Looking At Apple's Recent Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bearish stance on Apple.

Looking at options history for Apple AAPL we detected 100 trades.

If we consider the specifics of each trade, it is accurate to state that 38% of the investors opened trades with bullish expectations and 47% with bearish.

From the overall spotted trades, 13 are puts, for a total amount of $745,832 and 87, calls, for a total amount of $5,521,596.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $100.0 to $250.0 for Apple over the recent three months.

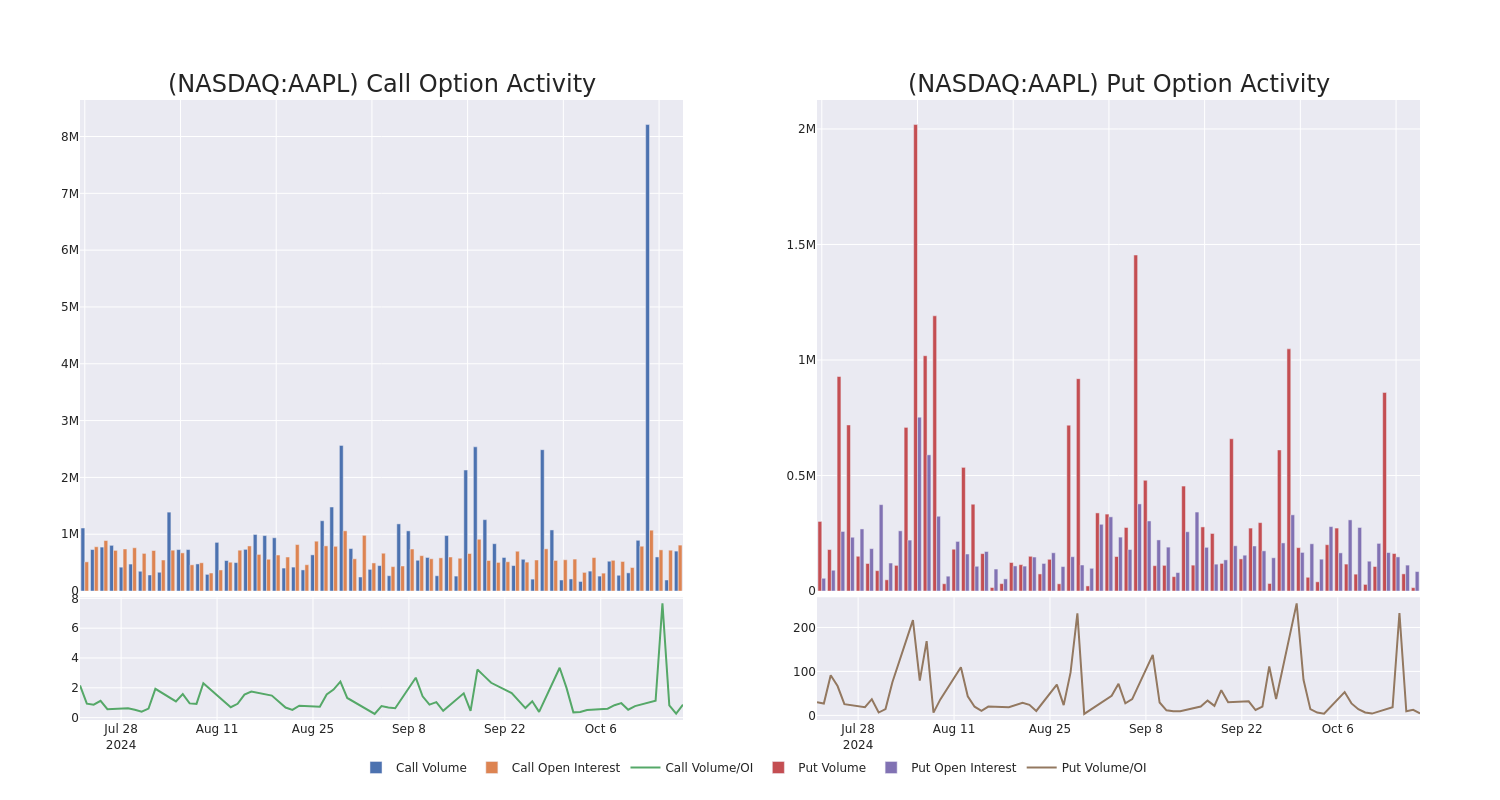

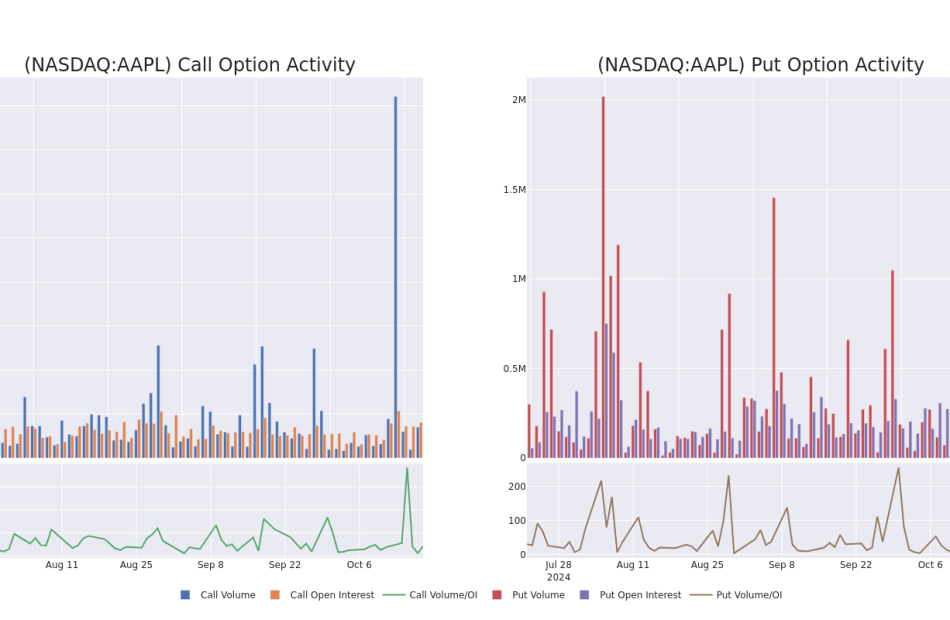

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Apple options trades today is 17176.67 with a total volume of 717,783.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Apple’s big money trades within a strike price range of $100.0 to $250.0 over the last 30 days.

Apple Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AAPL | CALL | SWEEP | BEARISH | 10/25/24 | $2.4 | $2.39 | $2.4 | $235.00 | $435.0K | 29.5K | 29.0K |

| AAPL | CALL | SWEEP | BEARISH | 10/18/24 | $7.3 | $7.2 | $7.2 | $227.50 | $249.1K | 9.5K | 859 |

| AAPL | PUT | SWEEP | BULLISH | 06/20/25 | $3.8 | $3.7 | $3.71 | $190.00 | $186.5K | 17.8K | 533 |

| AAPL | CALL | SWEEP | BEARISH | 06/20/25 | $45.8 | $45.65 | $45.73 | $200.00 | $137.2K | 7.4K | 30 |

| AAPL | CALL | SWEEP | NEUTRAL | 10/18/24 | $59.95 | $59.6 | $59.75 | $175.00 | $119.5K | 1.8K | 64 |

About Apple

Apple is among the largest companies in the world, with a broad portfolio of hardware and software products targeted at consumers and businesses. Apple’s iPhone makes up a majority of the firm sales, and Apple’s other products like Mac, iPad, and Watch are designed around the iPhone as the focal point of an expansive software ecosystem. Apple has progressively worked to add new applications, like streaming video, subscription bundles, and augmented reality. The firm designs its own software and semiconductors while working with subcontractors like Foxconn and TSMC to build its products and chips. Slightly less than half of Apple’s sales come directly through its flagship stores, with a majority of sales coming indirectly through partnerships and distribution.

Present Market Standing of Apple

- Trading volume stands at 26,764,299, with AAPL’s price up by 1.62%, positioned at $235.91.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 13 days.

What Analysts Are Saying About Apple

5 market experts have recently issued ratings for this stock, with a consensus target price of $237.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Needham downgraded its action to Buy with a price target of $260.

* In a cautious move, an analyst from B of A Securities downgraded its rating to Buy, setting a price target of $256.

* An analyst from Needham downgraded its action to Buy with a price target of $260.

* Maintaining their stance, an analyst from Barclays continues to hold a Underweight rating for Apple, targeting a price of $186.

* An analyst from Piper Sandler has revised its rating downward to Neutral, adjusting the price target to $225.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Apple options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply