Cryptocurrency Pepe's Price Increased More Than 11% Within 24 hours

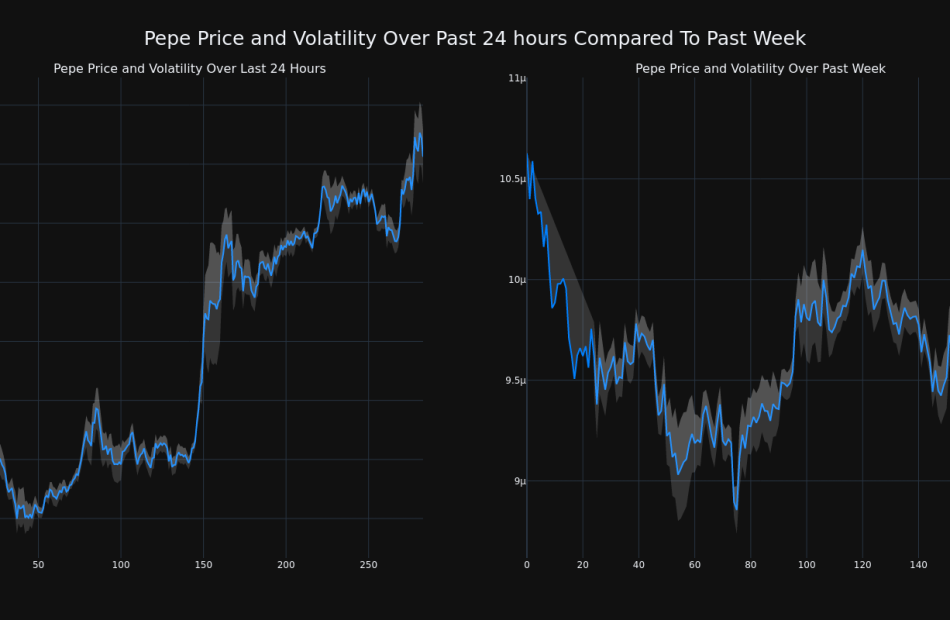

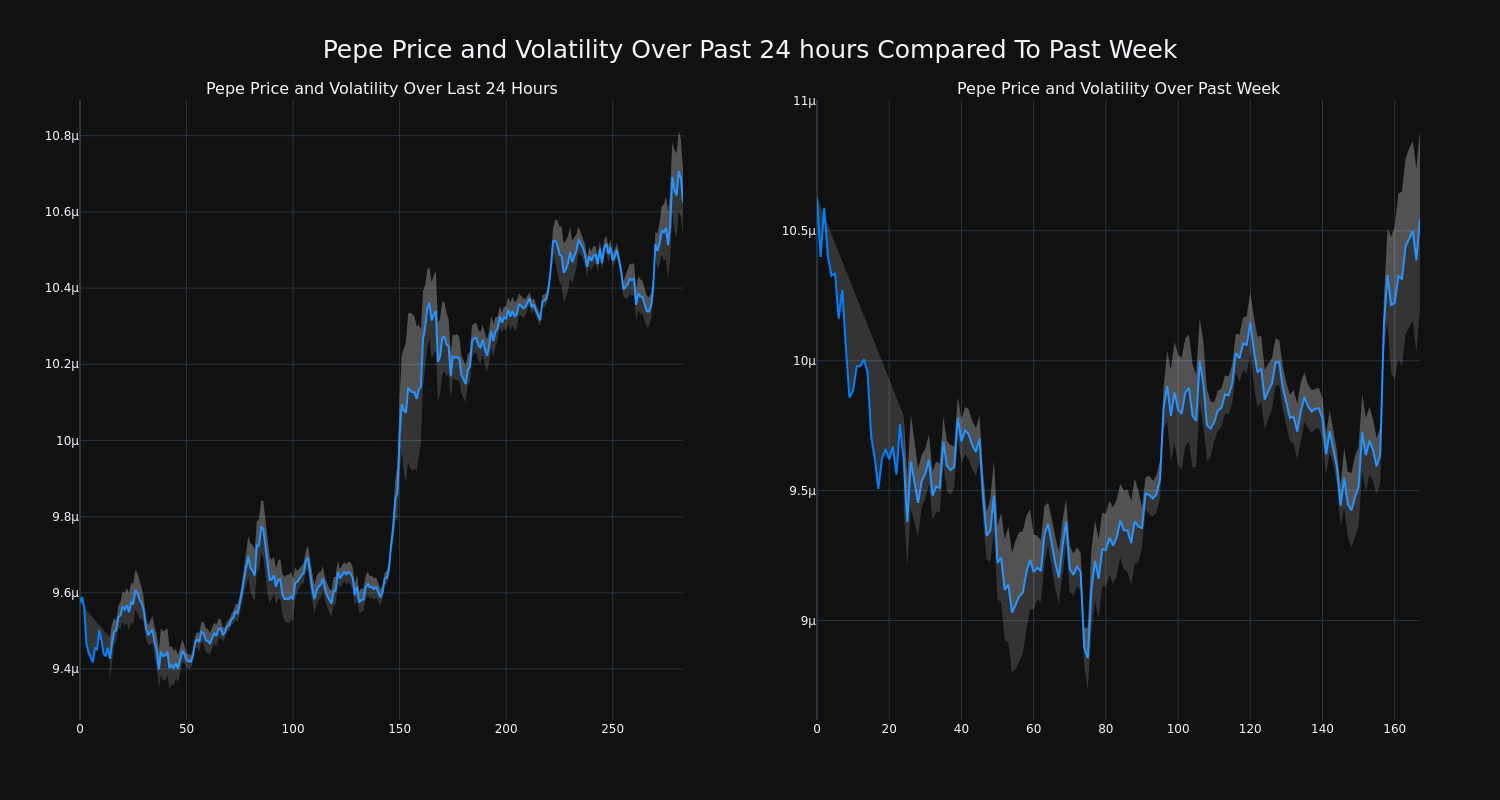

Pepe’s PEPE/USD price has increased 11.24% over the past 24 hours to $0.000011, which is in the opposite direction of its trend over the past week, where it has experienced a 1.0% loss, moving from $0.000011 to its current price.

The chart below compares the price movement and volatility for Pepe over the past 24 hours (left) to its price movement over the past week (right). The gray bands are Bollinger Bands, measuring the volatility for both the daily and weekly price movements. The wider the bands are, or the larger the gray area is at any given moment, the larger the volatility.

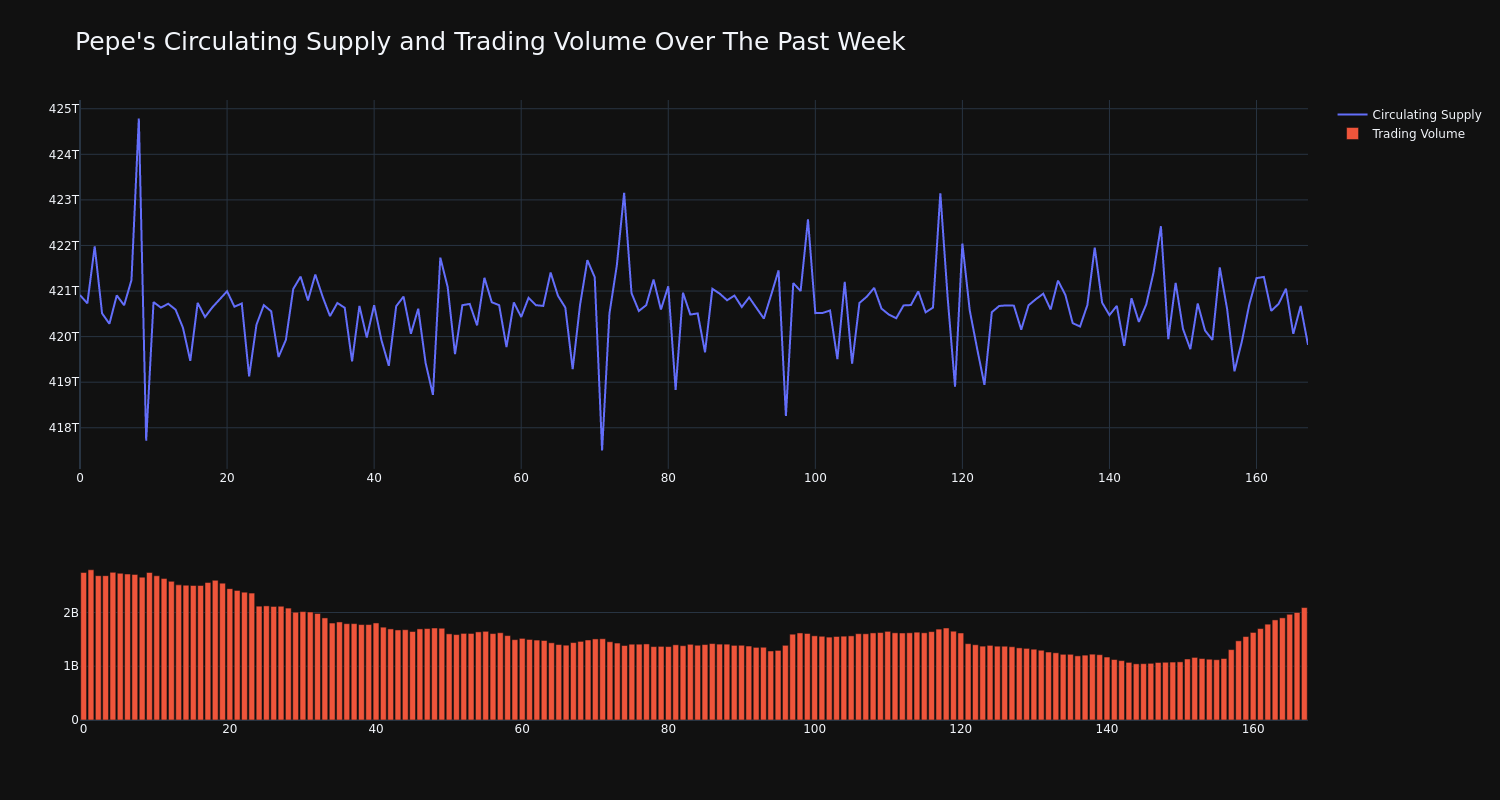

The trading volume for the coin has tumbled 24.0% over the past week along with the circulating supply of the coin, which has fallen 0.26%. This brings the circulating supply to 420.69 trillion, which makes up an estimated 100.0% of its max supply of 420.69 trillion. According to our data, the current market cap ranking for PEPE is #29 at $4.47 billion.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What's Next: Charles Schwab's Earnings Preview

Charles Schwab SCHW will release its quarterly earnings report on Tuesday, 2024-10-15. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate Charles Schwab to report an earnings per share (EPS) of $0.75.

Charles Schwab bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

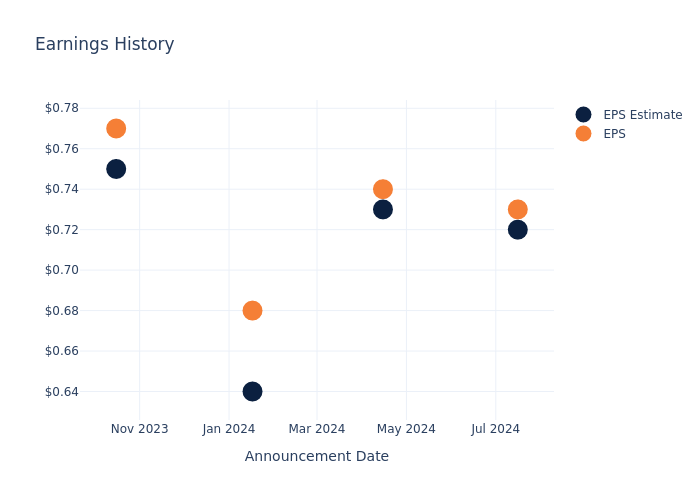

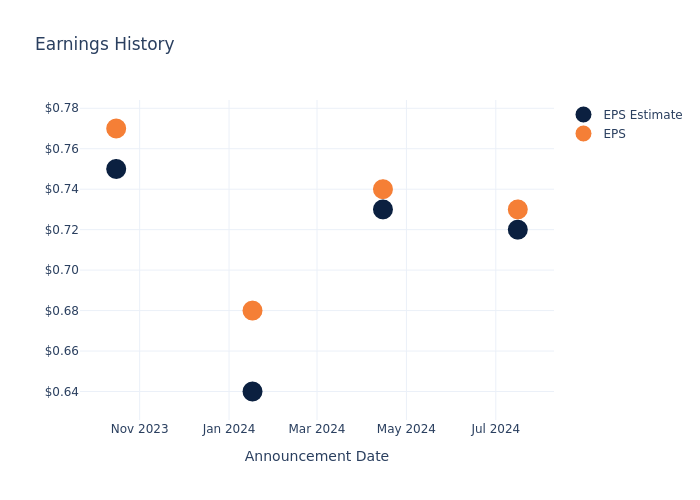

Earnings Track Record

In the previous earnings release, the company beat EPS by $0.01, leading to a 5.38% drop in the share price the following trading session.

Here’s a look at Charles Schwab’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.72 | 0.73 | 0.64 | 0.75 |

| EPS Actual | 0.73 | 0.74 | 0.68 | 0.77 |

| Price Change % | -5.0% | 3.0% | -1.0% | -0.0% |

Charles Schwab Share Price Analysis

Shares of Charles Schwab were trading at $67.68 as of October 11. Over the last 52-week period, shares are up 26.72%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for Charles Schwab visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

WETH's Price Increased More Than 7% Within 24 hours

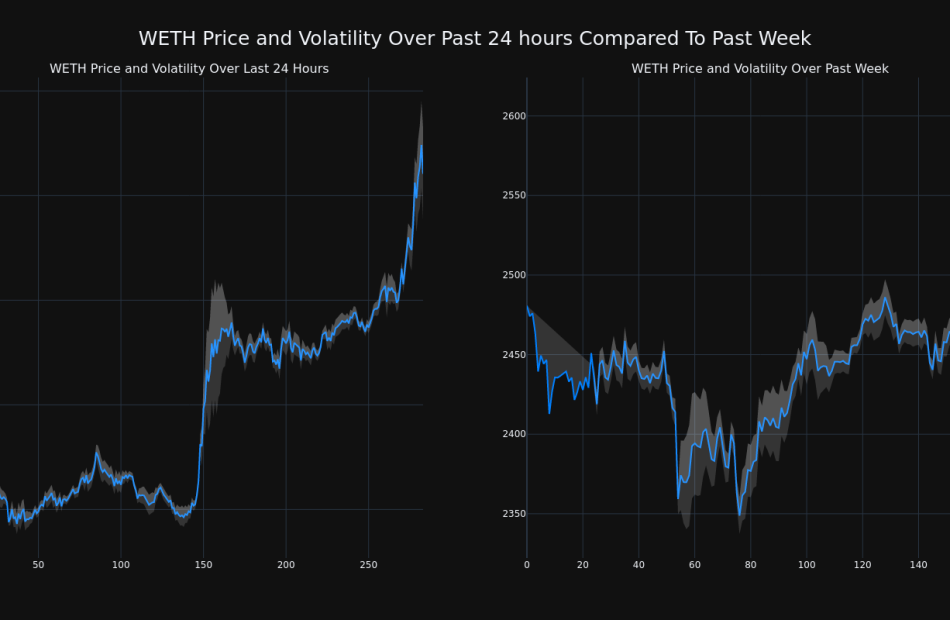

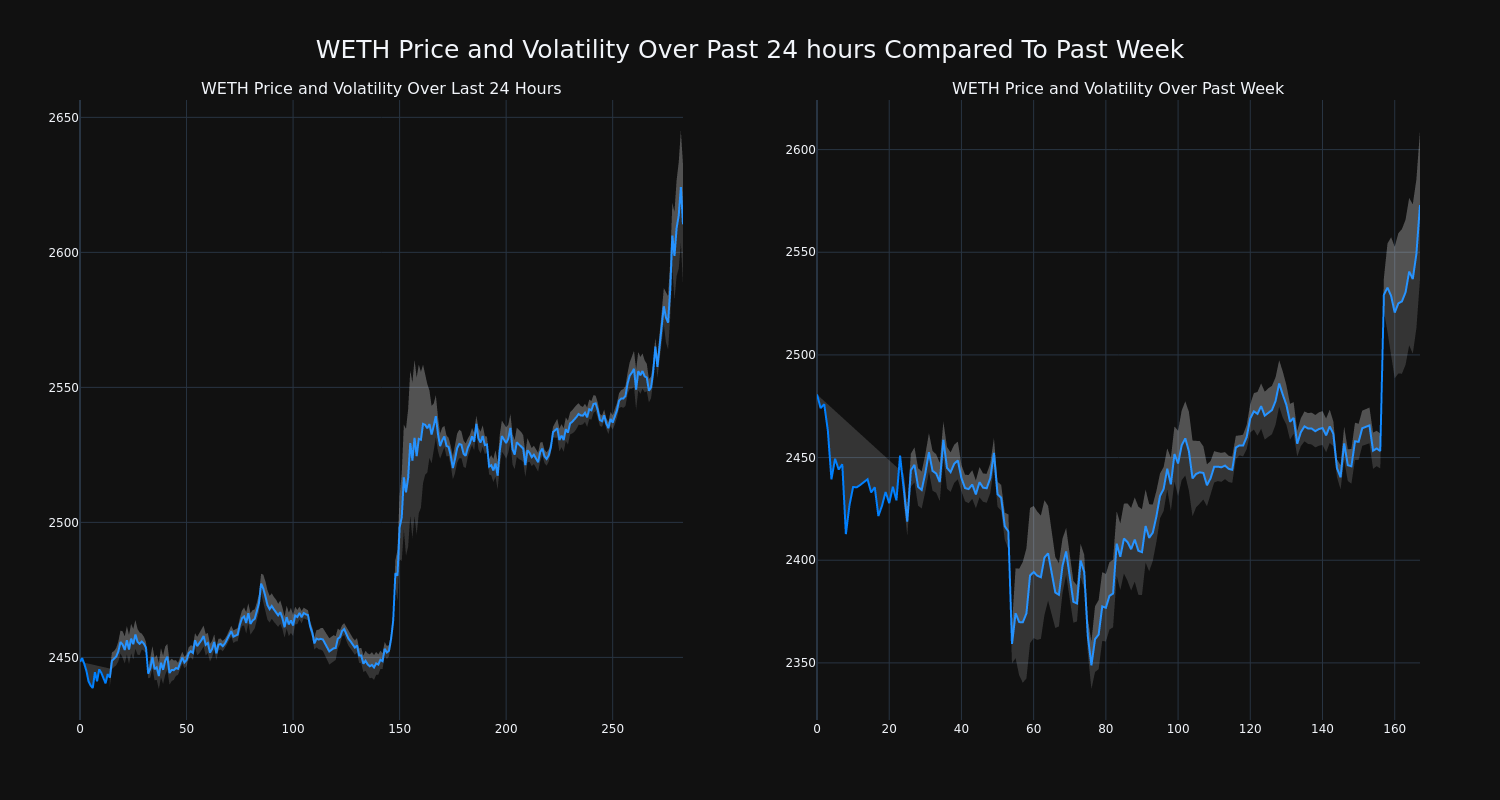

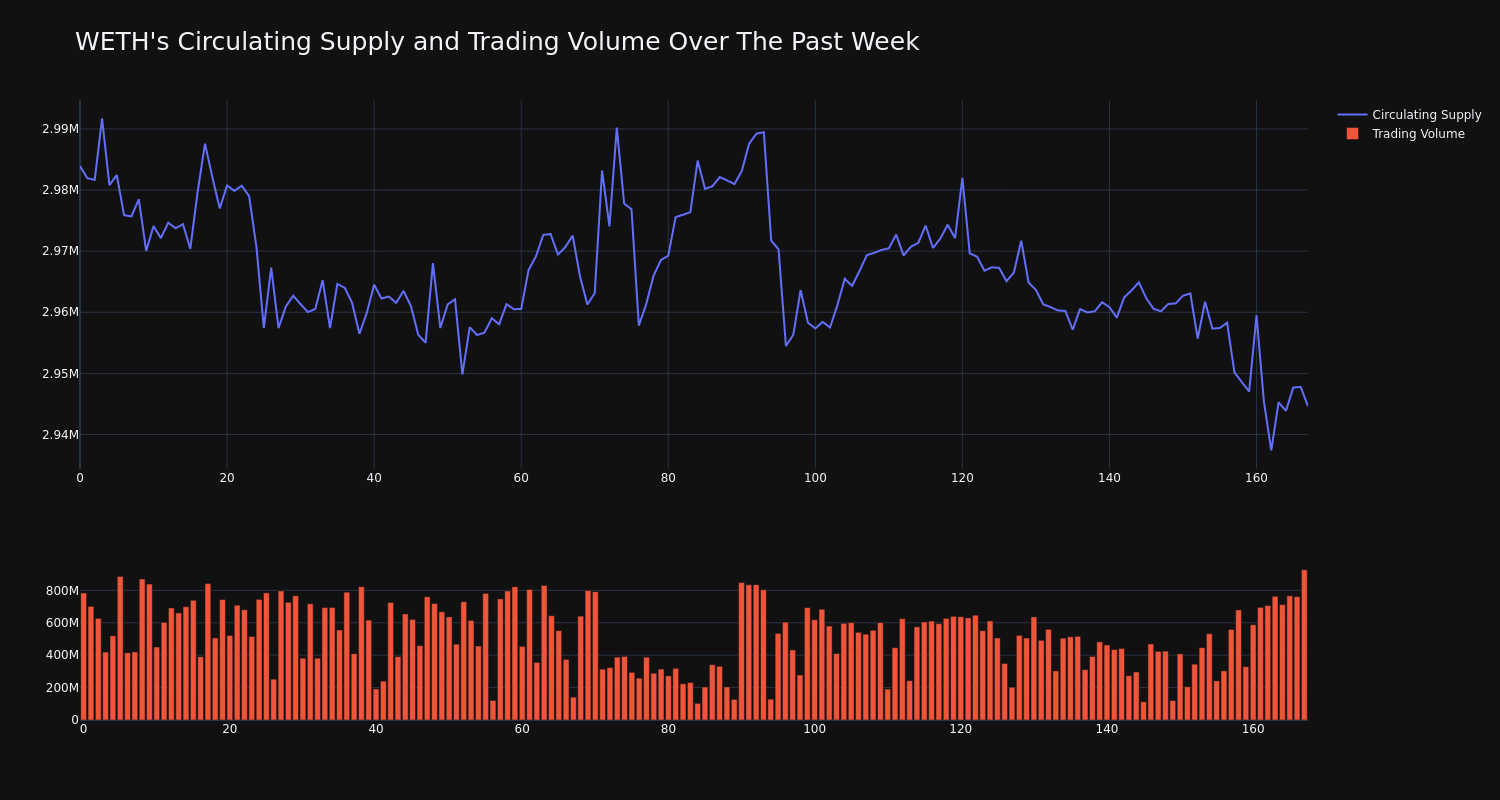

Over the past 24 hours, WETH’s WETH/USD price rose 7.08% to $2,617.98. This continues its positive trend over the past week where it has experienced a 4.0% gain, moving from $2,480.74 to its current price. As it stands right now, the coin’s all-time high is $4,799.89.

The chart below compares the price movement and volatility for WETH over the past 24 hours (left) to its price movement over the past week (right). The gray bands are Bollinger Bands, measuring the volatility for both the daily and weekly price movements. The wider the bands are, or the larger the gray area is at any given moment, the larger the volatility.

The trading volume for the coin has climbed 18.0% over the past week, moving opposite, directionally, with the overall circulating supply of the coin, which has decreased 1.32%. This brings the circulating supply to 2.94 million. According to our data, the current market cap ranking for WETH is #17 at $7.68 billion.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Where Will Palantir Stock Be In 1 Year?

At this time last year, the stock price for Palantir Technologies (NYSE: PLTR) was under $15 per share. As of mid-morning on Oct. 9, shares of Palantir were hovering around $43 — nearly triple where they were just one year ago.

Over the last year, Palantir’s software suite has garnered much attention as sophisticated data analytics platforms become a critical part of artificial intelligence (AI) roadmaps. But with shares of Palantir continuing to rise, investors need to start wondering how much longer the music is going to be playing.

Below, I’ll cover a number of catalysts that could spur even further growth for Palantir while also calling out some risks the company faces.

What could cause Palantir stock to run higher?

I see three key factors that could ignite further buying of Palantir stock over the next year.

1. Institutional Coverage and Ownership: Back in September, Palantir reached a critical milestone as it was inducted into the S&P 500. Now that Palantir is part of the exclusive index, I would not be surprised to see the company receive more attention from large financial institutions.

For example, high-profile investment banks such as JP Morgan or Wells Fargo could begin covering the stock from an equity research perspective. If more analysts from Wall Street’s largest banks begin to regularly report on Palantir and its prospects, the company has a good chance to land on more investors’ radar. This could be a positive catalyst for the stock as it broadens Palantir’s reach to a bigger pool of investors.

Moreover, I also think that more hedge funds may begin taking positions in Palantir. Steadily rising institutional ownership in Palantir could also be a catalyst that charges more gains for the stock.

2. More Partnerships: Earlier this year, Palantir signed two notable strategic partnerships. The deal with Microsoft revolves around increasing AI investments in the defense sector, while the relationship with Oracle is going to integrate cloud-based workflows into Palantir’s data analytics platform, Foundry.

I think the deals with Microsoft and Oracle bode well for Palantir’s chances to continue partnering with the tech sector’s largest businesses. Such relationships can help strengthen Palantir’s deal flow pipeline and provide many cross-selling opportunities, ultimately serving as lucrative catalysts for the company and the stock.

3. AI in the defense sector: One area of the AI realm that I think is misunderstood is how the technology can be leveraged in military operations. Defense tech is becoming more of a priority, and it’s taking many different forms. In cybersecurity, logistics, and even simulated combat operations, AI stands to be an important piece of technology for the military.

Keep in mind that nearly half of Palantir’s revenue stems from government contracts with the U.S. military and its Western allies. In just the last few months, Palantir has won a number of important AI-focused deals with the Department of Defense (DOD). I suspect that as AI investments become a more mainstream feature in defense budgets, Palantir will continue to benefit from these initiatives, given the company’s existing strong relationships with government agencies.

What could cause Palantir stock to sell off?

The chart below illustrates Palantir’s revenue and net income trajectory over the last several years. Investors can see that the company’s top line is accelerating while the business has finally reached consistent profitability.

Candidly, I am a little wary that the AI narrative itself is not going to be enough to keep investors interested in Palantir. While the company’s growth is undoubtedly impressive, there are other data analytics platforms for large enterprises on the market.

The company has a unique ability to reinvest its excess profits into areas including research and development (R&D), hiring efforts, marketing, or acquisitions.

I think Palantir is going to need to introduce additional products and services sooner rather than later; otherwise, the company’s future earnings reports may run the risk of being viewed as satisfactory, but not great. In turn, investors could quickly sour on Palantir and dump the stock in exchange for something more appealing.

Palantir’s valuation story tells itself

As of the time of this article, Palantir has a market capitalization of $96 billion. As much as I am a Palantir bull, I have to concede that this valuation is pricey for a company that’s only done $2.5 billion in sales over the last 12 months.

At some point, I think some investors are going to begin taking profits in Palantir and I would not be surprised if such an action takes place in the near-term. While I think Palantir has numerous catalysts, all of the ideas explored above are longer-term tailwinds. For this reason, I would not be surprised to see Palantir stock witness a sell-off over the next year as the company’s longer-term priorities continue to develop and take shape.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Wells Fargo is an advertising partner of The Ascent, a Motley Fool company. Adam Spatacco has positions in Palantir Technologies. The Motley Fool has positions in and recommends JPMorgan Chase, Oracle, and Palantir Technologies. The Motley Fool has a disclosure policy.

Where Will Palantir Stock Be In 1 Year? was originally published by The Motley Fool

Mark Cuban Clashes With Bill Ackman After Billionaire Fund Manager Calls Kamala Harris' Startup Tax Deduction Proposal 'Extremely Misleading:' 'We Need To Get You Watching Shark Tank'

Hedge fund manager Bill Ackman and Shark Tank fame Mark Cuban find themselves in the opposite camps regarding their political allegiance. The two discussed Democratic presidential candidate Kamala Harris’ policy proposal regarding tax concessions to startups, in an exchange on X on Sunday.

The Proposal: It all started when Harris posted on X about her proposal to incentivize startups by raising the startup expense reduction from the current $5,000. “Our plan to raise the startup expense deduction to $50,000 will strengthen our small businesses and lift up our communities,” she said.

Ackman Cries Foul: Pershing Square founder Ackman, who has pledged allegiance to Harris’ rival Donald Trump, said the proposal was misleading. “This is extremely misleading,” he said.

The hedge fund manager said that the startups mostly lose money in the first few years of operation and don’t generate profits that a tax deduction could offset. “This is not a $50k gift from the government that can be used to fund a startup despite how it is characterized by [Kamala Harris],” he said.

See Also: How To Invest In Startups

Cuban Defends Harris: Entrepreneur Cuban, who has had his fair share of experience with the startup ecosystem, stepped in to clarify the proposal’s utility to Ackman. Most new businesses are sub-Chapter S or LLC and are taxed at their personal rate, Cuban said.

S corporations, according to the Internal Revenue Service, are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. Shareholders of S corporations report the flow-through of income and losses on their personal tax returns and are assessed tax at their individual income tax rates.

“Since $50k is > standard deduction, and it’s likely that the entrepreneur has personal income to live off of, the money they save on taxes doesn’t hurt. Does it ?” he said. Also, Harris has committed to not raising taxes for anyone making under $400,000, and as a result, 99% of these people will pay the same or lower tax rate, he added.

Incentivizing startups is important as they are a significant part of annual job growth, Cuban said. “And if they grow into bigger businesses , even better,” he added.

Not the one to give up, Ackman asked Cuban as to what percentage of startup entrepreneurs who start S Corp or LLC structured businesses would have $50k of passive income. For $50K income, one should have about $1.5 million in a savings account or a $3 million, plus stock portfolio, he said.

Replying to Ackman, Cuban said, “We need to get you watching shark tank.” It’s not necessarily that the person has passive income, they could have jobs and start companies. “People go all in with their savings and start companies. People have w2 income from working a job, and quit to start a company,” he said, adding that he was fired from a job and then started a company.

Quoting himself as an example, Cuban said, “People create small companies and actually generate net income because they don’t pay themselves all that much, if at all.”

“Not everyone is going to use the full $50k. But every dollar in start up costs (of which we probably would agree there are too many) above 5k is a benefit to the entrepreneur,” he added.

Read Next:

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Aerosol Insecticides Market is Projected to Hit US$ 148.51 Billion with 5.1% CAGR by 2034 | Fact.MR Report

Rockville, MD , Oct. 14, 2024 (GLOBE NEWSWIRE) — According to a recently updated report by Fact.MR, a market research and competitive intelligence provider, the global Aerosol Insecticides Market is estimated to reach US$ 90.26 billion in 2024. The market is projected to advance at a CAGR of 5.1% between 2024 and 2034.

The global market for aerosol insecticides is seeing a considerable boom, driven by their adaptability and wide-ranging uses across several sectors. These easy and effective pest management technologies are seeing greater usage in families, agriculture, public health, and commercial settings globally. The development in urbanization and rising awareness of insect-borne illnesses have spurred the need for efficient pest management technologies. Aerosol insecticides provide advantages such as simplicity of usage, exact application, and rapid effects, making them attractive alternatives for both professional and consumer sectors.

In agriculture, they perform a critical function in safeguarding crops and cattle, while in urban areas; they assist in maintaining cleanliness standards in homes and businesses. The rise of e-Commerce has also made these items more accessible to customers internationally. As concerns about food security and public health continue to increase, the market for aerosol insecticides is projected to sustain its rising trajectory in the coming years.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=688

Key Takeaways from Market Study:

- The global aerosol insecticide market is projected to reach US$ 148.51 billion by the end of 2034.

- Eastern Europe is forecasted to progress at a CAGR of 3.5% between 2024 and 2034

- The market in India is estimated to reach a valuation of US$ 4.67 billion in 2024.

- Among several insects controlled, the demand for insecticides for use on crawling insects is analyzed to advance at a CAGR of 5.1% through 2034.

- The North American market is forecasted to hold a share of 29.9% of global market revenue by the end of 2034.

- In North America, the market in Mexico is projected to expand at a CAGR of 8.7% between 2024 and 2034.

“More farmers increasingly using aerosol insecticides for protection of crops from insects and pests leading to growing crop revenue every year,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Aerosol Insecticide Market:

Key industry participants like Beiersdorf AG; Henkel AG & Co., KGaA; Reckitt Benckiser; S. C. Johnson & Son, Inc.; Honeywell International Inc.; Procter & Gamble; Unilever; Oriflame Cosmetics S.A.; Estée Lauder Inc.; Colep Consumer Products; Akzo Nobel N.V. etc. are driving the aerosol insecticide industry.

Advancements in Insecticide Formulas Increasing Effectiveness While Reducing Impacts on Environment:

More manufacturers have created improved formulas that offer greater effectiveness while minimizing environmental impact. New micro-encapsulation techniques allow for a regulated release of active substances, offering long-lasting protection. Smart nozzle designs offer more accurate application, decreasing waste and boosting coverage in hard-to-reach places.

Eco-friendly solutions employing natural pyrethrin extracts or essential oils are attractive to ecologically aware customers. Some products now incorporate insect growth regulators, disrupting pest life cycles for long-term control. Advancements in propellant technology have led to more sustainable, low-global-warming-potential options.

Multi-function formulations that combine insecticide, disinfection, and deodorizer qualities are gaining favor in domestic and commercial settings. Moreover, advancements in packaging, such as rechargeable aerosol systems, are minimizing waste and improving consumer comfort.

These improvements are broadening the uses of aerosol insecticides across several industries, from agriculture to public health, driving higher usage and market growth globally.

Aerosol Insecticide Industry News:

- Key players in the aerosol insecticides market are adopting new strategies and launching innovative products like insect repellents and home insecticides. In March 2024, Procter & Gamble patented an aerosol packaging design using adsorbent materials to maintain constant pressure, incorporating a CO2 and Metal-Organic Framework (MOF) system.

- Beiersdorf announced in September 2023 that NIVEA and other deodorant brands will reduce can weight by 11.6% and use 50% recycled aluminum, cutting CO2 emissions by 58%. In October 2023, Envases Group and Colep Packaging formed a joint venture to establish an aerosol packaging facility in Mexico.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=RC&rep_id=688

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the aerosol insecticide market for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on insect type (flying insects, crawling insects), application (residential, commercial, industrial), and distribution channel (supermarkets/hypermarkets, convenience stores, online retail), across seven major regions of the world (North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, and MEA).

Key Segments of Aerosol Insecticide Market Research:

- By Insect Type :

- Flying Insects

- Crawling Insects

- Others

- By Application :

- Residential

- Commercial

- Industrial

- By Distribution Channel :

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Others

Check out More Related Studies Published by Fact.MR Research:

Home insecticides market is expected to reach $14.96 billion in 2022 and grow at a CAGR of 6.84% to reach $29 billion by 2032.

Insect growth regulators market was valued at $916.99 million in 2022 and is expected to grow at a CAGR of 7.1%, reaching $1.95 billion by 2033.

Benzotriazole market, valued at $400 million in 2023, is projected to reach $900 million by 2033, growing at a rapid CAGR of 8.4% during the forecast period.

Pine chemicals market is estimated to grow with a CAGR of over 5% during the forecast period (2019-2027) and reach a value pool of over US$ 19 Billion.

Panthenol market growth is projected to register the CAGR of ~5% during the period 2019-2029.

Magnesium nitrate hexahydrate market is valued at $770.8 million in 2023 and is projected to grow at a CAGR of 4.1%, reaching $1,152 million by 2033.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Meet the Warren Buffett ETF That Turned $10,000 Into Over $233,000

Warren Buffett sometimes says he’s a “business-picker” and not a stock-picker. He’s right, of course. However, the legendary investor doesn’t always pick individual businesses. Sometimes, Buffett picks a large basket of businesses.

I’m referring to the exchange-traded funds (ETFs) in Berkshire Hathaway‘s portfolio. Buffett’s ETFs have been big winners over the years. One of them even turned $10,000 into over $233,000.

Buffett’s biggest moneymaking ETF

Buffett doesn’t get very creative when selecting ETFs for Berkshire’s portfolio. The conglomerate owns only two funds — and they’re nearly identical.

Berkshire owns 39,400 shares of the SPDR S&P 500 ETF Trust (NYSEMKT: SPY), which is currently valued at nearly $22.6 billion. It also owns 43,000 shares of the Vanguard S&P 500 ETF (NYSEMKT: VOO), valued at nearly $22.7 billion.

Both ETFs attempt to track the performance of the S&P 500. Unsurprisingly, their holdings are nearly identical, with only minor differences in how much each stock makes up as a total percentage of assets.

Buffett bought these two S&P 500 ETFs in the fourth quarter of 2019. However, they were both racking up solid gains well before then. The SPDR S&P 500 ETF Trust has been the bigger winner because it was created much earlier than the Vanguard S&P 500 ETF. An initial investment of $10,000 when the SPDR S&P 500 ETF Trust launched in January 1993 would be worth roughly $233,320 today. That translates to an average annual return of nearly 10.5%.

Five secrets to this ETF’s success

The first and most important secret to success for the SPDR S&P 500 ETF is time. That’s also the most important factor in Buffett’s investing success, by the way. Consider that a $10,000 investment in the Vanguard S&P 500 ETF at its inception in September 2010 would be worth close to $68,000. Time is the key reason this total is much lower than the over $233,000 you’d have from investing in the SPDR ETF.

Another critical element of the SPDR S&P 500 ETF’s performance is diversification. The fund owns shares of 500 companies that span multiple sectors and industries.

The third success factor of the ETF is its regular rebalancing. Stocks are frequently added and dropped from the fund’s portfolio. The winners stay in while the losers are eliminated. This survival-of-the-fittest aspect of an S&P 500 index ETF is enormously important.

Dividends also play a huge role in the SPDR S&P 500 ETF’s total returns. Without dividends reinvested, the initial investment of $10,000 would be worth around $130,560. That’s not a bad return, but it’s a lot less than $233,000.

Finally, the SPDR S&P 500 ETF’s low costs affect its ability to achieve great returns. The ETF’s annual expense ratio is 0.0945%. While that’s higher than the expense ratio of 0.03% for the Vanguard S&P 500 ETF, it’s still low relative to many funds.

Could this Buffett ETF turn $10,000 into over $233,000 again?

State Street includes a disclaimer in the fine print of its information about the SPDR S&P 500 ETF Trust: “Past performance is not a reliable indicator of future performance.” This statement is correct. But could this high-flying Buffett ETF turn $10,000 into over $233,000 again? I think it’s possible.

The secrets to the ETF’s past success — time, diversification, rebalancing, dividends, and low costs — should enable it to perform well in the future. However, if I had to choose between the two ETFs in Berkshire’s portfolio, I’d go with the Vanguard S&P 500 ETF instead of the SPDR S&P 500 ETF Trust. The lower cost of the Vanguard ETF should allow it to make a little more money than the SPDR ETF over the long run.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,266!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,047!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,794!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Keith Speights has positions in Berkshire Hathaway and Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Berkshire Hathaway and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

Meet the Warren Buffett ETF That Turned $10,000 Into Over $233,000 was originally published by The Motley Fool

How To Earn $500 A Month From Goldman Sachs Stock Ahead Of Q3 Earnings

Next, we take this amount and divide it by Goldman Sachs’ $12.00 dividend: $6,000 / $12.00 = 500 shares

Investors would need to own 500 Goldman Sachs shares ($258,150 worth) to generate a monthly dividend income of $500.

Assuming a more conservative goal of $100 monthly ($1,200 annually), we do the same calculation: $1,200 / $12.00 = 100 shares, or $51,630 to generate a monthly dividend income of $100.

Note that dividend yield can change on a rolling basis, as the dividend payment and the stock price both fluctuate over time.

The dividend yield is calculated by dividing the annual dividend payment by the current stock price. As the stock price changes, the dividend yield will also change.

For example, if a stock pays an annual dividend of $2 and its current price is $50, its dividend yield would be 4%. However, if the stock price increases to $60, the dividend yield would decrease to 3.33% ($2/$60).

Conversely, if the stock price decreases to $40, the dividend yield would increase to 5% ($2/$40).

Further, the dividend payment itself can also change over time, which can also impact the dividend yield. If a company increases its dividend payment, the dividend yield will increase even if the stock price remains the same. Similarly, if a company decreases its dividend payment, the dividend yield will decrease.

Price Action: Shares of Goldman gained by 2.5% to close at $516.30 on Friday.

On Oct. 9, JMP Securities analyst Devin Ryan maintained Goldman Sachs with a Market Outperform and raised the price target from $525 to $550.

Read More:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Massachusetts Slaps Big Cannabis With $165K Fines For Safety Failures

Massachusetts cannabis regulators have fined two prominent companies, Ascend Wellness Holdings AAWH AAWH and Curaleaf Holdings CURA CURLF, for violations related to consumer safety practices. The fines, totaling $165,000, were issued after both companies self-reported the incidents, according to The Boston Globe.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

Ascend Wellness Faces Track-and-Trace Compliance Issues

Ascend Wellness, which operates three dispensaries in the state, was fined $85,000 for failing to properly comply with Massachusetts’ track-and-trace system. Regulators were unable to verify the delivery of nearly 900 cannabis products due to discrepancies in Ascend’s tracking processes.

The state’s Cannabis Control Commission (CCC) deemed the violations significant, but Ascend’s president and co-founder, Frank Perullo, reassured that the company has implemented corrective measures. “Ascend is fully committed to adhering to the regulations set forth by the CCC and places great importance on compliance,” Perullo said in a statement. “We have already implemented most of the necessary actions and remain dedicated to restoring trust.”

Read Also: Major Cannabis Merger Approved In New York: Can Weed Stock Investors Take Advantage?

Curaleaf Placed On Probation After Contamination Issues

Curaleaf, another major player in the Massachusetts cannabis industry, was fined $80,000 for not adhering to best practices in preventing contamination at its cultivation sites in Amesbury and Webster. Violations, dating back to 2021, included facility maintenance issues such as unsecured doors and gaps in ducts.

The CCC placed Curaleaf on a six-month probation, during which the company must report any pesticide detection and could be subject to third-party testing to ensure compliance.

In response, Curaleaf expressed its dedication to customer safety. “The health and safety of our patients and customers remains our number one priority,” the company said, adding that they have made necessary changes to prevent future issues.

Both companies have committed to improving their operations and working closely with regulators to ensure compliance moving forward.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Soil Compaction Machines Market is Set to Surge at 6.8% CAGR, to Reach US$ 10.6 billion by 2033 | Fact.MR Report

Rockville, MD, Oct. 14, 2024 (GLOBE NEWSWIRE) — The global soil compaction machines market stands at US$ 5.4 billion in 2023 and is projected to reach US$ 10.6 billion by the end of 2033. As per this study by Fact.MR, a market research and competitive intelligence provider, Asia Pacific is estimated to account for a significant share of the global market by the end of the study period (2023 to 2033).

Rising demand for soil compaction machines can be attributed to several prospects such as a growing world population, increasing investments in infrastructure development, and rapid industrialization around the world. Advancements in equipment technology are resulting in the development of more efficient and effective heavy construction equipment, which in turn, is creating an opportune scenario for soil compaction machine sales going forward.

Soil compaction machine manufacturers are continually innovating and launching new products that allow them to maximize their sales and revenue generation potential to stay competitive in the global landscape.

- In 2022, Ammann Group, a renowned Swiss supplier of construction equipment, announced the launch of two new roller machines with good compacting capabilities. Both ARS 30 and ARS 50 were single drum rollers designed to deliver high compaction.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=1978

Key Takeaways from Market Study

- The global soil compaction machines market stands at a valuation of US$ 5.4 billion in 2023.

- Demand for soil compaction machines is projected to expand at a CAGR of 8% from 2023 to 2033.

- Soil compaction machine sales are forecasted to reach US$ 10.6 billion by the end of 2033.

- Increasing investments in infrastructure development activity, high demand for affordable housing, launch of new construction projects, rapid industrialization and urbanization, and launch of new soil compaction machines are key market drivers.

- Soil compaction machine sales in Asia Pacific account for around 25% revenue share of the global market in 2023.

- Sales of soil compaction machines in China are projected to increase at 5% CAGR over the next ten years.

- Heavy soil compaction equipment accounts for more than 70% of the global market revenue at present.

“India, China, Kingdom of Saudi Arabia, and the United Arab Emirates are estimated to offer highly lucrative growth opportunities,” says a Fact.MR analyst

Leading Players Driving Innovation in the Soil Compaction Machines Market

Key Players in the soil compaction machines market are Caterpillar Inc., Volvo Construction Equipment, J.C. Bamford Excavators Limited, John Deere, Zoomlion Heavy Industries Science & Technology Co. Ltd., XCMG Co. Ltd., Sany Heavy Industries Co. Ltd., Fayat Group, Hitachi Construction Machinery, Wacker Neuson SE.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=S&rep_id=1978

Soil Compaction Machines Industry News:

- Dynapac, a Swedish international engineering company, displayed its newest dirt compaction at the American Rental Association (ARA) Show in February 2023. With its 84-inch drum, the CA30 Rhina soil compactor can compact a variety of soil types, making it a multipurpose tool for a wide range of uses.

- To better serve its customers’ diverse needs and maximize the performance of its soil compactors, Volvo Construction Equipment (Volvo CE) announced in March 2023 the introduction of new Compact Assist packages.

- The debut of a new sophisticated and intelligent CCC (continuous compaction control) system for asphalt and soil compactors was announced in June 2022 by Ammann, a well-known international corporation from Switzerland that is recognized for its intelligent soil compaction.

- The well-known construction equipment manufacturer Bobcat Company announced the introduction of new compaction machines in November 2022, marking its entry into the light compaction market. The company introduced nine machines designed for use in construction, roadwork, and landscaping, marking its entry into the light soil compaction market.

Winning Strategy

Development of soil compaction machines with advanced compaction capabilities is the prime focus of all soil compaction machine suppliers. Companies should also experiment with the automation of soil compaction equipment as the popularity of industrial automation increases around the world.

More Valuable Insights on Offer

Fact.MR, in its new offering, presents an unbiased analysis of the global soil compaction machines market, presenting historical demand data (2018 to 2022) and forecast statistics for the period (2023 to 2033).

The study divulges essential insights on the market based on product type (heavy compaction machines, light compaction machines) and application (building & construction, infrastructure, transport, others), across five major regions of the world (North America, Europe, Asia Pacific, Latin America, and MEA).

Check out More Related Studies Published by Fact.MR:

Agriculture Drone Market: Size is estimated at US$ 4.98 billion in 2024 and is evaluated to increase at a CAGR of 14.1% to reach US$ 18.64 billion by the end of 2034.

Blow Moulding Machine Market: Size was valued at US$ 2,443.4 million in 2023 and has been forecasted to expand at a noteworthy CAGR of 3.7% to end up at US$ 3,604.0 Million by 2034.

Land Survey Equipment System Market: Size is expected to reach a valuation of US$ 8,523.2 million in 2024 and is projected to climb to US$ 13,363.4 million by 2034, expanding at a CAGR of 4.6% during the forecast period of 2024 to 2034.

Portable Inverter Generator Market: Size was valued at US$ 3,404.1 million in 2023 and has been forecasted to expand at a noteworthy CAGR of 9.4% to end up at US$ 8,959.8 Million by 2034. The portable inverter generator market accounts for around 19% in overall generator market.

Hydraulic Hammer Market: Size is estimated to reach a value of US$ 1.49 billion in 2024 and is further projected to touch a valuation of US$ 2.64 billion by the end of 2034. Demand is evaluated to expand at a CAGR of 5.9% throughout the projection period (2024 to 2034).

Gasket and Seal Market: Size is estimated to be around US$ 86,936.1 million in 2024. Gasket and seal sales are projected to increase at a CAGR of 2.3%, reaching over US$ 109,133.1 million by 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.