Looking At Abercrombie & Fitch's Recent Unusual Options Activity

Investors with a lot of money to spend have taken a bearish stance on Abercrombie & Fitch ANF.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with ANF, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 9 uncommon options trades for Abercrombie & Fitch.

This isn’t normal.

The overall sentiment of these big-money traders is split between 33% bullish and 44%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $348,432, and 3 are calls, for a total amount of $137,710.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $135.0 to $200.0 for Abercrombie & Fitch during the past quarter.

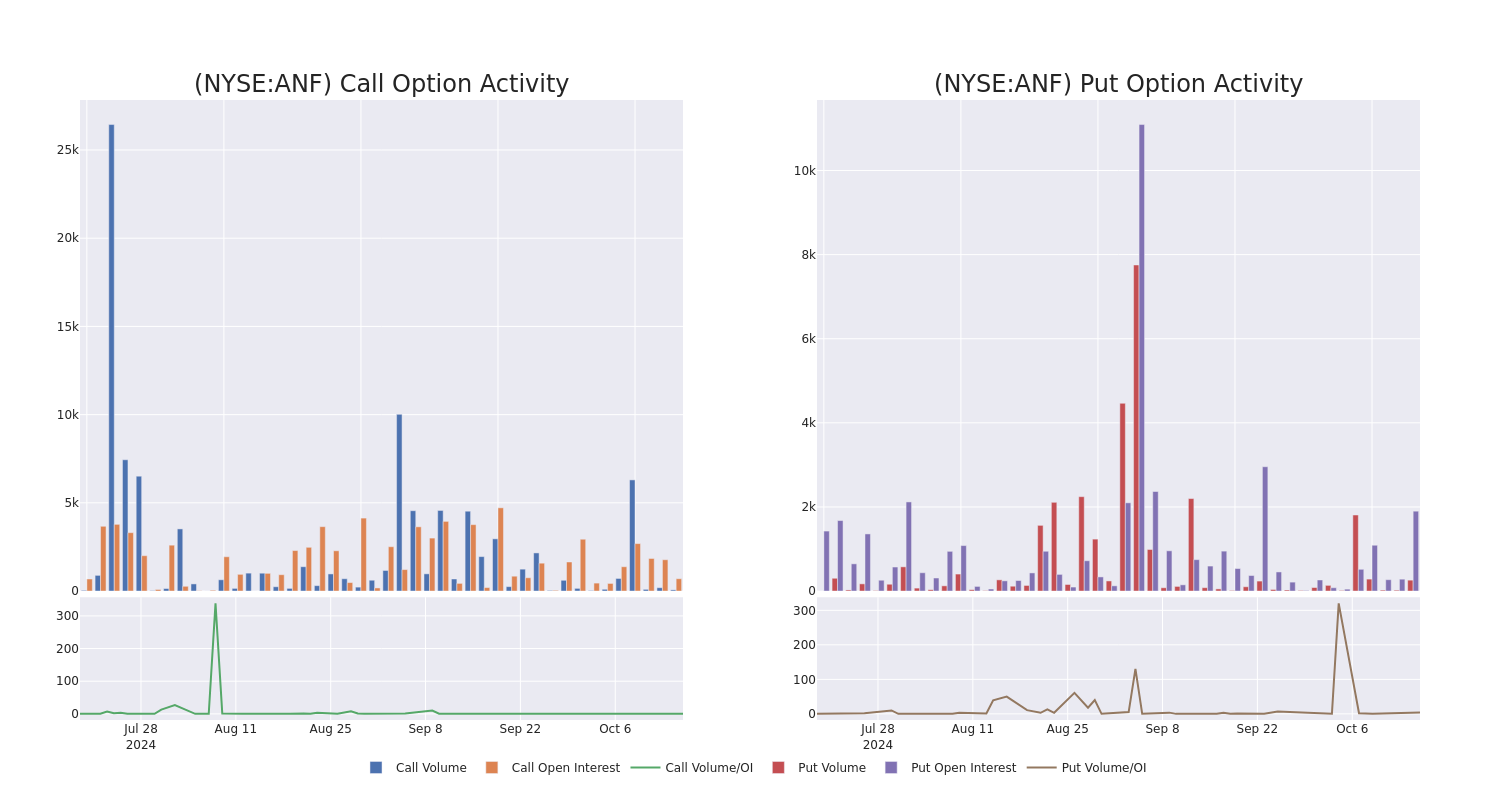

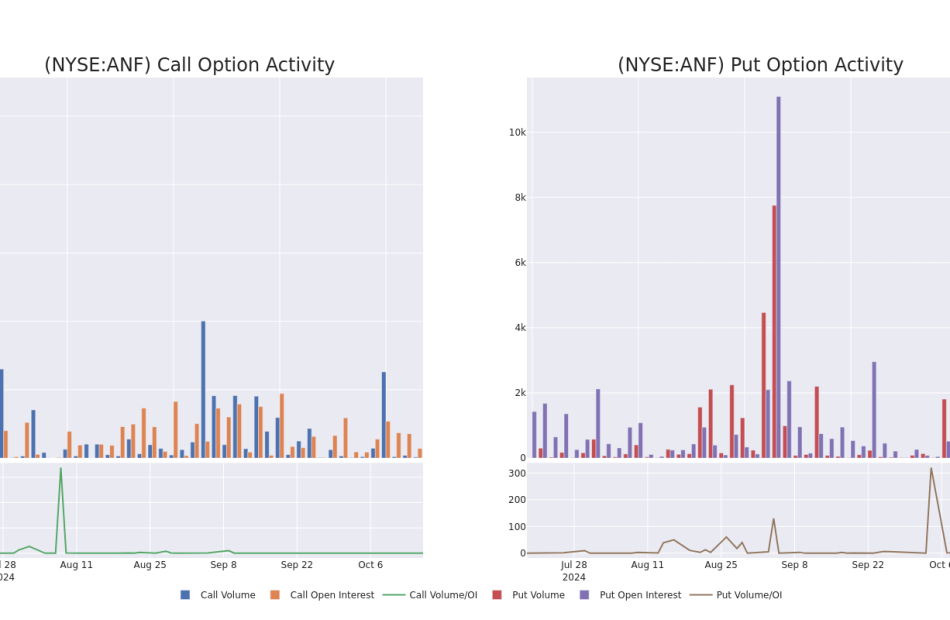

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Abercrombie & Fitch options trades today is 324.62 with a total volume of 326.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Abercrombie & Fitch’s big money trades within a strike price range of $135.0 to $200.0 over the last 30 days.

Abercrombie & Fitch Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ANF | PUT | SWEEP | BEARISH | 11/22/24 | $23.1 | $21.0 | $23.1 | $180.00 | $168.6K | 1.3K | 103 |

| ANF | CALL | TRADE | BULLISH | 11/15/24 | $16.4 | $16.0 | $16.24 | $155.00 | $64.9K | 402 | 46 |

| ANF | PUT | TRADE | NEUTRAL | 01/16/26 | $37.6 | $37.0 | $37.35 | $165.00 | $56.0K | 7 | 15 |

| ANF | PUT | TRADE | BEARISH | 01/17/25 | $42.1 | $41.9 | $42.1 | $200.00 | $42.1K | 26 | 20 |

| ANF | CALL | TRADE | BEARISH | 06/20/25 | $41.5 | $40.3 | $40.75 | $150.00 | $40.7K | 75 | 10 |

About Abercrombie & Fitch

Abercrombie & Fitch Co is a specialty retailer that sells casual clothing, personal-care products, and accessories for men, women, and children. It sells direct to consumers through its stores and websites, which include the Abercrombie & Fitch, Abercrombie kids, and Hollister brands. Most stores are in the United States, but the company does have many stores in Canada, Europe, and Asia. All stores are leased. Abercrombie ships to well over 100 countries via its websites. The company sources its merchandise from dozens of vendors that are primarily located in Asia and Central America. Abercrombie has two distribution centers in Ohio to support its North American operations. It uses third-party distributors for sales in Europe and Asia.

In light of the recent options history for Abercrombie & Fitch, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Abercrombie & Fitch’s Current Market Status

- With a trading volume of 653,080, the price of ANF is up by 0.98%, reaching $161.81.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 34 days from now.

Expert Opinions on Abercrombie & Fitch

1 market experts have recently issued ratings for this stock, with a consensus target price of $195.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from JP Morgan persists with their Overweight rating on Abercrombie & Fitch, maintaining a target price of $195.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Abercrombie & Fitch options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply