Examining the Future: Preferred Bank's Earnings Outlook

Preferred Bank PFBC is preparing to release its quarterly earnings on Monday, 2024-10-21. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Preferred Bank to report an earnings per share (EPS) of $2.38.

Preferred Bank bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

Overview of Past Earnings

During the last quarter, the company reported an EPS beat by $0.09, leading to a 4.68% increase in the share price on the subsequent day.

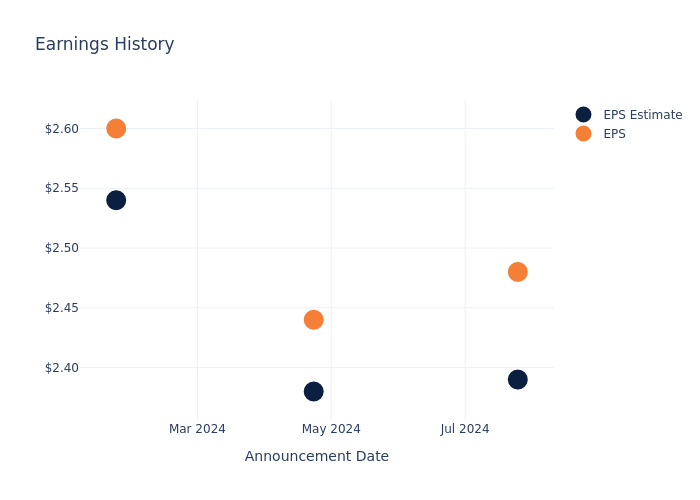

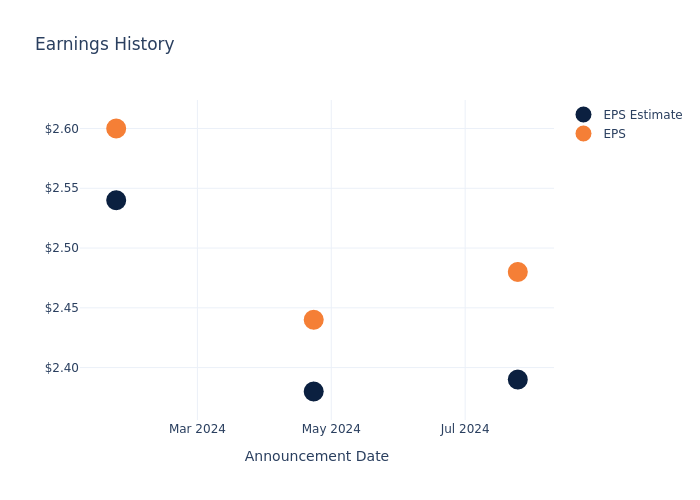

Here’s a look at Preferred Bank’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 2.39 | 2.38 | 2.54 | 2.56 |

| EPS Actual | 2.48 | 2.44 | 2.60 | 2.71 |

| Price Change % | 5.0% | -0.0% | -3.0% | -4.0% |

Performance of Preferred Bank Shares

Shares of Preferred Bank were trading at $85.08 as of October 17. Over the last 52-week period, shares are up 40.6%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for Preferred Bank visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply