Dollar Gen Options Trading: A Deep Dive into Market Sentiment

High-rolling investors have positioned themselves bearish on Dollar Gen DG, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in DG often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 9 options trades for Dollar Gen. This is not a typical pattern.

The sentiment among these major traders is split, with 44% bullish and 55% bearish. Among all the options we identified, there was one put, amounting to $39,618, and 8 calls, totaling $435,556.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $78.0 to $105.0 for Dollar Gen over the last 3 months.

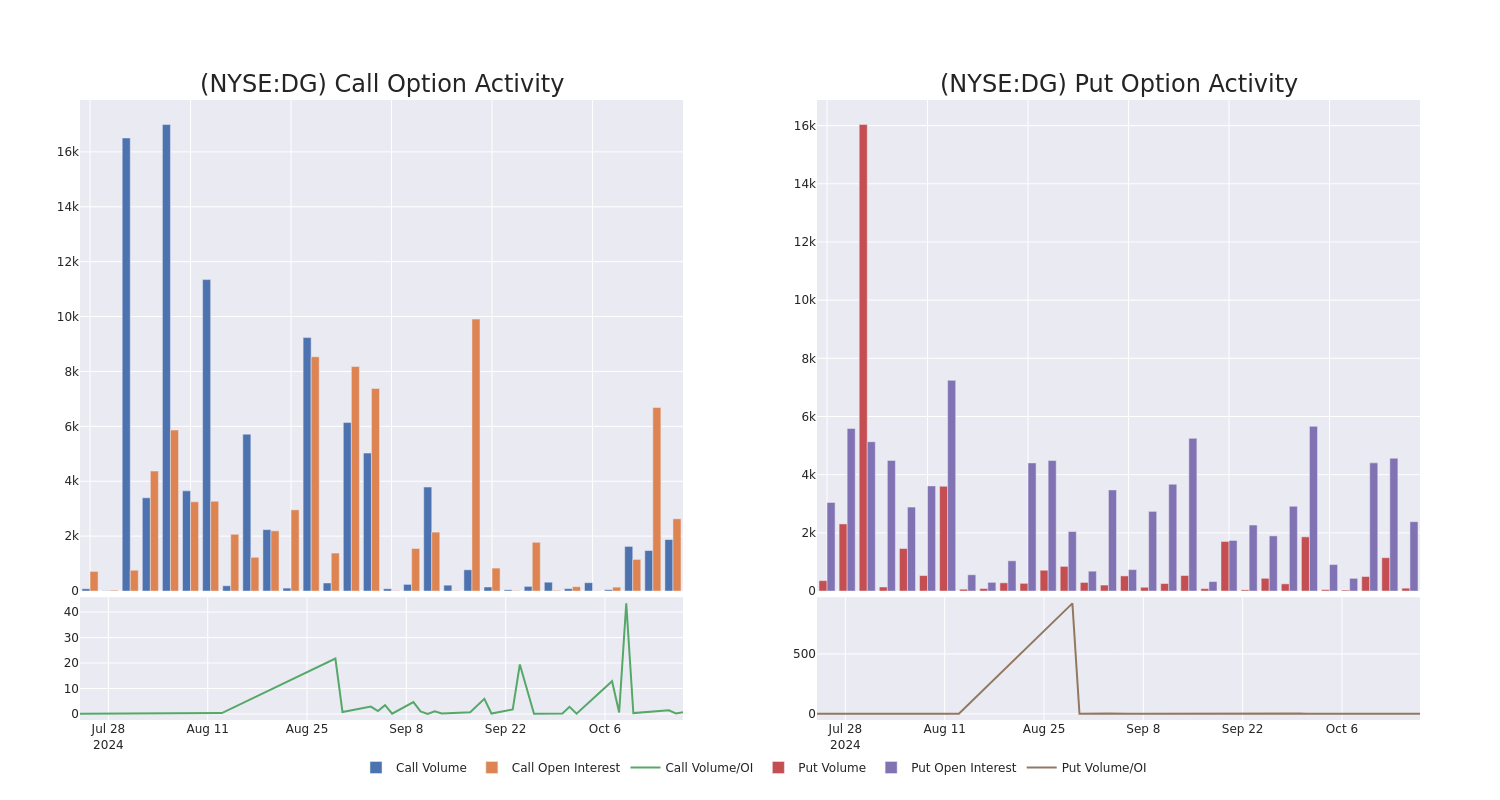

Analyzing Volume & Open Interest

In today’s trading context, the average open interest for options of Dollar Gen stands at 836.0, with a total volume reaching 1,975.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Dollar Gen, situated within the strike price corridor from $78.0 to $105.0, throughout the last 30 days.

Dollar Gen Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DG | CALL | TRADE | BEARISH | 01/16/26 | $9.3 | $9.2 | $9.2 | $100.00 | $91.9K | 766 | 249 |

| DG | CALL | TRADE | BEARISH | 01/16/26 | $7.95 | $7.8 | $7.8 | $105.00 | $87.3K | 97 | 114 |

| DG | CALL | SWEEP | BULLISH | 10/25/24 | $3.8 | $3.15 | $3.79 | $78.00 | $54.1K | 4 | 144 |

| DG | CALL | SWEEP | BEARISH | 11/15/24 | $5.15 | $4.8 | $5.0 | $80.00 | $54.0K | 914 | 108 |

| DG | CALL | TRADE | BULLISH | 01/16/26 | $9.3 | $9.2 | $9.3 | $100.00 | $50.2K | 766 | 8 |

About Dollar Gen

With more than 20,000 locations, Dollar General’s banner is nearly ubiquitous across the rural United States. Dollar General serves as a convenient shopping destination for fill-in store trips, with its value proposition most relevant to consumers in small communities with a dearth of shopping options. The retailer operates a frugal store of about 7,500 square feet and primarily offers an assortment of branded and private-label consumable items (80% of net sales) such as paper and cleaning products, packaged and perishable food, tobacco, and health and beauty items at low prices. Dollar General also offers a limited assortment of seasonal merchandise, home products, and apparel. The firm sells most items at a price point of $10 or less.

After a thorough review of the options trading surrounding Dollar Gen, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Dollar Gen

- Trading volume stands at 3,735,581, with DG’s price down by -0.44%, positioned at $81.87.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 49 days.

Expert Opinions on Dollar Gen

2 market experts have recently issued ratings for this stock, with a consensus target price of $79.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Melius Research downgraded its action to Hold with a price target of $85.

* In a cautious move, an analyst from Citigroup downgraded its rating to Sell, setting a price target of $73.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Dollar Gen options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply