Google Goes Nuclear For AI Power, Israeli Restraint Impacts Stocks, Gold, And Oil

To gain an edge, this is what you need to know today.

Google Goes Nuclear

Please click here for an enlarged chart of Nano Nuclear Energy Inc NNE.

Note the following:

- This article is about the big picture, not an individual stock. The chart of NNE is being used to illustrate the point.

- NNE is a micro reactor company.

- The trendline on the chart shows a steady uptrend since last month on the excitement about the use of nuclear power for AI data centers.

- As full disclosure, there is a position in NNE in The Arora Report’s ZYX Buy Change Alert.

- Alphabet Inc Class C GOOG has decided on nuclear power for AI data centers. Most importantly, Google has signed a Master Plant Development Agreement for smart modular reactors with Kairos Power. The first plant will be deployed by 2030.

- The Google agreement will likely build more excitement for nuclear power. The Arora Report has previously mentioned three conventional nuclear plant operators: Constellation Energy Corp CEG, Vistra Corp VST, and Public Service Enterprise Group Inc. PEG. There are two publicly traded smart modular reactors of note – Nuscale Power Corp SMR and Oklo Inc OKLO.

- There are reports Israel has told the U.S. that Israel will not attack Iran’s nuclear facilities or oil infrastructure. This development is impacting the markets in the following ways:

- Buying in stocks

- Selling in volatility index (VIX) futures

- Selling in the dollar

- Selling in oil

- Selling in gold and silver

- As full disclosure, The Arora Report anticipated this scenario as the highest probability scenario and gave the following signals. Readers of The Arora Report got ahead of the curve when they received a signal to take partial profits on gold ETF SPDR Gold Trust GLD in The Arora Report’s ZYX Allocation as well as silver ETF SLV and gold miner Newmont Corporation NEM in The Arora Report’s ZYX Buy.

- Earnings season is in full swing.

- Among important earnings of note, Bank of America Corp BAC and Goldman Sachs Group Inc GS reported earnings better than the consensus. As full disclosure, BAC is in The Arora Report’s ZYX Buy Core Model Portfolio and is long from $7.69.

- Johnson & Johnson JNJ reported lower than expected earnings.

- The nation’s largest health insurer UnitedHealth Group Inc UNH is lowering its outlook due to rising medical costs.

Magnificent Seven Money Flows

In the early trade, money flows are positive in Apple Inc AAPL, Amazon.com, Inc. AMZN, GOOG, Meta Platforms Inc META, Microsoft Corp MSFT, and Tesla Inc TSLA.

In the early trade, money flows are neutral in NVIDIA Corp NVDA.

In the early trade, money flows are positive in SPDR S&P 500 ETF Trust SPY and Invesco QQQ Trust Series 1 QQQ.

Momo Crowd And Smart Money In Stocks

Investors can gain an edge by knowing money flows in SPY and QQQ. Investors can get a bigger edge by knowing when smart money is buying stocks, gold, and oil. The most popular ETF for gold is SPDR Gold Trust GLD. The most popular ETF for silver is iShares Silver Trust SLV. The most popular ETF for oil is United States Oil ETF USO.

Bitcoin

Bitcoin BTC/USD is range bound.

Protection Band And What To Do Now

It is important for investors to look ahead and not in the rearview mirror.

Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider a protection band consisting of cash or Treasury bills or short-term tactical trades as well as short to medium term hedges and short term hedges. This is a good way to protect yourself and participate in the upside at the same time.

You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges.

A protection band of 0% would be very bullish and would indicate full investment with 0% in cash. A protection band of 100% would be very bearish and would indicate a need for aggressive protection with cash and hedges or aggressive short selling.

It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.

Traditional 60/40 Portfolio

Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time.

Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of five year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.

The Arora Report is known for its accurate calls. The Arora Report correctly called the big artificial intelligence rally before anyone else, the new bull market of 2023, the bear market of 2022, new stock market highs right after the virus low in 2020, the virus drop in 2020, the DJIA rally to 30,000 when it was trading at 16,000, the start of a mega bull market in 2009, and the financial crash of 2008. Please click here to sign up for a free forever Generate Wealth Newsletter.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dental Extraoral CBCT Market to Reach $2.0 Billion, Globally, by 2033 at 9.2% CAGR: Allied Market Research

Wilmington, Delaware, Oct. 15, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Dental Extraoral CBCT Market by Application (Dental implants, Orthodontics, Endodontic and Others), and End User (Hospitals, Dental clinics and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the dental extraoral CBCT market was valued at $0.8 billion in 2023, and is estimated to reach $2.0 billion by 2033, growing at a CAGR of 9.2% from 2024 to 2033.

The global dental extraoral CBCT market is experiencing growth due to increase in the dental disorders and innovation in production which is expected to drive the growth of the dental extraoral CBCT market.

Request Sample of the Report on Dental Extraoral CBCT Market 2033 – https://www.alliedmarketresearch.com/request-sample/A323993

Prime determinants of growth

The global dental extraoral CBCT market is experiencing growth due to several factors such as rising incidence of dental conditions such as cavities, periodontal diseases, and jaw disorders which necessitates advanced diagnostic tools like CBCT for accurate assessment and treatment planning. The surge in demand for cosmetic dental procedures, such as implants, veneers, and orthodontics, drives the need for precise imaging solutions provided by CBCT systems. Furthermore, continuous innovations in CBCT technology, including higher image resolution, reduced radiation exposure, and enhanced software capabilities are making these systems more efficient and appealing to dental professionals.

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $0.8 billion |

| Market Size in 2033 | $1.9 billion |

| CAGR | 9.2% |

| No. of Pages in Report | 280 |

| Segments Covered | Application, End User, and Region |

| Drivers |

|

| Opportunities |

|

| Restraint |

Want to Explore More, Connect to our Analyst – https://www.alliedmarketresearch.com/connect-to-analyst/A323993

Segment Highlights

Dental implants segment dominated the market in 2023

The dominance of the rising demand for dental implants as a preferred solution for tooth replacement, driven by the growing aging population and increased awareness of dental health, boosts the need for advanced imaging technologies like extraoral CBCT. The use of CBCT in implant dentistry leads to better patient outcomes, including reduced surgical time, fewer complications, and higher success rates, contributing to its widespread adoption. Additionally, the growing use of CBCT in other dental specialties, such as orthodontics, endodontics, oral and maxillofacial surgery, and periodontics, further underscores its importance in comprehensive dental care.

Dental clinics segment is likely to be lucrative by 2033

The growth of dental clinics is driven by several key factors, owing to rise in number of people suffering from dental diseases and increase in number of key players offering advanced extra oral CBCT systems. This has led to increase in the number of dental clinics that offer specialized dental treatment. Dental clinics typically handle a higher volume of patients compared to individual practices. The efficiency and thoroughness provided by CBCT systems are essential for managing and diagnosing multiple cases effectively.

Regional Outlook

By region, North America held the largest market share in terms of revenue in 2023, the global dental extraoral CBCT market revenue, and is likely to dominate the market during the forecast period. This is attributed to its advanced technology, strong demand & availability of dental extraoral CBCT, supportive regulatory environment, and collaborative ecosystem fostering innovation and market growth in the dental extraoral CBCT market. However, the Asia-Pacific region is expected to witness rapid industrialization in countries like China and India which has led to the establishment and expansion of manufacturing facilities, including advancements and accessibility of such dental extraoral CBCT products, which is expected to drive the market growth in the forecast period.

For Purchase Related Queries/Inquiry – https://www.alliedmarketresearch.com/purchase-enquiry/A323993

Key Players:

- Imaging Sciences International, LLC

The report provides a detailed analysis of these key players in the global dental extraoral CBCT market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Trending Reports in Healthcare Industry:

Point of Care Diagnostics Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Contraceptives Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Electrophysiology Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Orphan Drugs Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

AVENUE- A Subscription-Based Library (Premium on-demand, subscription-based pricing model) Offered by Allied Market Research:

AMR introduces its online premium subscription-based library Avenue, designed specifically to offer cost-effective, one-stop solution for enterprises, investors, and universities. With Avenue, subscribers can avail an entire repository of reports on more than 2,000 niche industries and more than 12,000 company profiles. Moreover, users can get an online access to quantitative and qualitative data in PDF and Excel formats along with analyst support, customization, and updated versions of reports.

Get an access to the library of reports at any time from any device and anywhere. For more details, follow the link: https://www.alliedmarketresearch.com/library-access

About Allied Market Research:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains. AMR offers its services across 11 industry verticals including Life Sciences, Consumer Goods, Materials & Chemicals, Construction & Manufacturing, Food & Beverages, Energy & Power, Semiconductor & Electronics, Automotive & Transportation, ICT & Media, Aerospace & Defense, and BFSI.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Toll Free: +1-800-792-5285

Int’l: +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What's Going On With Sidus Space Stock Today?

Sidus Space, Inc. SIDU shares are trading lower on Tuesday.

In an SEC filing, the company announced an offering of 3.75 million shares at an assumed price of $2.67 per share. The offering also contains up to 3.745 million pre-funded warrants to purchase up to 3.745 million shares of Class A common stock.

Per Sidus Space, the net proceeds from this offering will be approximately $8.9 million. The firm will use the net proceeds from this offering for sales and marketing, operational costs, product development, manufacturing expansion, and working capital, along with other general corporate purposes.

In a press release, Sidus Space announced that the U.S. Federal Communications Commission (FCC) has approved its operation of a micro constellation of remote sensing, multi-mission satellites in Low Earth Orbit (LEO).

This regulatory milestone is a significant step in Sidus Space’s plans for on-orbit expansion and underscores its strategic commitment to enabling new missions while delivering flexible, cost-effective data acquisition solutions through its innovative data-as-a-service model.

The company retains ownership of the data collected by its LizzieSat sensors for all missions, giving customers a distinct advantage in accessing valuable data streams.

The FCC approval marks a significant milestone for Sidus Space as it expands its on-orbit presence and enhances its capacity to provide a variety of industries with improved real-time, space-based data services.

According to Benzinga Pro, SIDU stock has lost over 79% in the past year.

Price Action: SIDU shares are trading lower by 11.2% to $2.335 at last check Tuesday.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Walgreens Posts Upbeat Earnings, Joins Wolfspeed, Ericsson And Other Big Stocks Moving Higher On Tuesday

U.S. stocks were lower, with the Dow Jones index falling around 100 points on Tuesday.

Shares of Walgreens Boots Alliance, Inc. WBA rose sharply during Tuesday’s session following better-than-expected quarterly earnings.

Walgreens reported fourth-quarter fiscal year 2024 sales of $37.55 billion, up 6% year over year (+6.1% on constant currency), beating the consensus of $35.76 billion, reflecting sales growth across all segments. Adjusted EPS was 39 cents, down 40.8%, beating the consensus of 36 cents, according to data from Benzinga Pro.

Walgreens Boots Alliance, Inc. WBA gained 12.3% to $10.11 on Tuesday.

Here are some other big stocks recording gains in today’s session.

Wolfspeed, Inc. WOLF shares jumped 25% to $14.24 after the company announced it signed a signed a non-binding preliminary memorandum of terms for up to $750 million in proposed direct funding under the CHIPS and Science Act.

MeiraGTx Holdings plc MGTX gained 13.4% to $5.26 after safety and tolerability was confirmed in its gene therapy study for Parkinson’s.

Telefonaktiebolaget LM Ericsson (publ) ERIC climbed 12.5% to $8.48 following a third-quarter earnings beat.

Rumble Inc. RUM gained 9.5% to $5.99.

Montrose Environmental Group, Inc. MEG gained 7.2% to $25.16. Montrose Environmental Group announced a $249 million US Army Corps Of Engineers Environmental Services contract.

TechTarget, Inc. TTGT gained 7.2% to $26.97. Craig-Hallum analyst Jason Kreyer upgraded TechTarget from Hold to Buy and raised the price target from $34 to $36.

Bit Digital, Inc. BTBT gained 5.8% to $3.4813. Bit Digital acquired Enovum Data Centers for total consideration of approximately $46 million.

Ardent Health Partners, Inc. ARDT gained 5.2% to $19.85.

Foot Locker, Inc. FL gained 4% to $24.72.

American Airlines Group Inc. AAL gained 3.3% to $12.27.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Altair Engineering Insider Trades Send A Signal

Disclosed on October 15, George J Christ, 10% Owner at Altair Engineering ALTR, executed a substantial insider sell as per the latest SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Tuesday showed that Christ sold 100,000 shares of Altair Engineering. The total transaction amounted to $9,523,390.

At Tuesday morning, Altair Engineering shares are down by 0.0%, trading at $95.5.

About Altair Engineering

Altair Engineering Inc is a provider of enterprise-class engineering software enabling origination of the entire product lifecycle from concept design to in-service operation. The integrated suite of software provided by the company optimizes design performance across multiple disciplines encompassing structures, motion, fluids, thermal management, system modeling, and embedded systems. It operates through two segments: Software which includes the portfolio of software products such as solvers and optimization technology products, modeling and visualization tools, industrial and concept design tools, and others; and Client Engineering Services which provides client engineering services to support customers. Majority of its revenue comes from the software segment.

Financial Milestones: Altair Engineering’s Journey

Revenue Growth: Altair Engineering’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 5.41%. This indicates a substantial increase in the company’s top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Analyzing Profitability Metrics:

-

Gross Margin: With a high gross margin of 79.49%, the company demonstrates effective cost control and strong profitability relative to its peers.

-

Earnings per Share (EPS): Altair Engineering’s EPS reflects a decline, falling below the industry average with a current EPS of -0.06.

Debt Management: Altair Engineering’s debt-to-equity ratio is below the industry average. With a ratio of 0.33, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Understanding Financial Valuation:

-

Price to Earnings (P/E) Ratio: The current Price to Earnings ratio of 298.62 is higher than the industry average, indicating the stock is priced at a premium level according to the market sentiment.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 12.84, Altair Engineering’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Altair Engineering’s EV/EBITDA ratio stands at 95.97, surpassing industry benchmarks. This places the company in a position with a higher-than-average market valuation.

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Pay Attention to Insider Transactions

It’s important to note that insider transactions alone should not dictate investment decisions, but they can provide valuable insights.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

Unlocking the Meaning of Transaction Codes

When it comes to transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S indicates a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Altair Engineering’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Kevin O'Leary Says 'It's Impossible To Time The Market.' Selling Too Soon Means Missing Out On Big Gains – 'Let The Market Do Its Thing'

You’re not alone if you’ve ever wondered whether it’s better to get in and out of stocks to make a quick profit or stay invested for the long haul. Many investors debate whether “timing the market” or “time in the market” is the smarter strategy.

Kevin O’Leary, a well-known investor and television personality, has clarified his position: “It’s impossible to time the market.” He’s not the only one. Legendary investor Warren Buffett has already echoed similar thoughts for decades, urging people to focus on the bigger picture.

Don’t Miss:

Timing the Market Is Risky Business

Kevin O’Leary recently shared his thoughts on investors who try to sell stocks when they believe they’re overvalued. “If you were concerned about valuations, you would have sold all your stock two quarters ago and you would have missed out on a huge part of this year’s gains,” O’Leary pointed out. His message? You can’t predict the market’s ups and downs and trying to do so can cost you.

Trending: This Adobe-backed AI marketing startup went from a $5 to $85 million valuation working with brands like L’Oréal, Hasbro, and Sweetgreen in just three years – here’s how there’s an opportunity to invest at $1,000 for only $0.50/share today.

O’Leary also highlighted that even the pros struggle with this: “88% of managers can’t beat the index. In other words, they can’t beat the S&P 500.” This means that most experts attempting to time the market are losing in the long run.

Instead of timing, O’Leary suggests diversifying your investments, maybe holding more fixed-income products or going to cash temporarily. But he warns against selling everything just because you think you know when the market will dip. It’s just too unpredictable.

Trending: Beating the market through ethical real estate investing’ — this platform aims to give tenants equity in the homes they live in while scoring 17.17% average annual returns for investors – here’s how to join with just $100

Warren Buffett, the “Oracle of Omaha,” has been saying the same thing for years – “Don’t watch the market closely.” He explains that reacting to every little market fluctuation can lead to poor decisions. He recommends that investors concentrate on the company’s long-term potential rather than fretting about day-to-day price fluctuations.

He famously said, “Only buy something that you’d be perfectly happy to hold if the market shuts down for 10 years.” His entire investment philosophy centers around purchasing solid, undervalued firms and remaining loyal to them through good times and bad. To him, investing in quality businesses with good leadership and long-term prospects is more important than trying to make quick profits based on market trends.

See Also: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

Buffett also made an excellent analogy about investing in stocks, comparing it to buying into a local business you believe in. “If you had a chance to buy into a good company in your hometown – and you knew it was a good company and knew good people were running it and you bought in at a fair price, you wouldn’t want to get a quote every day,” he explained.

For him, investing should be about the business itself, not the daily ups and downs of the stock price.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

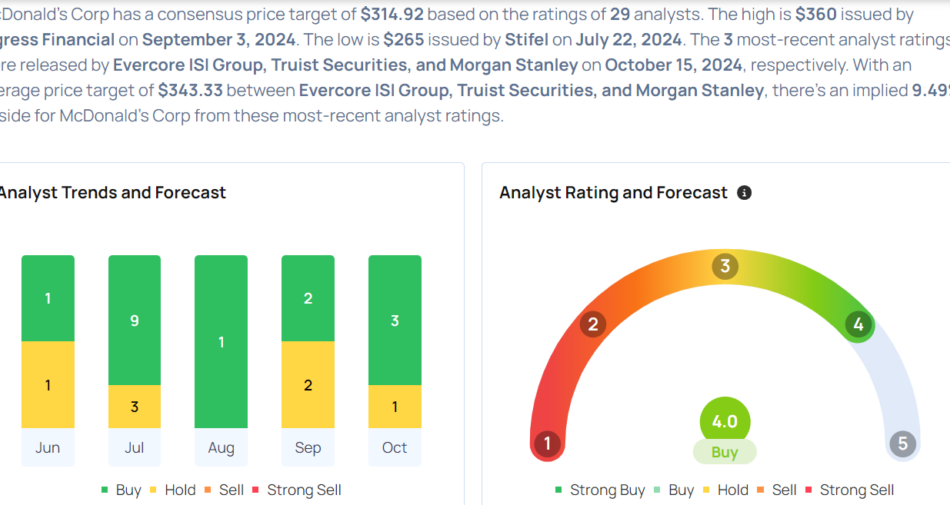

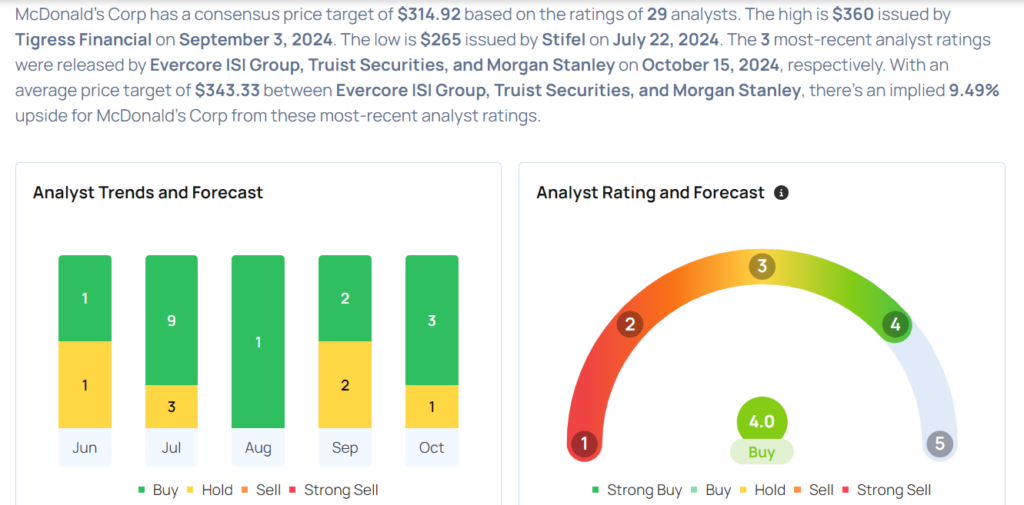

McDonald's To Rally Around 13%? Here Are 10 Top Analyst Forecasts For Tuesday

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

- Scotiabank raised FirstService Corporation FSV price target from $190 to $200. Scotiabank analyst Himanshu Gupta maintained a Sector Perform rating. FirstService shares closed at $184.78 on Monday. See how other analysts view this stock.

- DA Davidson boosted the price target for ACI Worldwide, Inc. ACIW from $52 to $57. DA Davidson analyst Peter Heckmann maintained a Buy rating. ACI Worldwide shares closed at $52.66 on Monday. See how other analysts view this stock.

- UBS cut the price target for Philip Morris International Inc. PM from $105 to $103. UBS analyst Faham Baig maintained a Sell rating. Philip Morris shares closed at $120.08 on Monday. See how other analysts view this stock.

- Wells Fargo raised The Sherwin-Williams Company SHW price target from $350 to $400. Wells Fargo analyst Michael Sison maintained an Equal-Weight rating. Sherwin-Williams shares closed at $384.16 on Monday. See how other analysts view this stock.

- BMO Capital raised S&P Global Inc. SPGI price target from $537 to $589. BMO Capital analyst Jeffrey Silber maintained an Outperform rating. S&P Global shares closed at $527.52 on Monday. See how other analysts view this stock.

- Truist Securities raised McDonald’s Corporation MCD price target from $295 to $350. Truist Securities analyst Jake Bartlett maintained a Buy rating. McDonald’s shares closed at $309.84 on Monday. See how other analysts view this stock.

- Evercore ISI Group raised the price target for Brinker International, Inc. EAT from $69 to $90. Evercore ISI Group analyst David Palmer maintained an In-Line rating. Brinker settled at $87.70 on Monday. See how other analysts view this stock.

- Piper Sandler raised Viper Energy, Inc. VNOM price target from $57 to $61. Piper Sandler analyst Mark Lear maintained an Overweight rating. Viper Energy shares closed at $51.97 on Monday. See how other analysts view this stock.

- Oppenheimer cut the price target for Zimmer Biomet Holdings, Inc. ZBH from $145 to $135. Oppenheimer analyst Steven Lichtman maintained an Outperform rating. Zimmer Biomet shares closed at $104.83 on Monday. See how other analysts view this stock.

- TD Cowen cut SM Energy Company SM price target from $64 to $60. TD Cowen analyst Gabe Daoud upgraded the stock from Hold to Buy. SM Energy shares closed at $44.62 on Monday. See how other analysts view this stock.

Considering buying MCD stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ASML cuts sales forecasts in Q3 earnings published early; shares plummet

By Toby Sterling and Nathan Vifflin

AMSTERDAM (Reuters) -Computer chip equipment maker ASML forecast on Tuesday lower than expected 2025 sales and bookings on sustained weakness in parts of the semiconductor market, pushing its shares to their biggest one-day drop since 1998.

The company said that despite a boom in AI-related chips, other parts of the semiconductor market are weaker for longer than expected, leading companies that make logic chips to delay orders and customers that make memory chips to only plan “limited” new capacity additions.

ASML, Europe’s biggest tech firm, is the leading supplier of equipment used to manufacture chips, with customers including AI chipmaker TSMC of Taiwan, as well as logic chip makers Intel and Samsung, and memory chip specialists Micron and SK Hynix.

The company published its quarterly earnings on its website a day earlier than expected in what a spokesperson described as a “technical error.”

“We expect our 2025 total net sales to grow to a range between 30-35 billion euros, which is the lower half of the range” previously forecast, Chief Executive Christophe Fouquet said in a statement.

Chip market weakness “is expected to continue in 2025, which is leading to customer cautiousness”, he said.

Trading in the shares was halted several times in Amsterdam before they closed down 16% at 668.10 euros.

The company’s earnings showed net profit of 2.1 billion euros on sales of 7.5 billion euros ($8.2 billion), slightly ahead of analyst estimates.

However, the company’s bookings were 2.6 billion euros, well below forecasts that had ranged between 4 billion euros and 6 billion euros.

REDUCED EXPECTATIONS

ASML’s share price slumped over the summer months following news Intel would cut its capital spending, and weakness in memory chip prices.

Still, ASML’s change in outlook was a negative surprise for analysts.

“As recently as early September, management had reiterated that the low-end of the 2025 range was still ‘conservative’,” Citi said in a note.

“We look for additional detail as to the more recent changes in demand that are affecting ASML’s reduced expectation for 2025 and what it means for customer plans for 2026.”

Analyst Michael Roeg of bank Degroof Petercam said he expected ASML’s warning to drag down the wider sector, but noted the company’s sales were still expected to rise in 2025 from 2024.

“There is still no downturn in (demand for equipment) despite sluggish end markets for chips,” he said.

Separately, ASML’s sales to China set a record at 2.79 billion euros, or 47% of its total, in the quarter.

ASML dominates the market for lithography equipment, which uses lasers to help create the circuitry of chips.

While ASML cannot sell its most advanced product range in China due to U.S.-led restrictions, Chinese chipmakers have been investing heavily in its equipment to make older generations of computer chips.

($1 = 0.9172 euros)

(Reporting by Toby SterlingEditing by Tomasz Janowski and Emelia Sithole-Matarise)

Ford Secures Supply Deal With LG Energy For Electric Commercial Vans

Ford Motor Company F disclosed that it inked supply agreements with LG Energy Solution to provide power for its electrified commercial van models in Europe.

As per the contract, LG Energy Solution plans to supply Ford with a total of 109 GWh of batteries for its electric commercial vans beginning in 2026. The contract duration ranges from four to six years.

Both companies also agreed to produce batteries for the current Ford Mustang Mach-E at LG Energy Solution’s Michigan facility starting in 2025 instead of Poland.

This shift aims to enhance business efficiency and leverage competitive market conditions, including IRA tax credits.

David Kim, CEO of LG Energy Solution, said, “These agreements attest to our experience and expertise in powering commercial vehicles with innovative battery technologies designed to handle extreme user environments,”

“Capitalizing on our local production capacity, we will secure leadership in the European market and deliver unmatched values to our customers through advanced battery technologies that effectively address diverse needs.”

This month, the company stated that it sold 23,509 electric vehicles in the three months through the end of September, marking a jump of 12.2% from the corresponding period last year, despite a sales slump for its Mustang Mach-E SUV.

Investors can gain exposure to the stock via First Trust Nasdaq Transportation ETF FTXR and Invesco Exchange-Traded Fund Trust II Invesco S&P Ultra Dividend Revenue ETF RDIV.

Price Action: Ford shares are up 0.18% at $10.94 premarket at the last check Tuesday.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

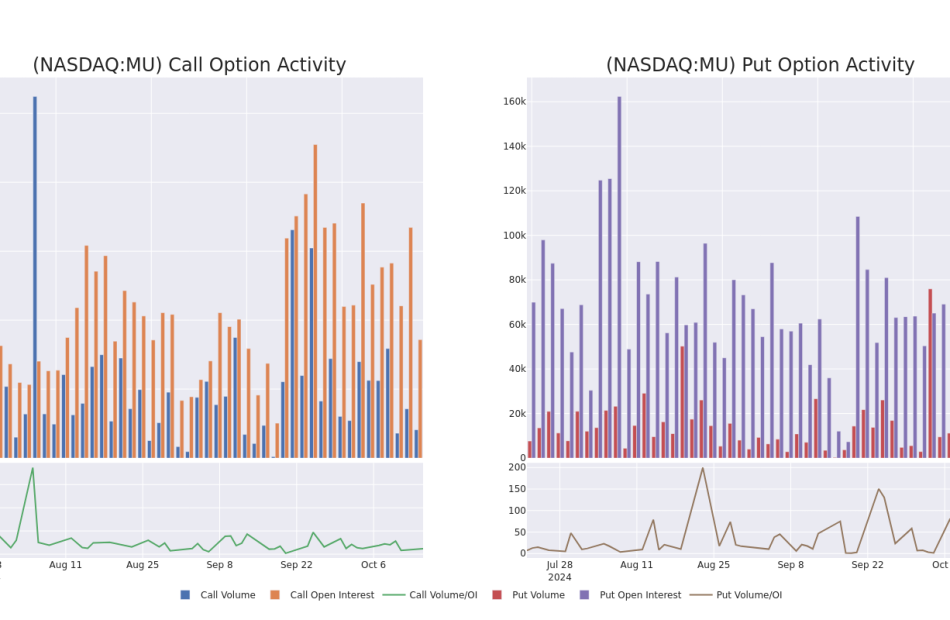

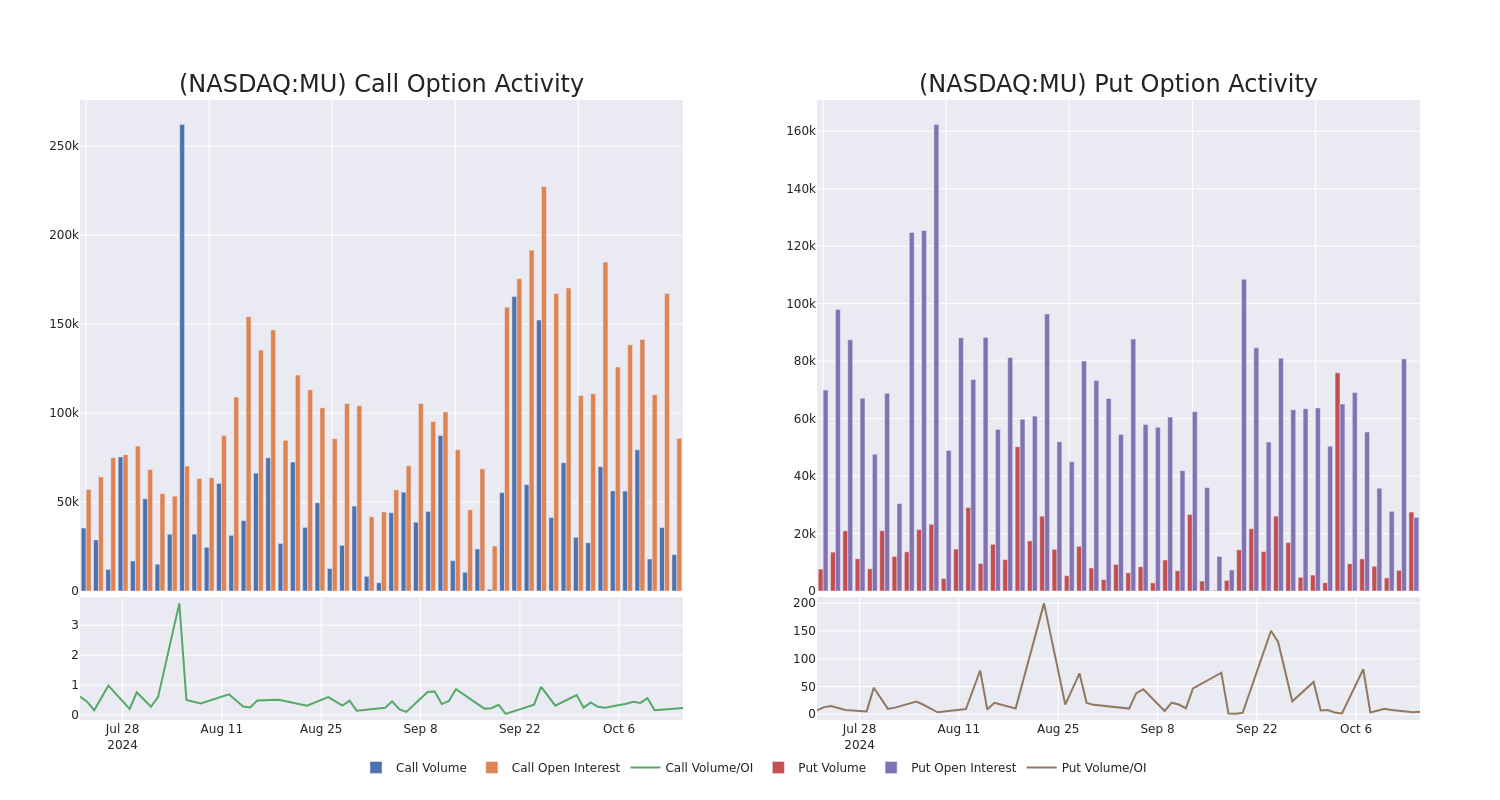

Check Out What Whales Are Doing With Micron Technology

Whales with a lot of money to spend have taken a noticeably bullish stance on Micron Technology.

Looking at options history for Micron Technology MU we detected 38 trades.

If we consider the specifics of each trade, it is accurate to state that 47% of the investors opened trades with bullish expectations and 36% with bearish.

From the overall spotted trades, 10 are puts, for a total amount of $680,046 and 28, calls, for a total amount of $1,689,518.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $45.0 and $190.0 for Micron Technology, spanning the last three months.

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Micron Technology’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Micron Technology’s whale trades within a strike price range from $45.0 to $190.0 in the last 30 days.

Micron Technology Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MU | CALL | SWEEP | BULLISH | 06/18/26 | $25.5 | $24.6 | $25.7 | $115.00 | $385.1K | 276 | 150 |

| MU | PUT | TRADE | BULLISH | 01/17/25 | $13.8 | $13.7 | $13.7 | $115.00 | $274.0K | 4.5K | 200 |

| MU | CALL | TRADE | BULLISH | 06/20/25 | $11.25 | $11.05 | $11.25 | $120.00 | $135.0K | 3.4K | 277 |

| MU | PUT | SWEEP | BEARISH | 10/18/24 | $0.54 | $0.48 | $0.54 | $100.00 | $106.5K | 11.9K | 6.3K |

| MU | CALL | TRADE | BULLISH | 02/21/25 | $3.05 | $3.0 | $3.05 | $135.00 | $91.5K | 4.0K | 807 |

About Micron Technology

Micron is one of the largest semiconductor companies in the world, specializing in memory and storage chips. Its primary revenue stream comes from dynamic random access memory, or DRAM, and it also has minority exposure to not-and or NAND, flash chips. Micron serves a global customer base, selling chips into data centers, mobile phones, consumer electronics, and industrial and automotive applications. The firm is vertically integrated.

Micron Technology’s Current Market Status

- Trading volume stands at 9,812,124, with MU’s price down by -3.09%, positioned at $104.99.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 64 days.

Professional Analyst Ratings for Micron Technology

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $137.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from TD Cowen continues to hold a Buy rating for Micron Technology, targeting a price of $135.

* An analyst from B of A Securities has decided to maintain their Buy rating on Micron Technology, which currently sits at a price target of $125.

* An analyst from Wells Fargo has decided to maintain their Overweight rating on Micron Technology, which currently sits at a price target of $175.

* Consistent in their evaluation, an analyst from TD Cowen keeps a Buy rating on Micron Technology with a target price of $115.

* An analyst from Stifel has decided to maintain their Buy rating on Micron Technology, which currently sits at a price target of $135.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Micron Technology with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.