Chinese E-Commerce Firms Alibaba, JD, PDD Gear Up For Singles' Day Shopping Festival

Alibaba Group Holding BABA and other Chinese e-commerce stocks listed in the U.S. continued to see a volatile session Tuesday as the fiscal stimulus by China failed to impress investors.

China’s economy has been battling weak growth, further escalated the domestic crackdown on the hyperscalars.

As the Chinese companies started recuperating from the crackdown, the U.S. launched its semiconductor sanctions on the country, depriving it of advanced artificial intelligence technology and reducing its dependence on the country by consolidating its semiconductor base.

Also Read: Alibaba’s Lazada Courts Armani and Other Luxury Brands, Seeks Edge Over Rivals in Southeast Asia

Chinese e-commerce companies, including JD.com, Inc. JD and PDD Holdings Inc. PDD, continued their downward trajectory on Tuesday.

Reportedly, China is weighing a fiscal stimulus of 6 trillion yuan, or $850 billion, in ultra-long special treasury bonds over the next three years to drive the economy.

Prior reports indicated that China’s central bank planned to slash banks’ reserve requirement ratio (RRR) by 50 basis points or half a percentage point and reduce the seven-day reverse repurchase rate to 1.5% from 1.7% to spur domestic spending.

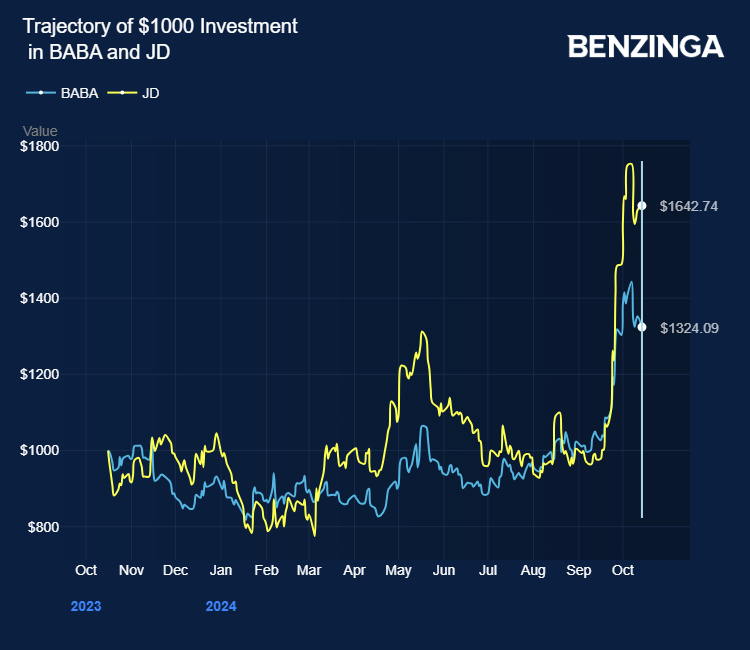

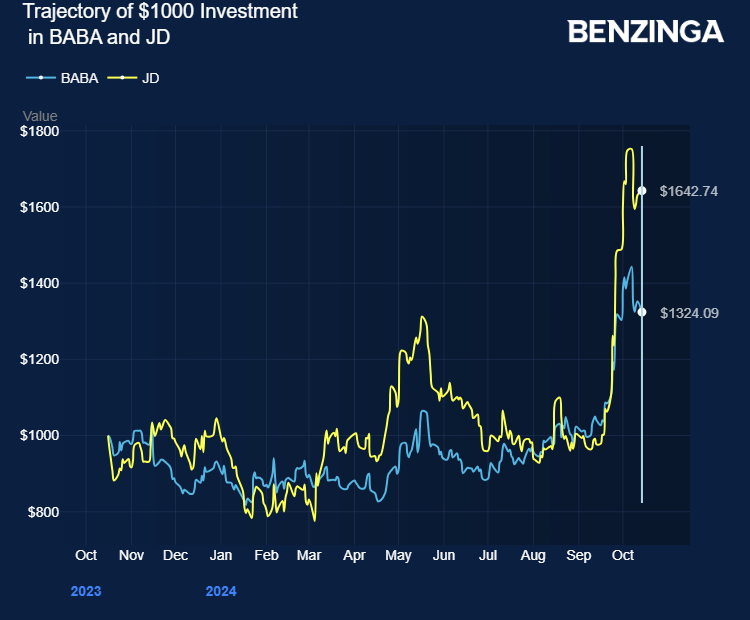

Reportedly, China’s stimulus package on September 24 restored over $3 trillion in market value to Chinese stocks trading in global markets. Alibaba, JD.com, and PDD stocks gained 29%-68% in the last 30 days.

Alibaba, JD.com, and PDD have officially started their promotions for the upcoming Singles’ Day shopping festival as the stimulus reports do the rounds.

The annual festival, which takes place on November 11, launched earlier than previous years in 2024, SCMP reports.

Alibaba launched its presale event on October 16, with at least 50% discounts and free nationwide shipping available across its platforms. JD.com and PDD have also rolled out their Singles’ Day promotions on the same day.

Alibaba has committed over $5.7 billion in resources to bolster its platforms during the event. JD.com has introduced price cuts on over a billion products, with significant discounts on high-ticket items.

Price Actions: At the last check on Tuesday, BABA stock was down 4.17% to $103.31. JD is down 7.68%, PDD is down 5.44%.

Also Read:

Image by Tada Images via Shutterstock

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply