US Stocks Set To End Week Strong As Netflix Q3 Earnings Boost Optimism, Gold Hits New Highs: What's Driving Sentiment Friday?

Wall Street is priming for a positive start on Friday after the major averages ended narrowly mixed in the previous session. Positive reaction to Netflix, Inc.’s NFLX earnings could provide a lift to the tech space, given earnings news flow from the sector will likely start in earnest next week. Earnings and speeches by Federal Reserve officials could set the tempo for Friday’s session. China’s third-quarter GDP rose slightly more than estimates, allaying the fears of traders. Gold continues to make record after record, while oil continues to have a volatile ride amid geopolitical tensions.

| Futures | Performance (+/-) |

| Nasdaq 100 | +0.39% |

| S&P 500 | +0.17% |

| Dow | +0.03% |

| R2K | +0.46% |

In premarket trading on Friday, the SPDR S&P 500 ETF Trust SPY rose 0.23% to $583.61 and the Invesco QQQ ETF QQQ jumped 0.51% to $493.75, according to Benzinga Pro data.

Cues From Last Session:

U.S. stocks closed narrowly mixed as traders digested a batch of mixed economic data as well as a flurry of earnings. After opening higher, the major indices experienced some volatility in the morning, although holding mostly above the unchanged line.

Stocks gave back most of their gains in late afternoon trading before finishing on a mixed note.

The Dow Industrials closed at fresh intraday and closing highs, thanks to a positive reaction to Travelers Companies, Inc.’s TRV earnings, while the S&P 500 Index hit an intraday high before squandering all the gains and closing marginally lower.

| Index | Performance (+/) | Value |

| Nasdaq Composite | +0.04% | 18,373.61 |

| S&P 500 Index | +0.02% | 5,841.47 |

| Dow Industrials | +0.37% | 43,239.05 |

| Russell 2000 | -0.25% | 2,280.85 |

Insights From Analysts:

After separate reports showed strong September retail sales growth, jobless claims, which fell after Hurricane Helene’s impact wore off, and a decline in industrial production amid the Boeing Co. BA strike, Comerica Chief Economist Bill Adams said, “The economy is in pretty good shape.” “Since consumer spending fuels two-thirds of U.S. demand, the economy can’t be doing too bad as long as consumers still have their pocketbooks open,” he said.

The economist expects the Hurricanes that devastated swathes of the Southeast in late September and early October to be a big drag on releases for October. This will make it difficult to read the underlying trend accurately, he said.

Calling the headwinds temporary, Adams said, “With the Fed expected to continue lowering interest rates through the turn of the year, credit-sensitive sectors of the economy should perk up in coming quarters, sustaining the economic expansion into 2025.”

See Also: Best Futures Trading Strategies in 2024

Upcoming Economic Data:

- The Commerce Department will release the housing starts report for September at 8:30 a.m. EDT. Economists, on average, estimate housing starts to come in at a seasonally adjusted annual rate of 1.35 million units, slightly down from the 1.36-million-unit rate in August. Building permits, an indicator of future housing starts may have declined from 1.48 million units to 1.45 million units.

- Among the Fed speakers scheduled for the day are:

- Atlanta Fed president Raphael Bostic: 9:30 a.m. EDT

- Minneapolis Fed President Neel Kashkari: 10 a.m. EDT

- Fed Governor Christopher Waller is due to speak at 12:10 p.m. EDT.

- The Atlanta Fed’s GDPNow data for the third quarter will be released at 10:30 a.m. EDT.

Stocks In Focus:

- Netflix climbed about 5.75% in premarket trading following the streaming giant’s quarterly results.

- Among the other stocks moving on earnings are Intuitive Surgical, Inc. ISRG (up nearly 7%), and Western Alliance Bancorporation WAL (down over 5.25%.

- Ally Financial Inc. ALLY, Autoliv, Inc. ALV, Fifth Third Bancorp FITB, Procter & Gamble Company PG, Regions Financial Corporation RF and Schlumberger Limited SLB and American Express Company AXP are among the noteworthy companies reporting ahead of the market opening.

- CVS Health Corporation CVS fell over 10% after the Wall Street Journal reported that the company is naming longtime executive David Joyner as its new chief, succeeding Karen Lynch.

- Coherent Corp. COHR fell over 6% on a negative analyst action.

Commodities, Bonds And Global Equity Markets:

Crude oil futures pulled back modestly but gold futures gained ground as they scaled a fresh record. Bitcoin BTC/USD added over 1.50% over the past 24 hours and traded just under the $68K mark.

The 10-year U.S. Treasury note yield was little changed at 4.097%.

Asian stocks closed mostly higher, led by China and Hong Kong, which rallied on the back of the Chinese third-quarter GDP data. The Japanese market benefited from the yen’s weakness. The European Central Bank’s rate cut also buoyed sentiment.

The European markets also advanced in early trading, although the U.K. market was experiencing some weakness.

Read Next:

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bank Earnings Propel Wall Street To Record Peaks, Oil Plunges Below $70, Gold Shines At All-Time Highs: This Week In The Market

Wall Street powered ahead this week as stronger-than-expected bank earnings and upbeat guidance pushed the S&P 500 and Dow Jones Industrial Average to record highs.

The September retail sales report positively surprised expectations, while a notable drop in weekly jobless claims reinforced the perception that the U.S. economy remains strong.

This momentum has led some economists to reconsider their expectations for the Federal Reserve’s next move, with growing doubts about the likelihood of further interest rate cuts as the economy races at full throttle.

The recent upswing in Treasury yields brought a twist to the housing market, sending mortgage rates soaring and hammering mortgage demand. Homebuyers pulled back sharply, with mortgage applications recording the sharpest weekly plunge since the depths of the pandemic in April 2020.

In the commodities market, oil prices tumbled below the $70-per-barrel mark, marking their worst weekly performance since December 2022. The selloff was triggered by a slight easing of tensions in the Middle East, though the geopolitical landscape remains fraught with risk.

Gold’s Bullish Trend

Gold, as tracked by the SPDR Gold Trust GLD, shined bright this week, surging to an all-time high above $2,700 per ounce. The precious metal logged four consecutive days of gains, cementing its status as a safe-haven asset ahead of the highly awaited U.S. presidential elections. Bank of America sees further upside to $3,000 per ounce.

Netflix Beats Expectations

Netflix Inc. NFLX reported strong third-quarter earnings, exceeding both revenue and EPS forecasts, and provided bullish guidance for the fourth quarter. The streaming giant anticipates a significant subscriber boost, largely driven by the popularity of “Squid Game” and its upcoming global content expansions.

Bitcoin ETF Inflows

BlackRock’s iShares Bitcoin Trust IBIT saw strong inflows, surpassing $1 billion in a week, indicating strong institutional interest. Fidelity leads Ethereum ETFs with $31 million in assets, reflecting growing demand for cryptocurrency exposure in traditional investment vehicles.

iPhone 16 Sales

Apple Inc. AAPL‘s iPhone 16 experienced a 20% sales increase in China, fueled by strong demand. The absence of AI capabilities led to early price cuts, highlighting competitive market pressures and evolving consumer expectations for advanced smartphone features.

Read Now:

Image: Illustrated using AI

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

MicroStrategy's 'Nav Premium' Shouldn't be Feared, Says Benchmark, Raising Price Target to $245

-

Benchmark has raised its price target for MicroStrategy’s stock from $215 to $245.

-

Analyst Mark Palmer argued the value of the company’s bitcoin holdings and its software business will continue to increase.

-

He also believes that the company’s high stock price is justified as it provides more value than just holding massive amounts of bitcoin.

Bears on MicroStrategy’s (MSTR) high stock price thanks to its perky valuation compared to the amount of its bitcoin {{BTC}} holdings are overlooking the company’s “unique” shareholder value, investment banking firm Benchmark said in a research report on Friday.

“We believe the ability of MSTR to generate compounding yield on its bitcoin holdings, using what management describes as “intelligent leverage,” differentiates its stock from alternative means of gaining exposure to bitcoin such as spot bitcoin ETFs,” Benchmark analyst Mark Palmer wrote.

Already bullish on the stock, Palmer reiterated his buy rating and lifted his price target to $245 from $215. Alongside a rise in the price of bitcoin to $68,400, MSTR shares are higher by 6.6% Friday to $206.19.

Led by Executive Chairman Michael Saylor, the stock of self-described Bitcoin Development Company currently trade at a 2.4X premium to the value of its bitcoin holdings, with some traders thusly believing that holding the equity instead of BTC itself (or the spot ETFs) is a bad move.

MicroStrategy’s net asset value (NAV) is calculated by dividing MSTR’s market capitalization by the value of its bitcoin stack. The NAV premium recently touched a new high of 2.5 times its bitcoin holdings, with a company market cap north of $41 billion against bitcoin holdings of around $17 billion.

Benchmark believes MicroStrategy’s business model justifies the premium to NAV and that traders should focus on the company’s BTC Yield. Introduced by Saylor and team earlier this year, Bitcoin Yield tracks the effectiveness of bitcoin investments by measuring the percentage change over time of the ratio between MSTR’s bitcoin holdings and its fully diluted share count. The Bitcoin Yield stood at 17.8% through September 19 compared to 1.8% and 7.3% in 2022 and 2023, respectively, according to Benchmark’s data.

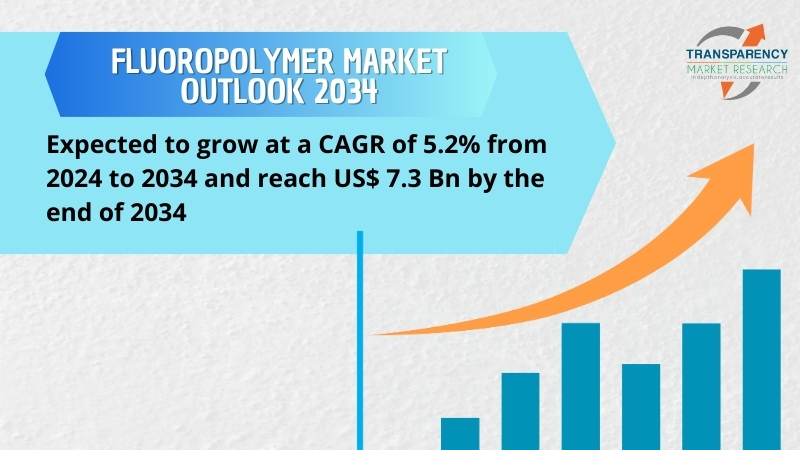

Fluoropolymer Market is set to expand at 5.2% CAGR from 2024 to 2034, attaining a Valuation of USD 7.3 billion | States Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Oct. 18, 2024 (GLOBE NEWSWIRE) — The global fluoropolymer industry (불소중합체 산업) was worth US$ 3.9 billion in 2023. A CAGR of 5.2% is projected between 2024 and 2034, resulting in a market value of US$ 7.3 billion in 2034. The fluoropolymer industry may see increased focus on sustainability due to regulatory restrictions and market demand. Manufacturers can allocate resources toward sustainable production methods, reusable materials, and biodegradable substitutes for conventional fluoropolymers.

Automation, the Internet of Things, and artificial intelligence (AI) are examples of Industry 4.0 technologies that could completely transform the production of fluoropolymers, resulting in more productivity, lower waste, and better product quality. The development of biomaterials, drug delivery systems, and sophisticated medical equipment will probably be greatly aided by fluoropolymers. Advancements in this field may result in better patient outcomes, lower healthcare expenses, and more business potential for producers of fluoropolymers.

Using lightweight materials such as fluoropolymers is becoming increasingly popular as the automotive industry focuses on fuel efficiency and emissions reduction. Fluoropolymers are lightweight, durable, and chemically resistant, making them an ideal choice for automotive components. As a result of their durability, non-stick properties, and safety, fluoropolymer-based products are highly sought after on the consumer products market.

Request a Sample Report to Learn about the Fluoropolymer Industry: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=94

Many industries, such as chemical processing, automotive, and electronics, rely on fluoropolymers for their special properties, including chemical resistance, high-temperature stability, and low friction. Fluoropolymers are becoming increasingly popular among industries like aircraft, semiconductors, and pharmaceuticals due to the growing demand for high-performance materials.

Key Findings of the Market Report

- Around the world, semiconductors are used in various electronic devices and systems.

- The Asia Pacific region held the largest share of the global market share in 2023.

- In 2023, polytetrafluoroethylene captured the largest share of the market.

- Based on application, pharmaceutical packaging will likely drive fluoropolymer demand.

Global Fluoropolymer Market: Growth Drivers

- Strict environmental regulations and an increased focus on sustainability drive the demand for fluoropolymers. Compared with traditional materials, these materials have a reduced environmental impact, driving the market upward.

- Due to ongoing technological advancements and product innovations in fluoropolymer production processes and formulations, new grades and varieties are developed with improved qualities, expanding their application scope and accelerating market growth.

- The semiconductor industry’s growing demand for high-purity materials and components necessitates fluoropolymers for semiconductor production processes such as etching, deposition, and wafer handling. The growing demand for these products is fueling the market’s expansion.

- In the medical and healthcare sectors, as well as pharmaceutical manufacturing and healthcare facilities, fluoropolymers are an important component considered biocompatible, chemical resistant, and sterile.

- Fluoropolymers are used in various consumer products since they are durable, non-stick, and resistant to acids and chemicals, such as textiles, coatings, and packaging.

Global Fluoropolymer Market: Regional Landscape

- Asia Pacific is driving demand for the fluoropolymers market. Fluoropolymers are in high demand in the chemical processing and building industries due to rising industrialization and infrastructural development in nations like China and India. The need for fluoropolymers in the manufacturing of semiconductors and electronic components is boosted by the growth of the electronics manufacturing industry in nations like South Korea and Japan.

- Increasing industrial and automotive use of fluoropolymer linings and coatings contributes to market growth. As aerospace and defense sectors demand high-performance materials, fluoropolymers are in greater demand. Environmental regulations and sustainability programs have made fluoropolymers an environmentally friendly substitute in nations such as South Korea and Japan.

- Healthcare is expanding, creating a greater need for fluoropolymers for pharmaceutical packaging and medical devices. China and India’s chemical processing sector is a major driver of the demand for corrosion-resistant pipes, tanks, and equipment made from fluoropolymers.

- With growing emphasis on water treatment and purification in countries, fluoropolymer membranes and filtration systems are becoming more important. Chemically resistant and thermally stable, fluoropolymers are highly regarded for fuel systems, hoses, and gaskets where the automobile industry is on the rise.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=94

Global Fluoropolymer Market: Competitive Landscape

The inorganic expansion of fluoropolymer market manufacturers aims to establish strong footholds in the industry. Fluoropolymers are also in high global demand, generating increased production capacity among key players.

Key Players Profiled

- E.I DuPont De Nemours and Company

- Solvay SA

- Asahi Glass Co. Ltd.

- 3M

- Daikin Industries Ltd.

- Honeywell International Inc.

- The Chemours Company

- Maxichem S.A.B. de C.V.

- Compagnie de Saint-Gobain SA

- W.L. Gore & Associates Inc.

- Zeus Industrial Products Inc.

Key Developments

- In July 2022, Daikin Industries, Ltd. invested in TeraWatt Technology Inc. Using fluorochemicals as the basis for its FUSION 25 strategic management plan, Daikin established new markets.

- Daikin plans to build its proposition capabilities with partners like customers and startups to grow markets like semiconductors, automobiles, lithium-ion batteries, and IT. With this investment, Daikin expects to improve its battery technology and develop new materials and applications.

Global Fluoropolymer Market: Segmentation

By Product Type

- Polytetrafluoroethylene

- Polyvinylidene Difluoride

- Fluorinated Ethylene Propylene

- Others

By Application

- Pharmaceutical Packaging

- Medical Devices

- Drug Delivery

- Others

Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Lead With Data-Driven Decisions. Buy Now To Turn Insights Into Competitive! https://www.transparencymarketresearch.com/checkout.php?rep_id=94<ype=S

Have a Look at Related Reports of Chemicals And Materials Domain:

Sodium Chloride Market (塩化ナトリウム市場) – The global sodium chloride market was estimated at a value of US$ 18 billion in 2022. It is anticipated to register a 3.8% CAGR from 2023 to 2031 and by 2031; the market is likely to attain US$ 26.1 billion by 2031.

Phosphoric Acid Market (سوق حمض الفوسفوريك) – The phosphoric acid market was valued at US$ 43.5 billion in 2022. The market is projected to reach US$ 60.6 billion by 2031. It is estimated to increase at a CAGR of 3.7% from 2023 to 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dividend Investor Making $1,000 Per Month With Just $40,000 Invested Shares His 'Hyper Dividend' Portfolio: Top 9 Stocks and ETFs

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Giving yields too much importance in dividend investing comes with risks and caveats. But high-yield dividend stocks have never lost their allure over the past several decades. For beginner investors with a limited budget and high-risk appetite, focusing on stocks with high yields is the only way to reach a significant dividend income.

While dividend growth stocks with strong fundamentals and growth history provide investors better long-term opportunities, many are crushing it by investing in high-yield stocks.

Check It Out:

About two months ago, a dividend investor shared his portfolio and income report on r/Dividends, a discussion board for dividend investors on Reddit. The investor said he collected about $1,000 monthly with $40,000 invested, giving the portfolio an insane yield of about 34%.

“I created a hyper dividend portfolio last month and collected 1k last month. Goal is to reach 2.5k /month by next August,” the investor said.

As expected, most of the holdings in the portfolio are risky high-yield options ETFs. When asked whether he’s aware of the risks of losses in principal that come with investing in such kinds of ETFs, the investor said:

“Yes, I know. These are called synthetic ETFs. Don’t care how they pay it as long as principal + interest < final value.”

Let’s look at some of the biggest holdings in this extremely high-yield dividend portfolio.

Please note that many of these holdings are risky ETFs. This article is based on an income report shared publicly by an investor. It’s not investment advice.

The YieldMax MSTR Option Income Strategy ETF

The YieldMax MSTR Option Income Strategy ETF (NYSE:MSTY) generates income by selling call options on MicroStrategy (MSTR) stock. Its distribution rate is about 75%.

The Simplify Volatility Premium ETF

The Simplify Volatility Premium ETF (NYSE:SVOL) is a high-yield (16%) dividend ETF gaining popularity on Reddit. The ETF generates income by shorting the CBOE Volatility Index (VIX) and betting that volatility will remain stable or decrease. Since the broader market tends to go higher in the long term, investing in this ETF suits those looking for stable income checks. The Redditor, earning $1,000 monthly with a $40,000 investment, said he owned 200 SVOL shares.

The Pacer Pacific Asset Floating Rate High Income ETF

The Redditor earned $1,000 monthly and said he owned about 100 shares of The Pacer Pacific Asset Floating Rate High Income ETF (NYSE:FLRT). FLRT generates income by primarily investing in floating-rate loans of non-investment-grade companies. These ETFs gain traction when interest rates are rising. The fund yields about 8%.

JPMorgan Equity Premium Income ETF

JPMorgan Equity Premium Income ETF (NYSE:JEPI) was among the notable dividend ETFs in the portfolio of the Redditor earning $1,000 a week with $40,000. His hyper-dividend portfolio had 100 JEPI shares. JEPI makes money by investing in large-cap U.S. stocks and selling call options. JEPI is ideal for those looking for exposure to defensive stocks. It usually underperforms during bull markets but protects investors against large losses during bear markets, as its portfolio consists of defensive equities like Trane Technologies PLC (NYSE:TT), Southern Co (NYSE:SO), Progressive Corp (NYSE:PGR), among others.

Trending: This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

YieldMax AMZN Option Income Strategy ETF

The YieldMax AMZN Option Income Strategy ETF (NYSE:AMZY) generates income by selling call options on Amazon. The Redditor with the hyper-dividend portfolio said he owned 100 AMZY shares. The fund has a distribution rate of about 41%. AMZY is down 9% so far this year.

YieldMax TSLA Option Income Strategy ETF

YieldMax TSLA Option Income Strategy ETF (NYSE:TSLY) is a popular YieldMax dividend ETF for high-yield seekers. With a distribution rate of over 120%, TSLY generates income by selling call options on Tesla shares. Over the past year, TSLY has been down about 55%, while Tesla stock has been down 7%.

Realty Income

Realty Income Corp (NYSE:O) is a staple in Reddit dividend portfolio success stories. The REIT has a dividend yield of over 5% and has raised its payouts for 30 years. The Redditor making $1,000 a month with $40,000 said he owned 100 shares of Realty Income.

JPMorgan Nasdaq Equity Premium Income ETF

The Redditor earning $1,000 a month had about 100 shares of JPMorgan Nasdaq Equity Premium Income ETF (NASDAQ:JEPQ) in his portfolio. JEPQ invests in Nasdaq companies and generates extra income by selling call options. As of Oct. 14, the ETF yields about 9.4%.

YieldMax NVDA Option Income Strategy ETF

YieldMax NVDA Option Income Strategy ETF (NYSE:NVDY) makes money by selling call options on Nvidia. Recently, the ETF has gained popularity amid the buzz around Nvidia. The fund has a distribution rate of about 57%. NVDY suits investors who believe in Nvidia’s long-term potential but want to hedge against possible declines in the chipmaker’s shares.

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Keep Reading:

This article Dividend Investor Making $1,000 Per Month With Just $40,000 Invested Shares His ‘Hyper Dividend’ Portfolio: Top 9 Stocks and ETFs originally appeared on Benzinga.com

A Look Ahead: Sandy Spring Bancorp's Earnings Forecast

Sandy Spring Bancorp SASR will release its quarterly earnings report on Monday, 2024-10-21. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate Sandy Spring Bancorp to report an earnings per share (EPS) of $0.46.

Anticipation surrounds Sandy Spring Bancorp’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

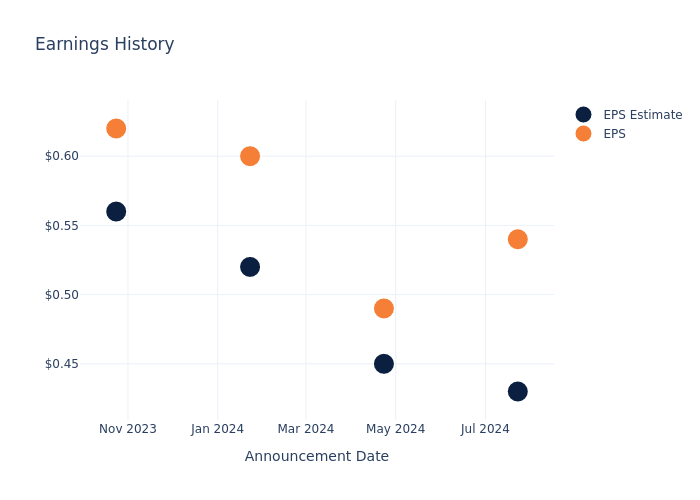

Performance in Previous Earnings

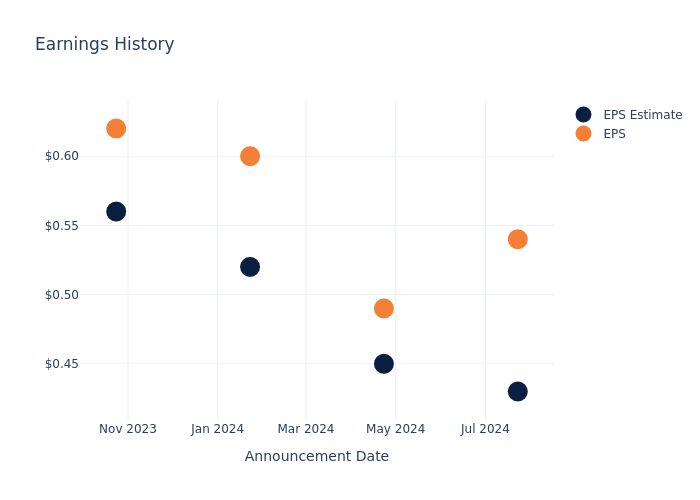

The company’s EPS beat by $0.11 in the last quarter, leading to a 2.86% drop in the share price on the following day.

Here’s a look at Sandy Spring Bancorp’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.43 | 0.45 | 0.52 | 0.56 |

| EPS Actual | 0.54 | 0.49 | 0.60 | 0.62 |

| Price Change % | -3.0% | -2.0% | 0.0% | -1.0% |

Stock Performance

Shares of Sandy Spring Bancorp were trading at $33.11 as of October 17. Over the last 52-week period, shares are up 66.74%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for Sandy Spring Bancorp visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

PIMCO Canada Announces Special Meeting Details for the Proposed Mergers of Certain Closed-end Funds

TORONTO, Oct. 18, 2024 (GLOBE NEWSWIRE) — PIMCO Canada Corp. (“PIMCO Canada”) announces further details about the previously announced proposed mergers (the “Mergers”) of PIMCO Tactical Income Fund PTI, PIMCO Tactical Income Opportunities Fund PTO and PIMCO Multi-Sector Income Fund PIX (collectively, the “Existing Funds”) into a new closed-end fund to be managed by PIMCO Canada, PIMCO Monthly Enhanced Income Fund (“PMEI”).

Pursuant to the terms of the Mergers, holders of units of the Existing Funds will become holders of the same class of units of PMEI. PIMCO Canada has determined that it is in the best interests of unitholders of the Existing Funds to merge into a single fund, which would permit PMEI to: (i) increase liquidity on the secondary market, and (ii) benefit from significant economies of scale, including greater investment flexibility. None of the costs and expenses associated with the Mergers will be borne by the Existing Funds or their respective unitholders. All such costs will be borne by the Manager.

The Mergers will be voted on at special meetings (the “Meetings”) of unitholders of the Existing Funds to be held on December 4, 2024. If required, adjourned meetings will be held on December 5, 2024. The record date for the purpose of determining which unitholders are entitled to receive notice of, and to vote at, the Meetings is October 16, 2024. Subject to the receipt of all necessary regulatory, unitholder and other third party approvals, and obtaining a receipt for the final non-offering prospectus of PMEI, it is expected that the proposed Mergers will take effect on or about December 20, 2024, or such other date as the Manager may determine in its sole discretion.

In advance of the Meetings, a notice-and-access document will be sent on or about October 31, 2024 to unitholders of record as at October 16, 2024. The notice-and-access document will describe how unitholders can obtain a copy of the management information circular (the “Circular”) that contains full details of the proposed Mergers. The notice-and-access document and the Circular are also available at www.sedarplus.ca and www.pimco.ca.

The independent review committee of each Existing Fund has reviewed the proposed Mergers, including the proposed steps to be taken in implementing the proposed Mergers, and has concluded that the proposed Mergers represent the business judgment of the Manager, uninfluenced by considerations other than the best interests of the Existing Funds, and the proposed Mergers will achieve a fair and reasonable result for each of the Existing Funds.

In addition, in anticipation of the proposed Merger, PIMCO Tactical Income Fund has terminated its “at-the-market” equity program effective today.

For further information on PIMCO Canada and the PIMCO funds, please visit www.pimco.ca or call us at 1 866 341 3350 (416 368 3350 in Toronto).

About PIMCO

PIMCO is one of the world’s premier fixed income investment managers. With its launch in 1971 in Newport Beach, California, PIMCO introduced investors to a total return approach to fixed income investing. In the 50+ years since, the firm continued to bring innovation and expertise to our partnership with clients seeking the best investment solutions. Today PIMCO has offices across the globe and 2,500+ professionals united by a single purpose: creating opportunities for investors in every environment. PIMCO is owned by Allianz SE, a leading global diversified financial services provider.

Forward-Looking Statements

Certain statements included in this news release constitute forward-looking statements, including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to the Funds. The forward-looking statements are not historical facts but reflect the Fund’s, PIMCO Canada and/or PIMCO’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations, including, but not limited to, market factors. Although the Fund, PIMCO Canada and/or PIMCO believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. The Fund, PIMCO Canada and/or PIMCO undertakes no obligation to update publicly or otherwise revise any forward-looking statement or information whether as a result of new information, future events or other factors which affect this information, except as required by law.

You will usually pay brokerage fees to your dealer if you purchase or sell units of the investment funds on Toronto Stock Exchange. If the units are purchased or sold on the TSX, investors may pay more than the current net asset value when buying units of the investment fund and may receive less than the current net asset value when selling them. There are ongoing fees and expenses associated with owning units of an investment fund. An investment fund must prepare disclosure documents that contain key information about the fund. You can find more detailed information about the fund in these documents. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

A word about risk: All investments contain risk and may lose value. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2024, PIMCO

The products and services provided by PIMCO Canada Corp. may only be available in certain provinces or territories of Canada and only through dealers authorized for that purpose.

PIMCO Canada has retained PIMCO LLC as sub-adviser. PIMCO Canada will remain responsible for any loss that arises out of the failure of its sub-adviser.

PIMCO Canada Corp. 199 Bay Street, Suite 2050, Commerce Court Station, P.O. Box 363, Toronto, ON, M5L 1G2 is a company of PIMCO, 416-368-3350

Contact:

Agnes Crane

PIMCO – Media Relations

Ph. 212-597-1054

Email: agnes.crane@pimco.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Hilton Hospitality, Apple Simplicity, Uber Convenience: ElevateOS Is the Future of Multifamily

Elevating Property Management and Resident Experiences Like Never Before

CHICAGO, Oct. 17, 2024 /PRNewswire/ — Elevated Living, the premier provider of integrated resident experience solutions, is excited to announce its rebranding to ElevateOS — the all-in-one resident operating system set to redefine how multifamily properties operate. Much like Apple transformed personal computing and Hilton reimagined hospitality, ElevateOS is reshaping the future of multifamily by offering a seamless, tech-driven platform that integrates every facet of property management and resident engagement.

A Full Operating System for Multifamily Living

Over the years, our solution has evolved from a custom-branded resident app to a comprehensive operating system that now powers entire portfolios, coast to coast. ElevateOS enables property owners, managers, and developers to streamline their operations, reduce costs, and accelerate decision-making — all while saving on-site management teams hours of time. With our all-in-one platform, everything from access control and smart home tech to service bookings is handled effortlessly, creating a frictionless experience for residents and staff alike.

“At ElevateOS, we believe in simplicity and efficiency,” said Konrad Koczwara, CEO of ElevateOS. “Our rebranding reflects the evolution of our technology into a full operating system, designed to unify the resident management process, improve property performance, and create smarter buildings.”

Introducing ElevateAI: The Future of Real-Time Property Insights

As part of the rebrand, we are thrilled to introduce ElevateAI, our new artificial intelligence module that is being seamlessly integrated into the ElevateOS platform. ElevateAI will provide real-time insights to property managers, enabling them to predict at-risk lease renewals and automate critical property-related tasks. By implementing ElevateAI throughout our platform, managers will have a powerful tool to make data-driven decisions, streamline operations, and improve retention and profitability.

“With ElevateAI, property managers can not only react faster but also proactively anticipate resident needs and optimize their workflows like never before,” Koczwara added.

Seamless Integration with What Properties Already Use

ElevateOS integrates the software and hardware already deployed in most properties, eliminating the need for multiple apps for residents and unnecessary logins for property staff. By consolidating an average of 4.7 point solutions per community, ElevateOS helps property owners cut operating expenses by $6–23 per unit per month. This reduction in OPEX represents a significant cost saving for multifamily properties while streamlining operations and improving resident experiences. ElevateOS allows owners and operators to view and analyze all property data and resident insights in one centralized platform.

Revolutionizing Resident Experiences with Uber-Like Convenience

One of the standout features of ElevateOS is its Uber-like functionality for residents, offering them the ability to book concierge services directly from the app. From housekeepers and dog walkers to personal trainers and grocery deliveries, residents can access a full suite of services at their fingertips. Some properties are already seeing more than $30+/unit per month in additional service revenue, driven entirely by the convenience of the platform.

“By unifying resident needs and property management into one cohesive platform, ElevateOS is transforming how multifamily communities operate,” said Mitch Karren, Chief Product & Strategy Officer. “We’ve created a technology solution that improves resident satisfaction while driving significant financial benefits for property owners.”

The Future of Multifamily is Here

With its rebranding, ElevateOS is cementing its place as the leader in multifamily property technology. Whether it’s simplifying operations, enhancing resident experiences, or driving revenue, ElevateOS — now with the power of ElevateAI — is designed to meet the needs of the modern multifamily property.

For more information about ElevateOS and how it’s reshaping the future of multifamily, visit https://elevateOS.com

About ElevateOS:

ElevateOS is the industry’s first all-in-one resident operating system for multifamily properties, integrating resident management, property operations, and concierge services into a single platform. With ElevateAI providing real-time insights and predictive analytics, ElevateOS empowers property owners and managers to make real-time decisions, improve operational efficiency, and boost NOI while delivering a seamless resident experience.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/hilton-hospitality-apple-simplicity-uber-convenience-elevateos-is-the-future-of-multifamily-302279947.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/hilton-hospitality-apple-simplicity-uber-convenience-elevateos-is-the-future-of-multifamily-302279947.html

SOURCE Elevated Living

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Decision: Global Infrastructure Investors III LLC Offloads $2.99B Worth Of EnLink Midstream Stock

Disclosed on October 17, Global Infrastructure Investors III LLC, 10% Owner at EnLink Midstream ENLC, executed a substantial insider sell as per the latest SEC filing.

What Happened: According to a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday, LLC sold 200,340,753 shares of EnLink Midstream. The total transaction value is $2,985,077,219.

At Friday morning, EnLink Midstream shares are up by 0.96%, trading at $14.74.

All You Need to Know About EnLink Midstream

EnLink Midstream LLC is an integrated midstream company. The company’s operating segment includes Permian; North Texas; Oklahoma; Louisiana and Corporate. The company generates maximum revenue from the Louisiana segment. The Louisiana segment includes natural gas pipelines, natural gas processing plants, storage facilities, fractionation facilities, and NGL assets.

Unraveling the Financial Story of EnLink Midstream

Revenue Growth: EnLink Midstream’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 2.18%. This indicates a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Energy sector.

Profitability Metrics:

-

Gross Margin: The company faces challenges with a low gross margin of 21.05%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): EnLink Midstream’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of 0.07.

Debt Management: EnLink Midstream’s debt-to-equity ratio surpasses industry norms, standing at 5.11. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Valuation Metrics: A Closer Look

-

Price to Earnings (P/E) Ratio: EnLink Midstream’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 48.67.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 0.98 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 9.15 is above the industry average, suggesting that the market values the company more highly for each unit of EBITDA. This could be attributed to factors such as strong growth prospects or superior operational efficiency.

Market Capitalization Analysis: Positioned below industry benchmarks, the company’s market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Impact of Insider Transactions on Investments

Insider transactions shouldn’t be used primarily to make an investing decision, however an insider transaction can be an important factor in the investing decision.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

A Deep Dive into Insider Transaction Codes

In the domain of transactions, investors frequently turn their focus to those taking place in the open market, as meticulously outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of EnLink Midstream’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Is What Whales Are Betting On Caterpillar

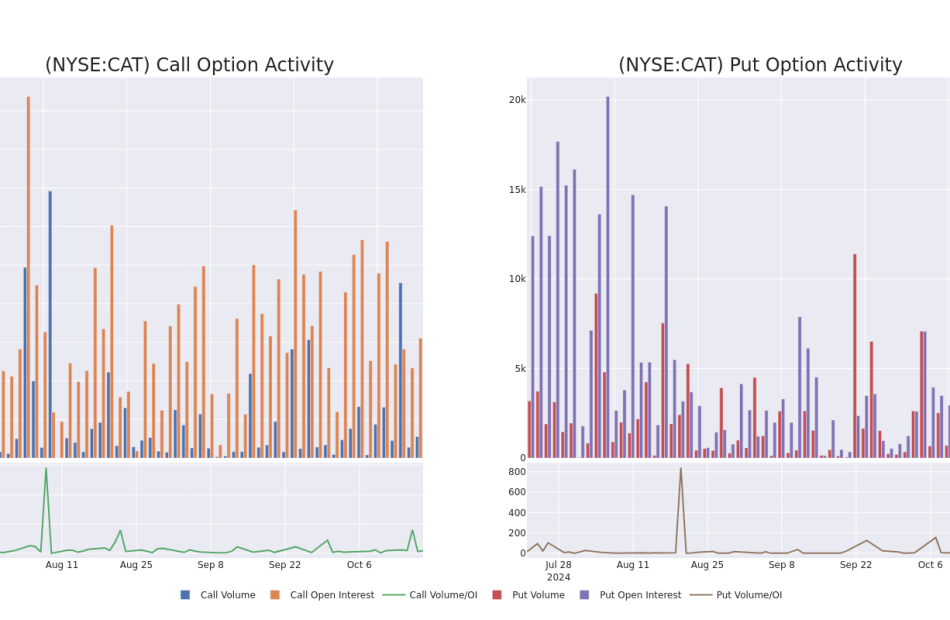

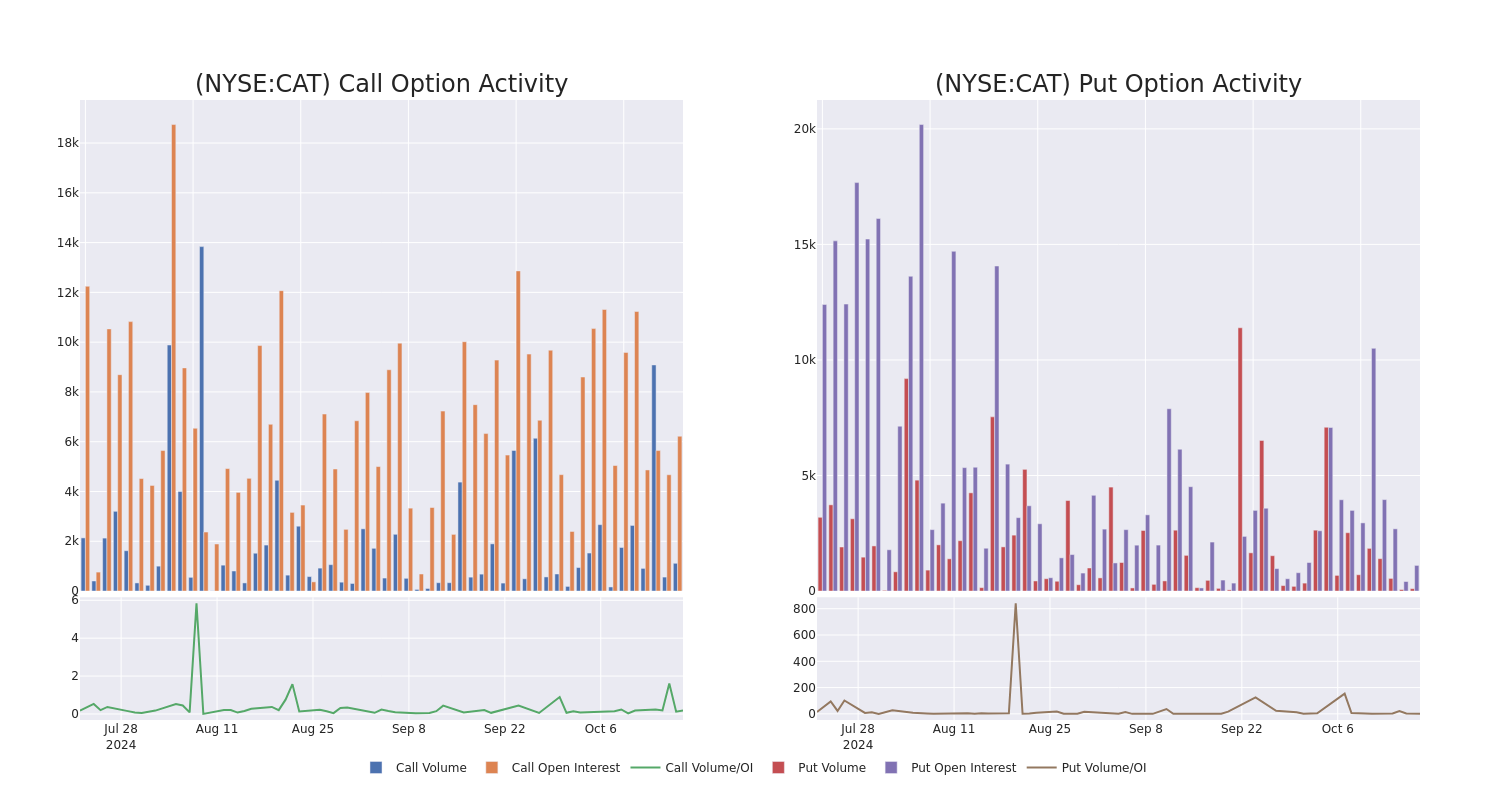

Financial giants have made a conspicuous bearish move on Caterpillar. Our analysis of options history for Caterpillar CAT revealed 16 unusual trades.

Delving into the details, we found 18% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $250,984, and 10 were calls, valued at $1,135,248.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $290.0 to $420.0 for Caterpillar over the recent three months.

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Caterpillar options trades today is 666.27 with a total volume of 1,219.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Caterpillar’s big money trades within a strike price range of $290.0 to $420.0 over the last 30 days.

Caterpillar Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CAT | CALL | SWEEP | BEARISH | 10/18/24 | $12.25 | $11.35 | $12.25 | $380.00 | $616.1K | 1.1K | 516 |

| CAT | CALL | TRADE | BULLISH | 12/20/24 | $14.8 | $14.4 | $14.8 | $400.00 | $97.6K | 753 | 122 |

| CAT | CALL | SWEEP | NEUTRAL | 11/15/24 | $35.45 | $34.9 | $35.19 | $360.00 | $91.5K | 1.0K | 32 |

| CAT | CALL | SWEEP | NEUTRAL | 11/15/24 | $37.25 | $36.8 | $36.99 | $360.00 | $85.1K | 1.0K | 121 |

| CAT | CALL | SWEEP | NEUTRAL | 11/15/24 | $37.1 | $36.65 | $36.93 | $360.00 | $70.1K | 1.0K | 59 |

About Caterpillar

Caterpillar is the top manufacturer of heavy equipment, power solutions, and locomotives. It is currently the world’s largest manufacturer of heavy equipment. The company is divided into four reportable segments: construction industries, resource industries, energy and transportation, and Cat Financial. Its products are available through a dealer network that covers the globe with about 2,700 branches maintained by 160 dealers. Cat Financial provides retail financing for machinery and engines to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Caterpillar product sales.

After a thorough review of the options trading surrounding Caterpillar, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Caterpillar

- With a volume of 850,803, the price of CAT is down -0.12% at $394.04.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 12 days.

What The Experts Say On Caterpillar

5 market experts have recently issued ratings for this stock, with a consensus target price of $433.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Morgan Stanley has revised its rating downward to Underweight, adjusting the price target to $332.

* Consistent in their evaluation, an analyst from B of A Securities keeps a Buy rating on Caterpillar with a target price of $434.

* Consistent in their evaluation, an analyst from Truist Securities keeps a Buy rating on Caterpillar with a target price of $456.

* An analyst from JP Morgan persists with their Overweight rating on Caterpillar, maintaining a target price of $500.

* An analyst from Citigroup has decided to maintain their Buy rating on Caterpillar, which currently sits at a price target of $445.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Caterpillar, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.