Meet the Unstoppable Growth Stock That Could Join Apple, Nvidia, and Microsoft in the $3 Trillion Club by 2028.

It was a mere 20 years ago that industrial and energy titans General Electric and ExxonMobil were the world’s most valuable companies when measured by market cap, with values of $319 billion and $283 billion, respectively. Now, just two decades later, technology interests lead the field.

Heading up the list are some of the world’s most familiar technology names. Apple tops the charts at $3.5 trillion (as of this writing). Nvidia and Microsoft are trailing close behind, with market caps of $3.2 trillion and $3.1 trillion, respectively.

With a market cap of just $2 trillion, it might seem a bit early to suggest that Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) has the makings for membership in the $3 trillion club. However, the stock has gained 88% since early last year and 172% over the past five years, and there’s every reason to believe its ascent will continue.

A combination of an improving economy, Alphabet’s market strength, and gains in the field of artificial intelligence (AI) could provide the boost the company needs to join this exclusive society.

Improving performance

The widespread challenges of the past few years have been glaringly obvious, marked by macroeconomic headwinds and the worst inflation rates since the early 1980s. These conditions weighed heavily on each of Alphabet’s major business segments and the stock plunged as much as 44% in response.

However, there’s been a marked improvement in recent months. In September, the Federal Reserve Bank cut interest rates for the first time since March 2020, and consumer confidence jumped to its highest level in months.

The economic rebound has had a dramatic effect on Alphabet’s results. In the second quarter, revenue of $84.7 billion climbed 14% year over year, while diluted earnings per share (EPS) of $1.89 jumped 31%.

Each of the company’s major operating segments did their part to boost the results. The rebound in advertising, which has suffered the most in recent years, had the most profound impact. Google advertising, which provides the bulk of Alphabet’s revenue, climbed 11% year over year, while Google Cloud — the company’s fastest-growing segment — jumped 29%.

An industry leader — in more ways than one

Google has long been the undisputed leader in search, recently capturing 90% of the search market, according to internet statistics aggregator StatCounter. The company has worked to consistently improve its search acumen and the underlying algorithms, becoming something of an AI subject matter expert along the way.

It’s also the undisputed leader in digital advertising, fueled primarily by Google Search and YouTube but also by its suite of products that count billions of users each. In 2023, Google captured an estimated 39% of worldwide digital advertising revenue, according to data compiled by Statista. For context, its closest competitor — Meta Platforms — garnered just 18%. This dominance is expected to continue.

Alphabet is also a strong contender in the realm of cloud computing. Google Cloud is part of the “Big Three” as the third-largest provider of cloud infrastructure services. The company controlled roughly 10% of the market in the second quarter, according to data supplied by Canalys. It was also the fastest-growing, with year-over-year revenue growth of 30%.

Helping fuel demand for Google Cloud is the company’s generative AI offerings. Alphabet has been using AI for years to inform its search results, and the company has refocused that expertise to fuel a suite of AI-powered models led by Gemini, one of the leading foundational AI models in the world. This is attracting new users to Google Cloud.

Uncertainty weighs on the stock

I’d be remiss if I didn’t address the elephant in the room. The antitrust case against Alphabet is one step closer to completion. The court found that Google had violated antitrust law, and the U.S. Justice Department is mulling recommendations regarding the appropriate remedies, though the judge will have the final say. One of the potential outcomes is a breakup of the company, which is something that hasn’t happened in decades. There are other less severe proposals, like sharing Google’s search code with rivals, blocking other providers from paying Google to be its default search engine and more.

A final decision won’t be reached for at least a year, and if Alphabet appeals (it says it will), the case could go on for several more. Wall Street hates uncertainty, so this has been an overhang for Alphabet stock in recent months.

All that aside, even if Alphabet were to be broken up — and I don’t believe it will — that could unlock additional value, enriching shareholders along the way. So, the current concerns are merely noise, in my opinion.

The path to $3 trillion

Alphabet currently boasts a market cap of roughly $2 trillion, which means it will take stock price gains of about 47% to drive its value to $3 trillion. According to Wall Street, Alphabet is expected to generate revenue of $347.4 billion in 2024, giving it a forward price-to-sales (P/S) ratio of roughly 6. Assuming its P/S remains constant, Alphabet would have to grow its revenue to roughly $510 billion annually to support a $3 trillion market cap.

Wall Street is currently forecasting revenue growth for Alphabet of about 11% annually over the next five years. If the company achieves that benchmark, it could achieve a $3 trillion market cap as early as 2028. It’s worth noting that Alphabet has grown its annual revenue by 368% over the past decade, so Wall Street could be lowballing its forecast.

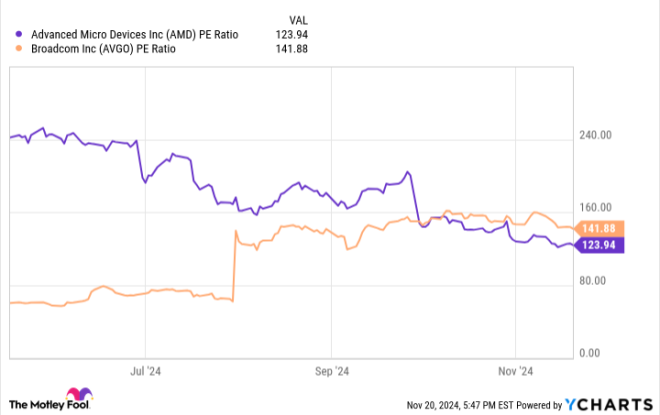

Furthermore, Alphabet is currently selling for roughly 24 times earnings, a significant discount compared to the multiple of 30 for the S&P 500. The aforementioned uncertainty is providing a very attractive entry point for savvy investors who plan to buy and hold for the long term.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $831,707!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Danny Vena has positions in Alphabet, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Meet the Unstoppable Growth Stock That Could Join Apple, Nvidia, and Microsoft in the $3 Trillion Club by 2028. was originally published by The Motley Fool

Leave a Reply