Oil and Copper Are Under Pressure

Source: Michael Ballanger 10/15/2024

Michael Ballanger of GGM Advisory Inc. sends his thoughts on the current state of the market, looking at oil, copper, gold, and silver.

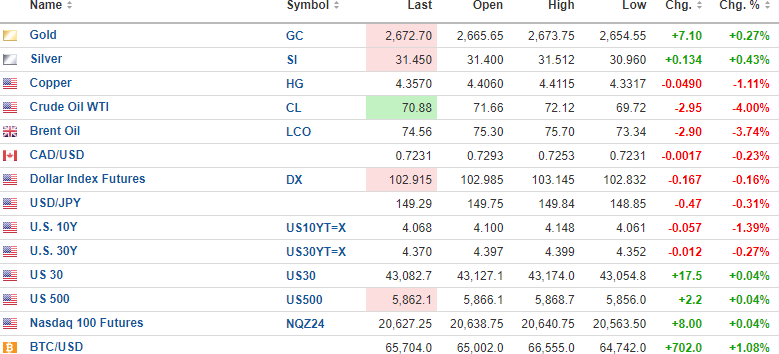

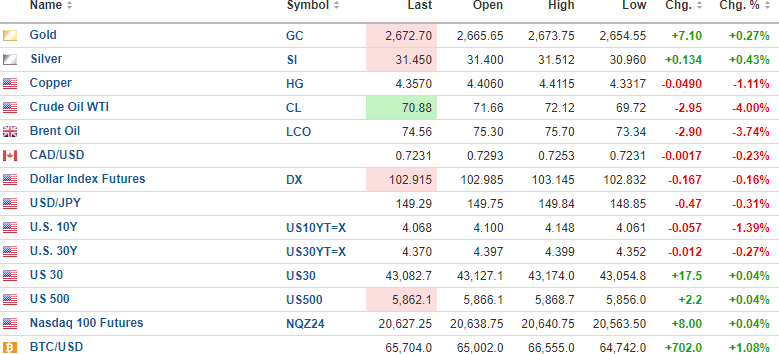

The USD Index futures are down 0.167% to 102.915 this morning with the 10-yr. (-1.39%) yield down to 4.068% and 30-yr. (-0.27%) down at 4.37%.

The metals are mixed with gold (+0.27%) and silver (+0.43%) higher, but copper (-1.11%) is down to $4.35/lb. Oil (-3.74%) is sharply lower, trading at USD $70.88/bbl. Stock futures are higher, with the DJIA futures up .04% and the S&P 500 futures (+0.04%) up, while NASDAQ futures are up by 0.04%. Risk barometer Bitcoin is up $702 to $65,704(+ 1.08%).

Due largely to the “Seasonal MACD Buy Signal” issued by The Stocks Trader’s Almanac yesterday, the Best Six Months of the trading year have just kicked into gear, with the major averages at or near all-time highs. The DJIA hit an all-time high yesterday at 43,139, with the S&P 500 hitting its ATH last Friday.

The NASDAQ Composite hit an ATH on July 11 at 18,671 and remains 169 points away. The Russell 2000 (small cap index) hit its ATH back in October 2021, with the ETF trading at $230.72 and is now $7.83 points away. Considering that September and October are seasonally weak months, it has been a statistical anomaly to be registering ATHs in mid-October during a presidential election year, but then again, this entire market is a “statistical anomaly” in many respects as I indicated last evening with those four charts. There was a time when one could use historical market patterns to time entries and exits, but with the algobots now controlling well over 70% of the volume on the NYSE, these historical norms are becoming less relevant every year.

Nonetheless, the markets are quickly approaching overbought territory and as can be observed from the chart of the S&P, it is trading a full 11.1% above its 200-dma, which is “overextended”, to put it mildly. I have to respect seasonality, so if there has been no meaningful drawdown by the end of this week, I will be looking to add a few calls in anticipation of a year-end rally.

Copper

I am posting the copper chart this morning and drawing your attention to the 100-DMA at $4.36/lb. With the price now beneath that level at $4.35 along with the overnight low of $4.3317, a close below the 100-dma sets up a test of the convergence zone between the 50- dma @ $4.27 and the 200-dma @ $4.24. That should be enough to take Freeport-McMoRan Inc. FCX back below the gap it created after the Chinese stimulus package was announced that took the stock from $45 on the close the prior session only to open $3.00 higher the following day at $48.10.

I was uneasy about selling the FCX calls and half of the shares back in the $51.50 range a few weeks back, but sometimes the discipline one acquires after being beaten like a common farm animal so many times pays off. I cannot count the number of times I stayed in a position that moved from a win to a loss because I failed to heed the old adage, “When conditions change, one must change.” When copper went into overbought conditions in late September, conditions changed. Hopefully, they are about to change again for the better.

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Freeport-McMoRan Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

- Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Behind the Scenes of Novo Nordisk's Latest Options Trends

Investors with a lot of money to spend have taken a bullish stance on Novo Nordisk NVO.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with NVO, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 15 uncommon options trades for Novo Nordisk.

This isn’t normal.

The overall sentiment of these big-money traders is split between 53% bullish and 40%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $369,668, and 11 are calls, for a total amount of $1,968,285.

Expected Price Movements

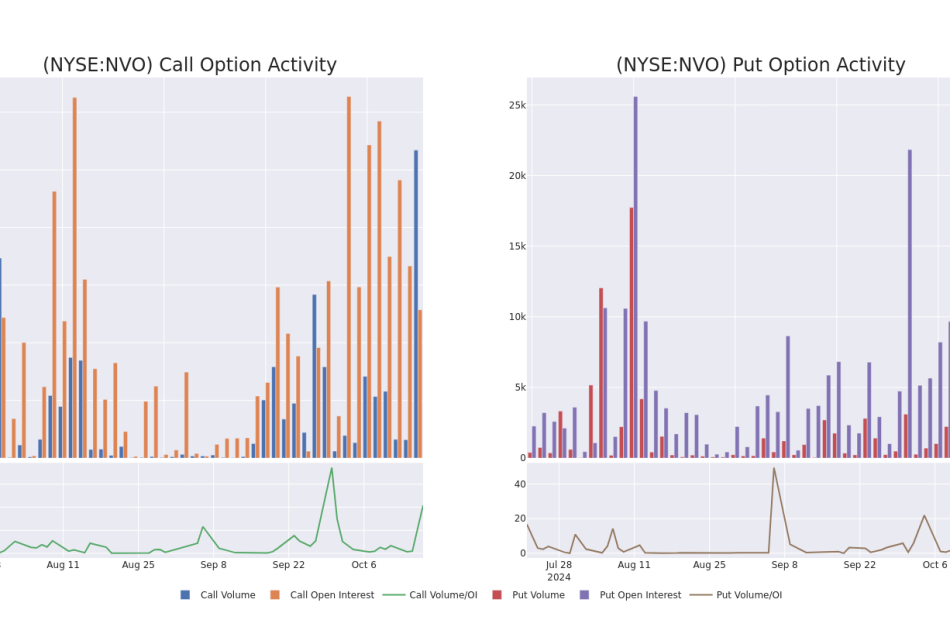

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $90.0 to $130.0 for Novo Nordisk over the last 3 months.

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Novo Nordisk’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Novo Nordisk’s substantial trades, within a strike price spectrum from $90.0 to $130.0 over the preceding 30 days.

Novo Nordisk Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVO | CALL | SWEEP | BULLISH | 11/15/24 | $5.05 | $5.0 | $5.0 | $120.00 | $494.5K | 955 | 695 |

| NVO | CALL | TRADE | BULLISH | 11/15/24 | $5.3 | $5.25 | $5.3 | $120.00 | $431.9K | 955 | 2.9K |

| NVO | PUT | SWEEP | BEARISH | 01/17/25 | $6.45 | $6.3 | $6.45 | $115.00 | $208.3K | 2.2K | 330 |

| NVO | CALL | SWEEP | BULLISH | 11/15/24 | $5.3 | $5.25 | $5.25 | $120.00 | $193.2K | 955 | 2.1K |

| NVO | CALL | SWEEP | BULLISH | 11/15/24 | $5.15 | $5.1 | $5.1 | $120.00 | $189.2K | 955 | 1.4K |

About Novo Nordisk

With roughly one third of the global branded diabetes treatment market, Novo Nordisk is the leading provider of diabetes-care products in the world. Based in Denmark, the company manufactures and markets a variety of human and modern insulins, injectable diabetes treatments such as GLP-1 therapy, oral antidiabetic agents, and obesity treatments. Novo also has a biopharmaceutical segment (constituting roughly 10% of revenue) that specializes in protein therapies for hemophilia and other disorders.

In light of the recent options history for Novo Nordisk, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Novo Nordisk

- With a trading volume of 1,633,351, the price of NVO is up by 0.47%, reaching $118.59.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 20 days from now.

What Analysts Are Saying About Novo Nordisk

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $158.66666666666666.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $160.

* Consistent in their evaluation, an analyst from BMO Capital keeps a Outperform rating on Novo Nordisk with a target price of $156.

* Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $160.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Novo Nordisk with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Want Decades of Passive Income? 2 Stocks to Buy Right Now

Buying and holding stocks is easier said than done. Ideally, you find a great company, buy the stock, and let it grow and pay you dividends forever. The problem is that few companies fit that bill. The world changes, and the competition is ruthless. A company must evolve and stay on top to justify owning the stock year in and year out.

Yet, there are some exceptions, and these are companies with wide moats and competitive advantages that have stood the test of time. If you want decades of passive income from steady dividend streams, listen up. Consider buying and holding these two stocks right now.

1. The battle-tested leader of big oil

ExxonMobil (NYSE: XOM) is an integrated oil major, a company that explores and drills for oil and gas, refines it, and sells it to the market. Participating in different parts of the oil and gas supply chain diversifies the company, helping it withstand fluctuations in commodity prices. For example, falling oil prices would hurt ExxonMobil’s exploration business but boost profit margins in the refining business. In total, ExxonMobil generates over $340 billion in annual revenue.

The company boasts a sprawling portfolio of assets, including land and equipment, valued at nearly half a trillion dollars on its balance sheet. ExxonMobil has proven able to shuffle its assets, selling pieces to raise cash or acquiring new assets when an opportunity arises. It acquired Pioneer Energy for almost $60 billion earlier this year, which boosted ExxonMobil’s footprint in resource-rich regions like the Permian Basin and Guyana.

ExxonMobil’s management team has also managed the company’s balance sheet well, which acts as a safety net when industry downturns hurt profits. The company has a stellar AA- credit rating from Standard & Poor’s and a debt-to-equity ratio of just 0.16, its lowest in a decade.

If that’s not enough to give you peace of mind, look at ExxonMobil’s dividend history. Management has raised the dividend for 42 consecutive years, including during multiple recessions and a worldwide pandemic that essentially froze the global economy and even took oil prices below zero for the first time.

ExxonMobil is as battle-tested as it comes in the energy sector. Renewable energy and climate change could start to eat into demand for fossil fuels over the coming decades, but oil and gas aren’t going away anytime soon. At the very least, ExxonMobil should have time to diversify its business or acquire smaller competitors as the industry consolidates.

The stock offers investors a solid 3% yield at its current share price, so investors can confidently buy ExxonMobil and collect the dividends for the foreseeable future.

2. An agricultural titan with top-notch brand power

Deere & Company (NYSE: DE) sells agricultural, forestry, and construction equipment worldwide. The company’s iconic John Deere brand is famous for its trademark green paint, arguably among the world’s most recognizable colors. Deere does more than sell equipment; it also makes money on financing, repair, and maintenance services.

In all, Deere generates over $54 billion in annual revenue. There is competition, but Deere’s long history and recognizable brand have earned consistently strong loyalty among farmers.

The Earth is only so large, and the world’s population continues to grow. According to the United Nations, the global population could increase from 8.2 billion to 9.7 billion by 2050. That means it will be crucial to farm as efficiently as possible and to get the most out of the land society has. Deere sells next-generation technology, such as autonomous equipment and cloud-based software, designed to help farmers become more efficient.

Farmers generally finance this expensive equipment, which adds some risk to Deere since it holds those loans. However, Deere comfortably maintains an investment-grade balance sheet with an A credit rating from Standard & Poor’s. When it comes to the dividend, management doesn’t always raise it. But make no mistake, Deere is a dividend growth stock. The dividend has grown 145% over the past decade.

Perhaps most importantly, Deere hasn’t cut the dividend since the 1980s, so management has maintained it through multiple cycles in the agricultural industry. The dividend yields 1.4% today, which isn’t a ton, but it is poised to grow over time. Analysts estimate Deere will grow earnings by an average of 12% annually over the next three to five years.

I wouldn’t be surprised to see many more years of solid growth ahead in a world that will need more food and efficient farming. The dividends should follow.

Should you invest $1,000 in ExxonMobil right now?

Before you buy stock in ExxonMobil, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ExxonMobil wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $831,707!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Deere & Company and S&P Global. The Motley Fool has a disclosure policy.

Want Decades of Passive Income? 2 Stocks to Buy Right Now was originally published by The Motley Fool

Super Micro Computer Says It's Shipping 100,000 GPUs Per Quarter. Time to Buy the Stock?

The artificial intelligence (AI) competition is in full swing, and each company is racing to build the best AI model possible and capture a potentially huge market. This parallels events like the California gold rush.

Not every prospector found gold, and many lost everything searching for it. However, one industry boomed during this time: picks and shovels. This gives rise to an investing strategy that looks for companies that sell modern-day picks and shovels to businesses that are competing in a category like AI.

Super Micro Computer (NASDAQ: SMCI) fits this description. It recently announced that it shipped more than 100,000 graphics processing units (GPUs, the main piece of hardware that does AI computing) in a quarter. That’s an unreal amount, but does it add up to a stock that’s worth buying?

Supermicro’s technology sets it apart from the competition

Supermicro (as it’s commonly called) provides parts and full-scale solutions for computing servers that can be customized to any size and tailored to specific workload types. This flexibility sets it apart from competitors, as does its liquid-cooled technology.

These servers consume a lot of power. That power is converted to heat, which must be dealt with; otherwise, the server would overheat and ruin millions of dollars worth of GPUs.

The standard solution is to cool the room with air conditioning, but that’s costly. Instead, Supermicro uses liquid-cooling technology, which eliminates the need for these giant air conditioning units specifically tailored for server rooms.

According to Supermicro, its cooling technology saves 40% on energy costs and provides 80% space savings because airflow is not required. With AI leaders building up their computing power, space becomes a premium, which is why Supermicro’s solution has risen to the top as a best-in-class option, even if its products cost more than its competitors’.

With Supermicro shipping racks filled with more than 100,000 GPUs per quarter, it’s clear the demand is high. But does that make the stock worth buying?

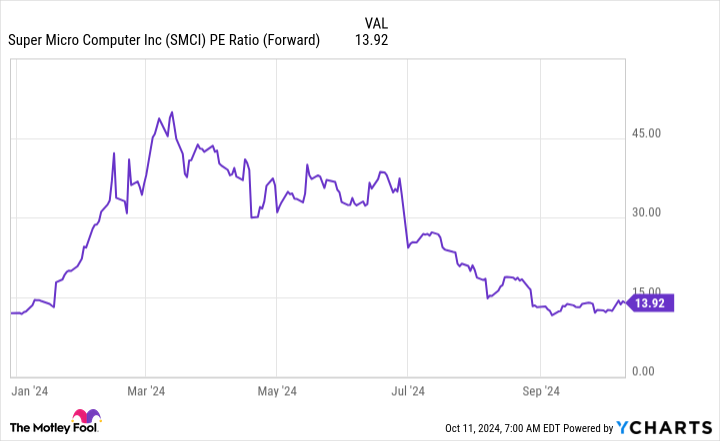

The stock is incredibly cheap, but there’s risk involved

While business appears to be booming, some other issues under the hood must be discussed.

In August, famed short-seller Hindenburg Research released a report on Supermicro claiming that the company is involved in accounting malpractice, something it was fined for by the Securities and Exchange Commission for issues that occurred in 2018.

Although Supermicro denied these allegations, it announced it was delaying filing its end-of-year Form 10-K report to assess the “effectiveness of internal controls over financial reporting.” That’s not a great look.

The Department of Justice also launched a probe into the company’s accounting practices, but it will be some time before we know the results.

Because there are a lot of unknowns with the company, you would be forgiven if you don’t want to invest in it. There are plenty of fine companies out there and taking a risk on Supermicro, considering all the controversy about its accounting, might not be worth it for you.

However, if it doesn’t bother you, the stock has real value.

Super Micro Computer trades for a dirt-cheap 13.9 times forward earnings right now. Compared to the S&P 500, which trades at 23.5 times forward earnings, it’s a massive discount to the broader market.

Management also expects its growth to continue for some time, because it believes it’s on a path to $50 billion in annual revenue. It expects $26 billion to $30 billion for fiscal year 2025 (ending June 30, 2025), which is significant growth from 2024’s $14.9 billion total.

Whether Supermicro stock is a buy right now is about risk tolerance. If you’re OK with some risk on the table, then there are many compelling reasons to buy the stock. But if you’re not, there are still plenty of great companies out there with market-beating potential.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,139!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,239!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $380,729!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Keithen Drury has positions in Super Micro Computer. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Super Micro Computer Says It’s Shipping 100,000 GPUs Per Quarter. Time to Buy the Stock? was originally published by The Motley Fool

Melania Trump Says Barron Was Blocked From Opening A Bank Account, Pointing To 'Cancel Culture'

Melania Trump recently claimed that her son, Barron, was denied a bank account due to “cancel culture” after the family left the White House. In her new memoir Melania, released recently, the former first lady expresses frustration over what she describes as politically motivated discrimination.

Don’t Miss:

“I was shocked and dismayed to learn that my longtime bank decided to terminate my account and deny my son the opportunity to open a new one,” she writes. According to her memoir, Melania suggests that the decision was rooted in political bias and raised concerns about civil rights violations. Some speculators, however, suggest that there may be other reasons, such as hefty fines and overdraft fees owed to specific financial institutions by Trump himself, that caused these account closures.

See Also: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

The timing of this incident coincided with the period following the Jan. 6 Capitol riot, although Melania doesn’t mention the event directly. She points out that she and Barron felt the sting of “cancel culture” during this time. “It is troubling to see financial services withheld based on political affiliation,” she stated, calling the decision unfair.

Her grievances weren’t limited to banking issues. Melania also shared how a media deal she worked on fell through after the backers pulled out, citing personal hatred toward her husband, Donald Trump. She wrote that the private equity firm backing her media initiative refused to honor their agreement despite her efforts to focus on business, not politics.

Trending: This Adobe-backed AI marketing startup went from a $5 to $85 million valuation working with brands like L’Oréal, Hasbro, and Sweetgreen in just three years – here’s how there’s an opportunity to invest at $1,000 for only $0.50/share today.

Another incident involved Melania’s charitable initiative, the Fostering the Future scholarship program, which provided educational support to foster care children. According to the memoir, a ‘leading tech-education company’ partnered with the initiative and later cut ties after her involvement became public.

She claims the company’s board didn’t want to be associated with her. “Despite my willingness to avoid any public association with the program, the school remained firm and terminated the agreement,” Melania explained.

In 2022, her Fostering the Future program was scrutinized when The New York Times reported that it wasn’t registered with Florida’s Consumer Services Division, triggering an investigation. Melania, however, fired back, accusing the media of attempting to “cancel” her and her charitable efforts.

Trending: ‘Scrolling to UBI’: Deloitte’s #1 fastest-growing software company allows users to earn money on their phones – invest today with $1,000 for just $0.25/share

Though Barron’s financial setback with the bank was highlighted in the memoir, Melania emphasized that it hasn’t affected him negatively. “He is doing great,” she shared during an appearance on Fox News’s The Five. “He loves his classes and professors. He is doing well. He is striving and enjoying being in New York City again.”

At 18, Barron Trump is now a student at New York University’s Stern School of Business, where he began classes in September. Melania’s book also touches on Barron’s past struggles with online bullying, referencing rumors that circulated in 2010 regarding his health. She described the bullying as “irreparable damage,” calling attention to the harsh treatment her son endured.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Melania Trump Says Barron Was Blocked From Opening A Bank Account, Pointing To ‘Cancel Culture’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

American Express Shows Bullish Signals Ahead Of Q3 Earnings, But Analysts Hold Back

American Express Co AXP will be reporting its third-quarter earnings on Oct. 18. Wall Street expects $3.80 in earnings per share and $16.67 billion in revenues as the company reports before market hours.

The stock is up 84.29% over the past year, 51.1% year-to-date.

Let’s look at what the charts indicate for the New York-based company and how its stock currently maps against Wall Street estimates.

American Express Stock Chart Is Bullish

American Express stock is exhibiting strong bullish momentum based on several technical indicators.

Chart created using Benzinga Pro

The stock is currently trading at $281.68, which places it above key moving averages—its five-day, 20-day and 50-day exponential moving averages—indicating significant buying pressure.

American Express’ stock price is above its eight-day SMA of $275.54. The 20-day SMA of $272.03 further confirms a bullish outlook. This suggests continued upward movement. The stock’s 50-day SMA at $259.88 and its 200-day SMA at $232.73 are also well below the current price, reinforcing this positive trend.

Chart created using Benzinga Pro

Additionally, the MACD indicator is at 5.32, which signals further bullish potential for American Express stock. However, caution is warranted as the RSI stands at 67.74, and rising to approach the overbought territory. This could suggest a short-term pullback.

However, the Bollinger Bands also indicate that the stock remains in a bullish phase with the stock trading in then upper bullish band.

Investors should monitor these technical signals closely as the stock approaches a potential breakout.

Read Also: Here’s How Much $1000 Invested In This Payments Company 15 Years Ago Would Be Worth Today

…But Analysts See 7% Downside

Ratings & Consensus Estimates: The consensus analyst rating on American Express stock stands at a Neutral currently with a price target of $228.60. The latest analyst ratings for American Express stock were issued by Morgan Stanley, Monness, Crespi, Hardt, and Barclays in October. These analysts have set an average price target of $266, indicating an implied downside of 6.54% for the stock.

AXP Price Action: American Express stock was trading at $284.62 at the time of publication.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dave Ramsey Says Buying Cars For Your Teenagers Leads To A Lifetime Of 'Ridiculous Expectations.' Better To Have Them 'Buy Their Own Cars'

Buying your teenager their first car might seem like a proud, memorable milestone. But according to financial expert Dave Ramsey, it’s not the best move if you want to set your kids up for a successful future.

Ramsey believes that buying your kids a car can create “ridiculous expectations” about money that could affect them for the rest of their lives. Rather, he advises letting them purchase a car independently, perhaps with some assistance.

Don’t Miss:

The best thing to do for your kids is have them buy their own cars.

When you buy new cars for teenagers, you’re setting them up for a life of ridiculous expectations. Think about their future.

If you have enough cash set aside, you and your child could agree on a matching plan…

— Dave Ramsey (@DaveRamsey) October 10, 2024

“When you buy new cars for teenagers, you’re setting them up for a life of ridiculous expectations,” Ramsey tweeted. In other words, handing over a car might give your teen the impression that big-ticket items are easy to come by. Instead of giving them a car, Ramsey advises giving them the opportunity to work, save and learn what it takes to make a major purchase independently.

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

“Think about their future,” Ramsey says. Encouraging your teen to purchase a car independently helps them develop lifelong financial skills. It also motivates them to see the benefits of saving money, working hard and making wise financial decisions.

Now, this doesn’t mean you can’t help at all. Ramsey suggests a middle ground: “If you have enough cash, you and your child could agree on a matching plan to help buy the car. Whatever your child saves, you’ll match.”

Trending: Studies show 50% of consumers think Financial Advisors cost much more than they do — to debunk this, this company provides matching for free and a complimentary first call with the matched advisor.

This method encourages your adolescent to save money while also lending a helpful hand without making things too simple. It lets parents encourage their children while ensuring they contribute fairly.

Encouraging your teenager to buy their own car isn’t just about getting the car. You’re teaching them important money skills. Dave Ramsey says, “Personal finance is 80% behavior and only 20% head knowledge.” When your teen saves for a car, they learn the habits they need to manage money well – which can help them a lot later in life.

See Also: I’m 62 Years Old And Have $1.2 Million Saved. Is This Enough to Retire Stress-Free?

Another essential component of this strategy is assisting teenagers in finding independent income sources. Ramsey points out that today, it’s arguably easier than ever for them to start making money through part-time jobs, freelance gigs or even small entrepreneurial ventures.

In the end, Ramsey stresses that allowing your adolescent or even older child to purchase a car on their own is “a tremendous gift” and a chance for them to learn responsibility, budgeting and the satisfaction of reaching a major objective.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Dave Ramsey Says Buying Cars For Your Teenagers Leads To A Lifetime Of ‘Ridiculous Expectations.’ Better To Have Them ‘Buy Their Own Cars’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SiriusPoint Announces Date for Third Quarter 2024 Earnings Release

HAMILTON, Bermuda, Oct. 17, 2024 (GLOBE NEWSWIRE) — SiriusPoint Ltd. SPNT (“SiriusPoint” or the “Company”) today announced that it is planning to release its third quarter 2024 financial results after the market close on Thursday, October 31, 2024. The Company will also hold a webcast, which can be accessed as a conference call, to discuss its financial results at 8:30 am (Eastern Time) on Friday, November 1, 2024.

The webcast of the live conference call can be accessed by logging onto the Investor Relations section of the Company’s website at www.siriuspt.com. The online replay of the webcast will be available on the Company’s website immediately following the call.

The conference call can be accessed by dialing 1-877-451-6152 (domestic) or 1-201-389-0879 (international) and asking for the SiriusPoint Ltd. Third Quarter 2024 Earnings Call. A replay will be available at the conclusion of the call and can be accessed by dialing 1-844-512-2921, or for international callers 1-412-317-6671, and providing the passcode 13748683. The replay will be available until 11:59 pm (Eastern Time) on November 15, 2024.

About SiriusPoint

SiriusPoint is a global underwriter of insurance and reinsurance providing solutions to clients and brokers around the world. Bermuda-headquartered with offices in New York, London, Stockholm and other locations, we are listed on the New York Stock Exchange (SPNT). We have licenses to write Property & Casualty and Accident & Health insurance and reinsurance globally. Our offering and distribution capabilities are strengthened by a portfolio of strategic partnerships with Managing General Agents and Program Administrators. With over $3.0 billion total capital, SiriusPoint’s operating companies have a financial strength rating of A- (Excellent) from AM Best, S&P and Fitch, and A3 from Moody’s. For more information, please visit https://www.siriuspt.com.

Contacts

Investor Relations

Liam Blackledge, SiriusPoint

liam.blackledge@siriuspt.com

+44 203 772 3082

Media

Sarah Hills, Rein4ce

sarah.hills@rein4ce.co.uk

+44 7718882011

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analyst Report: Truist Financial Corporation

Analyst Profile

Stephen Biggar

Director of Financial Institutions Research

Stephen is responsible for coverage of large global banks, regional banks and domestic credit card companies. He has covered financial services stocks for more than 20 years. He is also a member of the Argus Investment Policy Committee and Senior Portfolio Group, and frequently appears in print and broadcast media discussing the equity markets. Previously, he was the global director of equity research for S&P Capital IQ. He holds a degree in economics from Rutgers University.

Kelly Services Senior Vice President Trades $200K In Company Stock

A new SEC filing reveals that Nicola Soares, Senior Vice President at Kelly Services KELYA, made a notable insider purchase on October 16,.

What Happened: Soares’s recent purchase of 9,843 shares of Kelly Services, disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday, reflects confidence in the company’s potential. The total transaction value is $200,009.

Kelly Services shares are trading down 0.0% at $20.62 at the time of this writing on Thursday morning.

All You Need to Know About Kelly Services

Kelly Services Inc is a provider of workforce solutions and consulting and staffing services. The company’s operations are divided into five business segments namely Professional & Industrial, Science, Engineering & Technology, Education, Outsourcing & Consulting, and International. Other than OCG, each segment delivers talent through staffing services, permanent placement, or outcome-based services. OCG segment delivers talent solutions including managed service providers, payroll process outsourcing, recruitment process outsourcing, and talent advisory services. International also delivers RPO talent solutions within its local markets. The majority of revenue is derived from Professional & Industrial.

Kelly Services: Delving into Financials

Revenue Challenges: Kelly Services’s revenue growth over 3 months faced difficulties. As of 30 June, 2024, the company experienced a decline of approximately -13.12%. This indicates a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Evaluating Earnings Performance:

-

Gross Margin: The company shows a low gross margin of 20.21%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Kelly Services’s EPS reflects a decline, falling below the industry average with a current EPS of 0.13.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.21.

Valuation Metrics: A Closer Look

-

Price to Earnings (P/E) Ratio: Kelly Services’s P/E ratio of 15.62 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 0.17, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a below-average EV/EBITDA ratio of 10.38, Kelly Services presents an opportunity for value investors. This lower valuation may attract investors seeking undervalued opportunities.

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Pay Attention to Insider Transactions

It’s important to note that insider transactions alone should not dictate investment decisions, but they can provide valuable insights.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

Understanding Crucial Transaction Codes

Navigating through the landscape of transactions, investors often prioritize those unfolding in the open market, precisely detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Kelly Services’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.