Antimicrobial Plastics Market to Reach $87.4 Billion, Globally, by 2033 at 7.4% CAGR: Allied Market Research

Wilmington, Delaware , Oct. 18, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Antimicrobial Plastics Market by Additive (Inorganic and and Organic), Plastic (Engineering, High-Performance and Others), End-Use (Healthcare, Packaging, Automotive, Consumer Goods, Building and Construction and And Others): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the antimicrobial plastics market was valued at $43.1 billion in 2023, and is estimated to reach $87.4 billion by 2033, growing at a CAGR of 7.4% from 2024 to 2033.

Prime determinants of growth

The antimicrobial plastics market is driven by key factors, including the increasing emphasis on hygiene and sanitation, particularly in healthcare settings where preventing infections is critical. Consumer demand for hygienic products in everyday items like smartphones, kitchenware, and personal care products also fuels market growth. Additionally, stringent regulatory standards and technological advancements in antimicrobial additives enhance the appeal and effectiveness of these materials. However, the market faces restraints such as the high cost of antimicrobial additives, which can increase production costs and deter adoption. Regulatory challenges and the potential development of microbial resistance to antimicrobial agents also pose significant hurdles. Environmental concerns regarding the disposal and lifecycle impact of antimicrobial plastics further limit market expansion. Despite these challenges, there are substantial opportunities for growth, particularly in emerging markets with rising consumer spending power. Increased investment in healthcare infrastructure and rise in demand for hygienic packaging solutions in these regions can drive the adoption of antimicrobial plastics. Furthermore, ongoing innovations aimed at developing more cost-effective and environmentally friendly antimicrobial solutions present significant opportunities for market expansion.

Download Sample Pages of Research Overview: https://www.alliedmarketresearch.com/request-sample/5716

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $43.1 Billion |

| Market Size in 2033 | $87.4 Billion |

| CAGR | 7.4% |

| No. of Pages in Report | 250 |

| Segments Covered | Additive, Plastic, End-Use and Region. |

| Drivers |

|

| Opportunities |

|

| Restraint |

|

The organic segment is expected to witness rapid growth throughout the forecast period.

By additive, organic additives are preferred due to their effectiveness in inhibiting microbial growth on plastic surfaces while maintaining material integrity and performance. These additives are widely used across various applications such as healthcare, consumer goods, and packaging, where stringent hygiene standards and safety are paramount. Their versatility and compatibility with different plastic materials contribute to their prominence in the antimicrobial plastics market, driving continued adoption and growth globally.

The engineering plastics segment is expected to lead throughout the forecast period.

By plastic, engineering plastics, known for their superior mechanical properties, durability, and resistance to heat and chemicals, are widely utilized in applications requiring antimicrobial properties. These plastics include materials such as polycarbonate, polyamide (nylon), and polyoxymethylene (POM), among others. They are commonly used in healthcare equipment, automotive interiors, electronics, and industrial components where antimicrobial protection is essential. The demand for antimicrobial engineering plastics is driven by the need for reliable microbial control in critical environments while maintaining high performance and longevity of the materials.

Procure Complete Report (226 Pages PDF with Insights, Charts, Tables, and Figures) @ https://www.alliedmarketresearch.com/checkout-final/antimicrobial-plastics-market

The healthcare segment is expected to lead throughout the forecast period.

By end use, antimicrobial plastics play a crucial role in the healthcare industry by helping to reduce the risk of infections and ensuring hygiene standards in medical equipment, devices, and hospital environments. This sector demands materials that can effectively inhibit microbial growth while maintaining safety and durability. Following healthcare, packaging is another significant segment, driven by the need for antimicrobial solutions to extend shelf life and prevent contamination in food, pharmaceuticals, and other perishable goods. Automotive, consumer goods, and building & construction sectors also utilize antimicrobial plastics to enhance product safety and longevity in various applications.

Asia-Pacific to maintain its dominance by 2033.

In the Asia-Pacific region, the antimicrobial plastics market is projected to witness significant growth driven by increasing healthcare expenditures and rising consumer awareness of hygiene. Countries such as China, Japan, and South Korea lead in adopting antimicrobial plastics across medical devices, consumer electronics, and food packaging sectors. The market benefits from robust manufacturing capabilities and technological advancements in antimicrobial additives. Regulatory support for safety standards further facilitates market expansion.

Want to Access the Statistical Data and Graphs, Key Players’ Strategies: https://www.alliedmarketresearch.com/antimicrobial-plastics-market/purchase-options

Players: –

- LyondellBasell Industries Holdings B.V.

The report provides a detailed analysis of these key players in the global antimicrobial plastics market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

Web: www.alliedmarketresearch.com

Allied Market Research Blog: https://blog.alliedmarketresearch.com

Blog: https://www.newsguards.com/

Follow Us on | Facebook | LinkedIn | YouTube |

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Buffett's Berkshire continues to reduce Bank of America stake

(Reuters) – Billionaire Warren Buffett’s Berkshire Hathaway (BRK-B) has unloaded more Bank of America (BAC) stock as it continues to trim stake in the U.S. banking giant, according to a regulatory filing.

Berkshire sold nearly 8.7 million shares for $370 million, as of Oct. 15, the filing showed.

Last week, Berkshire sold 9.5 million shares worth $382.4 million that brought its stake in the company to below 10%, according to a separate regulatory filing.

The investment giant began trimming its stake in mid-July when it sold about 33.9 million shares for around $1.48 billion. Since then, it has netted more than $10 billion from these sales.

Buffett, one of the world’s most revered investors, first invested in Bank of America back 2011 when he purchased $5 billion worth of its preferred stock.

(Reporting by Jaiveer Singh Shekhawat in Bengaluru; Editing by Tasim Zahid)

China Moves to Support Markets After Data Showing Economy Slowed

(Bloomberg) — China’s central bank moved to support markets just as data showed the economy expanding the least in six quarters, signaling the government’s intent to continue a stimulus push to draw a line under the slowdown.

Most Read from Bloomberg

The People’s Bank of China disclosed more details of its measures to boost capital markets minutes after authorities released figures showing China’s slowdown deepened in the third quarter. At a separate event in Beijing, PBOC Governor Pan Gongsheng flagged the real estate and stock markets as key challenges in the economy that require targeted policy support.

Coordinated or not, the moves by the PBOC and its governor appeared to bolster hope that Beijing would do what it takes to ensure the country reaches its 2024 growth target of around 5%. Although the expansion was slower than in previous quarters, better-than-expected data for September offered tentative signs the economy has bottomed out.

The probability of China achieving its growth goal “now looks very high,” said Jacqueline Rong, chief China economist at BNP Paribas SA. “Only a mild rebound in the fourth quarter will get the job done.”

China’s benchmark CSI 300 Index of onshore stocks rebounded from earlier losses to close up 3.6% higher, after the central bank kicked off a re-lending facility for listed companies and major shareholders to buy back shares. Stocks also got a boost from President Xi Jinping’s call for efforts to achieve the year’s economic goals and financial support for technology, with chipmaker Semiconductor Manufacturing International Corp. gaining 20%.

What Bloomberg Economics Says…

“Given the force and breadth of the policy response in recent weeks, the economy has likely bottomed out. The government will probably now concentrate on implementation, with a particular focus on ensuring local officials deliver fiscal spending that’s been budgeted for the year.”

— Chang Shu and Eric Zhu

Read the full note here.

The Friday data painted a mixed economic picture for the last quarter.

Gross domestic product increased 4.6% in the July-to-September period from a year prior, data released by the National Bureau of Statistics showed, bringing growth for the first nine months to 4.8% — the lower end of China’s annual growth goal.

Things appeared to take a turn for the better during the last stretch of the period, with retail sales accelerating in September to grow 3.2% after expanding 2.1% the prior month.

The better-than-expected consumption gauge likely received a boost from government subsidies for upgrading consumer goods. Home appliances saw a 21% surge in sales from a year ago, picking up from a 3% gain in the previous month. Increased subsidies for car purchases also paid off, with auto sales snapping a six-month declining streak.

“The economy will perform better in the fourth quarter given the new stimulus measures,” said Larry Hu, head of China economics at Macquarie Group Ltd.

The appliance and goods trade-in program is part of China’s stimulus measures including interest rate cuts, with the elite Politburo led by Xi supercharging the push with a vow to stabilize the beleaguered real estate sector.

The slate of measures prompted a historic stock rally and led banks including Goldman Sachs Group Inc. to upgrade their forecasts for China’s growth. But skepticism has grown over whether authorities are willing to deploy greater fiscal firepower to turn around the economy and markets.

Investors now expect Chinese lawmakers to approve additional budget or debt sales to fund public spending in a meeting as soon as this month after authorities promised fiscal support.

At a Beijing forum, PBOC’s Pan reiterated that the monetary authority will make a reasonable rebound in prices a key policy consideration. A broad measure of prices fell for a sixth quarter, data showed Friday, extending the economy’s deflation streak, the longest since 1999.

Apart from retail sales, industrial production and fixed-asset investment also picked up in September, and jobless rate fell to 5.1%, the lowest since June.

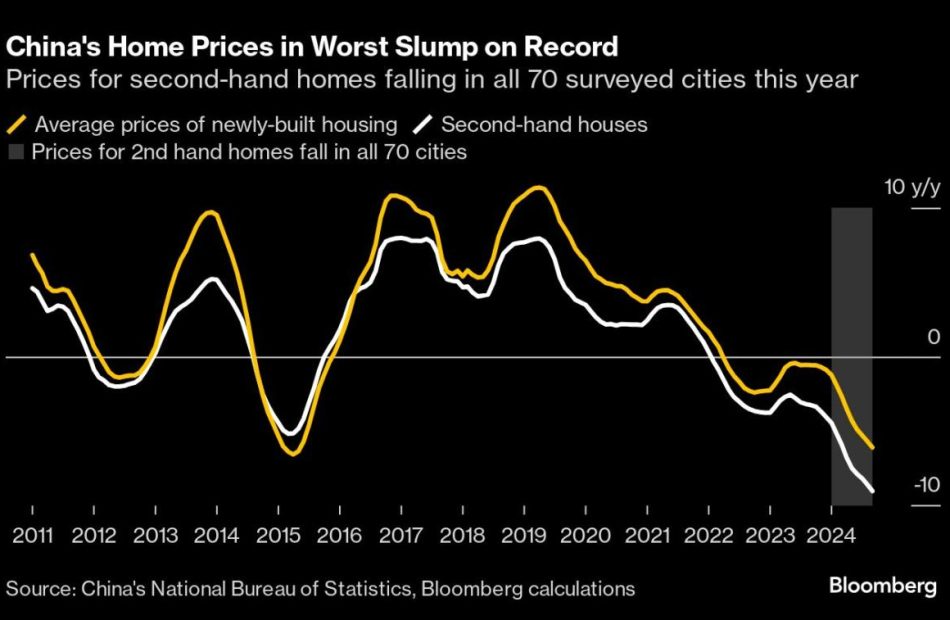

New home prices, however, fell for a 16th month, dropping at almost the same pace as in August.

“There is still a lack of stabilization in the property market yet, indeed indicating the needs for continued policy easing,” said Xiaojia Zhi, chief China economist at Credit Agricole.

The NBS said there’s reason for caution despite improvements in the main indicators as the stimulus measures are rolled out, citing an “increasingly complex and grim” external environment and a need to strengthen the economy’s foundation.

Data released before Friday underscored those challenges. Exports in September slowed sharply, curbing a trade rebound that has been a highlight for the economy. Deflationary pressures continued to build, with consumer prices still weak and factory gate prices falling for 24 straight months.

Economists have urged Beijing to boost consumer spending to avoid a spiral of falling prices, which could risk a self-reinforcing cycle of declining spending, shrinking business revenues and job losses. But authorities have shown little urgency to ramp up consumption with any direct stimulus or large-scale handouts, which Xi has long resisted due to concerns over what he calls “welfarism.”

What’s Wrong With China’s Economy? What’s Xi Doing?: QuickTake

China has so far appeared to be focusing its fiscal policy on reining in local debt risks, with Finance Minister Lan Fo’an promising what he described would be the biggest effort in years to bring hidden debt onto local governments’ balance sheet.

The strategy is aimed at easing the debt servicing burden for the authorities by bringing down interest costs and delaying loan repayment. This frees up cash and gives local governments greater scope to drive economic growth.

“The improvement in the growth momentum of the key monthly indicators may provide some comfort to policymakers,” said Louis Kuijs, chief Asia-Pacific economist at S&P Global Ratings. “Yet I don’t think that one month of slightly better activity data can justify reducing policy support to growth, especially not at a time when deflation risks have increased.”

–With assistance from Tian Chen, James Mayger and Jing Li.

(Updates with market close and Xi Jinping comments in fifth paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Breakthrough Properties Joined by San Diego Mayor Todd Gloria to Celebrate the Opening of Torrey View By Breakthrough Development

Fully Leased Life Science Campus is Now Home to Leading Companies

Including Pfizer and BD Biosciences

SAN DIEGO, Oct. 17, 2024 /PRNewswire/ — Breakthrough Properties was joined by San Diego Mayor Todd Gloria, UCSD Chancellor Pradeep Khosla, Ph.D. and representatives from Pfizer and BD Biosciences on September 30 to commemorate the opening of Torrey View, its newly-developed, 10-acre life science campus in Del Mar Heights.

Breakthrough successfully pre-leased the entire 520,000-square-foot campus to an impressive lineup of leading companies months prior to completion. The oncology division of biopharmaceutical company Pfizer leased 230,000 square feet spanning two buildings. Global medical technology company BD (Becton, Dickinson and Company) created a 220,000-square-foot innovation center for its Biosciences division across a third building. Charles River Laboratories, Actio Biosciences and Architect Therapeutics have also established a presence at the campus.

Breakthrough Properties, a joint venture of Tishman Speyer and Bellco Capital, acquired the Torrey View site in October 2020 and transformed it into a world-class research and development center, which has achieved USGBC LEED Gold certification.

“This world-class campus is a setting fit for some of the brightest minds in medicine, and will further strengthen the thriving innovation ecosystem that fuels groundbreaking discoveries,” said San Diego Mayor Todd Gloria. “I’m proud that top life-science companies continue to choose San Diego as their home, and I look forward to seeing the life-changing advancements that will come from this new facility.”

“We are delighted to celebrate the completion of Torrey View alongside Mayor Gloria, UCSD Chancellor Dr. Pradeep Khosla and our many distinguished guests from San Diego’s vibrant life sciences community,” said Breakthrough CEO Dan Belldegrun. “We developed Torrey View as a premier hub of innovation and collaboration where important research will be conducted and advanced. We’re proud to welcome these cutting-edge companies to their new home.”

“Torrey View showcases Breakthrough’s ability to deliver the best real estate product for the best minds in life science,” said Tishman Speyer CEO Rob Speyer. “The work happening within these walls will literally save lives and reshape healthcare. I congratulate the Breakthrough team and thank our partners in the community for championing this project.”

“We’re proud to soon open the doors at our new site here in Torrey View, a site that will continue to enable world-class scientific innovation and the delivery of impactful new medicines to patients with cancer,” said Jeff Settleman, Ph.D., Chief Scientific Officer for Oncology Research and Development Pfizer La Jolla site head. “Over the past few years, Pfizer has made a significant investment in the oncology therapeutic space – this new state-of-the-art facility is a reflection of our commitment to both our colleagues and the patients we serve.”

“We need ecosystems like Torrey View to bring together the brightest minds, most innovative companies and forward-thinking entrepreneurs,” said UCSD Chancellor Pradeep Khosla, Ph.D. “With the extensive premier life science space and amenities that Torrey View plans to offer, it is poised to become a hub for groundbreaking research, development and discovery. Academia needs strong partnerships to achieve maximum success.”

Breakthrough developed Torrey View alongside its co-equity partners Mitsui Fudosan America, Investment Management Corporation of Ontario (IMCO) and AP2. To realize its vision, Breakthrough collaborated with life science architectural firm Flad Architects and general contractor Clark Construction. JLL exclusively handled the leasing program at the development.

The campus features expansive ocean views and a full suite of curated campus amenities, including a client clubhouse, multiple dining options, a Jay Wright-designed fitness center and pickleball court, a 400-person conference facility, robust bike and surfboard storage and onsite parking via a partially below grade garage covered by open green spaces and gardens.

Breakthrough is one of the most active players in the sector with a portfolio that spans more than five million square feet of premier life science environments in operation and in the development pipeline across the United States and Europe. Breakthrough’s ongoing commitment to sustainability involves a particular emphasis on increasing energy efficiency, reducing carbon emissions and providing healthy workspaces for users, including targeting LEED Gold certification at its United States properties, as well as BREEAM Outstanding certification in all of its projects across the United Kingdom and EU markets.

In addition to Torrey View, Breakthrough’s San Diego portfolio encompasses Torrey Plaza, Callan Ridge and Governor Pointe, a two-story life science campus nearing completion. Other portfolio highlights include The 105, a state-of-the-art facility fully leased by CRISPR Therapeutics, and One Milestone, two interconnected lab buildings under development at the Enterprise Research Campus, in Boston; 2300 Market, a research & development building nearing completion in Philadelphia; and Trinity, a bespoke lab and office project being developed in Oxford UK. In addition, StudioLabs by Breakthrough — curated, turn-key innovation environments for hypergrowth users — are being launched in several new markets.

About Breakthrough Properties

Formed in 2019 as a joint venture between global real estate owner, developer, and investor Tishman Speyer and biotechnology investment firm Bellco Capital, Breakthrough Properties is a life science real estate development company that leverages cross-sector collaboration to deliver environments that foster innovation and scientific breakthroughs. Breakthrough Properties’ mission is to acquire, develop and operate the best life science properties in leading urban technology centers around the world and support scientific innovation across biotechnology, agriculture, and nutrition. Breakthrough combines Tishman Speyer’s decades of global real estate development experience with Bellco Capital’s industry-making biotechnology entrepreneurship to reimagine environments where companies can create life-changing therapies for patients.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/breakthrough-properties-joined-by-san-diego-mayor-todd-gloria-to-celebrate-the-opening-of-torrey-view-by-breakthrough-development-302279810.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/breakthrough-properties-joined-by-san-diego-mayor-todd-gloria-to-celebrate-the-opening-of-torrey-view-by-breakthrough-development-302279810.html

SOURCE Breakthrough Properties

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nearly 10% Of Gen Zers Are Moving For Abortion Access–Survey Finds Housing Decisions Shaped By Rights

Young Americans are increasingly factoring reproductive rights into their housing decisions, with seven of every 10 Generation Z members planning moves specifically to areas where abortion remains legal.

A nationwide survey of 1,802 Americans, conducted by Ipsos for Redfin in September, found a broader pattern of housing choices shaped by access to reproductive health care, particularly among younger generations.

Don’t Miss:

The desire to live in areas with legal abortion access spans all age groups, with millennials showing the strongest preference at 59%. More than half of Gen Z and Gen X respondents expressed similar preferences, while baby boomers split evenly, with 50% favoring locations where abortion is legal.

Political affiliation significantly influences housing preferences, according to the report. Three-quarters of likely Kamala Harris voters want to live where abortion is legal, compared to 35% of likely Donald Trump voters.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

The survey found that 6% of Harris supporters and 4% of Trump supporters cite abortion access as a direct reason for planned relocations.

Beyond abortion rights, the survey also highlighted strong preferences regarding fertility treatment access. About two-thirds of both millennials and Gen Zers want to live in areas with easy access to IVF and other fertility treatments. The issue crosses political lines, with 52% of Trump voters and 75% of Harris voters preferring locations where IVF treatments are readily available.

See Also: This Jeff Bezos-backed startup will allow you to become a landlord in just 10 minutes, and you only need $100.

The findings come amid ongoing changes in the reproductive rights landscape following the 2022 Supreme Court decision overturning Roe v. Wade. Recent state-level restrictions on IVF access have further complicated the terrain for Americans making housing decisions.

The data suggests a measurable impact on migration patterns, particularly among younger Americans who increasingly view reproductive health care access as a factor in choosing where to live. Overall, 54% of survey respondents prefer locations with legal abortion access, while 28% specifically seek areas where it is restricted.

Trending: If there was a new fund backed by Jeff Bezos offering a 7-9% target yield with monthly dividends would you invest in it?

These demographic shifts could reshape housing markets as Americans, especially younger generations, vote with their feet on reproductive rights issues. The trend, according to the report, appears more pronounced in states where recent legislation has altered access to abortion or fertility treatments.

So, where do Trump and Harris stand on abortion rights?

Harris is committed to reinstating nationwide abortion rights, according to Politico, advocating for a federal guarantee of the right to choose.

On the other hand, Trump’s presidency played a chief role in ending Roe vs. Wade through his Supreme Court appointments. While he supports state-level decisions on abortion laws, he has not endorsed a nationwide ban, according to NBC News.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump-Affiliated Entity Will Get 75% Of World Liberty Financial's Revenue and 22% OF WLFI Token Supply — Assumes Zero Liability

The cryptocurrency platform backed by Donald Trump, World Liberty Financial (WLFI), would allocate 75% of its protocol revenues to a firm associated with the former President.

What Happened: According to the World Liberty Gold Paper, WLFI, heavily promoted by Trump in recent months, might channel nearly three-fourths of its revenues to DT Marks DEFI, LLC.

The Gold Paper said that the entity used “reasonable efforts” to request the owners and principals, including Trump, to promote the WLF project from time to time, and permitted WLF to utilize the former President’s name, image, and likeness.

For these services and rights, the WLF team decided to allocate 75% of the revenue to the entity. Additionally, 22.5 billion of the platform’s governance token, WLFI, or 22.4% of the total supply, would be reserved for DT Marks DEFI, LLC,

See Also: This Trader Netted Over $5M With 4 Different Meme Coins: Here’s How

The net protocol revenues include all income streams for WLF, such as platform usage fees, token sale earnings, and advertising, after deducting agreed expenses and reserves for ongoing operations.

The Gold Paper recognized Trump as “chief crypto advocate,” and part of the supporting team, but issued a disclaimer that neither Trump nor any of his family members and associated companies have a direct voice in WLFI’s operations.

The Trump campaign team and the WLFI team didn’t immediately respond to Benzinga’s request for additional information about DT Marks DEFI, LLC.

Why It Matters: The WLFI token, launched with much fanfare earlier this week, has been off to a sluggish start, raising just over 4% of its intended token presale amount.

Part of the poor response could be because the token is non-transferable and non-yielding, and locked indefinitely in a wallet.

Influential cryptocurrency advocates such as Mark Cuban questioned the motives behind the token sale, with Cuban wondering why Trump would venture into cryptocurrency when he has support from influential figures like Elon Musk.

Image via Flickr

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SerDes Market to Reach $2.7 Billion, Globally, by 2032 at 13.3% CAGR: Allied Market Research

Wilmington, Delaware , Oct. 18, 2024 (GLOBE NEWSWIRE) —

Allied Market Research published a report, titled, “SerDes Market by Component (Clock Multiplier Uni, Lanes and Physical Coding Sub-Block), and Industry Vertical (Automotive, Consumer electronics, IT and telecom, Aerospace, Military and Defense, Manufacturing and Others): Global Opportunity Analysis and Industry Forecast, 2024-2032″. According to the report, the serdes market was valued at $0.9 billion in 2023, and is estimated to reach $2.7 billion by 2032, growing at a CAGR of 13.3% from 2024 to 2032.

Download Research Report Sample & TOC: https://www.alliedmarketresearch.com/request-sample/A324260

(We are providing report as per your research requirement, including the Latest Industry Insight’s Evolution, and Potential)

Prime determinants of growth

The increasing demand for high-speed data transfer in various applications, such as data centers, telecommunication networks, and high-performance computing, is a significant driver for the SerDes market. SerDes technology enables efficient, reliable, and high-speed data communication, which is critical for modern computing environments. The rapid growth of data centers, driven by the exponential increase in data generation and cloud computing services, necessitates advanced interconnect solutions. SerDes technology is crucial for enhancing data transfer speeds and bandwidth within data centers, supporting their efficient operation and scalability. The deployment of 5G networks and advancements in fiber-optic communication systems require high-speed data transmission solutions. SerDes technology plays a vital role in the backbone of these advanced telecommunication infrastructures by ensuring efficient data flow and connectivity.

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2024–2032 |

| Base Year | 2023 |

| Market Size in 2023 | $0.9 billion |

| Market Size in 2032 | $2.7 billion |

| CAGR | 13.3% |

| No. of Pages in Report | 250 |

| Segments Covered | Component, Industry Vertical and Region. |

| Drivers | Increasing adoption of cloud computing High-speed data transmission demand 5G and advanced communication technologies |

| Opportunities | Rising integration of Serdes technology within consumer electronics |

| Restraint | High development costs Power consumption concerns |

Segment Highlights

The demand for the physical coding sub-block (PCS) segment in the SerDes market is driven by the increasing need for high-speed and reliable data transmission in advanced communication systems. PCS plays a crucial role in encoding and decoding data to ensure error-free transmission over various mediums, such as fiber optics and high-speed cables. As data centers, 5G networks, and high-performance computing applications continue to expand, the requirement for efficient and robust data integrity mechanisms grows. Additionally, the rise of complex electronic devices and IoT applications necessitates advanced PCS solutions to maintain high data rates and signal integrity, further propelling market demand.

The demand for the IT and telecom segment in the SerDes market is driven by the increasing need for high-speed data transmission and communication efficiency. As telecommunications networks evolve to support higher bandwidths and faster data rates, SerDes plays a crucial role in enabling the seamless transmission of data across these networks. In IT infrastructure, especially in data centers and cloud computing environments, SerDes facilitates the rapid transfer of large volumes of data, enhancing overall system performance and scalability. The technology’s ability to handle complex data traffic while maintaining signal integrity makes it indispensable for meeting the growing demands of modern communication and computing applications.

Get Customized Reports with your Requirements: https://www.alliedmarketresearch.com/request-for-customization/A324260

Regional Outlook

Asia-Pacific attained the highest market share in the SerDes market as the region witnessed significant growth in data center infrastructure, driven by the expansion of cloud services and the increasing adoption of digital technologies. SerDes technology is crucial for data centers to manage high-speed data transmission efficiently. Asia-Pacific is experiencing robust growth in telecommunications, particularly with the deployment of 5G networks and the expansion of broadband services. SerDes is essential for supporting the high bandwidth and low latency requirements of these advanced networks. The region is a hub for semiconductor manufacturing, with leading players producing SerDes components locally. This availability of advanced semiconductor technology supports the widespread adoption of SerDes in various applications. Asia-Pacific has a large and growing market for consumer electronics, including smartphones, tablets, and IoT devices. SerDes technology is integral to these devices for efficient data communication and connectivity.

Players: -

- Texas Instruments Inc.

- ON Semiconductor Corporation

- STMicroelectronics NV

- Renesas Electronics Corp

- NXP Semiconductors NV

- Cypress Semiconductor Corp.

The report provides a detailed analysis of these key players in the global SerDes market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Inquiry before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/A324260

Recent Industry News

- In September 2022, The Arora v FPGA, a 12.5 Gbps high-speed SerDes interface, was introduced by Gowin Semiconductor. The business also contracted with WPG, the biggest distributor of semiconductors in Europe.

- In August 2022, The Arora v FPGA, a high-speed SerDes interface with a 22nm 12.5 Gbps, was introduced by Gowin Semiconductor. Also, the business inked a contract with WPG, the biggest distributor of semiconductors in Europe.

- In June 2023, The Japanese government launched a new initiative to promote the development of high-speed SerDes technology for data centers and cloud computing applications. This initiative aims to enhance the performance and efficiency of data transmission in data centers, which are increasingly relying on high-speed SerDes links.

- In July 2023, The European Commission announced a new research program to develop next-generation SerDes technology for high-performance computing (HPC) applications. This program aims to support the development of faster and more efficient SerDes solutions for data transfer between processors, memory, and other components in HPC systems.

Key Benefits for Stakeholders

- This SerDes market report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the serdes market analysis from 2024 to 2032 to identify the prevailing serdes market opportunities. In the report SerDes market size is in $ billion from 2023 to 2032.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the SerDes market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players. The SerDes market share by key players is also covered in the report.

- The report includes the analysis of the regional as well as global SerDes market trends, key players, market segments, application areas, and SerDes market growth strategies.

Procure Complete Report (250 Pages PDF with Insights, Charts, Tables, and Figures) @ https://bit.ly/3Y7qtyR

SerDes Market Key Segments:

By Component:

- Physical Coding Sub-Block

By Industry Vertical:

By Region:

- North America: (U.S., Canada, Mexico)

- Europe: (France, Germany, Italy, UK, Rest of Europe)

- Asia-Pacific: (China, Japan, India, South Korea, Rest of Asia-Pacific)

- LAMEA: (Latin America, Middle East, Africa)

Access AVENUE – A Subscription-Based Library (Premium On-Demand, Subscription-Based Pricing Model) @ https://www.alliedmarketresearch.com/library-access

Avenue is a user-based library of global market report database, provides comprehensive reports pertaining to the world’s largest emerging markets. It further offers e-access to all the available industry reports just in a jiffy. By offering core business insights on the varied industries, economies, and end users worldwide, Avenue ensures that the registered members get an easy as well as single gateway to their all-inclusive requirements.

Avenue Library Subscription | Request For 14 Days Free Trial of Before Buying: https://www.alliedmarketresearch.com/avenueTrial

Trending Reports in Semiconductor and Electronics Industry:

Cables and wires for aerospace and defense market valued at $27.8 billion in 2022, and is projected to reach $47 billion by 2032

Medium voltage cable accessories market valued at $15.3 billion in 2020 and is projected to reach $25.5 billion by 2030

Cable conduit systems market was valued at $6.13 billion in 2020, and is projected to reach $12.24 billion by 2030

Cable management market size was valued at $18.31 billion in 2019, and is projected to reach $35.02 billion by 2027

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports Insights” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060

Fax: +1-800-792-5285

help@alliedmarketresearch.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Sam Altman-backed nuclear power stock soared 150% in a month

As tech giants turn their attention toward nuclear power for artificial intelligence and data centers, one producer is seeing its shares surge.

Oklo, a nuclear power company that counts OpenAI chief executive Sam Altman as an investor, has seen its shares climb around 150% in the past month. The stock is up almost 50% so far this year. However, during mid-day trading on Thursday, Oklo was down almost 5%.

The Santa Clara, California-based company, which has three project sites, says it’s “developing next-generation fission powerhouses to produce abundant, affordable, clean energy at a global scale.” Oklo’s Aurora powerhouse can produce 15 megawatts of electrical power (MWe), which the company says can scale up to 50 MWe and operate for ten years or longer before needing to be refueled.

Oklo’s shares have been on the up since Microsoft (MSFT) made a 20-year power purchase agreement in September with Constellation Energy (CEG) that will restart the Unit 1 reactor at Three Mile Island. Constellation, which owns most of the U.S.’s nuclear power plants, has seen its shares rise around 36% in the past month. Its stock is up 138% so far this year.

Through the Microsoft and Constellation deal, which will launch the Crane Clean Energy Center (CCEC), Microsoft will purchase energy from the Unit 1 reactor as part of its sustainability goal. The CCEC, which is expected to come online by 2028, will add more than 800 MW of carbon-free electricity to the power grid, a study by the Pennsylvania Building and Construction Trades Council found.

This week, Google (GOOGL) announced it had signed “the world’s first corporate agreement to purchase nuclear energy” from small modular reactors, or SMRs, developed by California-based Kairos Power. The tech giant said it expects to bring Kairos Power’s first SMR online by the end of the decade.

OceanFirst Financial Corp. Announces Third Quarter Financial Results

RED BANK, N.J., Oct. 17, 2024 (GLOBE NEWSWIRE) — OceanFirst Financial Corp. OCFC (the “Company”), the holding company for OceanFirst Bank N.A. (the “Bank”), announced net income available to common stockholders of $24.1 million, or $0.42 per diluted share, for the three months ended September 30, 2024, an increase from $19.7 million, or $0.33 per diluted share, for the corresponding prior year period, and $23.4 million, or $0.40 per diluted share, for the prior linked quarter. For the nine months ended September 30, 2024, the Company reported net income available to common stockholders of $75.1 million, or $1.29 per diluted share, an increase from $73.3 million, or $1.24 per diluted share, for the corresponding prior year period. Selected performance metrics are as follows (refer to “Selected Quarterly Financial Data” for additional information):

| For the Three Months Ended, | For the Nine Months Ended, | |||||||||||||

| Performance Ratios (Annualized): | September 30, | June 30, | September 30, | September 30, | September 30, | |||||||||

| 2024 | 2024 | 2023 | 2024 | 2023 | ||||||||||

| Return on average assets | 0.71 | % | 0.70 | % | 0.57 | % | 0.74 | % | 0.73 | % | ||||

| Return on average stockholders’ equity | 5.68 | 5.61 | 4.75 | 5.98 | 6.03 | |||||||||

| Return on average tangible stockholders’ equity (a) | 8.16 | 8.10 | 6.93 | 8.62 | 8.85 | |||||||||

| Return on average tangible common equity (a) | 8.57 | 8.51 | 7.29 | 9.05 | 9.31 | |||||||||

| Efficiency ratio | 65.77 | 62.86 | 63.37 | 62.71 | 62.15 | |||||||||

| Net interest margin | 2.67 | 2.71 | 2.91 | 2.73 | 3.09 | |||||||||

(a) Return on average tangible stockholders’ equity and return on average tangible common equity (“ROTCE”) are non-GAAP (“generally accepted accounting principles”) financial measures and exclude the impact of intangible assets and goodwill from both assets and stockholders’ equity. ROTCE also excludes preferred stock from stockholders’ equity. Refer to “Explanation of Non-GAAP Financial Measures,” “Selected Quarterly Financial Data” and “Non-GAAP Reconciliation” tables for additional information regarding non-GAAP financial measures.

Core earnings1 for the three and nine months ended September 30, 2024 were $23.2 million and $71.5 million, respectively, or $0.39 and $1.22 per diluted share, an increase from $18.6 million or $0.32 per diluted share and a decrease from $78.4 million or $1.33 per diluted share, for the corresponding prior year periods, and an increase from $22.7 million, or $0.39 per diluted share, for the prior linked quarter.

Core earnings PTPP1 for the three and nine months ended September 30, 2024 was $30.9 million and $99.8 million, respectively, or $0.53 and $1.71 per diluted share, as compared to $35.0 million and $118.7 million, or $0.59 and $2.01 per diluted share, for the corresponding prior year periods, and $32.7 million, or $0.56 per diluted share, for the prior linked quarter. Selected performance metrics are as follows:

| For the Three Months Ended, | For the Nine Months Ended, | ||||||||||||||||||

| September 30, | June 30, | September 30, | September 30, | September 30, | |||||||||||||||

| Core Ratios1 (Annualized): | 2024 | 2024 | 2023 | 2024 | 2023 | ||||||||||||||

| Return on average assets | 0.69 | % | 0.68 | % | 0.54 | % | 0.71 | % | 0.78 | % | |||||||||

| Return on average tangible stockholders’ equity | 7.85 | 7.86 | 6.54 | 8.20 | 9.46 | ||||||||||||||

| Return on average tangible common equity | 8.24 | 8.26 | 6.88 | 8.61 | 9.96 | ||||||||||||||

| Efficiency ratio | 66.00 | 63.47 | 64.29 | 63.49 | 60.79 | ||||||||||||||

| Core diluted earnings per share | $ | 0.39 | $ | 0.39 | $ | 0.32 | $ | 1.22 | $ | 1.33 | |||||||||

| Core PTPP diluted earnings per share | 0.53 | 0.56 | 0.59 | 1.71 | 2.01 | ||||||||||||||

Key developments for the recent quarter are described below:

- Net Interest Income Stabilization: Net interest income of $82.2 million for the quarter as compared to $82.3 million in the prior linked quarter.

- Deposits: Total deposits increased by $122.2 million to $10.1 billion from $10.0 billion and the loan-to-deposit ratio was 99% at September 30, 2024.

- Strategic Investments: The results include $3.3 million of expenses, of which $1.7 million related to merger and acquisition costs, for the talent acquisition of Garden State Home Loans, Inc. and acquisition of Spring Garden Capital Group, LLC.2 These are expected to improve future operating performance by expanding fee revenue and specialty finance offerings.

- Asset Quality: Asset quality metrics remain strong as non-performing loans and loans 30 to 89 days past due as a percentage of total loans receivable were 0.28% and 0.15%, respectively. Non-performing loans decreased by $5.3 million, to $28.1 million, and the Company recorded net loan recoveries of $88,000 for the quarter.

Chairman and Chief Executive Officer, Christopher D. Maher, commented on the Company’s results, “We are pleased to present our current quarter results, which builds on the existing strength of our balance sheet, including robust capital and asset quality, coupled with stabilization of net interest income and margin. The quarter includes additional investments in mortgage banking activities, which will expand our digital channels and fee revenue and, in October, we completed an acquisition of a specialty finance company expanding our product offerings.” Mr. Maher added, “Additionally, the Company hosted its third annual CommUNITYFirst Day. Thank you to our incredible employees and community partners for a successful event involving over 700 employees and nearly 3,000 hours across our communities.”

The Company’s Board of Directors declared its 111th consecutive quarterly cash dividend on common stock. The quarterly cash dividend on common stock of $0.20 per share will be paid on November 15, 2024 to common stockholders of record on November 4, 2024. The Company’s Board of Directors also declared a quarterly cash dividend on preferred stock of $0.4375 per depositary share, representing 1/40th interest in the Series A Preferred Stock. This dividend will be paid on November 15, 2024 to preferred stockholders of record on October 31, 2024.

1 Core earnings and core earnings before income taxes and provision for credit losses (“PTPP” or “Pre-Tax-Pre-Provision”), and ratios derived therefrom, are non-GAAP financial measures. For the periods presented, core earnings exclude merger related expenses, net branch consolidation expense, net (gain) loss on equity investments, net loss on sale of investments, net gain on sale of trust business, the Federal Deposit Insurance Corporation (“FDIC”) special assessment, and the income tax effect of these items, (collectively referred to as “non-core” operations). PTPP excludes the aforementioned pre-tax “non-core” items along with income tax expense (benefit) and provision for credit losses. Refer to “Explanation of Non-GAAP Financial Measures,” “Selected Quarterly Financial Data” and the “Non-GAAP Reconciliation” tables for additional information regarding non-GAAP financial measures.

2 The talent acquisition of Garden State Home Loans, Inc. was effective August 3, 2024. Additionally, the acquisition of Spring Garden Capital Group, LLC was effective October 1, 2024.

Results of Operations

The current quarter was impacted by a continued mix-shift and repricing of funding costs. Further, the results were impacted by the following non-recurring events: $1.7 million of merger related expenses, a $1.4 million gain on sale of a portion of the Company’s trust business, a $855,000 gain on sale of assets held for sale, and the resolution, via sale of collateral, of a single commercial real estate relationship of $7.2 million that was moved to non-accrual and partially charged-off in prior periods.

Net Interest Income and Margin

Three months ended September 30, 2024 vs. September 30, 2023

Net interest income decreased to $82.2 million, from $91.0 million, primarily reflecting the net impact of the higher interest rate environment.

Net interest margin decreased to 2.67%, from 2.91%, which included the impact of purchase accounting accretion of 0.02% and 0.06%, respectively. Net interest margin decreased primarily due to the increase in cost of funds outpacing the increase in yield on average interest-earning assets.

Average interest-earning assets decreased by $152.1 million due to balance sheet contraction while the average yield for interest-earning assets increased to 5.26%, from 5.08%.

The cost of average interest-bearing liabilities increased to 3.20%, from 2.71%, primarily due to higher cost of deposits. The total cost of deposits (including non-interest bearing deposits) increased to 2.44%, from 1.99%. Average interest-bearing liabilities decreased by $5.8 million, primarily due to a decrease in total deposits, largely offset by an increase in total borrowings.

Nine months ended September 30, 2024 vs. September 30, 2023

Net interest income decreased to $250.7 million, from $281.9 million, reflecting the net impact of the higher interest rate environment. Net interest margin decreased to 2.73%, from 3.09%, which included the impact of purchase accounting accretion and prepayment fees of 0.04% and 0.05% for the respective periods.

Average interest-earning assets increased by $45.8 million, primarily driven by an increase in securities growth of $153.9 million, which was funded through the decrease of $135.4 million of interest-earning deposits and short-term investments. The average yield increased to 5.25%, from 4.90%.

The total cost of average interest-bearing liabilities increased to 3.12%, from 2.29%. The total cost of deposits (including non-interest bearing deposits) increased to 2.37%, from 1.48%. Average interest-bearing liabilities increased by $258.0 million, primarily due to an increase in total deposits, partly offset by a decrease in total borrowings.

Three months ended September 30, 2024 vs. June 30, 2024

Net interest income decreased by $44,000, as the increase in cost of deposits slightly outpaced the decrease in Federal Home Loan Bank (“FHLB”) advance costs and the yield of average interest earning assets. Net interest margin decreased to 2.67%, from 2.71%, which included the impact of purchase accounting accretion of 0.02% and 0.04% for the respective periods.

Average interest-earning assets increased by $28.9 million, primarily due to an increase in interest-earning deposits and short-term investments, partly offset by a decrease in loans. The yield on average interest-earning assets increased to 5.26%, from 5.25%.

The total cost of average interest-bearing liabilities increased to 3.20%, from 3.14%, primarily due to higher cost of deposits. Total cost of deposits (including non-interest bearing deposits) increased to 2.44%, from 2.37%. Average interest-bearing liabilities increased by $1.8 million, primarily due to an increase in FHLB advances, partly offset by a decrease in deposits and other borrowings.

Provision for Credit Losses

Provision for credit losses for the three and nine months ended September 30, 2024 was $517,000 and $4.2 million, respectively, as compared to $10.3 million and $14.5 million for the corresponding prior year periods, and $3.1 million in the prior linked quarter. The lower provision for the current quarter was a result of flat loan growth, net loan recoveries, and the net effect of shifts in the Company’s loan portfolio and external macro economic forecasts.

Net loan recoveries were $88,000 and net loan charge-offs were $1.7 million for the three and nine months ended September 30, 2024, respectively, as compared to net loan charge-offs of $8.3 million for both the three and nine months ended September 30, 2023. Net loan charge-offs were $1.5 million in the prior linked quarter. The prior year periods and prior linked quarter included partial charge-offs of $8.4 million and $1.6 million, respectively, for the single commercial real estate relationship disclosed previously. Refer to “Results of Operations” section for further discussion.

Non-interest Income

Three months ended September 30, 2024 vs. September 30, 2023

Other income increased to $14.7 million, as compared to $10.8 million. Other income was favorably impacted by non-core operations related to net gains on equity investments of $1.4 million and $1.5 million, for the respective quarters, and a $1.4 million gain on sale of a portion of the Company’s trust business in the current quarter.

Excluding non-core operations, other income increased by $2.5 million, primarily driven by increases in fees and service charges of $918,000 related to treasury management fees, a non-recurring gain on sale of assets held for sale of $855,000, and net gain on sale of loans of $439,000.

Nine months ended September 30, 2024 vs. September 30, 2023

Other income increased to $38.0 million, as compared to $21.8 million. The current period was favorably impacted by non-core operations related to net gains on equity investments of $4.2 million and a $2.6 million gain on sale of a portion of the Company’s trust business. The prior year was adversely impacted by non-core operations of $6.6 million, primarily related to losses on sale of investments.

Excluding non-core operations, other income increased by $2.8 million, primarily driven by increases in the cash surrender value of bank owned life insurance of $1.5 million, which included one-time death benefits in the current period, net gain on sale of loans of $1.2 million, and gain on sale of assets held for sale of $855,000. This was partially offset by a decrease in trust and asset management revenue of $590,000, related to the sale of a portion of the Company’s trust business.

Three months ended September 30, 2024 vs. June 30, 2024

Other income in the prior linked quarter was $11.0 million and was favorably impacted by non-core operations of $887,000 related to net gains on equity investments. Excluding non-core operations, other income increased by $1.7 million, primarily due increases in fees and service charges of $1.1 million related to treasury management fees, and the gain on sale of assets held for sale of $855,000, as noted above.

Non-interest Expense

Three months ended September 30, 2024 vs. September 30, 2023

Operating expenses decreased to $63.7 million, as compared to $64.5 million. Operating expenses were adversely impacted by non-core operations related to merger related expenses of $1.7 million in the current quarter.

Excluding non-core operations, operating expenses decreased by $2.4 million. The primary driver was a decrease in professional fees of $3.3 million as the Company realized benefits from the performance improvement initiatives and investments made in the prior periods. This was partially offset by an increase in other operating expense of $1.1 million, which was partly due to additional loan servicing expenses.

Nine months ended September 30, 2024 vs. September 30, 2023

Operating expenses decreased to $181.0 million, as compared to $188.7 million. Operating expenses were adversely impacted by $2.1 million in the current year of non-core operations related to merger related expenses and a FDIC special assessment, and by $92,000 in the prior year for merger related and net branch consolidation expenses.

Excluding non-core operations, operating expenses decreased by $9.7 million. The primary drivers were decreases in professional fees of $8.6 million and compensation and employee benefits expenses of $1.9 million, which were due to the same initiatives discussed in the three-month periods above. This was partially offset by an increase in other operating expenses of $1.3 million, which was partly due to additional loan servicing expenses.

Three months ended September 30, 2024 vs. June 30, 2024

Excluding non-core operations, operating expenses increased by $3.4 million. The primary drivers were increases in compensation and benefits of $2.7 million, related to additional personnel in connection with the expansion of fee revenue noted above, and other operating expense of $854,000, which was partly due to additional loan servicing expenses.

Income Tax Expense

The provision for income taxes was $7.5 million and $25.2 million for the three and nine months ended September 30, 2024, respectively, as compared to $6.5 million and $24.1 million for the same prior year periods, and $7.1 million for the prior linked quarter. The effective tax rate was 22.9% and 24.4% for the three and nine months ended September 30, 2024, respectively, as compared to 23.9% and 24.0% for the same prior year periods, and 22.5% for the prior linked quarter. The Company’s current quarter effective tax rate was positively impacted by geographic mix as compared to the same prior year period and the nine months ended September 30, 2024 was adversely impacted by the non-recurring write-off of a deferred tax asset of $1.2 million net of other state effects. The prior linked quarter’s effective tax rate was positively impacted by the net effect of state law changes.

Financial Condition

September 30, 2024 vs. December 31, 2023

Total assets decreased by $49.8 million to $13.49 billion, from $13.54 billion, primarily due to decreases in loans, partly offset by net increase in total debt securities. Total loans decreased by $172.4 million to $10.02 billion, from $10.19 billion, primarily due to a decrease in the total commercial portfolio of $188.4 million driven by loan payoffs. The loan pipeline increased by $168.6 million to $351.6 million, from $183.0 million. Held-to-maturity debt securities decreased by $84.6 million to $1.08 billion, from $1.16 billion, primarily due to principal repayments. Debt securities available-for-sale increased $157.9 million to $911.8 million, from $753.9 million, primarily due to new purchases. Other assets decreased by $20.3 million to $159.3 million, from $179.7 million, primarily due to a decrease in market values associated with customer interest rate swap programs.

Total liabilities decreased by $82.3 million to $11.79 billion, from $11.88 billion primarily related to lower deposits and a funding mix shift. Deposits decreased by $318.8 million to $10.12 billion, from $10.43 billion, primarily due to decreases in high-yield savings accounts of $326.9 million and time deposits of $224.6 million, offset by increases in money market accounts of $266.8 million. Time deposits decreased to $2.22 billion, from $2.45 billion, representing 22.0% and 23.4% of total deposits, respectively, which was primarily related to planned runoff of brokered time deposits, which decreased by $430.4 million, offset by increases in retail time deposits of $221.4 million. The loan-to-deposit ratio was 99.1%, as compared to 97.7%. FHLB advances increased by $43.2 million to $891.9 million, from $848.6 million and other borrowings increased by $223.5 million to $419.9 million, from $196.5 million, as a result of lower cost funding availability.

Other liabilities decreased by $43.1 million to $257.6 million, from $300.7 million, primarily due to a decrease in the market values of derivatives associated with customer interest rate swaps and related collateral received from counterparties.

Capital levels remain strong and in excess of “well-capitalized” regulatory levels at September 30, 2024, including the Company’s estimated common equity tier one capital ratio which increased to 11.3%, up approximately 40 basis points from December 31, 2023.

Total stockholders’ equity increased to $1.69 billion, as compared to $1.66 billion, primarily reflecting net income, partially offset by capital returns comprising of dividends and share repurchases. For the nine months ended September 30, 2024, the Company repurchased 1,383,238 shares totaling $21.5 million representing a weighted average cost of $15.38. The Company had 1,551,200 shares available for repurchase under the authorized repurchase program. Additionally, accumulated other comprehensive loss decreased by $8.7 million primarily due to increases in fair market value of available-for-sale debt securities, net of tax.

The Company completed its annual goodwill impairment test as of August 31, 2024. Based on a quantitative assessment, the Company concluded that goodwill was not impaired. However, the Company continues to monitor its goodwill as further and continued negative industry and economic trends and decline in the Company’s stock price may result in a re-evaluation before the next required annual test.

The Company’s tangible common equity3 increased by $35.0 million to $1.13 billion. The Company’s stockholders’ equity to assets ratio was 12.56% at September 30, 2024, and tangible common equity to tangible assets ratio increased by 30 basis points during the quarter to 8.68%, primarily due to the drivers described above.

Book value per common share increased to $29.02, as compared to $27.96. Tangible book value per common share3 increased to $19.28, as compared to $18.35.

3 Tangible book value per common share and tangible common equity to tangible assets are non-GAAP financial measures and exclude the impact of intangible assets, goodwill, and preferred equity from both stockholders’ equity and total assets. Refer to “Explanation of Non-GAAP Financial Measures” and the “Non-GAAP Reconciliation” tables for additional information regarding non-GAAP financial measures.

Asset Quality

September 30, 2024 vs. December 31, 2023

Overall asset quality metrics remained stable. The Company’s non-performing loans decreased to $28.1 million from $29.5 million and represented 0.28% and 0.29% of total loans, respectively. The allowance for loan credit losses as a percentage of total non-performing loans was 245.45%, as compared to 227.21%. The level of 30 to 89 days delinquent loans decreased to $15.5 million, from $19.2 million. Criticized and classified assets increased to $189.1 million, from $146.9 million. The Company’s allowance for loan credit losses was 0.69% of total loans, as compared to 0.66%. Refer to “Provision for Credit Losses” section for further discussion.

The Company’s asset quality, excluding purchased with credit deterioration (“PCD”) loans, was as follows. Non-performing loans decreased to $25.3 million, from $26.4 million. The allowance for loan credit losses as a percentage of total non-performing loans was 273.51%, as compared to 254.64%. The level of 30 to 89 days delinquent loans, excluding non-performing loans, decreased to $14.2 million, from $17.7 million. The allowance for loan credit losses plus the unamortized credit and PCD marks amounted to $74.8 million, or 0.75% of total loans, as compared to $74.7 million, or 0.73% of total loans.

Explanation of Non-GAAP Financial Measures

Reported amounts are presented in accordance with GAAP. The Company’s management believes that the supplemental non-GAAP information, which consists of reported net income excluding non-core operations and in some instances excluding income taxes and provision for credit losses, and reporting equity and asset amounts excluding intangible assets, goodwill or preferred stock, all of which can vary from period to period, provides a better comparison of period-to-period operating performance. Additionally, the Company believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and, therefore, such information is useful to investors. These disclosures should not be viewed as a substitute for financial results in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures, which may be presented by other companies. Refer to the Non-GAAP Reconciliation table at the end of this document for details on the earnings impact of these items.

Conference Call

As previously announced, the Company will host an earnings conference call on Friday, October 18, 2024 at 11:00 a.m. Eastern Time. The direct dial number for the call is (833) 470-1428, using the access code 257920. For those unable to participate in the conference call, a replay will be available. To access the replay, dial (866) 813-9403, access code 120573, from one hour after the end of the call until November 15, 2024. The conference call, as well as the replay, are also available (listen-only) by internet webcast at www.oceanfirst.com in the Investor Relations section.

OceanFirst Financial Corp.’s subsidiary, OceanFirst Bank N.A., founded in 1902, is a $13.5 billion regional bank providing financial services throughout New Jersey and in the major metropolitan areas between Massachusetts and Virginia. OceanFirst Bank delivers commercial and residential financing, treasury management, trust and asset management, and deposit services and is one of the largest and oldest community-based financial institutions headquartered in New Jersey. To learn more about OceanFirst, go to www.oceanfirst.com.

Forward-Looking Statements

In addition to historical information, this news release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which are based on certain assumptions and describe future plans, strategies and expectations of the Company. These forward-looking statements are generally identified by use of the words “believe”, “expect”, “intend”, “anticipate”, “estimate”, “project”, “will”, “should”, “may”, “view”, “opportunity”, “potential”, or similar expressions or expressions of confidence. The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations of the Company and its subsidiaries include, but are not limited to: changes in interest rates, inflation, general economic conditions, potential recessionary conditions, levels of unemployment in the Company’s lending area, real estate market values in the Company’s lending area, potential goodwill impairment, natural disasters, potential increases to flood insurance premiums, the current or anticipated impact of military conflict, terrorism or other geopolitical events, the level of prepayments on loans and mortgage-backed securities, legislative/regulatory changes, monetary and fiscal policies of the U.S. Government including policies of the U.S. Treasury and the Board of Governors of the Federal Reserve System, the quality or composition of the loan or investment portfolios, demand for loan products, deposit flows, the availability of low-cost funding, changes in liquidity, including the size and composition of the Company’s deposit portfolio, and the percentage of uninsured deposits in the portfolio, changes in capital management and balance sheet strategies and the ability to successfully implement such strategies, competition, demand for financial services in the Company’s market area, changes in consumer spending, borrowing and saving habits, changes in accounting principles, a failure in or breach of the Company’s operational or security systems or infrastructure, including cyberattacks, the failure to maintain current technologies, failure to retain or attract employees, the effect of the Company’s rating under the Community Reinvestment Act, the impact of pandemics on our operations and financial results and those of our customers and the Bank’s ability to successfully integrate acquired operations. These risks and uncertainties are further discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, under Item 1A – Risk Factors and elsewhere, and subsequent securities filings and should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

OceanFirst Financial Corp.

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

(dollars in thousands)

| September 30, | June 30, | December 31, | September 30, | |||||||||

| 2024 | 2024 | 2023 | 2023 | |||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | ||||||||||

| Assets | ||||||||||||

| Cash and due from banks | $ | 214,171 | $ | 181,198 | $ | 153,718 | $ | 408,882 | ||||

| Debt securities available-for-sale, at estimated fair value | 911,753 | 721,484 | 753,892 | 453,208 | ||||||||

| Debt securities held-to-maturity, net of allowance for securities credit losses of $902 at September 30, 2024, $958 at June 30, 2024, $1,133 at December 31, 2023 and $932 at September 30, 2023 (estimated fair value of $1,007,781 at September 30, 2024, $1,003,850 at June 30, 2024, $1,068,438 at December 31, 2023 and $1,047,342 at September 30, 2023) | 1,075,131 | 1,105,843 | 1,159,735 | 1,189,339 | ||||||||

| Equity investments | 95,688 | 104,132 | 100,163 | 97,908 | ||||||||

| Restricted equity investments, at cost | 98,545 | 92,679 | 93,766 | 82,484 | ||||||||

| Loans receivable, net of allowance for loan credit losses of $69,066 at September 30, 2024, $68,839 at June 30, 2024, $67,137 at December 31, 2023 and $63,877 at September 30, 2023 | 9,963,598 | 9,961,117 | 10,136,721 | 10,068,156 | ||||||||

| Loans held-for-sale | 23,036 | 2,062 | 5,166 | — | ||||||||

| Interest and dividends receivable | 48,821 | 50,976 | 51,874 | 50,030 | ||||||||

| Premises and equipment, net | 116,087 | 117,392 | 121,372 | 122,646 | ||||||||

| Bank owned life insurance | 269,138 | 267,867 | 266,498 | 265,071 | ||||||||

| Assets held for sale | — | 28 | 28 | 3,004 | ||||||||

| Goodwill | 506,146 | 506,146 | 506,146 | 506,146 | ||||||||

| Core deposit intangible | 7,056 | 7,859 | 9,513 | 10,489 | ||||||||

| Other assets | 159,313 | 202,972 | 179,661 | 240,820 | ||||||||

| Total assets | $ | 13,488,483 | $ | 13,321,755 | $ | 13,538,253 | $ | 13,498,183 | ||||

| Liabilities and Stockholders’ Equity | ||||||||||||

| Deposits | $ | 10,116,167 | $ | 9,994,017 | $ | 10,434,949 | $ | 10,533,929 | ||||

| Federal Home Loan Bank advances | 891,860 | 789,337 | 848,636 | 606,056 | ||||||||

| Securities sold under agreements to repurchase with customers | 81,163 | 80,000 | 73,148 | 82,981 | ||||||||

| Other borrowings | 419,927 | 424,490 | 196,456 | 196,183 | ||||||||

| Advances by borrowers for taxes and insurance | 27,282 | 25,168 | 22,407 | 29,696 | ||||||||

| Other liabilities | 257,576 | 332,074 | 300,712 | 411,734 | ||||||||

| Total liabilities | 11,793,975 | 11,645,086 | 11,876,308 | 11,860,579 | ||||||||

| Stockholders’ equity: | ||||||||||||

| OceanFirst Financial Corp. stockholders’ equity | 1,693,654 | 1,675,885 | 1,661,163 | 1,636,891 | ||||||||

| Non-controlling interest | 854 | 784 | 782 | 713 | ||||||||

| Total stockholders’ equity | 1,694,508 | 1,676,669 | 1,661,945 | 1,637,604 | ||||||||

| Total liabilities and stockholders’ equity | $ | 13,488,483 | $ | 13,321,755 | $ | 13,538,253 | $ | 13,498,183 | ||||

OceanFirst Financial Corp.

CONSOLIDATED STATEMENTS OF INCOME

(in thousands, except per share amounts)

| For the Three Months Ended, | For the Nine Months Ended, | ||||||||||||||||

| September 30, | June 30, | September 30, | September 30, | September 30, | |||||||||||||

| 2024 | 2024 | 2023 | 2024 | 2023 | |||||||||||||

| |———————- (Unaudited) ———————-| | |———- (Unaudited) ———–| | ||||||||||||||||

| Interest income: | |||||||||||||||||

| Loans | $ | 136,635 | $ | 136,049 | $ | 133,931 | $ | 409,805 | $ | 384,755 | |||||||

| Debt securities | 19,449 | 19,039 | 15,223 | 58,349 | 43,829 | ||||||||||||

| Equity investments and other | 5,441 | 4,338 | 9,256 | 14,399 | 18,956 | ||||||||||||

| Total interest income | 161,525 | 159,426 | 158,410 | 482,553 | 447,540 | ||||||||||||

| Interest expense: | |||||||||||||||||

| Deposits | 62,318 | 60,071 | 53,287 | 182,244 | 112,551 | ||||||||||||

| Borrowed funds | 16,988 | 17,092 | 14,127 | 49,603 | 53,082 | ||||||||||||

| Total interest expense | 79,306 | 77,163 | 67,414 | 231,847 | 165,633 | ||||||||||||

| Net interest income | 82,219 | 82,263 | 90,996 | 250,706 | 281,907 | ||||||||||||

| Provision for credit losses | 517 | 3,114 | 10,283 | 4,222 | 14,525 | ||||||||||||

| Net interest income after provision for credit losses | 81,702 | 79,149 | 80,713 | 246,484 | 267,382 | ||||||||||||

| Other income: | |||||||||||||||||

| Bankcard services revenue | 1,615 | 1,571 | 1,507 | 4,602 | 4,381 | ||||||||||||

| Trust and asset management revenue | 384 | 419 | 662 | 1,329 | 1,919 | ||||||||||||

| Fees and service charges | 6,096 | 5,015 | 5,178 | 15,584 | 15,939 | ||||||||||||

| Net gain on sales of loans | 505 | 420 | 66 | 1,282 | 119 | ||||||||||||

| Net gain (loss) on equity investments | 1,420 | 887 | 1,452 | 4,230 | (5,908 | ) | |||||||||||

| Income from bank owned life insurance | 1,779 | 1,726 | 1,390 | 5,367 | 3,853 | ||||||||||||

| Commercial loan swap income | 414 | 241 | 11 | 793 | 712 | ||||||||||||

| Other | 2,471 | 706 | 496 | 4,768 | 748 | ||||||||||||

| Total other income | 14,684 | 10,985 | 10,762 | 37,955 | 21,763 | ||||||||||||

| Operating expenses: | |||||||||||||||||

| Compensation and employee benefits | 35,844 | 33,136 | 35,534 | 101,739 | 103,676 | ||||||||||||

| Occupancy | 5,157 | 5,175 | 5,466 | 15,531 | 15,970 | ||||||||||||

| Equipment | 1,026 | 1,068 | 1,172 | 3,224 | 3,478 | ||||||||||||

| Marketing | 1,385 | 1,175 | 1,183 | 3,550 | 3,126 | ||||||||||||

| Federal deposit insurance and regulatory assessments | 2,618 | 2,685 | 2,557 | 8,438 | 6,771 | ||||||||||||

| Data processing | 5,940 | 6,018 | 6,086 | 17,914 | 18,405 | ||||||||||||

| Check card processing | 1,153 | 1,075 | 1,154 | 3,278 | 3,649 | ||||||||||||

| Professional fees | 1,970 | 2,161 | 5,258 | 6,863 | 15,439 | ||||||||||||

| Amortization of core deposit intangible | 803 | 810 | 987 | 2,457 | 3,008 | ||||||||||||

| Branch consolidation expense, net | — | — | — | — | 70 | ||||||||||||

| Merger related expenses | 1,669 | — | — | 1,669 | 22 | ||||||||||||

| Other operating expense | 6,171 | 5,317 | 5,087 | 16,365 | 15,109 | ||||||||||||

| Total operating expenses | 63,736 | 58,620 | 64,484 | 181,028 | 188,723 | ||||||||||||

| Income before provision for income taxes | 32,650 | 31,514 | 26,991 | 103,411 | 100,422 | ||||||||||||

| Provision for income taxes | 7,464 | 7,082 | 6,459 | 25,183 | 24,109 | ||||||||||||

| Net income | 25,186 | 24,432 | 20,532 | 78,228 | 76,313 | ||||||||||||

| Net income (loss) attributable to non-controlling interest | 70 | 59 | (135 | ) | 72 | (34 | ) | ||||||||||

| Net income attributable to OceanFirst Financial Corp. | 25,116 | 24,373 | 20,667 | 78,156 | 76,347 | ||||||||||||

| Dividends on preferred shares | 1,004 | 1,004 | 1,004 | 3,012 | 3,012 | ||||||||||||

| Net income available to common stockholders | $ | 24,112 | $ | 23,369 | $ | 19,663 | $ | 75,144 | $ | 73,335 | |||||||

| Basic earnings per share | $ | 0.42 | $ | 0.40 | $ | 0.33 | $ | 1.29 | $ | 1.24 | |||||||

| Diluted earnings per share | $ | 0.42 | $ | 0.40 | $ | 0.33 | $ | 1.29 | $ | 1.24 | |||||||

| Average basic shares outstanding | 58,065 | 58,356 | 59,104 | 58,405 | 59,037 | ||||||||||||

| Average diluted shares outstanding | 58,068 | 58,357 | 59,111 | 58,407 | 59,068 | ||||||||||||

OceanFirst Financial Corp.

SELECTED LOAN AND DEPOSIT DATA

(dollars in thousands)

| LOANS RECEIVABLE | At | |||||||||||||||||||||

| September 30, | June 30, | March 31, | December 31, | September 30, | ||||||||||||||||||