2 Ultra-High-Yield Dividend Stocks You Can Buy Now and Hold at Least a Decade

Everyday investors looking for ultra-high-yield dividend stocks have limited options to choose from. Dividend yields drop as prices rise, and the market has been soaring over the past few years.

The benchmark S&P 500 index has risen by 51% since the end of 2022. In such a buoyant market, finding top dividend payers that offer high yields is a challenge, but it isn’t impossible.

Ares Capital (NASDAQ: ARCC) and PennantPark Floating Rate Capital (NYSE: PFLT) are a pair of well-manged business development companies (BDCs) that offer eye-popping dividend yields. Here’s why income-seeking investors want to add them to a diversified portfolio now and hold them for the long run.

Ares Capital

The first ultra-high-yield dividend stock investors want to load up on is Ares Capital. At recent prices, it offers a huge 9% yield.

Ares Capital is the world’s largest publicly traded BDC. These specialized entities are generally popular among income-seeking investors because they can legally avoid paying income taxes by distributing nearly all their earnings to shareholders as dividend payments.

The BDC industry is a lucrative one because U.S. banks have been increasingly hesitant to lend to businesses directly for decades. All over America, companies starved for capital are willing to pay higher interest rates than you might imagine. The average yield on debt securities in Ares Capital’s portfolio was 12.2% in the second quarter.

The folks who run Ares Capital’s investment committee have 30 years of experience on average and it shows. The BDC’s portfolio grew to $25 billion at the end of June with loans out to 525 different companies. Just 1.5% of the portfolio, at cost, was on nonaccrual status.

Investing in any one midsize business or industry can be dangerous, but Ares Capital’s portfolio is well diversified. Its largest components are in the software, software services, and healthcare services industries. These industries represent just 37% of the overall portfolio.

Lots of diversification and a terrific track record support an investment-grade credit rating that makes it easier to turn a profit in good times and bad. This July, Ares Capital’s excellent credit rating allowed it to raise $850 million by offering five-year notes with a 5.95% coupon. That’s less than half the yield it receives from the debt securities in its portfolio.

This dividend payer isn’t risk-free, but it would take a prolonged recession that forces a wave of defaults across not just one but several of the economy’s more reliable industries before investors need to worry about a severe dividend cut.

PennantPark Floating Rate Capital

PennantPark Floating Rate Capital is another BDC that gives investors an ultra-high dividend yield to consider. At recent prices, it offers a 10.5% yield and monthly payments.

Other BDCs like Ares Capital compete over up-market businesses, but PennantPark gets the pick of the litter when it comes to smaller companies that earn between $10 million and $50 million annually.

As its name implies, practically all of PennantPark Floating Rate Capital’s debt investments collect interest at variable rates. Nearly all of its loans are of the first-lien senior secured variety too. These loans are first in line to be repaid in the event of bankruptcy.

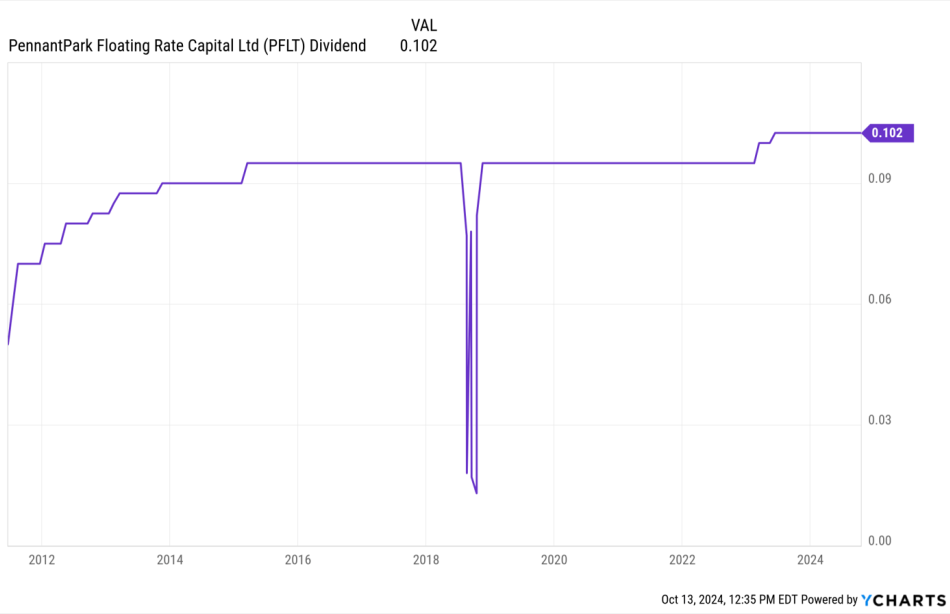

With 26 years of industry experience, PennantPark’s underwriting team is nearly as experienced as Ares Capital’s. With a brief exception in 2018, it’s raised or maintained its dividend payout since its initial public offering in 2011.

Investors can reasonably expect continued stability from PennantPark in the decade ahead. Just three companies representing 1.5% of its overall portfolio at cost were on nonaccrual status at the end of June.

This BDC is most exposed to the professional services, aerospace, and defense industries. The portfolio is so diversified that these industries represent just 15.4% of the total.

While smaller, PennantPark’s portfolio is arguably even more diverse than Ares Capital’s portfolio. Buying some shares now to lock in a dividend yield at a double-digit percentage looks like a great idea for just about any income-seeking investor.

Should you invest $1,000 in Ares Capital right now?

Before you buy stock in Ares Capital, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ares Capital wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Cory Renauer has positions in Ares Capital. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

2 Ultra-High-Yield Dividend Stocks You Can Buy Now and Hold at Least a Decade was originally published by The Motley Fool

Leave a Reply