A Look at SLB's Upcoming Earnings Report

SLB SLB is preparing to release its quarterly earnings on Friday, 2024-10-18. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect SLB to report an earnings per share (EPS) of $0.88.

The announcement from SLB is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

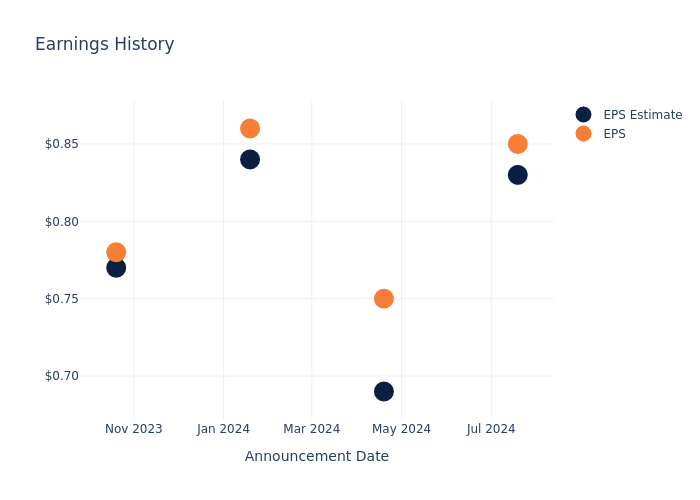

Performance in Previous Earnings

The company’s EPS beat by $0.02 in the last quarter, leading to a 0.0% drop in the share price on the following day.

Here’s a look at SLB’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.83 | 0.69 | 0.84 | 0.77 |

| EPS Actual | 0.85 | 0.75 | 0.86 | 0.78 |

| Price Change % | 2.0% | -2.0% | 2.0% | -3.0% |

Analysts’ Perspectives on SLB

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on SLB.

The consensus rating for SLB is Outperform, derived from 17 analyst ratings. An average one-year price target of $62.44 implies a potential 42.95% upside.

Peer Ratings Overview

In this comparison, we explore the analyst ratings and average 1-year price targets of Baker Hughes, Halliburton and TechnipFMC, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Baker Hughes received a Outperform consensus from analysts, with an average 1-year price target of $43.42, implying a potential 0.6% downside.

- Analysts currently favor an Buy trajectory for Halliburton, with an average 1-year price target of $42.17, suggesting a potential 3.46% downside.

- Analysts currently favor an Buy trajectory for TechnipFMC, with an average 1-year price target of $33.0, suggesting a potential 24.45% downside.

Snapshot: Peer Analysis

In the peer analysis summary, key metrics for Baker Hughes, Halliburton and TechnipFMC are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Schlumberger | Outperform | 12.84% | $1.88B | 5.32% |

| Baker Hughes | Outperform | 13.05% | $1.49B | 3.74% |

| Halliburton | Buy | 0.60% | $1.12B | 7.22% |

| TechnipFMC | Buy | 17.92% | $500.90M | 6.24% |

Key Takeaway:

SLB ranks highest in Gross Profit and Return on Equity among its peers. It is in the middle for Revenue Growth.

Unveiling the Story Behind SLB

SLB is the largest oilfield service firm in the world, with expertise in myriad disciplines, including reservoir performance, well construction, production enhancement, and more recently, digital solutions. It maintains a reputation as one of the industry’s leading innovators, which has earned it dominant share in numerous end markets.

SLB: Delving into Financials

Market Capitalization Highlights: Above the industry average, the company’s market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Positive Revenue Trend: Examining SLB’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 12.84% as of 30 June, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Energy sector.

Net Margin: SLB’s financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 12.17%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): SLB’s ROE surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 5.32% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): SLB’s ROA excels beyond industry benchmarks, reaching 2.29%. This signifies efficient management of assets and strong financial health.

Debt Management: SLB’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.63.

To track all earnings releases for SLB visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply