Why I Keep Buying These 14 Incredible Growth Stocks

Investing in individual growth stocks can be a rollercoaster ride, but the potential rewards can be substantial. Since the 2008 financial crisis, numerous growth stocks have significantly outperformed passive index funds.

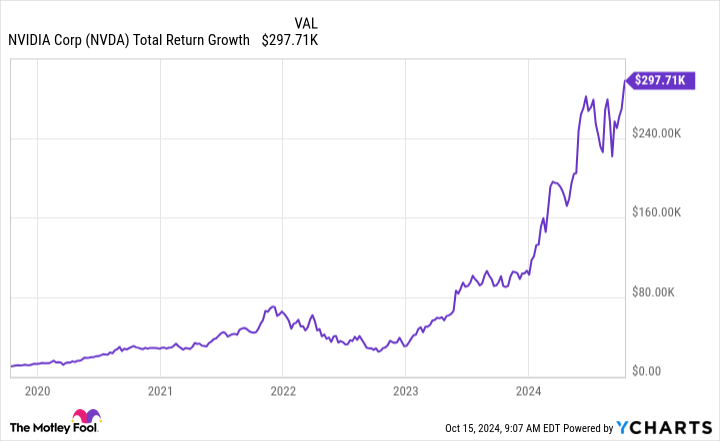

Some standout performers have even delivered returns exceeding 1,000% in less than five years. Nvidia (NASDAQ: NVDA), the chipmaker at the heart of the artificial intelligence (AI) revolution, exemplifies this potential, turning a $10,000 investment into nearly $300,000 over the past 60 months.

My tax-advantaged portfolios include 14 stocks primarily held for their growth prospects. While some of these growth stocks pay dividends, that’s not the main reason for owning them.

Here, I’ll explain why I continue to invest in each of these companies and discuss their 12-month upside potential based on Wall Street’s consensus price targets and year-to-date performance.

Archer Aviation: Pioneering electric air taxis

Archer Aviation (NYSE: ACHR) is at the forefront of the electric vertical takeoff and landing (eVTOL) aircraft industry. The company aims to revolutionize urban transportation with its electric air taxis, potentially disrupting the $1 trillion global urban air mobility market.

Wall Street’s consensus suggests a 209% upside potential for Archer Aviation, highlighting its promising long-term growth prospects despite a negative 49.8% year-to-date performance. The company’s progress in aircraft development and strategic partnerships with major airlines bolster its potential for future success.

Aspen Aerogels: Innovating in high-performance insulation

Aspen Aerogels (NYSE: ASPN) develops advanced aerogel insulation materials for various industries, including electric vehicles, energy infrastructure, and sustainable building materials. The company’s products offer superior thermal performance and energy efficiency.

Aspen Aerogels has outperformed the S&P 500 with a 44.2% year-to-date gain in 2024. The 43.8% upside potential projected by analysts over the next 12 months stems from the growing demand for high-performance insulation materials across multiple industries.

CRISPR Therapeutics: Pioneering gene-editing therapies

CRISPR Therapeutics (NASDAQ: CRSP) is at the forefront of developing gene-editing therapies for serious diseases. Fewer than 12 months ago, the company achieved a major milestone with the approval of Casgevy, its groundbreaking treatment for sickle cell disease and beta-thalassemia, developed in partnership with Vertex Pharmaceuticals.

Wall Street projections indicate a 72% upside for CRISPR Therapeutics over the next 12 months despite a negative 23.6% year-to-date performance. Along with the company’s robust pipeline, the recent approval of Casgevy, the first CRISPR-based therapy to reach the market, could drive significant long-term growth.

GE Aerospace: Focused on aviation innovation

Following its recent transformation, General Electric has become GE Aerospace (NYSE: GE), concentrating on its core aviation business. The company is a global leader in aircraft engines and systems, positioning it to benefit from the recovery and growth in the commercial aviation sector.

GE Aerospace has outperformed the S&P 500 with an 88.8% year-to-date gain. The 6.3% upside potential projected by analysts points to the company’s streamlined focus on aviation and improving industry dynamics.

Howmet Aerospace: Advancing aerospace innovation

Howmet Aerospace (NYSE: HWM) provides advanced engineered solutions for the aerospace and transportation industries. The company’s lightweight materials and innovative technologies are crucial for improving fuel efficiency and performance in aircraft and vehicles.

Howmet Aerospace has significantly outperformed the S&P 500 with an 89.6% year-to-date gain. The modest 2.6% upside projected by analysts highlights the company’s strong recent performance and solid position in the recovering aerospace market.

Intuitive Machines: Pioneering commercial lunar missions

Intuitive Machines (NASDAQ: LUNR) is a leader in commercial lunar payload delivery and orbital services. The company aims to become a key player in the growing commercial space industry with planned lunar missions and innovative space technologies.

Intuitive Machines has significantly outperformed the S&P 500 with a 206% year-to-date gain. Analysts’ 38.2% upside potential projected over the next 12 months underscores the company’s potential in the rapidly expanding commercial space market.

Joby Aviation: Transforming urban air mobility

Joby Aviation (NYSE: JOBY) is developing eVTOL aircraft for commercial passenger service. The company aims to launch an air taxi service that could revolutionize urban transportation. It also recently scored a major investment from Toyota Motor.

Wall Street projections indicate a 45.7% upside potential for Joby Aviation over the next 12 months despite a negative 17.2% year-to-date performance. The company’s progress in aircraft development and certification processes could position it as a leader in the emerging urban air mobility market.

Kratos Defense & Security Solutions: Innovating in defense technology

Kratos Defense & Security Solutions (NASDAQ: KTOS) specializes in uncrewed systems, satellite communications, and cybersecurity for defense and commercial markets. The company’s focus on next-generation defense technologies positions it well in the evolving defense landscape.

Kratos has gained 24.9% year to date, modestly outperforming the broader market represented by the S&P 500. The company’s innovative defense solutions and growing government contracts could drive significant future growth. That said, Wall Street analysts think the stock is fairly valued at current levels.

Navitas Semiconductor: Enabling efficient power electronics

Navitas Semiconductor (NASDAQ: NVTS) develops gallium nitride (GaN) power integrated circuits, which offer superior efficiency and performance compared to traditional silicon-based solutions. The company’s technology has applications in fast charging, renewable energy, and electric vehicles.

Despite a negative 67.7% year-to-date performance, Wall Street projections suggest a 114% upside potential for Navitas Semiconductor. The growing adoption of GaN technology in various industries could drive significant long-term growth for the company.

Nvidia: Powering the AI revolution

Nvidia is a leader in graphics processing units (GPUs) and is at the forefront of the AI computing revolution. The company’s chips are essential for training and running advanced AI models, positioning it to benefit from the rapidly growing AI market.

Nvidia’s stock has soared 178% year to date, significantly outperforming the S&P 500. The chipmaker’s strong market position and growth prospects in AI and other high-performance computing applications contribute to the 10.4% gain projected by analysts over the next 12 months.

Palantir Technologies: Harnessing data for actionable insights

Palantir Technologies (NYSE: PLTR) provides data analytics software to government agencies and commercial clients, helping them make better decisions. The company’s AI-powered platforms are increasingly crucial for organizations dealing with complex data challenges.

Palantir Technologies has surged 150% year to date, outperforming the S&P 500 by a wide margin. While current projections suggest a -34% potential downside from current levels, the company’s expanding commercial business and AI capabilities could drive long-term growth.

Prime Medicine: Advancing precision gene editing

Prime Medicine (NASDAQ: PRME) is developing a next-generation gene-editing platform called prime editing, which offers potential advantages over existing CRISPR technologies. The company aims to develop therapies for a wide range of genetic diseases.

Prime Medicine’s stock has fallen 57.7% year to date, but Wall Street projections suggest a 269% upside potential from current levels. The company’s innovative gene-editing technology and broad therapeutic potential could drive substantial long-term growth.

Rocket Lab USA: Expanding access to space

Rocket Lab USA (NASDAQ: RKLB) provides launch services and spacecraft solutions for the growing small satellite market. The company aims to increase the frequency and reliability of space access with its innovative rocket technology and manufacturing capabilities.

Rocket Lab USA has outperformed the S&P 500 with a 76.6% year-to-date gain. While current projections suggest a -20% potential downside, the company’s expanding launch capabilities and space systems business could drive long-term growth in the commercial space industry.

Taiwan Semiconductor Manufacturing: Dominating chip production

Taiwan Semiconductor Manufacturing (NYSE: TSM) is the world’s largest contract chipmaker, supplying advanced semiconductors to tech giants globally. The company’s technological leadership and scale give it a significant competitive advantage in the growing semiconductor market.

Taiwan Semiconductor Manufacturing has outperformed the S&P 500 with an 84.8% year-to-date gain. The modest 3.7% upside projected by analysts underscores the company’s strong recent performance and crucial role in the global technology supply chain.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,139!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,239!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $380,729!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

George Budwell has positions in Archer Aviation, Aspen Aerogels, CRISPR Therapeutics, GE Aerospace, Howmet Aerospace, Intuitive Machines, Joby Aviation, Kratos Defense & Security Solutions, Navitas Semiconductor, Nvidia, Palantir Technologies, Prime Medicine, Rocket Lab USA, Taiwan Semiconductor Manufacturing, and Toyota Motor. The Motley Fool has positions in and recommends CRISPR Therapeutics, Nvidia, Palantir Technologies, Taiwan Semiconductor Manufacturing, and Vertex Pharmaceuticals. The Motley Fool recommends Rocket Lab USA. The Motley Fool has a disclosure policy.

Why I Keep Buying These 14 Incredible Growth Stocks was originally published by The Motley Fool

Leave a Reply