Steel Dynamics Analysts Increase Their Forecasts After Better-Than-Expected Earnings

Steel Dynamics Inc STLD posted better-than-expected third-quarter earnings, after the closing bell on Wednesday.

Steel Dynamics posted quarterly GAAP earnings of $2.05 per share, beating market estimates of $1.97 per share. The company’s quarterly sales came in at $4.34 billion versus expectations of $4.177 billion.

“The teams achieved a solid third quarter 2024 performance across the platforms, with adjusted EBITDA of $557 million and cash flow from operations of $760 million,” said Mark D. Millett, Co-Founder, Chairman, and Chief Executive Officer. “With our proven through-cycle cash generation, we increased liquidity to $3.1 billion, while also investing $621 million in our internal ongoing growth initiatives and distributing $381 million to our shareholders through cash dividends and share repurchases. Our three-year after-tax return-on-invested capital of 26 percent is a testament to our ongoing high-return capital allocation execution.

Steel Dynamics shares gained 1.2% to trade at $136.70 on Friday.

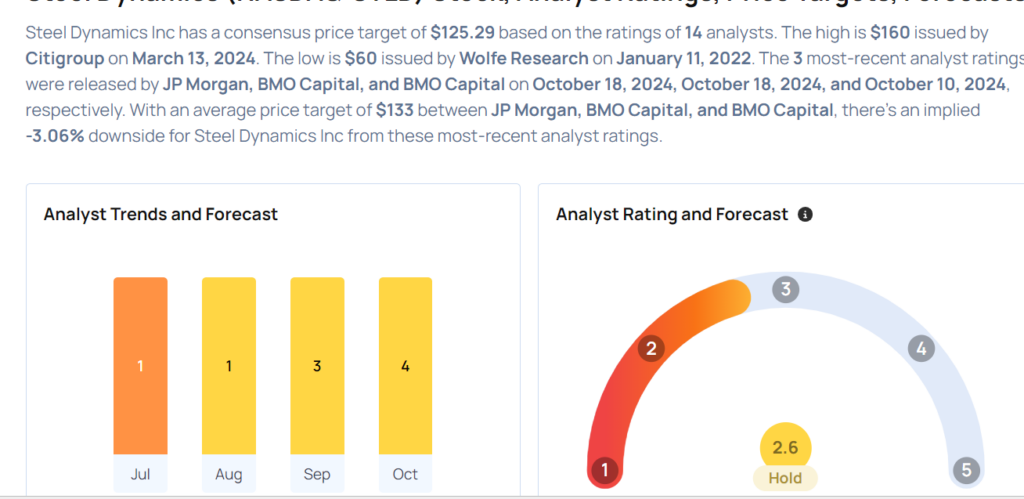

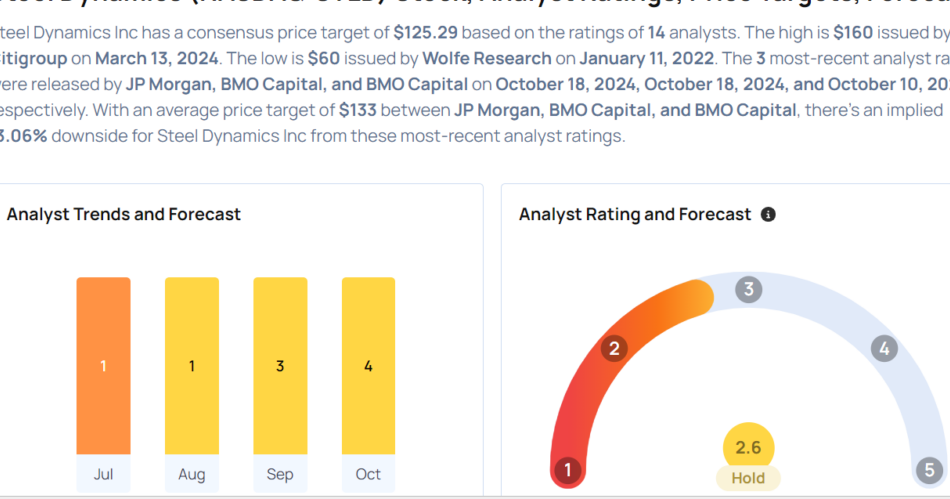

These analysts made changes to their price targets on Steel Dynamics following earnings announcement.

- BMO Capital analyst Katja Jancic maintained Steel Dynamics with a Market Perform and raised the price target from $130 to $135.

- JP Morgan analyst Bill Peterson maintained Steel Dynamics with a Neutral and raised the price target from $129 to $134.

Considering buying STLD stock? Here’s what analysts think:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply