3 Heavily Shorted Stocks That Are Down More Than 75% Since 2021. Can They Turn Things Around?

Investing in struggling stocks that are also heavily shorted can be an incredibly risky move. But if these types of stocks are able to turn things around and prove their doubters wrong, the upside can also be significant. It’s not a suitable investment strategy for most investors, but if you have a high risk tolerance, there are three potential contrarian plays to consider.

Medical Properties Trust (NYSE: MPW), Beyond Meat (NASDAQ: BYND), and Plug Power (NASDAQ: PLUG) are three beaten-down stocks that many short-sellers are betting will continue to struggle. Below, I’ll look at just how heavily shorted these stocks are, what has to happen for them to turn things around, and whether they are worth potentially investing in today.

Medical Properties Trust: 50% short interest

A real estate investment trust (REIT) can sometimes be an attractive investment for its recurring dividend income and stability. But a REIT is only as stable as its tenants. And Medical Properties Trust is a REIT which has had problems with key tenants in the past, including Steward Health, which filed for bankruptcy protection earlier this year.

The turbulence in Medical Properties’ earnings has resulted in a disastrous performance for the stock, which is down a whopping 79% since 2021. And while the REIT has distanced itself from Steward Health and is relying on new tenants, short interest remains incredibly high at around 50% of the stock’s float.

For Medical Properties to turn things around, it needs to prove that it can get back to generating positive earnings numbers and that its new tenants are much safer. The healthcare REIT has incurred a net loss for three consecutive quarters. It’ll take time for Medical Properties to demonstrate it’s a safer option for investors, and with the company cutting its dividend twice since last year, it won’t be easy for many investors to trust this stock.

With interest rates potentially coming down further next year, I think there could be a contrarian play here as REITs may become more attractive investments amid lower rates. And with so much bearishness priced into its valuation, Medical Properties may not have to perform too well to impress the market these days. This is a highly risky stock, but there are reasons to consider taking a chance on it. The safe option, however, would be to wait at least a couple of quarters to see if Medical Properties is able to find some stability in its earnings.

Beyond Meat: 40% short interest

Another heavily shorted stock is Beyond Meat. The fake meat company hasn’t been doing well for multiple reasons. Not only has demand been unimpressive, but its gross margins are also often negative, which makes it difficult to see a path to profitability for the business anytime soon. With short interest as high as 40%, investors clearly aren’t believing the hype around Beyond Meat’s plant-based foods. Since 2021, Beyond Meat has lost a staggering 95% of its value; it’s nearly impossible for the stock to have performed worse since then.

In the trailing 12 months, Beyond Meat’s net loss of $314.4 million is nearly as high as its revenue of $317.8 million. Unfortunately, there’s no easy way to see a turnaround for Beyond Meat. It needs a plant-based product that is in high demand and for which it can charge a high enough price to significantly bolster its margins. And until that happens, it’s difficult to even see a path for a turnaround.

This food stock may be too risky an investment, even for contrarian investors.

Plug Power: 29% short interest

Shares of Plug Power are also down more than 90% since 2021 as the hype surrounding hydrogen energy has crumbled drastically in recent years. The company has reported massive losses, which make Beyond Meat’s numbers almost look decent. Over the past four quarters, Plug has incurred a net loss of nearly $1.5 billion on sales of $684.5 million. And like Beyond Meat, it regularly reports a negative gross margin, which is a huge red flag for investors. Short interest in Plug Power is just under 30%.

If you’re a believer in hydrogen energy, you might be tempted to take a chance on Plug Power. But the risk is that the company may not be around even if hydrogen energy takes off and becomes the preferred power solution in the future. While Plug Power may boast about a leadership position in the hydrogen industry, that hasn’t amounted to a strong financial position for the business, and that’s what’s arguably more important for investors.

Plug Power reported $285.2 million cash (including restricted cash) as of the end of June. And for a company that has burned through $422.5 million in just the past six months from its day-to-day operating activities, the problem is clear: The business needs to drastically slow its cash burn and cut expenses. Regardless of the potential in hydrogen, it’ll be all for naught if Plug Power continues to accumulate these types of losses. That’s why I think it may be the riskiest stock on this list, and the one which may have the hardest path to turning things around.

Without clear evidence of a significant improvement in its financials, this is a stock that you’ll probably want to steer clear of.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,049!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,847!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $378,583!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Beyond Meat. The Motley Fool has a disclosure policy.

3 Heavily Shorted Stocks That Are Down More Than 75% Since 2021. Can They Turn Things Around? was originally published by The Motley Fool

Ohio Woman Scores $15M Lottery Win, But A Huge Tax Bill Means She May Only Take Home $4.5M – Here's Why

In a stroke of unbelievable fortune, Jeanne, a Sandusky, Ohio resident, won $15 million in the state’s 50th Anniversary scratch-off game this past June.

Describe when Jeanne told the Ohio Lottery Commission that she had “dropped to the floor” after realizing her win. At the store, the clerk and Jeanne had cried together, leaving bystanders wondering what on earth had just happened.

Don’t Miss:

While $15 million might seem like a life-altering sum, Jeanne’s final payout will be much less due to taxes, leaving her with around $4.5 million. It’s a classic example of a lottery winner facing a significant reduction in winnings after taxes – an issue many winners don’t see coming.

Jeanne had the option of receiving $600,000 annually over 25 years (which totals the advertised $15 million) or a lump sum of around $7.5 million. She chose the lump sum. According to Moneywise, Jeanne will be left with around $4.5 million after paying federal and state taxes, a far cry from the headline-making prize.

Trending: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

So, why is there such a huge difference between the $15 million jackpot and her final earnings?

The IRS requires lottery agencies to withhold 24% of any prize over $5,000. For Jeanne, that meant $1.8 million was withheld for federal taxes from her $7.5 million lump sum. But the story doesn’t end there.

Since lottery winnings are taxed as ordinary income, Jeanne’s windfall pushes her into the highest federal income tax bracket of 37%. This means her total federal tax liability rises to approximately $2.73 million, Moneywise reported.

State taxes also take a bite out of Jeanne’s winnings. Ohio taxes lottery income at 3.5%, which means Jeanne will owe around $262,000 to the Buckeye State. Jeanne’s total tax burden is nearly $3 million, leaving her with just $4.5 million. It’s not bad for a $50 scratch-off, but far from the $15 million advertised.

Given these eye-watering deductions, one might wonder if Jeanne should have opted for the annuity. Would she have taken home more money in the long run?

By choosing the $600,000 annual payment for 25 years, Jeanne would receive the full $15 million over time. Her tax burden would be spread out and she’d pay yearly taxes based on her income.

Trending: Studies show 50% of consumers think Financial Advisors cost much more than they do — to debunk this, this company provides matching for free and a complimentary first call with the matched advisor.

In 2024, that means she’d owe roughly $180,000 in federal taxes and $20,000 in state taxes on the first $600,000 installment, according to current tax brackets. However, tax rates could shift over the next two decades, potentially lightening her tax load if Ohio’s proposed income tax elimination passes.

Many financial experts advocate for the annuity option as it ensures a steady income stream. According to certified financial planner Michael Kitces, annuities can reduce the risk of quickly burning through a lump sum. Steady payments help prevent financial risks.

That said, the lump sum offers immediate financial freedom, likely why Jeanne chose it. Many winners use lump sums to pay off debts, buy homes or invest in growth opportunities.

But as tempting as immediate access to millions might be, experts warn that having a plan in place is essential. Without solid financial advice, it’s easy for winners to blow through their money faster than they think.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Ohio Woman Scores $15M Lottery Win, But A Huge Tax Bill Means She May Only Take Home $4.5M – Here’s Why originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A French crypto whale backing Trump may be moving markets many times its size

Legendary investor Stanley Druckenmiller, when he wasn’t beating himself up for selling out of Nvidia too early, made an interesting observation in a Bloomberg Television interview: the market, particularly as seen in bank stocks and in crypto, has already started to price in an election victory by former President Donald Trump.

Nikolaos Panigirtzoglou, global markets strategist at JPMorgan, has reached a similar conclusion, and pointed out that markets are increasingly pricing in not just a Trump victory but a sweep by Republicans in the Senate and House.

Most Read from MarketWatch

“The rising probability of a Republican sweep is also seen in the market moves over the past two weeks with stronger U.S. equities and in particularl U.S. banks, a stronger dollar, tighter credit spreads and higher U.S. Treasury yields,” he says. He did say that the market is not pricing in as high a probability of a so-called red sweep as the 45% chance implied in betting markets.

But then again, there’s something funny going on in betting markets. Particularly at the crypto-fueled Polymarket, betting odds are pricing a much higher probability of a Trump victory than the roughly 50-50 odds that polls — and poll readers like Nate Silver — are assessing.

One of the advantages of crypto markets is that observers can trace trades back to individual user handles, if not know who the person is behind that handle. And the big whale on Polymarket goes by the handle Fredi9999, who was betting for Trump, and against Vice President Kamala Harris, even as this article was being written.

Over on the social media service X, an account calling himself Domer says he’s interacted with Fredi9999 — and also come to the conclusion the same person is behind three other accounts, that as of Wednesday had cumulatively placed at least $25 million in bets for Trump or against Harris. Another user found that the four accounts rarely trade at the same time, and all are funded from crypto exchange Kraken in either $500,000 or $1 million deposits.

Domer says clues as to the whale’s identity comes from comments that Fredi9999, and another user called Michie, made on Polymarket.

“You can see the uncommon spacing around punctuation which strongly implies a French speaker. The French also use ellipses much more than other languages utilize them,” according to this analysis. “Fredi uses a mix of British and American English in their comments, sometimes using the ‘ou’ in a word like favourite and sometimes dropping it. They called math ‘maths’ which is the British version. All in all, AI thinks the writing/spelling/weird misspellings points to a Frenchman who has learned British English and spent time in America.” And then, in an apparent exchange over Discord, the user confirmed that he or she was French.

That this trader is French, or not, doesn’t really matter; this person’s outsized betting is the issue. This $25 million or so outlay in the comparatively tiny political betting market seems to be moving around stock, bond and currency markets that are orders of magnitude larger. Some $514 billion exchanged hands in the U.S. stock market on Wednesday.

The other question is whether betting markets should be given greater weight than polls. It’s true that, for instance, Trump was noticeably given less credit in polls in 2016 than he should have, and also performed better (though he lost) in 2020 than polls suggested. On the other hand, in the midterm elections in 2022 Democrats outperformed the betting market anticipation of a red wave. Domer, who says he has followed political betting markets since 2007, also points out that whales have backed losing Republican presidential candidates in both 2008 and in 2012.

The markets

U.S. stock index futures ES00 NQ00 were mostly stronger early Thursday, given a lift by Taiwan Semiconductor’s results. Gold GC00 surpassed but then fell back below $2,700 an ounce. The yield on the 10-year Treasury BX:TMUBMUSD10Y moved higher after the economic data.

|

Key asset performance |

Last |

5d |

1m |

YTD |

1y |

|

S&P 500 |

5842.47 |

0.87% |

3.99% |

22.49% |

35.41% |

|

Nasdaq Composite |

18,367.08 |

0.41% |

4.52% |

22.35% |

37.95% |

|

10-year Treasury |

4.039 |

-2.60 |

32.40 |

15.81 |

-95.08 |

|

Gold |

2699 |

1.95% |

3.34% |

30.27% |

35.85% |

|

Oil |

70.67 |

-6.51% |

-0.63% |

-0.93% |

-20.74% |

|

Data: MarketWatch. Treasury yields change expressed in basis points |

|||||

The buzz

A flurry of economic data saw a better-than-forecast rise in U.S. retail sales in September, of 0.4%, as initial jobless claims fell by 19,000 to 241,000.

Taiwan Semiconductor Manufacturing Co. TSM — the contract chip manufacturer for clients including Nvidia — reduced some of the fears around the semiconductor market after forecasting fourth-quarter sales between $26.1 billion and $26.9 billion, well above the $24.9 billion forecast in a FactSet-compiled analyst poll. Its CEO said the AI revolution is for real.

Lucid Group stock LCID tumbled as the EV maker forecast heavy losses and planned to sell more stock.

After the close, Netflix NFLX reports results. Read preview of Netflix results.

Expedia stock EXPE climbed on a report that Uber Technologies UBER may bid for the company.

Best of the web

Fannie Mae CEO says she has never seen a housing market like this before.

Meta fires staff for abusing $25 meal credits.

Tulsa has benefited from an experiment paying remote workers $10,000 to move there.

The chart

The ECB decides on Thursday, will likely join the net proportion of central banks whose latest move is an interest rate cut. “This move is pre-emptive in the sense that the authorities want to get ahead of a recession threat that hasn’t yet materialized. Pre-emptive easing is typically bullish for risk assets,” says TS Lombard strategist Dario Perkins. Perkins says the path ahead is full of pitfalls and the destination — a neutral level — is fuzzy. Labor markets will be key as to how this new easing cycle plays out, he adds.

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

|

Ticker |

Security name |

|

NVDA |

Nvidia |

|

TSM |

Taiwan Semiconductor Manufacturing |

|

TSLA |

Tesla |

|

GME |

GameStop |

|

DJT |

Trump Media & Technology |

|

NIO |

Nio |

|

AMD |

Advanced Micro Devices |

|

GEVO |

Gevo |

|

AAPL |

Apple |

|

ASML |

ASML Holding |

Random reads

A rare copy of the U.S. Constitution is expected to sell for millions.

Police in a Cleveland suburb were called upon to attend to a giant, runaway pumpkin.

An office worker wins compensation after a boss refused to say hello to her three times.

Need to Know starts early and is updated until the opening bell, but to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Check out On Watch by MarketWatch, a weekly podcast about the financial news we’re all watching – and how that’s affecting the economy and your wallet. MarketWatch’s Jeremy Owens trains his eye on what’s driving markets and offers insights that will help you make more informed money decisions. Subscribe on Spotify and Apple.

Most Read from MarketWatch

This Sam Altman Startup Has Exploded 125% This Month As Nuclear Stocks Heat Up

Oklo (OKLO) — the nuclear power startup backed by OpenAI head Sam Altman — has surged more than 125% in October as major hyperscalers have decided to double down on the nuclear renaissance to fuel data centers and artificial intelligence.

Nuclear energy-related plays, including Oklo, have been on a tear since late September when Microsoft (MSFT) announced a two-decade contract with S&P 500 component Constellation Energy (CEG) to provide nuclear power for the tech giant’s data centers.

Now, Amazon.com (AMZN) and Alphabet (GOOGL) have also inked nuclear deals, sending nuclear-related stocks higher. However, many of the stocks are extended.

↑

X

Why Minervini Calls Volatility This Market’s ‘Comet In The Sky’ Moment

Both Amazon and Google announced in recent days decisions to invest in developing the emerging small modular reactors, or SMRs, technology. SMRs do not currently exist but there are a number of companies working to develop the technology. In March, Amazon made an early move toward nuclear, paying $650 million for a Talen Energy (TLNE) nuclear-powered data center campus in Pennsylvania.

Top hyperscalers — the largest cloud, data center and AI operators, which include Amazon, Microsoft, Alphabet and Meta (META) — are increasingly looking to nuclear power as a solution to vaulting energy consumption from data centers.

AI And Nuclear Energy

So far in 2024, nuclear power and utility stocks have been riding the artificial intelligence energy wave.

Artificial intelligence — and the data centers needed to train the systems — are expected to boost energy demand throughout this decade. In the U.S., McKinsey & Co. projects that data center energy demand will grow from around 4% currently, as percentage of total energy demand, to 11%-12% by 2030.

Bitcoin Miners Forge Lucrative AI Deals. They Have A Big Advantage.

Many technology companies are investing in or partnering with nuclear power providers to ensure energy supplies for their data centers.

Morgan Stanley analysts have proclaimed in recent months that a “nuclear renaissance” is underway.

They wrote that nuclear power, while still a divisive issue, is making a comeback. The firm sees $1.5 trillion in investment in new capacity through 2050.

Meanwhile, Morgan Stanley analyst David Arcaro wrote that the Constellation-Microsoft deal “proves out the value of nuclear power for hyperscalers, with higher prices for future deals.”

Stocks Rally

S&P 500 leader Vistra (VST), a nuclear power utilities play, jumped 3% to 131.16 Friday during market trade. Fellow S&P 500 component Constellation Energy edged down 0.4% Friday.

Vistra and Constellation Energy have surged 40% and 30%, respectively, since The Microsoft-Constellation Energy deal on Sept. 20.

JPMorgan on Thursday initiated coverage of S&P 500 components Constellation Energy and Vistra Energy. The firm handed both VST and CEG an overweight rating.

JPMorgan has a 342 price target on Constellation Energy and a 178 price target on Vistra. This represents further 22% upside to CEG and 31% upside for VST compared to current trading levels.

Meanwhile, Oklo ballooned 15.9% to 18.23 on Friday after declining 5% Thursday. Oklo stock surged 40.5% on Wednesday and clearing an early entry Tuesday. The Altman-backed SMR developer, had soared 125% in October and around 190% since the Microsoft-Constellation Energy deal.

ARK Invest’s Cathie Wood has been building a position in Oklo worth more than $2 million since mid-July. Peter Thiel is also a major investor in Oklo.

Fellow SMR-focused company Nano Nuclear Energy (NNE) also gained 8.8% Friday. NNE shares leapt 37.8% on Wednesday. NuScale Power (SMR) jumped 1% Friday after retreating 5.6% Thursday. SMR shares soared 40% on Wednesday.

Uranium refiner Cameco (CCJ) gained 2.4% Friday. The stock jumped 7.8% to 55.77 during market trade on Wednesday, gapping above a 52.32 buy point. CCJ was Wednesday’s IBD Stock Of The Day.

Canada-based Cameco is one of the world’s largest providers of uranium with utilities around the globe relying on the company to provide nuclear fuel solutions.

Meanwhile, Uranium Energy (UEC), which engages in uranium exploration and development in the U.S. Southwest and Paraguay, advanced 1.3% Friday, adding to 4.7% gain from Thursday.

The company said Thursday it received approval from the Wyoming Department of Environmental Quality to increase uranium production capacity at a major processing plant.

Please follow Kit Norton on X @KitNorton for more coverage.

YOU MAY ALSO LIKE:

Is Tesla Stock A Buy Or A Sell?

Get Full Access To IBD Stock Lists And Ratings

Learning How To Pick Great Stocks? Read Investor’s Corner

AI Is Fueling A ‘Nuclear Renaissance.’ Bill Gates And Jeff Bezos Are In The Mix.

Bullish Trend Continues; Two Warren Buffett Stocks In Buy Zones

Yogesh Gupta At Progress Software Decides to Exercises Options Worth $1.08M

Disclosed in a recent SEC filing on October 17, Gupta, Chief Executive Officer at Progress Software PRGS, made a noteworthy transaction involving the exercise of company stock options.

What Happened: Gupta, Chief Executive Officer at Progress Software, made a strategic move by exercising stock options for 69,195 shares of PRGS as detailed in a Form 4 filing on Thursday with the U.S. Securities and Exchange Commission. The transaction value amounted to $1,082,209.

The Friday morning update indicates Progress Software shares down by 0.0%, currently priced at $66.33. At this value, Gupta’s 69,195 shares are worth $1,082,209.

Discovering Progress Software: A Closer Look

Progress Software Corporation is a provider of cloud-based security solutions to large-and mid-sized organizations in a wide range of industries. Its product includes OpenEdge; Chef; Developer Tools; Kemp LoadMaster; MOVEit; DataDirect; WhatsUp Gold; Sitefinity; Flowmon and Corticon. The company derives revenue from perpetual licenses to its products, but some products also use term licensing models. Its cloud-based offerings use a subscription-based model. A majority of the firm’s revenue is generated in the United States and it also has presence in Canada, the Middle East, and Africa (EMEA), Latin America, and Asia Pacific.

A Deep Dive into Progress Software’s Financials

Revenue Growth: Progress Software displayed positive results in 3 months. As of 31 August, 2024, the company achieved a solid revenue growth rate of approximately 2.11%. This indicates a notable increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Evaluating Earnings Performance:

-

Gross Margin: With a high gross margin of 83.73%, the company demonstrates effective cost control and strong profitability relative to its peers.

-

Earnings per Share (EPS): Progress Software’s EPS is below the industry average. The company faced challenges with a current EPS of 0.66. This suggests a potential decline in earnings.

Debt Management: Progress Software’s debt-to-equity ratio is below the industry average at 1.91, reflecting a lower dependency on debt financing and a more conservative financial approach.

Navigating Market Valuation:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 35.66 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: The P/S ratio of 4.11 is lower than the industry average, implying a discounted valuation for Progress Software’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Progress Software’s EV/EBITDA ratio at 15.02 suggests potential undervaluation, falling below industry averages.

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Exploring the Significance of Insider Trading

Insider transactions serve as a piece of the puzzle in investment decisions, rather than the entire picture.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Breaking Down the Significance of Transaction Codes

Digging into the details of stock transactions, investors frequently turn their attention to those taking place in the open market, as outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Progress Software’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Texas natural-gas pipeline eases bottlenecks, paves way for higher shale output

By Georgina McCartney

MIDLAND, Texas (Reuters) – A new pipeline carrying shale natural gas from west Texas toward export hubs on the U.S. Gulf Coast has eased constraints that crashed local prices this year, and will help pave the way for higher U.S. oil production, energy executives said.

Pipeline companies largely quit adding new capacity following the pandemic, when shale production dried up and pipeline utilization plummeted. The 580-mile (933-km) Matterhorn Express pipeline is the first new natural-gas pipeline built in the Permian basin in three years.

Matterhorn began operations last month, relieving bottlenecks that had forced producers at times to pay other parties to receive their gas, or to seek state permits to burn the gas.

The line, a joint venture between WhiteWater Midstream, EnLink Midstream, Devon Energy and MPLX, can carry up to 2.5 billion cubic feet of gas per day, adding 14% in new regional capacity as it ramps up this year.

The Permian basin, which straddles Texas and New Mexico, accounts for half of U.S. crude output and is the second-largest shale-gas producing region.

“Matterhorn has freed up space, and the price we are getting for gas now has been positive for almost a month,” said Mike Oestmann, CEO of Midland producer Tall City Exploration. “We produced a lot of gas that we not only didn’t get paid for, we paid for it to be taken away,” he added.

Gas prices at the Waha hub in west Texas have been broadly pricing above zero since mid-September, after Matterhorn started operating. Last week, Waha prices reached their highest level since mid-June, at $2.35 per million British thermal units.

For oil and gas producers, the pipeline is helping drive up profits with gas fetching higher prices, allowing them to increase crude production growth with less gas flaring, analysts said. Natural gas is a byproduct of oil production.

“If you cannot move the gas out and you have to increase flaring levels or bring in other mitigating measures, then that just really puts a ceiling on how much oil you can produce,” said Jason Feit, advisor at consultancy Enverus.

Matterhorn will help unlock higher Permian oil output, said David Seduski, head of North American gas analysis at consultancy Energy Aspects. It estimates Matterhorn carried 0.6 bcf/d last week.

Most of the Permian’s estimated 2025 oil-production growth would be unfeasible without more gas pipeline capacity, said Seduski, who forecasts an additional 350,000 barrels per day next year.

A fifth of Permian oil producers polled in September reported plans to increase well completions once the pipeline bottleneck is cleared, according to the Federal Reserve Bank of Dallas’ quarterly energy survey.

Permian crude-oil production is forecast to rise by 6.1% to 6.27 million bpd this year, and hit 6.5 million bpd next year, according to the Energy Information Administration, due in part to improved drilling efficiency.

SHORT-TERM RELIEF

Matterhorn will likely be filled next year, resulting again in pipeline constraints, market participants said.

Permian gas production is set to swell to 24.5 bcf/d for 2024, from 22.7 bcf/d in 2023, according to the EIA. It is projected to reach 25.8 bcf/d in 2025.

“Matterhorn only gives you so long, maybe 12 to 18 months, and then you need another pipe,” Jim Simpson, CEO of advisory firm East Daley, said in an interview.

The Blackcomb gas pipeline, which reached final investment decision in July, will move another 2.5 bcf/d of natural gas from the Permian to south Texas. It will start up in the second half of 2026.

The period between Matterhorn filling and Blackcomb starting operations may depress Waha gas prices as producers face more bottlenecks, said Jay Stevens, director of market analytics at Aegis Hedging.

(Reporting by Georgina McCartney in Midland, Texas; Editing by Rod Nickel)

3 No-Brainer Pharmaceutical Stocks to Buy With $500 Right Now

Pharmaceutical stocks make fantastic long-term investments because they can excel in any market environment. Regardless of the economic situation, patients need their medicines and will continue to buy them, resulting in a certain steadiness in revenue and growth for pharma companies.

What’s a no-brainer pharma stock? It’s one that you can hold onto for the long term due to its solid portfolio of products and strong pipeline. This sort of company would have proven its strength by delivering earnings growth over time, and innovation may extend this strength well into the future.

Pharma companies also are known for paying dividends, offering you a guaranteed stream of annual revenue. Below are three no-brainer pharma stocks to buy now if you have $500 to invest.

1. Abbott Laboratories

Abbott Laboratories (NYSE: ABT) makes pharmaceuticals, but the company also has three other winning businesses: medical devices, diagnostics, and nutrition. This diversification is Abbott’s strength; if one business reaches a stumbling block, others can compensate. For example, today, a drop in coronavirus testing sales is weighing on the diagnostics business, but medical devices saw double-digit revenue growth in the recent quarter.

Abbott continues to grow, thanks to a steady flow of new product approvals, and has proven its ability to deliver returns to investors over time. The company is the most profitable healthcare stock ever for investors, according to a report by Hendrik Bessembinder at Arizona State University. Abbott stock delivered a cumulative compound return of 7,803,730% between 1937 and December of last year, the professor’s report showed.

Investors in this healthcare company also benefit from its commitment to dividend growth. Abbott is a Dividend King, meaning it’s raised the dividend payment annually for more than 50 consecutive years. This shows rewarding shareholders is a priority, suggesting the company will continue along this path.

On top of this, Abbott recently authorized a new repurchase program of up to $7 billion in stock — another effort to reward shareholders and demonstrate confidence in the company’s future.

2. Pfizer

Pfizer (NYSE: PFE) stock hasn’t made much of a move this year and has slipped nearly 30% over the past three years. The stock is trading today at a dirt cheap valuation of 11x forward earnings estimates, so now is a good time to get in on the stock.

The company has traversed tough times, posting a steep drop in coronavirus vaccine and treatment sales, but a whole new batch of new products, current blockbusters, and a big investment in the oncology business should significantly add to growth in the coming years. Pfizer predicts that new products outside of the coronavirus business should contribute $20 billion to 2030 revenue.

The acquisition of oncology specialist Seagen already has started to bear fruit, too. “Seagen products are contributing meaningfully to our revenue,” Chief Executive Officer Albert Bourla said in the latest earnings call. And the company is working toward a goal of launching at least eight blockbuster oncology medicines by 2030.

Though Pfizer isn’t a Dividend King, the company pays a dividend of $1.68 per share at a high yield of 5.6% and has committed to growing its dividend over time.

3. Johnson & Johnson

Johnson & Johnson (NYSE: JNJ) spun out its consumer health business last year into a separate entity — Kenvue — to focus on the higher-growth businesses of pharmaceuticals and medtech, and this move is proving to be a winner. The company reported operational sales growth of 6.3% for its innovative-medicines branch and 6.4% growth for medtech in the most recent quarter.

This marked the second-straight quarter of innovative-medicine sales surpassing $14 billion — and 11 of the company’s major brands soared in the double digits. In other impressive news, immunotherapy Darzalex became the first product in J&J’s portfolio to deliver $3 billion in sales in a single quarter. And recent approvals of Tremfya in ulcerative colitis and Rybrevant plus Lazcluze in non-small cell lung cancer should add to growth ahead.

As for medtech, recent acquisitions and divestitures positively impacted growth by nearly 3% in the quarter. Thanks to J&J’s purchases of Shockwave and Abiomed, the company has become a leader in four of the biggest and fastest-growing cardiovascular-intervention markets.

J&J’s solid financial situation — with $19 billion in free cash flow — should help it maintain its position as a Dividend King well into the future. It’s a fantastic buy for passive income, as well as long-term earnings growth.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,049!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,847!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $378,583!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Abbott Laboratories, Kenvue, and Pfizer. The Motley Fool recommends Johnson & Johnson and recommends the following options: long January 2026 $13 calls on Kenvue. The Motley Fool has a disclosure policy.

3 No-Brainer Pharmaceutical Stocks to Buy With $500 Right Now was originally published by The Motley Fool

How Does Cannabis Legalization Affect Organized Crime? New Research Sheds Light

The five years after Canada legalized recreational cannabis have produced enough data for researchers to look at important questions like how organized crime is affected by legalization, or not.

A recent study, published in Sociological Inquiry, explores how the shift to a legal market has reshaped criminal enterprises once heavily involved in the illicit cannabis trade.

Key Findings On Organized Crime & Cannabis

The research, conducted by scientists Martin Bouchard, Naomi Zakimi -of Simon Fraser University-, and Benoît Gomis -of the University of Toronto– shows that the legal cannabis market now dominates in Canada, accounting for over 71% of household expenditures on cannabis as of 2023. However, nearly 29% of the market still belongs to unlicensed sellers.

Some of the study’s most notable findings include:

- A Shrinking Illicit Market: Legal cannabis sales have steadily increased since legalization, gradually cutting into the black market.

- Organized Crime’s Resilience: Criminal organizations are adapting, either by diverting legal cannabis into the unlicensed market or shifting their operations to illegal drugs.

- Consumer Challenges: High prices, inconsistent quality, and limited accessibility in the legal market continue to drive some consumers toward cheaper, unlicensed alternatives.

- Cross-Border Smuggling: Despite legalization, some unlicensed products are smuggled out of Canada into markets abroad, particularly in the U.S.

- Shifting Criminal Focus: With cannabis becoming less profitable, many criminal groups are focusing on more dangerous drugs like opioids.

Read Also: Legal Weed = Less Crime: FBI Data Shows Surprising Benefits Of Cannabis Legalization

Methods And Indicators

To draw these conclusions, the researchers conducted a comprehensive review of more than 5,000 sources, including academic papers, media reports and government publications.

The key indicators used to assess the impact of cannabis legalization on organized crime include several metrics, such as price comparison between legal and illicit cannabis markets, supply-demand balance and cash circulation.

Lower legal cannabis prices tend to pull consumers away from illegal sources, so price monitoring is crucial. Cannabis demand estimates and legal supply are also analyzed to measure how well the legal market meets consumption needs, which could reduce reliance on the illicit market. Other indicators include tracking illicit cannabis seizures by law enforcement, examining criminal justice data for organized crime ties and analyzing cash circulation as an indicator of illegal market transactions.

These methods, along with interviews and internal documents, provide a more nuanced understanding of how organized crime has responded to legalization.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Recommendations For Policy Makers

One key finding is that the link between unlicensed and licensed cannabis is persistent and complex.

“Policies and law enforcement interventions aiming to address the illicit cannabis trade in Canada may indeed have consequences on legal cannabis production, sales, and consumption as well. The legal market may need to compete by learning from the consumer preferences established in the illegal market.”

Thus there’s a need for a comprehensive approach.

“Regulators and politicians would do well to measure expectations: the illegal activities along cannabis supply chains will persist and eliminating them altogether is an unrealistic goal,” the researchers add.

Cover: Courtesy of the California Department of Cannabis Control.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

George Carrara Takes Money Off The Table, Sells $90K In Build-A-Bear Workshop Stock

Revealing a significant insider sell on October 17, George Carrara, Board Member at Build-A-Bear Workshop BBW, as per the latest SEC filing.

What Happened: Carrara opted to sell 2,500 shares of Build-A-Bear Workshop, according to a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The transaction’s total worth stands at $90,675.

Monitoring the market, Build-A-Bear Workshop‘s shares down by 0.0% at $37.76 during Friday’s morning.

About Build-A-Bear Workshop

Build-A-Bear Workshop Inc is a U.S.-based specialty retailer of customized stuffed animals and related products. The company operates through three segments. Its Direct-to-consumer segment with key revenue, includes the operating activities of corporately-managed locations and other retail delivery operations in the U.S., Canada, China, Denmark, Ireland, and the U.K., including the company’s e-commerce sites and temporary stores. The international franchising segment includes the licensing activities of the company’s franchise agreements with store locations in Europe, Asia, Australia, the Middle East, and Africa. The commercial segment includes the transactions with other businesses, mainly comprised of licensing the intellectual properties for third-party use and wholesale activities.

Build-A-Bear Workshop’s Economic Impact: An Analysis

Revenue Growth: Build-A-Bear Workshop’s revenue growth over a period of 3 months has been noteworthy. As of 31 July, 2024, the company achieved a revenue growth rate of approximately 2.36%. This indicates a substantial increase in the company’s top-line earnings. When compared to others in the Consumer Discretionary sector, the company excelled with a growth rate higher than the average among peers.

Evaluating Earnings Performance:

-

Gross Margin: The company maintains a high gross margin of 54.18%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Build-A-Bear Workshop’s EPS is below the industry average. The company faced challenges with a current EPS of 0.64. This suggests a potential decline in earnings.

Debt Management: With a below-average debt-to-equity ratio of 0.81, Build-A-Bear Workshop adopts a prudent financial strategy, indicating a balanced approach to debt management.

Assessing Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 10.67 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 1.1 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio of 7.69 trails industry averages, indicating a potential disparity in market valuation that could be advantageous for investors.

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Understanding the Significance of Insider Transactions

Insider transactions contribute to decision-making but should be supplemented by a comprehensive investment analysis.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Breaking Down the Significance of Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Build-A-Bear Workshop’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

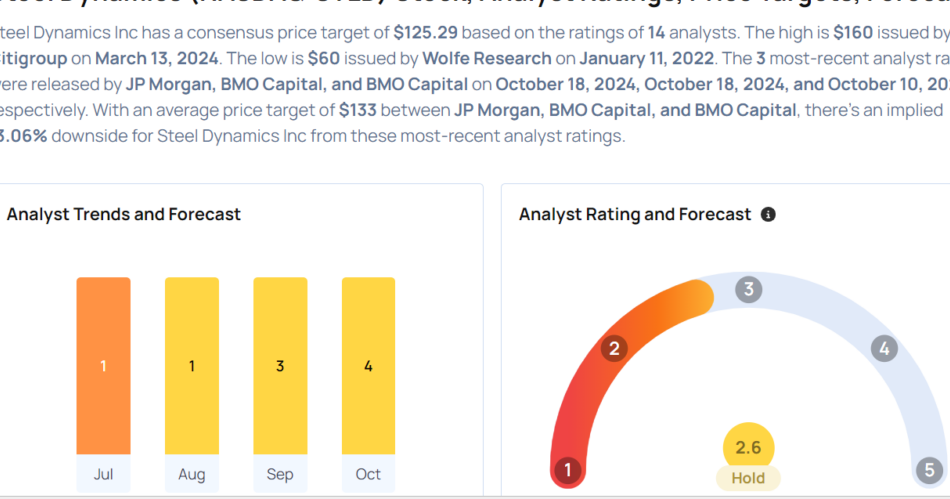

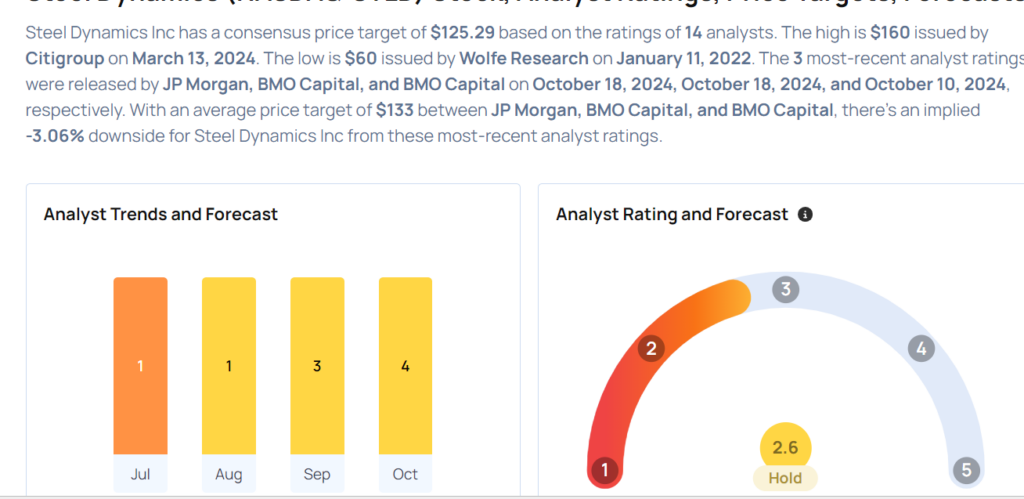

Steel Dynamics Analysts Increase Their Forecasts After Better-Than-Expected Earnings

Steel Dynamics Inc STLD posted better-than-expected third-quarter earnings, after the closing bell on Wednesday.

Steel Dynamics posted quarterly GAAP earnings of $2.05 per share, beating market estimates of $1.97 per share. The company’s quarterly sales came in at $4.34 billion versus expectations of $4.177 billion.

“The teams achieved a solid third quarter 2024 performance across the platforms, with adjusted EBITDA of $557 million and cash flow from operations of $760 million,” said Mark D. Millett, Co-Founder, Chairman, and Chief Executive Officer. “With our proven through-cycle cash generation, we increased liquidity to $3.1 billion, while also investing $621 million in our internal ongoing growth initiatives and distributing $381 million to our shareholders through cash dividends and share repurchases. Our three-year after-tax return-on-invested capital of 26 percent is a testament to our ongoing high-return capital allocation execution.

Steel Dynamics shares gained 1.2% to trade at $136.70 on Friday.

These analysts made changes to their price targets on Steel Dynamics following earnings announcement.

- BMO Capital analyst Katja Jancic maintained Steel Dynamics with a Market Perform and raised the price target from $130 to $135.

- JP Morgan analyst Bill Peterson maintained Steel Dynamics with a Neutral and raised the price target from $129 to $134.

Considering buying STLD stock? Here’s what analysts think:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.