Not Dogecoin, Not Shiba Inu But Lesser-Known BOOK OF MEME And Cat In A Dogs World Token Emerge As Best-Performing Cryptos

Memecoins made full use of the return of bullish sentiment on Monday, with the less established ones topping the biggest market gainers list.

What happened: Solana SOL/USD-based BOOK OF MEME pumped over 28% to become the best-performing cryptocurrency in the last 24 hours.

The token spiked to levels not seen since July 30, with trading volume surging over 68% to $702.34 million.

| Cryptocurrency | Gains +/- | Price (Recorded at 11:30 p.m. EDT) |

| BOOK OF MEME (BOME) | +28.76% | $0.01099 |

| Cat in a dogs world (MEW) | +22.00% | $0.008811 |

| Bonk BONK/USD | +10.04% | $0.00002346 |

.Cat-themed memecoin cat in a dogs world occupied the second spot in the biggest 24-hour gainers list after a 22% surge. The coin’s trading volume nearly doubled over the last 24 hours, indicating high buying pressure.

Yet another Solana-based token, Bonk, bounced 10%, becoming the best-performing billion-dollar capitalization meme coin in the 24-hour period.

Blue-chip currencies such as Dogecoin DOGE/USD and Shiba Inu SHIB/USD also saw decent gains, rising 3.78% and 3.13%, respectively.

Overall, the total meme coin market capitalization rose over 6% in the last 24 hours.

The upsurge followed a broader market rally that saw market bellwether Bitcoin BTC/USD surge over 5% to hit levels not seen since late July.

Photo by stockphoto-graf on Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

S&P 500 Extends Record Highs, Dow Breaks 43,000 Ahead Of Pivotal Earnings Week, Bitcoin's Rally Lifts Crypto Stocks: What's Driving Markets Monday?

Both the S&P 500 and the Dow Jones Industrial Average extended their record highs on Monday, reflecting continued bullish sentiment as investors anticipate key corporate earnings reports later this week.

The S&P 500 surged past 5,850 points during midday trading in New York, while the Dow Jones broke above the 43,000 mark for the first time. Wall Street celebrated the two-year anniversary of the bull market’s start.

However, the Nasdaq 100 is still lagging. It gained 0.7% on the day but remains about 1% below its all-time high set on July 10.

Small-cap stocks also advanced, with the Russell 2000 climbing 0.6%. Among sectors, utilities and technology led the gains, while semiconductors and homebuilders were the top-performing industries.

Despite no major economic data releases, U.S. Treasury yields edged higher, with the 10-year yield reaching 4.13%, its highest level since late July. The U.S. dollar also rose by 0.3%.

Commodities were the weakest asset class, weighed down by uncertainty over China’s stimulus measures. Gold, silver, and copper fell 0.4%, 1.2%, and 2%, respectively. Crude oil prices dropped 2.3% as OPEC’s weakening demand outlook dampened sentiment.

Chinese equities, tracked by the iShares MSCI China ETF MCHI, declined 1.1%.

In the crypto space, Bitcoin BTC/USD stood out as the best performer, rallying 4.5% to surpass $65,000. Other cryptocurrencies and crypto-linked stocks followed its lead.

Monday’s Performance In Major US Indices, ETFs

| Major Indices | Price | 1-day %chg |

| S&P 500 | 5,857.62 | 0.7% |

| Nasdaq 100 | 20,409.65 | 0.7% |

| Russell 2000 | 2,245.80 | 0.6% |

| Dow Jones | 43,027.29 | 0.4% |

According to Benzinga Pro data:

- The SPDR S&P 500 ETF Trust SPY rose 0.7% to $583.72.

- The SPDR Dow Jones Industrial Average DIA rose 0.4% to $430.59.

- The tech-heavy Invesco QQQ Trust Series QQQ rallied 0.8% to $497.15.

- The iShares Russell 2000 ETF IWM rose 0.6% to $222.52.

- The Technology Select Sector SPDR Fund XLK outperformed, up 1.2%. The Energy Select Sector SPDR Fund XKE lagged, down 0.3%.

Monday’s Stock Movers

- Vistra Corp. VST surged more than 5% after BNP Paribas initiated coverage with an Outperform rating and a $231 price target.

- Wells Fargo & Co. WFC rallied 3.7%, after soaring 5.6% Friday, after Bank of America Securities raised the price target on the stock from $70 to $75.

- SoFi Technologies Inc. SOFI soared over 9% following the announcement of a major agreement with Fortress Investment Group LLC for its loan-platform business.

- Upstart Holdings Inc. UPST jumped over 4% after Wedbush upgraded the stock to Neutral, boosting its price target from $10 to $45.

- Coinbase Global Inc. COIN, CleanSpark Inc. CLSK and MARA Holdings Inc. MARA rallied 7.7%, 7.3% and 5.4%, respectively, on the heels of Bitcoin’s rally.

Read Next:

Image created using artificial intelligence via Midjourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dow Jones Up As Warren Buffett Buys This Stock; Nvidia Rallies, Eyes Key Milestone (Live Coverage)

The Dow Jones Industrial Average rallied out of the red to set a record high Monday even as Boeing (BA) fell amid heavy job cuts. Warren Buffett-led Berkshire Hathaway (BRKB) increased a holding while famed investor Cathie Wood unloaded a big winner. And Nvidia (NVDA) helped propel the Nasdaq higher on the stock market today as it eyes an important achievement.

Stocks ended the day near session highs. The Dow Jones Industrial Average started out in the hole, but reversed higher and jumped 201 points for the day. This equates to a gain of 0.5% and a fresh closing high. Apple (AAPL), Travelers Cos. (TRV) and McDonald’s (MCD) outperformed.

↑

X

Techs Take Lead As Indexes Extend Gains; Delta, Pulte, Corning In Focus

The Nasdaq composite was off session highs but remained up nearly 1%. It sits more than 5% above its 50-day moving average and less than 200 points from its all-time high. Arm (ARM) continued to build up steam in the tech-heavy index, rising nearly 7%. Marvell Technology (MRVL) also outperformed with a gain of 5%.

Stock Market Today: Tech Shines As Energy Lags

The benchmark S&P 500 gapped up to also hit another record high as it popped 0.9%. Utilities play Vistra (VST) and Qualcomm (QCOM) were strong here. Vistra rallied nearly 6% while Qualcomm gained close to 5%.

The S&P 500 sectors were nearly all positive. Technology and utilities were the best performers while energy was the only area in negative territory.

Volume fell on both the Nasdaq and the New York Stock Exchange compared with Friday, according to early data. Breadth was solid though, with gainers outnumbering decliners by less than 4-to-3 on the Nasdaq and more than 4-to-3 on the NYSE. A total of 232 stocks hit 12-month highs on the NYSE while 305 did the same on the Nasdaq.

Small caps reversed higher, with the Russell 2000 rising 0.7%. Growth stocks were off highs, but the Innovator IBD 50 (FFTY) exchange traded fund was still up 0.8%. It now sits nearly 7% above its 50-day moving average.

03:07 p.m. ET

Industry Groups: These Chip Plays Shine

The relative performance of Investor Business Daily’s 197 industry groups offered a more in-depth perspective of the action on the stock market today.

The chip equipment group — which includes the likes of ASML (ASML) and KLA (KLAC) — was in front. Cable stocks, desktop software plays and wholesale electronics companies were all having strong sessions too.

Other groups that outperformed included building maintenance and services firms, wireless telecom stocks and water supply utilities.

By contrast, the discount retailers group (whose members include Dollar General (DG) and Dollar Tree (DLTR)), toy companies, foreign banks, and oil and gas field services firms were all lagging.

Meanwhile, yields came in mixed. The 10-year Treasury note stood flat at 4.1% while the 2-year dipped five basis points to 3.95%.

02:09 p.m. ET

Magnificent Seven: Nvidia Shines, Eyes Record

The so-called Magnificent Seven group of stocks mostly made gains on the stock market today.

Nvidia stock was up nearly 3% and is closing in on a 140.76 buy point. It got a boost after TD Cowen reiterated the stock as a buy and named it a “top pick.”

Leaderboard stock Nvidia is currently the world’s second-largest company by market cap at $3.397 trillion. If it continues to build on its gains it could surpass current number one Apple (AAPL), which sits at $3.5 trillion.

Outside of Nvidia, Apple was actually faring best among the Magnificent Seven as it rose more than 1%. Google-parent Alphabet (GOOGL) and Microsoft (MSFT) turned in similar gains.

Tesla (TSLA) and Meta Platforms (META) also were each up nearly 1%. E-commerce giant Amazon (AMZN) lagged with a dip of 0.6%.

The Roundhill Magnificent Seven (MAGS) exchange traded fund rose more than 1% Monday. So far in October it holds a slight loss of 0.3%, but it is clear of its major moving averages.

Stock Market Today: Cooked Goose Flashes Sell Signal

One stock that has been disappointing of late is Canada Goose (GOOS)

The clothing stock fell more than 7% in heavy volume and has fallen by a similar amount year to date.

It triggered a sell signal by undercutting the important 50-day moving average. The stock already had a bearish look though, with its 50-day line sitting below its 200-day moving average.

The stock has a poor Relative Strength Rating of 25, which puts it in the bottom quarter of stocks in terms of price performance over the past 12 months.

12:32 p.m. ET

Warren Buffett Hikes Sirius Stake, Stock Pops

There are few money managers followed as closely as legendary value investor Warren Buffett. And the Oracle of Omaha has been on maneuvers once again, with his firm Berkshire Hathaway raising its stake in Sirius XM (SIRI).

The company, which Buffett has led since 1970, bought around 3.6 million shares in the satellite and online radio company last week.

This has increased Berkshire’s holdings in the firm to more than 108 million shares, an SEC filing showed.

Sirius XM stock was in rally mode Monday, jumping nearly 9%. It remains below its 50-day moving average but is nearing a test of the downward-trending line.

Despite this, Sirius stock has taken a pounding so far in 2024. It is now down more than 50% year to date.

These Stocks Test Buy Points

A couple of issues were testing buy points on the stock market today amid the generally positive action.

Columbia Banking System (COLB) is in a buy zone above a 27.08 entry on its weekly chart, according to MarketSurge analysis.

Performance is strong, but not ideal, with its IBD Composite Rating sitting at 89 out of 99. Its Relative Strength Rating comes in at 89 also.

Funds have been heavy buyers recently, with its Accumulation/Distribution Rating coming in at A-. In total, funds currently hold 61% of shares, according to MarketSurge data.

Eaton (ETN) is in the 5% buy zone above a consolidation entry of 345.19, MarketSurge analysis shows. This is a midstage pattern, which is neutral.

The diversified operator has an EPS Rating of 94 out of 99. The firm is a power management play, and operates in the electrical, aerospace and mobility sectors.

10:45 a.m. ET

Boeing Stock Skids Amid Cuts, Profit Warning

There are few industrial behemoths bigger than Boeing. But the stock was falling again on the stock market today amid more negative news.

Last Friday the firm announced it plans cut 10% of its global workforce, roughly 17,000 jobs. In addition, it is delating the launch of its 777X jet. It rounded off a triple helping of disappointing developments by warning that third-quarter sales will come in well below analyst estimates.

Boeing stock was already pressured on labor woes, with a crippling strike hitting the firm after talks broke down.

The Dow Jones giant fell nearly 3% in early Monday trading. It had already been sitting at 23-month lows and is more than 9% below its 50-day moving average.

China e-commerce play PDD (PDD), which is domiciled in Dublin, Ireland, was one of the worst Nasdaq performers as it fell nearly 5%. It tumbled despite the communist country’s finance minister Lan Fo’an announcing more stimulus measures over the weekend.

Stock Market Today: Flutter Rebounds On Upgrade

Gambling play Flutter (FLUT) took a pounding on Friday, ending the session down an eye-watering 8.8%. Crucially, it managed to find support above the 50-day moving average.

It was rallying back in early trade Monday, popping more than 3%. It has now moved back above a 226.40 entry, according to MarketSurge analysis.

Flutter got a boost on the stock market today after Wells Fargo analyst Daniel Politzer upgraded it from equal weight to overweight. He also hiked his target price from 224 to 295.

He said the stock was hit Friday to reflect a “near-worst case U.K. tax scenario,” but he also said the firm should be able to withstand costly regulatory changes “better than smaller competitors.”

Cathie Wood Unloads This Stock After Big Rally

A gambler once advised Kenny Rogers that “you’ve got to know when to fold them.”

And it seems ARK Invest’s Wood has taken those words of wisdom to heart, given she locked in some gains with a stock that’s been on a rip-roaring run in 2024.

Her ARK Innovation ETF (ARKK) sold 142,619 shares of Robinhood Markets (HOOD), which provides an electronic trading platform to facilitate commission-free trading in securities such as stocks and exchange-traded funds.

As of Friday’s close, Robinhood stock had risen by over 106% for the year so far and it added to those gains today.

That was not the only move made by the fund on Friday. It also jettisoned 106,522 shares in Moderna (MRNA).

Moderna is badly underperforming, especially compared to Robinhood. It has fallen more than 41% so far this year.

Stock Market Today: Three Near Entries

With stocks trading around highs it is a good time to be watching for stocks testing entries.

Computer networking play Radware (RDWR) is in the 5% buy zone above a consolidation entry of 23.05, MarketSurge analysis shows. This is an early-stage pattern, which is a bonus.

The stock has an EPS Rating of 93 out of 99. Analysts see per-share earnings rising 81% in 2024 and increasing 13% next year.

Big Money has been buying shares of late, with its Accumulation/Distribution Rating coming in at B+. In total, funds currently hold 46% of shares, according to MarketSurge data.

Celestica, Amalgamated Actionable

Electronic contract manufacturing stock Celestica (CLS) is in the actionable zone above a consolidation buy point of 63.49.

The stock is an excellent all-around performer, with its IBD Composite Rating a best-possible 99. It also has a perfect EPS Rating of 99. This makes it of interest to those following the IBD investing methodology.

Finally, Amalgamated Bank (AMAL) was in the buy zone on the stock market today above a flat-base buy point of 33.24, according to MarketSurge analysis.

It too is strong all-around performer, and holds an IBD Composite Rating of 98. It sits near the summit of the Northeast banks industry group, which ranks 15th out of the 197 tracked by IBD.

Please follow Michael Larkin on X at @IBD_MLarkin for more analysis of growth stocks.

YOU MAY ALSO LIKE:

Cruise Line Stocks Fall After Despite Key Earnings Beat

These Are The five Best Stocks To Buy And Watch Now

Join IBD Live Each Morning For Stock Tips Before The Open

This Is The Ultimate Warren Buffett Stock, But Should You Buy It?

HubSpot Boosts Portfolio With Strategic Buyout: Will the Stock Gain?

HubSpot, Inc. HUBS recently inked a definitive agreement to acquire Cacheflow, an industry leader in B2B subscription billing management and configure, price, quote (CPQ) solution, for an undisclosed amount. Cacheflow will operate as HUBS’ wholly owned subsidiary following the completion of the buyout.

Cascheflow’s AI native billing and subscription management solution is designed to streamline software buying and selling processes in a B2B space. The solution provides a unified, no-code platform for automating the SaaS sales flow.

In 2023, HubSpot introduced Commerce Hubs’ on its smart CRM (Customer Relationship Management) to simplify various processes such as invoicing and payments. HUBS’ Commerce Hub offering has gained solid market traction over the past year. With this acquisition, the company is aiming to further strengthen Commerce Hubs’ functionalities and enhance its prospects across industries.

Cacheflow’s portfolio will make the quote-to-cash process easier, thereby simplifying the buying process and boosting customer satisfaction. It will also strengthen HUBS’ ability to address areas such as upselling, renewals and other commerce functions. Automation of subscription billing and CPQ will enable businesses to close deals faster and expedite revenue collection. A seamless purchasing process will also enhance customer retention. This will also bolster Commerce HUBS’ capabilities in managing clients and transaction data, enhancing enterprises’ visibility and decision-making.

Will This Buyout Drive HUBS’ Share Performance?

Customers appreciate flexibility and customization during product purchases. However, ensuring this in a legacy CPQ system, which involves several steps for product configuration, quote generation and pricing changes, is a time-consuming endeavor. This outdated billing and payment system leads to lengthy sales cycles and inefficient revenue collection. To tackle these challenges, enterprises are increasingly looking for a solution to automate key components of revenue management and enhance customer experience.

The subscription and billing management market is projected to grow at a substantial rate in the upcoming years. By integrating Cacheflow’s AI-powered capabilities into Commerce Hub, HUBS is aiming to capitalize on these evolving market trends. The buyout will augment HubSpot’s ability to address the complete commerce cycle for enterprises. This bodes well for long-term growth.

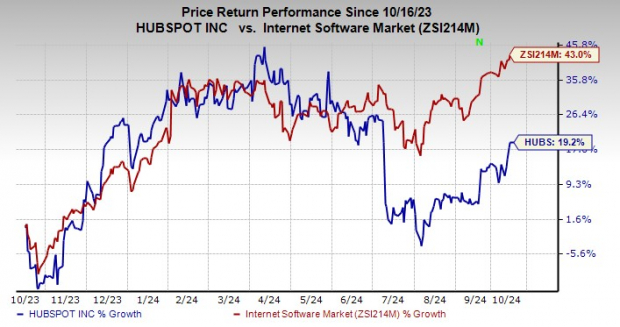

HUBS Stock’s Price Performance

Shares of HubSpot have gained 19.2% over the past year compared with the industry’s 43% growth.

Image Source: Zacks Investment Research

HUBS’ Zacks Rank and Key Picks

HubSpot currently carries a Zacks Rank #3 (Hold).

Zillow Group, Inc. ZG carries a Zacks Rank #2 (Buy) at present. In the last reported quarter, it delivered an earnings surprise of 25.81%.

ZG delivered an earnings surprise of 37.41%, on average, in the trailing four quarters. The company is witnessing solid momentum in rental revenues, driven by growth in both multi and single-family listings, which is a positive factor.

Ubiquiti Inc. sports a Zacks Rank of 1 at present. The company offers a comprehensive portfolio of networking products and solutions for service providers and enterprises.

Its excellent global business model, which is flexible and adaptable to evolving changes in markets, helps it to beat challenges and maximize growth. The company’s effective management of its strong global network of more than 100 distributors and master resellers improved its UI’s visibility for future demand and inventory management techniques.

Workday Inc. sports a Zacks Rank of 1 at present. In the last reported quarter, it delivered an earnings surprise of 7.36%.

WDAY is a leading provider of enterprise-level software solutions for financial management and human resource domains. The company’s cloud-based platform combines finance and HR in a single system that makes the process easier for organizations to provide analytical insights and decision support.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Is What Whales Are Betting On Hilton Worldwide Holdings

Investors with a lot of money to spend have taken a bearish stance on Hilton Worldwide Holdings HLT.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with HLT, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 10 uncommon options trades for Hilton Worldwide Holdings.

This isn’t normal.

The overall sentiment of these big-money traders is split between 30% bullish and 60%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $140,860, and 6 are calls, for a total amount of $734,796.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $200.0 and $240.0 for Hilton Worldwide Holdings, spanning the last three months.

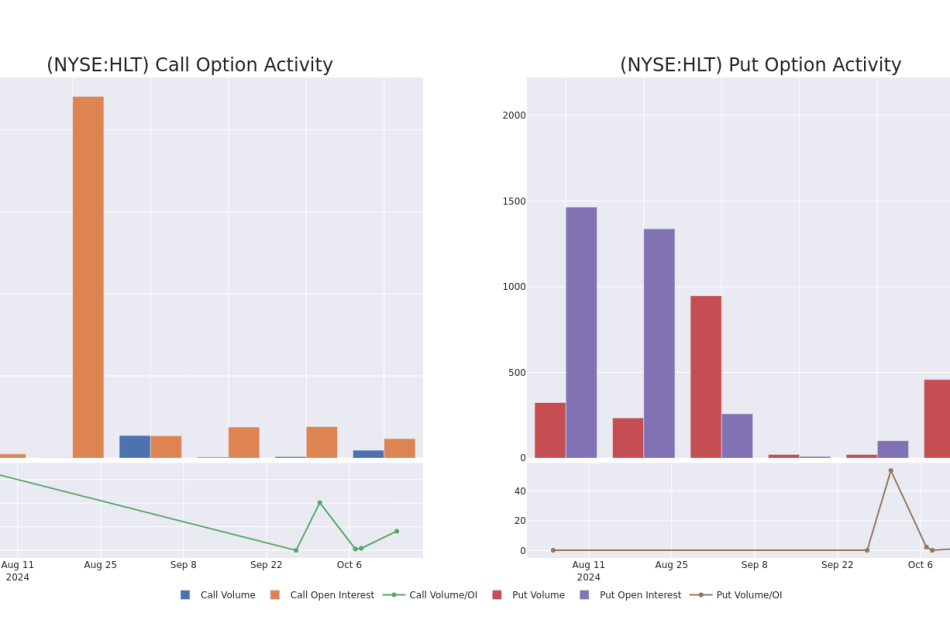

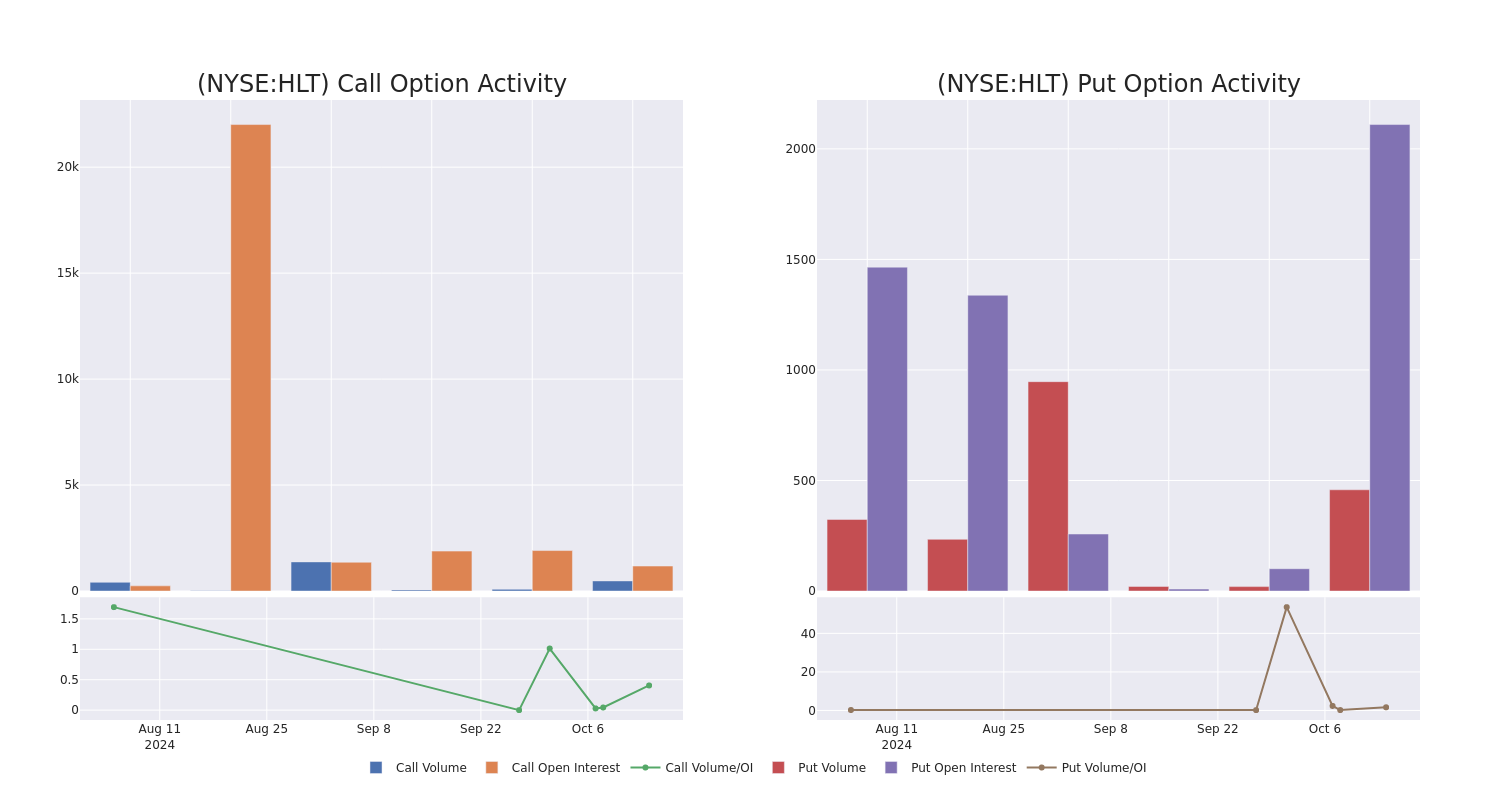

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Hilton Worldwide Holdings’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Hilton Worldwide Holdings’s substantial trades, within a strike price spectrum from $200.0 to $240.0 over the preceding 30 days.

Hilton Worldwide Holdings Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HLT | CALL | SWEEP | NEUTRAL | 11/15/24 | $13.7 | $12.3 | $13.0 | $230.00 | $497.6K | 78 | 401 |

| HLT | CALL | TRADE | BULLISH | 01/16/26 | $50.4 | $49.1 | $50.23 | $210.00 | $100.4K | 251 | 25 |

| HLT | CALL | SWEEP | BEARISH | 10/18/24 | $18.7 | $18.1 | $18.1 | $220.00 | $45.2K | 650 | 37 |

| HLT | PUT | SWEEP | BEARISH | 11/15/24 | $4.2 | $4.1 | $4.19 | $230.00 | $43.6K | 577 | 231 |

| HLT | CALL | TRADE | BEARISH | 10/18/24 | $38.9 | $37.5 | $37.5 | $200.00 | $37.5K | 115 | 10 |

About Hilton Worldwide Holdings

Hilton Worldwide Holdings operates 1.2 million rooms across its more than 20 brands serving the premium economy scale through luxury segments. Hampton and Hilton are the two largest brands, representing 28% and 19%, respectively, of the company’s total rooms, as of Dec. 31, 2023. Recent brands launched over the last few years include Home2, Curio, Canopy, Spark, Tru, Tempo, and LivSmart, as well as a partnership with Small Luxury Hotels and acquisitions of Nomad and Graduate Hotels. Managed and franchised hotels represent the vast majority of adjusted EBITDA, predominantly from the Americas regions.

Having examined the options trading patterns of Hilton Worldwide Holdings, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Hilton Worldwide Holdings Standing Right Now?

- With a trading volume of 1,027,306, the price of HLT is down by -0.16%, reaching $237.76.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 9 days from now.

What Analysts Are Saying About Hilton Worldwide Holdings

In the last month, 1 experts released ratings on this stock with an average target price of $245.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Goldman Sachs has revised its rating downward to Buy, adjusting the price target to $245.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Hilton Worldwide Holdings, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Higher Costs to Hurt Huntington Bancshares' Q3 Earnings, NII to Aid

Huntington Bancshares Incorporated HBAN is slated to report third-quarter 2024 results results on Oct. 17, before the opening bell. The company’s quarterly revenues and earnings are expected to have declined year over year.

In the last reported quarter, the bank recorded a positive earnings surprise of 7.14%. Results have reflected improvements in average loans and deposits. However, a fall in net interest income (NII) and elevated expenses were headwinds.

HBAN has an impressive earnings surprise history. Its earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average beat being 8.87%.

The Zacks Consensus Estimate for HBAN’s third-quarter earnings of 30 cents per share has remained unchanged in the past seven days. The figure indicates a 16.67% decline from the year-ago reported number.

The consensus estimate for revenues is pegged at $1.86 billion, indicating a year-over-year decline of 1.67%.

Key Factors & Estimates for HBAN’s Q3 Result

Loans & NII: On Sept. 18, the Federal Reserve cut the interest rates by 50 basis points to 4.75-5% for the first time since March 2020. While the rate cut is not expected to significantly affect HBAN’s NII in the quarter under review, greater clarity on the Fed’s rate cut path, along with a stabilizing macroeconomic environment, is likely to have aided the lending outlook.

The Zacks Consensus Estimate for NII is pegged at $1.35 billion, indicating a 3% rise sequentially.

Per the Fed’s latest data, the demand for commercial and industrial loans and consumer loans was decent in the third quarter of 2024, while real estate loan was subdued.

Given the company’s significant exposure to commercial loans, HBAN’s lending book is likely to have been supported by the decent demand in commercial loans while the subdued real estate loan demand might have offset growth to some extent.

The Zacks Consensus Estimate for average total earning assets of $180.5 billion for the quarter under review indicates a 1.4% rise from the prior quarter’s levels.

Non-Interest Income: As the central bank lowered the interest rates, mortgage rates started to come down. The rates declined to almost 6.2% by the end of the third quarter. Although mortgage origination volume remained subdued in the quarter under review, refinancing activities witnessed a significant surge supported by lower mortgage rates. This is likely to have supported HBAN’s mortgage banking fees. The Zacks Consensus Estimate for mortgage banking income is pegged at $30.6 million, suggesting a 1.8% increase from the prior quarter’s reported figure.

Global mergers and acquisitions in the third quarter of 2024 showed improvement after subdued 2023 and 2022.

Both deal value and volume were decent during the quarter, driven by solid financial performance, higher chances of a soft landing of the U.S. economy, buoyant markets and interest rate cuts. Also, the performance of the capital markets business, including issuance activities, improved. As a result, the company’s capital markets and advisory fees are expected to have increased.

The Zacks Consensus Estimate for capital markets and advisory fees is pegged at $76.14 million, indicating 4.3% growth sequentially.

The strong performance of the equity market is likely to have supported wealth and asset management revenues during the quarter under review.The Zacks Consensus Estimate for wealth and asset management revenues is pegged at $92 million, indicating a 2.3% rise from the previous quarter’s reported figure.

The consensus estimate for customer deposit and loan fees for the third quarter is pegged at $84.6 million, indicating a rise of 1.9% on a sequential basis. The consensus mark for insurance income of $18.3 million implies a sequential rise of 1.7%.

The consensus mark for total non-interest income is pegged at $507.4 million, indicating a 3.3% sequential rise.

Expenses: Huntington Bancshares’ higher outside data processing and other services expenses, deposit and marketing expenses are anticipated to have raised its costs in the third quarter. Also, the bank’s efforts to expand its commercial banking capabilities in high growth markets by adding more branches and hiring professionals are expected to have contributed to higher costs.

Though strategic efficiency initiatives are likely to reduce expenses to some extent, long-term investments in key growth initiatives are expected to have kept its expense base higher.

Asset Quality: HBAN is likely to have set aside a substantial amount of money for potential delinquent loans, given the expectations of an economic slowdown.

The Zacks Consensus Estimate for total non-performing assets of $780.08 million indicates a marginal increase from the figure reported in the prior quarter.

What Our Model Unveils for HBAN?

Per our proven model, the chances of Huntington Bancshares beating estimates this time are low. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here, as you can see below.

Earnings ESP: Huntington Bancshares has an Earnings ESP of -2.78%.

Zacks Rank: HBAN currently carries a Zacks Rank of 3.

Stocks to Consider

Here are some finance stocks that you may want to consider, as our model shows that these hold the right combination of elements to post an earnings beat this time around.

First Horizon Corporation FHN has an Earnings ESP of +3.18% and carries a Zacks Rank #3 at present. The company is scheduled to release its third-quarter 2024 earnings on Oct. 16.

FHN’s quarterly earnings estimates have been unchanged over the past seven days.

The Earnings ESP for M&T Bank Corporation MTB is +0.33% and it also carries a Zacks Rank #3 at present. The company is slated to report its third-quarter 2024 results on Oct. 17.

The Zacks Consensus Estimate for MTB’s quarterly earnings has remained unchanged in the past seven days.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.