Oil and Copper Are Under Pressure

Source: Michael Ballanger 10/15/2024

Michael Ballanger of GGM Advisory Inc. sends his thoughts on the current state of the market, looking at oil, copper, gold, and silver.

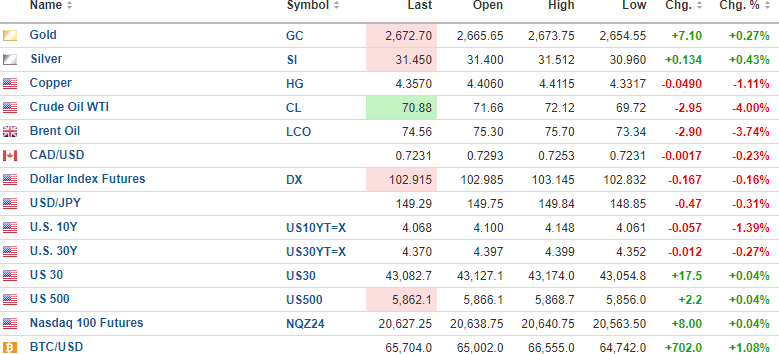

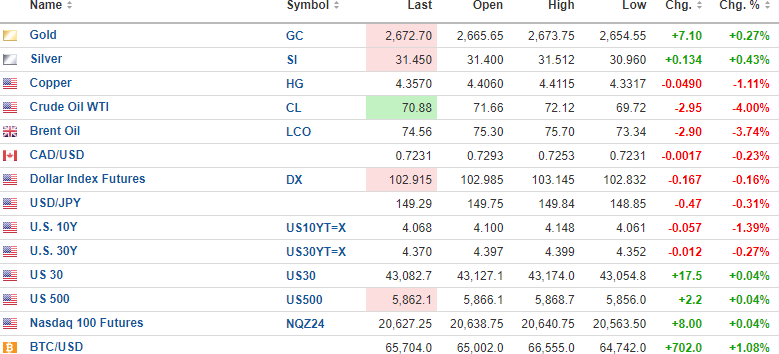

The USD Index futures are down 0.167% to 102.915 this morning with the 10-yr. (-1.39%) yield down to 4.068% and 30-yr. (-0.27%) down at 4.37%.

The metals are mixed with gold (+0.27%) and silver (+0.43%) higher, but copper (-1.11%) is down to $4.35/lb. Oil (-3.74%) is sharply lower, trading at USD $70.88/bbl. Stock futures are higher, with the DJIA futures up .04% and the S&P 500 futures (+0.04%) up, while NASDAQ futures are up by 0.04%. Risk barometer Bitcoin is up $702 to $65,704(+ 1.08%).

Due largely to the “Seasonal MACD Buy Signal” issued by The Stocks Trader’s Almanac yesterday, the Best Six Months of the trading year have just kicked into gear, with the major averages at or near all-time highs. The DJIA hit an all-time high yesterday at 43,139, with the S&P 500 hitting its ATH last Friday.

The NASDAQ Composite hit an ATH on July 11 at 18,671 and remains 169 points away. The Russell 2000 (small cap index) hit its ATH back in October 2021, with the ETF trading at $230.72 and is now $7.83 points away. Considering that September and October are seasonally weak months, it has been a statistical anomaly to be registering ATHs in mid-October during a presidential election year, but then again, this entire market is a “statistical anomaly” in many respects as I indicated last evening with those four charts. There was a time when one could use historical market patterns to time entries and exits, but with the algobots now controlling well over 70% of the volume on the NYSE, these historical norms are becoming less relevant every year.

Nonetheless, the markets are quickly approaching overbought territory and as can be observed from the chart of the S&P, it is trading a full 11.1% above its 200-dma, which is “overextended”, to put it mildly. I have to respect seasonality, so if there has been no meaningful drawdown by the end of this week, I will be looking to add a few calls in anticipation of a year-end rally.

Copper

I am posting the copper chart this morning and drawing your attention to the 100-DMA at $4.36/lb. With the price now beneath that level at $4.35 along with the overnight low of $4.3317, a close below the 100-dma sets up a test of the convergence zone between the 50- dma @ $4.27 and the 200-dma @ $4.24. That should be enough to take Freeport-McMoRan Inc. FCX back below the gap it created after the Chinese stimulus package was announced that took the stock from $45 on the close the prior session only to open $3.00 higher the following day at $48.10.

I was uneasy about selling the FCX calls and half of the shares back in the $51.50 range a few weeks back, but sometimes the discipline one acquires after being beaten like a common farm animal so many times pays off. I cannot count the number of times I stayed in a position that moved from a win to a loss because I failed to heed the old adage, “When conditions change, one must change.” When copper went into overbought conditions in late September, conditions changed. Hopefully, they are about to change again for the better.

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Freeport-McMoRan Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

- Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply