Kevin O'Leary Says 'It's Impossible To Time The Market.' Selling Too Soon Means Missing Out On Big Gains – 'Let The Market Do Its Thing'

You’re not alone if you’ve ever wondered whether it’s better to get in and out of stocks to make a quick profit or stay invested for the long haul. Many investors debate whether “timing the market” or “time in the market” is the smarter strategy.

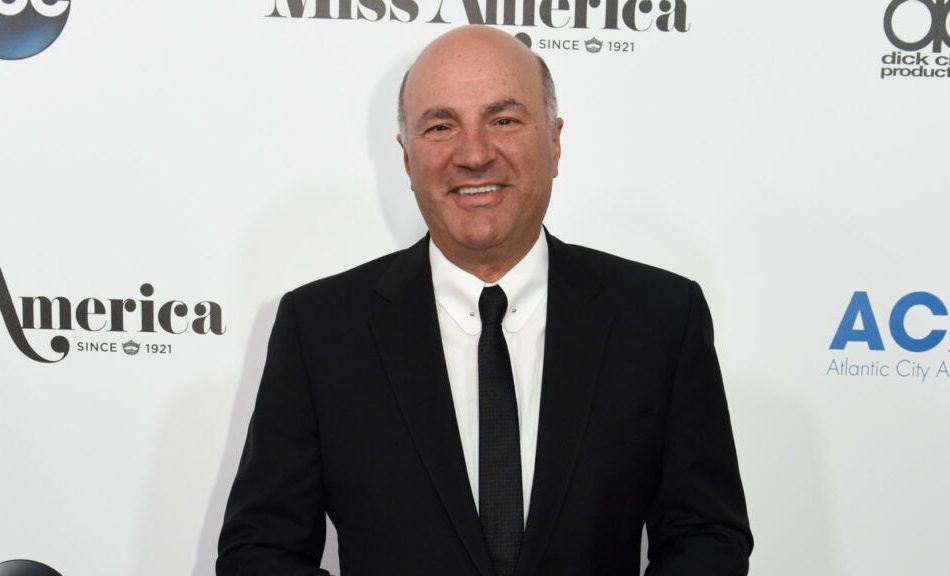

Kevin O’Leary, a well-known investor and television personality, has clarified his position: “It’s impossible to time the market.” He’s not the only one. Legendary investor Warren Buffett has already echoed similar thoughts for decades, urging people to focus on the bigger picture.

Don’t Miss:

Timing the Market Is Risky Business

Kevin O’Leary recently shared his thoughts on investors who try to sell stocks when they believe they’re overvalued. “If you were concerned about valuations, you would have sold all your stock two quarters ago and you would have missed out on a huge part of this year’s gains,” O’Leary pointed out. His message? You can’t predict the market’s ups and downs and trying to do so can cost you.

Trending: This Adobe-backed AI marketing startup went from a $5 to $85 million valuation working with brands like L’Oréal, Hasbro, and Sweetgreen in just three years – here’s how there’s an opportunity to invest at $1,000 for only $0.50/share today.

O’Leary also highlighted that even the pros struggle with this: “88% of managers can’t beat the index. In other words, they can’t beat the S&P 500.” This means that most experts attempting to time the market are losing in the long run.

Instead of timing, O’Leary suggests diversifying your investments, maybe holding more fixed-income products or going to cash temporarily. But he warns against selling everything just because you think you know when the market will dip. It’s just too unpredictable.

Trending: Beating the market through ethical real estate investing’ — this platform aims to give tenants equity in the homes they live in while scoring 17.17% average annual returns for investors – here’s how to join with just $100

Warren Buffett, the “Oracle of Omaha,” has been saying the same thing for years – “Don’t watch the market closely.” He explains that reacting to every little market fluctuation can lead to poor decisions. He recommends that investors concentrate on the company’s long-term potential rather than fretting about day-to-day price fluctuations.

He famously said, “Only buy something that you’d be perfectly happy to hold if the market shuts down for 10 years.” His entire investment philosophy centers around purchasing solid, undervalued firms and remaining loyal to them through good times and bad. To him, investing in quality businesses with good leadership and long-term prospects is more important than trying to make quick profits based on market trends.

See Also: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

Buffett also made an excellent analogy about investing in stocks, comparing it to buying into a local business you believe in. “If you had a chance to buy into a good company in your hometown – and you knew it was a good company and knew good people were running it and you bought in at a fair price, you wouldn’t want to get a quote every day,” he explained.

For him, investing should be about the business itself, not the daily ups and downs of the stock price.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply