Where Will Nvidia Stock Be in 1 Year?

The roller coaster doesn’t seem to be stopping as Nvidia (NASDAQ: NVDA). The centerpiece of the artificial intelligence (AI) boom has also been the main driver of the S&P 500 index’s performance since late 2022. This year alone, roughly a quarter of the index’s 20% rise can be attributed to the chipmaker.

That’s a lot of weight on Nvidia’s shoulders. Investors are hyperfocused on its every move, seeing it as a bellwether for the market at large. The good news for investors, then, is that the AI giant is charging full steam ahead. It will face challenges and overcome obstacles, but Nvidia has several catalysts that could boost its bottom line in the not-too-distant future. What will the next year bring for Nvidia?

Demand is still extremely high for its bread and butter

The uber-powerful chips the company designs and sells are the backbone of its success. That’s why investors were spooked when the company announced its first real snafu since the AI boom took off. Production issues were discovered in the newest version of its AI chips originally set to begin rolling out in the third quarter. These chips, dubbed Blackwell, are now expected to hit the market a quarter later in Q4. Luckily, this delay is shorter than some feared, and the company assured investors that the delay had been accounted for in its guidance.

Critically, any loss from Blackwell chips in the short term is being compensated for by the still extremely high demand for its current-generation Hopper chips. When Blackwell does begin rolling out, the company expects the demand to be even stronger. As CEO Jensen Huang put it, “The anticipation for Blackwell is incredible.”

Now, while Nvidia has generally delivered on its promises in the past, it’s a good idea to take a company’s promises with a grain of salt. Company brass was a little light on details around the delay, and there is always a chance that things won’t go as planned. If more delays are announced, it could spell trouble for Nvidia. Still, I don’t see any reason to believe that will happen here or that this will develop into a major problem.

Nvidia makes more than its flagship chips

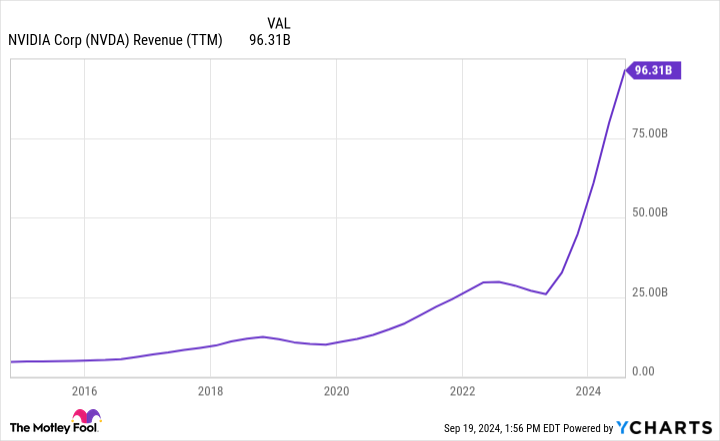

Nvidia’s data center segment, under which its AI chips fall, is by far its most lucrative. I think the chart below puts into perspective just how important the segment is for the company.

See that incredible inflection point in 2023? That is almost entirely coming from its data center growth.

Now, its chips are undoubtedly the heart of this, but it’s not the only product the company offers in this segment. Nvidia aims to be a full-service provider of data center hardware and software. Nvidia has a platform called Spectrum-X that, although launched as recently as last year, has already seen a big uptick in sales.

The platform is a networking solution that allows customers to keep up with the intensive networking demands of AI computing without abandoning ethernet. Ethernet — a networking technology — has been the standard for decades and is used in almost every data center in the world. As Nvidia continues to build ever more powerful chips, existing ethernet networks are struggling to keep up with the flow of data, creating a bottleneck.

This could mean having to retrofit a data center, removing the miles and miles of ethernet cables and associated hardware, and replacing it with faster technology. Remember, these data centers are massive — we’re talking the size of multiple football fields in some cases — so you can imagine this would be incredibly costly. Spectrum-X allows the bones of these networks to remain, upgrading only critical parts of the network infrastructure. This is a huge cost saver for data centers.

Nvidia leadership was excited by Spectrum-X in the company’s latest earnings call. CFO, Colette Kress reported that Nvidia’s “Ethernet for AI” — of which Spectrum-X is a primary part — revenue “doubled sequentially with hundreds of customers adopting our Ethernet offerings” and that the platform “has broad market support from OEM and ODM partners.” The company expects Spectrum to be a multibillion-dollar product line in a year.

Beyond this, Nvidia is rolling out new software to help companies build custom AI solutions and is pushing further into the automotive industry, a segment that could be massive in a few years’ time once driverless technology matures. In the short term, however, this will still be a significant revenue source as AI is integrated into car “infotainment” systems. This is already happening, but expect to see more car companies advertise this system in the coming year.

Nvidia is on the right path

Without getting specific about a price target, I think Nvidia will outperform the market over the coming year. Yes, at a price-to-earnings ratio (P/E) of 56.07, it does carry a premium, but this is pretty much at or below where it has been trading since the beginning of 2020. Furthermore, its forward P/E is currently sitting at 34.2, slightly below its average since the AI boom took off. These figures look fine to me considering Nvidia’s growth potential.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,266!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,047!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,794!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Where Will Nvidia Stock Be in 1 Year? was originally published by The Motley Fool

Leave a Reply