D.R. Horton Unusual Options Activity

Investors with significant funds have taken a bearish position in D.R. Horton DHI, a development that retail traders should be aware of.

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in DHI usually indicates foreknowledge of upcoming events.

Today, Benzinga’s options scanner identified 10 options transactions for D.R. Horton. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 20% being bullish and 50% bearish. Of all the options we discovered, 9 are puts, valued at $283,812, and there was a single call, worth $48,990.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $185.0 and $195.0 for D.R. Horton, spanning the last three months.

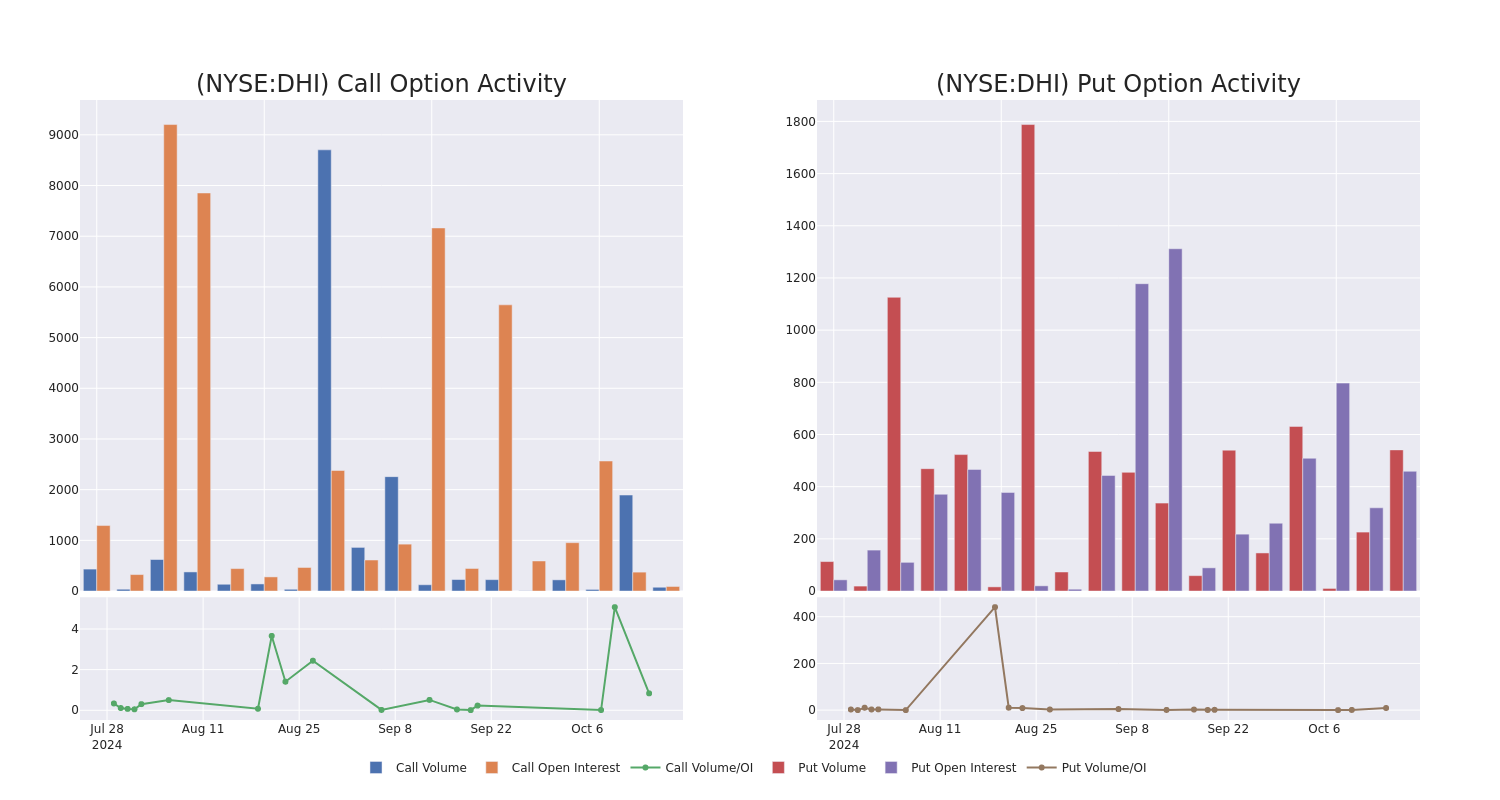

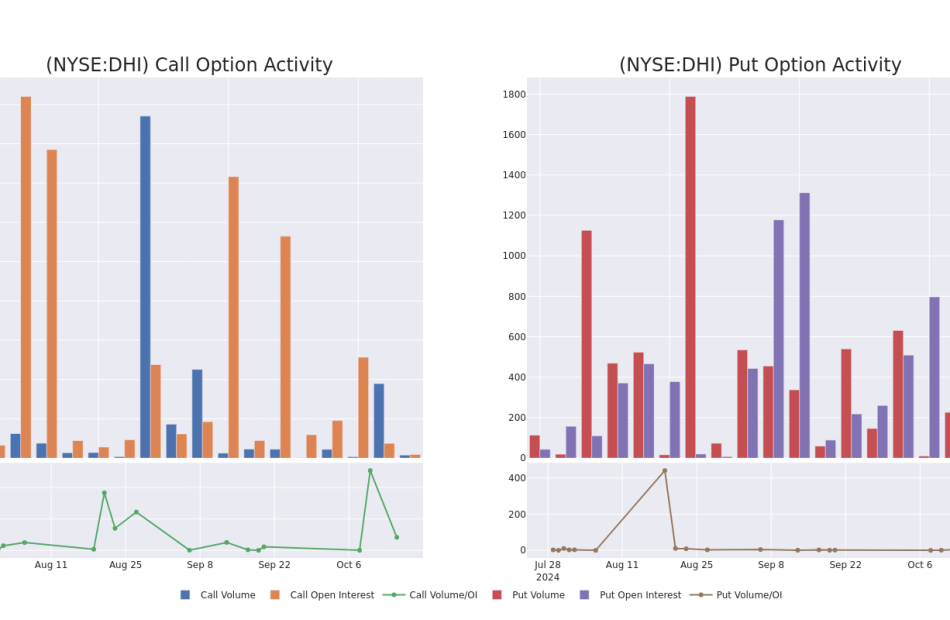

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for D.R. Horton’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of D.R. Horton’s whale trades within a strike price range from $185.0 to $195.0 in the last 30 days.

D.R. Horton Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DHI | CALL | TRADE | BEARISH | 10/25/24 | $7.4 | $6.9 | $6.9 | $185.00 | $48.9K | 90 | 75 |

| DHI | PUT | TRADE | NEUTRAL | 11/15/24 | $10.5 | $10.2 | $10.37 | $195.00 | $41.4K | 224 | 5 |

| DHI | PUT | SWEEP | BEARISH | 01/17/25 | $13.7 | $13.4 | $13.8 | $195.00 | $37.2K | 206 | 45 |

| DHI | PUT | SWEEP | BEARISH | 11/15/24 | $10.5 | $10.2 | $10.38 | $195.00 | $36.7K | 224 | 80 |

| DHI | PUT | SWEEP | BEARISH | 01/17/25 | $13.9 | $13.4 | $13.68 | $195.00 | $30.4K | 206 | 67 |

About D.R. Horton

D.R. Horton is a leading homebuilder in the United States with operations in 118 markets across 33 states. D.R. Horton mainly builds single-family detached homes (over 90% of home sales revenue) and offers products to entry-level, move-up, luxury buyers, and active adults. The company offers homebuyers mortgage financing and title agency services through its financial services segment. D.R. Horton’s headquarters are in Arlington, Texas, and it manages six regional segments across the United States.

Having examined the options trading patterns of D.R. Horton, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is D.R. Horton Standing Right Now?

- With a trading volume of 763,432, the price of DHI is up by 2.42%, reaching $191.63.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 14 days from now.

Expert Opinions on D.R. Horton

1 market experts have recently issued ratings for this stock, with a consensus target price of $215.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from B of A Securities has decided to maintain their Buy rating on D.R. Horton, which currently sits at a price target of $215.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for D.R. Horton, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply