3 Mid-Cap Stocks Under $20 With Insider Buying and Major Upside

The financial news frequently emphasizes stocks with heavy insider selling, premised on the assumption that insiders believe the stock is overpriced and that they are taking profits ahead of retail investors. However, most of the time, these sales are part of a previously disclosed plan and disclosed to the SEC months in advance.

This proves the saying that investors have many reasons to sell a stock, but the same is not necessarily true of insider buying. Typically, insiders have only one reason to buy a stock. That is, they believe it’s fundamentally undervalued.

When you combine an undervalued stock with a price below $20, you have a chance for impressive gains. That’s the case with the three stocks on this list. Plus, you can factor in the idea that these are mid-cap stocks that offer more potential for growth than more mature large-cap stocks but remove the risk that can be found in unprofitable small-cap stocks.

Transocean Is Well-Positioned for a Potential Oil Supercycle

Transocean Ltd. RIG leases rigs and drilling equipment for oil companies. The company’s lease rate directly correlates to the price of oil at the time the contracts are originated. RIG stock is trading at $4.26 as of October 11, 2024.

However, even with a consensus Hold rating, analysts are forecasting a price of $6.88, which offers a 61% upside.

An insider has bought shares on two separate occasions since its second-quarter earnings report in July. The transactions amounted to $3.5 million shares of RIG stock.

But why should you believe the insiders? First, the macroeconomic picture is favorable. The Federal Reserve started its interest rate cutting cycle with an aggressive 50-basis point cut in September. Energy stocks are expected to benefit as lower rates tend to stimulate business activity which is generally bullish for oil.

Second, the company signed two high-value contracts which will have over 90% of its fleet committed through 2025. And the company is well-positioned for more contracts if offshore drilling projects become less regulated in 2025.

Crescent Energy Nears 52-Week High and New Highs Could Be Ahead

Another mid-cap stock in the energy sector is Crescent Energy Co. CRGY. The company has a different way of playing the energy sector because its business model focuses on acquiring resources rather than developing them. Its portfolio is heavily concentrated in the Eagle Ford and Uinta Basins.

Since the company’s second-quarter earnings report in August, different executives and insiders have purchased CRGY stock on four separate occasions.

The purchases seem well timed, as the stock was up 31% in the month ending October 11 and is nearing its 52-week high. The short-term catalyst for the stock is its inclusion in the S&P SmallCap 600 index, which usually brings with it a flurry of buying from institutional investors whose funds use the index as a benchmark.

That said, the longer-term catalyst for CRGY stock is similar to that of other oil companies: a resurgence in oil prices due to increased drilling activity in 2025 and beyond. Analysts give the stock a $16.20 price target, which offers investors a 20% upside.

Forget the Robo Taxi; Mobileye May Be a Better Short-Term Buy

When combing through the list of stocks with heavy insider buying on MarketBeat, Mobileye Global Inc. MBLY instantly caught my eye. The company, which is partially owned by Intel Corp. INTC, is a leader in autonomous driving technology.

The company’s EyeQ chips power Mobileye’s flagship SuperVision platform, consisting of 11 cameras and autonomous vehicle maps that grow smarter over time.

MBLY stock went public in October 2022. The meme stock movement was over at that point, but for about a year, Mobileye delivered an impressive return for investors. It’s been a long fall from that point. In fact, the stock is down over 72% in 2024. The Mobileye analyst forecasts on MarketBeat show the stock with three uncomfortable sell ratings.

Still, the stock has a consensus Hold and a $26.85 price target, which provides an upside of over 107%. Autonomous driving may still be years away (the Robo Taxi isn’t set for production until 2027), but no matter who wins the White House, the move towards non-carbon transportation is not slowing down.

The article “3 Mid-Cap Stocks Under $20 With Insider Buying and Major Upside” first appeared on MarketBeat.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

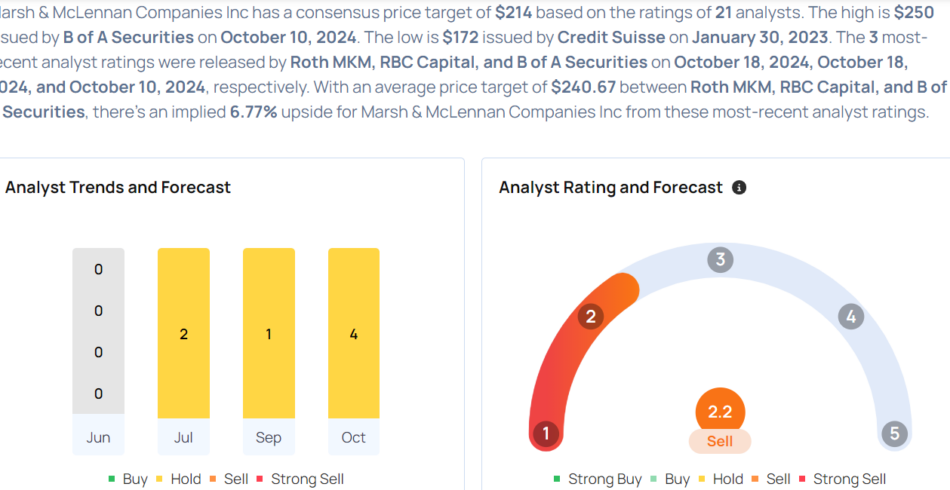

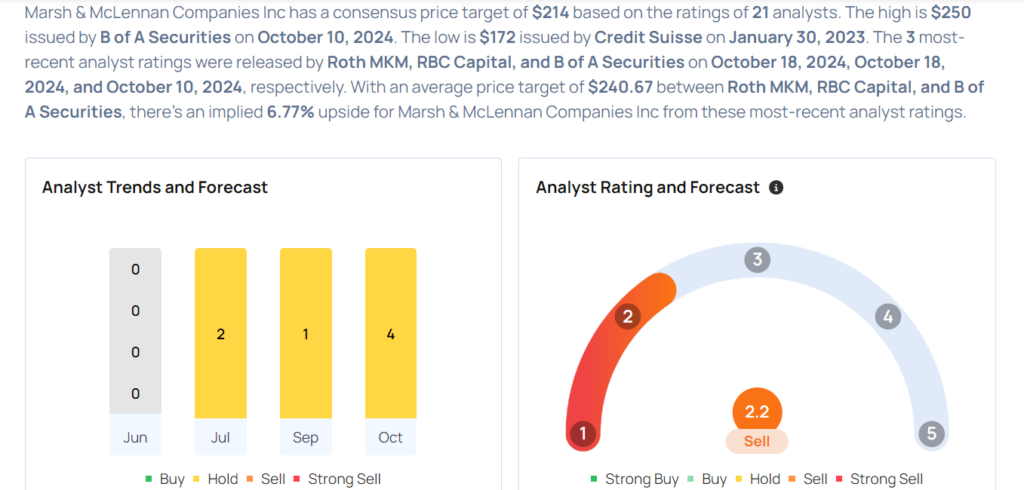

These Analysts Boost Their Forecasts On Marsh & McLennan Following Upbeat Earnings

Marsh & McLennan MMC reported better-than-expected third-quarter earnings on Thursday.

Marsh & McLennan reported quarterly earnings of $1.63 per share which beat the analyst consensus estimate of $1.57 per share. The company reported quarterly sales of $5.70 billion which met the analyst consensus estimate.

John Doyle, President and CEO, said: “This was a milestone quarter for Marsh McLennan as we delivered strong results and announced the acquisition of McGriff Insurance Services. Our performance demonstrated continued momentum, with 5% underlying revenue growth, 110 basis points of margin expansion and adjusted EPS growth of 4%, or 11% excluding a one-time tax benefit a year ago. We remain on track for another great year in 2024.”

M&T Bank shares fell 0.4% to trade at $198.04 on Friday.

These analysts made changes to their price targets on M&T Bank following earnings announcement.

- RBC Capital analyst Scott Heleniak maintained Marsh & McLennan with a Sector Perform and raised the price target from $232 to $242.

- Roth MKM analyst Harry Fong maintained Marsh & McLennan with a Neutral and raised the price target from $220 to $230.

Considering buying MMC stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

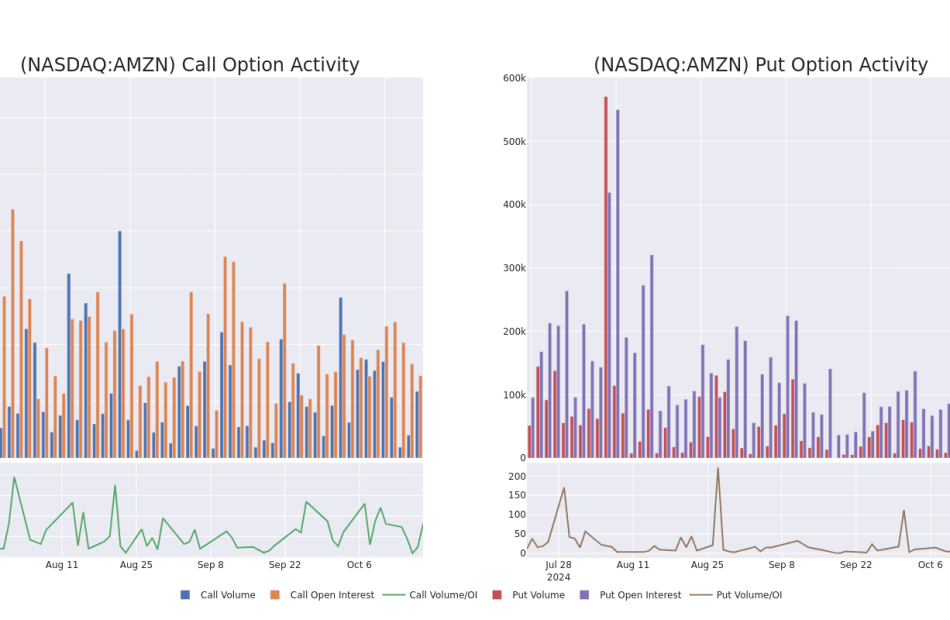

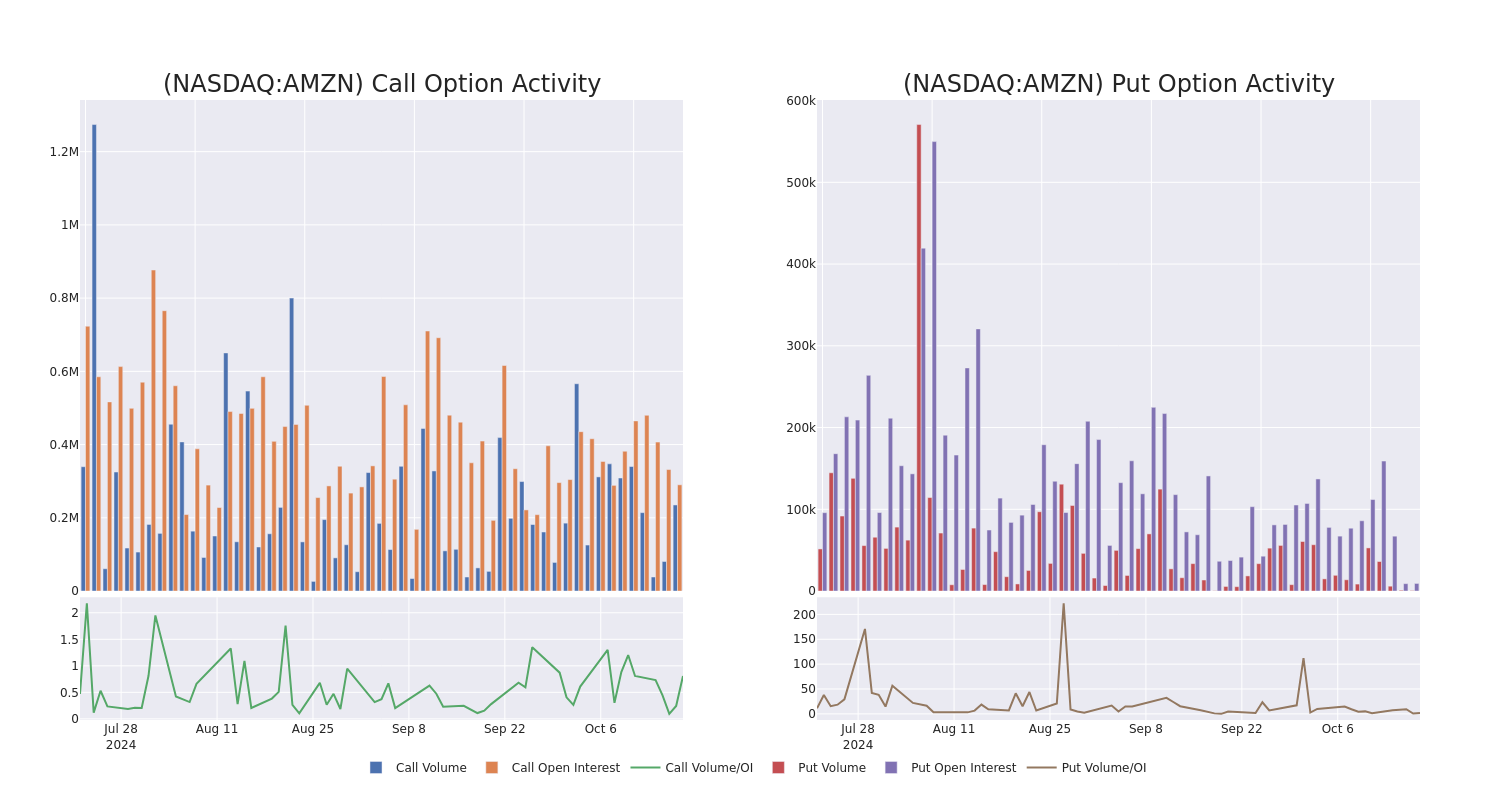

Amazon.com Unusual Options Activity

Deep-pocketed investors have adopted a bullish approach towards Amazon.com AMZN, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in AMZN usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 48 extraordinary options activities for Amazon.com. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 58% leaning bullish and 29% bearish. Among these notable options, 5 are puts, totaling $235,930, and 43 are calls, amounting to $3,342,988.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $50.0 to $225.0 for Amazon.com over the last 3 months.

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Amazon.com’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Amazon.com’s whale trades within a strike price range from $50.0 to $225.0 in the last 30 days.

Amazon.com Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMZN | CALL | SWEEP | BULLISH | 03/21/25 | $6.0 | $5.9 | $6.0 | $220.00 | $385.7K | 4.5K | 3.8K |

| AMZN | CALL | SWEEP | BULLISH | 03/21/25 | $5.9 | $5.8 | $5.9 | $220.00 | $361.6K | 4.5K | 1.8K |

| AMZN | CALL | SWEEP | BULLISH | 03/21/25 | $6.0 | $5.9 | $6.0 | $220.00 | $356.5K | 4.5K | 2.7K |

| AMZN | CALL | SWEEP | BULLISH | 03/21/25 | $5.95 | $5.9 | $5.95 | $220.00 | $286.1K | 4.5K | 4.6K |

| AMZN | CALL | SWEEP | BULLISH | 04/17/25 | $5.4 | $5.3 | $5.4 | $225.00 | $135.0K | 987 | 1.7K |

About Amazon.com

Amazon is the leading online retailer and marketplace for third party sellers. Retail related revenue represents approximately 75% of total, followed by Amazon Web Services’ cloud computing, storage, database, and other offerings (15%), advertising services (5% to 10%), and other the remainder. International segments constitute 25% to 30% of Amazon’s non-AWS sales, led by Germany, the United Kingdom, and Japan.

In light of the recent options history for Amazon.com, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Amazon.com Standing Right Now?

- Trading volume stands at 18,285,398, with AMZN’s price up by 1.65%, positioned at $190.62.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 13 days.

What Analysts Are Saying About Amazon.com

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $248.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Truist Securities has decided to maintain their Buy rating on Amazon.com, which currently sits at a price target of $265.

* An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $230.

* An analyst from JMP Securities downgraded its action to Market Outperform with a price target of $265.

* An analyst from Evercore ISI Group downgraded its action to Outperform with a price target of $240.

* Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Amazon.com with a target price of $240.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Amazon.com, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Meet the Unstoppable Growth Stock That Could Join Apple, Nvidia, and Microsoft in the $3 Trillion Club by 2028.

It was a mere 20 years ago that industrial and energy titans General Electric and ExxonMobil were the world’s most valuable companies when measured by market cap, with values of $319 billion and $283 billion, respectively. Now, just two decades later, technology interests lead the field.

Heading up the list are some of the world’s most familiar technology names. Apple tops the charts at $3.5 trillion (as of this writing). Nvidia and Microsoft are trailing close behind, with market caps of $3.2 trillion and $3.1 trillion, respectively.

With a market cap of just $2 trillion, it might seem a bit early to suggest that Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) has the makings for membership in the $3 trillion club. However, the stock has gained 88% since early last year and 172% over the past five years, and there’s every reason to believe its ascent will continue.

A combination of an improving economy, Alphabet’s market strength, and gains in the field of artificial intelligence (AI) could provide the boost the company needs to join this exclusive society.

Improving performance

The widespread challenges of the past few years have been glaringly obvious, marked by macroeconomic headwinds and the worst inflation rates since the early 1980s. These conditions weighed heavily on each of Alphabet’s major business segments and the stock plunged as much as 44% in response.

However, there’s been a marked improvement in recent months. In September, the Federal Reserve Bank cut interest rates for the first time since March 2020, and consumer confidence jumped to its highest level in months.

The economic rebound has had a dramatic effect on Alphabet’s results. In the second quarter, revenue of $84.7 billion climbed 14% year over year, while diluted earnings per share (EPS) of $1.89 jumped 31%.

Each of the company’s major operating segments did their part to boost the results. The rebound in advertising, which has suffered the most in recent years, had the most profound impact. Google advertising, which provides the bulk of Alphabet’s revenue, climbed 11% year over year, while Google Cloud — the company’s fastest-growing segment — jumped 29%.

An industry leader — in more ways than one

Google has long been the undisputed leader in search, recently capturing 90% of the search market, according to internet statistics aggregator StatCounter. The company has worked to consistently improve its search acumen and the underlying algorithms, becoming something of an AI subject matter expert along the way.

It’s also the undisputed leader in digital advertising, fueled primarily by Google Search and YouTube but also by its suite of products that count billions of users each. In 2023, Google captured an estimated 39% of worldwide digital advertising revenue, according to data compiled by Statista. For context, its closest competitor — Meta Platforms — garnered just 18%. This dominance is expected to continue.

Alphabet is also a strong contender in the realm of cloud computing. Google Cloud is part of the “Big Three” as the third-largest provider of cloud infrastructure services. The company controlled roughly 10% of the market in the second quarter, according to data supplied by Canalys. It was also the fastest-growing, with year-over-year revenue growth of 30%.

Helping fuel demand for Google Cloud is the company’s generative AI offerings. Alphabet has been using AI for years to inform its search results, and the company has refocused that expertise to fuel a suite of AI-powered models led by Gemini, one of the leading foundational AI models in the world. This is attracting new users to Google Cloud.

Uncertainty weighs on the stock

I’d be remiss if I didn’t address the elephant in the room. The antitrust case against Alphabet is one step closer to completion. The court found that Google had violated antitrust law, and the U.S. Justice Department is mulling recommendations regarding the appropriate remedies, though the judge will have the final say. One of the potential outcomes is a breakup of the company, which is something that hasn’t happened in decades. There are other less severe proposals, like sharing Google’s search code with rivals, blocking other providers from paying Google to be its default search engine and more.

A final decision won’t be reached for at least a year, and if Alphabet appeals (it says it will), the case could go on for several more. Wall Street hates uncertainty, so this has been an overhang for Alphabet stock in recent months.

All that aside, even if Alphabet were to be broken up — and I don’t believe it will — that could unlock additional value, enriching shareholders along the way. So, the current concerns are merely noise, in my opinion.

The path to $3 trillion

Alphabet currently boasts a market cap of roughly $2 trillion, which means it will take stock price gains of about 47% to drive its value to $3 trillion. According to Wall Street, Alphabet is expected to generate revenue of $347.4 billion in 2024, giving it a forward price-to-sales (P/S) ratio of roughly 6. Assuming its P/S remains constant, Alphabet would have to grow its revenue to roughly $510 billion annually to support a $3 trillion market cap.

Wall Street is currently forecasting revenue growth for Alphabet of about 11% annually over the next five years. If the company achieves that benchmark, it could achieve a $3 trillion market cap as early as 2028. It’s worth noting that Alphabet has grown its annual revenue by 368% over the past decade, so Wall Street could be lowballing its forecast.

Furthermore, Alphabet is currently selling for roughly 24 times earnings, a significant discount compared to the multiple of 30 for the S&P 500. The aforementioned uncertainty is providing a very attractive entry point for savvy investors who plan to buy and hold for the long term.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $831,707!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Danny Vena has positions in Alphabet, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Meet the Unstoppable Growth Stock That Could Join Apple, Nvidia, and Microsoft in the $3 Trillion Club by 2028. was originally published by The Motley Fool

Pharmacy Retailer CVS Health Backs Away From Annual Forecast, Names New CEO

On Friday, CVS Health Inc (NYSE:CVS) appointed longtime executive David Joyner as its new president and CEO, replacing Karen Lynch amid the company’s ongoing financial struggles.

Joyner, previously president of CVS Caremark and an executive vice president at the company, steps into this leadership role as Roger Farah, CVS’s board chairman, assumes the executive chair position.

The company warned that its upcoming third-quarter earnings, set for release on November 6, will miss Wall Street projections.

The company revealed preliminary third-quarter 2024 adjusted EPS of $1.05-$1.10, compared to the consensus of $1.70. Analysts expect sales of $92.73 billion.

Results for the third quarter include charges to record premium deficiency reserves (PDRs), primarily related to the company’s Medicare and Individual Exchange businesses inside its Health Care Benefits segment, of approximately $1.1 billion, which lowered third quarter 2024 Adjusted EPS by $0.63.

In the third quarter of 2024, CVS continued to experience medical cost trends over those projected in its prior outlook.

The Medical Benefit Ratio for the third quarter is currently expected to be approximately 95.2%, which includes a 220-basis point impact from the PDRs.

The company added, ” In light of continued elevated medical cost pressures in the Health Care Benefits segment, investors should no longer rely on the company’s previous guidance.”

The pharmacy giant is also backing away from the fiscal year 2024 issued during the second-quarter earnings release.

The company reported second-quarter sales of $91.23 billion, missing the consensus of $91.51 billion. Adjusted EPS of $1.83 decreased from $2.21 in the prior year, beating the consensus of $1.73.

In Q2 earnings, CVS Health revised its 2024 adjusted EPS guidance to $6.40-$6.65 from at least $7.00 versus consensus of $6.98.

CVS Health forecasted 2024 sales of $369.0 billion—$372.0 billion versus a consensus of $368.876 billion at prior guidance of at least $369 billion.

The company expected a medical benefits ratio of 90.6% – 90.8% versus ~89.8% expected earlier.

The company is already struggling as the Federal Trade Commission (FTC) filed a formal complaint against three major pharmacy benefit managers (PBMs)—CVS Health’s Caremark, Cigna Corp’s (NYSE:CI) Express Scripts, and UnitedHealth Group Inc’s (NYSE:UNH) Optum—for allegedly engaging in unfair and anti-competitive practices that have inflated the list price of insulin medications.

As per an October report, CVS Health is also considering a major restructuring that could involve separating its retail and insurance businesses.

These talks with financial advisers explore how a potential breakup would work, although no final decisions have been made yet.

Price Action: At last check on Friday, CVS stock was down 12.30% at $55.87 during the premarket session.

Read Next:

Image via Shutterstock

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Pharmacy Retailer CVS Health Backs Away From Annual Forecast, Names New CEO originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

F.N.B. Corporation Reports Third Quarter 2024 Earnings

Deposit Growth of $1.8 billion, or 5%, Linked-Quarter and Tangible Book Value per Share (non-GAAP) Growth of 15% from the Year-Ago Quarter

PITTSBURGH, Oct. 17, 2024 /PRNewswire/ — F.N.B. Corporation FNB reported earnings for the third quarter of 2024 with net income available to common stockholders of $110.1 million, or $0.30 per diluted common share. Comparatively, third quarter of 2023 net income available to common stockholders totaled $143.3 million, or $0.40 per diluted common share, and second quarter of 2024 net income available to common stockholders totaled $123.0 million, or $0.34 per diluted common share.

On an operating basis, third quarter of 2024 earnings per diluted common share (non-GAAP) was $0.34, excluding $0.04 per share of significant items impacting earnings. By comparison, the third quarter of 2023 was $0.40 per diluted common share (non-GAAP) on an operating basis and the second quarter of 2024 was $0.34 per diluted common share (non-GAAP) on an operating basis, excluding less than $0.01 per share of significant items impacting earnings.

“FNB’s third quarter operating earnings per diluted common share (non-GAAP) totaled $0.34 with significant tangible book value per share (non-GAAP) growth of 15% year-over-year to a record $10.33, strong sequential annualized revenue growth of 9% with record non-interest income of $90 million, and a solid operating return on average tangible common equity (non-GAAP) of 14%,” said F.N.B. Corporation Chairman, President and Chief Executive Officer, Vincent J. Delie, Jr. “FNB’s robust linked-quarter deposit growth of $1.8 billion, or 5%, highlights our ability to leverage our significant client relationships, digital and data analytics capabilities as part of our Clicks to Bricks strategy and our diverse geographic footprint to manage the loan-to-deposit ratio which improved nearly 500 basis points from last quarter to 91.7%. FNB’s capital levels reached all-time highs with tangible common equity ratio (non-GAAP) at 8.2% and CET1 ratio at 10.4%. Our credit metrics ended the quarter at solid levels with the reserve coverage ratio up slightly given our proactive approach to credit risk management. FNB is well-positioned to continue execution of our proven strategies for ongoing success.”

Third Quarter 2024 Highlights

(All comparisons refer to the third quarter of 2023, except as noted)

- Period-end total loans and leases increased $1.6 billion, or 4.9%. Commercial loans and leases increased $1.0 billion, or 5.1%, and consumer loans increased $530.9 million, or 4.4%. FNB’s loan growth was driven by the continued success of our strategy to grow high-quality loans and deepen customer relationships across our diverse geographic footprint.

- On a linked-quarter basis, period-end total loans and leases decreased $39.6 million, or 0.1%, with an increase in commercial loans and leases of $92.6 million and a decrease in consumer loans of $132.2 million. In September 2024, FNB sold approximately $431 million of performing indirect auto loans as part of its balance sheet management repositioning actions. The related loss on sale of $11.6 million is reflected as a significant item impacting earnings in other non-interest expense. The loan sale positively impacted the loan-to-deposit ratio by approximately 120 basis points and the Common Equity Tier 1 (CET1) regulatory capital ratio by approximately 10 basis points. Excluding the indirect auto loan sale, period-end loans and leases increased $391.4 million, or 1.2%.

- Period-end total deposits increased $2.2 billion, or 6.2%, driven by an increase of $1.9 billion in shorter-term time deposits and $1.5 billion in interest-bearing demand deposits offsetting the decline of $833.2 million in non-interest-bearing demand deposits and $357.6 million in savings deposits with customers continuing to opt for higher-yielding deposit products.

- On a linked-quarter basis, period-end total deposits increased $1.8 billion, or 5.1%, with increases in interest-bearing demand deposits of $1.3 billion and shorter-term time deposits of $783.4 million offsetting the slight decline in non-interest-bearing demand deposits of $191.5 million and savings deposits of $117.0 million. The mix of non-interest-bearing deposits to total deposits equaled 27% at September 30, 2024, compared to 29% at the prior quarter end, reflecting the strong interest-bearing deposit growth and fairly stable non-interest-bearing deposit balances.

- The loan-to-deposit ratio was 92% at September 30, 2024, compared to 96% at June 30, 2024, reflecting $1.8 billion of linked-quarter deposit growth and the previously-mentioned indirect auto loan sale.

- Net interest income totaled $323.3 million, an increase of $7.4 million, or 2.4%, from the prior quarter, primarily due to improved earning asset yields and loan growth, as well as lower short-term borrowing levels, offsetting the higher cost of interest-bearing deposits.

- Net interest margin (FTE) (non-GAAP) remained stable with a 1 basis point decline to 3.08% from the prior quarter, reflecting an 8 basis point increase in the total yield on earning assets (non-GAAP) and a 10 basis point increase in the total cost of funds.

- Non-interest income totaled a record $89.7 million, an increase of 10.0% from the year-ago quarter, benefiting from our diversified business model and related revenue generation.

- Pre-provision net revenue (non-GAAP) totaled $163.6 million, a 7.7% decrease from the prior quarter. On an operating basis, pre-provision net revenue (non-GAAP) totaled $178.8 million, a 0.5% increase from the prior quarter, driven by continued strong non-interest income generation and growth in net interest income, offset by an increase in non-interest expense.

- Reported non-interest expense totaled $249.4 million, compared to $226.6 million in the prior quarter, which included $15.3 million1 of significant items in the third quarter of 2024 and $0.8 million2 in the second quarter of 2024. When adjusting for the significant items, non-interest expense increased $8.4 million, or 3.7%, linked-quarter on an operating basis (non-GAAP). The efficiency ratio (non-GAAP) remained at a solid level of 55.2%, compared to 51.7% for the year-ago quarter, and 54.4% for the prior quarter.

- The provision for credit losses was $23.4 million, an increase of $3.2 million from the prior quarter with net charge-offs of $21.5 million compared to $7.8 million in the prior quarter. The ratio of non-performing loans and other real estate owned (OREO) to total loans and leases and OREO totaled 0.39%, compared to 0.33% in the prior quarter, and total delinquency increased 16 basis points from the prior quarter to 0.79%. Overall, asset quality metrics continue to remain near historically low levels.

- The CET1 regulatory capital ratio was 10.4% (estimated), compared to 10.2% at both September 30, 2023, and June 30, 2024. Tangible book value per common share (non-GAAP) of $10.33 increased $1.31, or 14.5%, compared to September 30, 2023, and $0.45, or 4.6%, compared to June 30, 2024. Accumulated other comprehensive income/loss (AOCI) reduced the tangible book value per common share (non-GAAP) by $0.43 as of September 30, 2024, primarily due to the impact of interest rates on the fair value of available-for-sale (AFS) securities, compared to a reduction of $1.06 as of September 30, 2023, and $0.67 as of June 30, 2024.

|

1 Third quarter 2024 non-interest expense significant items included $11.6 million (pre-tax) loss on indirect auto loan sale and a $3.7 million (pre-tax) software impairment. |

||||||

|

2 Second quarter 2024 non-interest expense significant item included $0.8 million (pre-tax) of FDIC special assessment expense related to last year’s bank failures. |

||||||

|

Non-GAAP measures referenced in this release are used by management to measure performance in operating the business that management believes enhances investors’ ability to better understand the underlying business performance and trends related to core business activities. Reconciliations of non-GAAP operating measures to the most directly comparable GAAP financial measures are included in the tables at the end of this release. For more information regarding our use of non-GAAP measures, please refer to the discussion herein under the caption, Use of Non-GAAP Financial Measures and Key Performance Indicators. |

||||||

|

Quarterly Results Summary |

3Q24 |

2Q24 |

3Q23 |

||

|

Reported results |

|||||

|

Net income available to common stockholders (millions) |

$ 110.1 |

$ 123.0 |

$ 143.3 |

||

|

Net income per diluted common share |

0.30 |

0.34 |

0.40 |

||

|

Book value per common share |

17.38 |

16.94 |

16.13 |

||

|

Pre-provision net revenue (non-GAAP) (millions) |

163.6 |

177.2 |

190.1 |

||

|

Operating results (non-GAAP) |

|||||

|

Operating net income available to common stockholders (millions) |

$ 122.2 |

$ 123.7 |

$ 143.3 |

||

|

Operating net income per diluted common share |

0.34 |

0.34 |

0.40 |

||

|

Operating pre-provision net revenue (millions) |

178.8 |

178.0 |

190.1 |

||

|

Average diluted common shares outstanding (thousands) |

362,426 |

362,701 |

361,778 |

||

|

Significant items impacting earnings(a) (millions) |

|||||

|

Pre-tax FDIC special assessment |

$ — |

$ (0.8) |

$ — |

||

|

After-tax impact of FDIC special assessment |

— |

(0.6) |

— |

||

|

Pre-tax software impairment |

(3.7) |

— |

— |

||

|

After-tax impact of software impairment |

(2.9) |

— |

— |

||

|

Pre-tax loss on indirect auto loan sale |

(11.6) |

— |

— |

||

|

After-tax impact of loss on indirect auto loan sale |

(9.1) |

— |

— |

||

|

Total significant items pre-tax |

$ (15.3) |

$ (0.8) |

$ — |

||

|

Total significant items after-tax |

$ (12.0) |

$ (0.6) |

$ — |

||

|

Capital measures |

|||||

|

Common equity tier 1 (b) |

10.4 % |

10.2 % |

10.2 % |

||

|

Tangible common equity to tangible assets (non-GAAP) |

8.17 |

7.86 |

7.54 |

||

|

Tangible book value per common share (non-GAAP) |

$ 10.33 |

$ 9.88 |

$ 9.02 |

||

|

(a) Favorable (unfavorable) impact on earnings. |

|||||

|

(b) Estimated for 3Q24. |

|||||

Third Quarter 2024 Results – Comparison to Prior-Year Quarter

(All comparisons refer to the third quarter of 2023, except as noted)

Net interest income totaled $323.3 million, a slight decrease of $3.3 million, or 1.0%, primarily due to higher deposit costs resulting from balance migration to higher yielding deposit products, partially offset by growth in earning assets and higher earning asset yields.

The net interest margin (FTE) (non-GAAP) decreased 18 basis points to 3.08%. The yield on earning assets (non-GAAP) increased 40 basis points to 5.51% driven by a 50 basis point increase in yields on investment securities to 3.33% which benefited from the balance sheet restructuring in late 2023 and a 34 basis point increase in yields on loans to 6.03%. Total cost of funds increased 63 basis points to 2.56% with a 72 basis point increase in interest-bearing deposit costs to 3.08%, and an increase of 66 basis points in total borrowing costs. Our total cumulative spot deposit beta since the Federal Open Market Committee (FOMC) interest rate increases began in March 2022 equaled 40% at August 31, 2024. In September 2024, FOMC the lowered the targeted Federal Funds interest rate by 50 basis points.

Average loans and leases totaled $33.8 billion, an increase of $2.1 billion, or 6.5%, including growth of $1.2 billion in commercial loans and leases and $819.7 million in consumer loans. Commercial real estate increased $972.8 million, or 8.3%, commercial and industrial loans increased $213.8 million, or 2.9%, and commercial leases increased $62.1 million, or 9.9%. The increase in average commercial loans and leases was driven by activity across the footprint, with over half of the year-over-year growth in North and South Carolina. The increase in commercial real estate included fundings on previously originated projects. The increase in average consumer loans included a $1.4 billion increase in residential mortgages largely due to the continued successful execution in key markets by our expanded mortgage banker team and long-standing strategy of serving the purchase market. This growth was partially offset by a decrease in average indirect auto loans of $528.4 million reflecting the sale of $332 million of such loans that closed in the first quarter of 2024 and $431 million that closed in the third quarter of 2024, partially offset by new organic growth in the portfolio.

Average deposits totaled $35.6 billion, an increase of $1.5 billion, or 4.3%, from the prior-year quarter. The growth in average time deposits of $1.5 billion and average interest-bearing demand deposits of $1.2 billion more than offset the decline in average non-interest-bearing demand deposits of $905.9 million and average savings deposits of $394.5 million as customers continued to migrate balances into higher-yielding products. The funding mix has shifted compared to the year-ago quarter with non-interest-bearing deposits comprising 27% of total deposits at September 30, 2024, compared to 31% a year ago.

Non-interest income totaled a record $89.7 million, a 10.0% increase compared to $81.6 million in the third quarter of 2023. Service charges increased $2.8 million, or 13.1%, primarily due to strong Treasury Management activity and higher consumer transaction levels. Mortgage banking operations income increased $1.6 million, driven by improved gain on sale from strong production volumes partially offset by a mortgage servicing rights (MSR) impairment of $2.8 million in the third quarter of 2024 reflecting accelerating prepayment speed assumptions given the recent declines in mortgage rates. Wealth Management revenues increased $1.9 million, or 11.1%, as securities commissions and fees and trust income increased 19.8% and 5.6%, respectively, through continued strong contributions across the geographic footprint. Bank-owned life insurance increased $3.3 million, reflecting higher life insurance claims.

Non-interest expense totaled $249.4 million, increasing $31.4 million, or 14.4%. When adjusting for $15.3 million3 of significant items in the third quarter of 2024, operating non-interest expense (non-GAAP) totaled $234.2 million, an increase of $16.2 million, or 7.4%. Salaries and benefits increased $12.7 million, or 11.2%, primarily from normal annual merit increases and higher production-related commissions given the strong non-interest income activity, as well as strategic hiring associated with our focus to grow market share and continued investments in our risk management infrastructure. Net occupancy and equipment increased $4.3 million, or 10.3%, largely due to the $3.7 million software impairment. Outside services increased $3.6 million, or 17.2%, due to higher volume-related technology and third-party costs. FDIC insurance increased $1.8 million, or 21.8%, primarily due to loan growth and balance sheet mix shift.

The ratio of non-performing loans and OREO to total loans and OREO increased 3 basis points to 0.39%. Total delinquency increased 16 basis points to 0.79%, compared to 0.63% at September 30, 2023. Overall, asset quality metrics continue to remain near historically low levels.

The provision for credit losses was $23.4 million, compared to $25.9 million in the third quarter of 2023. The third quarter of 2024 reflected net charge-offs of $21.5 million, or 0.25% annualized of total average loans, compared to $37.7 million, or 0.47% annualized. The allowance for credit losses (ACL) was $420.2 million, an increase of $19.5 million, with the ratio of the ACL to total loans and leases stable at 1.25%.

The effective tax rate was 21.4%, compared to 11.5% in the third quarter of 2023, with the prior year rate favorably impacted by renewable energy investment tax credits recognized as part of a solar project financing transaction.

The CET1 regulatory capital ratio was 10.4% (estimated) at September 30, 2024, and 10.2% at September 30, 2023. Tangible book value per common share (non-GAAP) was $10.33 at September 30, 2024, an increase of $1.31, or 14.5%, from $9.02 at September 30, 2023. AOCI reduced the current quarter tangible book value per common share (non-GAAP) by $0.43, compared to a reduction of $1.06 at the end of the year-ago quarter.

|

3 Third quarter 2024 non-interest expense significant items included $11.6 million (pre-tax) loss on indirect auto loan sale and a $3.7 million (pre-tax) software impairment. |

||||||

Third Quarter 2024 Results – Comparison to Prior Quarter

(All comparisons refer to the second quarter of 2024, except as noted)

Net interest income totaled $323.3 million, an increase of $7.4 million, or 2.4%, from the prior quarter total of $315.9 million, primarily due to higher earning asset yields and loan growth, as well as the favorable mix-shift in interest-bearing liabilities, partially offset by the higher cost of interest-bearing deposits and continued growth in higher yielding deposit product balances. The total yield on earning assets (non-GAAP) increased 8 basis points to 5.51% due to higher yields on both loans and investment securities. The total cost of funds increased 10 basis points to 2.56%, as the cost of interest-bearing deposits increased 15 basis points to 3.08% and was partially offset by a decrease in long-term borrowing costs of 5 basis points to 5.24%. The funding mix improved linked-quarter reflecting strong deposit growth which reduced total borrowings. Period-end total borrowings were $4.1 billion, a decrease of $1.6 billion, or 27.6%, from the prior quarter. The resulting net interest margin (FTE) (non-GAAP) decreased 1 basis point to 3.08%.

Average loans and leases totaled $33.8 billion, an increase of $547.0 million, or 1.6%, as average commercial loans and leases increased $221.5 million, or 1.1%, and average consumer loans increased $325.4 million, or 2.6%, inclusive of a partial quarter’s impact of the previously mentioned $431 million indirect auto loan sale that closed in September 2024. The increase in average commercial loans and leases included growth of $97.0 million, or 1.3%, in commercial and industrial loans and $96.8 million, or 0.8%, in commercial real estate loans. The quarterly growth of commercial loans and leases was led by the Charleston, Cleveland and Harrisburg markets. For consumer lending, average residential mortgages increased $487.0 million, driven by the seasonal growth in mortgage originations but at a much slower pace than the prior quarter by design given pricing strategies.

Average deposits totaled $35.6 billion, increasing $1.0 billion, or 2.9%, due to organic growth in new and existing customer relationships through our successful deposit initiatives. Average certificates of deposits increased $588.7 million and average interest-bearing-demand deposits increased $553.0 million, which were partially offset by declines in average savings balances of $78.9 million and average non-interest-bearing deposit balances of $54.1 million, resulting from customers’ preferences for higher-yielding deposit products. The mix of non-interest-bearing deposits to total deposits was 27% at September 30, 2024, a decline from 29% at June 30, 2024, driven by the strong growth in interest-bearing deposit balances. The loan-to-deposit ratio was 92% at September 30, 2024, compared to 96%, reflecting $1.8 billion of linked-quarter deposit growth and the previously mentioned indirect auto loan sale.

Non-interest income totaled a record $89.7 million, an increase of $1.8 million, or 2.0%, from the prior quarter. Capital markets income totaled $6.2 million, an increase of $1.1 million, or 20.4%, led by broad-based contributions from syndications, debt capital markets, customer swap activity and international banking. Service charges increased $0.7 million, or 3.0%, primarily due to strong Treasury Management activity and higher consumer transaction levels. Bank-owned life insurance increased $3.1 million, reflecting higher life insurance claims. Mortgage banking operations income decreased $1.4 million, or 20.4%, driven by a net MSR impairment of $2.8 million in the third quarter of 2024 due to accelerating prepayment speed assumptions given recent declines in mortgage rates.

Non-interest expense totaled $249.4 million, compared to $226.6 million in the prior quarter. When adjusting for significant items of $15.3 million4 in the third quarter of 2024 and $0.8 million5 in the second quarter of 2024, non-interest expense increased $8.4 million, or 3.7%, on an operating basis (non-GAAP). Salaries and employee benefits increased $5.1 million, primarily due to production-related variable compensation, lower salary deferrals related to slowing mortgage production, as well as strategic hiring associated with our focus to grow market share and continued investments in our risk management infrastructure. Marketing expenses increased $2.0 million, or 50.3%, due to the opportunistic timing of marketing campaigns related to our successful deposit initiatives. Outside services increased $1.1 million, or 4.9%, largely due to higher volume-related technology and third-party costs. The efficiency ratio (non-GAAP) remained at a solid level of 55.2%, compared to 54.4% for the prior quarter.

The ratio of non-performing loans and OREO to total loans and OREO increased 6 basis points to 0.39%, and delinquency increased 16 basis points to 0.79%. Overall, asset quality metrics continue to remain near historically low levels. The provision for credit losses was $23.4 million, compared to $20.2 million. The third quarter of 2024 reflected net charge-offs of $21.5 million, or 0.25% annualized of total average loans, compared to $7.8 million, or 0.09% annualized. The ACL was $420.2 million, an increase of $1.4 million, with the ratio of the ACL to total loans and leases equaling 1.25% at September 30, 2024, compared to 1.24% at June 30, 2024.

The effective tax rate was 21.4%, compared to 21.6%.

The CET1 regulatory capital ratio was 10.4% (estimated), compared to 10.2% at June 30, 2024. Tangible book value per common share (non-GAAP) was $10.33 at September 30, 2024, an increase of $0.45 per share, or 18.1% annualized. AOCI reduced the current quarter-end tangible book value per common share (non-GAAP) by $0.43, compared to a reduction of $0.67 at the end of the prior quarter.

|

4 Third quarter 2024 non-interest expense significant items included $11.6 million (pre-tax) loss on indirect auto loan sale and a $3.7 million (pre-tax) software impairment. |

||||||

|

5 Second quarter 2024 non-interest expense significant item included $0.8 million (pre-tax) of FDIC special assessment expense related to last year’s bank failures. |

||||||

Use of Non-GAAP Financial Measures and Key Performance Indicators

To supplement our Consolidated Financial Statements presented in accordance with GAAP, we use certain non-GAAP financial measures, such as operating net income available to common stockholders, operating earnings per diluted common share, return on average tangible equity, return on average tangible common equity, operating return on average tangible common equity, return on average tangible assets, tangible book value per common share, the ratio of tangible common equity to tangible assets, pre-provision net revenue (reported), operating pre-provision net revenue, operating non-interest expense, efficiency ratio, and net interest margin (FTE) to provide information useful to investors in understanding our operating performance and trends, and to facilitate comparisons with the performance of our peers. Management uses these measures internally to assess and better understand our underlying business performance and trends related to core business activities. The non-GAAP financial measures and key performance indicators we use may differ from the non-GAAP financial measures and key performance indicators other financial institutions use to assess their performance and trends.

These non-GAAP financial measures should be viewed as supplemental in nature, and not as a substitute for, or superior to, our reported results prepared in accordance with GAAP. When non-GAAP financial measures are disclosed, the Securities and Exchange Commission’s (SEC) Regulation G requires: (i) the presentation of the most directly comparable financial measure calculated and presented in accordance with GAAP and (ii) a reconciliation of the differences between the non-GAAP financial measure presented and the most directly comparable financial measure calculated and presented in accordance with GAAP. Reconciliations of non-GAAP operating measures to the most directly comparable GAAP financial measures are included later in this release under the heading “Reconciliations of Non-GAAP Financial Measures and Key Performance Indicators to GAAP.”

Management believes items such as merger expenses, FDIC special assessment, software impairment, loss on indirect auto loan sales, preferred deemed dividend at redemption and branch consolidation costs are not organic to run our operations and facilities. These items are considered significant items impacting earnings as they are deemed to be outside of ordinary banking activities. These costs are specific to each individual transaction and may vary significantly based on the size and complexity of the transaction.

To facilitate peer comparisons of net interest margin and efficiency ratio, we use net interest income on a taxable-equivalent basis in calculating net interest margin by increasing the interest income earned on tax-exempt assets (loans and investments) to make it fully equivalent to interest income earned on taxable investments (this adjustment is not permitted under GAAP). Taxable-equivalent amounts for 2024 and 2023 were calculated using a federal statutory income tax rate of 21%.

Cautionary Statement Regarding Forward-Looking Information

This document may contain statements regarding F.N.B. Corporation’s outlook for earnings, revenues, expenses, tax rates, capital and liquidity levels and ratios, asset quality levels, financial position and other matters regarding or affecting our current or future business and operations. These statements can be considered “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve various assumptions, risks and uncertainties which can change over time. Actual results or future events may be different from those anticipated in our forward-looking statements and may not align with historical performance and events. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance upon such statements. Forward-looking statements are typically identified by words such as “believe,” “plan,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “will,” “should,” “project,” “goal,” and other similar words and expressions. We do not assume any duty to update forward-looking statements, except as required by federal securities laws.

FNB’s forward-looking statements are subject to the following principal risks and uncertainties:

- Our business, financial results and balance sheet values are affected by business, regulatory, economic and political circumstances, including, but not limited to: (i) developments with respect to the U.S. and global financial markets; (ii) supervision, regulation, enforcement and other actions by several governmental agencies, including the Federal Reserve Board, Federal Deposit Insurance Corporation, Financial Stability Oversight Council, U.S. Department of Justice (DOJ), Consumer Financial Protection Bureau, U.S. Treasury Department, Office of the Comptroller of the Currency and Department of Housing and Urban Development, state attorney generals and other governmental agencies, whose actions may affect, among other things, our consumer and mortgage lending and deposit practices, capital structure, investment practices, dividend policy, annual FDIC insurance premium assessment, growth opportunities, money supply, market interest rates or otherwise affect business activities of the financial services industry; (iii) a slowing of the U.S. economy in general and regional and local economies within our market area; (iv) inflation concerns; (v) the impacts of tariffs or other trade policies of the U.S. or its global trading partners; and (vi) the sociopolitical environment in the U.S.

- Business and operating results are affected by our ability to identify and effectively manage risks inherent in our businesses, including, where appropriate, through effective use of systems and controls, third-party insurance, derivatives, and capital management techniques, and to meet evolving regulatory capital and liquidity standards.

- Competition can have an impact on customer acquisition, growth and retention, and on credit spreads, deposit gathering and product pricing, which can affect market share, loans, deposits and revenues. Our ability to anticipate, react quickly and continue to respond to technological changes and significant adverse industry and economic events can also impact our ability to respond to customer needs and meet competitive demands.

- Business and operating results can also be affected by difficult to predict uncertainties, such as widespread natural and other disasters, wars, pandemics, global events and geopolitical instability, including the Ukraine–Russia conflict and the potential for broader conflict in the Middle East, shortages of labor, supply chain disruptions and shipping delays, terrorist activities, system failures, security breaches, significant political events, cyber-attacks, international hostilities or other extraordinary events which are beyond FNB’s control and may significantly impact the U.S. or global economy and financial markets generally, or us or our counterparties, customers or third-party vendors specifically.

- Our ability to take certain capital actions, including returning capital to shareholders, is subject to us meeting or exceeding minimum capital levels. Our regulatory capital ratios in the future will depend on, among other things, our financial performance, the scope and terms of final capital regulations then in effect and management actions affecting the composition of our balance sheet.

- Historically we have grown our business in part through acquisitions, new strategic and business initiatives and new products. Potential risks and uncertainties include those presented by the nature of the business acquired, the strategic or business initiative or the new product, including in some cases those associated with our entry into new business lines or new geographic or other markets and risks resulting from our inexperience in those new areas, as well as risks and uncertainties related to the acquisition transactions themselves, increased scrutiny associated with the regulatory approval process, other regulatory issues stemming from such acquisitions or new initiatives or product lines, the integration of the acquired businesses into us after closing or any failure to execute strategic, risk management or operational plans.

- Legal, regulatory and accounting developments could have an impact on our ability to operate and grow our businesses, financial condition, results of operations, competitive position, and reputation. Reputational impacts could affect matters such as business generation and retention, liquidity, funding, and the ability to attract and retain talent. These developments could include:

- Policies and priorities of the current U.S. presidential administration, including legislative and regulatory reforms, more aggressive approaches to supervisory or enforcement priorities with consumer and anti-discrimination lending laws by the federal banking regulatory agencies and the DOJ, changes affecting oversight of the financial services industry, regulatory obligations or restrictions, consumer protection, taxes, employee benefits, compensation practices, pension, bankruptcy and other industry aspects, and changes in accounting policies and principles.

- Ability to continue to attract, develop and retain key talent.

- Changes to laws and regulations, including changes affecting the oversight of the financial services industry along with changes in enforcement and interpretation of such laws and regulations, and changes to accounting standards governing bank capital requirements, loan loss reserves and liquidity standards.

- Changes in governmental monetary and fiscal policies, including interest rate policies and strategies of the Federal Open Market Committee.

- Unfavorable resolution of legal proceedings or other claims and regulatory and other governmental investigations or inquiries. These matters may result in monetary judgments or settlements, enforcement actions or other remedies, including fines, penalties, restitution or alterations in our business practices, including financial and other types of commitments, and in additional expenses and collateral costs, and may cause reputational harm to us.

- Results of the regulatory examination and supervision process, including our failure to satisfy requirements imposed by the federal bank regulatory agencies or other governmental agencies.

- Business and operating results that are affected by our ability to effectively identify and manage risks inherent in our businesses, including, where appropriate, through effective use of policies, processes, systems and controls, third-party insurance, derivatives, and capital and liquidity management techniques.

- The impact on our financial condition, results of operations, financial disclosures and future business strategies related to the impact on the allowance for credit losses due to changes in forecasted macroeconomic conditions as a result of applying the “current expected credit loss” accounting standard, or CECL.

- A failure or disruption in or breach of our operational or security systems or infrastructure, or those of third parties, including as a result of cyber-attacks or campaigns.

- Increased funding costs and market volatility due to market illiquidity and competition for funding.

FNB cautions that the risks identified here are not exhaustive of the types of risks that may adversely impact FNB and actual results may differ materially from those expressed or implied as a result of these risks and uncertainties, including, but not limited to, the risk factors and other uncertainties described under Item 1A. Risk Factors and the Risk Management sections of our 2023 Annual Report on Form 10-K (including the MD&A section), our subsequent 2024 Quarterly Reports on Form 10-Q (including the risk factors and risk management discussions) and our other 2024 filings with the SEC, which are available on our corporate website at https://www.fnb-online.com/about-us/investor-information/reports-and-filings or the SEC’s website at www.sec.gov. We have included our web address as an inactive textual reference only. Information on our website is not part of our SEC filings.

Conference Call

F.N.B. Corporation FNB announced the financial results for the third quarter of 2024 after the market close on Thursday, October 17, 2024. Chairman, President and Chief Executive Officer, Vincent J. Delie, Jr., Chief Financial Officer, Vincent J. Calabrese, Jr., and Chief Credit Officer, Gary L. Guerrieri, plan to host a conference call to discuss the Company’s financial results on Friday, October 18, 2024, at 8:30 AM ET.

Participants are encouraged to pre-register for the conference call at https://dpregister.com/sreg/10192978/fd90570726. Callers who pre-register will be provided a conference passcode and unique PIN to bypass the live operator and gain immediate access to the call. Participants may pre-register at any time, including up to and after the call start time.

Dial-in Access: The conference call may be accessed by dialing (844) 802-2440 (for domestic callers) or (412) 317-5133 (for international callers). Participants should ask to be joined into the F.N.B. Corporation call.

Webcast Access: The audio-only call and related presentation materials may be accessed via webcast through the “About Us” tab of the Corporation’s website at www.fnbcorporation.com and clicking on “Investor Relations” then “Investor Conference Calls.” Access to the live webcast will begin approximately 30 minutes prior to the start of the call.

Presentation Materials: Presentation slides and the earnings release will also be available on the Corporation’s website at www.fnbcorporation.com by accessing the “About Us” tab and clicking on “Investor Relations” then “Investor Conference Calls.”

A replay of the call will be available shortly after the completion of the call until midnight ET on Friday, October 25, 2024. The replay can be accessed by dialing 877-344-7529 (for domestic callers) or 412-317-0088 (for international callers); the conference replay access code is 9877633. Following the call, a link to the webcast and the related presentation materials will be posted to the “Investor Relations” section of F.N.B. Corporation’s website at www.fnbcorporation.com.

About F.N.B. Corporation

F.N.B. Corporation FNB, headquartered in Pittsburgh, Pennsylvania, is a diversified financial services company operating in seven states and the District of Columbia. FNB’s market coverage spans several major metropolitan areas including: Pittsburgh, Pennsylvania; Baltimore, Maryland; Cleveland, Ohio; Washington, D.C.; Charlotte, Raleigh, Durham and the Piedmont Triad (Winston-Salem, Greensboro and High Point) in North Carolina; and Charleston, South Carolina. The Company has total assets of $48 billion and approximately 350 banking offices throughout Pennsylvania, Ohio, Maryland, West Virginia, North Carolina, South Carolina, Washington, D.C. and Virginia.

FNB provides a full range of commercial banking, consumer banking and wealth management solutions through its subsidiary network which is led by its largest affiliate, First National Bank of Pennsylvania, founded in 1864. Commercial banking solutions include corporate banking, small business banking, investment real estate financing, government banking, business credit, capital markets and lease financing. The consumer banking segment provides a full line of consumer banking products and services, including deposit products, mortgage lending, consumer lending and a complete suite of mobile and online banking services. FNB’s wealth management services include asset management, private banking and insurance.

The common stock of F.N.B. Corporation trades on the New York Stock Exchange under the symbol “FNB” and is included in Standard & Poor’s MidCap 400 Index with the Global Industry Classification Standard (GICS) Regional Banks Sub-Industry Index. Customers, shareholders and investors can learn more about this regional financial institution by visiting the F.N.B. Corporation website at www.fnbcorporation.com.

|

F.N.B. CORPORATION AND SUBSIDIARIES |

|||||||||||||||

|

CONSOLIDATED STATEMENTS OF INCOME |

|||||||||||||||

|

(Dollars in thousands, except per share data) |

|||||||||||||||

|

(Unaudited) |

% Variance |

||||||||||||||

|

3Q24 |

3Q24 |

For the Nine Months Ended |

% |

||||||||||||

|

3Q24 |

2Q24 |

3Q23 |

2Q24 |

3Q23 |

2024 |

2023 |

Var. |

||||||||

|

Interest Income |

|||||||||||||||

|

Loans and leases, including fees |

$ 515,948 |

$ 494,119 |

$ 455,975 |

4.4 |

13.2 |

$ 1,491,226 |

$ 1,278,329 |

16.7 |

|||||||

|

Securities: |

|||||||||||||||

|

Taxable |

48,541 |

47,795 |

37,373 |

1.6 |

29.9 |

142,391 |

108,567 |

31.2 |

|||||||

|

Tax-exempt |

7,007 |

7,067 |

7,178 |

(0.8) |

(2.4) |

21,179 |

21,549 |

(1.7) |

|||||||

|

Other |

11,276 |

8,207 |

12,835 |

37.4 |

(12.1) |

28,661 |

32,619 |

(12.1) |

|||||||

|

Total Interest Income |

582,772 |

557,188 |

513,361 |

4.6 |

13.5 |

1,683,457 |

1,441,064 |

16.8 |

|||||||

|

Interest Expense |

|||||||||||||||

|

Deposits |

199,036 |

179,960 |

139,008 |

10.6 |

43.2 |

549,394 |

334,898 |

64.0 |

|||||||

|

Short-term borrowings |

29,934 |

32,837 |

23,207 |

(8.8) |

29.0 |

90,472 |

54,992 |

64.5 |

|||||||

|

Long-term borrowings |

30,473 |

28,501 |

24,565 |

6.9 |

24.1 |

85,364 |

58,695 |

45.4 |

|||||||

|

Total Interest Expense |

259,443 |

241,298 |

186,780 |

7.5 |

38.9 |

725,230 |

448,585 |

61.7 |

|||||||

|

Net Interest Income |

323,329 |

315,890 |

326,581 |

2.4 |

(1.0) |

958,227 |

992,479 |

(3.5) |

|||||||

|

Provision for credit losses |

23,438 |

20,189 |

25,934 |

16.1 |

(9.6) |

57,517 |

58,511 |

(1.7) |

|||||||

|

Net Interest Income After Provision for Credit Losses |

299,891 |

295,701 |

300,647 |

1.4 |

(0.3) |

900,710 |

933,968 |

(3.6) |

|||||||

|

Non-Interest Income |

|||||||||||||||

|

Service charges |

24,024 |

23,332 |

21,245 |

3.0 |

13.1 |

67,925 |

62,043 |

9.5 |

|||||||

|

Interchange and card transaction fees |

12,922 |

13,005 |

13,521 |

(0.6) |

(4.4) |

38,627 |

39,419 |

(2.0) |

|||||||

|

Trust services |

11,120 |

11,475 |

10,526 |

(3.1) |

5.6 |

34,019 |

31,767 |

7.1 |

|||||||

|

Insurance commissions and fees |

5,118 |

5,973 |

5,047 |

(14.3) |

1.4 |

17,843 |

18,830 |

(5.2) |

|||||||

|

Securities commissions and fees |

7,876 |

7,980 |

6,577 |

(1.3) |

19.8 |

24,011 |

20,980 |

14.4 |

|||||||

|

Capital markets income |

6,194 |

5,143 |

7,077 |

20.4 |

(12.5) |

17,668 |

19,754 |

(10.6) |

|||||||

|

Mortgage banking operations |

5,540 |

6,956 |

3,914 |

(20.4) |

41.5 |

20,410 |

13,676 |

49.2 |

|||||||

|

Dividends on non-marketable equity securities |

6,560 |

6,895 |

5,779 |

(4.9) |

13.5 |

19,648 |

15,354 |

28.0 |

|||||||

|

Bank owned life insurance |

6,470 |

3,419 |

3,196 |

89.2 |

102.4 |

13,232 |

9,016 |

46.8 |

|||||||

|

Net securities gains (losses) |

(28) |

(3) |

(55) |

— |

— |

(31) |

(78) |

— |

|||||||

|

Other |

3,892 |

3,747 |

4,724 |

3.9 |

(17.6) |

12,120 |

10,488 |

15.6 |

|||||||

|

Total Non-Interest Income |

89,688 |

87,922 |

81,551 |

2.0 |

10.0 |

265,472 |

241,249 |

10.0 |

|||||||

|

Non-Interest Expense |

|||||||||||||||

|

Salaries and employee benefits |

126,066 |

120,917 |

113,351 |

4.3 |

11.2 |

376,109 |

347,544 |

8.2 |

|||||||

|

Net occupancy |

22,384 |

18,632 |

18,241 |

20.1 |

22.7 |

60,611 |

52,300 |

15.9 |

|||||||

|

Equipment |

23,469 |

24,335 |

23,332 |

(3.6) |

0.6 |

71,576 |

66,749 |

7.2 |

|||||||

|

Amortization of intangibles |

4,376 |

4,379 |

5,040 |

(0.1) |

(13.2) |

13,197 |

15,203 |

(13.2) |

|||||||

|

Outside services |

24,383 |

23,250 |

20,796 |

4.9 |

17.2 |

70,513 |

60,733 |

16.1 |

|||||||

|

Marketing |

6,023 |

4,006 |

5,419 |

50.3 |

11.1 |

15,460 |

13,063 |

18.3 |

|||||||

|

FDIC insurance |

10,064 |

9,954 |

8,266 |

1.1 |

21.8 |

32,680 |

23,102 |

41.5 |

|||||||

|

Bank shares and franchise taxes |

3,931 |

3,930 |

3,927 |

— |

0.1 |

11,987 |

12,025 |

(0.3) |

|||||||

|

Merger-related |

— |

— |

— |

— |

— |

— |

2,215 |

(100.0) |

|||||||

|

Other |

28,735 |

17,209 |

19,626 |

67.0 |

46.4 |

61,006 |

56,936 |

7.1 |

|||||||

|

Total Non-Interest Expense |

249,431 |

226,612 |

217,998 |

10.1 |

14.4 |

713,139 |

649,870 |

9.7 |

|||||||

|

Income Before Income Taxes |

140,148 |

157,011 |

164,200 |

(10.7) |

(14.6) |

453,043 |

525,347 |

(13.8) |

|||||||

|

Income taxes |

30,045 |

33,974 |

18,919 |

(11.6) |

58.8 |

97,572 |

91,169 |

7.0 |

|||||||

|

Net Income |

110,103 |

123,037 |

145,281 |

(10.5) |

(24.2) |

355,471 |

434,178 |

(18.1) |

|||||||

|

Preferred stock dividends |

— |

— |

2,010 |

— |

(100.0) |

6,005 |

6,030 |

(0.4) |

|||||||

|

Net Income Available to Common Stockholders |

$ 110,103 |

$ 123,037 |

$ 143,271 |

(10.5) |

(23.2) |

$ 349,466 |

$ 428,148 |

(18.4) |

|||||||

|

Earnings per Common Share |

|||||||||||||||

|

Basic |

$ 0.30 |

$ 0.34 |

$ 0.40 |

(11.8) |

(25.0) |

$ 0.97 |

$ 1.19 |

(18.5) |

|||||||

|

Diluted |

0.30 |

0.34 |

0.40 |

(11.8) |

(25.0) |

0.96 |

1.18 |

(18.6) |

|||||||

|

Cash Dividends per Common Share |

0.12 |

0.12 |

0.12 |

— |

— |

0.36 |

0.36 |

— |

|||||||

|

F.N.B. CORPORATION AND SUBSIDIARIES |

|||||||||

|

CONSOLIDATED BALANCE SHEETS |

|||||||||

|

(Dollars in millions) |

|||||||||

|

(Unaudited) |

% Variance |

||||||||

|

3Q24 |

3Q24 |

||||||||

|

3Q24 |

2Q24 |

3Q23 |

2Q24 |

3Q23 |

|||||

|

Assets |

|||||||||

|

Cash and due from banks |

$ 596 |

$ 448 |

$ 409 |

33.0 |

45.7 |

||||

|

Interest-bearing deposits with banks |

1,482 |

1,432 |

1,228 |

3.5 |

20.7 |

||||

|

Cash and Cash Equivalents |

2,078 |

1,880 |

1,637 |

10.5 |

26.9 |

||||

|

Securities available for sale |

3,494 |

3,364 |

3,145 |

3.9 |

11.1 |

||||

|

Securities held to maturity |

3,820 |

3,893 |

3,922 |

(1.9) |

(2.6) |

||||

|

Loans held for sale |

193 |

132 |

110 |

46.2 |

75.5 |

||||

|

Loans and leases, net of unearned income |

33,717 |

33,757 |

32,151 |

(0.1) |

4.9 |

||||

|

Allowance for credit losses on loans and leases |

(420) |

(419) |

(401) |

0.2 |

4.7 |

||||

|

Net Loans and Leases |

33,297 |

33,338 |

31,750 |

(0.1) |

4.9 |

||||

|

Premises and equipment, net |

505 |

489 |

460 |

3.3 |

9.8 |

||||

|

Goodwill |

2,478 |

2,477 |

2,477 |

— |

— |

||||

|

Core deposit and other intangible assets, net |

56 |

60 |

74 |

(6.7) |

(24.3) |

||||

|

Bank owned life insurance |

657 |

667 |

660 |

(1.5) |

(0.5) |

||||

|

Other assets |

1,398 |

1,415 |

1,261 |

(1.2) |

10.9 |

||||

|

Total Assets |

$ 47,976 |

$ 47,715 |

$ 45,496 |

0.5 |

5.5 |

||||

|

Liabilities |

|||||||||

|

Deposits: |

|||||||||

|

Non-interest-bearing demand |

$ 9,870 |

$ 10,062 |

$ 10,704 |

(1.9) |

(7.8) |

||||

|

Interest-bearing demand |

15,999 |

14,697 |

14,530 |

8.9 |

10.1 |

||||

|

Savings |

3,231 |

3,348 |

3,588 |

(3.5) |

(9.9) |

||||

|

Certificates and other time deposits |

7,671 |

6,887 |

5,793 |

11.4 |

32.4 |

||||

|

Total Deposits |

36,771 |

34,994 |

34,615 |

5.1 |

6.2 |

||||

|

Short-term borrowings |

1,562 |

3,616 |

2,066 |

(56.8) |

(24.4) |

||||

|

Long-term borrowings |

2,515 |

2,016 |

1,968 |

24.8 |

27.8 |

||||

|

Other liabilities |

879 |

999 |

953 |

(12.0) |

(7.8) |

||||

|

Total Liabilities |

41,727 |

41,625 |

39,602 |

0.2 |

5.4 |

||||

|

Stockholders’ Equity |

|||||||||

|

Preferred stock |

— |

— |

107 |

— |

(100.0) |

||||

|

Common stock |

4 |

4 |

4 |

— |

— |

||||

|

Additional paid-in capital |

4,693 |

4,690 |

4,689 |

0.1 |

0.1 |

||||

|

Retained earnings |

1,886 |

1,820 |

1,664 |

3.6 |

13.3 |

||||

|

Accumulated other comprehensive loss |

(154) |

(243) |

(382) |

(36.6) |

(59.7) |

||||

|

Treasury stock |

(180) |

(181) |

(188) |

(0.6) |

(4.3) |

||||

|

Total Stockholders’ Equity |

6,249 |

6,090 |

5,894 |

2.6 |

6.0 |

||||

|

Total Liabilities and Stockholders’ Equity |

$ 47,976 |

$ 47,715 |

$ 45,496 |

0.5 |

5.5 |

||||

|

F.N.B. CORPORATION AND SUBSIDIARIES |

3Q24 |

2Q24 |

3Q23 |

|||||||||||||||

|

(Dollars in thousands) |

Interest |

Interest |

Interest |

|||||||||||||||

|

(Unaudited) |

Average |

Income/ |

Yield/ |

Average |

Income/ |

Yield/ |

Average |

Income/ |

Yield/ |

|||||||||

|

Balance |

Expense |

Rate |

Balance |

Expense |

Rate |

Balance |

Expense |

Rate |

||||||||||

|

Assets |

||||||||||||||||||

|

Interest-bearing deposits with banks |

$ 1,003,513 |

$ 11,276 |

4.47 % |

$ 868,390 |

$ 8,207 |

3.80 % |

$ 1,223,226 |

$ 12,835 |

4.16 % |

|||||||||

|

Taxable investment securities (2) |

6,177,736 |

48,317 |

3.13 |

6,154,907 |

47,564 |

3.09 |

6,046,294 |

37,140 |

2.46 |

|||||||||

|

Non-taxable investment securities (1) |

1,023,050 |

8,816 |

3.45 |

1,033,552 |

8,911 |

3.45 |

1,051,475 |

9,107 |

3.46 |

|||||||||

|

Loans held for sale |

300,326 |

5,729 |

7.61 |

110,855 |

2,519 |

9.09 |

109,568 |

2,416 |

8.80 |

|||||||||

|

Loans and leases (1) (3) |

33,802,701 |

511,564 |

6.03 |

33,255,738 |

492,902 |

5.96 |

31,739,561 |

454,780 |

5.69 |

|||||||||

|

Total Interest Earning Assets (1) |

42,307,326 |

585,702 |

5.51 |

41,423,442 |

560,103 |

5.43 |

40,170,124 |

516,278 |

5.11 |

|||||||||

|

Cash and due from banks |

414,536 |

387,374 |

445,341 |

|||||||||||||||

|

Allowance for credit losses |

(427,826) |

(414,372) |

(415,722) |

|||||||||||||||

|

Premises and equipment |

501,588 |

484,851 |

461,598 |

|||||||||||||||

|

Other assets |

4,620,414 |

4,590,486 |

4,432,826 |

|||||||||||||||

|

Total Assets |

$ 47,416,038 |

$ 46,471,781 |

$ 45,094,167 |

|||||||||||||||

|

Liabilities |

||||||||||||||||||

|

Deposits: |

||||||||||||||||||

|

Interest-bearing demand |

$ 15,215,815 |

108,762 |

2.84 |

$ 14,662,774 |

98,211 |

2.69 |

$ 13,997,552 |

75,840 |

2.15 |

|||||||||

|

Savings |

3,281,732 |

10,406 |

1.26 |

3,360,593 |

10,136 |

1.21 |

3,676,239 |

9,875 |

1.07 |

|||||||||

|

Certificates and other time |

7,234,412 |

79,868 |

4.39 |

6,645,682 |

71,613 |

4.33 |

5,698,129 |

53,293 |

3.71 |

|||||||||

|

Total interest-bearing deposits |

25,731,959 |

199,036 |

3.08 |

24,669,049 |

179,960 |

2.93 |

23,371,920 |

139,008 |

2.36 |

|||||||||

|

Short-term borrowings |

2,345,960 |

29,934 |

5.06 |

2,640,985 |

32,837 |

4.99 |

2,245,089 |

23,207 |

4.09 |

|||||||||

|

Long-term borrowings |

2,314,914 |

30,473 |

5.24 |

2,164,983 |

28,501 |

5.29 |

1,974,017 |

24,565 |

4.94 |

|||||||||

|

Total Interest-Bearing Liabilities |

30,392,833 |

259,443 |

3.39 |

29,475,017 |

241,298 |

3.29 |

27,591,026 |

186,780 |

2.69 |

|||||||||

|

Non-interest-bearing demand deposits |

9,867,006 |

9,921,073 |

10,772,923 |

|||||||||||||||

|

Total Deposits and Borrowings |

40,259,839 |

2.56 |

39,396,090 |

2.46 |

38,363,949 |

1.93 |

||||||||||||

|

Other liabilities |

985,545 |

1,037,452 |

850,382 |

|||||||||||||||

|

Total Liabilities |

41,245,384 |

40,433,542 |

39,214,331 |