This Is What Whales Are Betting On Hilton Worldwide Holdings

Investors with a lot of money to spend have taken a bearish stance on Hilton Worldwide Holdings HLT.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with HLT, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 10 uncommon options trades for Hilton Worldwide Holdings.

This isn’t normal.

The overall sentiment of these big-money traders is split between 30% bullish and 60%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $140,860, and 6 are calls, for a total amount of $734,796.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $200.0 and $240.0 for Hilton Worldwide Holdings, spanning the last three months.

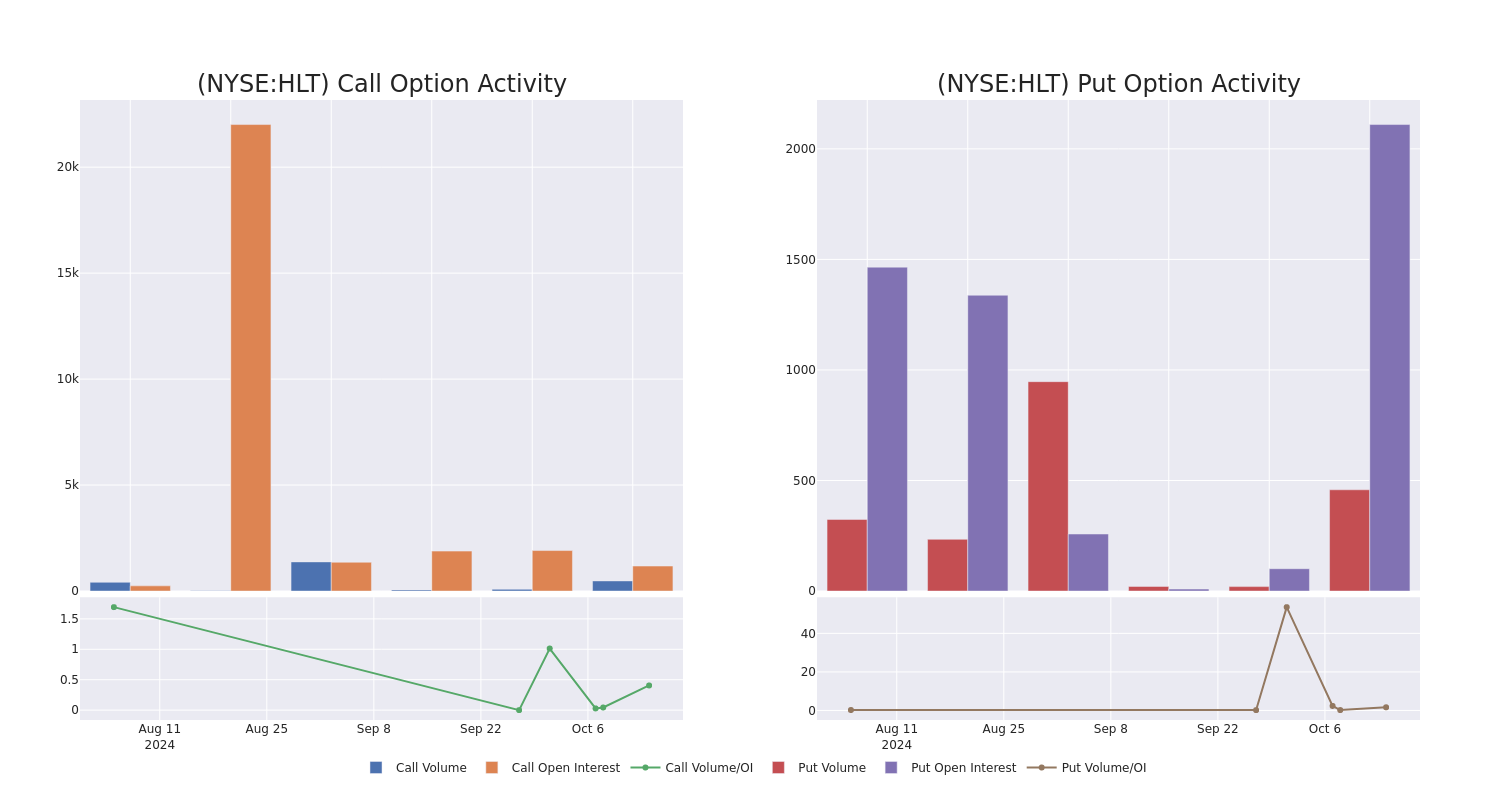

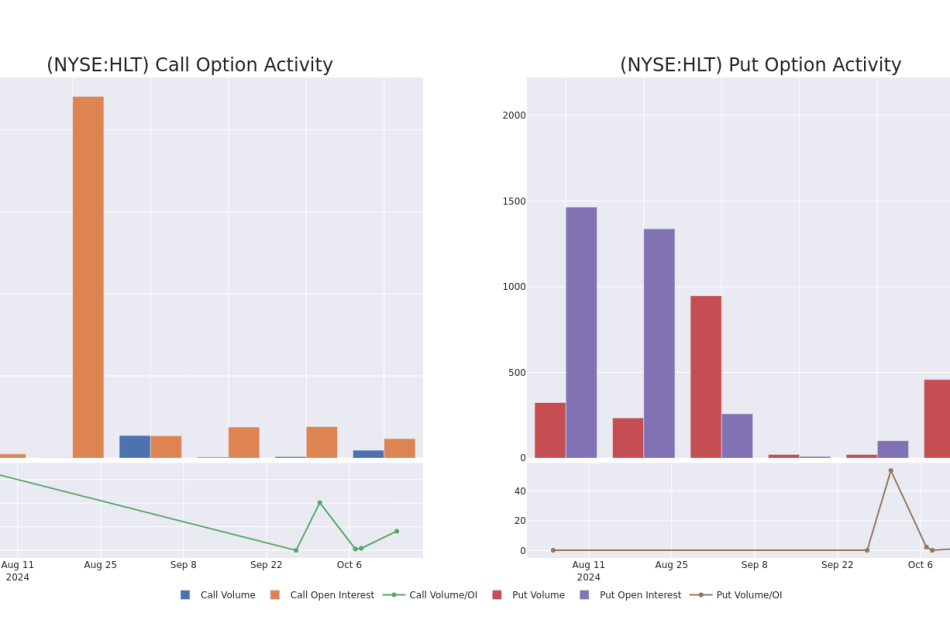

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Hilton Worldwide Holdings’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Hilton Worldwide Holdings’s substantial trades, within a strike price spectrum from $200.0 to $240.0 over the preceding 30 days.

Hilton Worldwide Holdings Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HLT | CALL | SWEEP | NEUTRAL | 11/15/24 | $13.7 | $12.3 | $13.0 | $230.00 | $497.6K | 78 | 401 |

| HLT | CALL | TRADE | BULLISH | 01/16/26 | $50.4 | $49.1 | $50.23 | $210.00 | $100.4K | 251 | 25 |

| HLT | CALL | SWEEP | BEARISH | 10/18/24 | $18.7 | $18.1 | $18.1 | $220.00 | $45.2K | 650 | 37 |

| HLT | PUT | SWEEP | BEARISH | 11/15/24 | $4.2 | $4.1 | $4.19 | $230.00 | $43.6K | 577 | 231 |

| HLT | CALL | TRADE | BEARISH | 10/18/24 | $38.9 | $37.5 | $37.5 | $200.00 | $37.5K | 115 | 10 |

About Hilton Worldwide Holdings

Hilton Worldwide Holdings operates 1.2 million rooms across its more than 20 brands serving the premium economy scale through luxury segments. Hampton and Hilton are the two largest brands, representing 28% and 19%, respectively, of the company’s total rooms, as of Dec. 31, 2023. Recent brands launched over the last few years include Home2, Curio, Canopy, Spark, Tru, Tempo, and LivSmart, as well as a partnership with Small Luxury Hotels and acquisitions of Nomad and Graduate Hotels. Managed and franchised hotels represent the vast majority of adjusted EBITDA, predominantly from the Americas regions.

Having examined the options trading patterns of Hilton Worldwide Holdings, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Hilton Worldwide Holdings Standing Right Now?

- With a trading volume of 1,027,306, the price of HLT is down by -0.16%, reaching $237.76.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 9 days from now.

What Analysts Are Saying About Hilton Worldwide Holdings

In the last month, 1 experts released ratings on this stock with an average target price of $245.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Goldman Sachs has revised its rating downward to Buy, adjusting the price target to $245.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Hilton Worldwide Holdings, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply