Unpacking the Latest Options Trading Trends in Applied Digital

Investors with a lot of money to spend have taken a bullish stance on Applied Digital APLD.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with APLD, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 10 options trades for Applied Digital.

This isn’t normal.

The overall sentiment of these big-money traders is split between 70% bullish and 30%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $35,255, and 9, calls, for a total amount of $595,670.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $6.0 to $16.0 for Applied Digital during the past quarter.

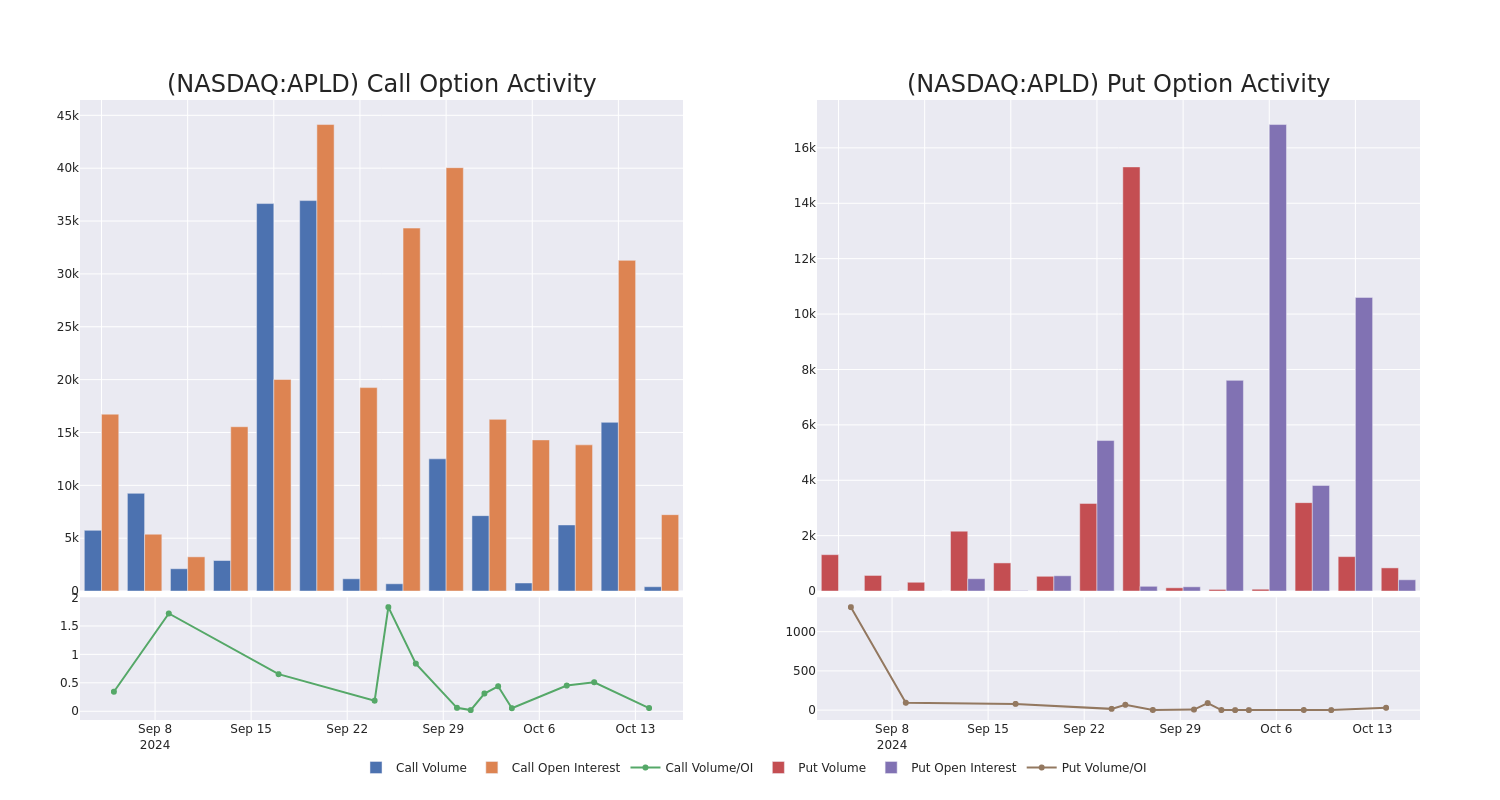

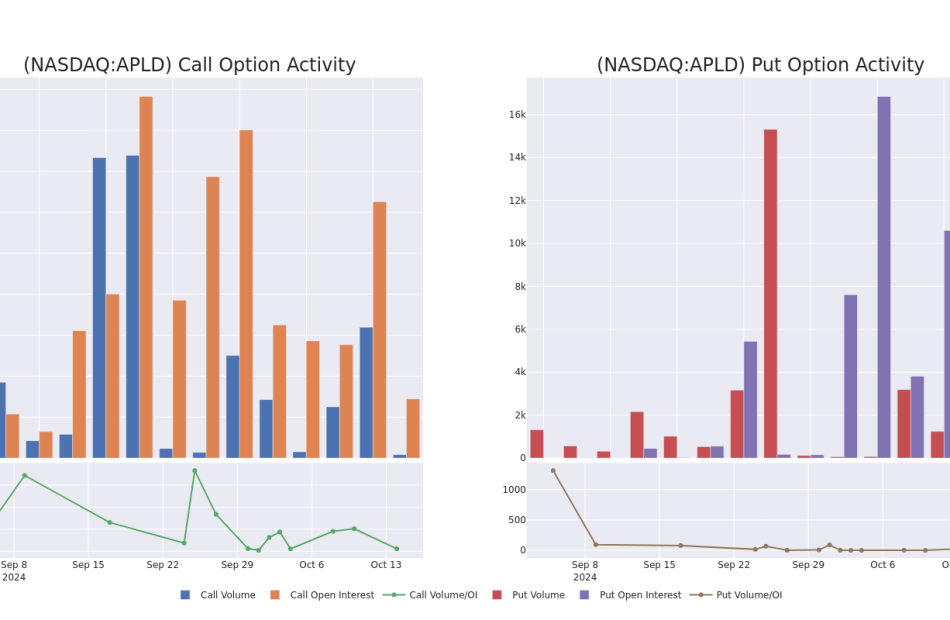

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Applied Digital’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Applied Digital’s significant trades, within a strike price range of $6.0 to $16.0, over the past month.

Applied Digital Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| APLD | CALL | SWEEP | BEARISH | 01/17/25 | $2.9 | $2.8 | $2.8 | $6.00 | $98.0K | 1.3K | 362 |

| APLD | CALL | SWEEP | BULLISH | 01/17/25 | $1.5 | $1.4 | $1.5 | $10.00 | $75.0K | 13.7K | 3.0K |

| APLD | CALL | TRADE | BULLISH | 01/17/25 | $1.45 | $1.4 | $1.45 | $10.00 | $72.5K | 13.7K | 1.5K |

| APLD | CALL | TRADE | BULLISH | 01/17/25 | $1.45 | $1.35 | $1.45 | $10.00 | $70.3K | 13.7K | 2.5K |

| APLD | CALL | SWEEP | BULLISH | 01/17/25 | $1.4 | $1.3 | $1.4 | $10.00 | $70.0K | 13.7K | 1.0K |

About Applied Digital

Applied Digital Corp is a designer, developer, and operator of next-generation digital infrastructure across North America. It provides digital infrastructure solutions and cloud services to industries like High-Performance Computing (HPC) and Artificial Intelligence (AI). The company operates in the following business segments; Data Center Hosting Business, Cloud Services Business, and HPC Hosting Business. The majority of its revenue is generated from the Data Center Hosting Business which operates data centers to provide energized space to crypto mining customers.

Having examined the options trading patterns of Applied Digital, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Applied Digital

- Currently trading with a volume of 10,409,860, the APLD’s price is up by 2.6%, now at $7.49.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 90 days.

Expert Opinions on Applied Digital

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $10.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* In a cautious move, an analyst from Roth MKM downgraded its rating to Buy, setting a price target of $10.

* Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $11.

* Consistent in their evaluation, an analyst from Craig-Hallum keeps a Buy rating on Applied Digital with a target price of $12.

* An analyst from HC Wainwright & Co. has decided to maintain their Buy rating on Applied Digital, which currently sits at a price target of $10.

* Maintaining their stance, an analyst from Lake Street continues to hold a Buy rating for Applied Digital, targeting a price of $11.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Applied Digital options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply