Dow Jumps 250 Points; U.S. Bancorp Earnings Top Views

U.S. stocks traded higher midway through trading, with the Dow Jones index gaining over 250 points on Wednesday.

The Dow traded up 0.59% to 42,994.38 while the NASDAQ fell 0.05% to 18,306.79. The S&P 500 also rose, gaining, 0.19% to 5,826.42.

Check This Out: Top 3 Tech And Telecom Stocks That Could Lead To Your Biggest Gains This Quarter

Leading and Lagging Sectors

Utilities shares jumped by 0.8% on Tuesday.

In trading on Tuesday, consumer staples shares fell by 0.5%.

Top Headline

U.S. Bancorp USB posted better-than-expected quarterly earnings on Wednesday.

The company reported third-quarter adjusted earnings per share of $1.03, beating the analyst consensus estimate of 99 cents. Quarterly revenues of $6.864 billion missed the analyst consensus estimate of $6.895 billion.

Equities Trading UP

- 180 Life Sciences Corp ATNF shares shot up 713% to $12.36. 180 Life Sciences interim CEO said that the company is planning to enter the online gaming industry with its newly acquired gaming technology platform.

- Shares of Altus Power, Inc. AMPS got a boost, surging 15% to $3.48 after the company announced that a formal review of strategic alternatives has been underway by its Board of Directors. Also, the company reaffirmed its FY24 guidance.

- Versus Systems Inc. VS shares were also up, gaining 399% to $5.64 after the company announced a $2.5 million investment and licensing agreement with ASPIS.

Equities Trading DOWN

- Bright Minds Biosciences Inc DRUG shares dropped 37% to $24.24. Firefly Neuroscience collaborated with Bright Minds Biosciences to analyze the data from its positive Phase 1 study using its Artificial Intelligence.

- Shares of Silvaco Group, Inc. SVCO were down 25% to $8.34 after the company reported a decline in orders from Asia during third quarter and cut its FY24 revenue outlook.

- Novavax, Inc. NVAX was down, falling 17% to $10.45 after the FDA placed a clinical hold on the company’s investigational new drug application for its COVID-19-influenza combination and standalone influenza vaccine candidates.

Commodities

In commodity news, oil traded down 0.2% to $70.46 while gold traded up 0.6% at $2,694.90.

Silver traded up 1.6% to $32.270 on Wednesday, while copper rose 1% to $4.3810.

Euro zone

European shares were mixed today. The eurozone’s STOXX 600 gained 0.02%, Germany’s DAX gained 0.1% and France’s CAC 40 fell 0.17%. Spain’s IBEX 35 Index rose 0.75%, while London’s FTSE 100 gained 1.15%.

Asia Pacific Markets

Asian markets closed mostly lower on Wednesday, with Japan’s Nikkei 225 falling 1.83%, Hong Kong’s Hang Seng Index falling 0.16%, China’s Shanghai Composite Index gaining 0.05% and India’s BSE Sensex falling 0.39%.

Economics

- U.S. mortgage applications fell by 17% from the previous week during the second week of October.

- Export prices in the U.S. declined by 0.7% month-over-month in September, exceeding market estimates of a 0.4% fall.

- Import prices declined by 0.4% from the previous month in September.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Chinese Stocks on Brink of Correction as Investor Patience Wanes

(Bloomberg) — Chinese stocks fell to the verge of a correction in a sign of growing disappointment over the pace of stimulus rollout.

Most Read from Bloomberg

The CSI 300 Index ended the day 0.6% lower, bringing its declines from an Oct. 8 high to nearly 10%. A gauge of Chinese shares listed in Hong Kong swung between gains and losses before trading up 0.4% as of 3:36 p.m. local time.

The market has been on a roller-coaster ride since late September, when a series of stimulus measures by the central bank unleashed a burst of optimism that’s now quickly cooling. As Beijing takes its time detailing a fiscal spending plan, skepticism is growing whether authorities are willing to deploy greater firepower to turn around the economy and markets.

“This historic surge in momentum at the end of September is of course unsustainable, and given how fast markets rose, it can fall equally fast,” said Marvin Chen, a strategist at Bloomberg Intelligence. “But overall policy actions are moving in the right direction at a quicker pace and when the dust settles, China equities may still trade in a higher range than before.”

While a decline of 10% would push a benchmark into a technical correction, the extreme volatility gripping Chinese stocks of late has made such milestones less meaningful. The CSI 300 soared more than 30% in about three weeks since mid-September before losing momentum.

Chinese investors have been split over whether the rally has already peaked out, or whether there’s room for further gains.

In a fund manager survey by BofA Securities performed Oct. 4-10, roughly half of the respondents saw up to 10% upside potential for Chinese offshore stocks over the next six months, while another 33% saw gains between 10% to 20%.

Nearly a third of them said they are building exposure on signs of easing, up sharply from just 8% in the previous month. Still, three quarters of the respondents said the market is going through a “structural de-rating.”

Property Stocks

The next key event is a press briefing by the housing minister on Thursday, where authorities may provide more details of measures to support the country’s slumping property sector and bolster economic growth. Any disappointment from that event may reignite a selloff.

Chinese property stocks jumped ahead of the briefing, with a Bloomberg Intelligence gauge of developer shares gaining as much as 10% after shedding 7% on Tuesday. The sector has been at the center of investor focus, with stocks seeing wild swings as policy expectations waxed and waned.

Minister Ni Hong will be the latest senior economic official to speak in public about the government’s pivot toward stabilizing growth, after People’s Bank of China Governor Pan Gongsheng, Minister of Finance Lan Fo’an and the chairman of the country’s economic planning agency, Zheng Shanjie.

The last two pressers by the National Development and Reform Commission and the MoF “have been disappointing so there should be no reason to lift hopes for the briefing tomorrow,” said Vey-Sern Ling, managing director at Union Bancaire Privee.

–With assistance from Abhishek Vishnoi and Jake Lloyd-Smith.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Insider Unloading: Joanne D Smith Sells $173K Worth Of Delta Air Lines Shares

Joanne D Smith, EVP & Chief People Officer at Delta Air Lines DAL, reported an insider sell on October 15, according to a new SEC filing.

What Happened: Smith’s recent move involves selling 3,431 shares of Delta Air Lines. This information is documented in a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday. The total value is $173,131.

The latest market snapshot at Wednesday morning reveals Delta Air Lines shares up by 4.36%, trading at $55.03.

Delving into Delta Air Lines’s Background

Atlanta-based Delta Air Lines is one of the world’s largest airlines, with a network of over 300 destinations in more than 50 countries. Delta operates a hub-and-spoke network, where it gathers and distributes passengers across the globe through its biggest hubs in Atlanta, New York, Salt Lake City, Detroit, Seattle, and Minneapolis-St. Paul. Delta has historically earned most of its international revenue and profits from flying passengers over the Atlantic Ocean.

Delta Air Lines’s Economic Impact: An Analysis

Positive Revenue Trend: Examining Delta Air Lines’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 1.22% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Insights into Profitability:

-

Gross Margin: The company excels with a remarkable gross margin of 24.41%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): Delta Air Lines’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 1.98.

Debt Management: Delta Air Lines’s debt-to-equity ratio is below the industry average at 1.79, reflecting a lower dependency on debt financing and a more conservative financial approach.

Exploring Valuation Metrics Landscape:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 7.31, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: With a P/S ratio of 0.56 below industry standards, the stock shows potential undervaluation, making it an appealing investment option for those focusing on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Delta Air Lines’s EV/EBITDA ratio stands at 8.37, surpassing industry benchmarks. This places the company in a position with a higher-than-average market valuation.

Market Capitalization Analysis: With a profound presence, the company’s market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Activity Matters in Finance

While insider transactions provide valuable information, they should be part of a broader analysis in making investment decisions.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

The Insider’s Guide to Important Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Delta Air Lines’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

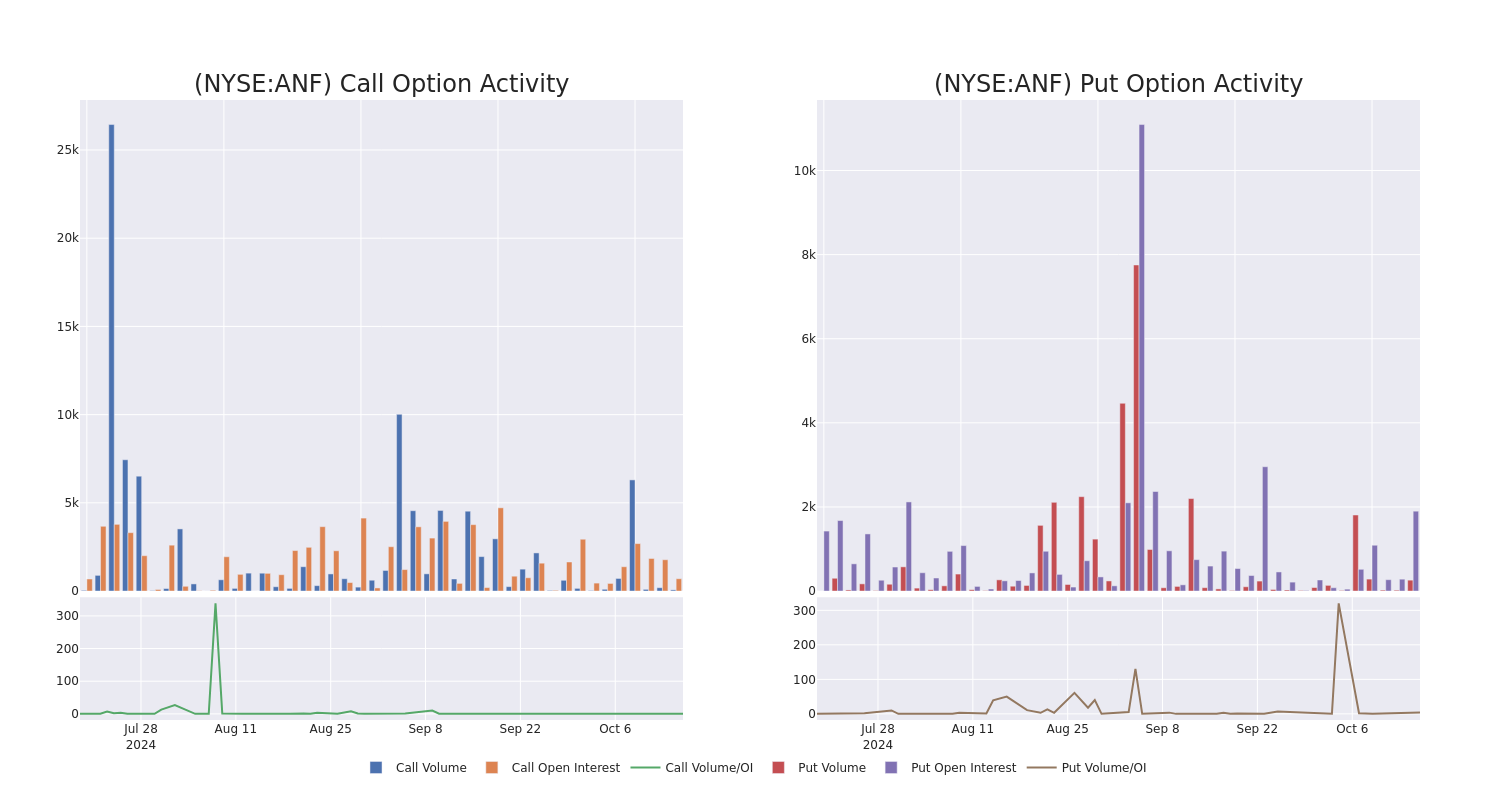

Looking At Abercrombie & Fitch's Recent Unusual Options Activity

Investors with a lot of money to spend have taken a bearish stance on Abercrombie & Fitch ANF.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with ANF, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 9 uncommon options trades for Abercrombie & Fitch.

This isn’t normal.

The overall sentiment of these big-money traders is split between 33% bullish and 44%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $348,432, and 3 are calls, for a total amount of $137,710.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $135.0 to $200.0 for Abercrombie & Fitch during the past quarter.

Volume & Open Interest Development

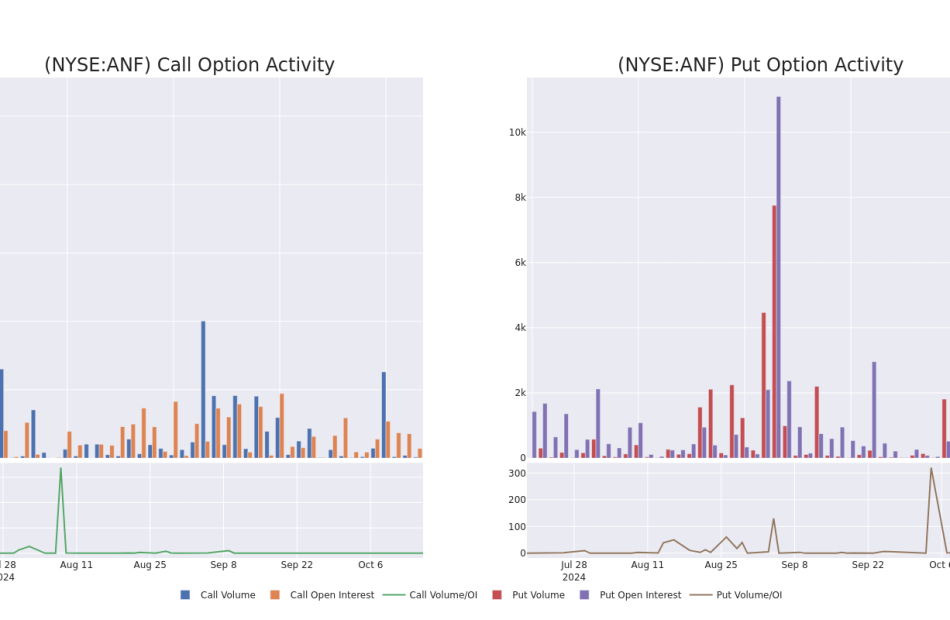

In terms of liquidity and interest, the mean open interest for Abercrombie & Fitch options trades today is 324.62 with a total volume of 326.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Abercrombie & Fitch’s big money trades within a strike price range of $135.0 to $200.0 over the last 30 days.

Abercrombie & Fitch Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ANF | PUT | SWEEP | BEARISH | 11/22/24 | $23.1 | $21.0 | $23.1 | $180.00 | $168.6K | 1.3K | 103 |

| ANF | CALL | TRADE | BULLISH | 11/15/24 | $16.4 | $16.0 | $16.24 | $155.00 | $64.9K | 402 | 46 |

| ANF | PUT | TRADE | NEUTRAL | 01/16/26 | $37.6 | $37.0 | $37.35 | $165.00 | $56.0K | 7 | 15 |

| ANF | PUT | TRADE | BEARISH | 01/17/25 | $42.1 | $41.9 | $42.1 | $200.00 | $42.1K | 26 | 20 |

| ANF | CALL | TRADE | BEARISH | 06/20/25 | $41.5 | $40.3 | $40.75 | $150.00 | $40.7K | 75 | 10 |

About Abercrombie & Fitch

Abercrombie & Fitch Co is a specialty retailer that sells casual clothing, personal-care products, and accessories for men, women, and children. It sells direct to consumers through its stores and websites, which include the Abercrombie & Fitch, Abercrombie kids, and Hollister brands. Most stores are in the United States, but the company does have many stores in Canada, Europe, and Asia. All stores are leased. Abercrombie ships to well over 100 countries via its websites. The company sources its merchandise from dozens of vendors that are primarily located in Asia and Central America. Abercrombie has two distribution centers in Ohio to support its North American operations. It uses third-party distributors for sales in Europe and Asia.

In light of the recent options history for Abercrombie & Fitch, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Abercrombie & Fitch’s Current Market Status

- With a trading volume of 653,080, the price of ANF is up by 0.98%, reaching $161.81.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 34 days from now.

Expert Opinions on Abercrombie & Fitch

1 market experts have recently issued ratings for this stock, with a consensus target price of $195.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from JP Morgan persists with their Overweight rating on Abercrombie & Fitch, maintaining a target price of $195.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Abercrombie & Fitch options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

An Overview of Texas Capital Bancshares's Earnings

Texas Capital Bancshares TCBI will release its quarterly earnings report on Thursday, 2024-10-17. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate Texas Capital Bancshares to report an earnings per share (EPS) of $0.95.

The market awaits Texas Capital Bancshares’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

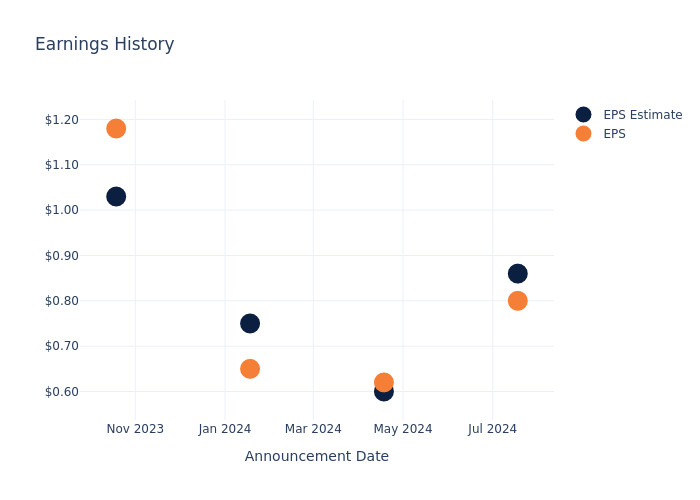

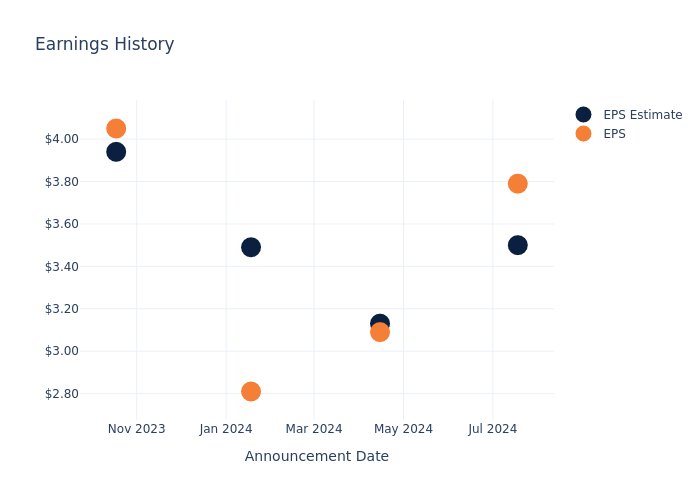

Earnings History Snapshot

During the last quarter, the company reported an EPS missed by $0.06, leading to a 0.06% drop in the share price on the subsequent day.

Here’s a look at Texas Capital Bancshares’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.86 | 0.60 | 0.75 | 1.03 |

| EPS Actual | 0.80 | 0.62 | 0.65 | 1.18 |

| Price Change % | -0.0% | 5.0% | 1.0% | -5.0% |

Market Performance of Texas Capital Bancshares’s Stock

Shares of Texas Capital Bancshares were trading at $77.57 as of October 15. Over the last 52-week period, shares are up 40.12%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

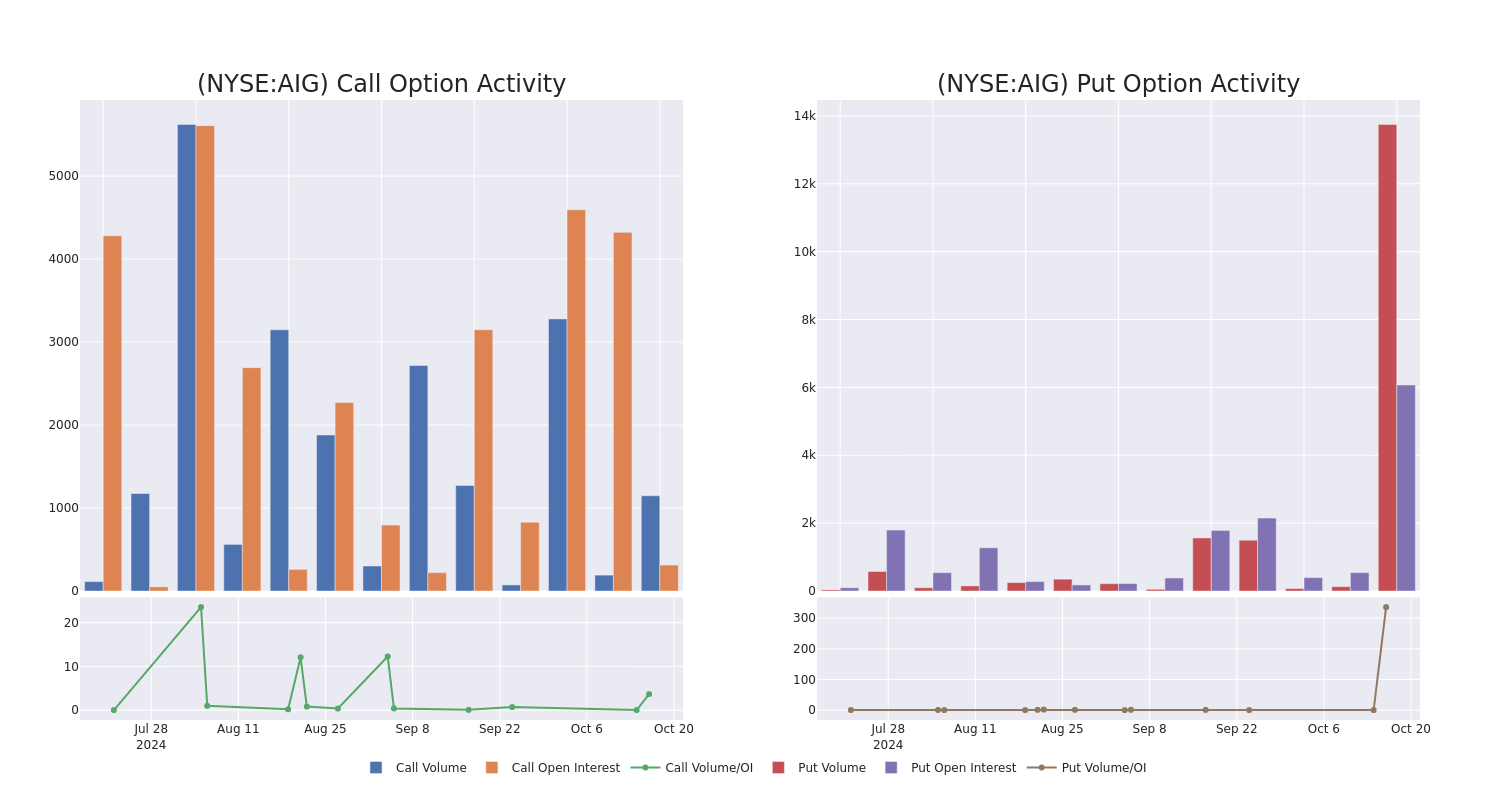

American Intl Gr's Options Frenzy: What You Need to Know

Whales with a lot of money to spend have taken a noticeably bearish stance on American Intl Gr.

Looking at options history for American Intl Gr AIG we detected 11 trades.

If we consider the specifics of each trade, it is accurate to state that 45% of the investors opened trades with bullish expectations and 54% with bearish.

From the overall spotted trades, 9 are puts, for a total amount of $927,850 and 2, calls, for a total amount of $91,715.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $70.0 to $78.0 for American Intl Gr over the recent three months.

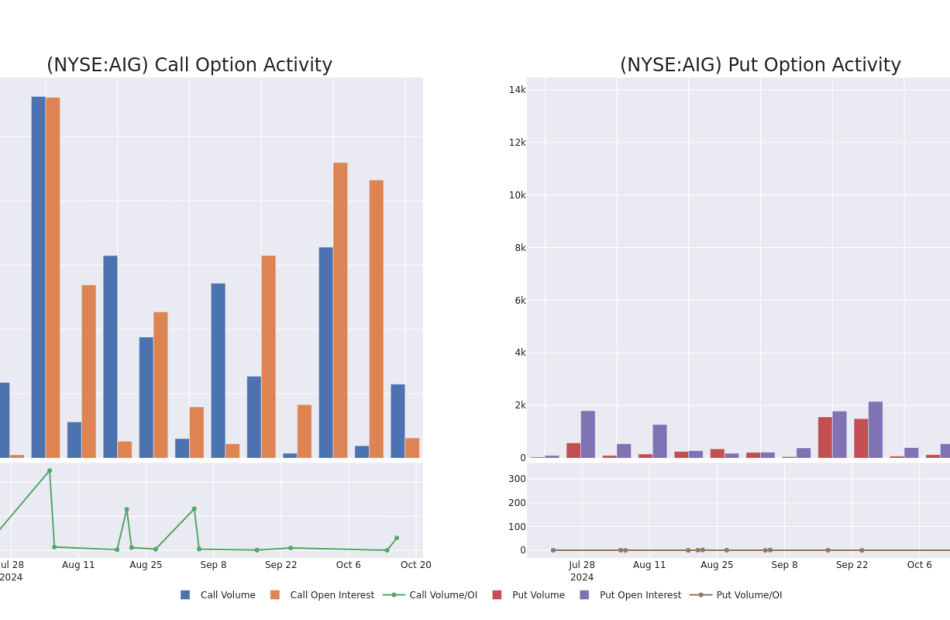

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in American Intl Gr’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to American Intl Gr’s substantial trades, within a strike price spectrum from $70.0 to $78.0 over the preceding 30 days.

American Intl Gr Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AIG | PUT | SWEEP | BULLISH | 12/20/24 | $2.2 | $2.15 | $2.15 | $75.00 | $430.0K | 3.0K | 1.8K |

| AIG | PUT | SWEEP | BEARISH | 12/20/24 | $1.05 | $0.95 | $1.05 | $70.00 | $105.0K | 3.0K | 3.2K |

| AIG | PUT | SWEEP | BEARISH | 11/01/24 | $1.25 | $1.15 | $1.2 | $77.00 | $100.4K | 9 | 1.3K |

| AIG | PUT | SWEEP | BEARISH | 11/01/24 | $1.25 | $1.2 | $1.25 | $77.00 | $70.2K | 9 | 1.3K |

| AIG | CALL | SWEEP | BEARISH | 02/21/25 | $10.0 | $9.9 | $9.9 | $70.00 | $53.4K | 157 | 55 |

About American Intl Gr

American International Group is one of the largest insurance and financial services firms in the world and has a global footprint. It operates through a wide range of subsidiaries that provide property, casualty, and life insurance. The company recently spun off its life insurance operations (Corebridge), but still retains a majority stake.

Following our analysis of the options activities associated with American Intl Gr, we pivot to a closer look at the company’s own performance.

Where Is American Intl Gr Standing Right Now?

- Currently trading with a volume of 889,881, the AIG’s price is up by 0.43%, now at $77.31.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 19 days.

Expert Opinions on American Intl Gr

5 market experts have recently issued ratings for this stock, with a consensus target price of $85.4.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Jefferies has decided to maintain their Buy rating on American Intl Gr, which currently sits at a price target of $88.

* An analyst from BMO Capital downgraded its action to Market Perform with a price target of $84.

* An analyst from JP Morgan has elevated its stance to Overweight, setting a new price target at $89.

* An analyst from Evercore ISI Group persists with their In-Line rating on American Intl Gr, maintaining a target price of $78.

* Maintaining their stance, an analyst from UBS continues to hold a Buy rating for American Intl Gr, targeting a price of $88.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for American Intl Gr with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Is Nano Nuclear Energy Stock Gaining Today?

Nano Nuclear Energy Inc. NNE shares are trading higher on Wednesday.

In fact, shares of all nuclear-linked stocks are trading higher after Amazon Web Services announced plans to invest over $500 million in nuclear power.

AWS, Amazon’s cloud computing subsidiary, has signed three agreements to support nuclear energy development, including building Small Modular Reactors (SMRs).

This includes a deal with Energy Northwest for four SMRs generating up to 960 MW and partnerships with X-energy and Dominion Energy to explore additional projects in Virginia.

Read More: Nuclear Stocks Soar As Amazon Becomes Latest Tech Giant To Invest In Nuclear Power

The company has appointed John G. Vonglis, the former Chief Financial Officer of the U.S. Department of Energy and Acting Director of its Advanced Research Projects Agency-Energy, as the Chairman of its Executive Advisory Board for Strategic Initiatives.

Vonglis served as the Senate-confirmed Chief Financial Officer and Chief Risk Officer of the DOE from 2017 to 2019.

Last month, the firm announced the launch of NANO Nuclear Space to explore the potential commercial applications of its developing micronuclear reactor technology in space.

Nano Nuclear Energy said that NNS would optimize NANO’s existing reactor designs, including the “ZEUS” solid core battery and “ODIN” low-pressure coolant reactor, for potential use in cis-lunar space—the area between Earth and the Moon. The company said these technologies aim to support extraterrestrial power systems, human habitation and propulsion for long-distance missions.

Price Action: NNE shares are trading higher by 14% to $17.76 at last check Wednesday.

Photo by Sundry Photography via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

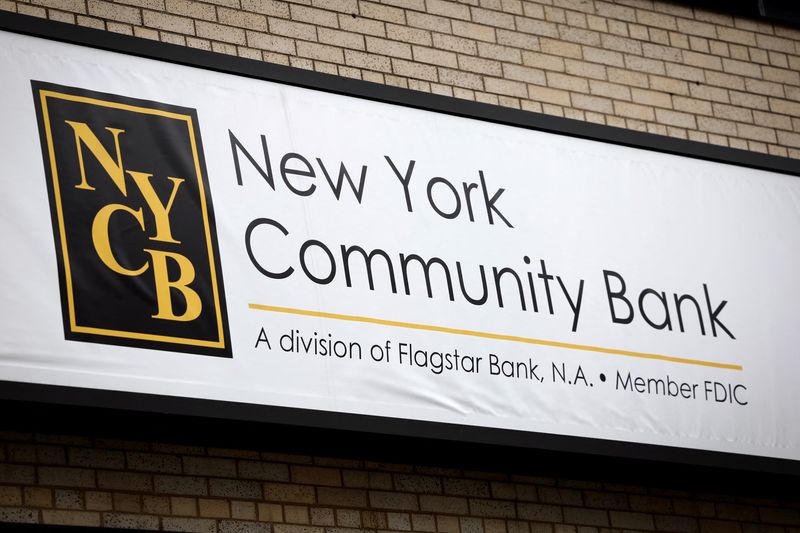

NYCB to be renamed Flagstar Financial as turnaround gathers pace

(Reuters) -New York Community Bancorp will rename itself as Flagstar Financial, the U.S. regional lender said on Tuesday, amid efforts to turn around its struggling business.

The bank came under pressure after it reported in January increased stress in its commercial real estate portfolio that also rekindled concerns over the health of the sector recovering from the failures of a slew of regional banks in 2023.

Under Joseph Otting, a former comptroller of the currency who was named CEO in March, NYCB has laid out a plan to return to profitability and vowed to shrink its balance sheet by reducing non-core assets.

The name change marks “another milestone in our ongoing transformation”, Otting said in a statement on Tuesday.

NYCB will also change its stock symbol to “FLG.” The name change will become effective on Oct. 25.

Flagstar Bank is a subsidiary of New York Community Bancorp. The lender announced its $2.6 billion acquisition of Flagstar in 2021.

(Reporting by Jaiveer Singh Shekhawat in Bengaluru; Editing by Sriraj Kalluvila and Alan Barona)

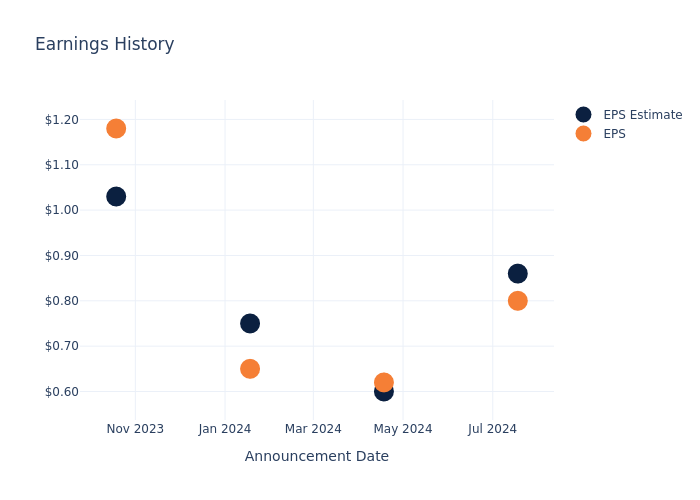

Uncovering Potential: M&T Bank's Earnings Preview

M&T Bank MTB is gearing up to announce its quarterly earnings on Thursday, 2024-10-17. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that M&T Bank will report an earnings per share (EPS) of $3.64.

Investors in M&T Bank are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

Historical Earnings Performance

In the previous earnings release, the company beat EPS by $0.29, leading to a 1.27% drop in the share price the following trading session.

Here’s a look at M&T Bank’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 3.50 | 3.13 | 3.49 | 3.94 |

| EPS Actual | 3.79 | 3.09 | 2.81 | 4.05 |

| Price Change % | -1.0% | -3.0% | 5.0% | -1.0% |

Tracking M&T Bank’s Stock Performance

Shares of M&T Bank were trading at $185.88 as of October 15. Over the last 52-week period, shares are up 57.78%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for M&T Bank visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Looking At WAVE Life Sciences's Recent Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on WAVE Life Sciences.

Looking at options history for WAVE Life Sciences WVE we detected 13 trades.

If we consider the specifics of each trade, it is accurate to state that 53% of the investors opened trades with bullish expectations and 46% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $251,490 and 10, calls, for a total amount of $481,968.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $7.5 to $15.0 for WAVE Life Sciences during the past quarter.

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for WAVE Life Sciences options trades today is 608.71 with a total volume of 10,303.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for WAVE Life Sciences’s big money trades within a strike price range of $7.5 to $15.0 over the last 30 days.

WAVE Life Sciences Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WVE | PUT | TRADE | BULLISH | 01/17/25 | $2.15 | $1.7 | $1.7 | $12.50 | $170.0K | 1 | 1.0K |

| WVE | CALL | SWEEP | BEARISH | 11/15/24 | $2.5 | $1.95 | $2.0 | $15.00 | $84.8K | 3 | 1.9K |

| WVE | CALL | SWEEP | BEARISH | 01/17/25 | $7.9 | $7.5 | $7.7 | $7.50 | $77.0K | 510 | 111 |

| WVE | CALL | SWEEP | BULLISH | 01/17/25 | $7.7 | $7.4 | $7.5 | $7.50 | $75.0K | 510 | 212 |

| WVE | CALL | SWEEP | BEARISH | 10/18/24 | $5.9 | $5.6 | $5.67 | $7.50 | $56.9K | 1.3K | 114 |

About WAVE Life Sciences

WAVE Life Sciences Ltd is unlocking the broad potential of RNA medicines also known as oligonucleotides, it targeting ribonucleic acid (RNA), to transform human health. RNA medicines platform, PRISMTM, combines multiple modalities, chemistry innovation, and deep insights into human genetics to deliver scientific breakthroughs that treat both rare and prevalent disorders. Its toolkit of RNA-targeting modalities includes RNA editing, splicing, antisense silencing, and RNA interference, providing capabilities for designing and sustainably delivering candidates that optimally address disease biology. Its programs are for rare and prevalent diseases, including alpha-1 antitrypsin deficiency, obesity, Duchenne muscular dystrophy, and Huntington’s disease.

In light of the recent options history for WAVE Life Sciences, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

WAVE Life Sciences’s Current Market Status

- Currently trading with a volume of 13,020,486, the WVE’s price is up by 74.92%, now at $14.97.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 22 days.

Professional Analyst Ratings for WAVE Life Sciences

5 market experts have recently issued ratings for this stock, with a consensus target price of $14.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from RBC Capital keeps a Sector Perform rating on WAVE Life Sciences with a target price of $7.

* An analyst from B. Riley Securities has revised its rating downward to Buy, adjusting the price target to $11.

* Maintaining their stance, an analyst from B. Riley Securities continues to hold a Buy rating for WAVE Life Sciences, targeting a price of $19.

* An analyst from JP Morgan has revised its rating downward to Overweight, adjusting the price target to $13.

* An analyst from HC Wainwright & Co. has decided to maintain their Buy rating on WAVE Life Sciences, which currently sits at a price target of $22.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for WAVE Life Sciences with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.