Bluerock Homes Trust (BHM) Announces Fourth Quarter Dividends on Series A Preferred Stock

NEW YORK, Oct. 14, 2024 /PRNewswire/ — Bluerock Homes Trust, Inc. BHM (the “Company”) today announced that its Board of Directors has authorized and the Company has declared monthly cash dividends on the Company’s Series A Redeemable Preferred Stock (the “Series A Preferred Stock”) for the fourth quarter of 2024, equal to a quarterly rate of $0.375 per share (the “Series A Preferred Dividends”).

The Series A Preferred Dividends will be payable in cash as follows: accrued but unpaid dividends of $0.125 per share to be paid on Tuesday, November 5, 2024 to Series A Preferred stockholders of record as of Friday, October 25, 2024; $0.125 per share to be paid on Thursday, December 5, 2024 to Series A Preferred stockholders of record as of Monday, November 25, 2024; and $0.125 per share to be paid on Friday, January 3, 2025 to Series A Preferred stockholders of record as of Tuesday, December 24, 2024. Newly-issued shares of Series A Preferred Stock held for only a portion of each applicable monthly dividend period will receive a prorated Series A Preferred Dividend based on the actual number of days in the applicable dividend period during which each such share of Series A Preferred Stock was outstanding, as permitted under the Articles Supplementary to the Company’s charter dated March 14, 2023.

The Board of Directors has previously authorized, and in connection with the Series A Preferred Dividends the Company has also declared, enhanced special dividends on the Series A Preferred Stock for the fourth quarter of 2024 (the “Series A Preferred Enhanced Special Dividends”), which will be seamlessly aggregated with the regular monthly Series A Preferred Dividends so as to effect a dividend rate of the average one month term Secured Overnight Financing Rate (the “SOFR Rate”) plus 2.0%, subject to a 6.5% minimum and 8.5% maximum annual rate, calculated and paid monthly. The Series A Preferred Enhanced Special Dividends will be calculated based on the SOFR Rate for each day commencing on the 26th day of the prior month and ending on the 25th day of the applicable month, payable on the 5th of each month.

About Bluerock Homes Trust, Inc.

Bluerock Homes Trust, Inc. BHM, headquartered in New York, New York, is an externally managed REIT that owns and operates high-quality single-family properties located in attractive markets with a focus on the knowledge-economy and high quality of life regions of the Sunbelt and high growth areas of the Western United States. BHM’s principal objective is to generate attractive risk-adjusted investment returns by assembling a portfolio of pre-existing single-family rental homes and developing build-to-rent communities. BHM properties are located across a diverse group of growth markets and will seek to target a growing pool of middle-market renters seeking the single-family lifestyle without the upfront and ongoing investments associated with home ownership. For more information, please visit bluerockhomes.com.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward-looking statements are based upon the Company’s present expectations, but these statements are not guaranteed to occur. Furthermore, the Company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes. Investors should not place undue reliance upon forward-looking statements. For further discussion of the factors that could affect outcomes, please refer to the risk factors set forth in Item 1A of the Company’s Annual Report on Form 10-K filed by the Company with the U.S. Securities and Exchange Commission (“SEC”) on March 12, 2024, and subsequent filings by the Company with the SEC. We claim the safe harbor protection for forward looking statements contained in the Private Securities Litigation Reform Act of 1995.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/bluerock-homes-trust-bhm-announces-fourth-quarter-dividends-on-series-a-preferred-stock-302275357.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/bluerock-homes-trust-bhm-announces-fourth-quarter-dividends-on-series-a-preferred-stock-302275357.html

SOURCE Bluerock Homes Trust, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ethylene Market is Expected to Develop at a Modest 6% CAGR through 2031 | SkyQuest Technology

Westford, USA, Oct. 15, 2024 (GLOBE NEWSWIRE) — SkyQuest projects that the Ethylene market will attain a value of USD 194.7 billion by 2031, with a CAGR of 6% over the forecast period (2024-2031). Rapidly surging demand for packaged products and growing advancements in packaging technology are projected to augment the demand for ethylene in the near future. The increase in use of ethylene derivatives in multiple industry verticals is also estimated to create new opportunities for ethylene companies in the future.

Download a detailed overview: https://www.skyquestt.com/sample-request/ethylene-market

Browse in-depth TOC on “Ethylene Market” Pages – 197, Tables – 95, Figures – 76

Ethylene Market Report Overview:

| Report Coverage | Details |

| Market Revenue in 2023 | $ 129.5 Billion |

| Estimated Value by 2031 | $ 194.7 Billion |

| Growth Rate | Poised to grow at a CAGR of 6% |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Feedstock, Application, End-Use, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the world |

| Report Highlights | Updated financial information/product portfolio of players |

| Key Market Opportunities | High demand for lightweight materials |

| Key Market Drivers | Growing demand for packaging around the world |

Polyethylene Projected to Account for the Highest Ethylene Demand through 2031

Rapidly surging use of low-density and high-density polyethylene products in multiple industry verticals ranging from packaging to automotive are slated to help the dominance of this segment. High demand for lightweight products in different industry verticals is also expected to help ethylene companies generate substantial revenue in the future. Emphasis on sustainability is also a key factor promoting the demand for low-density polyethylene products.

Demand for Ethylene in Automobile Industry is Slated to Surge at a Noteworthy Pace Going Forward

Request Free Customization of this report: https://www.skyquestt.com/speak-with-analyst/ethylene-market

The rising emphasis of vehicle manufacturers on reducing weight to comply with strict emission mandates and improve vehicle efficiency are slated to help promote the use of ethylene in the future. Growing use of lightweight components for manufacturing vehicles and the use of ethylene in engine coolant and antifreeze manufacturing will also create new business scope for ethylene providers in the long run.

Asia Pacific Region Takes the Crown When It Comes to Global Ethylene Demand Outlook

The Asia Pacific region is home to some of the most prominent industrial organizations in the world including a vast range of verticals ranging from food & beverages to automotive. High demand for packaging, rising automotive manufacturing activities, e-commerce boom, and increasing disposable income are some key factors that can directly or indirectly favor the sales of ethylene going forward. India and China are estimated to be the top markets in this region.

Is this report aligned with your requirements? Interested in making a Purchase – https://www.skyquestt.com/buy-now/ethylene-market

Ethylene Market Insights:

Drivers

- High demand for ethylene derivatives

- Rising use of ethylene in packaging products

- Growing demand for packaged products around the world

Restraints

- Fluctuations in raw material pricing and availability

- Stringent regulatory mandates for ethylene use

Prominent Players in Ethylene Market

- Royal Dutch Shell

- ExxonMobil Corporation

- Sinopec

- LyondellBasell Industries N.V.

- Saudi Basic Industries Corporation (SABIC)

- Dow Chemical Company

- Total S.A.

- Chevron Phillips Chemical Company

- Formosa Plastics Corporation

- INEOS Group AG

Key Questions Answered in Ethylene Market Report

- What drives the global Ethylene market growth?

- Who are the leading Ethylene providers in the world?

- Which region leads the demand for Ethylene in the world?

This report provides the following insights:

- Analysis of key drivers (high use of ethylene derivatives, growing demand for packaging products), restraints (fluctuations in raw material availability and pricing, strict regulations regarding ethylene use), and opportunities (rising demand for lightweight products in multiple industries), influencing the growth of Ethylene market.

- Market Penetration: All-inclusive analysis of product portfolio of different market players and status of new product launches.

- Product Development/Innovation: Elaborate assessment of R&D activities, new product development, and upcoming trends of the Ethylene market.

- Market Development: Detailed analysis of potential regions where the market has potential to grow.

- Market Diversification: Comprehensive assessment of new product launches, recent developments, and emerging regional markets.

- Competitive Landscape: Detailed analysis of growth strategies, revenue analysis, and product innovation by new and established market players.

Related Reports:

Plastic Market: Global Opportunity Analysis and Forecast, 2024-2031

Coating Resins Market: Global Opportunity Analysis and Forecast, 2024-2031

Green Cement Market: Global Opportunity Analysis and Forecast, 2024-2031

Petrochemicals Market: Global Opportunity Analysis and Forecast, 2024-2031

Toluene Market: Global Opportunity Analysis and Forecast, 2024-2031

About Us:

SkyQuest is an IP focused Research and Investment Bank and Accelerator of Technology and assets. We provide access to technologies, markets and finance across sectors viz. Life Sciences, CleanTech, AgriTech, NanoTech and Information & Communication Technology.

We work closely with innovators, inventors, innovation seekers, entrepreneurs, companies and investors alike in leveraging external sources of R&D. Moreover, we help them in optimizing the economic potential of their intellectual assets. Our experiences with innovation management and commercialization has expanded our reach across North America, Europe, ASEAN and Asia Pacific.

Contact:

Mr. Jagraj Singh

Skyquest Technology

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 351-333-4748

Email: sales@skyquestt.com

Visit Our Website: https://www.skyquestt.com/

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Paints & Coatings Market Estimated to Reach $227.5 billion by 2029 Globally, at a CAGR of 3.2%, says MarketsandMarkets™

Delray Beach, FL, Oct. 15, 2024 (GLOBE NEWSWIRE) — The Paints & Coatings Market by Resin Type (Acrylic, Alkyd, Epoxy, Polyurethane, Fluoropolymer, Vinyl, Polyester), Technology (Waterborne Coatings, Solvent-borne Coatings, Powder Coatings), End Use (Architectural, Industrial), Region – Global Forecast to 2029, is projected to reach a market size of USD 227.5 billion by 2029 from USD 194.5 billion in 2024, at a CAGR of 3.2%. The Asia pacific is one of the prominent consumers of paints & coatings across the globe. Currently, the requirement for paints & coatings is growing tremendously for automotive, packaging, construction, electronics, and others. The growth of the emerging economies as China, India, Brazil and Mexico among others contribute significantly for the development of the global paints & coatings market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=156661838

Browse in-depth TOC on “Paints & Coatings Market”

592 – Market Data Tables

67 – Figures

452 – Pages

List of Key Players in Paints & Coatings Market:

- Akzo Nobel N.V. (Netherlands)

- PPG Industries Inc. (US)

- The Sherwin-Williams Company (US)

- Axalta Coating Systems LLC. (US)

- Jotun A/S (Norway)

Drivers, Restraints, Opportunities and Challenges in Paints & Coatings Market:

- Driver: Environmental regulations boosting the demand for VOC-free coatings

- Restraint: Requirement of more drying time for waterborne coatings

- Opportunity: Increasing applications of fluoropolymers in the building & construction industry

- Challenge: Difficulties: Strict regulations

Key Findings of the Study:

- Growing share of waterborne coatings to support eco-friendly coatings

- Acrylic Resins is projected to be the fastest growing resin type of paints & coatings market.

- Asia Pacific leads the paints & coatings market with global growth trends and regional shifts

Get Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=156661838

The major markets are in Asia Pacific, followed by North America and Europe. The Asia Pacific region’s growth is mostly attributable to strong economic growth and significant investments made in a range of industries, including general industrial, construction, automobile OEMs, and architecture. The manufacturing sector has benefited greatly from the global economic recovery, while the demand for new residential development and infrastructure has been fueled by rising urbanization.

The construction and renovation of roads, bridges, water and sewer systems, smart cities, and other infrastructure have increased demand for paints and coatings. In contrast, industrialized economies such as the US, Germany, UK, France, and Japan have matured markets for paints & coatings. As a result, in order to combat concerns such as declining sales, many businesses are refocusing their efforts in areas with consistent demand.

Get 10% Customization on this Report: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=156661838

Economic uncertainty, erratic raw material costs, unstable foreign exchange rates, sluggish economic growth, and the disparity between raw material supply and demand are the main obstacles faced by producers of paints & coatings in developed nations. In order to maintain their competitive edge and take advantage of the rising demand for paints and coatings worldwide, these factors have forced manufacturers to investigate new strategies, such as diversifying their product portfolios, investing in research and development, and increasing their presence in emerging markets.

Browse Adjacent Markets: Coatings Adhesives Sealants and Elastomers Market Research Reports & Consulting

Related Reports:

- Flexible Packaging Market – Global Forecast to 2027

- Green Hydrogen Market – Global Forecast to 2030

- Methanol Market – Global Forecast to 2028

About MarketsandMarkets™ MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report. MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients. Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes. The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing. Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook. Contact: Mr. Rohan Salgarkar MarketsandMarkets Inc. 1615 South Congress Ave. Suite 103, Delray Beach, FL 33445 USA : 1-888-600-6441 UK +44-800-368-9399 Email: sales@marketsandmarkets.com Visit Our Website: https://www.marketsandmarkets.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Orthopedic Surgical Robot Market is Projected to Reach a Valuation of US$ 8.34 Billion at a CAGR of 13.5% by 2034 | Fact.MR Report

Rockville, MD , Oct. 15, 2024 (GLOBE NEWSWIRE) — Fact.MR, a market research and intelligence provider, states in its latest industry report that the global orthopedic surgical robot market is estimated to reach a valuation of US$ 2.35 billion in 2024 and further expand at a CAGR of 13.5% from 2024 to 2034.

The number of surgical procedures conducted each year is increasing across the world, leaving surgeons to have to execute more difficult and time-consuming procedures. Fractures are becoming one of the main forces behind the increased demand for robotic arms; these robotic arms can print a 3D image of the shattered bone fragment, allowing surgeons to connect the 3D portion to the wounded location and treat the patient.

As the prevalence of osteoarthritis rises, more patients seek total knee replacement surgery to alleviate the discomfort caused by arthritis. People with arthritis have difficulty walking and climbing stairs, but surgery allows them to regain their fitness. The elderly population is increasing, as are orthopedic problems such as osteoporosis. The number of procedures is growing as the incidence of orthopedic problems grows. This is boosting the production of surgical robots.

For More Insights into the Market, Request a Sample of this Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=10148

Key Takeaways from the Market Study:

- The global orthopedic surgical robot market is forecasted to reach a valuation of US$ 8.34 billion by the end of 2034.

- North America is evaluated to hold a global market share of 51.2% by 2034.

- The market in East Asia is forecasted to expand at a noteworthy CAGR of 15.8% from 2024 to 2034.

- The United States is projected to occupy a share of 94.4% of the North American market by 2034. Sales of orthopedic surgical robots in the country are evaluated to rise at a CAGR of 13.3% through 2034.

- The South Korean market is forecasted to expand at a CAGR of 15.9% from 2024 to 2034.

- Based on product type, sales of disposable orthopedic surgical robots are set to reach US$ 885.5 million in 2024.

“Orthopedic surgical robots enhance surgical precision and reduce surgery time, which leads to higher success rates and improved patient experience. This is a major factor driving market growth,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Orthopedic Surgical Robot Market:

Medrobotics Corporation; Medtronic; Renishaw Plc; Smith and Nephew; Stryker Corporation; THINK Surgical Inc.; Transenterix; Zimmer Biomet; Accuracy Incorporated; Globus Medical; Auris Health Inc.; Johnson & Johnson Services Inc.; Nordson Corporation; OMNLife Science Inc.; Intuitive Surgical; Wright Medical Group N.V.

Focus on Reducing Risks During Orthopedic Surgery:

Orthopedic robots make it easier to insert implants accurately and provide tailored treatment to patients. They can reduce tissue injury, blood loss, and complication risk. They are at the core of the push toward digitally assisted surgery and the ongoing hunt for surgical innovation. Orthopedic businesses are taking note and pushing the boundaries to enhance robotic platforms beyond their existing capabilities.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=S&rep_id=10148

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the orthopedic surgical robot market for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on product type (systems, disposables), application (partial knee replacement, total knee replacement, MIS fusion, other indications), and end user (hospitals, ambulatory surgical, specialty clinics), across seven major regions of the world (North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, and MEA).

Orthopedic Surgical Robot Industry News:

Stryker completed the acquisition of Vocera Communications in February 2022. Our aspirations for digital advancement can now be accelerated and innovations can be advanced thanks to this acquisition. The addition of Vocera to Stryker’s Medical business expands the company’s focus on reducing adverse events throughout the continuum of care and improves the company’s Advanced Digital Healthcare services.

Checkout More Related Studies Published by Fact.MR Research:

Orthopedic Surgical Robot Market: As per a new study released by Fact.MR, the global orthopedic surgical robot market is poised to reach a size of US$ 2.35 billion in 2024 and thereafter increase at a CAGR of 13.5% to climb to a value of US$ 8.34 billion by the end of 2034.

Radiosurgery and Radiotherapy Robots Market: The global radiosurgery and radiotherapy robots market is set to enjoy a valuation of US$ 5.8 billion in 2022. Worldwide sales of radiosurgery and radiotherapy robots are predicted to increase at a steady CAGR of 4.6% to reach a market valuation of US$ 7.1 billion by the end of 2026.

X-ray-based Robots Market: Worldwide sales of X-ray-based robots are anticipated to increase at a high-value CAGR of 7.1% from 2022 to 2027. In 2022, the global X-ray-based robots market is valued at US$ 4.25 billion and is projected to reach a market size of US$ 6 billion by 2027.

Orthopedic Braces and Support System Market: Sales of orthopedic braces and support systems are slated to accelerate at a CAGR of 6% to top US$ 5.5 Bn by 2031. Demand for knee braces and supports is set to increase at a CAGR of 5% across the assessment period of 2021 to 2031.

Orthopedic Devices Market: The global orthopedic devices market is estimated to evolve at a CAGR of 4% from 2023 to 2033. At present, the market is valued at US$ 45 billion and is thus expected to reach a size of US$ 67 billion by the end of 2033.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade Finance Market is Expected to Grow at a CAGR of 7.5% through 2031 | SkyQuest Technology

Westford, USA, Oct. 15, 2024 (GLOBE NEWSWIRE) — SkyQuest projects that the trade finance market will attain a value of USD 87.81 billion by 2031, with a CAGR of 7.5% over the forecast period (2024-2031). Increasing international trade volumes, ongoing digital transformation, and the rise of emerging economies as key players in global trade are slated to drive the demand for Trade Finance over the coming years. Reduced paperwork, enhanced transparency, and accelerated transaction speeds are some key benefits of trade finance that are expected to benefit market development in the future.

Download a detailed overview: https://www.skyquestt.com/sample-request/trade-finance-market

Browse in-depth TOC on “Trade Finance Market” Pages – 197, Tables – 95, Figures – 76

Trade Finance Market Overview:

| Report Coverage | Details |

| Market Revenue in 2023 | $49.24 Billion |

| Estimated Value by 2031 | $87.81 Billion |

| Growth Rate | Poised to grow at a CAGR of 7.5% |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Instrument Type, Service Provider, Trade Type, Enterprise Size, Industry, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the world |

| Report Highlights | Updated financial information/product portfolio of players |

| Key Market Opportunities | Use of blockchain and artificial intelligence technologies |

| Key Market Drivers | Increasing international trade volume |

Credit and Guarantees Account for a Dominant Share of the Global Trade Finance Demand

High use of credit by trade organizations around the world for their operations is projected to help the high market share of the credit and guarantees segment. Rising volume of international trade transactions and the growing need for bigger capital are also expected to help promote the dominance of this segment over the coming years.

Request Free Customization of this report: https://www.skyquestt.com/speak-with-analyst/trade-finance-market

Demand for Trade Finance for Agriculture Applications is Slated to Rise at a Noteworthy Pace Going Forward

Rapidly increasing global population and expansion of commodity markets have resulted in the growing need for trade finance in the agriculture industry. Rising imports and exports of different agricultural products around the world are also expected to help create new opportunities for trade finance companies in the future. Rising emphasis of governments to improve food security of their countries will also benefit trade finance market growth going forward.

North America Estimated to Spearhead the Demand for Trade finance Owing to High Trade Activity

North America has emerged as a global trade hub for multiple commodities, and this has allowed it to become the top spot for trade finance companies as well. The presence of a strong economy and robust international trade activity in this region are also expected to generate new business scope for trade finance providers in the long run. The United States and Canada are slated to bring in major revenue for trade finance companies operating in the North American region.

Trade Finance Market Insights:

Drivers

- Growing international trade volumes

- Increasing development of emerging economies around the world

- High demand for capital for trade

Restraints

- High complexity of trade finance offerings

- Increasing costs of trade finance services

Prominent Players in Trade Finance Market

- Citigroup Inc. (US)

- BNP Paribas SA (France)

- HSBC Holdings plc (UK)

- Mitsubishi UFJ Financial Group, Inc. (Japan)

- JPMorgan Chase & Co. (US)

- UniCredit S.p.A. (Italy)

- Credit Agricole Group (France)

- Santander Group (Spain)

- Bank of America Corporation (US)

- Standard Chartered Bank (UK)

Key Questions Answered in Trade Finance Market Report

- What drives the global market growth?

- Who are the leading Trade Finance providers in the world?

- Which region leads the demand for Trade Finance in the world?

Is this report aligned with your requirements? Interested in making a Purchase – https://www.skyquestt.com/buy-now/trade-finance-market

This report provides the following insights:

Analysis of key drivers (rapidly increasing international trade volumes, rising development of emerging countries), restraints (complexity of trade finance offering, high costs of trade finance services), and opportunities (use of blockchain and artificial intelligence technologies), influencing the growth of Trade Finance market.

- Market Penetration: All-inclusive analysis of product portfolio of different market players and status of new product launches.

- Product Development/Innovation: Elaborate assessment of R&D activities, new product development, and upcoming trends of the Trade Finance market.

- Market Development: Detailed analysis of potential regions where the market has potential to grow.

- Market Diversification: Comprehensive assessment of new product launches, recent developments, and emerging regional markets.

- Competitive Landscape: Detailed analysis of growth strategies, revenue analysis, and product innovation by new and established market players.

Related Reports:

Specialty Insurance Market: Global Opportunity Analysis and Forecast, 2024-2031

Microfinance Market: Global Opportunity Analysis and Forecast, 2024-2031

Banknote Market: Global Opportunity Analysis and Forecast, 2024-2031

Insurance Brokerage Market: Global Opportunity Analysis and Forecast, 2024-2031

Commercial Insurance Market: Global Opportunity Analysis and Forecast, 2024-2031

About Us:

SkyQuest is an IP focused Research and Investment Bank and Accelerator of Technology and assets. We provide access to technologies, markets and finance across sectors viz. Life Sciences, CleanTech, AgriTech, NanoTech and Information & Communication Technology.

We work closely with innovators, inventors, innovation seekers, entrepreneurs, companies and investors alike in leveraging external sources of R&D. Moreover, we help them in optimizing the economic potential of their intellectual assets. Our experiences with innovation management and commercialization have expanded our reach across North America, Europe, ASEAN and Asia Pacific.

Contact:

Mr. Jagraj Singh

Skyquest Technology

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 351-333-4748

Email: sales@skyquestt.com

Visit Our Website: https://www.skyquestt.com/

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

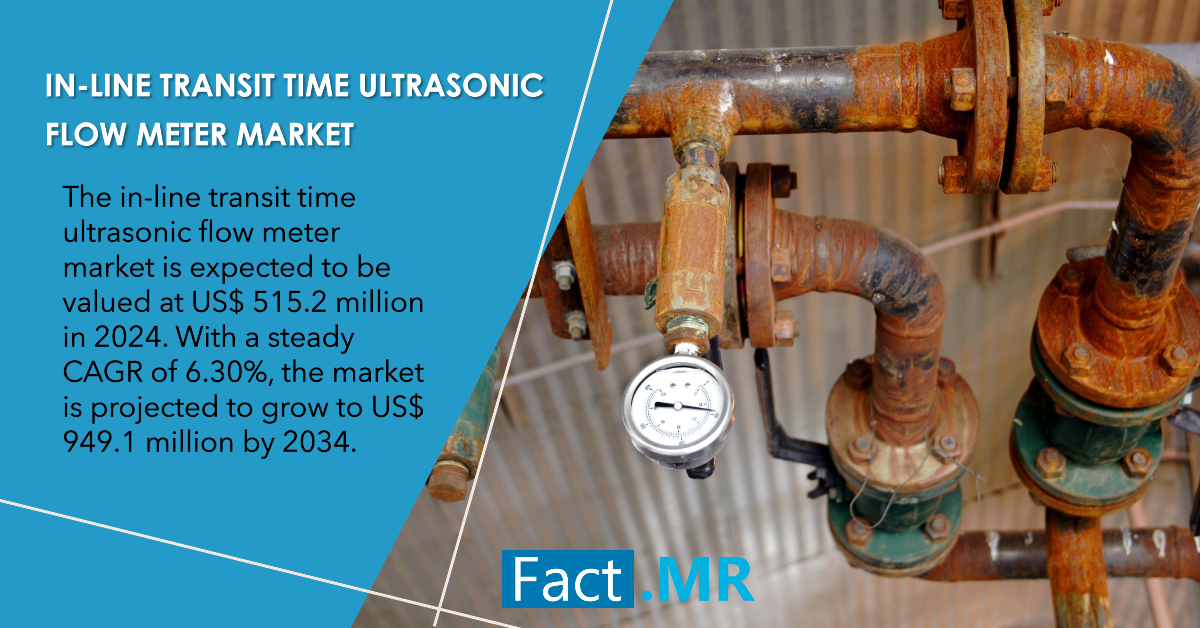

In-Line Transit Time Ultrasonic Flow Meter Market is Projected to Reach US$ 949.1 Million by 2034 | Fact.MR Report

Rockville, MD , Oct. 15, 2024 (GLOBE NEWSWIRE) — The global In-Line Transit Time Ultrasonic Flow Meter Market is estimated to be US$ 515.2 million in 2024 and is projected to grow steadily with a 6.30% CAGR through 2034. The market is projected to surpass a valuation of US$ 949.1 million by 2034.

In-line transit time ultrasonic flow meters are gaining a lot of impetus in industrial and commercial settings as they provide accurate and non-intrusive flow measurement solutions. Industries and manufacturing units are increasingly preferring these flow meters due to their capability to offer precise and non-disruptive measurement solutions for fluid flow.

The significance of these flow meters is also touching the skies, especially in industries where precision, efficiency, and environmental considerations are of paramount importance. These manufacturing units use flow meters to optimize their fluid processes, ensuring precision and efficiency in every operation. This increased significance has pushed the demand for

in-line transit time ultrasonic flow meters to unprecedented levels.

Businesses and manufacturing units also prefer these flow meters as they offer unrivaled precision, efficiency, and environmental compatibility. Businesses in pharmaceutical manufacturing, chemical processing, or other precision-critical industries rely on in-line transit time ultrasonic flow meters to provide highly accurate measurements.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=9691

Key Takeaways from the Market Study:

- The global in-line transit time ultrasonic flow meter market is projected to expand at a CAGR of 6.30% for the forecast period of 2024 to 2034.

- The North American in-line transit time ultrasonic flow meter market is expected to grow at a CAGR of 6.50% from 2024 to 2034.

- The United States holds a dominant share of 68.30% of the in-line transit time ultrasonic flow meter market in the North American region.

- China dominates the in-line transit time ultrasonic flow meter market in the East Asian region, valued at US$ 100.5 million in 2024.

- The in-line transit time ultrasonic flow meter industry in the United States is expected to rise at a CAGR of 6.40% from 2024 to 2034.

- Based on the technology, the multipath segment held a 68.80% market share in 2024.

- The gas flow measurement segment also leads the market with a 61.50% share in 2024, based on application.

“There is still little to no awareness regarding the benefits of in-line transit timer ultrasonic flow meters. Companies in the in-line transit time ultrasonic flow meters market must conduct educational programs and training sessions for clients, distributors, and industry professionals to enhance understanding and awareness of in-line transit time ultrasonic flow meters,” opines a Fact.MR analyst.

Leading Players Driving Innovation in the In-Line Transit Time Ultrasonic Flow Meter Market:

Key industry participants like Emerson Electric Co, KROHNE Group, Pietro Fiorentini S.p.A., SICK MAIHAK, Inc., Siemens AG, Gruppo Antonini S.p.A. (M&T), Endress+Hauser Management AG, Baker Hughes Company, Elster Instromet (Honeywell), Danfoss, Omega Engineering Inc., Transus Instruments, RMG Messtechnik GmbH. etc. are driving the in-line transit time ultrasonic flow meter industry.

In-Line Transit Time Ultrasonic Flow Meter Industry News:

- To go along with their full-sized clamp-on variant, AW Lake introduced the portable CUTT transit time ultrasonic flow meter in July 2022. Under difficult circumstances, the device enabled accurate, non-contact flow measurements. Because of its simplicity of deployment, end users were able to save time and money while still using it for precise chemical and water flow measurements that did not disrupt processes.

- The FF1225 Series Ultrasonic Flare Gas Flow Meter, designed for accurate flare gas metering, was introduced by Lauris Technologies in June 2023. In contrast to subpar options selected for cost-cutting, this solution guarantees precise flow measurements and lowers maintenance expenses. It provides options including temperature and pressure transducers, local or distant mount transmitters, and a multi-path version that achieves less than 1% flow uncertainty.

- August 21, 2023 saw the completion of Emerson’s acquisition of FLEXIM, a Berlin-based manufacturer of ultrasonic flowmeters. Emerson’s position as a top provider of flowmeters and automation solutions is strengthened by this final agreement, which is a component of their ongoing collaboration that began in 2016.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=9691

Competitive Landscape:

In-line transit time ultrasonic flow meter industry leaders prioritize comprehensive investment in research and development activities, aiming to innovate and enhance the technology, functionality, and features of in-line transit time ultrasonic flow meters. The focus of these market giants extends beyond innovation, encompassing a commitment to the continuous improvement of measurement accuracy and reliability.

By placing a strong emphasis on these aspects, these companies navigate the dynamic market environment, ensuring that their in-line transit time ultrasonic flow meters meet and exceed industry standards.

Key Segments Covered in In-Line Transit Time Ultrasonic Flowmeter Industry Research:

- By Technology:

- Single/Dual Path

- Multi Path

- By Application:

- Liquid Flow Measurement

- Gas Flow Measurement

- By End-User:

- Oil & Gas

- Power Generation

- Chemicals

- Others (Water & Wastewater, Food & Beverages)

Check out More Related Studies Published by Fact.MR Research:

Ultrasonic flow meter market size is estimated at US$ 2.15 billion in 2024 & is projected to reach US$ 4.11 billion, with noteworthy CAGR of 6.7% from 2024 to 2034.

Gas and liquid flow management system market stands at US$ 18.58 billion and is expected to climb to a market valuation of US$ 27.25 billion by the end of 2032.

SCR power controller market is expanding from an estimated $178.6 million in 2024 to a colossal $274.4 million by 2034, fueled by a CAGR of 4.4%.

Ride-on power trowel market is likely to reach a valuation of around US$ 87 million in 2022. The sales of ride-on power trowel are slated to accelerate at a steady CAGR of 4.6% to top US$ 137 million by 2032.

Sales of combined heat and power systems have reached US$ 20.17 billion in 2023 and are expected to climb to US$ 29.86 billion by the end of 2033.

Power tool batteries market is currently valued at US$ 2.5 billion in 2023 and is estimated to climb to US$ 6.5 billion by the end of 2033.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

$100 Invested In Mueller Industries 15 Years Ago Would Be Worth This Much Today

Mueller Industries MLI has outperformed the market over the past 15 years by 5.75% on an annualized basis producing an average annual return of 17.65%. Currently, Mueller Industries has a market capitalization of $8.34 billion.

Buying $100 In MLI: If an investor had bought $100 of MLI stock 15 years ago, it would be worth $1,123.66 today based on a price of $73.60 for MLI at the time of writing.

Mueller Industries’s Performance Over Last 15 Years

Finally — what’s the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

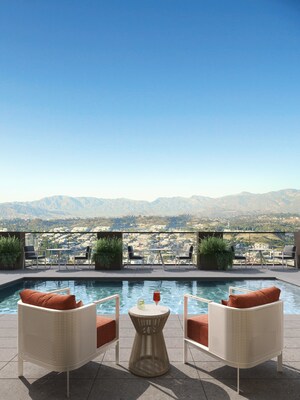

ELLORE TO ELEVATE SENIOR LIVING IN SANTA CLARA

The Luxury Residential Building Will Deliver a New Benchmark for Senior Living Rooted in Wellness and Community for the Generation that Built Silicon Valley

SANTA CLARA, Calif., Oct. 14, 2024 /PRNewswire/ — Ellore, Santa Clara’s newest luxury senior living community, officially launches leasing. Developed by Related California and operated by Oakmont Management Group, Ellore is a blend of sophistication, innovation and sustainability to fit the Silicon Valley lifestyle. Located at 2350 Calle De Luna, Ellore is comprised of 176 residences (including independent living, assisted living and memory care), thoughtfully-designed amenities, diverse programming and services for a wide range of needs.

“Ellore is a tribute to the people who have invested so much to make Silicon Valley the vibrant community it is today.”

The 20-story tower is designed by the acclaimed Steinberg Hart with interiors by MAWD – March and White Design. Each residence is crafted with Italian-made cabinetry and fully customized, spa-like bathrooms and envisioned to meet individualized needs including studio, one- and two-bedroom apartment homes and penthouse suites as well as furnished respite suites (located on the fourth floor) and dedicated memory care residences. All independent and assisted living residences feature full-size kitchens.

“We are proud to finally reach this milestone for Ellore with our partners at Oakmont Management Group,” said Nick Vanderboom, Chief Operating Officer of Related California. “Located in the heart of The Clara District, Ellore will set a new standard of luxury senior living in Silicon Valley by offering residents thoughtfully curated homes, amenities and programming for older adults without sacrificing design, comfort and lifestyle.”

“Ellore is a tribute to the people who have invested so much to make Silicon Valley the vibrant and world-renowned community it is today,” said Lola Bullock, Executive Director of Ellore. “It’s an honor to provide them with this mindful living space and care program that makes the most of modern technologies and wellness practices in a classic luxury environment.”

From discreetly coordinated services to personalized assistance, residents at Ellore experience care that seamlessly integrates into their daily lives, always delivered with the utmost respect for dignity and comfort. Its tailored care plans, with highly trained team members available to deliver individualized personal care, respect each resident’s independence and privacy.

Ellore’s wide range of amenities and programming provide residents a built-in community with a boutique feel. The third floor is home to its main restaurant, The Summit Room, with an outdoor dining terrace, cocktail lounge and bar, expansive library lounge as well as a private dining room. The fourth floor hosts an on-site wellness center including a concierge physician’s office and physical therapy suite. The 20th floor includes its activity room which will host a multitude of events including art classes, games, lectures, and more, a fitness center, yoga studio, state-of-the-art theater, spa treatment room, private showers and an outdoor saltwater plunge pool, which overlooks the Diablo Mountains.

Ellore is located in The Clara District, a vibrant 45-acre community designed to be a premier destination for living, dining, shopping, and entertainment. Framed by Santa Clara’s salt ponds, Levi’s Stadium and the Diablo Mountain Range with a neighborhood dog park, children’s play structure, dining options, parks, trails, and transit all within walking distance, the community offers something for everyone.

Residences are now available for reservation and move-ins are expected to begin in early 2025. For more information on Ellore or to schedule your exclusive tour, please visit https://elloreseniorliving.com, call (669) 288-5610, or visit the information center at 2350 Calle De Luna (open daily from 8 AM to 6 PM).

About Related California

Since 1989, Related California has undertaken a range of transformational developments from best-in-class, luxury high-rise residential properties to the redevelopment of obsolete public housing, spanning a broad spectrum of urban infill, affordable, mixed-income and market rate multi-family developments. The company has a development portfolio of more than 20,700 residential units completed or under construction, and more than 4,600 affordable and 7,200 market rate units in pre-development.

Related California has a long history of community partnership, having collaborated with more than 40 municipalities and over 30 non-profit organizations throughout the state. The company has successfully developed and managed a broad range of property types throughout Alameda, Contra Costa, Los Angeles, Orange, Sacramento, San Bernardino, San Diego, San Francisco and Santa Clara counties. Related California has developed more than $10.3 billion in assets and has a track record of consistently developing communities that exceed industry benchmarks in design, construction, sustainability and property management. For more information about Related California, visit www.relatedcalifornia.com.

About Oakmont Management Group

Oakmont Management Group, based in Irvine, Calif., is a recognized leader in the senior living industry that manages a portfolio of nearly 100 communities in California, Nevada and Hawaii. Residents receive customized services delivered in luxurious, resort-style settings. With an impressive array of five-star amenities and compassionate team members, residents of Oakmont Management Group communities benefit from the finest senior living experience in the industry. For more information about Oakmont Management Group, visit www.oakmontseniorliving.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/ellore-to-elevate-senior-living-in-santa-clara-302275578.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/ellore-to-elevate-senior-living-in-santa-clara-302275578.html

SOURCE Oakmont Management Group

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia and other chip stocks surge with no sign of AI spending slowdown — for now

Nvidia’s (NVDA) record close on Monday comes as AI hardware stocks continue a recent tear fueled by investor enthusiasm over surging artificial intelligence demand.

Nvidia shares are up 8% from last week, pushing the chipmaker closer to unseating Apple (AAPL) as Wall Street’s most valuable company. The stock’s rally follows recent comments from CEO Jensen Huang and the chipmaker’s partners touting an intense need for the company’s AI chips.

Other AI chip and hardware stocks Arm (ARM), Qualcomm (QCOM), Broadcom (AVGO), Super Micro Computer (SMCI), Astera Labs (ALAB), and Micron (MU) have risen, too, as the companies have given separate indications of strong demand for their products, thanks to the AI boom. TSMC (TSM) stock also closed at a record high Monday.

All in all, the PHLX Semiconductor Index (^SOX) is up 4.5% over the past five days, outperforming the S&P 500 (^GSPC), which rose 2.9% over the same time frame.

The upward trajectory of AI chip stocks is a positive sign for AI hardware spending that assuages Wall Street’s concerns of a near-term slowdown on investment.

“While Phase 2 stocks [i.e. AI infrastructure-related stocks, such as Arm, TSMC, and SMCI] appear modestly expensive relative to history, it is possible that the demand for AI leads the mega-cap tech stocks to spend even more on AI-related capex than investors and analysts currently expect,” Goldman Sachs (GS) analysts wrote in their report on Oct. 10.

Google (GOOG), Microsoft (MSFT), Amazon (AMZN), and Meta (META) have all indicated that they will continue to spend large sums on AI infrastructure through next year, to the benefit of AI hardware companies, led by Nvidia. As a whole, mega-cap tech companies are set to spend $215 billion on AI capital expenditures in 2024 and $250 billion in 2025, according to Goldman Sachs.

OpenAI’s recent $6.6 billion funding round is also expected to put cash in the hands of hardware companies — namely Nvidia — as it continues evolving its AI models.

JPMorgan (JPM) analyst Harlan Sur sees revenues for the semiconductor industry growing 6% to 8% in 2024. “We remain positive on semiconductor and semiconductor equipment stocks,” he said in a recent note to investors, “as we believe stocks should continue to move higher in anticipation of better supply/demand in 2H24/25 and stable/rising earnings power trends in CY24/25.”

A slowdown in investment will eventually come, though. The question is when.

Whereas AI software is typically offered on a subscription basis, hardware is a one-time sale. Analysts have warned that AI chip stocks are in a bubble that will eventually burst once Big Tech’s massive spending on AI infrastructure eases.

Indeed, tech giants’ most recent earnings reports put on display a widening gap between their hefty spending on artificial intelligence infrastructure and their return on investment — and tested Wall Street’s thinning patience. The stocks of Google, Microsoft, and Amazon all fell late this summer following their quarterly financial reports, which showed billions in AI spending.

“We continue to believe that spending on data center infrastructure will be strong this year and possibly into next year,” D.A. Davidson analyst Gil Luria told Yahoo Finance in an email, “but that there is an eventual peak of capex spending by the hyperscalers, as early as next [calendar] year.”

Laura Bratton is a reporter for Yahoo Finance. Follow her on X @LauraBratton5.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Electric Truck Market is Projected to Grow at a 14.5% CAGR Reaching US$ 78 Billion by 2033 | Fact.MR Report

Rockville, MD, Oct. 15, 2024 (GLOBE NEWSWIRE) — As per Fact.MR, a provider of market research and competitive intelligence, the global electric truck market is predicted to expand at a CAGR of 14.5% to reach a valuation of US$ 78 billion by the end of 2033.

Electric trucks are commercial vehicles propelled by battery packs and designed for cargo transportation. Notably, these trucks feature fewer moving parts within their motors compared to their diesel counterparts, eliminating the need for complex multi-speed transmissions. This reduction in components not only cuts down vehicle maintenance expenses but also enhances reliability, all while significantly minimizing noise pollution.

Preference for electric trucks over diesel alternatives is spurred by governmental incentives aimed at fostering electric truck adoption, alongside the undeniable benefits they offer, including abundant torque, negligible noise emissions, and reduced maintenance expenditures.

Governments across the world are increasingly recognizing the urgency of reducing carbon emissions and promoting cleaner transportation options. To achieve these goals, various countries have introduced supportive policies, incentives, and subsidies aimed at boosting the adoption of electric vehicles, including electric trucks. These initiatives not only encourage manufacturers to develop electric truck models but also incentivize fleet operators to transition to cleaner alternatives.

Ongoing advancements in electric vehicle battery technology are driving down the cost of electric vehicle batteries. As batteries represent a substantial portion of an electric vehicle’s overall cost, this reduction has a direct impact on the affordability of electric trucks. Lower battery costs not only make electric trucks more accessible to consumers but also enhance their feasibility for commercial fleet operators.

For More Insights into the Market, Request a Sample of this Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=8887

Key Takeaways from Market Study

- The global market for electric trucks is valued at US$ 19.5 billion in 2023.

- Worldwide demand for electric trucks is predicted to increase at a CAGR of 14.5% through 2033.

- By the end of 2033, the market is anticipated to reach US$ 78 billion.

- Over the forecast period, the Asia Pacific market is expected to expand at a CAGR of 23%.

- In terms of vehicle type, use of light-duty electric trucks is forecasted to rise at a CAGR of 6% through 2033.

- Battery electric trucks command the foremost portion of the market share.

“Electric trucks have gained significant attention and momentum due to increasing concerns about environmental sustainability, need to reduce emissions, and advancements in battery technology. Electric trucks are considered a promising solution to address the transportation sector’s environmental impact, particularly in terms of air pollution and greenhouse gas emissions,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Electric Truck Market:

Key players in the electric truck market are BYD Company Limited, AB Volvo, Daimler AG, Foton Motors Inc., Volkswagen AG, Hino Motors Ltd, Toyota Motor Corporation, Dongfeng Motor Corporation, Navistar, Inc.

Market Competition

Established automotive manufacturers, as well as new entrants and startups, are investing in the development of electric trucks. These companies are focusing on improving technology, expanding product offerings, and addressing the unique challenges posed by electric trucks, such as battery life, charging times, and upfront costs.

- In January 2022, Volvo Group, Daimler Truck, and Traton Group concluded the last phase of establishing their previously announced collaborative venture focused on charging infrastructure in Europe. This joint endeavor intends to deploy and manage a network comprising 1,700 high-capacity charge points powered by sustainable green energy. These charging stations are strategically positioned along highways and near logistics hubs across Europe.

Electric Truck Industry News:

- Dongfeng Rich 6 electric vehicle, an electric pickup truck created in partnership with Nissan, was unveiled by Dongfeng Motor Corporation. An electric motor producing 160 horsepower and 420 Nm of torque powers the car.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=S&rep_id=8887

More Valuable Insights on Offer

Fact.MR, in its new offering, presents an unbiased analysis of the global electric truck market, presenting historical demand data for 2018 to 2022 and forecast statistics for 2023 to 2033.

The study divulges essential insights into the market based on propulsion (battery electric trucks, hybrid electric trucks, plug-in hybrid electric trucks, fuel cell electric trucks), vehicle type (light-duty trucks, medium-duty trucks, heavy-duty trucks), range (up to 150 miles, 151 to 300 miles, above 300 miles), and end use (last-mile delivery, long-haul transportation, refuse services, field services, distribution services), across five major regions of the world (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa).

Check out More Related Studies Published by Fact.MR:

Motorcycle Filter Market: Size is forecasted to expand at a CAGR of 5.1% to reach a valuation of US$ 6.36 billion by the end of 2034.

Tire Pressure Sensor and Airbag Sensor Market: Size is expected to grow at a compound annual growth rate (CAGR) of 6.7%, from a valuation of US$ 5.56 billion in 2024 to US$ 10.63 billion by 2034.

Automotive Battery Market: Size is expected to grow at a compound annual growth rate (CAGR) of 6.1%, from US$ 52.71 billion in 2024 to US$ 95.29 billion by 2034.

Two Wheeler Accessory Market: Size is set to reach a valuation of US$ 40.64 billion in 2024 and further expand at a CAGR of 5.1% to end up at US$ 66.83 billion by the year 2034.

Recreational Vehicle Market: Size is estimated to be valued at US$ 50.33 billion in 2024 and is forecasted to expand at a CAGR of 4.3% to reach US$ 76.68 billion by 2034.

Motorized Quadricycle Market: Size is set to reach US$ 1.21 billion in 2024 and expand at a CAGR of 14.7% to end up at US$ 4.76 billion by the end of 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.