Better Artificial Intelligence Stock: Palantir vs. UiPath

Palantir (NYSE: PLTR) and UiPath (NYSE: PATH) represent two different ways to invest in the growing artificial intelligence (AI) market. Palantir mines data from disparate sources to help its government and commercial clients make data-driven decisions, and UiPath’s software robots help companies automate repetitive tasks.

Palantir went public via a direct listing in September 2020. Its stock started trading at $10, and it’s more than quadrupled to a record high of more than $43. It was also added to the S&P 500 this September. UiPath went public via a traditional IPO at $56 in April 2021, but it now trades at $13. Let’s see if Palantir will remain the better AI stock for the foreseeable future.

How Palantir proved the bears wrong

Palantir was founded more than two decades ago in response to the Sept. 11 attacks. It was partly funded by the CIA’s Q-Tel venture arm, and it was reportedly used to track down Osama bin Laden in 2011. Most U.S. government agencies now use Palantir’s Gotham platform to manage their data, and it says its ultimate goal is to become the “default operating system for data across the U.S. government.” It’s also been expanding its Foundry platform for large commercial customers.

Palantir initially claimed it could grow its revenue by at least 30% annually through 2025. Its revenue increased 47% in 2020 and 41% in 2021, but only grew 24% in 2022 and 17% in 2023. It blamed that slowdown on the uneven timing of its government contracts and tougher macro headwinds, which curbed Foundry’s commercial growth.

But as Palantir’s top-line growth cooled off, it reined in its spending and turned firmly profitable on a generally accepted accounting principles (GAAP) basis in 2023. Those stable profits set it up for its recent inclusion in the S&P 500.

Palantir expects its revenue to increase 23%-24% this year as it secures new government contracts for Gotham, expands Foundry’s higher-growth U.S. commercial business, and launches new generative AI tools for processing large amounts of data. Analysts expect its GAAP EPS to more than double for the full year.

From 2023 to 2026, analysts expect its revenue and GAAP EPS to grow at a compound annual growth rate (CAGR) of 22% and 56%, respectively, as it scales up its business. Those growth rates are impressive, but a lot of that optimism is already baked into the stock at 184 times next year’s earnings and 29 times next year’s sales.

How UiPath proved the bulls wrong

UiPath gained a first-mover advantage in the robotic process automation (RPA) software market when it was founded nearly two decades ago. Its RPA tools can be plugged into an organization’s existing software to automate repetitive tasks like onboarding customers, entering data, processing invoices, and sending out mass emails. Its new AI services can also analyze the data that flows through those robots.

UiPath is now the world’s largest RPA software provider, and its revenue surged 81% in fiscal 2021 (which ended in January 2021) and 47% in fiscal 2022. Its revenue only rose 19% in fiscal 2023 as the macro and geopolitical headwinds drove many companies to rein in their software spending, but accelerated again with 24% growth in fiscal 2024.

For fiscal 2025, UiPath expects its revenue to only rise 9%. It mainly blamed that slowdown on the rough macro environment again, but it also coincided with the rapid adoption of newer generative AI tools that can automate many of the same repetitive tasks. The abrupt resignation of its CEO Rob Enslin this year raised even more red flags.

From fiscal 2024 to fiscal 2026, analysts expect UiPath’s revenue to grow at a CAGR of 11%. But they also expect the company to stay unprofitable on a GAAP basis — and it could struggle to narrow its losses as it tries to keep pace with newer generative AI tools. UiPath’s stock only trades at 4 times next year’s sales, but it could struggle to command a higher valuation unless it stays relevant in the rapidly shifting AI market.

The better buy: Palantir

I wouldn’t rush to buy either of these stocks right now. Palantir’s stock still looks a bit too pricey, and UiPath hasn’t presented any viable ways to reignite its growth engines yet. But if I had to choose one, I’d stick with Palantir because it’s larger, growing faster, is more profitable, has a wider moat, and has been added to the S&P 500 index.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,266!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,047!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,794!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Leo Sun has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies and UiPath. The Motley Fool has a disclosure policy.

Better Artificial Intelligence Stock: Palantir vs. UiPath was originally published by The Motley Fool

GLMX Reports Third Quarter 2024 Activity

NEW YORK, Oct. 15, 2024 (GLOBE NEWSWIRE) — GLMX, a leading global provider of transformative technology solutions for securities financing, money markets, and total return swaps, reported its third quarter platform activity along with significant developments in the company’s overall growth.

- Average Daily Volume (ADV) of $1.01 trillion, up 99% year-on-year and the first quarter over $1 trillion in ADV for GLMX.

- Average Daily Balance (ADB) of $2.75 trillion, up 74% year-on-year.

3Q 2024 Highlights:

- Balances on the GLMX platform reached $3 trillion, a significant milestone and a reflection of the firm’s dedication to delivering client success through innovative technology.

- GLMX continues to onboard clients in Securities Lending for both equities and fixed income, demonstrating traction in a rapidly growing and changing market.

- To support its geographic expansion and overall company growth, GLMX is pleased to welcome new hires in NY, London, and Singapore.

- To address growing business in the Asia-Pacific region, GLMX has opened a new office in Singapore, and hired James Davis and Rachel Han. Davis has joined in a business development role, and Han has joined in a client operations role.

- Industry veterans James Day (London) and Jay Epstein (NY), have been hired to fill senior roles in the newly created Client Relationship Management team.

CEO Glenn Havlicek commented,”GLMX’s powerful growth trajectory has shown significant durability for what is now over 5 years. Very excitingly, we have begun to see this growth expand beyond our traditional repo business and into adjacent securities finance and money market segments. As ever, our sole priority is to consistently deliver purpose-built technology that supports the success of our clients across the entire securities financing and money market ecosystem.”

About GLMX

GLMX is a technology company serving the capital markets and is a leading global provider of transformative technology for equities and fixed income securities financing. With offices in North America, the United Kingdom, and Asia-Pacific, global buy-side and sell-side institutions rely on GLMX for access to enhanced market liquidity and to maximize trade lifecycle efficiency and reporting.

GLMX’s powerful market position continues to grow as it diversifies, taking its proven model into adjacent market sectors such as Total Return Swaps (TRS), and Time Deposits, CDs, and Commercial Paper. For more information about GLMX, please visit www.glmx.com.

Media inquiries, please contact:

GLMX

646 854-4569

sales@glmx.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Chemical Feed System Market is Expected to Reach US$ 1.04 Billion with Grow at a 6% CAGR by 2034 | Fact. MR Report

Rockville, MD , Oct. 15, 2024 (GLOBE NEWSWIRE) — Fact.MR, a market research and competitive intelligence provider, in its newly published report, states that the global Chemical Feed System Market is estimated to reach a valuation of US$ 579.6 million in 2024. The market is further forecasted to advance at a CAGR of 6% between 2024 and 2034.

Chemical feed systems are in increased demand worldwide due to their vital function in several sectors and their adaptability. These systems, which accurately regulate the input of chemicals to different processes, have proven essential in a variety of industries, from industrial production and water treatment to agricultural and pharmaceutical manufacturing.

Demand for water treatment services has increased because of stringent environmental restrictions globally and the growing need for clean drinking water. Adoption in the agricultural sector is driven by the expansion of precision agriculture and the need for increased yields at the same time.

Wider use of these technologies has resulted from the pursuit of process optimization and quality control in manufacturing. The food and pharmaceutical sectors, with their strict regulations, also play a big role in the increasing demand. The need for chemical feed systems is projected to rise consistently on a worldwide scale as enterprises attempt to maintain efficiency, safety, and compliance with changing laws. This highlights the significance of chemical feed systems in contemporary industrial processes.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=624

Key Takeaways from the Market Study:

- The global chemical feed system market is projected to reach a valuation of US$ 1.04 billion by the end of 2034.

- The North American market is estimated to hold a share of 30.2% by the end of 2034.

- The market in East Asia is projected to advance at a CAGR of 6.4% between the year 2024 to 2034.

- The market in the United States in the North American region is analyzed to progress at a CAGR of 5.6% through 2034, occupying a significant market share of 68.2% by 2034.

- Japan in East Asia is approximated to capture a share of 27.4% by 2034.

- Based on the different applications, the demand for chemical feed systems in disinfection applications is evaluated to reach a valuation of US$ 115.8 million in 2024.

“Chemical feed systems are helping industries meet strict environment and safety regulations, thereby creating prospects for market players,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Chemical Feed System Market:

Key industry participants like The MAHER Corporation; Grundfos; OMEGA Engineering; Walchem; LEWA; LMI Pumps; Watson-Marlow; ProMinent Fluid Controls; IWAKI. etc. are driving the chemical feed system industry.

Integration of Advanced Technologies in Chemical Feed Systems Aligning Well with Sustainability Initiatives:

These systems have undergone a revolutionary transformation thanks to the intelligent integration of IoT sensors and AI-powered analytics for predictive maintenance and real-time monitoring. The industrial and water treatment industries are especially drawn to this increased control and effectiveness. Developments in materials science have resulted in the creation of components that are resistant to corrosion, prolonging the life of systems and lowering maintenance expenses. Furthermore, recently developed modular designs provide previously unheard flexibility, making it simple to scale and adjust to shifting process needs.

The accuracy of precision dosing technology has advanced to unprecedented heights, with certain systems being able to dispense at the nanoliter scale. In the manufacturing of specialized chemicals and medicines, accuracy is essential. In addition, environment-friendly advancements, such as solar-powered systems and chemical choices that decompose into water are bringing these items into line with sustainability objectives. Energy-efficient pump designs also have a lower environmental effect and minimal operating expenses. Modern features like these are not only increasing efficiency but also creating new uses, which is fueling chemical feed systems’ explosive growth around the globe.

Chemical Feed System Industry News:

- Key players in the chemical feed system industry are intensifying their research efforts and launching new products in response to fierce competition, particularly in countries with high energy demands and limited natural resources. The emergence of natural gas vehicles and the growing desire among nations to reduce dependence on imported oil and gas offer significant growth opportunities for market participants.

- Additionally, the industry’s focus on sustainability across various sectors and regions will drive market expansion. To capitalize on this trend, companies need to strategically position their products and solutions in both established and emerging high-growth markets.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=RC&rep_id=624

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the chemical feed system market for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on type (oxygen scavengers, corrosion inhibitors, scale inhibitors, biocides), end use (power generation, oil & gas, chemical manufacturing, metal & mining, food & beverages, paper & pulp), across seven major regions of the world (North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, and MEA).

Key Segments of Chemical Feed System Market Research:

- By Type :

- Oxygen Scavenger

- Corrosion Inhibitors

- Scale Inhibitors

- Biocides

- By End Use :

- Power Generation

- Oil & Gas

- Chemical Manufacturing

- Metal & Mining

- Food & Beverages

- Paper & Pulp

Check out More Related Studies Published by Fact.MR Research:

Metal Biocides Market stands at US$ 3.5 billion in 2023 and is projected to surpass US$ 5.4 billion by the end of 2033, increasing at a CAGR of 4.4% from 2023 to 2033.

Process Oil Market is estimated to be worth US$ 4,196.4 million in 2024. The market is projected to register a CAGR of 4.5% from 2024 to 2034. The market is expected to reach a value of US$ 6,516.9 million by 2034.

Sales of Base Oil are projected to reach $46.2 billion by 2034, up from $36.8 billion in 2024, growing at a CAGR of 2.3% during this period.

Metal Magnesium Market size is projected to reach US$ 8.36 billion by 2034, up from US$ 5.04 billion in 2024, which equals expansion at a CAGR of 5.2% through 2034.

Gas Separation Membrane Market is forecasted to expand at a CAGR of 8% from 2023 to 2033. The market is valued at US$ 1.3 billion in 2023 and is thus expected to reach a size of US$ 2.8 billion by 2033-end.

Metal Biocides Market stands at US$ 3.5 billion in 2023 and is projected to surpass US$ 5.4 billion by the end of 2033, increasing at a CAGR of 4.4% from 2023 to 2033.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stock-Split Watch: 3 Tech Stocks That Look Ready to Split

Many popular tech stocks split their shares over the past two years. Stock splits don’t actually make a stock fundamentally cheaper, since they merely cut a single share into smaller slices to reduce the trading price.

Yet stock splits generate lots of media buzz and attract smaller investors who don’t want to pay hundreds or thousands of dollars for a single share of a hot company. Stock splits also make it cheaper to trade options, since a single contract is still tethered to 100 shares, and they allow companies to offer their employees more flexible stock-based compensation plans.

Therefore, investors should still pay attention to which hot tech stocks might split in the future. I think these three companies might be ripe for stock splits: MercadoLibre (NASDAQ: MELI), ASML (NASDAQ: ASML), and Salesforce (NYSE: CRM).

1. MercadoLibre

MercadoLibre, the largest e-commerce company in Latin America, went public at $18 in 2007 and now trades at about $2,040. But even after turning a $1,000 investment into more than $113,000, it’s still never split its high-flying stock.

From 2007 to 2023, MercadoLibre’s revenue rose at a compound annual growth rate (CAGR) of 38%. That robust growth was driven by its expansion across 18 countries, rising internet penetration rates across Latin America, and the stickiness of its Mercado Pago ecosystem of digital payment and fintech services. It also built a massive logistics network before many of its domestic and overseas competitors, and its profitability improved as economies of scale kicked in and diluted its expenses.

From 2023 to 2026, analysts expect MercadoLibre’s revenue to grow at a CAGR of 27% as its earnings per share (EPS) increases at a CAGR of 51%. Those are incredible growth rates for a stock that trades at 41 times next year’s earnings.

MercadoLibre’s stock could head a lot higher on its own over the next few years, but a stock split might draw in a fresh generation of retail investors who were initially driven away by its four-digit trading price.

2. ASML

ASML, the world’s leading producer of lithography systems for manufacturing semiconductors, has implemented four stock splits since its IPO in 1995. It executed two 2-for-1 splits in 1997 and 1998, a 3-for-1 split in 2000, and an 8-for-9 reverse split aimed at optimizing its capital structure in 2007. It’s soared from its split-adjusted initial public offering (IPO) price of $1.85 to $834 today, so a $1,000 investment would have blossomed to more than $450,000.

From 1996 to 2023, ASML’s revenue grew at a CAGR of 15%. Its growth was initially driven by its dominance of the market for deep ultraviolet (DUV) lithography systems, which are used to optically etch circuit patterns onto silicon wafers. It subsequently became the only manufacturer of extreme ultraviolet (EUV) lithography systems, which are required to produce the world’s smallest and densest chips. As a result, all of the world’s most advanced chip foundries — including Taiwan Semiconductor Manufacturing Company, Samsung, and Intel — use ASML’s EUV systems to produce their most advanced chips.

From 2023 to 2026, analysts expect ASML’s revenue to rise at a CAGR of 13% and its EPS to grow at a CAGR of 19%. Tighter export curbs are throttling its sales of advanced systems to China, but the gradual rollout of its next-gen “high-NA” EUV systems should offset that pressure. Its stock still looks reasonably valued at 26 times next year’s earnings, but a split could bring its trading price back to the double-digits again and make it more appealing to new investors.

3. Salesforce

Salesforce, the world’s largest provider of cloud-based customer relationship management (CRM) services, went public at a split-adjusted price of $2.75 per share in 2004. At its current price of $290, a $1,000 investment in its IPO would be worth more than $105,000 today. It underwent a single 4-for-1 stock split in 2013.

From fiscal 2004 to fiscal 2024 (which ended in January 2024), Salesforce’s revenue rose at a CAGR of 35%. It grew rapidly as more companies replaced their desktop-based CRM software with its cloud-based CRM services. It also expanded its cloud ecosystem with more marketing, analytics, e-commerce, and collaboration services.

However, Salesforce’s growth has slowed down over the past few years as the CRM market matured and it faced tougher macro and competitive headwinds. Activist pressure also forced it to focus on cutting costs instead of making big acquisitions to inorganically boost its revenues. From fiscal 2024 to fiscal 2027, analysts only expect its revenue to grow at a CAGR of 9% — but they expect its EPS to increase at a CAGR of 27% as it streamlines its spending.

Salesforce’s stock looks historically cheap at 26 times its forward adjusted earnings, and it even declared its first dividend earlier this year. But a split might make its stock, which has slipped about 3% over the past six months, a bit more appealing.

Should you invest $1,000 in MercadoLibre right now?

Before you buy stock in MercadoLibre, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and MercadoLibre wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Leo Sun has positions in ASML and MercadoLibre. The Motley Fool has positions in and recommends ASML, MercadoLibre, Salesforce, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Stock-Split Watch: 3 Tech Stocks That Look Ready to Split was originally published by The Motley Fool

Cosmetic Packaging Market is Estimated to Grow at a CAGR of 3.6% through 2031, Report by SkyQuest Technology

Westford, USA, Oct. 15, 2024 (GLOBE NEWSWIRE) — SkyQuest projects that the global cosmetic packaging market will attain a value of USD 68.74 billion by 2031, with a CAGR of 3.6% over the forecast period (2024-2031). Rapidly increasing demand for cosmetics and personal care products around the world is slated to drive the demand for cosmetic packaging over the coming years. Rising disposable income of people and advancements in packaging technologies are expected to drive the cosmetic packaging market growth.

Download a detailed overview: https://www.skyquestt.com/sample-request/cosmetic-packaging-market

Browse in-depth TOC on “Cosmetic Packaging Market” Pages – 197, Tables – 95, Figures – 76

Cosmetic Packaging Market Report Overview:

| Report Coverage | Details |

| Market Revenue in 2023 | $ 51.8 billion |

| Estimated Value by 2031 | $ 68.74 billion |

| Growth Rate | Poised to grow at a CAGR of 3.6% |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Cosmetic Type, Material Type, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the world |

| Report Highlights | Updated financial information/product portfolio of players |

| Key Market Opportunities | Development of sustainable and anti-counterfeit packaging |

| Key Market Drivers | Rising aesthetic awareness among people around the world |

Plastic is Projected to Account for Substantial Market Share

Just like any other packaging product, cosmetic packaging is also mostly made from plastic owing to its proven efficacy in the world of packaging. Easy availability and the potential to brand plastic packaging as per cosmetic brand standards are also expected to help the dominance of this segment over the coming years. However, bans on the use of plastic in packaging could reduce the market share of this segment in the long run.

Use of Cosmetic Packaging for Makeup Products is Estimated to Surge at an Impressive Pace in the Future

Rising number of working females and increasing interest in makeup across the world are projected to help promote sales of makeup products and make this a highly opportune segment. The growing need to look perfect and increasing availability of multiple makeup products from renowned brands are also expected to help create high demand for cosmetic packaging in this segment over the coming years.

Asia Pacific Region is Estimated to Spearhead Demand for Cosmetic Packaging Trends

Asia Pacific is undergoing rapid urbanization, and the influence of the West is also increasing in this region. The factor coupled with evolving consumer preferences and changing beauty standards are estimated to promote the sales of cosmetics thereby driving market growth as well. Increasing disposable income of people in countries such as India and China will also create lucrative opportunities for cosmetic packaging providers going forward.

Request Free Customization of this report: https://www.skyquestt.com/speak-with-analyst/cosmetic-packaging-market

Cosmetic Packaging Market Insights:

Drivers

- Rising disposable income of people promoting sales of cosmetics

- Increasing aesthetic awareness around the world owing to rising social media influence

- Rapidly expanding cosmetics and personal care industry

Restraints

- Bans on the use of plastic materials for cosmetic packaging

- Stringent regulatory mandates for cosmetic packaging

Prominent Players in Cosmetic Packaging Market

- Amcor (Switzerland)

- Gerresheimer AG

- AptarGroup, Inc.

- Albea S.A.

- HCP Packaging

- RPC Group plc

- Silgan Holdings Inc.

- Quadpack Industries

- Libo Cosmetics Company Ltd.

- Fusion Packaging

Key Questions Answered in Cosmetic Packaging Market Report

- What drives the global market growth?

- Who are the leading Cosmetic Packaging providers in the world?

- Which region leads the demand for Cosmetic Packaging in the world?

Is this report aligned with your requirements? Interested in making a Purchase – https://www.skyquestt.com/buy-now/cosmetic-packaging-market

This report provides the following insights:

- Analysis of key drivers (growing disposable income of people promoting sales of cosmetics, rising aesthetic awareness among people, expansion of the personal care and cosmetics industry), restraints (bans on use of plastic in packaging, strict regulatory requirements for cosmetic packaging), and opportunities (development of sustainable cosmetic packaging solutions, demand for anti-counterfeit packaging) influencing the growth of Cosmetic Packaging market.

- Market Penetration: All-inclusive analysis of product portfolio of different market players and status of new product launches.

- Product Development/Innovation: Elaborate assessment of R&D activities, new product development, and upcoming trends of the Cosmetic Packaging market.

- Market Development: Detailed analysis of potential regions where the market has potential to grow.

- Market Diversification: Comprehensive assessment of new product launches, recent developments, and emerging regional markets.

- Competitive Landscape: Detailed analysis of growth strategies, revenue analysis, and product innovation by new and established market players.

Related Reports:

Luxury Apparel Market: Global Opportunity Analysis and Forecast, 2024-2031

Luxury Jewelry Market: Global Opportunity Analysis and Forecast, 2024-2031

Out Of Home Advertising Market: Global Opportunity Analysis and Forecast, 2024-2031

Private Tutoring Market: Global Opportunity Analysis and Forecast, 2024-2031

Decorative Lighting Market: Global Opportunity Analysis and Forecast, 2024-2031

About Us:

SkyQuest is an IP focused Research and Investment Bank and Accelerator of Technology and assets. We provide access to technologies, markets and finance across sectors viz. Life Sciences, CleanTech, AgriTech, NanoTech and Information & Communication Technology.

We work closely with innovators, inventors, innovation seekers, entrepreneurs, companies and investors alike in leveraging external sources of R&D. Moreover, we help them in optimizing the economic potential of their intellectual assets. Our experiences with innovation management and commercialization have expanded our reach across North America, Europe, ASEAN and Asia Pacific.

Contact:

Mr. Jagraj Singh

Skyquest Technology

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 351-333-4748

Email: sales@skyquestt.com

Visit Our Website: https://www.skyquestt.com/

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Chinese stocks slide, intensifying debate over market’s outlook

(Bloomberg) — Chinese stocks tumbled as doubts resurfaced on whether Beijing’s stimulus blitz will be enough to prop up an economy mired in deflation and a property crisis.

Most Read from Bloomberg

The CSI 300 Index fell 2.7%, extending losses since an Oct. 8 high to more than 9%. A gauge of Chinese shares listed in Hong Kong slumped 4%, capping its worst day in a week. The yuan also weakened.

Volatility has gripped the market in recent sessions as investors debate the sustainability of the rebound that began late last month, with the lack of clarity over the size of Beijing’s planned fiscal boost weighing on sentiment. Weak recent economic data, including figures on inflation and trade, have underscored the need for more stimulus.

There are concerns that “any stimulus might be more focused on risk mitigation, especially about local government debt, rather than growth,” said Xin-Yao Ng, investment manager of Asian equities at abrdn Asia Ltd. “Investors definitely prefer a bazooka to reflate the economy quickly.”

Tuesday’s price action suggests that investors were unimpressed by a Caixin report that said China may raise 6 trillion yuan ($846 billion) from ultra-long special government bonds over three years. Bloomberg later reported that local authorities will be issuing the notes mainly to refinance their off-balance-sheet debt.

Following the central bank’s easing steps in late September, investors have been clamoring for the government to bolster fiscal spending. Officials promised new measures to support the property sector and hinted at greater government borrowing at a weekend briefing, without giving an amount.

There’s concern “that the stimulus announced so far just isn’t enough,” said Nathan Thooft, chief investment officer and senior portfolio manager at Manulife Investment Management. “We put on a tactical overweight to Chinese equities. We are not necessarily believers that this is a structural shift.”

The yuan slid as much as 0.6% to 7.1343 per dollar in the offshore market, the weakest level in about a month. The so-called China proxies in Asia — currencies that are affected by investor confidence on the country — also dropped.

The Hang Seng China Enterprises Index, which comprises Chinese shares listed in Hong Kong, is now down more than 12% since Oct. 7.

Growing Divide

As the rally falters, a divide is growing among global investors.

Morgan Stanley Wealth Management warned that investors should steer clear of soaring Chinese equities as the stimulus measures won’t be enough to repair the struggling economy. Wells Fargo Investment Institute is also skeptical that the rebound will last given the depressed sentiment surrounding China’s consumers.

UBS Group AG still sees value, saying heightened retail investor interest should give stocks further upward momentum.

China’s export growth slowed more than expected in September, curbing a trade rebound that has been a bright spot for a weakening economy. Loan expansion also disappointed in a sign of still weak domestic demand.

“China’s signal on policy stimulus prompted us to go modestly overweight, especially given depressed valuations,” strategists at BlackRock Investment Institute including Wei Li wrote in a note. “Details have been scant, so we could change our view if future announcements disappoint.”

–With assistance from Sujata Rao and Tian Chen.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Want to Buy Nvidia, Microsoft, and Apple? Consider This Vanguard Growth ETF

The S&P 500 (SNPINDEX: ^GSPC) is home to 500 different companies, but it’s weighted by market capitalization, which means the largest names in the index have a greater influence over its performance than the smallest.

Apple, Nvidia, and Microsoft are the top three companies in the S&P 500, with a combined market cap of $9.8 trillion, which represents 19.7% of the index. Nvidia stock, for example, was up 156% through the first half of 2024, which accounted for one-third of the entire 15% gain in the S&P 500.

In other words, investors who don’t have America’s tech giants in their portfolio are probably underperforming the broader market. But there’s a simple way to buy them without having to predict which ones might deliver the best returns from here.

The Vanguard Mega Cap Growth ETF (NYSEMKT: MGK) is an exchange-traded fund (ETF) with a concentrated portfolio filled with the largest tech stocks an investor could want. Here’s why it might be a great alternative to buying individual stocks.

The world’s highest-quality companies in one ETF

ETFs can hold hundreds, or even thousands, of different stocks. However, the Vanguard Mega Cap Growth ETF holds just 71, so it’s ideal for investors who already have an existing portfolio, but specifically want to add some exposure to the largest growth companies in America.

The ETF holds stocks from 10 different sectors of the economy, but technology has a whopping 61.4% weighting because of the sheer size of companies like Apple, Microsoft, and Nvidia.

In fact, the ETF is highly concentrated toward its top five holdings for that reason. The table shows their weightings in the ETF, compared to their weightings in the S&P 500 index:

|

Stock |

Vanguard ETF Portfolio Weighting |

S&P 500 Weighting |

|---|---|---|

|

1. Apple |

13.52% |

6.97% |

|

2. Microsoft |

12.68% |

6.54% |

|

3. Nvidia |

11.29% |

6.20% |

|

4. Meta Platforms |

4.96% |

2.41% |

|

5. Amazon |

4.54% |

3.45% |

Data source: Vanguard. Portfolio weightings are accurate as of Aug. 31, and are subject to change.

Having a much higher weighting toward these stocks can be a double-edged sword. It means the Vanguard ETF will outperform the S&P 500 when those specific stocks are doing well, but it’s likely to underperform if they hit a rough patch, because it lacks diversity relative to the index.

With that said, these five companies are among the most important players in the fast-growing artificial intelligence (AI) industry. Apple is rolling out its Apple Intelligence software, which it developed in partnership with OpenAI. It’s going to transform the way iPhone, iPad, and Mac users create and consume content. Since Apple has over 2.2 billion active devices worldwide, the company could soon become the biggest distributor of AI to consumers.

Microsoft and Amazon have developed their own AI virtual assistants, which are embedded into their flagship software products. Plus, the Microsoft Azure and Amazon Web Services cloud platforms are two of the largest AI distribution channels for businesses, allowing them to access ready-made models and data center computing power for their development needs.

Nvidia’s graphics processing chips (GPUs) for the data center are at the heart of the entire AI revolution. Its H100 GPU set the benchmark for AI developers last year, and the company is preparing to ship large volumes of its new Blackwell-based GPUs, which will deliver an incredible leap in performance and cost efficiency.

Outside its top five positions, the Vanguard ETF also holds popular megacap stocks like Eli Lilly, Tesla, Costco Wholesale, and McDonald’s — so it isn’t all about technology.

The Vanguard ETF consistently outperforms the S&P 500

The Vanguard ETF has delivered a compound annual return of 13.1% since it was established in 2007, which is much better than the average annual return of 10.2% in the S&P 500.

The ETF has delivered an even stronger compound annual return of 20.2% over the last five years. That’s because of the rapid adoption of technologies like cloud computing and AI, which have propelled stocks like Nvidia, Microsoft, and Amazon to multitrillion-dollar valuations. The S&P 500 has gained 16.7% per year (on average) over that same stretch.

In other words, if technology stocks continue to lead the broader market higher, investors should expect the Vanguard ETF to outperform the S&P 500 because of its enormous exposure to the sector. Some forecasts on Wall Street suggest AI could add anywhere from $7 trillion to $200 trillion to the global economy over the next decade. If that’s true, tech stocks will be one of the best places to invest.

Conversely, if AI fails to live up to the hype, the Vanguard ETF could underperform for a period of time because stocks like Nvidia would lose a chunk of the value they have created over the last couple of years.

This Vanguard ETF is very cheap to own, with an expense ratio of just 0.07% (the portion of the fund deducted each year to cover management costs), which is more than 90% cheaper than comparable funds, according to Vanguard. Therefore, investors seeking exposure to the big end of the stock market without having to pick individual winners and losers should look no further.

Should you invest $1,000 in Vanguard World Fund – Vanguard Mega Cap Growth ETF right now?

Before you buy stock in Vanguard World Fund – Vanguard Mega Cap Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard World Fund – Vanguard Mega Cap Growth ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, Costco Wholesale, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Want to Buy Nvidia, Microsoft, and Apple? Consider This Vanguard Growth ETF was originally published by The Motley Fool

Provident Bank's First-Time Home Buyer Survey Reveals That While Homeownership Continues to Be Challenging, Many Americans Are Finding Their Home in Less Than a Year

ISELIN, N.J., Oct. 15, 2024 (GLOBE NEWSWIRE) — Provident Bank, a leading New Jersey-based financial institution, has released the results of its First-Time Home Buyer Survey, taking stock of the generational differences in how Americans are navigating a complicated housing market. This year’s survey revealed that, not surprisingly, searching for a first home is extremely challenging. The top two factors impacting budgets are high mortgage rates and the lack of homes within an original budget. However, across generations, Americans appear to be buying their first home after only looking less than a year, signaling growing optimism in the market.

Potential homeowners are prolonging the buying process and waiting to make a final purchase:

Searching for a new home is challenging for first-time home buyers across generations. There are frequent bidding wars, which can lead to many making sacrifices for their dream home.

- Over 40% of Gen Xers have been involved in a significant number (5+) of bidding wars during the home-buying process. Comparatively, only 30% of Millennial respondents have had the same experience.

- Over 50% of Gen X respondents have had to significantly adjust their search criteria to stay within budget. Nearly 50% of both Millennials and Gen X respondents noted that they’ve settled for an older home that needs renovations to complete the buying process, compared to only 39% of Gen Z respondents.

Amidst all of these challenges, Americans still look toward traditional financial avenues to complete the home-buying process:

Overall, potential homeowners are still looking to traditional financial institutions to help them through the home-buying process. However, there are clear differences between how generations think about their financing options and the experts available to them.

- Over half of respondents noted that their savings account is their main source of capital for their down payment. The second highest source of capital stems from access to first-time home buyer program grant(s).

- 15% of Gen X respondents will look to a fintech company for financing for buying a first home compared to only 6% of Gen Z respondents. Nearly 56% of Gen X respondents will be speaking to a traditional bank as a source for the financing process in buying their first home.

- Just under 50% of all Millennial respondents noted they would look to a traditional bank for financing to buy their first home.

“The findings from this year’s survey support what we’ve been hearing directly from customers – in order to navigate a highly competitive home buying market, understanding all of the financing resources and capital requirements at your disposal is the key to success,” said Margaret Volk, Senior Vice President, and Director of Mortgage and Consumer Lending, at Provident Bank. “Especially as we enter a new phase of the mortgage rate cycle, we believe it is our responsibility to ensure our customers are equipped with the resources and information needed to navigate the financing process to achieve such an important life goal like buying a home.”

The survey was conducted by Survey Monkey, a market research provider, on behalf of Provident Bank. The findings are based on 1,000 responses.

About Provident Bank

Founded in Jersey City in 1839, Provident Bank is the oldest community-focused financial institution based in New Jersey and is the wholly owned subsidiary of Provident Financial Services, Inc. PFS. With assets of $24.07 billion as of June 30, 2024, Provident Bank offers a wide range of customized financial solutions for businesses and consumers with an exceptional customer experience delivered through its convenient network of 140 branches across New Jersey and parts of New York and Pennsylvania, via mobile and online banking, and from its customer contact center. The bank also provides fiduciary and wealth management services through its wholly owned subsidiary, Beacon Trust Company, and insurance services through its wholly owned subsidiary, Provident Protection Plus, Inc. To learn more about Provident Bank, go to www.provident.bank or call our customer contact center at 800.448.7768.

Media Contact:

Provident Bank

Keith Buscio – keith.buscio@provident.bank

Vested

providentbank@fullyvested.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ARS Pharmaceuticals, Inc. is on the Move, Here's Why the Trend Could be Sustainable

While “the trend is your friend” when it comes to short-term investing or trading, timing entries into the trend is a key determinant of success. And increasing the odds of success by making sure the sustainability of a trend isn’t easy.

The trend often reverses before exiting the trade, leading to a short-term capital loss for investors. So, for a profitable trade, one should confirm factors such as sound fundamentals, positive earnings estimate revisions, etc. that could keep the momentum in the stock alive.

Our “Recent Price Strength” screen, which is created on a unique short-term trading strategy, could be pretty useful in this regard. This predefined screen makes it really easy to shortlist the stocks that have enough fundamental strength to maintain their recent uptrend. Also, the screen passes only the stocks that are trading in the upper portion of their 52-week high-low range, which is usually an indicator of bullishness.

There are several stocks that passed through the screen:

ARS Pharmaceuticals, Inc.

SPRY is one of them. Here are the key reasons why this stock is a solid choice for “trend” investing.

A solid price increase over a period of 12 weeks reflects investors’ continued willingness to pay more for the potential upside in a stock. SPRY is quite a good fit in this regard, gaining 37.8% over this period.

However, it’s not enough to look at the price change for around three months, as it doesn’t reflect any trend reversal that might have happened in a shorter time frame. It’s important for a potential winner to maintain the price trend. A price increase of 9.2% over the past four weeks ensures that the trend is still in place for the stock of this company.

Moreover, SPRY is currently trading at 84.9% of its 52-week High-Low Range, hinting that it can be on the verge of a breakout.

Looking at the fundamentals, the stock currently carries a Zacks Rank #2 (Buy), which means it is in the top 20% of more than the 4,000 stocks that we rank based on trends in earnings estimate revisions and EPS surprises — the key factors that impact a stock’s near-term price movements.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Another factor that confirms the company’s fundamental strength is its Average Broker Recommendation of #1 (Strong Buy). This indicates that the brokerage community is highly optimistic about the stock’s near-term price performance.

So, the price trend in SPRY may not reverse anytime soon.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

[Latest] Global Motor Space Heater Market Size/Share Worth USD 34.69 Billion by 2033 at a 11.34% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

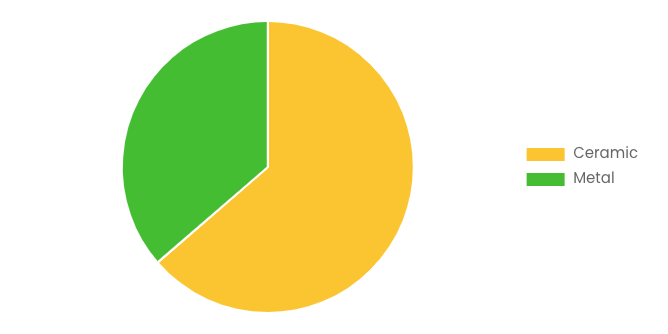

Austin, TX, USA, Oct. 15, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Motor Space Heater Market Size, Trends and Insights By Type (Convective Space Heaters, Radiative Heaters), By Material (Ceramic, Metal), By Application (Discrete Industry, Process industry), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

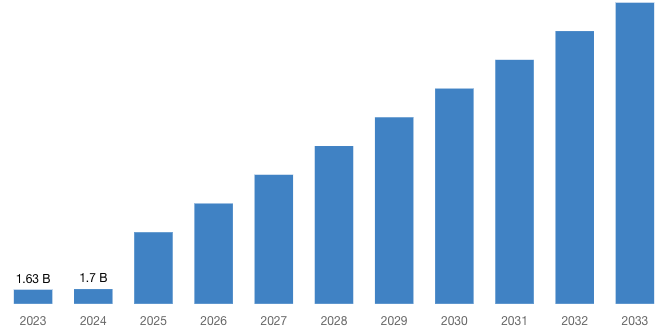

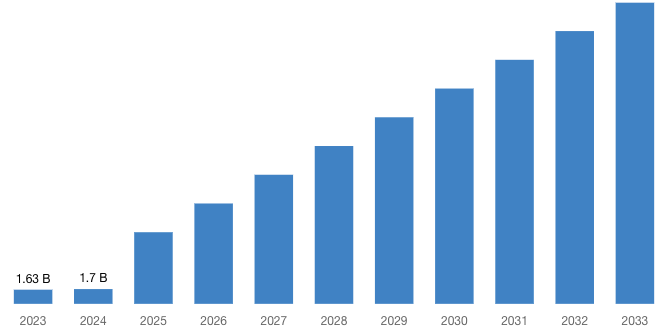

“According to the latest research study, the demand of global Motor Space Heater Market size & share was valued at approximately USD 1.63 Billion in 2023 and is expected to reach USD 1.70 Billion in 2024 and is expected to reach a value of around USD 34.69 Billion by 2033, at a compound annual growth rate (CAGR) of about 11.34% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Motor Space Heater Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=52603

Motor Space Heater Market: Overview

The Motor Space Heater Market is encountering significant development, powered by the rising interest in energy-effective warming arrangements across different modern areas. Motor space heaters are quickly becoming popular with businesses worldwide as they emphasize minimizing their environmental impact and maximizing their energy efficiency.

These heaters, which are renowned for their effectiveness and dependability, are becoming essential components in a wide range of industries, including construction, the automotive industry, and manufacturing.

The motor space heater market is being driven forward mainly by the need to maintain precise temperatures and the growing automation of industrial processes. Innovative headways are empowering the improvement of further developed and effective radiators, opening up new roads for market development.

Also, elevated accentuation on further developing wellbeing principles in modern settings supports the interest in these Heaters.

Request a Customized Copy of the Motor Space Heater Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=52603

By type, the surge in global construction schemes, alongside heightened demand for advanced and efficient heating systems, has significantly boosted the Convective Space Heaters segment in the Motor Space Heater Market. The increasing prevalence of smart homes and the integration of IoT and other advanced technologies into heating systems are also pivotal factors propelling market growth.

On the other hand, Due to their capacity to provide instantaneous heating, the radiative heaters market is expected to grow rapidly during the forecast period. Dissimilar to convective Heaters, radiative radiators straightforwardly heat the items and individuals in the room, going with them a favoured decision for spot heating and little spaces.

The continuous mechanical headways and item advancements in the field of radiative radiators are supposed to additionally push their interest. The improvement of infrared radiative Heaters, which are more energy-proficient and give quicker warming, is probably going to support the market development of this segment.

By Application, Due to the widespread use of motor space heaters in various process industries like oil and gas, chemical, food and beverage, and pharmaceuticals, the process industry segment commanded a significant revenue share of the market in 2023.

These ventures require exact temperature control for their tasks, and engine space warmers give a proficient answer for keeping up with ideal temperature conditions. The discrete business section is supposed to lead the market about income during the forecast time frame, attributable to the rising requirement for exact temperature control in their assembling processes.

Besides, rising mechanical progressions and item advancements in the field of engine space warmers, like the improvement of energy-effective and conservative radiators, are probably going to support the market development of the fragment during the forecast period.

Due to the rapid industrialization and urbanization of nations like India and China, which has resulted in an increased demand for motor space heaters, Asia-Pacific held a significant share of the market in 2023. The development of different end-use ventures, for example, car, assembling, and development in China has additionally contributed essentially to the interest in engine space radiators.

Additionally, the government’s efforts to promote appliances that save energy have contributed to the region’s increasing market. Due to the rising demand for energy-efficient heating solutions in the residential and commercial sectors, the market in North America is expected to increase significantly during the forecast period.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 1.70 Billion |

| Projected Market Size in 2033 | USD 34.69 Billion |

| Market Size in 2023 | USD 1.63 Billion |

| CAGR Growth Rate | 11.34% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Type, Material, Application and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Motor Space Heater report is available upon request; please contact us for more information.)

Request a Customized Copy of the Motor Space Heater Market Report @ https://www.custommarketinsights.com/report/motor-space-heater-market/

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Motor Space Heater report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Motor Space Heater Market Report @ https://www.custommarketinsights.com/report/motor-space-heater-market/

CMI has comprehensively analyzed the Global Motor Space Heater market. The driving forces, restraints, challenges, opportunities, and key trends have been explained in depth to depict the in-depth scenario of the market. Segment wise market size and market share during the forecast period are duly addressed to portray the probable picture of this Global Motor Space Heater industry.

The competitive landscape includes key innovators, after market service providers, market giants as well as niche players are studied and analyzed extensively concerning their strengths, weaknesses as well as value addition prospects. In addition, this report covers key players profiling, market shares, mergers and acquisitions, consequent market fragmentation, new trends and dynamics in partnerships.

Key questions answered in this report:

- What is the size of the Motor Space Heater market and what is its expected growth rate?

- What are the primary driving factors that push the Motor Space Heater market forward?

- What are the Motor Space Heater Industry’s top companies?

- What are the different categories that the Motor Space Heater Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Motor Space Heater market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Motor Space Heater Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/motor-space-heater-market/

Motor Space Heater Market: Regional Analysis

By region, the global motor space heater market is segmented into North America, Asia Pacific, Europe, the Middle East, Africa and Latin America. Among all of these, Asia Pacific held the highest market share in 2023 and is expected to keep its dominance during the forecast period.

Due to the rapid industrialization and urbanization of countries like India and China, which has resulted in an increased demand for motor space heaters, Asia-Pacific held a significant share of the market in 2023.

The development of different end-use ventures, for example, car, assembling, and development in China has additionally contributed essentially to the interest in engine space radiators. Additionally, the government’s efforts to promote appliances that save energy have contributed to the region’s expanding market growth.

Europe held the second largest market share in 2023 and is expected to keep its position during the forecast period. Countries such as Germany, France, Russia, the U.K., Spain and the Netherlands are driving the market growth during the forecast period.

Request a Customized Copy of the Motor Space Heater Market Report @ https://www.custommarketinsights.com/report/motor-space-heater-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Motor Space Heater Market Size, Trends and Insights By Type (Convective Space Heaters, Radiative Heaters), By Material (Ceramic, Metal), By Application (Discrete Industry, Process industry), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/motor-space-heater-market/

List of the prominent players in the Motor Space Heater Market:

- ABB

- Jenkins

- OMEGA Engineering

- Siemens

- SINOMAS

- BARTEC

- Electro-Flex

- Ghanacon Products

- Gulf Electroquip

- Hilkar

- L&S Electric

- Nidec Motors

- SIMEL

- Emerson Electric Co.

- Honeywell International Inc.

- TE Connectivity Ltd.

- Watlow Electric Manufacturing Company

- Pentair Thermal Management

- Delta-Therm Corporation

- Indeeco (A Unit of GE)

- Others

Click Here to Access a Free Sample Report of the Global Motor Space Heater Market @ https://www.custommarketinsights.com/report/motor-space-heater-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Surface Mining Equipment Market: Surface Mining Equipment Market Size, Trends and Insights By Equipment Type (Mining Drills and Breakers, Crushing, Pulverizing, and Screening Equipment, Excavators, Loaders, Dozers, Haul Trucks, Others), By Mineral Type (Metallic Ore Mining, Non-metallic Ore Mining, Coal Mining), By Application (Mining, Infrastructure, Others), By End-user (Mining Companies, Construction Companies, Government Agencies, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Vinyl Siding Market: Vinyl Siding Market Size, Trends and Insights By Product Type (Horizontal Siding, Vertical Siding, Shakes and Shingles, Board and Batten, Insulated Siding), By Installation Type (New Installation, Replacement), By Application (Exterior Walls, Soffit, Fascia), By End User (Residential, Commercial), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Amusement Machine Market: Amusement Machine Market Size, Trends and Insights By Type (Arcade, Pinball, Redemption, Others), By Component (Hardware, Software, Services), By Installation (Indoor, Outdoor), By End Use (Residential, Commercial), By Distribution Channel (Online, Offline), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Fire Pump Test Meter Market: Fire Pump Test Meter Market Size, Trends and Insights By Meter Type (Digital Meter, Analog Meter), By Body Type (Flanged Body, Grooved Body, Others), By Body Size (1″ to 2″, 2″ to 4″, 4″ to 8″, 8″ to 12″), By End-User (Oil & Gas, Chemicals & Petrochemicals, Power Generation, Fire Protection, Water Treatment, Industrial Manufacturing, Commercial Buildings, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

B2B Telecommunication Market: B2B Telecommunication Market Size, Trends and Insights By Solution (WAN, VoIP, Cloud Services, M2M Communication, Unified Communication and Collaboration), By Enterprise Size (Small & Medium Enterprise, Large Enterprise), By Vertical (BFSI, Healthcare, Media and Entertainment, Government, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Gyro Compass Market: Gyro Compass Market Size, Trends and Insights By Type (Mechanical Gyro Compass, Fiber Optic Gyro Compass, Ring Laser Gyro Compass, MEMS Gyro Compass, Others), By Application (Marine Navigation, Aviation Navigation, Land-based Navigation, Others), By Vessel (Merchant Vessels, Naval Vessels, Fishing Vessels, Recreational Boats, Others), By End-Use Industry (Shipping Industry, Aviation Industry, Defense Sector, Offshore Industry, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Vibratory Plate Compactors Market: Vibratory Plate Compactors Market Size, Trends and Insights By Type (Single Plate Compactor, Reversible Plate Compactor), By Fuel (Diesel, Gasoline, Electric), By End User (Contactors, Municipal Authorities), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Fencing Market: US Fencing Market Size, Trends and Insights By Distribution Channel (Online, Retail), By Installation (Do-It-Yourself, Contractor), By Application (Residential, Agricultural, Industrial), By Material (Metal, Wood, Plastic & Composites, Concrete), By End User (Military and Defense, Energy and Power, Mining, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Motor Space Heater Market is segmented as follows:

By Type

- Convective Space Heaters

- Radiative Heaters

By Material

By Application

- Discrete Industry

- Process industry

Click Here to Get a Free Sample Report of the Global Motor Space Heater Market @ https://www.custommarketinsights.com/report/motor-space-heater-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Motor Space Heater Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Motor Space Heater Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Motor Space Heater Market? What Was the Capacity, Production Value, Cost and PROFIT of the Motor Space Heater Market?

- What Is the Current Market Status of the Motor Space Heater Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Motor Space Heater Market by Considering Applications and Types?

- What Are Projections of the Global Motor Space Heater Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Motor Space Heater Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Motor Space Heater Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Motor Space Heater Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Motor Space Heater Industry?

Click Here to Access a Free Sample Report of the Global Motor Space Heater Market @ https://www.custommarketinsights.com/report/motor-space-heater-market/

Reasons to Purchase Motor Space Heater Market Report

- Motor Space Heater Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Motor Space Heater Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Motor Space Heater Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Motor Space Heater Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Motor Space Heater market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Motor Space Heater Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/motor-space-heater-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Motor Space Heater market analysis.

- The competitive environment of current and potential participants in the Motor Space Heater market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Motor Space Heater market should find this report useful. The research will be useful to all market participants in the Motor Space Heater industry.

- Managers in the Motor Space Heater sector are interested in publishing up-to-date and projected data about the worldwide Motor Space Heater market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Motor Space Heater products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Motor Space Heater Market Report @ https://www.custommarketinsights.com/report/motor-space-heater-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Motor Space Heater Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/motor-space-heater-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.