Arista Networks Options Trading: A Deep Dive into Market Sentiment

Financial giants have made a conspicuous bullish move on Arista Networks. Our analysis of options history for Arista Networks ANET revealed 21 unusual trades.

Delving into the details, we found 28% of traders were bullish, while 28% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $296,060, and 13 were calls, valued at $495,684.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $300.0 and $420.0 for Arista Networks, spanning the last three months.

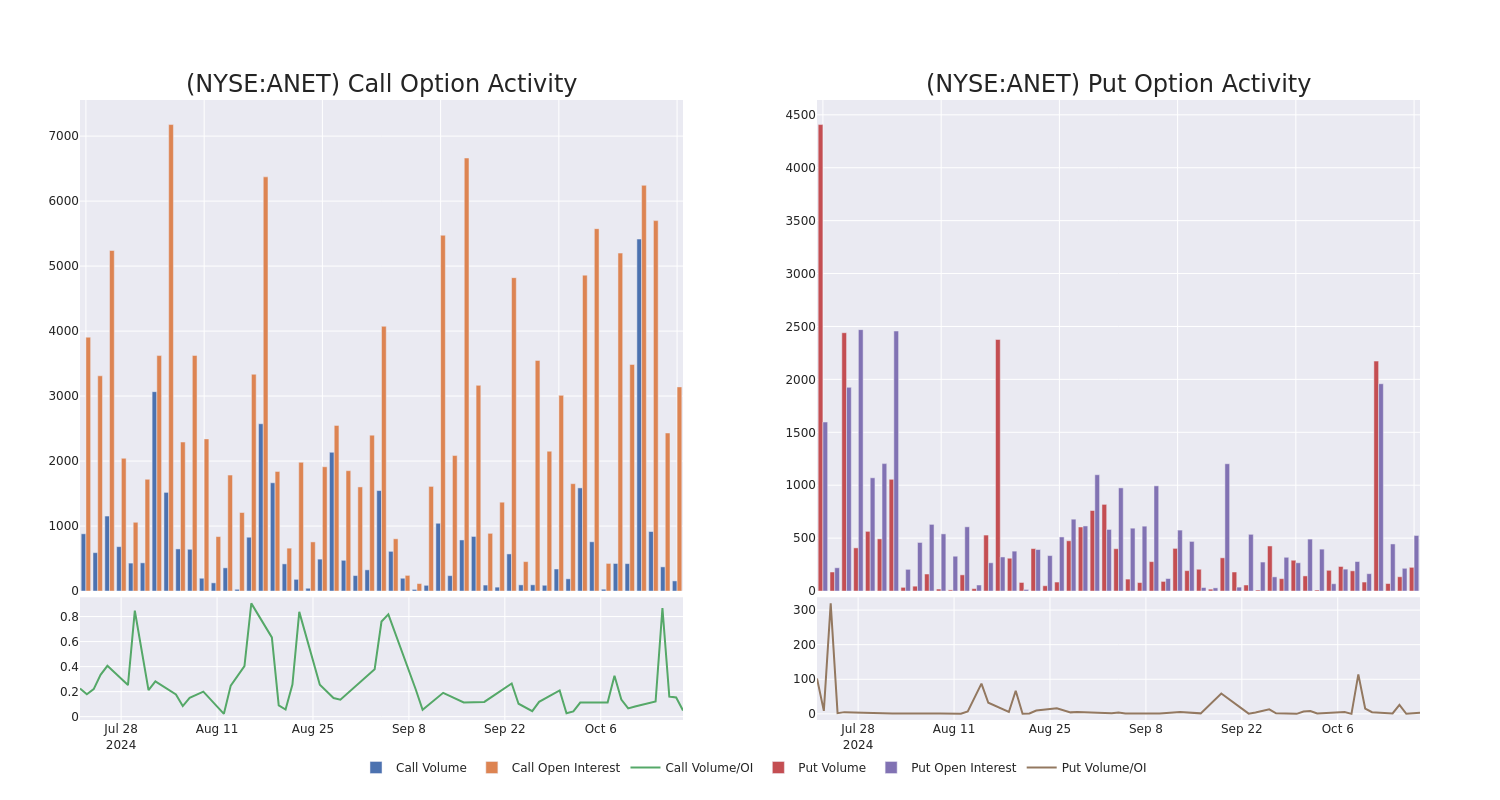

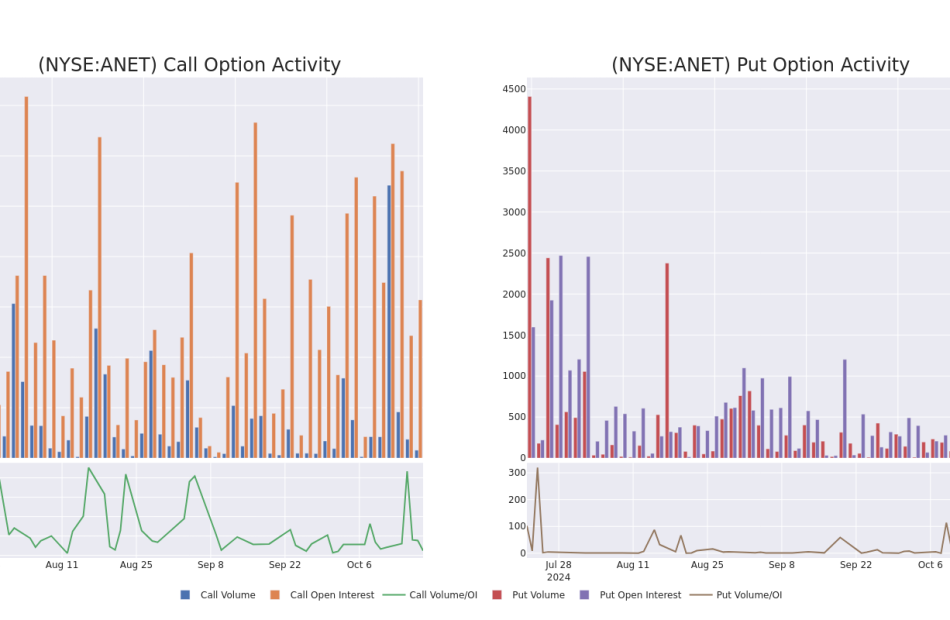

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Arista Networks’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Arista Networks’s substantial trades, within a strike price spectrum from $300.0 to $420.0 over the preceding 30 days.

Arista Networks Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ANET | CALL | TRADE | NEUTRAL | 11/15/24 | $94.1 | $92.6 | $93.47 | $310.00 | $65.4K | 118 | 7 |

| ANET | CALL | TRADE | NEUTRAL | 01/17/25 | $115.7 | $112.1 | $113.6 | $300.00 | $56.8K | 323 | 0 |

| ANET | PUT | TRADE | BEARISH | 11/15/24 | $22.0 | $21.6 | $21.92 | $400.00 | $54.8K | 176 | 55 |

| ANET | CALL | TRADE | BULLISH | 02/21/25 | $46.4 | $46.1 | $46.4 | $400.00 | $46.4K | 121 | 2 |

| ANET | PUT | TRADE | BULLISH | 10/25/24 | $8.2 | $4.6 | $4.6 | $405.00 | $45.9K | 44 | 0 |

About Arista Networks

Arista Networks is a networking equipment provider that primarily sells Ethernet switches and software to data centers. Its marquee product is its extensible operating system, or EOS, that runs a single image across every single one of its devices. The firm operates as one reportable segment. It has steadily gained market share since its founding in 2004, with a focus on high-speed applications. Arista counts Microsoft and Meta Platforms as its largest customers and derives roughly three quarters of its sales from North America.

Following our analysis of the options activities associated with Arista Networks, we pivot to a closer look at the company’s own performance.

Where Is Arista Networks Standing Right Now?

- With a trading volume of 612,154, the price of ANET is down by -1.35%, reaching $401.87.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 20 days from now.

Expert Opinions on Arista Networks

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $438.3333333333333.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Citigroup has decided to maintain their Buy rating on Arista Networks, which currently sits at a price target of $460.

* An analyst from Goldman Sachs has decided to maintain their Buy rating on Arista Networks, which currently sits at a price target of $430.

* An analyst from Evercore ISI Group has decided to maintain their Outperform rating on Arista Networks, which currently sits at a price target of $425.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Arista Networks with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply