Blowout Growth From 3 Stocks Is About To Leave Nvidia In The Dust

Investors are on the lookout for blowout revenue growth in the S&P 500’s ongoing third-quarter earnings season. And believe it or not, Nvidia isn’t the top dog.

↑

X

Beating The Market: How To Find Outperforming Stocks

Three S&P 500 companies, including Super Micro Computer (SMCI), Micron Technology (MU) and Newmont (NEM), are expected to post 88% or higher revenue growth in the third quarter, says an Investor’s Business Daily analysis of data from S&P Global Market Intelligence and MarketSurge. That’s even higher than the 82% top-line growth expected from Nvidia.

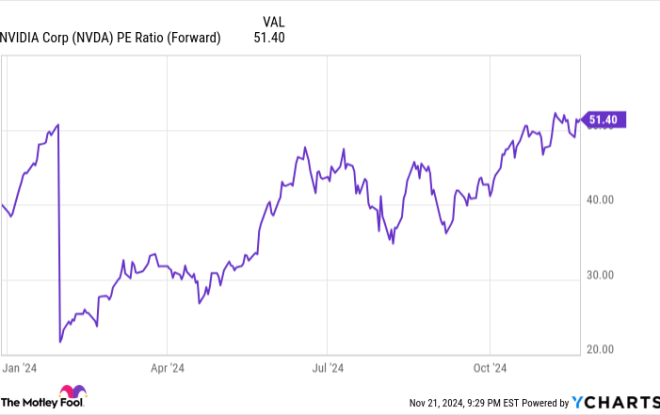

Seeing a materials company plus two smaller tech firms outgrow Nvidia (NVDA) is further proof of how the S&P 500 market rally continues to include more sectors and companies. Revenue in the S&P 500 as a whole is only seen rising 4.6%. That makes companies putting up double-digit growth all the more interesting.

Biggest S&P 500 Grower: Super Micro Computer

There’s no question where analysts think the most top-line growth will come from. They’re looking squarely at Super Micro Computer.

The maker of high-end computer systems is expected to post $6.6 billion in third quarter revenue, up 205% from the same year-ago period. No other S&P 500 company comes even close. Micron’s predicted revenue growth in the quarter is 91%, making it a distant No. 2.

Super Micro’s stock has been sliding below its moving averages, knocking its RS Rating down to just 20. But with an EPS Rating of 99, it’s still a powerhouse. Shares are up more than 65% this year. The company is due to report quarterly results on Oct. 29.

Micron is no slouch either. It’s shares, too, are down in the past few weeks, explaining the low RS Rating of 57. But the stock is still up 27% this year. And it has an EPS Rating of 80.

Not Just S&P 500 Tech

It’s tempting to think only tech stocks are putting up growth. But that’s not true.

Analysts like miner Newmont will post revenue of 88%. That’s a solid Nvidia-beating number. S&P 500 companies in communications services, health care and utilities are seen putting up 8%, 6.8% and 6.7% revenue growth, respectively in the quarter.

So if you’re looking for growth, don’t assume Nvidia is your only option.

Biggest S&P 500 Revenue Growth Expected

| Company | Ticker | Rev growth |

|---|---|---|

| Super Micro Computer | SMCI | 204.6% |

| Micron Technology | MU | 90.7% |

| Newmont | NEM | 87.5% |

| Nvidia | NVDA | 81.6% |

| Broadcom | AVGO | 51.4% |

| Western Digital | WDC | 49.8% |

| ONEOK | OKE | 48.4% |

| RTX | RTX | 47.2% |

| Seagate Technology | STX | 45.7% |

| Atmos Energy | ATO | 43.8% |

Sources: IBD, S&P Global Market Intelligence

Follow Matt Krantz on X (Twitter) @mattkrantz

YOU MAY ALSO LIKE:

Leave a Reply