

A class action lawsuit has already been filed. If you wish to review a copy of the Complaint, you can visit the firm’s site: bgandg.com/POWW or you may contact Peretz Bronstein, Esq. or his Client Relations Manager, Nathan Miller, of Bronstein, Gewirtz & Grossman, LLC at 332-239-2660. If you suffered a loss in AMMO you have until November 29, 2024, to request that the Court appoint you as lead plaintiff. Your ability to share in any recovery doesn’t require that you serve as lead plaintiff.

There is No Cost to You

We represent investors in class actions on a contingency fee basis. That means we will ask the court to reimburse us for out-of-pocket expenses and attorneys’ fees, usually a percentage of the total recovery, only if we are successful.

Why Bronstein, Gewirtz & Grossman

Bronstein, Gewirtz & Grossman, LLC is a nationally recognized firm that represents investors in securities fraud class actions and shareholder derivative suits. Our firm has recovered hundreds of millions of dollars for investors nationwide.

Attorney advertising. Prior results do not guarantee similar outcomes.

Contact

Bronstein, Gewirtz & Grossman, LLC

Peretz Bronstein or Nathan Miller

332-239-2660 | info@bgandg.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

My mother-in-law stole $25,000 from my husband’s emergency fund. We donated to charity rather than give her a birthday gift — and she cried foul.

Dear Quentin,

Shortly after my husband and I married, he discovered his mother had been using a power of attorney to withdraw thousands of dollars at a time from one of his bank accounts. She took $25,000. As his power of attorney, she had access to his emergency fund. The bank helped him move the remaining funds, and had him write a revocation of the power of attorney.

He also sent the revocation to his other financial institutions. He couldn’t close the bank account because his stepdad’s name is on the account, which was his mom’s idea. It’s interesting that she withdrew $25,000 by illegally using the power of attorney while her husband could have legally withdrawn it since his name is on the account.

Most Read from MarketWatch

A few weeks later, she reminded him of her upcoming birthday and wedding anniversary. He wasn’t going to send an expensive gift after she took $25,000, so instead he sent a card and made a donation to a charity. She responded that a donation is appropriate when a person requests you do that, and that she prefers gifts.

Justifying her theft

When she stopped working years ago she cared for her own father, who contributed to her home expenses, and then she had an inheritance from him after he passed away, which she used to go to Italy, an Alaskan cruise and Ireland. (There were no trips to see her son, though he’s been flying to visit her all these years.) Those funds are gone.

They listed their home for sale last April, and it’s still listed. I’m guessing she justified the theft by thinking of it as borrowing from her son who owes her for the cost of raising him (she talks about how much she spent on him growing up and uses that as a reason he owes her all the time), and maybe thought she’d repay him when she sold the house.

There’s still the issue of the open account. We can’t close it because his stepdad’s name is on it, and he feels he needs to constantly check his accounts in case she somehow gets access and makes withdrawals. Someone suggested a credit freeze, but a friend recommended against that. Is there anything else you recommend we do to protect ourselves going forward?

Happily Married

Dear Happily Married,

Dial “M” for mother-in-law.

Ireland is a lovely place to visit, but as an Irishman, I’m obviously biased. It was the only good decision your mother-in-law made. The rest leaves a lot to be desired, including her belief that she should receive a gift rather than a donation. One woman’s life-threatening emergency is another woman’s trip to the hairdresser. The boundaries were unclear from the start.

A power of attorney has a fiduciary responsibility to put the interests of the benefactor before all else. Your husband could give his mother another gift for her birthday — a lawsuit. He could sue her for abusing her role as power of attorney. Fair warning: That could be costly and timely, and as she was a co-owner (assuming she was not just a co-signer) it may complicate things.

It’s time to redraw some boundaries and enforce them. Your husband should tell his stepfather to close the account and, if he refuses, he should take his name off the account. That should be relatively straightforward with most banks, as long as there are no outstanding debts. It will also help prevent your mother-in-law and her partner from running up debts in your husband’s name.

Typically, the opposite happens: Younger relatives take advantage of older ones. I have received many letters about elder financial abuse, particularly in relation to adult children hitting parents up for money or stealing from their parents’ bank accounts by persuading them to add their names as co-signatories (so they inherit the bank account after the parent dies).

I’m reminded of the case of Axton Betz-Hamilton, who discovered that the woman she trusted most was stealing her identity: her own mother. She received a copy of her credit report when she was 19; it was replete with fraudulent credit-card entries and credit-collection agencies. Axton won an award for her work on identity theft, and her mother even attended the ceremony.

There are ways to set ground rules for the relationship going forward: “What happened to the $25,000 in the bank account?” (She may obfuscate and claim ignorance.) Questions can be more powerful than explanations. After all, your husband is merely telling her that he knows what she did — he is not looking for explanations or justifications.

But acting like nothing happened sets a bad precedent.

More columns from Quentin Fottrell: