Uranium Energy Unusual Options Activity For October 16

Investors with a lot of money to spend have taken a bearish stance on Uranium Energy UEC.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with UEC, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 10 uncommon options trades for Uranium Energy.

This isn’t normal.

The overall sentiment of these big-money traders is split between 30% bullish and 60%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $82,500, and 7 are calls, for a total amount of $374,700.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $2.5 and $10.0 for Uranium Energy, spanning the last three months.

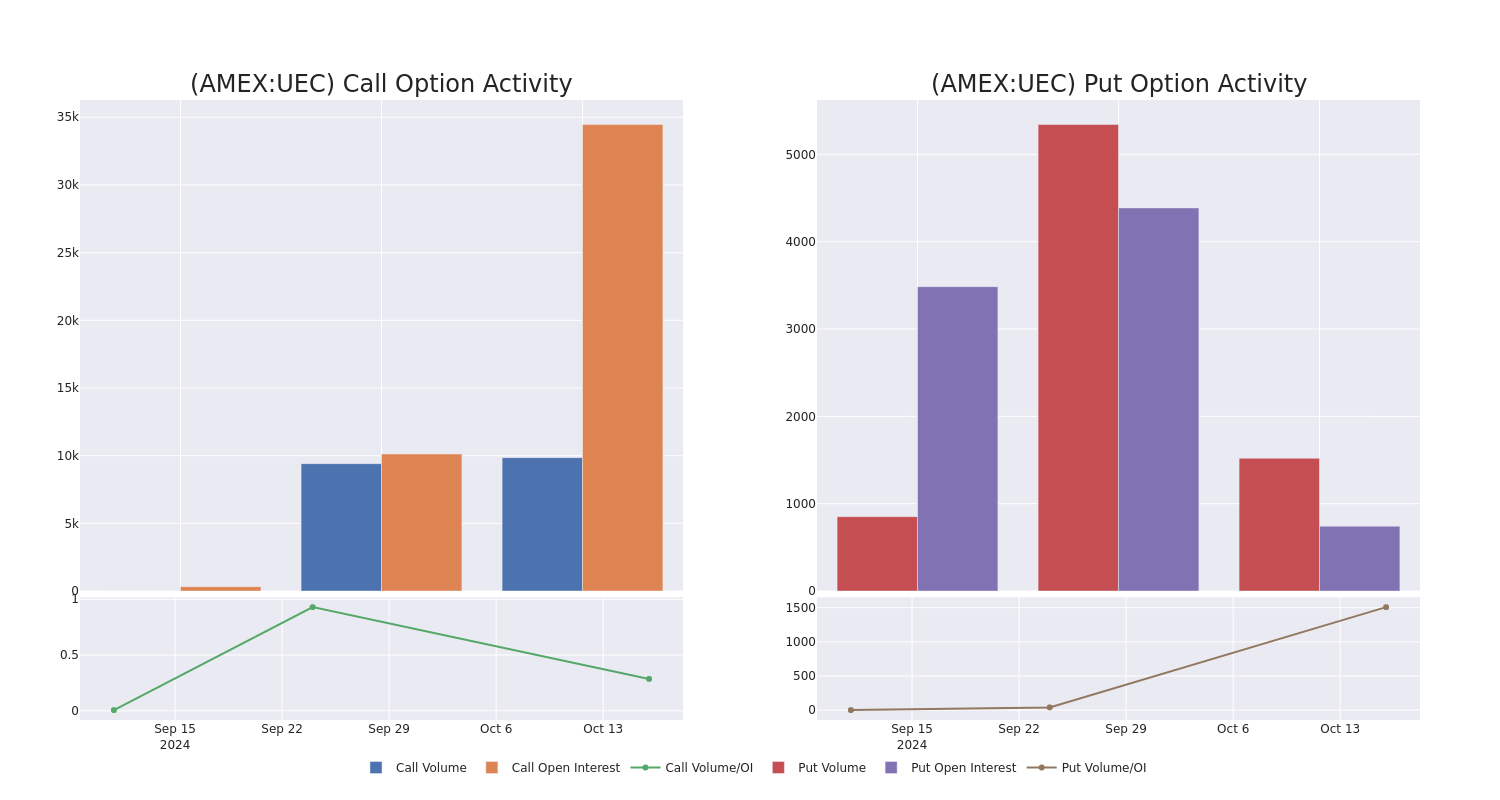

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Uranium Energy’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Uranium Energy’s significant trades, within a strike price range of $2.5 to $10.0, over the past month.

Uranium Energy Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UEC | CALL | TRADE | BULLISH | 01/17/25 | $5.2 | $4.5 | $5.1 | $2.50 | $101.9K | 482 | 200 |

| UEC | CALL | SWEEP | BEARISH | 11/15/24 | $1.25 | $1.2 | $1.2 | $7.00 | $60.0K | 7.6K | 822 |

| UEC | CALL | TRADE | BEARISH | 11/15/24 | $1.25 | $1.15 | $1.15 | $7.00 | $57.5K | 7.6K | 1.3K |

| UEC | CALL | SWEEP | BEARISH | 01/17/25 | $0.55 | $0.5 | $0.5 | $9.00 | $50.0K | 877 | 1.0K |

| UEC | CALL | SWEEP | BEARISH | 01/17/25 | $0.45 | $0.4 | $0.4 | $10.00 | $40.1K | 25.4K | 2.4K |

About Uranium Energy

Uranium Energy Corp is engaged in uranium mining and related activities. The company is working towards fueling the demand for carbon-free nuclear energy, a key solution to climate change, and energy source for the low-carbon future. The company is advancing its next generation of low-cost, environmentally friendly, in-situ recovery (ISR) mining uranium projects. The company has two extraction-ready ISR hub and spoke platforms in South Texas and Wyoming. UEC also has seven U.S. ISR uranium projects with all of their permits in place, with additional diversified holdings of uranium assets across the U.S., Canada and Paraguay.

In light of the recent options history for Uranium Energy, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Uranium Energy’s Current Market Status

- With a trading volume of 12,278,005, the price of UEC is up by 8.51%, reaching $7.96.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 13 days from now.

Professional Analyst Ratings for Uranium Energy

In the last month, 2 experts released ratings on this stock with an average target price of $9.875.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Roth MKM continues to hold a Buy rating for Uranium Energy, targeting a price of $9.

* In a cautious move, an analyst from HC Wainwright & Co. downgraded its rating to Buy, setting a price target of $10.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Uranium Energy with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply